Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and why:

Dave: The start of earnings season was a story of “not bad”, with lower price movement than usual for both hits and misses…

Source: Strategas as of 07.25.2022

Source: Strategas as of 07.25.2022

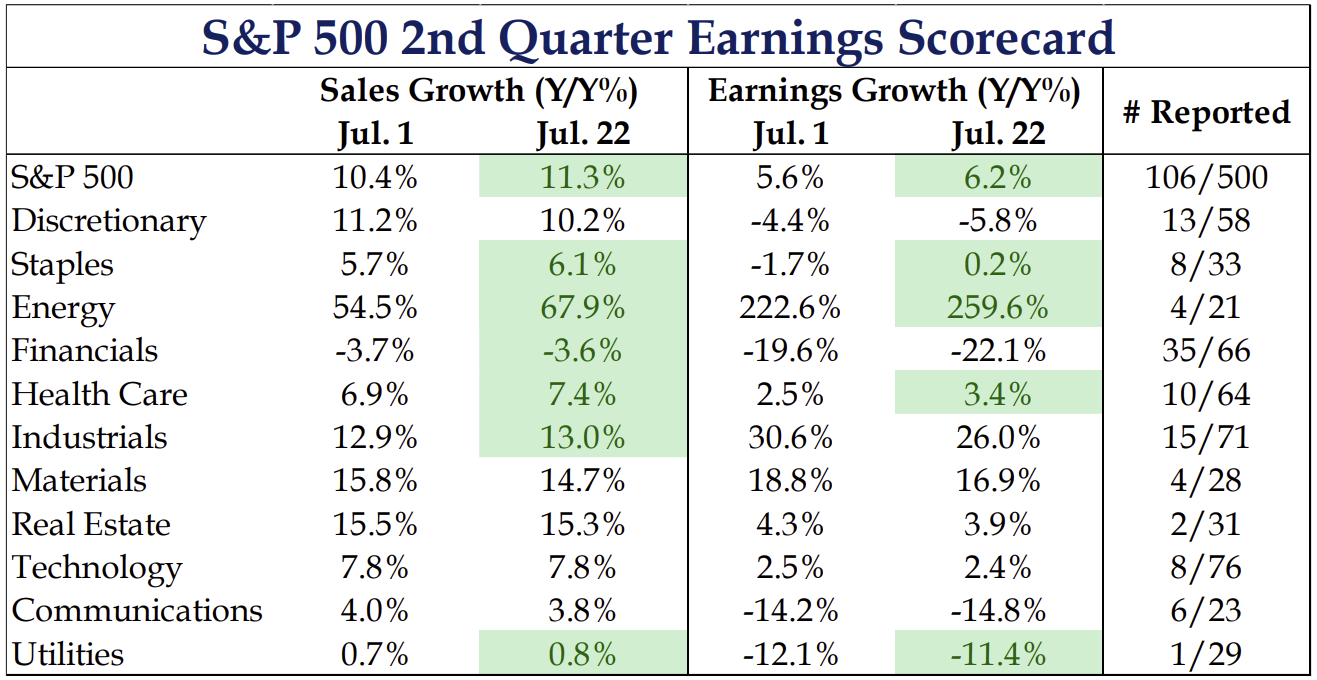

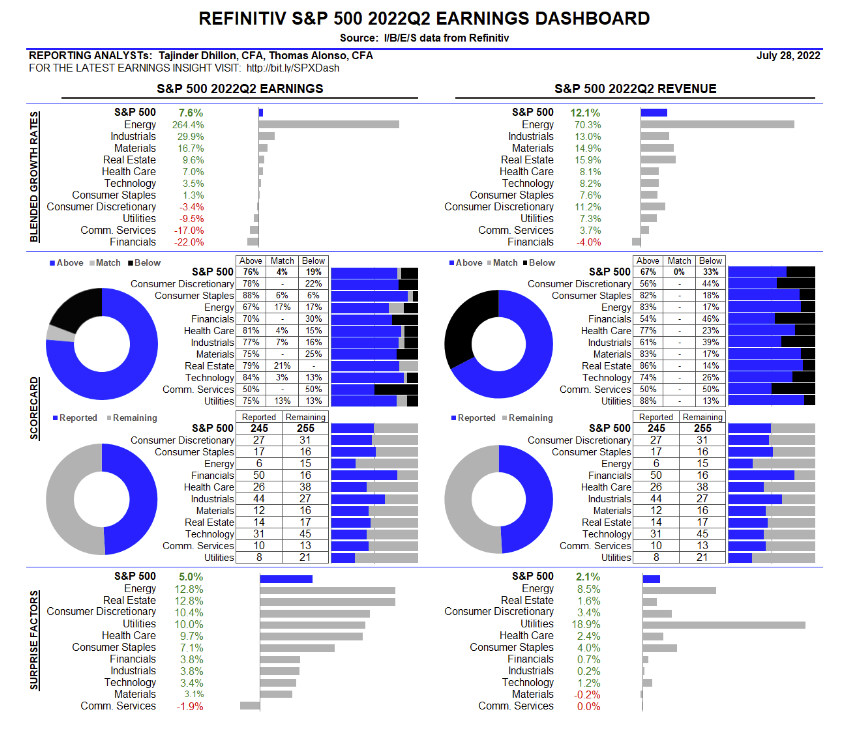

…and by the end of the week with a clearer picture of decent earnings and stronger sales

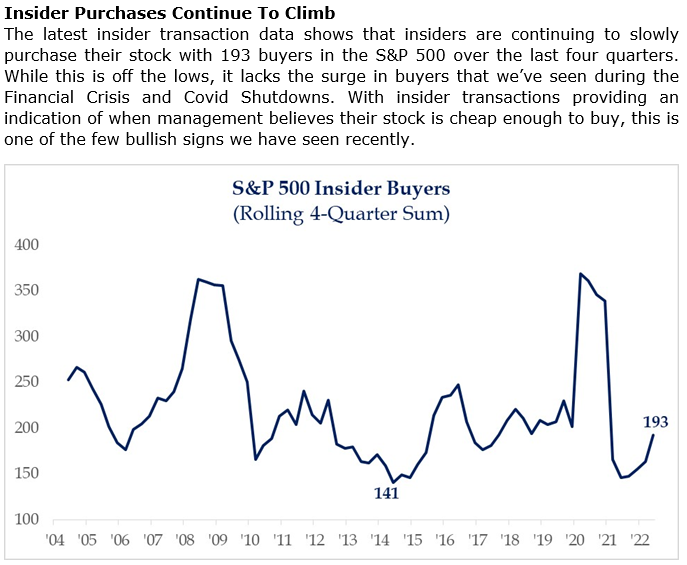

Brad: Insiders showing signs of starting to put money to work at lower prices

Source: Strategas as of 07.26.2022

Source: Strategas as of 07.26.2022

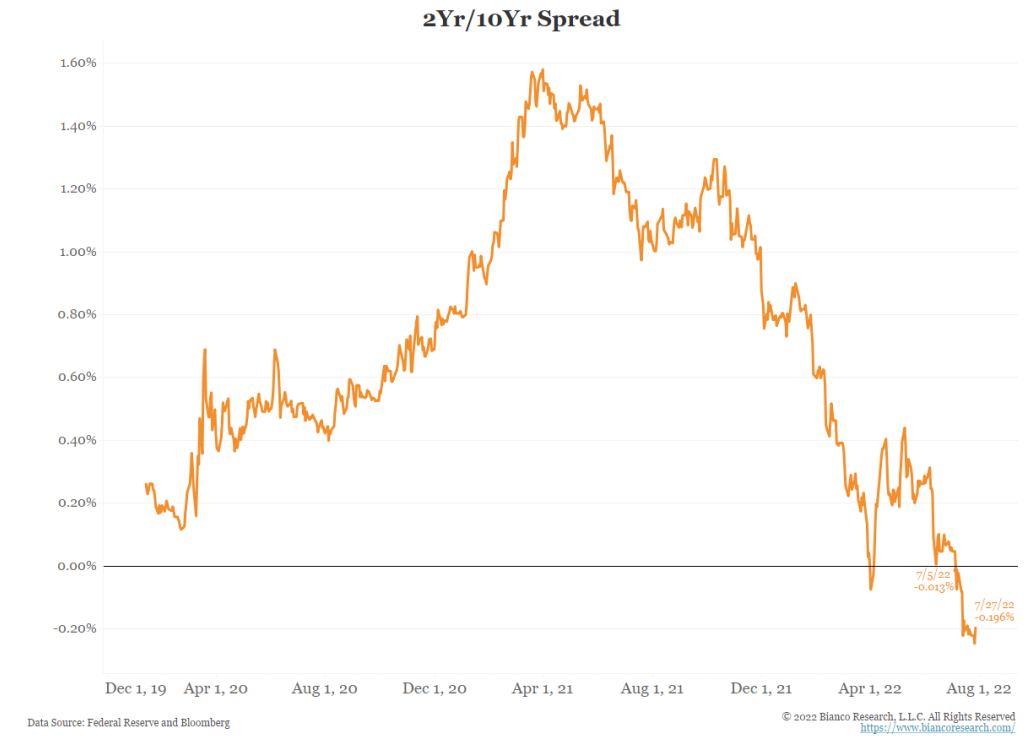

JL: The yield curve continues to head negative…

Data as of 07.27.2022

Data as of 07.27.2022

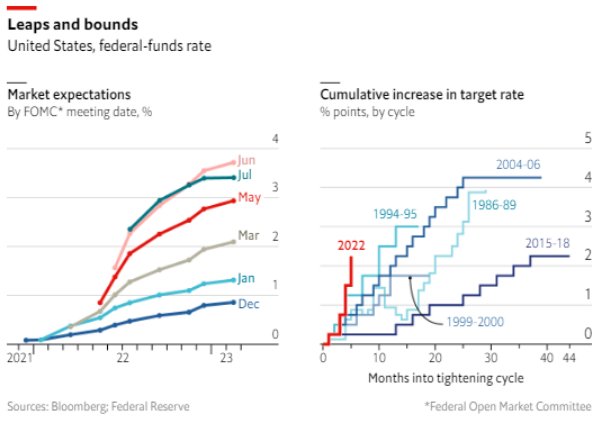

…as markets adjust to the Fed’s historically sharp interest rate hiking cycle

Source: Bianco as of 07.27.2022

Source: Bianco as of 07.27.2022

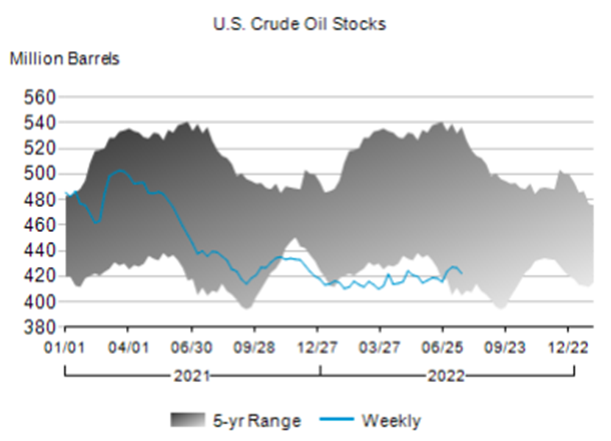

Joseph: US crude oil supply is trickling along near its lows…

Source: EIA as 07.27.2022

Source: EIA as 07.27.2022

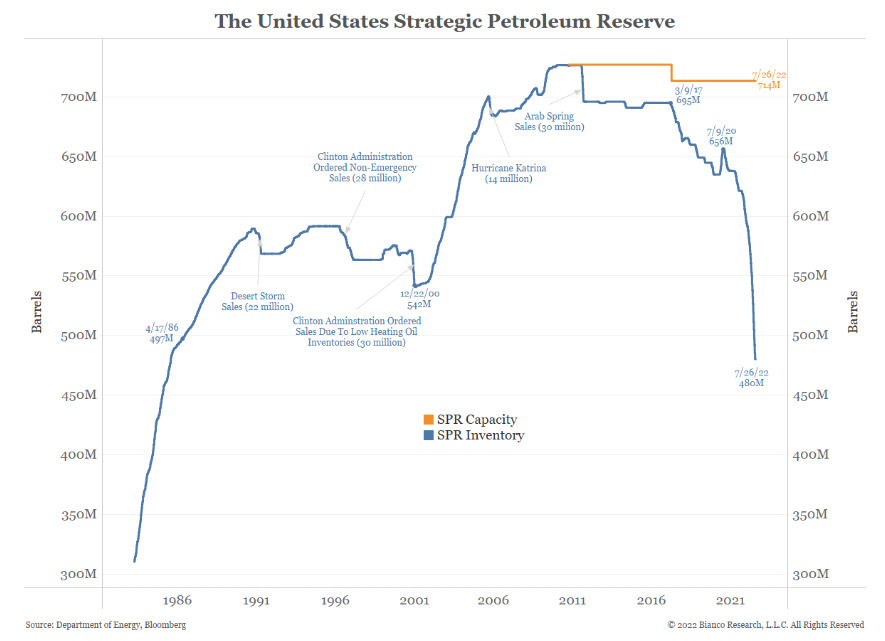

…despite a large draw from our Strategic Petroleum Reserves

Data as of 07.26.2022

Data as of 07.26.2022

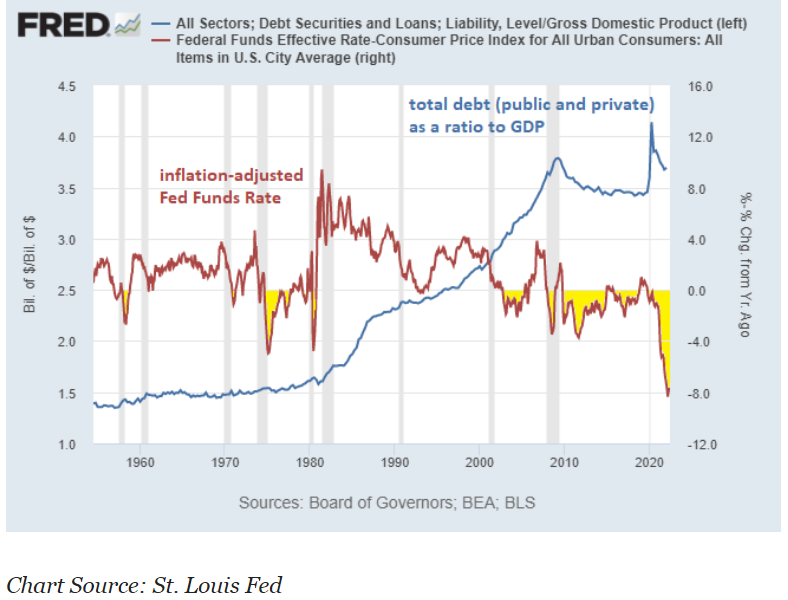

JL: The Fed has one eye on economic data but likely also aware of the large debt expansion in recent decades

Source: Lyn Alden as of 07.27.2022

Source: Lyn Alden as of 07.27.2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Treasury yield is the return on investment, expressed as a percentage, on the U.S. government’s debt obligations. Looked at another way, the Treasury yield is the effective interest rate that the U.S. government pays to borrow money for different lengths of time.

Fixed income securities are subject to certain risks including, but not limited to: interest rate (changes in interest rates may cause a decline in market value or an investment), credit, prepayment, call (some bonds allow the issuer to call a bond for redemption before it matures), and extension (principal repayments may not occur as quickly as anticipated, causing the expected maturity of a security to increase).

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2207-33.