Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from junk stocks to megacaps, to housing and liquidity, to the impact of tariffs and trade on earnings and international economic power. Have a great weekend!

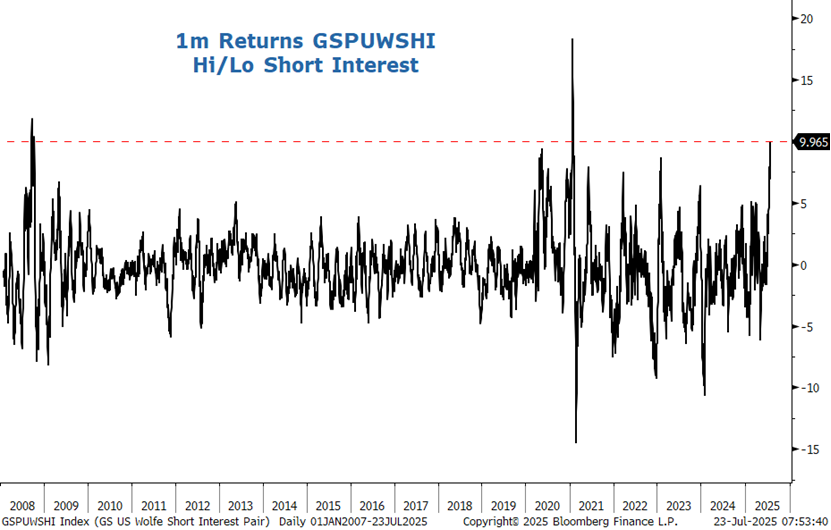

Brad: The past few weeks have been one of the wilder periods of low-quality speculation in recent years

Brian: with retail traders embracing technology companies with questionable fundamentals

Source: Goldman Sachs as of 07.23.2025

Source: Goldman Sachs as of 07.23.2025

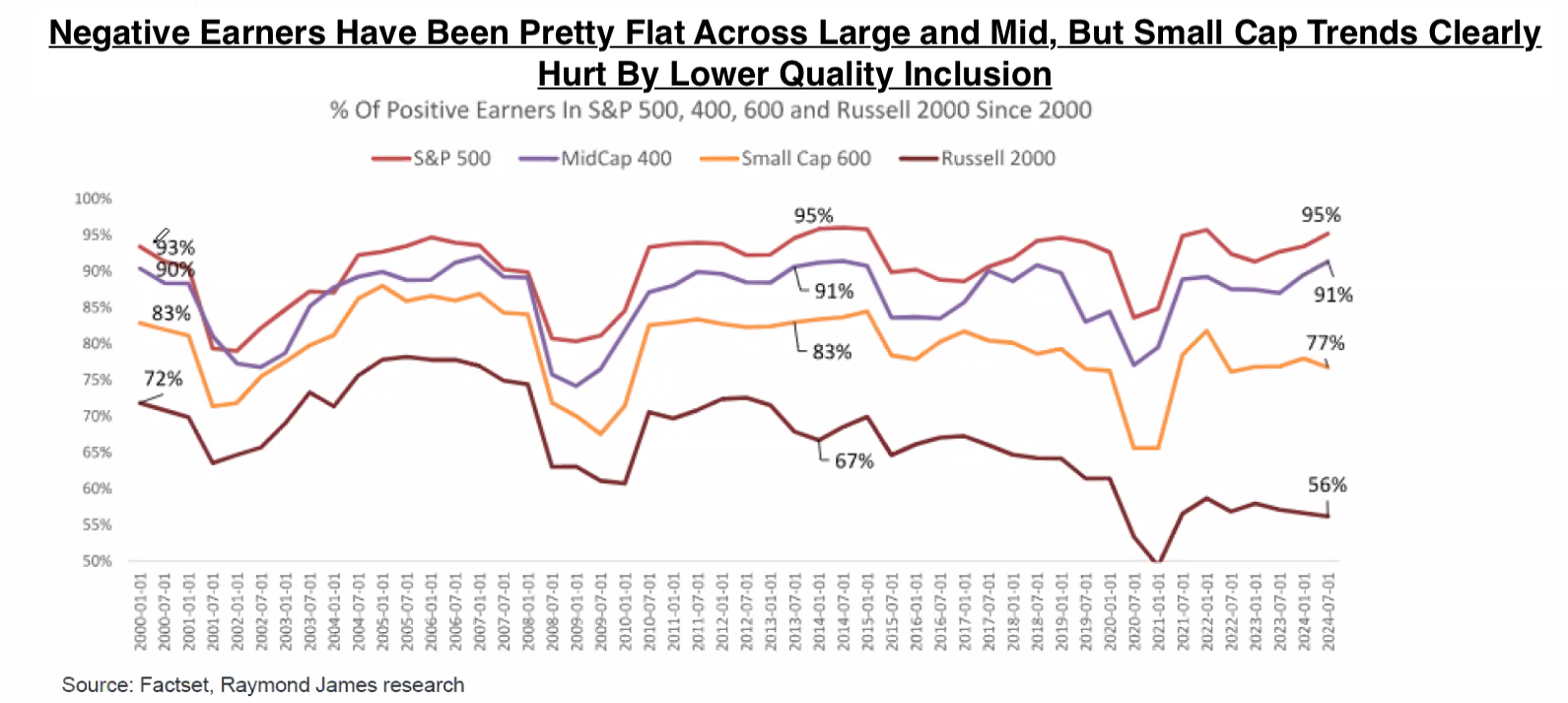

Dave: Over longer periods of time, the inclusion of low quality companies has amplified the performance disparity across indexes of varying market caps

Data as of June 2025

Data as of June 2025

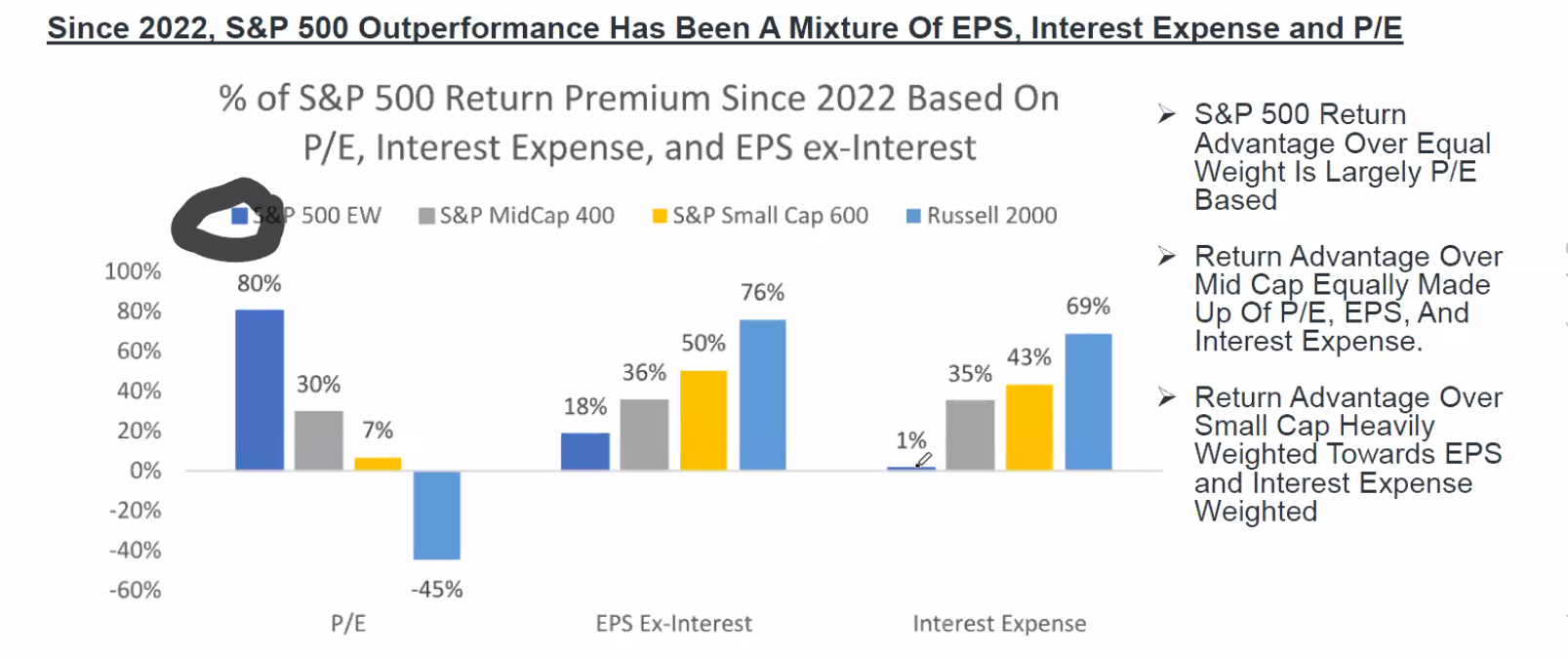

Dave: with investor preference for more reliable fundamentals a significant factor in the dominance of US large cap stocks over other equity styles

Source: Raymond James as of June 2025

Source: Raymond James as of June 2025

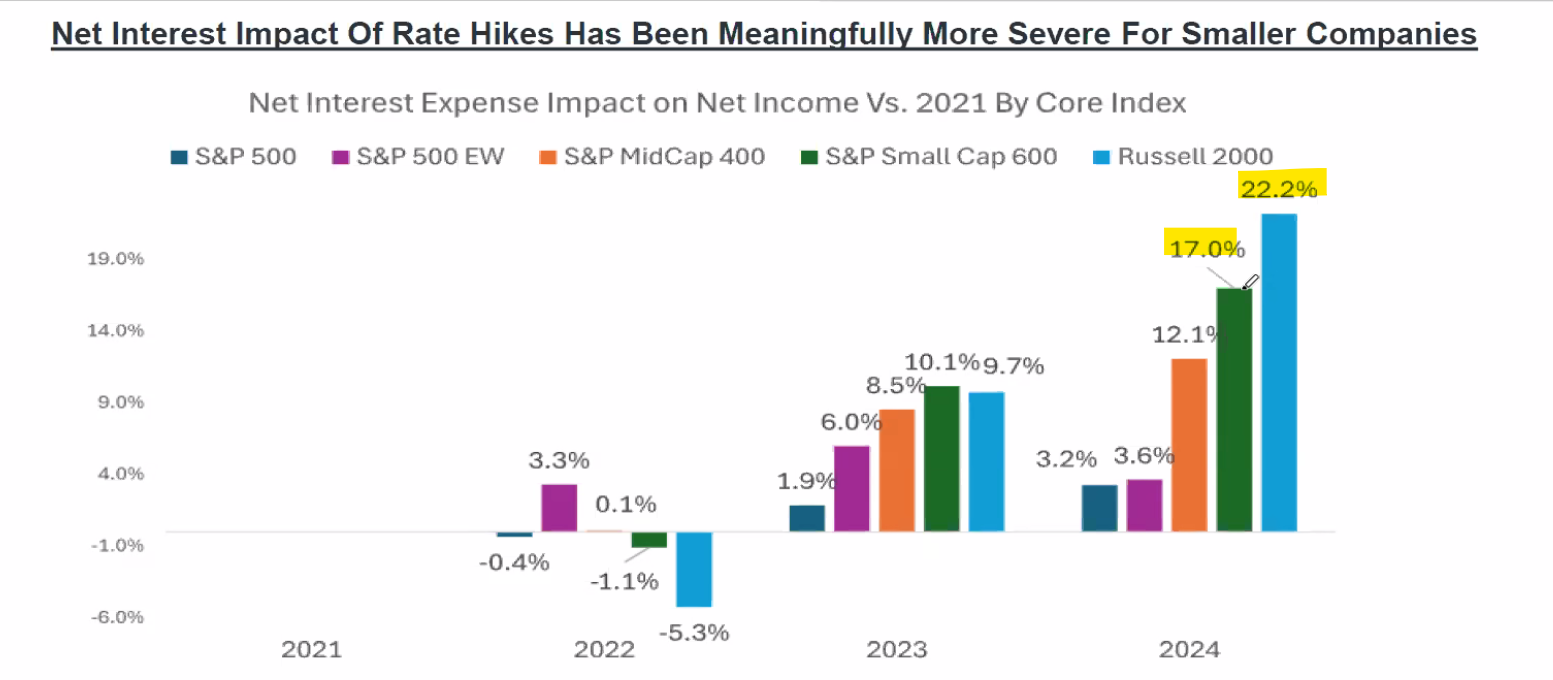

Dave: and small caps in particular being hammered by the shift to a higher interest rate regime

Source: Raymond James as of June 2025

Source: Raymond James as of June 2025

Dave: An obvious tailwind for larger US tech companies is the explosion in artificial intelligence (AI), clearly reflected in the extreme growth of data usage

Brett: and while we get short periods when investors anticipate a slowing in the rate of AI growth, the AI leaders have continued to roar back and drive performance

Brad: A weaker US dollar gets discussed often, as a tailwind to earnings, but the actual impact is not that large

Data as of June 2025

Data as of June 2025

John Luke: so most of the earnings (and performance) leadership has been driven by superior fundamentals

Data as of 07.21.2025

Data as of 07.21.2025

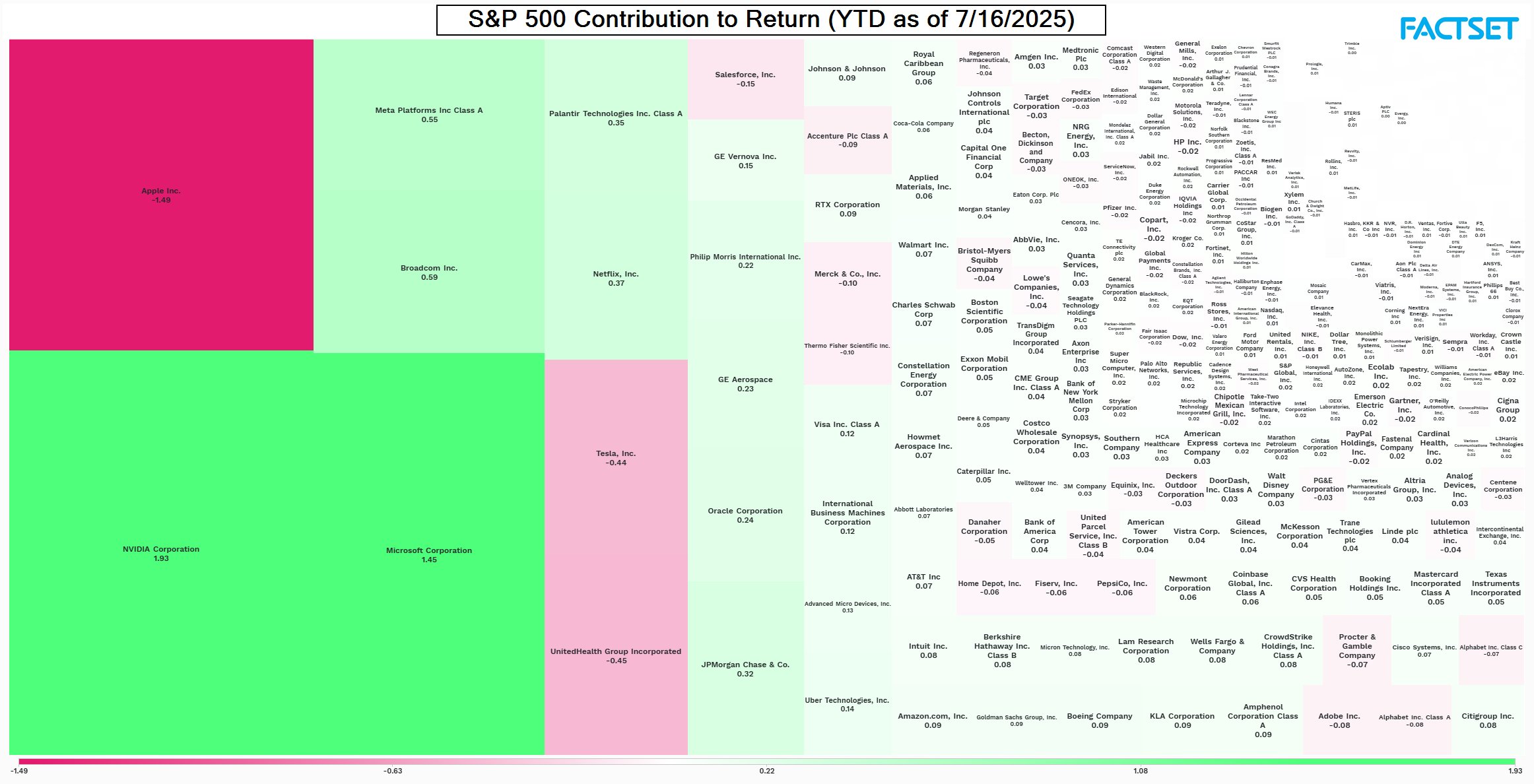

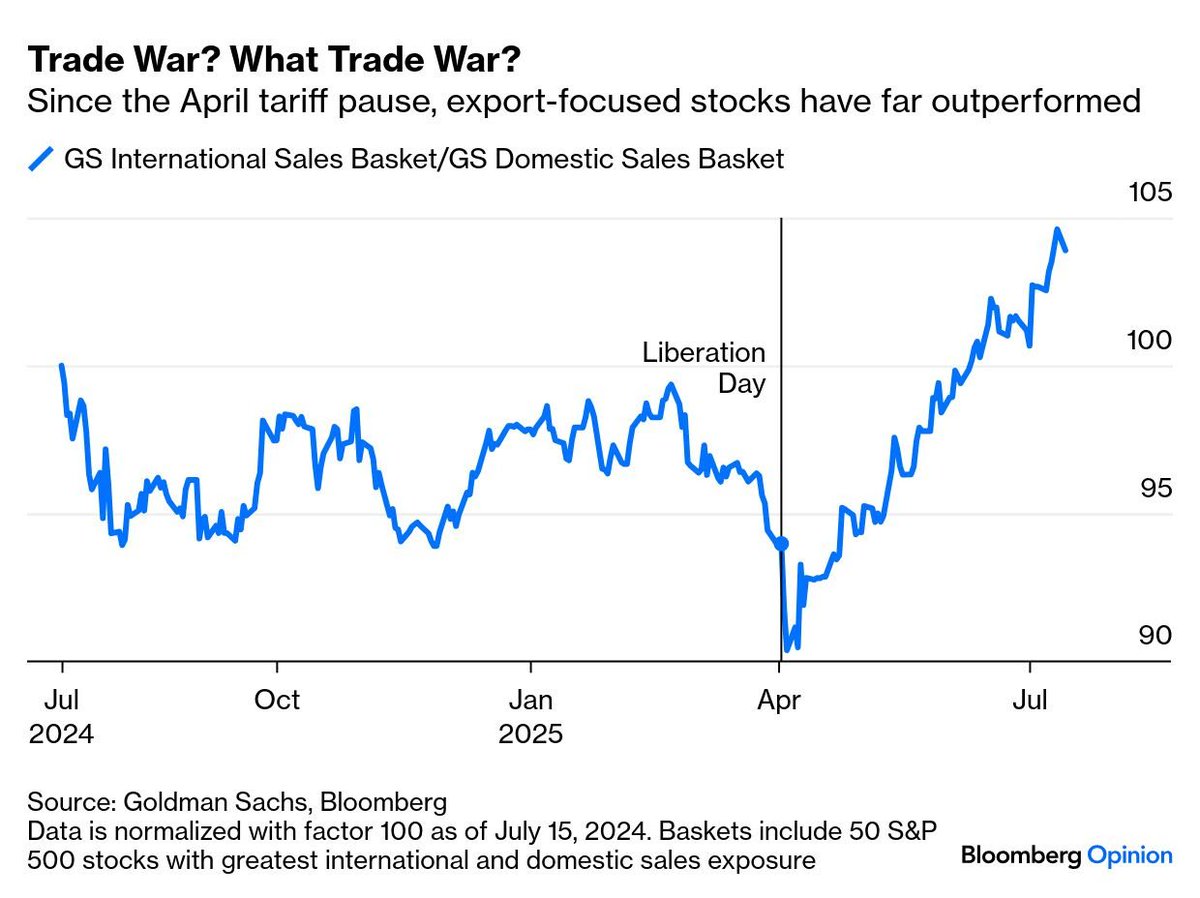

Ten: US exporters are doing just fine, regardless of tariff concerns

Data as of 07.16.2025

Data as of 07.16.2025

Arch: building on a US-centric ability for businesses to adapt and grow better than foreign companies

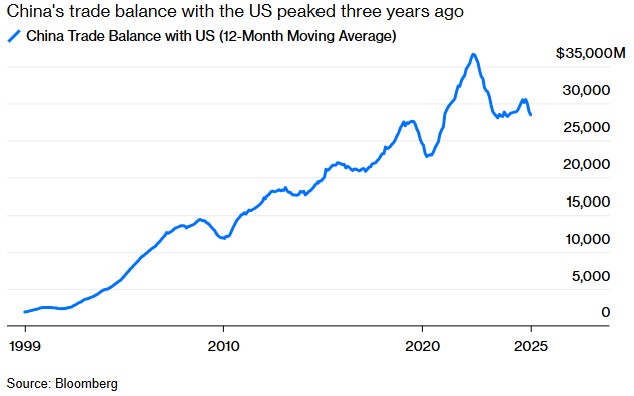

Jake: And while China benefitted dramatically from US companies’ desire to cut costs

Data as of 07.16.2025

Data as of 07.16.2025

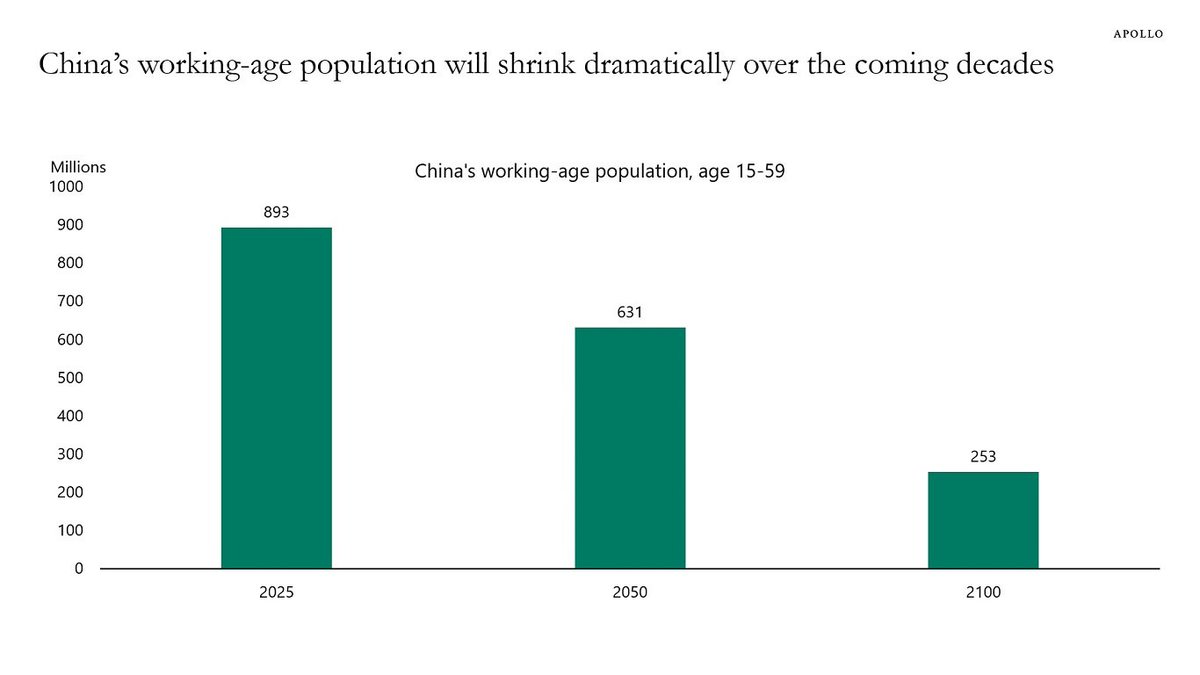

Beckham: its rise in economic strength faces a serious demographic challenge

Source: Apollo as of 07.23.2025

Source: Apollo as of 07.23.2025

Brad: Markets have likely benefitted from structural liquidity flowing into financial assets

Dave: but that support starts disappearing as the summer heat fades

Source: Strategas as of 07.14.2025

Source: Strategas as of 07.14.2025

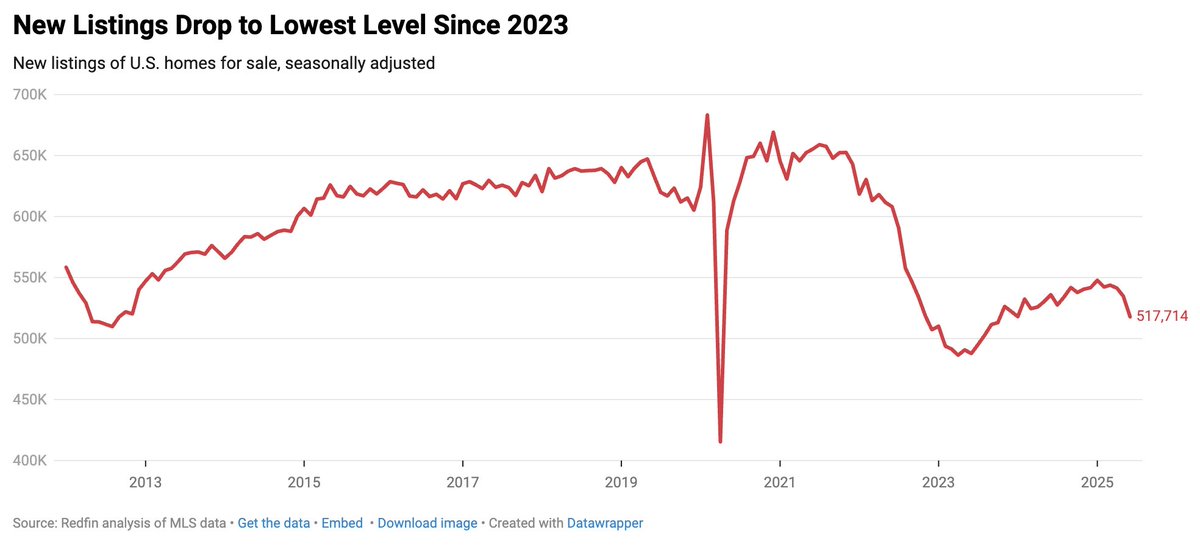

Joseph: One piece of the economy that’s clearly NOT clicking is housing, as activity continues to fall

Data as of 07.22.2025

Data as of 07.22.2025

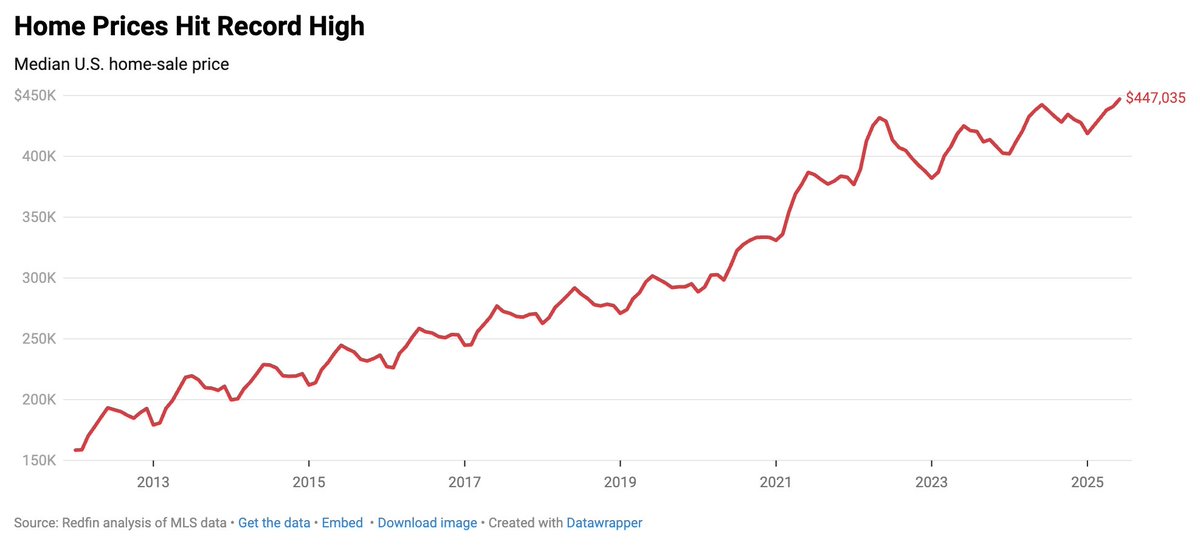

Joseph: and the backdrop of low listings and high prices makes it really hard for aspirational homeowners to enter the market

Data as of 07.22.2025

Data as of 07.22.2025

JD: But just like individual stocks can have their own bull and bear markets, real estate dynamics are generally tied to local conditions

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2507-25.