Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

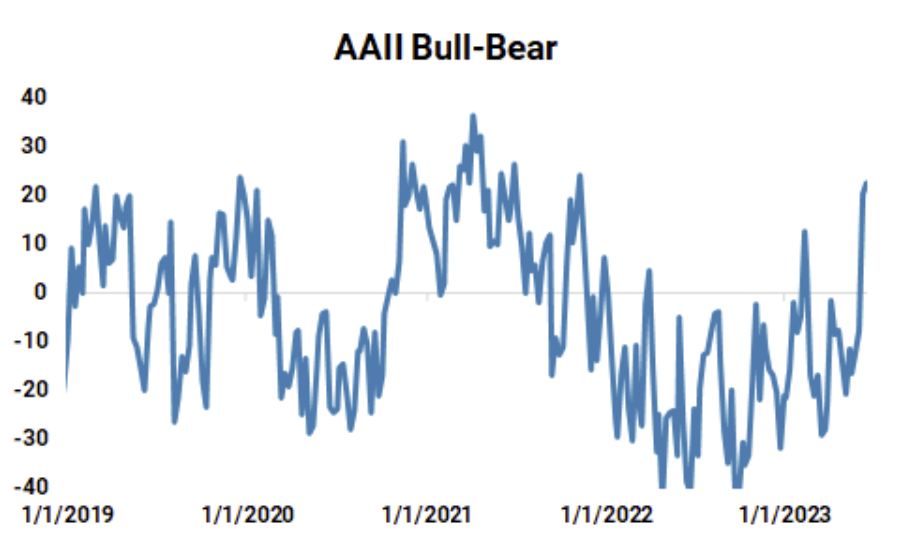

Dave: Right on cue, investors are finally turning bullish…after stocks stage a significant rally

Source: AAII as of 06.16.2023

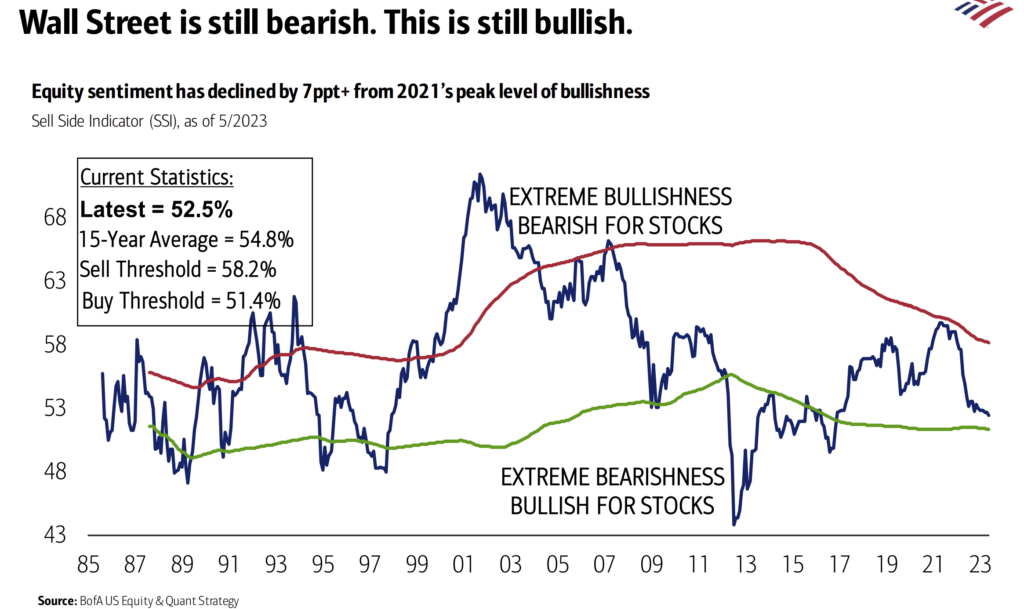

Dave: though their bearishness was right in line with most of Wall Street

Data as of May 2023

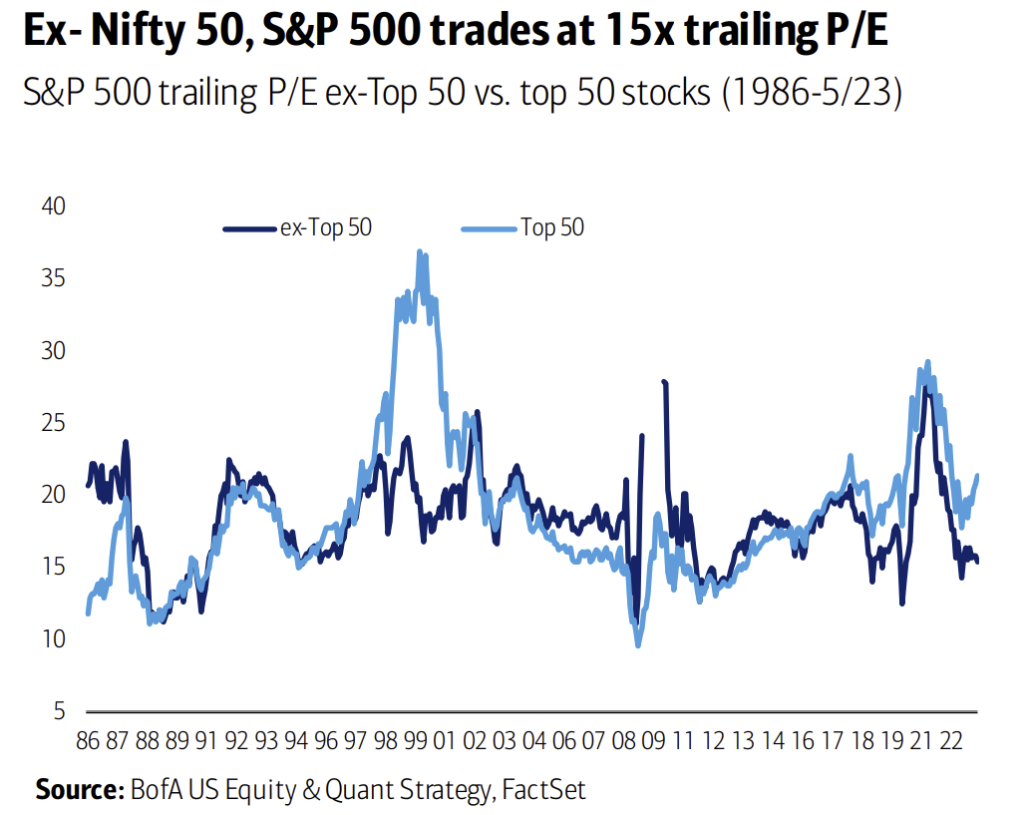

Dave: Outside of megacap tech, valuations aren’t so crazy

Data as of May 2023

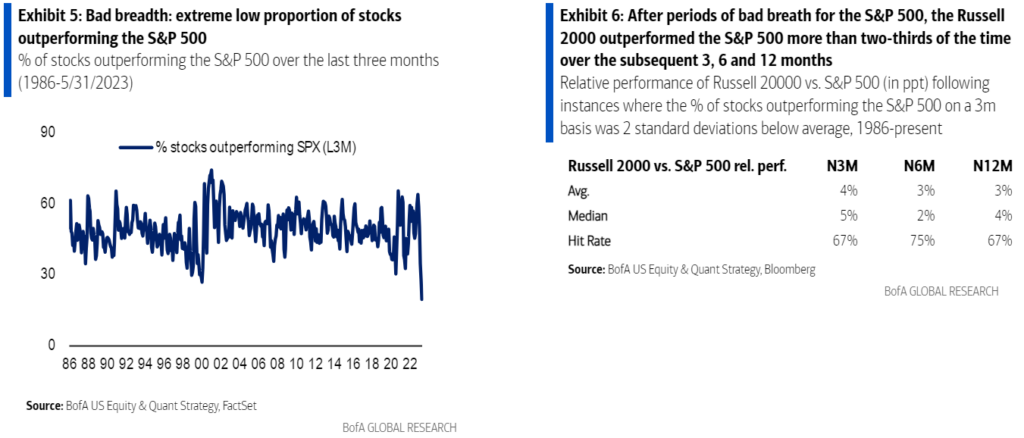

Brad: and holders of the broader market of stocks are hoping for at least some restoration of historical norms

Data as of 05.31.2023

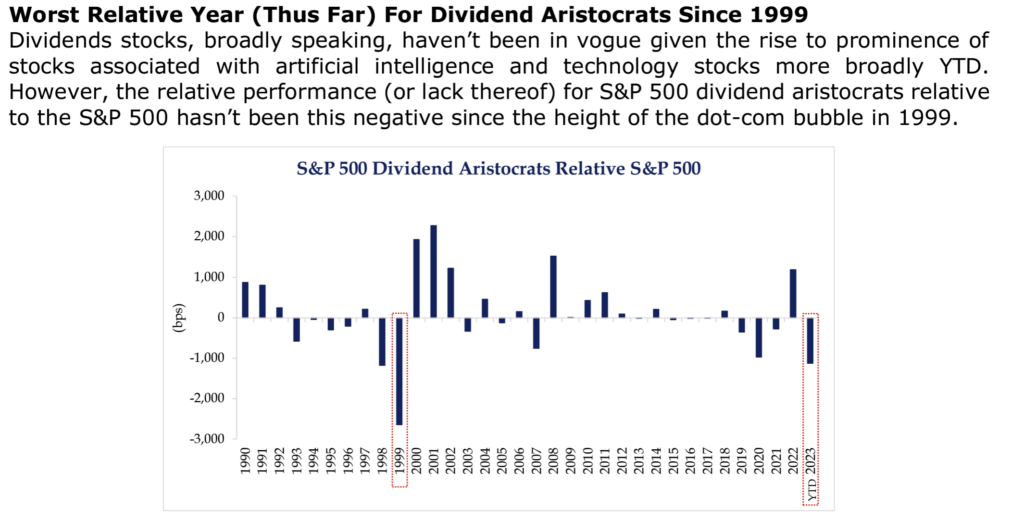

Dave: especially those holding boring old dividend-payers

Source: Strategas as of 06.21.2023

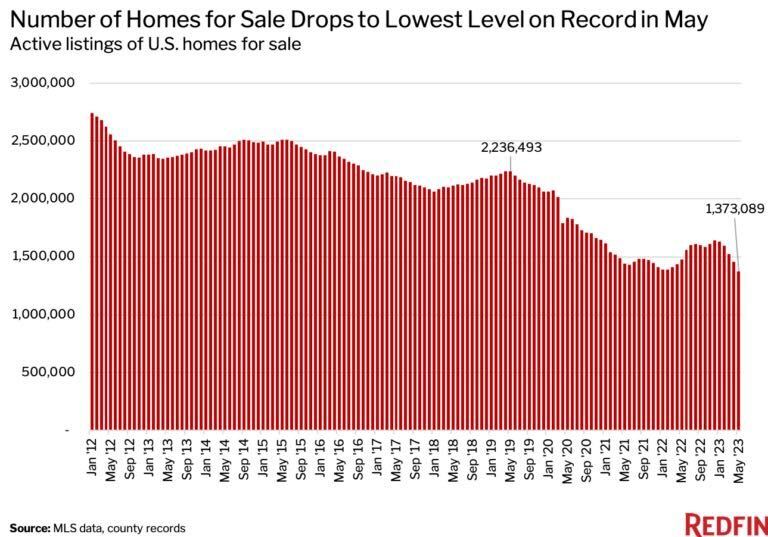

Dave: Home inventory is super-tight, with few willing to give up their existing mortgage

Data as of June 2023

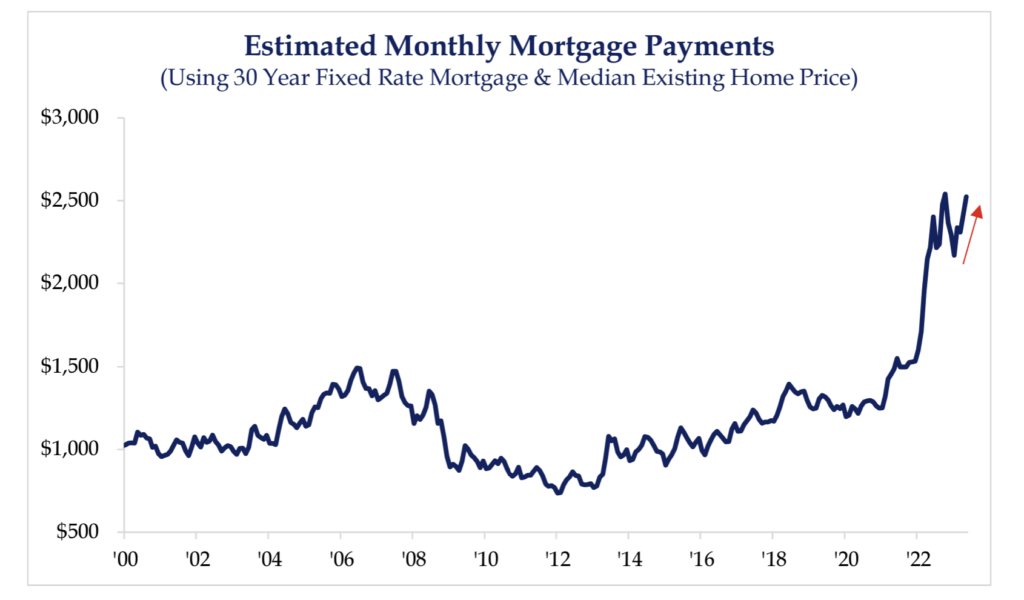

Dave: which would normally lead to bidding wars if not for the historically high cost to buy

Source: Strategas as of 06.20.2023

John Luke: The Bank of England is back on the offensive to fight persistent inflation

Data as of 06.20.2023

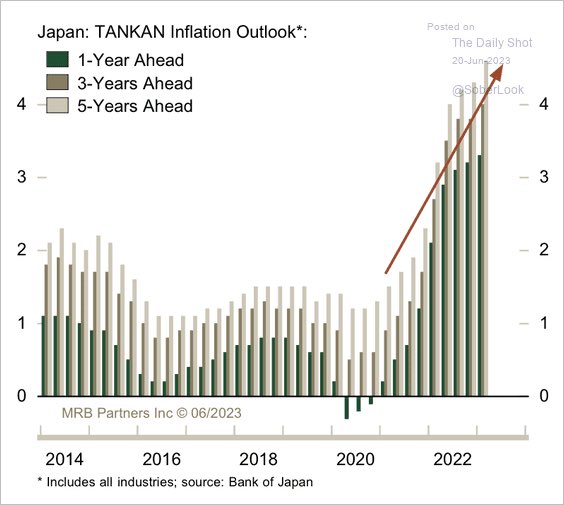

Beckham: and even historically deflationary Japan is seeing inflation on the rise

Data as of 06.20.2023

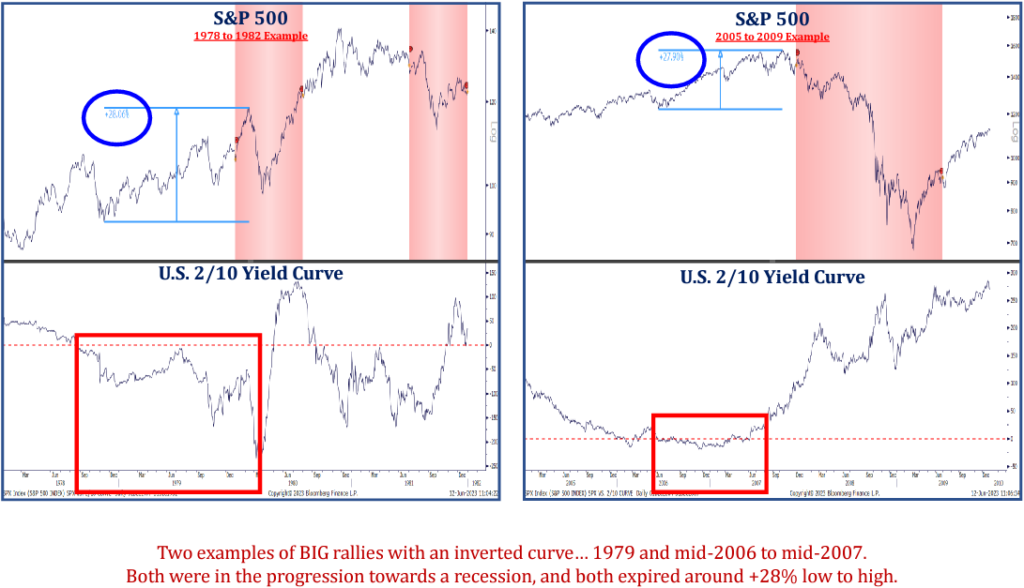

Brad: We’ve not had many examples of sustained equity rallies with inverted yield curves

Source: Strategas as of 06.16.2023

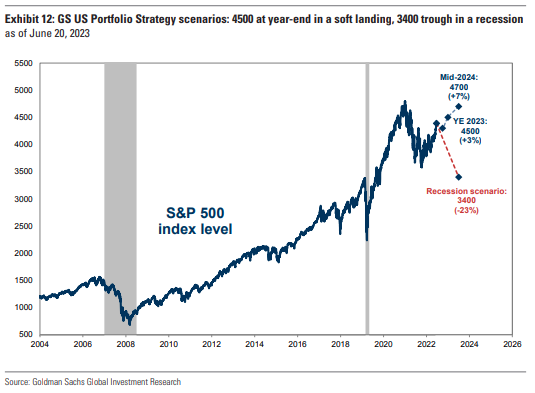

Joseph: and the reward/risk of soft landing vs. recession is seen as pretty unfavorable by much of Wall Street

Dave: Recession or not, stocks are pricing in solid but not spectacular earnings coming out of the recent weakness

Data as of 06.20.23

Data as of 06.20.23

John Luke: which seems a minimum requirement given the lack of equity risk premium currently available to investors

Data as of 06.16.2023

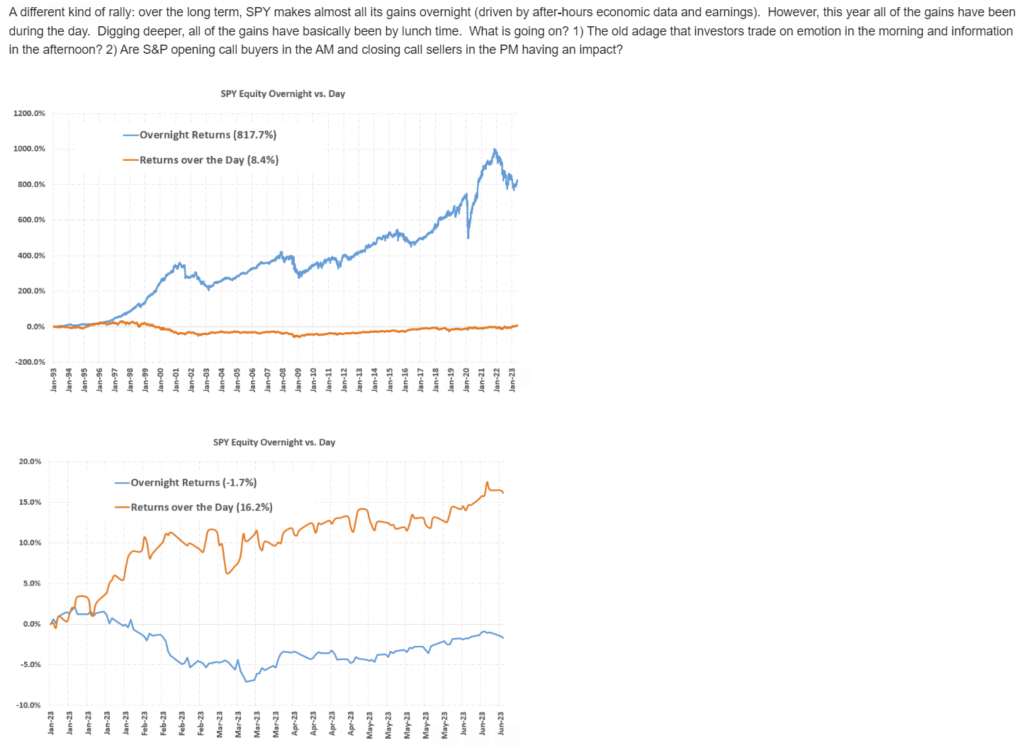

Mark: This year’s market has been different from recent years, with most of the gains occurring during trading hours not overnight

Source: Raymond James as of 06.20.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2306-17.