Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

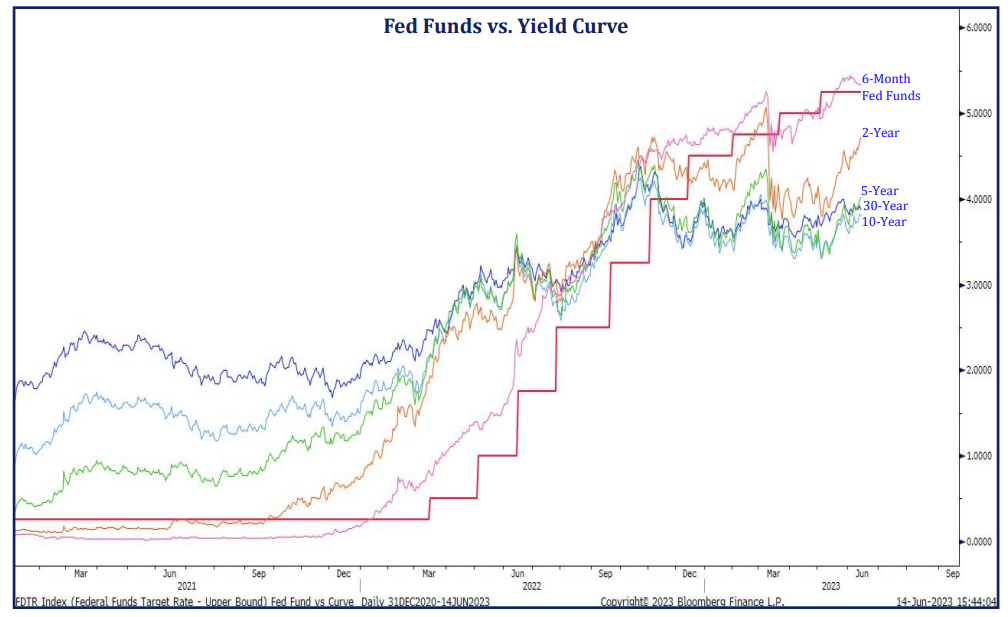

John Luke: Most of the yield curve has separated itself from the Fed Funds rate, with seemingly no rush to sync up

Source: Strategas as of 06.14.2023

Source: Strategas as of 06.14.2023

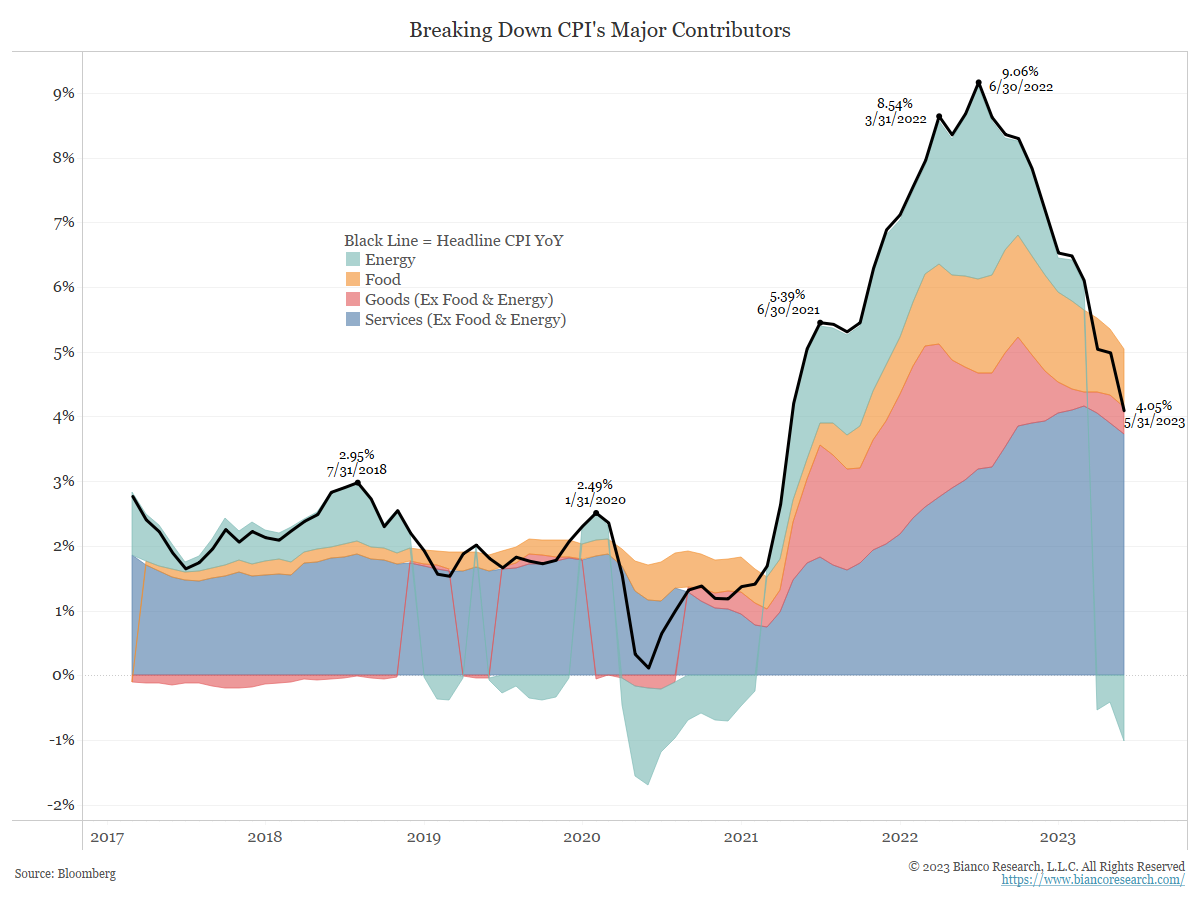

John Luke: Clearly the Fed sees that inflation means more than just the latest CPI headline

Source: US Bureau of Labor Statistics as of 6.15.2023

Source: US Bureau of Labor Statistics as of 6.15.2023

John Luke: with services being a stickier item than goods ever was

Source: Bianco Research as of 5.31.2023

Source: Bianco Research as of 5.31.2023

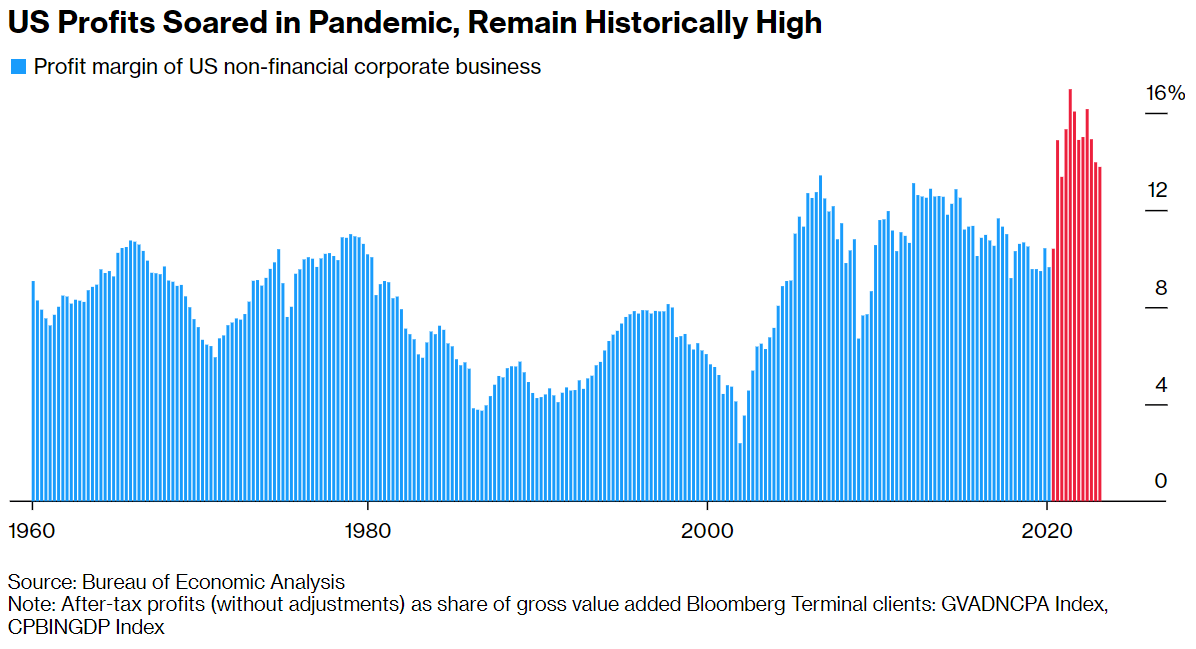

John Luke: For better or worse, corporate profit margins remain off the charts

Source: Bloomberg as of 5.31.2023

Source: Bloomberg as of 5.31.2023

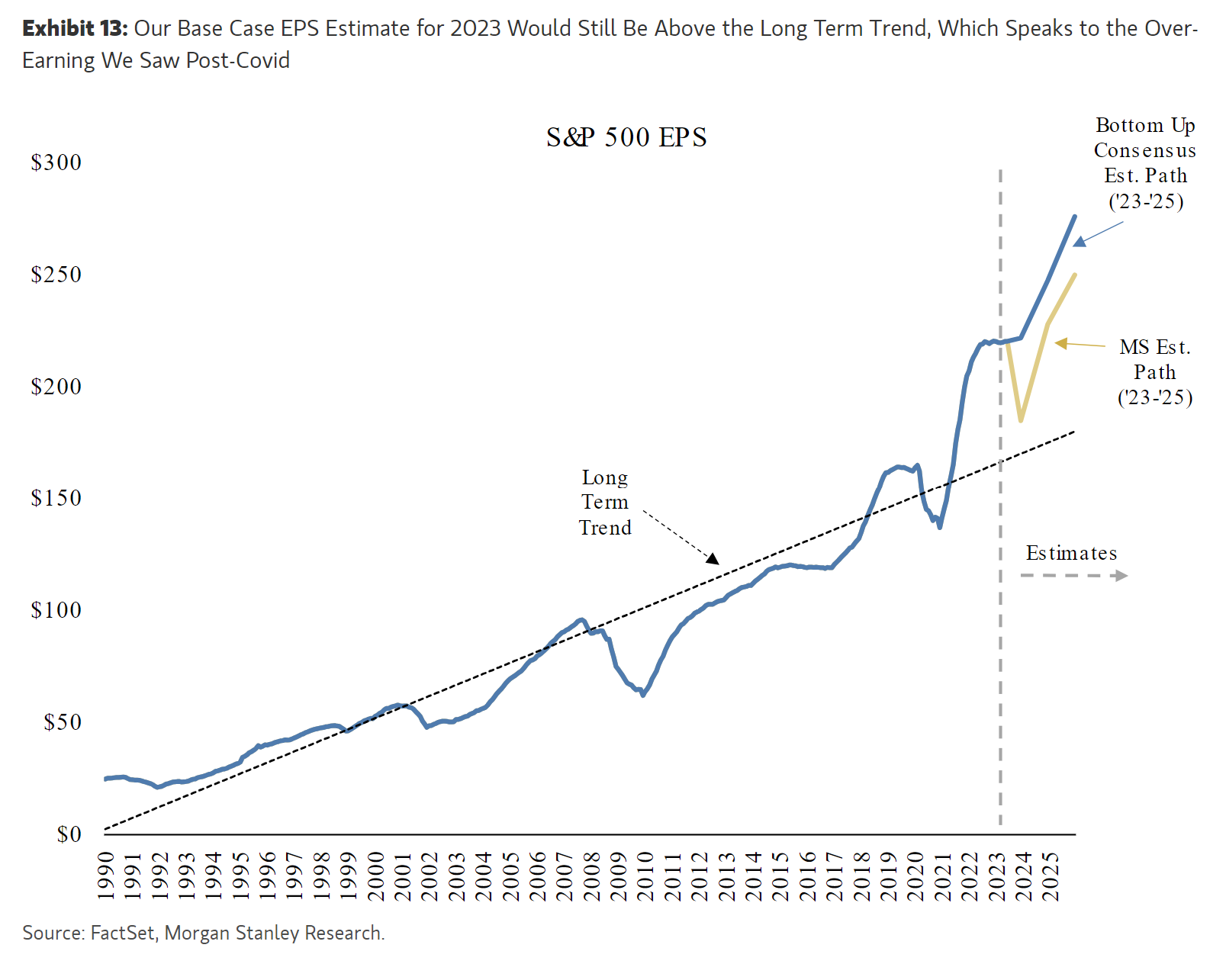

Dave: and based on future earnings estimates, strategists think this will remain the case

Source: Morgan Stanley as of 6.15.2023

Source: Morgan Stanley as of 6.15.2023

John Luke: The impact of quantitative easing is most obvious in the huge expansion of the Fed’s balance sheet

Source: Strategas as of 06.12.2023

Source: Strategas as of 06.12.2023

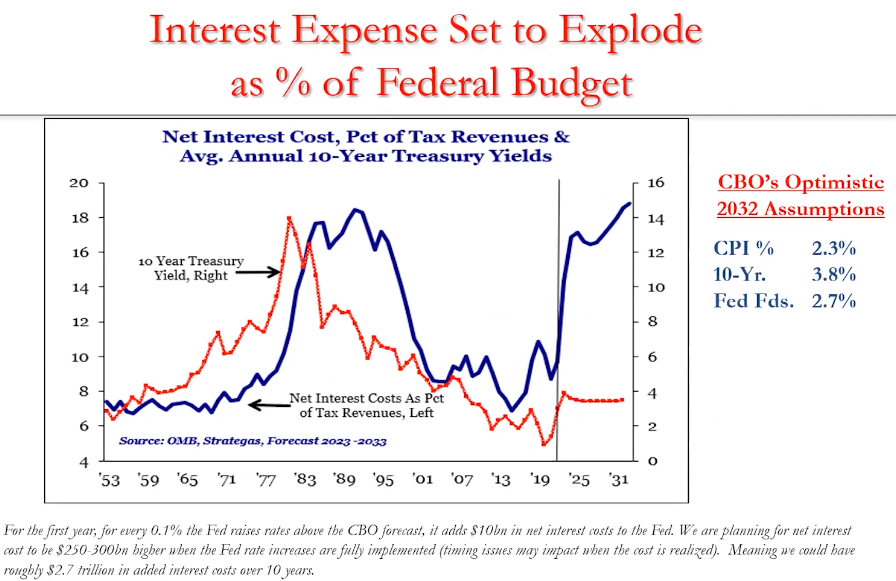

John Luke: which will be tougher to maintain as higher rates push interest expense higher

Source: Strategas as of 6.14.2023

Source: Strategas as of 6.14.2023

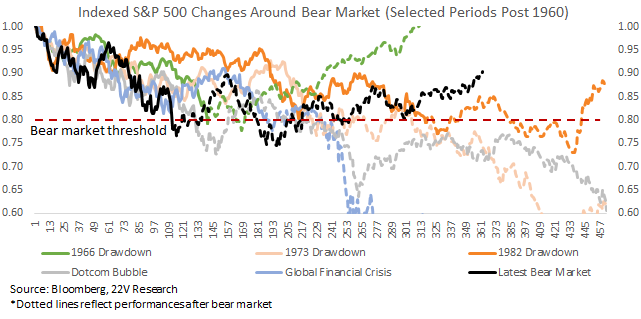

Dave: Judging by recent bear markets, this strength is too much to maintain a “bear market” label

Source: Bloomberg as of 06.14.2023

Source: Bloomberg as of 06.14.2023

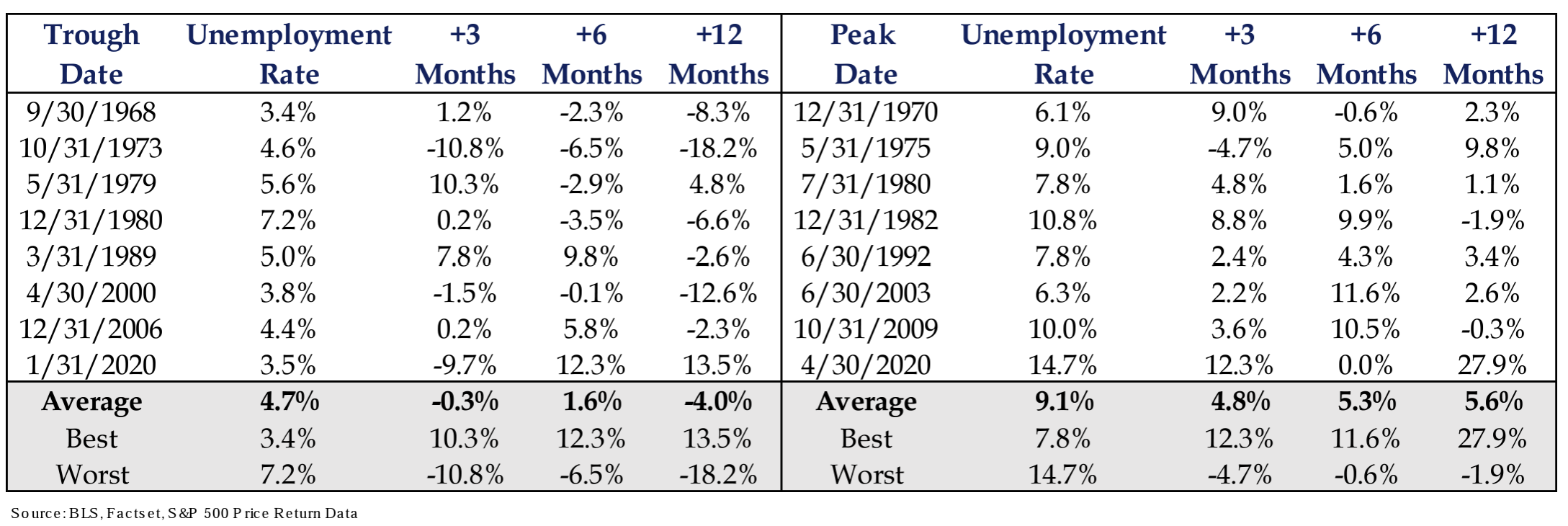

Dave: but bear markets generally end with high unemployment, not record lows

Source: BLS as of 6.16.2023

Source: BLS as of 6.16.2023

John Luke: and with valuations so high

Source: Strategas as of 6.12.2023

Source: Strategas as of 6.12.2023

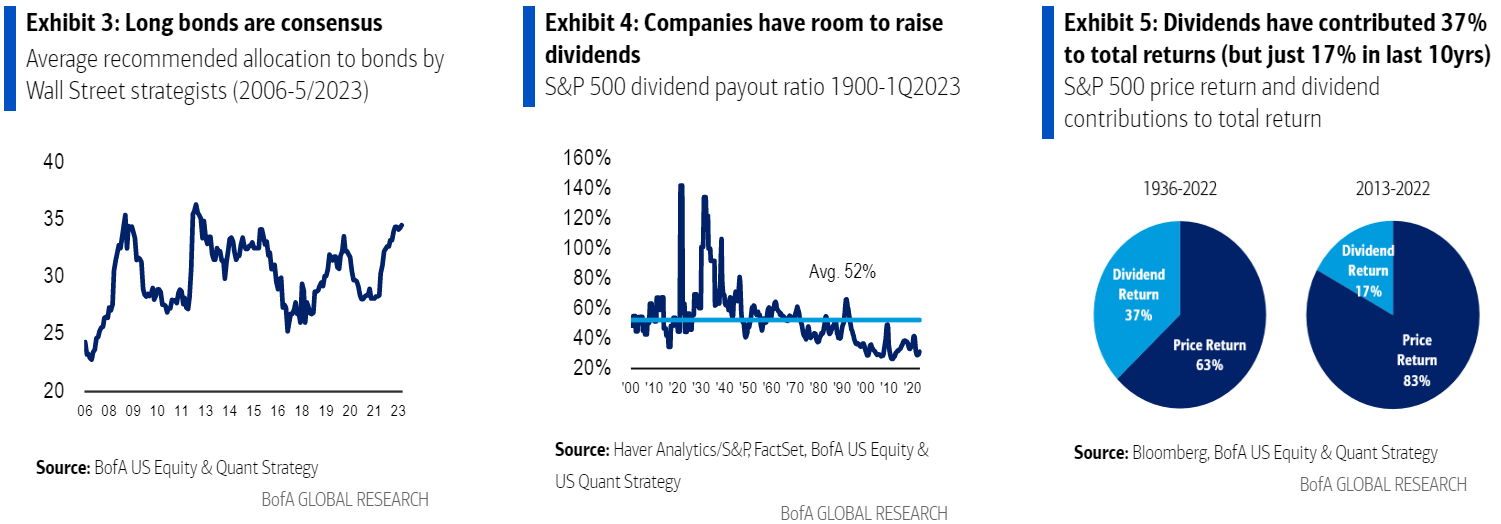

John Luke: Investors have been flocking to these new higher rates in bonds, but may be missing a huge dividend growth opportunity

Source: Bank of America as of 6.15.2023

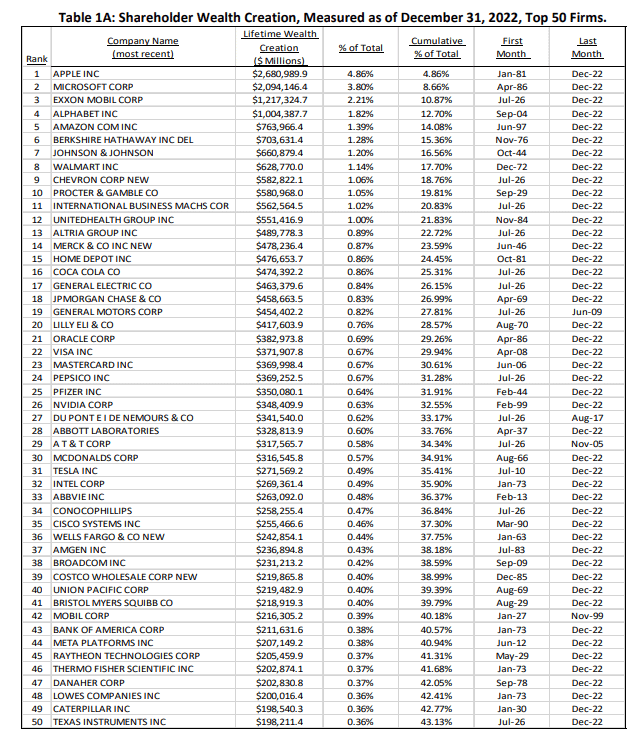

John Luke: Compounders can only do their thing if held for the long-term, interesting look at the past decade’s biggest wealth creators

Source: Mauboussin as of 12.31.2022

Source: Mauboussin as of 12.31.2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2306-15.