Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

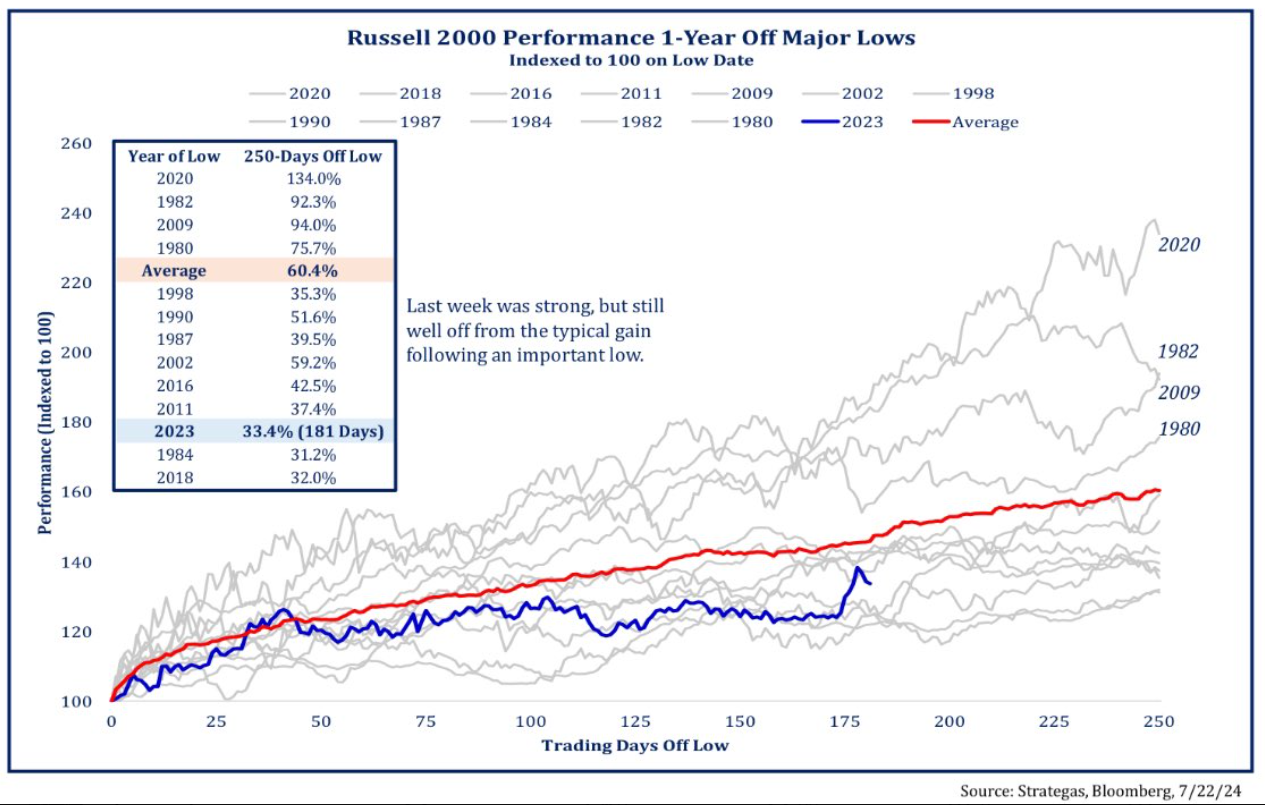

Brad: Smaller stocks are still lagging their historical recovery pace

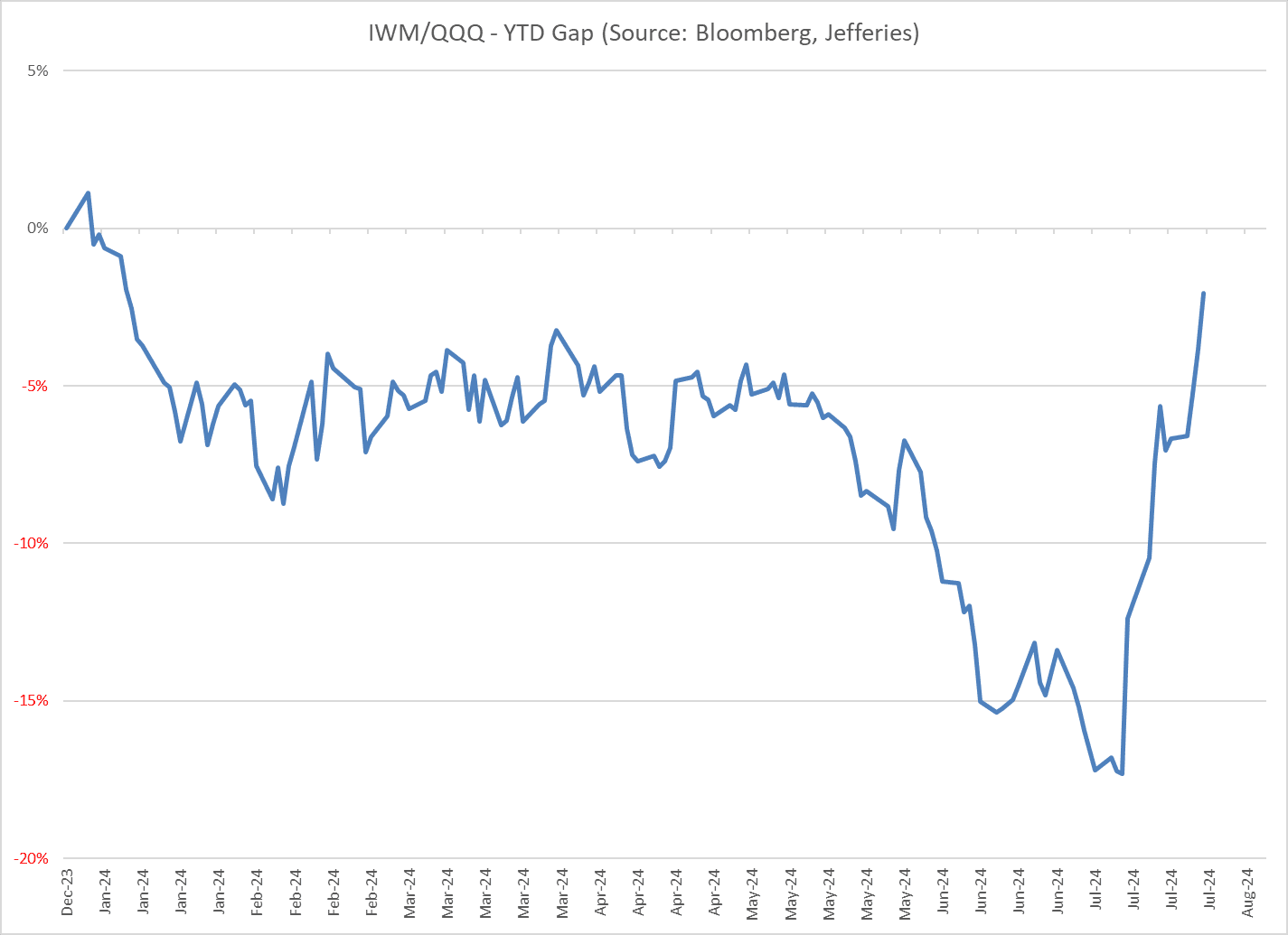

Dave: but they sure as heck made up some ground on large caps in the past two weeks!

Data as of 07.25.2024

Data as of 07.25.2024

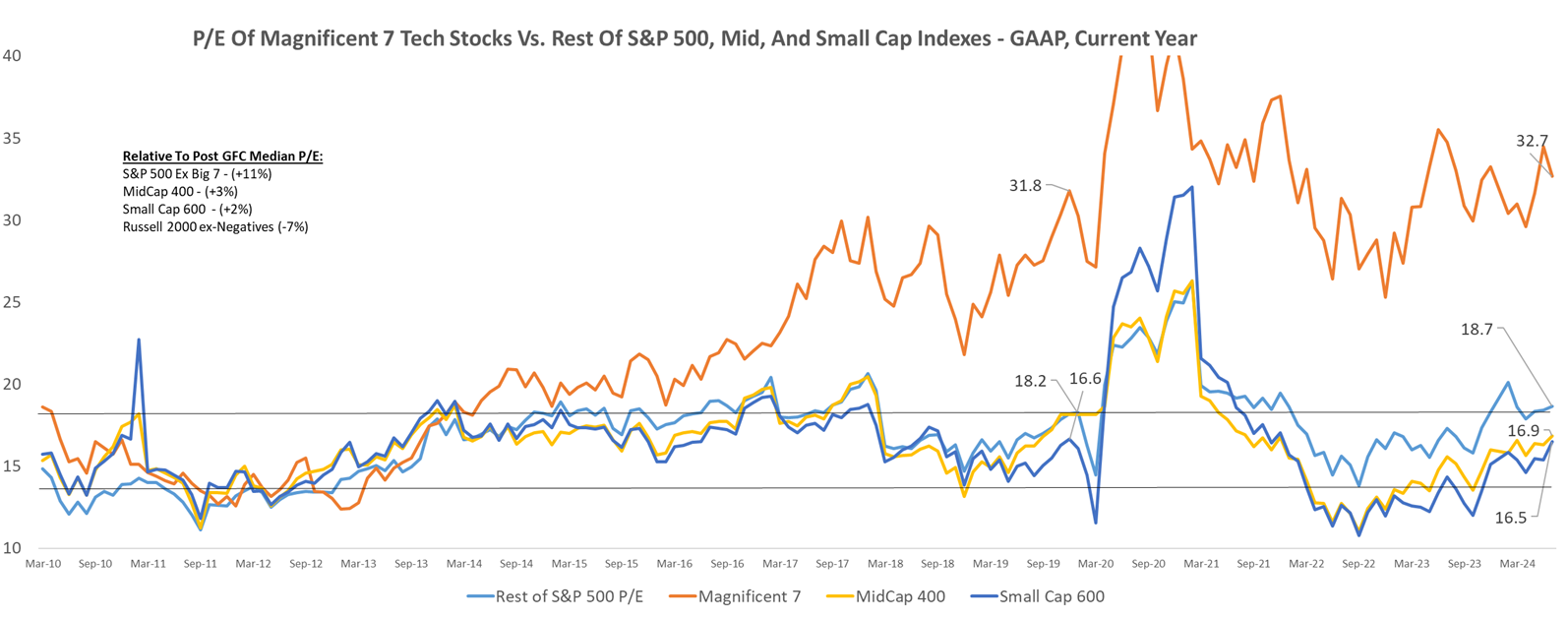

Beckham: Those small caps do have the advantage of much lower valuations than the popular megacap tech stocks

Source: Raymond James as of 07.26.2024

Source: Raymond James as of 07.26.2024

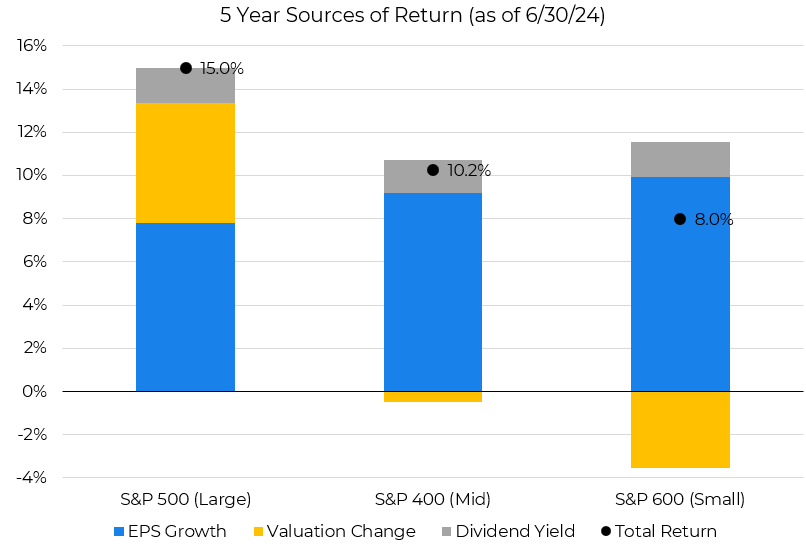

Brian: with rising valuations driving much of the difference in small vs. large performance in recent years

Source: Aptus via Morningstar

Source: Aptus via Morningstar

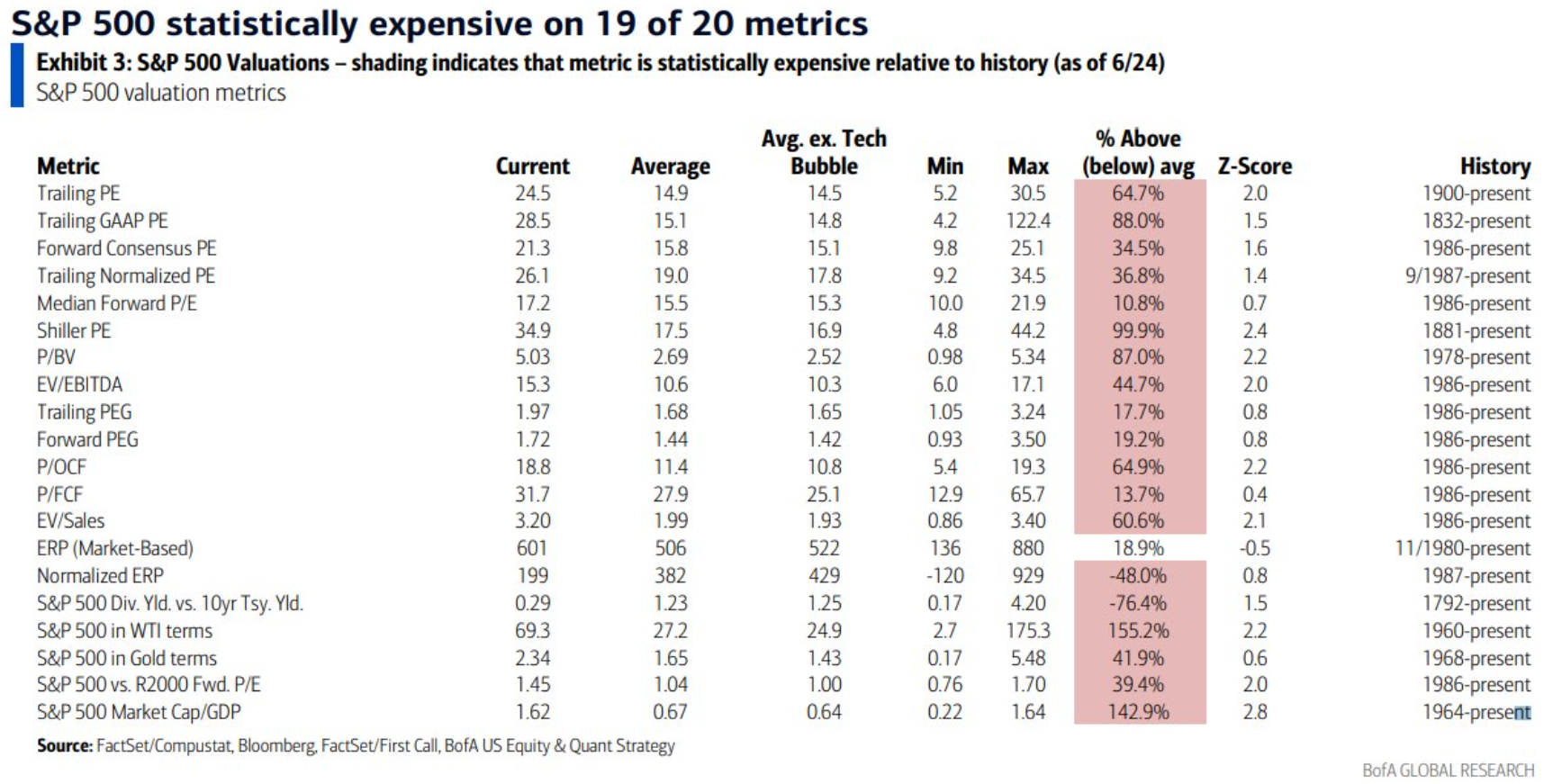

John Luke: and leaving large caps in a very expensive state compared to their historical valuations

Data as of 07.19.2024

Data as of 07.19.2024

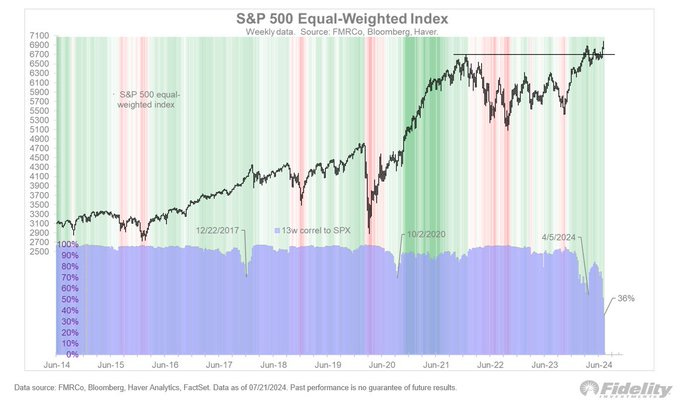

Arch: The cap-weighted and equal-weighted versions of the S&P 500 (same stocks!) have completely split apart in recent months

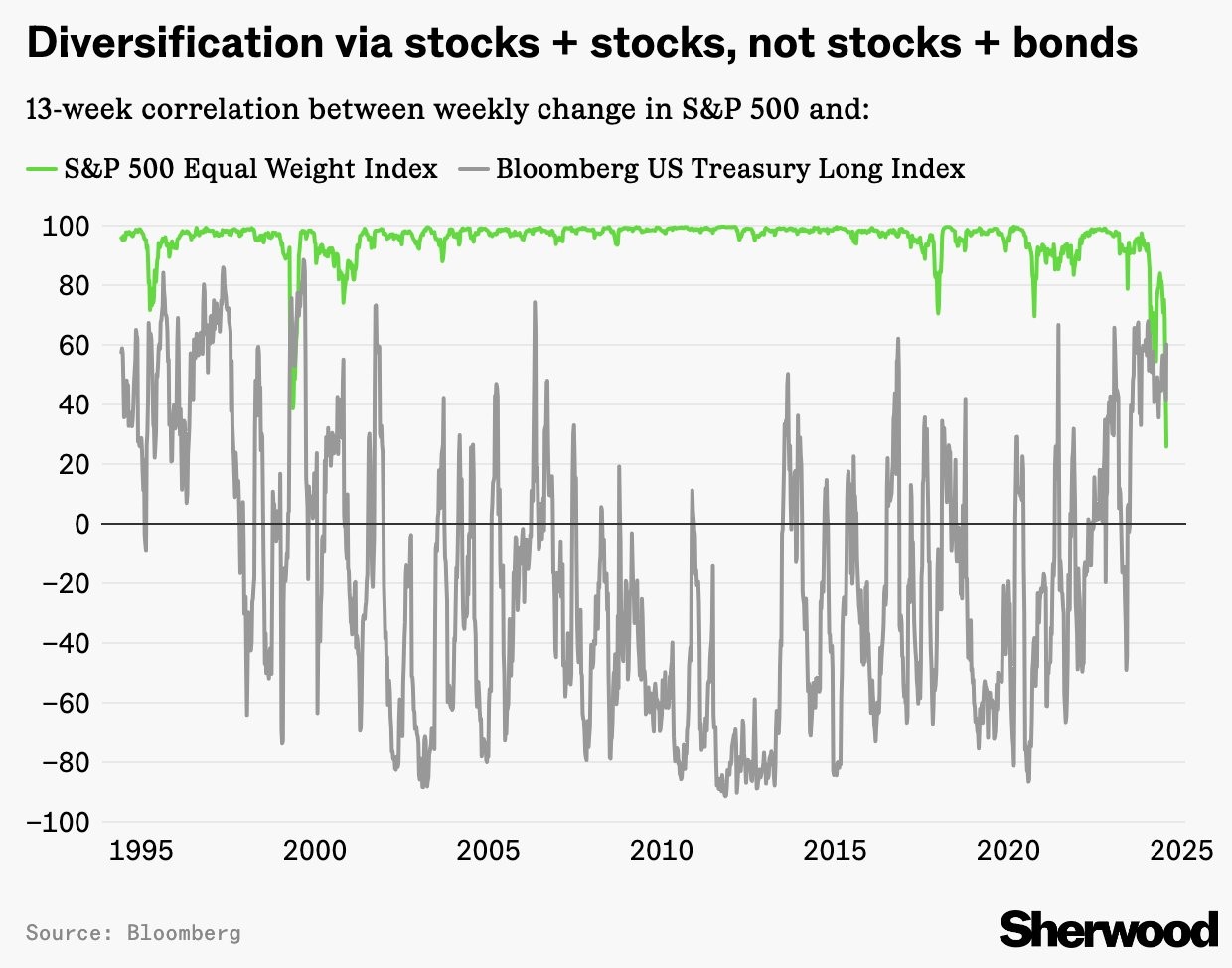

Brett: leaving S&P 500 stocks even less correlated to each other than they’ve been to bonds

Data as of 07.24.2024

Data as of 07.24.2024

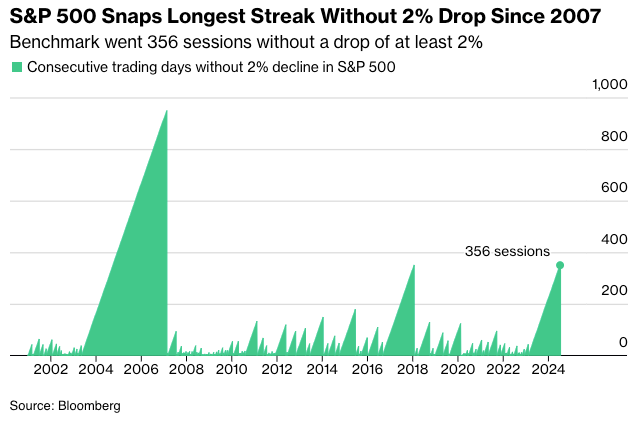

Joseph: We finally saw the 2% one-day drop that had eluded the S&P 500 for 16 months

Data as of 07.25.2024

Data as of 07.25.2024

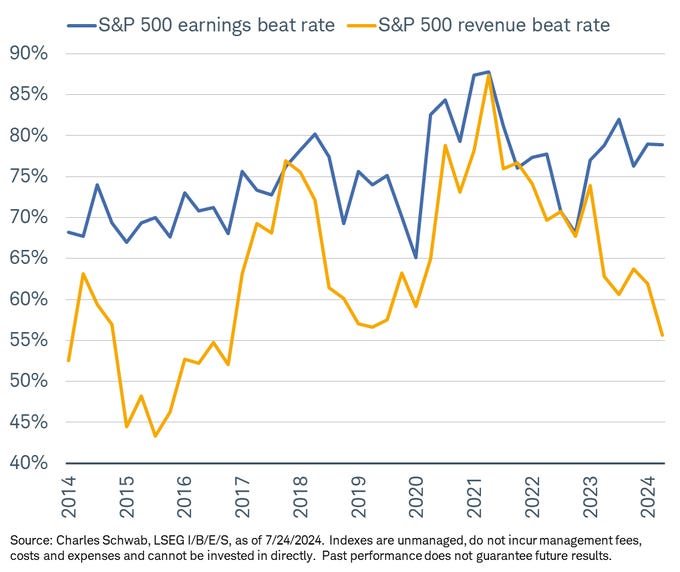

Brett: maybe triggered by the lack of sales growth behind some key earnings reports

JD: There are some components of inflation measures that just aren’t able to be tackled by Fed policy

Data as of June 2024

Data as of June 2024

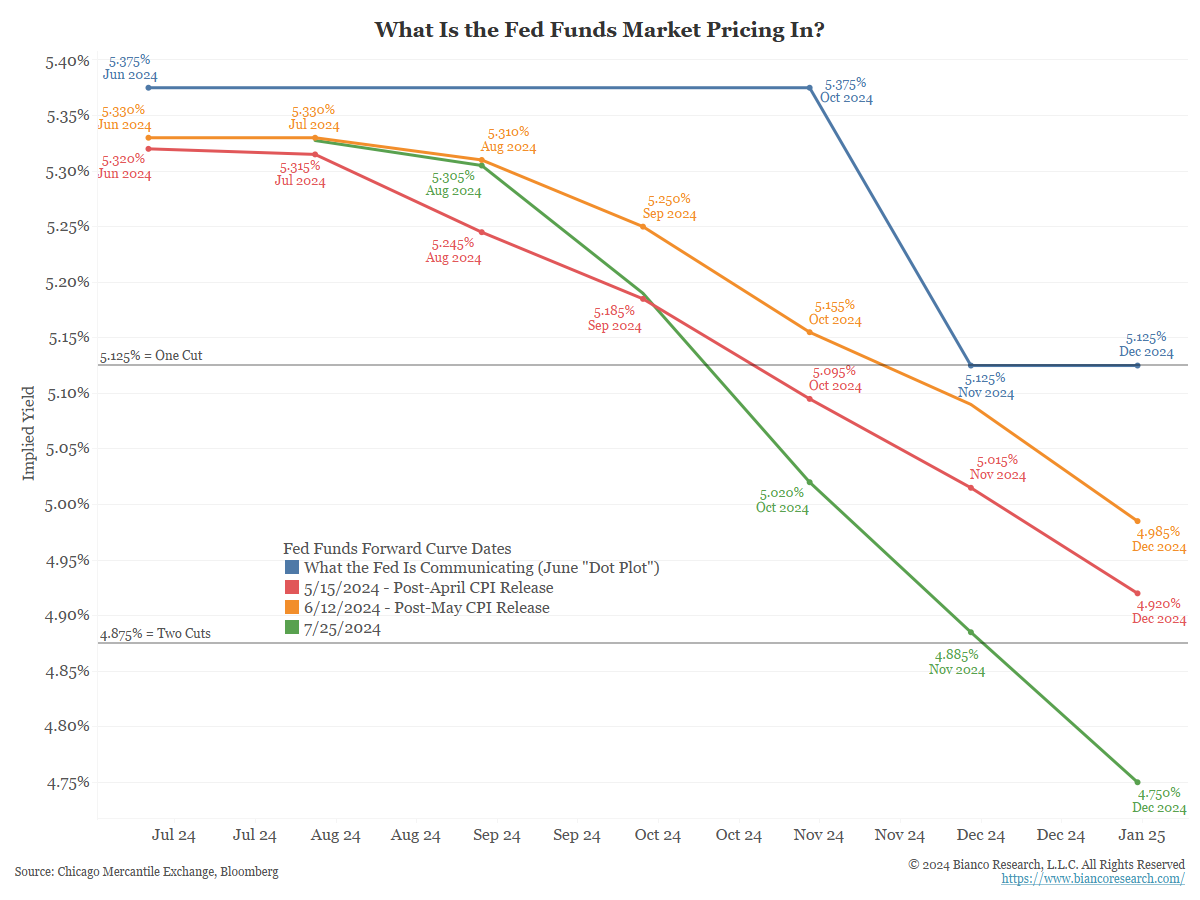

John Luke: and markets are again getting more aggressive in pricing in 2024 FOMC rate cuts

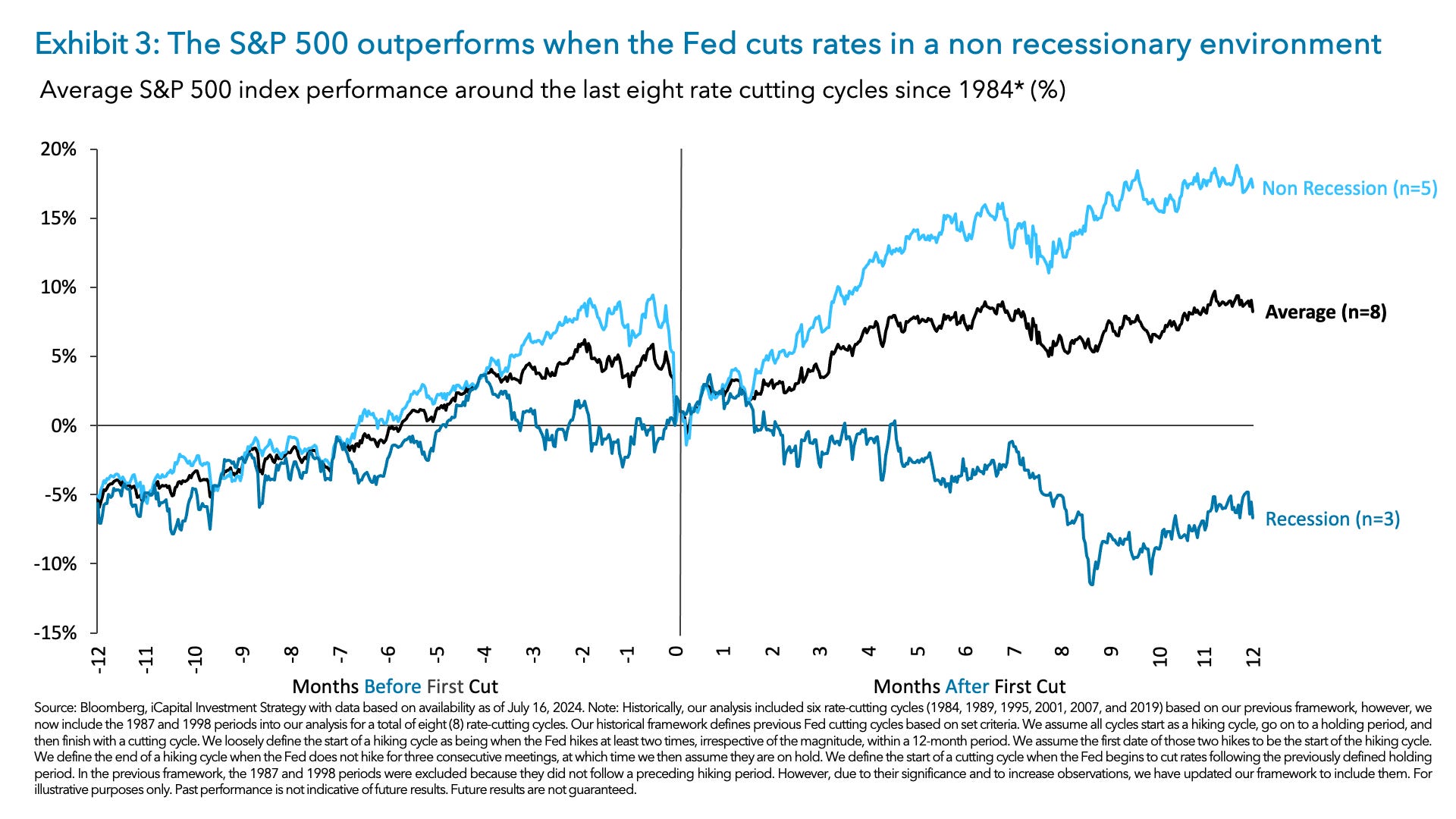

Arch: as it has in the past, how stocks respond to cuts will likely be driven by the overall growth of the economy

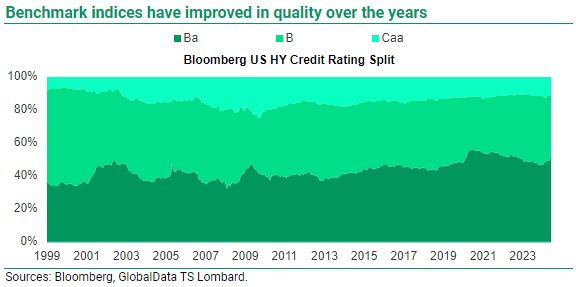

Joseph: While not very attractive due to compressed yields, the credit status of high-yield bonds has improved slightly in recent years

Data as of June 2024

Data as of June 2024

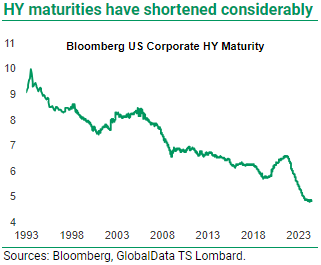

Joseph: though more issuers may face refinancing challenges as maturities have shortened

Data as of June 2024

Data as of June 2024

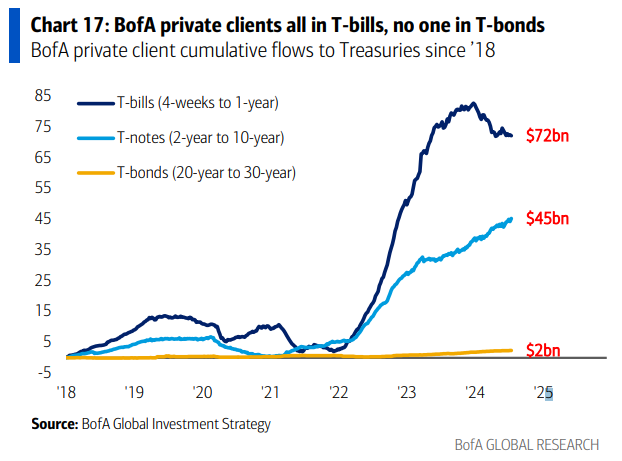

Brian: Investors have fallen in love with T-bills and even Notes, but still have little interest in locking in yields beyond that

Data as of June 2024

Data as of June 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2407-33.