Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

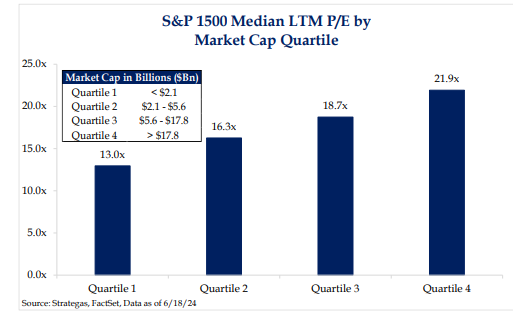

Dave: Bigger stocks have been rewarded with higher valuations

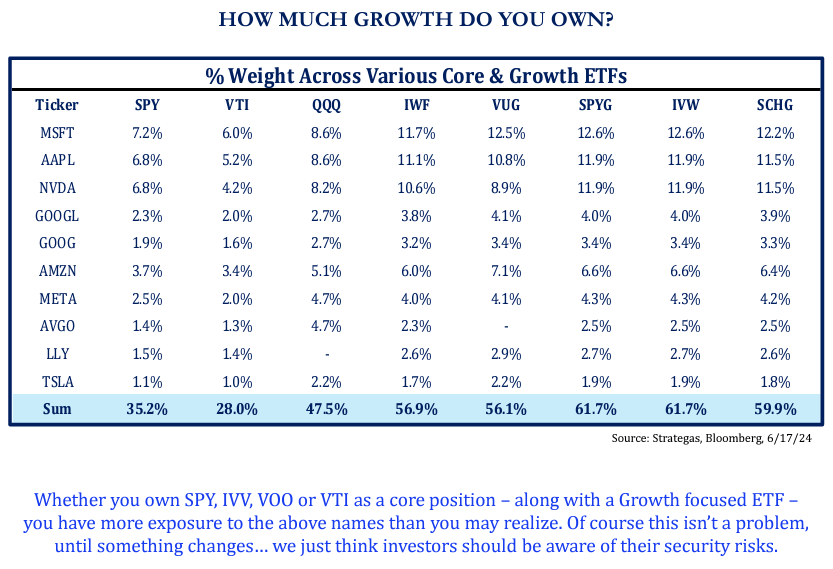

Brad: and the dominance of the biggest of the big makes them huge components across commonly used funds

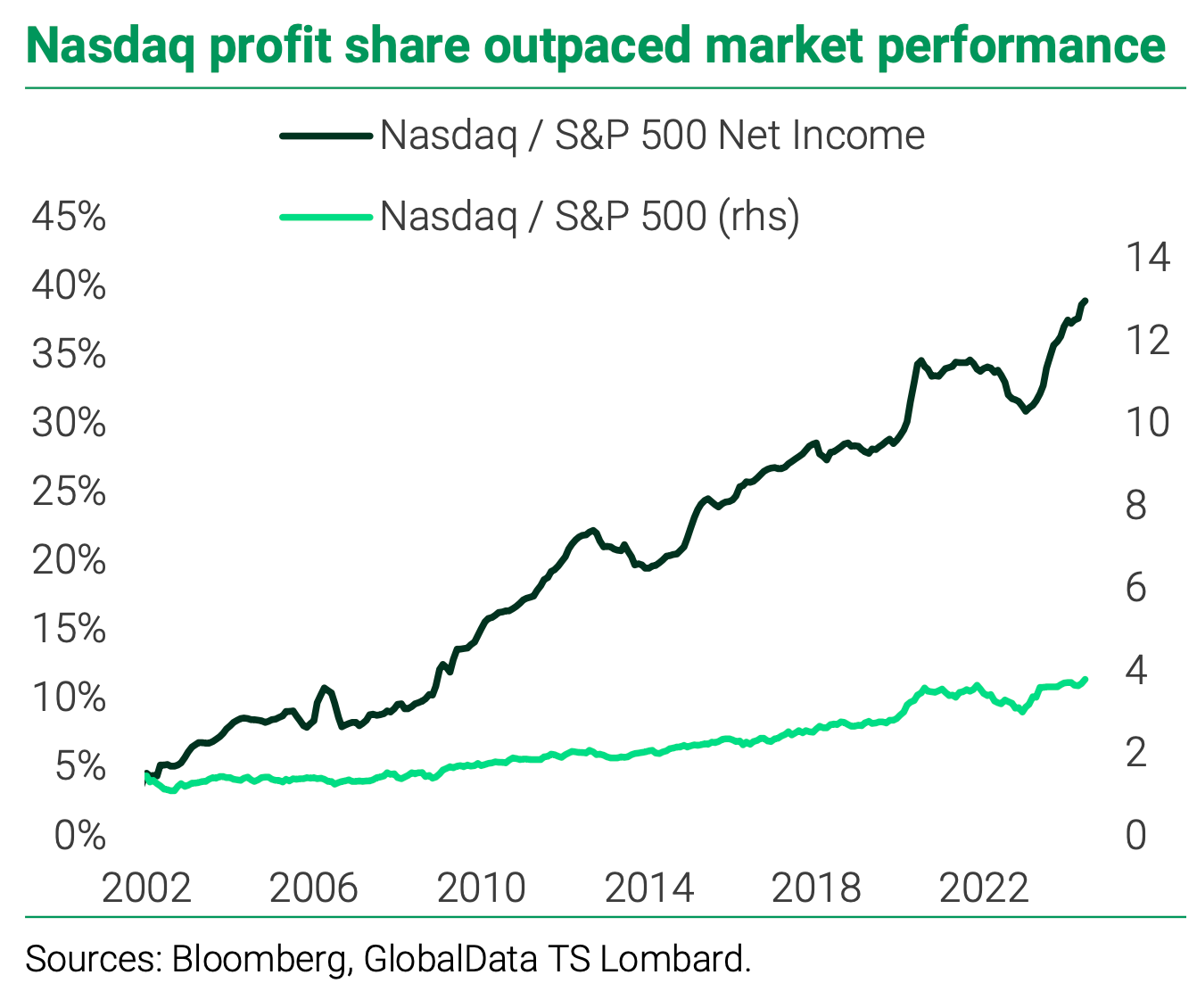

Beckham: that said, those big NASDAQ names have generally earned their leadership positions through consistent growth

Data as of May 2024

Data as of May 2024

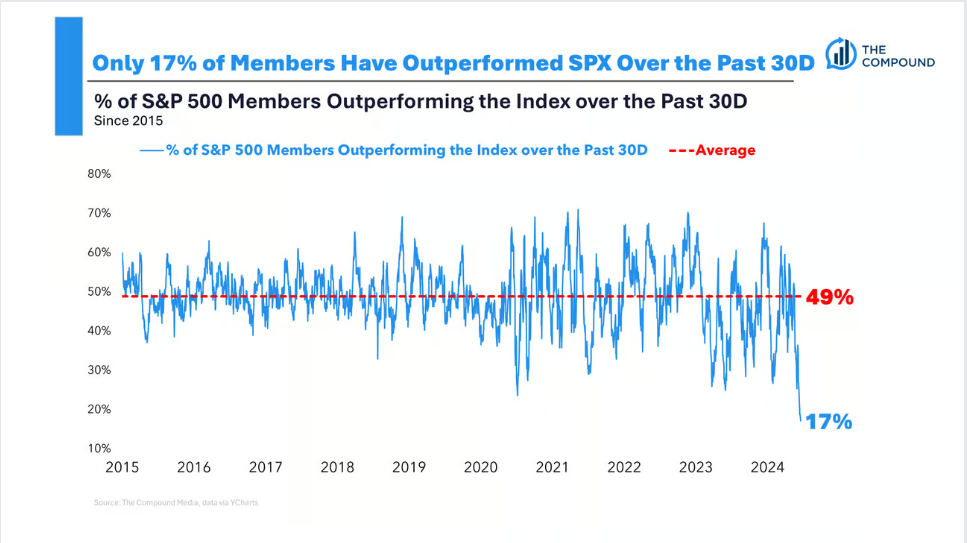

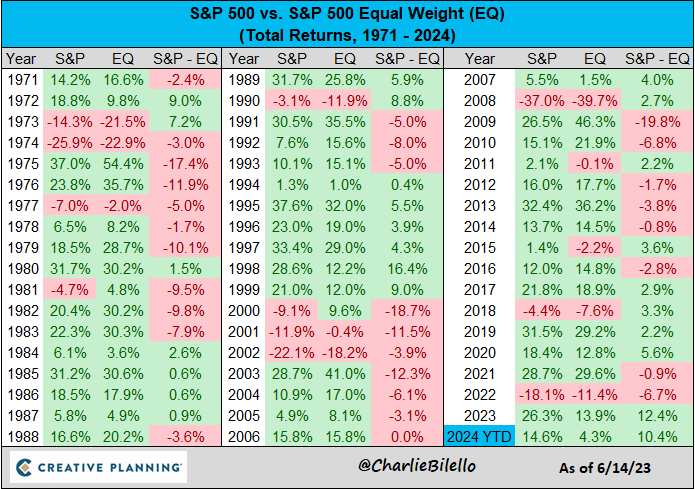

Brett: The other side of megacap domination is that very few stocks have been able to keep up with the S&P 500

Source: The Compound Media as of 06.18.2024

Source: The Compound Media as of 06.18.2024

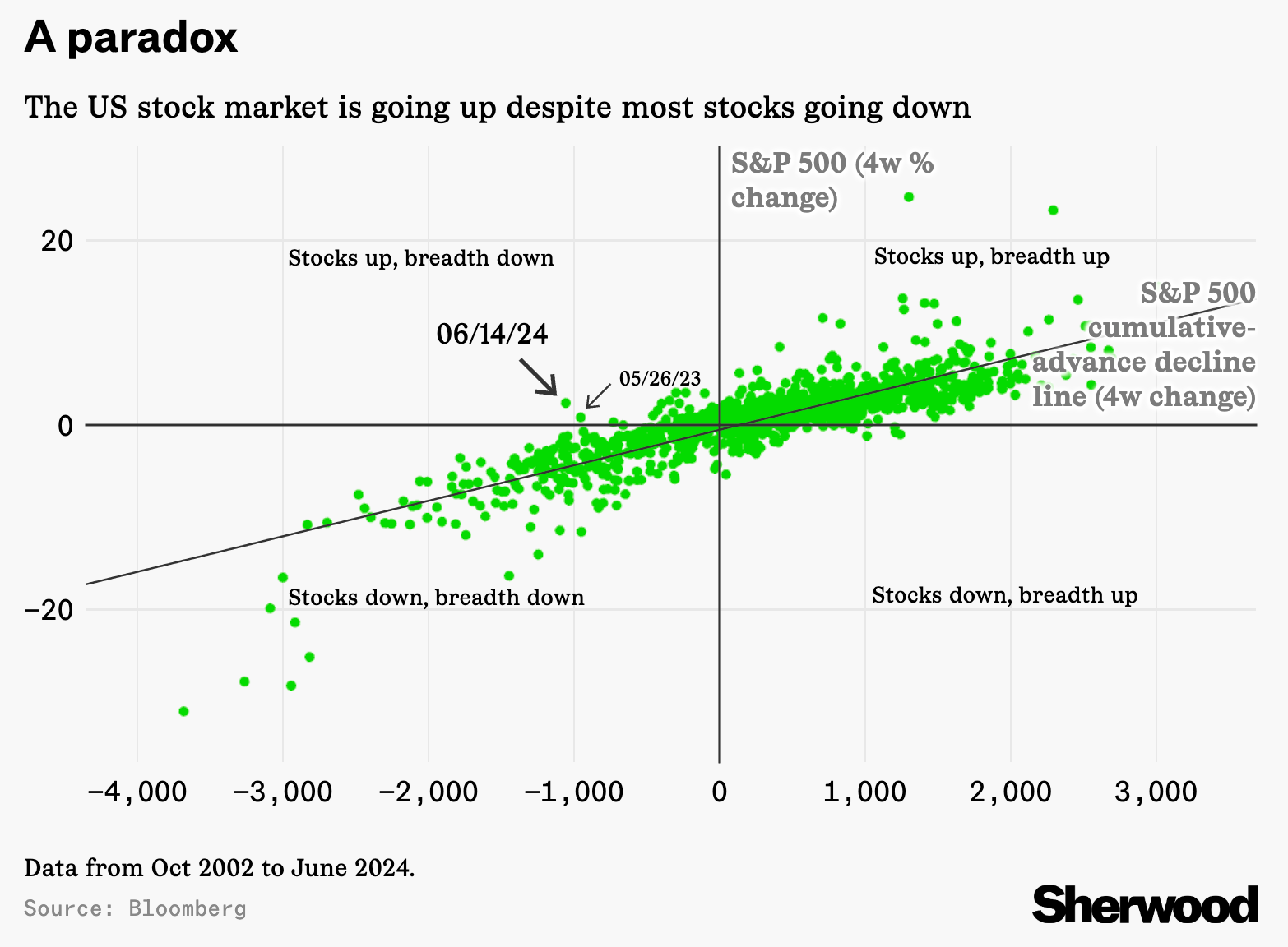

Arch: with the divergence between the broader market and the index a historical outlier

Joseph: and only 1998-99 eclipsing the current period for range of dispersion

Data as of 06.14.2024

Data as of 06.14.2024

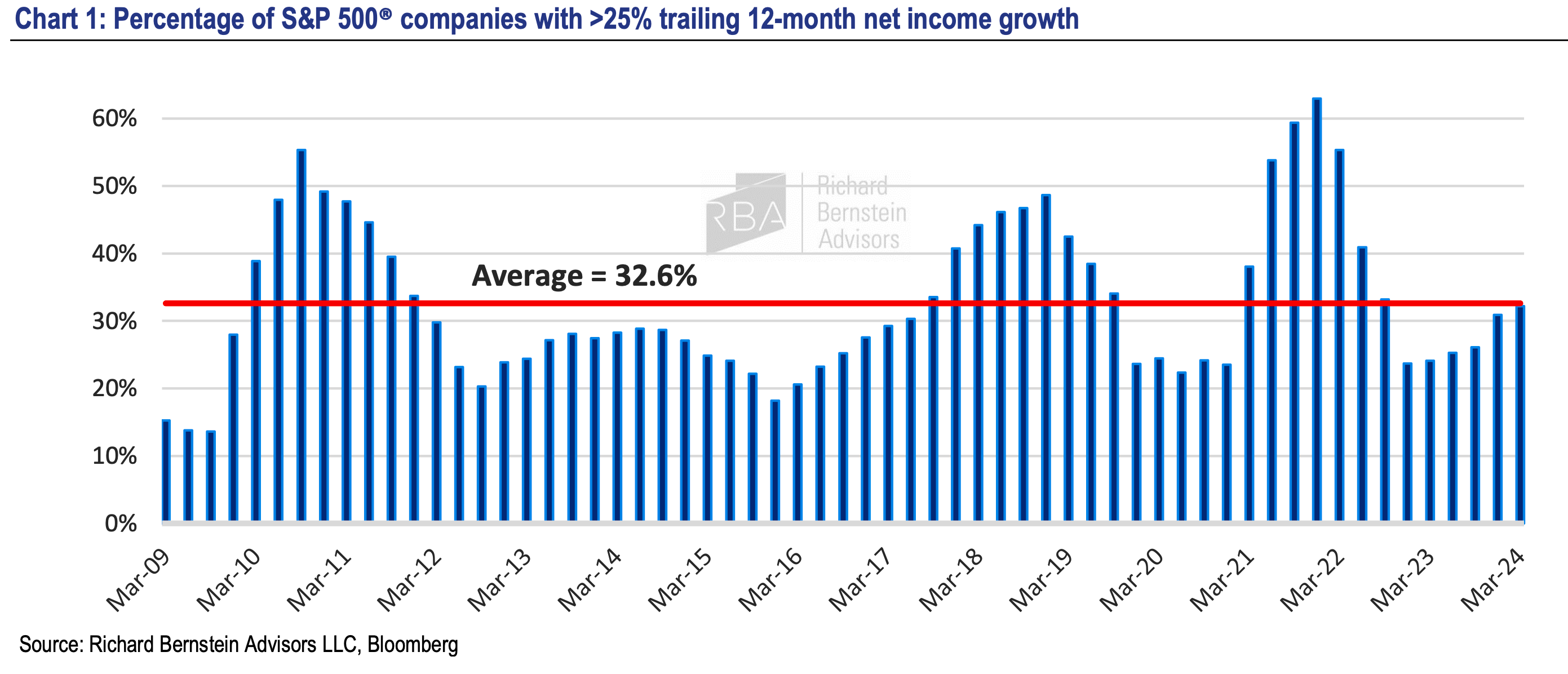

Brad: We’re finally seeing a higher % of companies achieve strong year-over-year growth

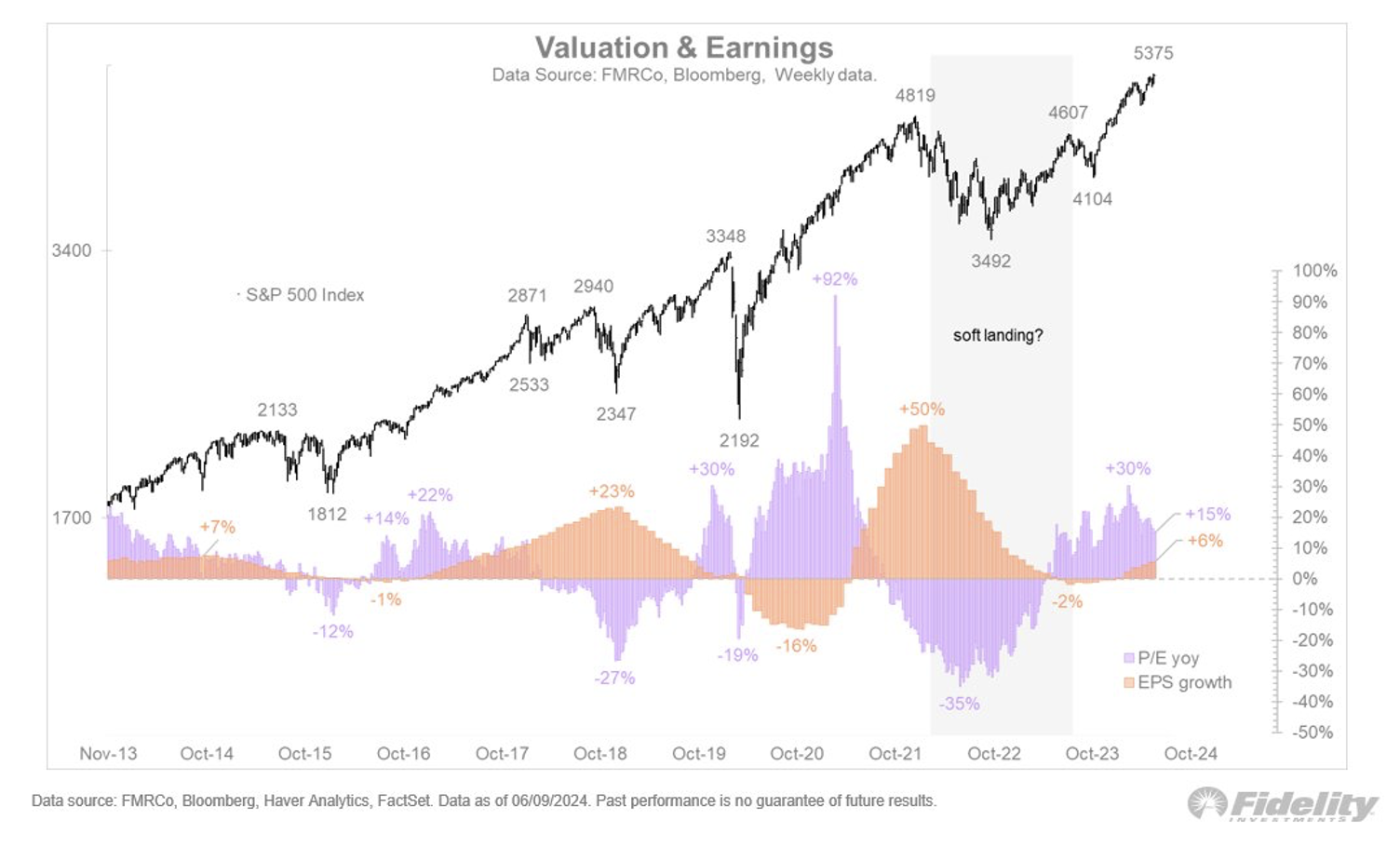

Data as of 06.09.2024

Data as of 06.09.2024

JD: leading to a bit of a catchup in the “Growth” component of “Yield + Growth”

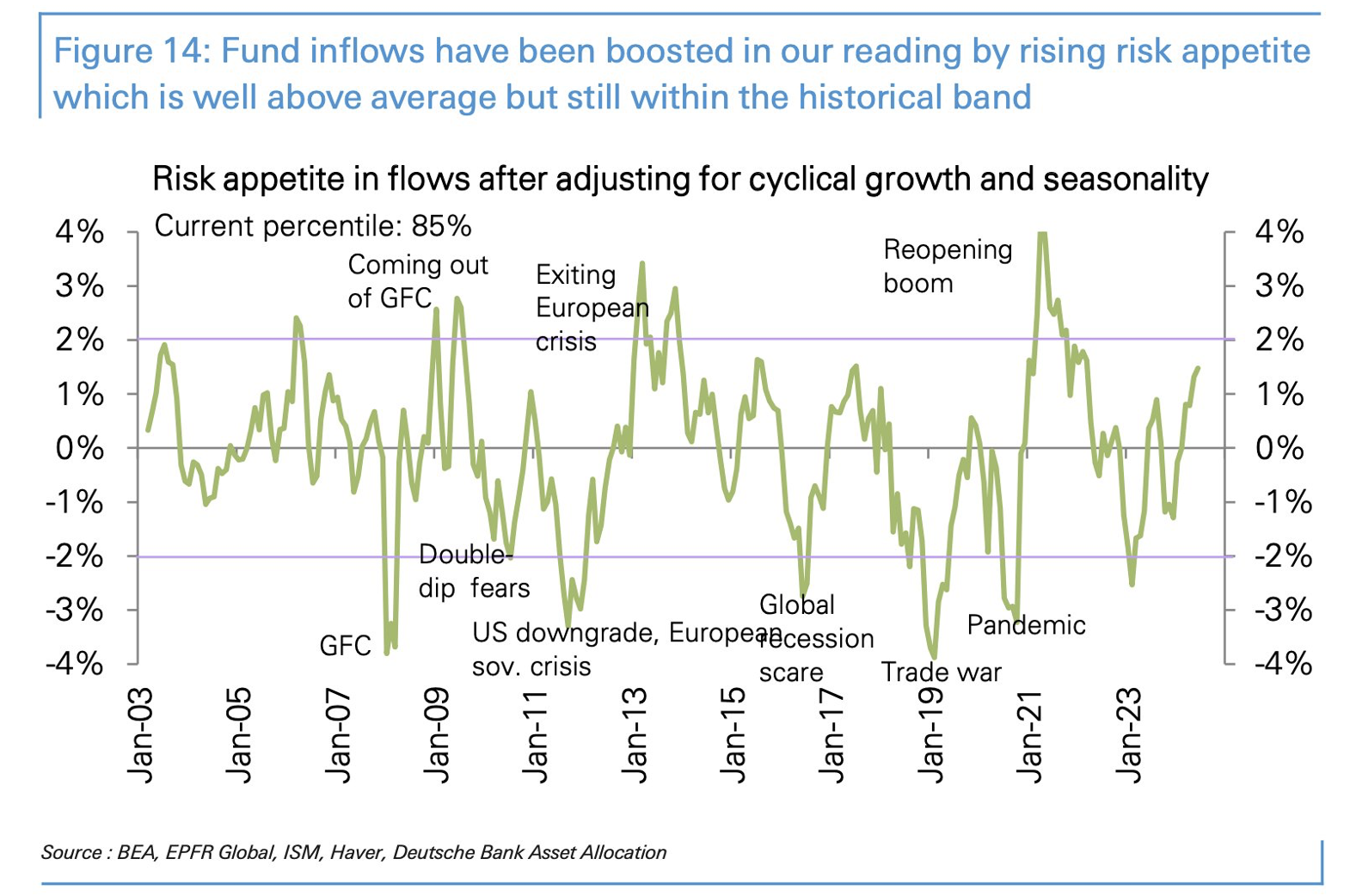

Brian: According to this indicator, risk appetite is returning for public fund buyers

Data as of 06.14.2024

Data as of 06.14.2024

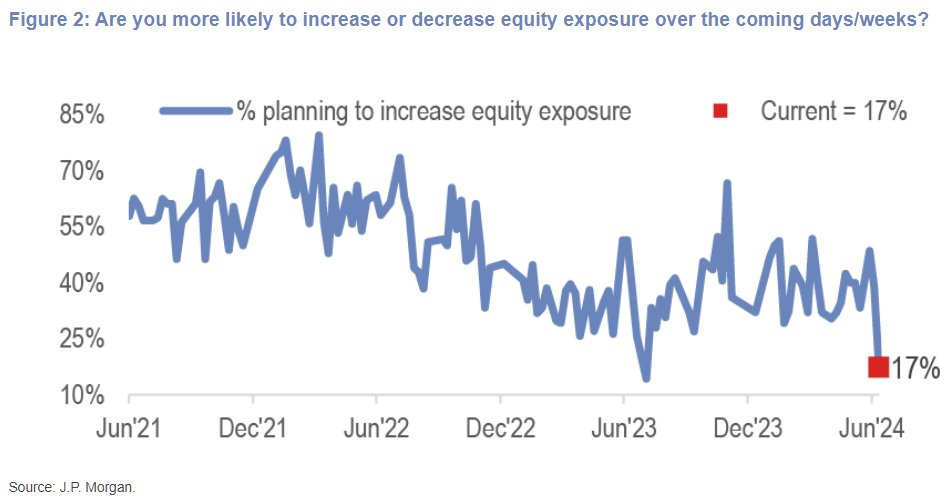

Brett: though it appears that institutions are not at all interested in buying stocks after the rally

Data as of 06.14.2024

Data as of 06.14.2024

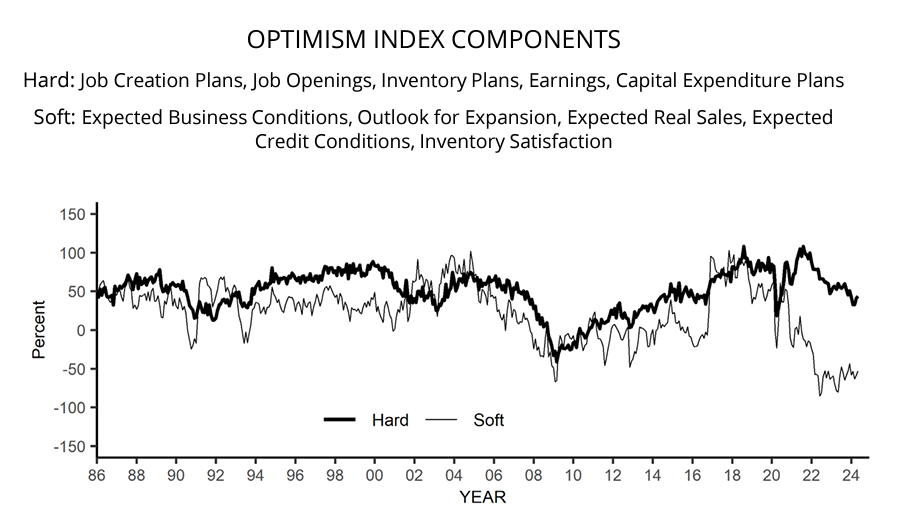

John Luke: but we know that sentiment and surveys can be a bit squishy, look here at the difference between what businesses are doing and how they feel

Source: NFIB as of 06.09.2024

Source: NFIB as of 06.09.2024

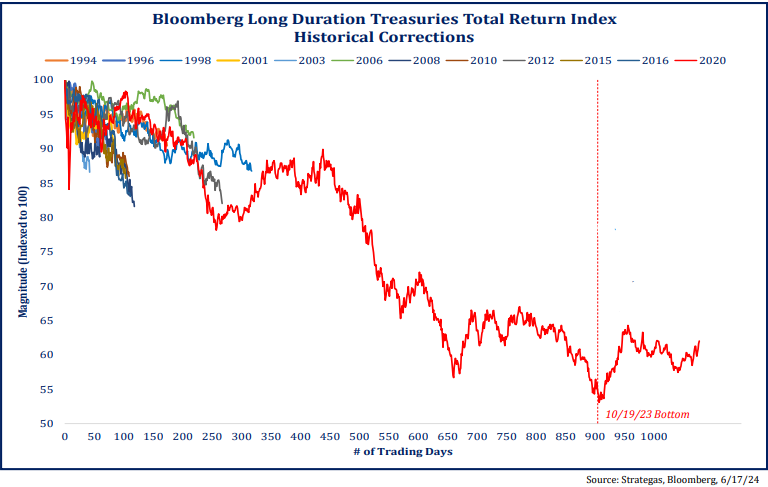

John Luke: If you’re wondering whether this is a normal bear market for bonds, it’s not

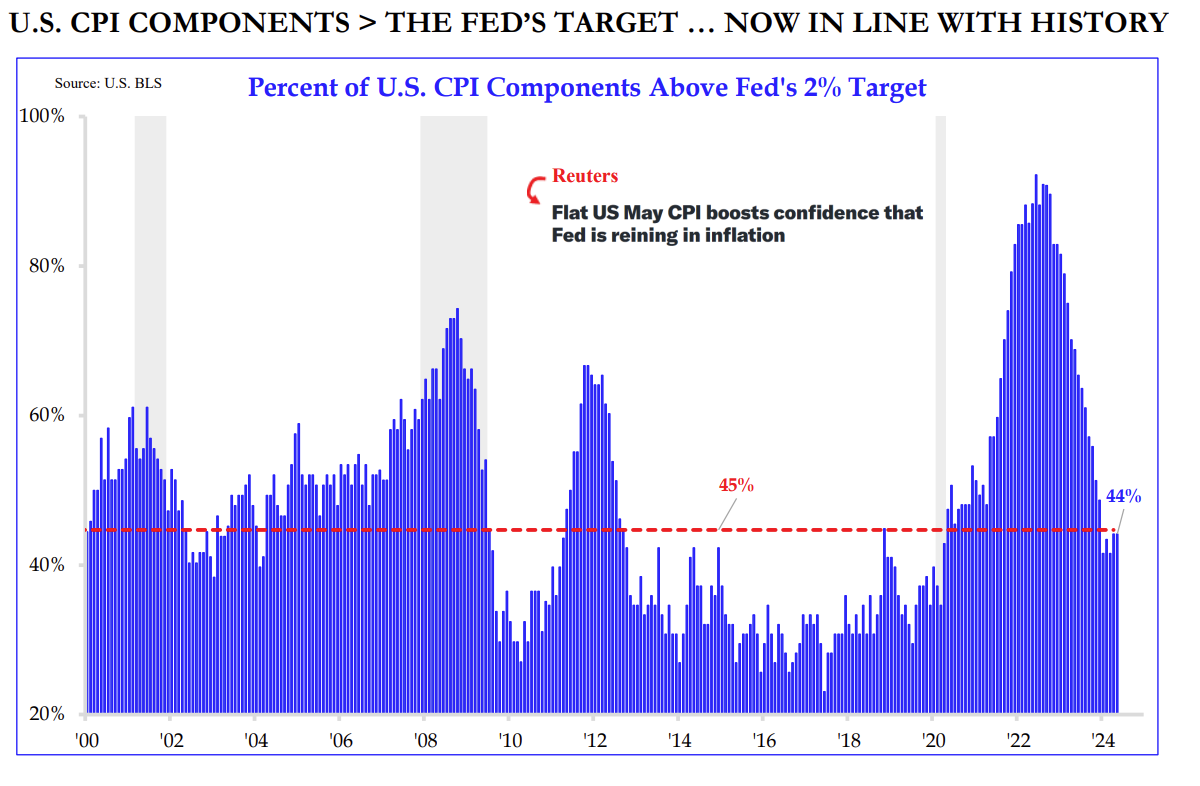

John Luke: and after all of that we’ve just now reached the point where half of the components have returned to the Fed’s target rate for rising prices

Source: Strategas as of 06.17.2024

Source: Strategas as of 06.17.2024

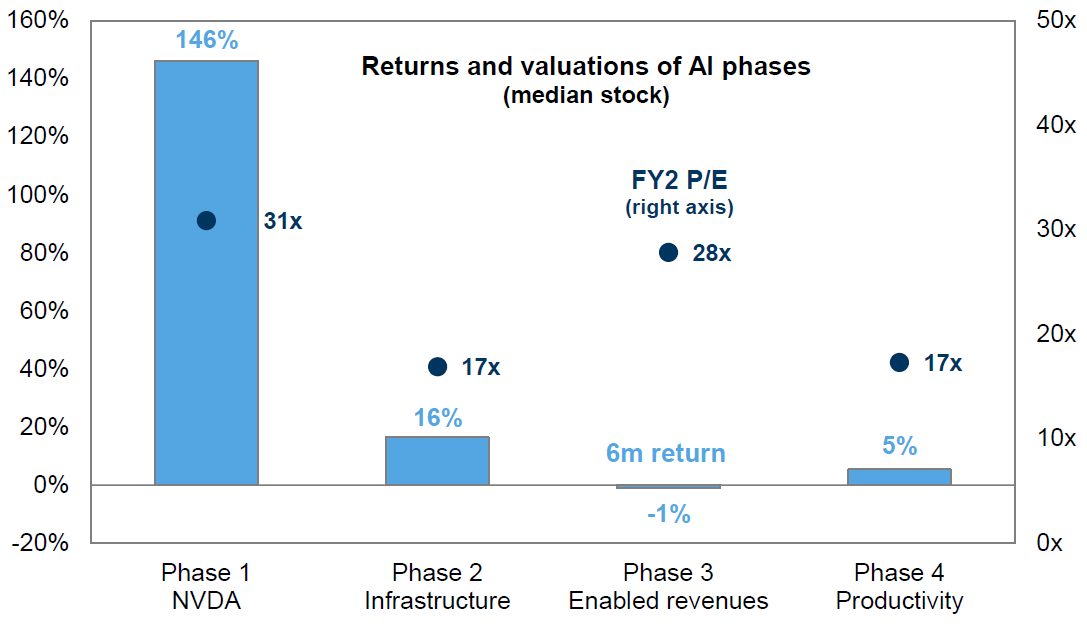

Brad: The continuing theme of the past year is the impact of artificial intelligence (AI), with NVDA as the poster child

Source: Goldman Sachs as of June 2024

Source: Goldman Sachs as of June 2024

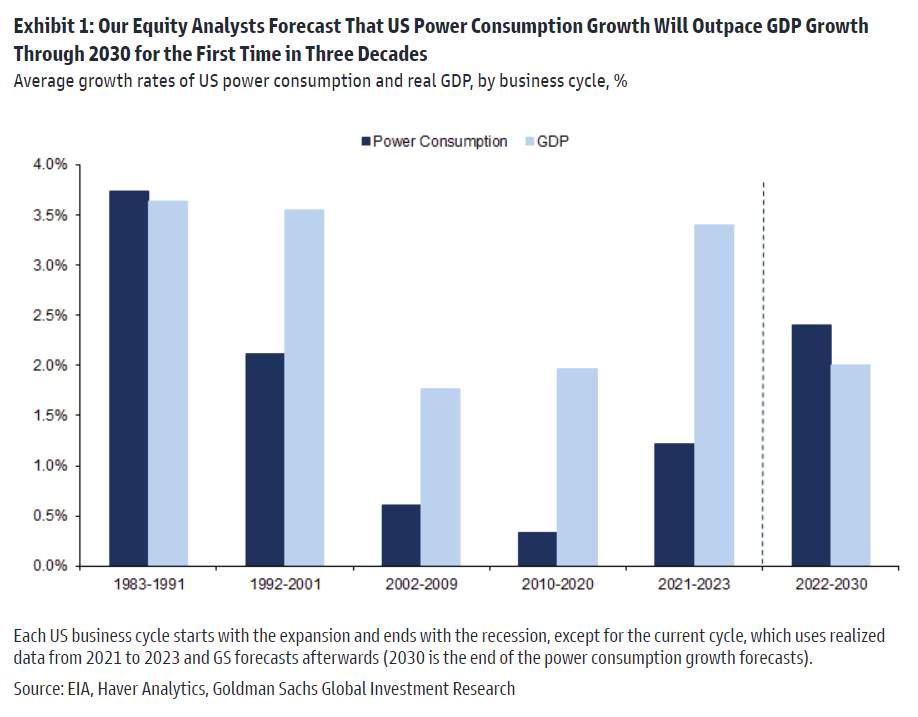

Joseph: but its contribution to higher power consumption seems pretty clear

Data as of May 2024

Data as of May 2024

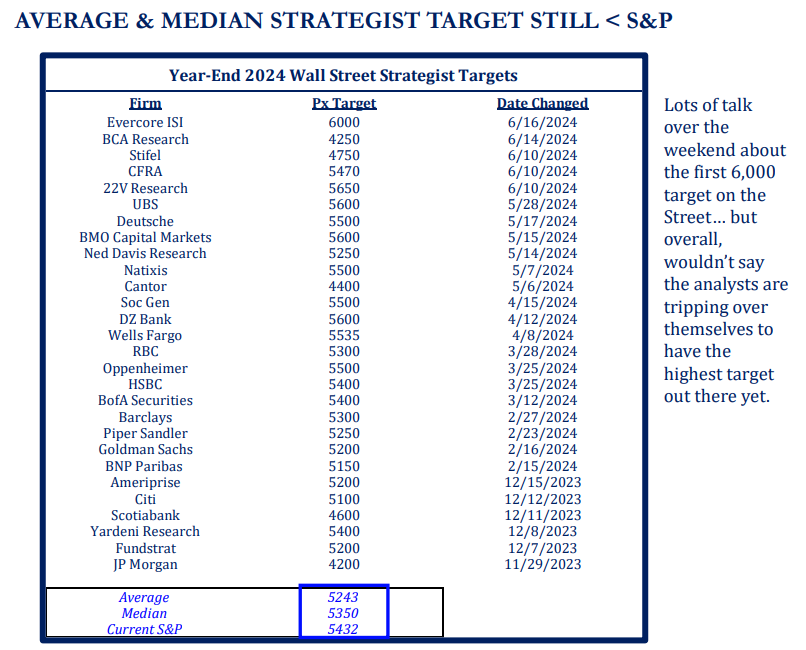

Dave: Wall Street strategists will eventually chase prices higher but they’ve not fully caved yet

Source: Strategas as of 06.17.2024

Source: Strategas as of 06.17.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2406-19.