Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

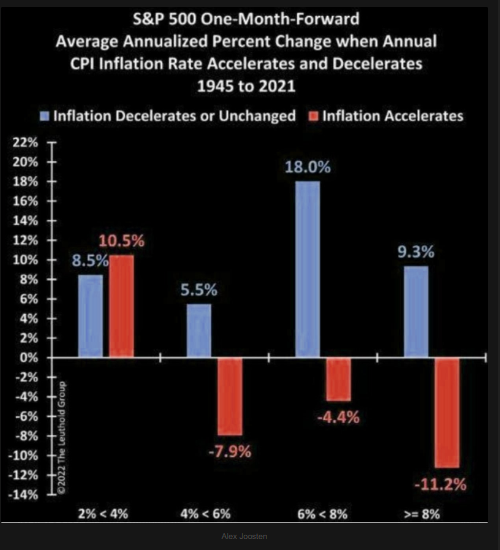

John Luke: The cleanest story since the October low has been decelerating headline inflation, which lines up with the history of stocks and CPI

Source: The Market Ear June 2023

Source: The Market Ear June 2023

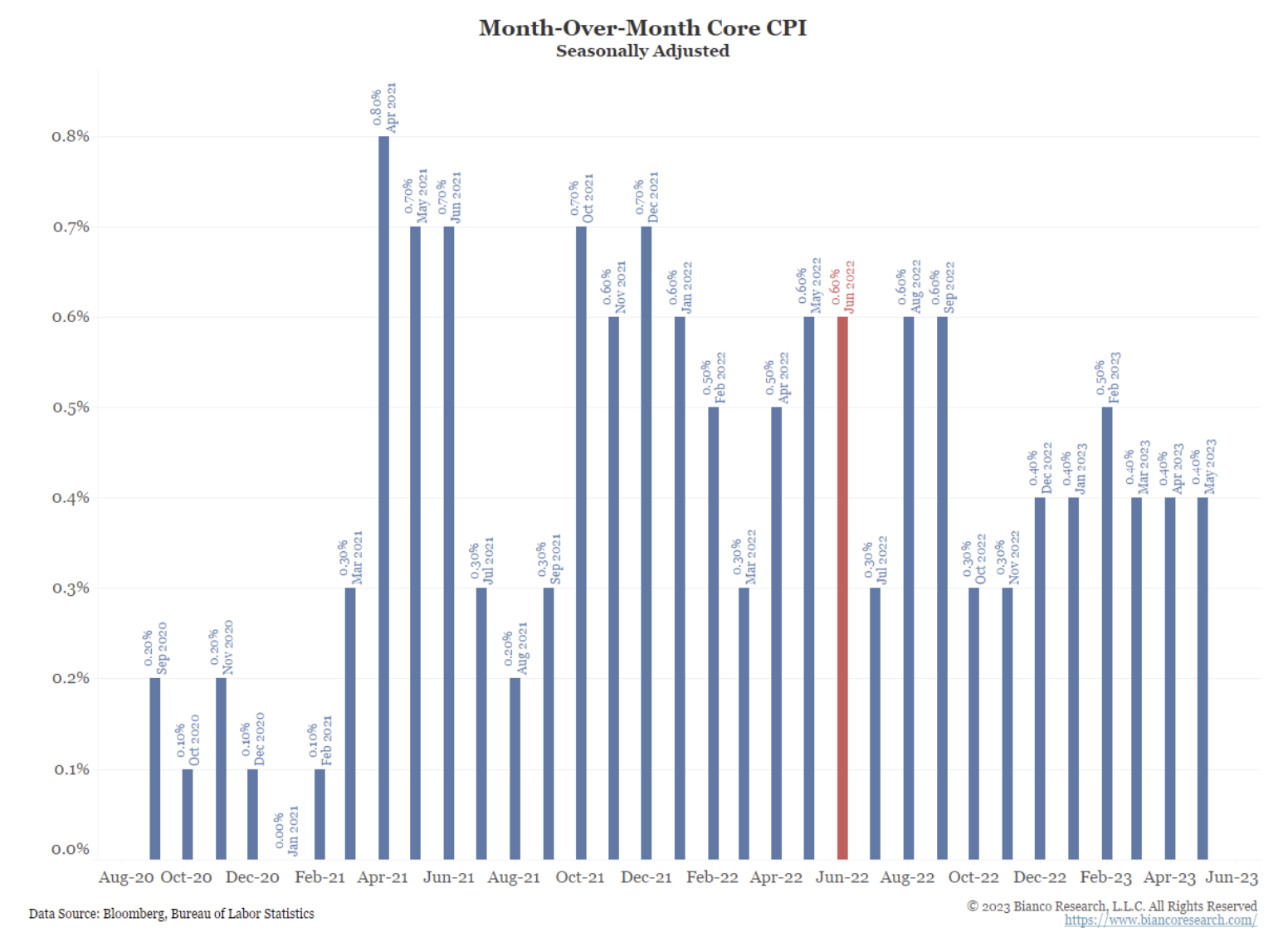

Dave: and while headline CPI has been way up and now way down, Core CPI has been stable at a high rate for 2 years now

Data as of June 2023

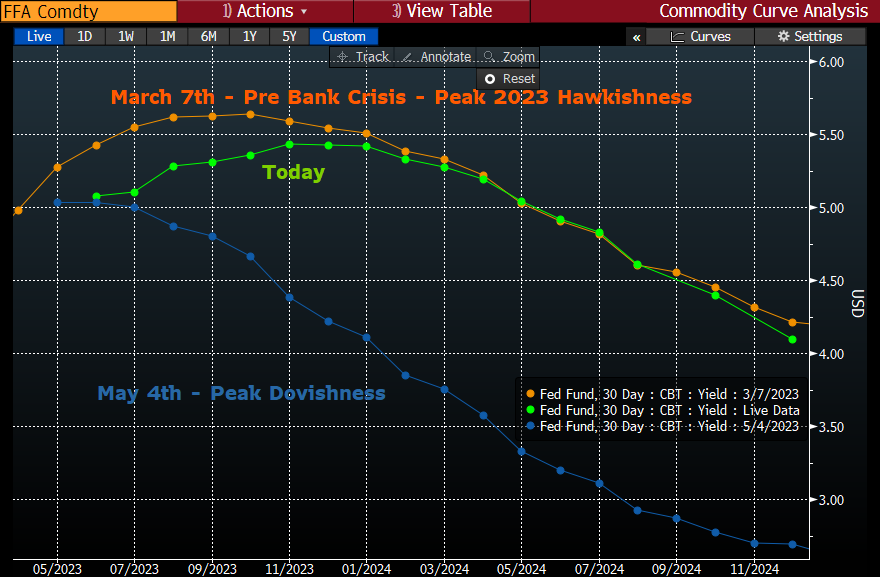

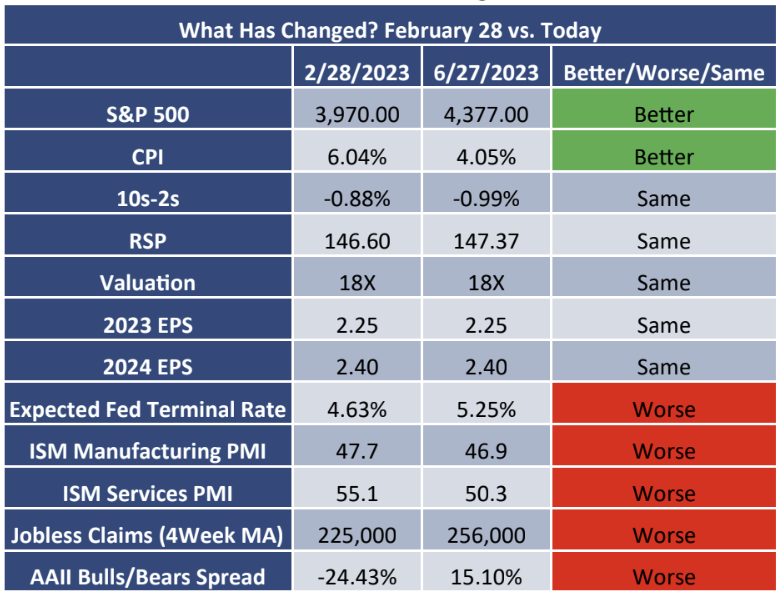

John Luke: Rate expectations have been fully restored to their standing ahead of the March banking crisis

Source: Raymond James as of 06.28.2023

Source: Raymond James as of 06.28.2023

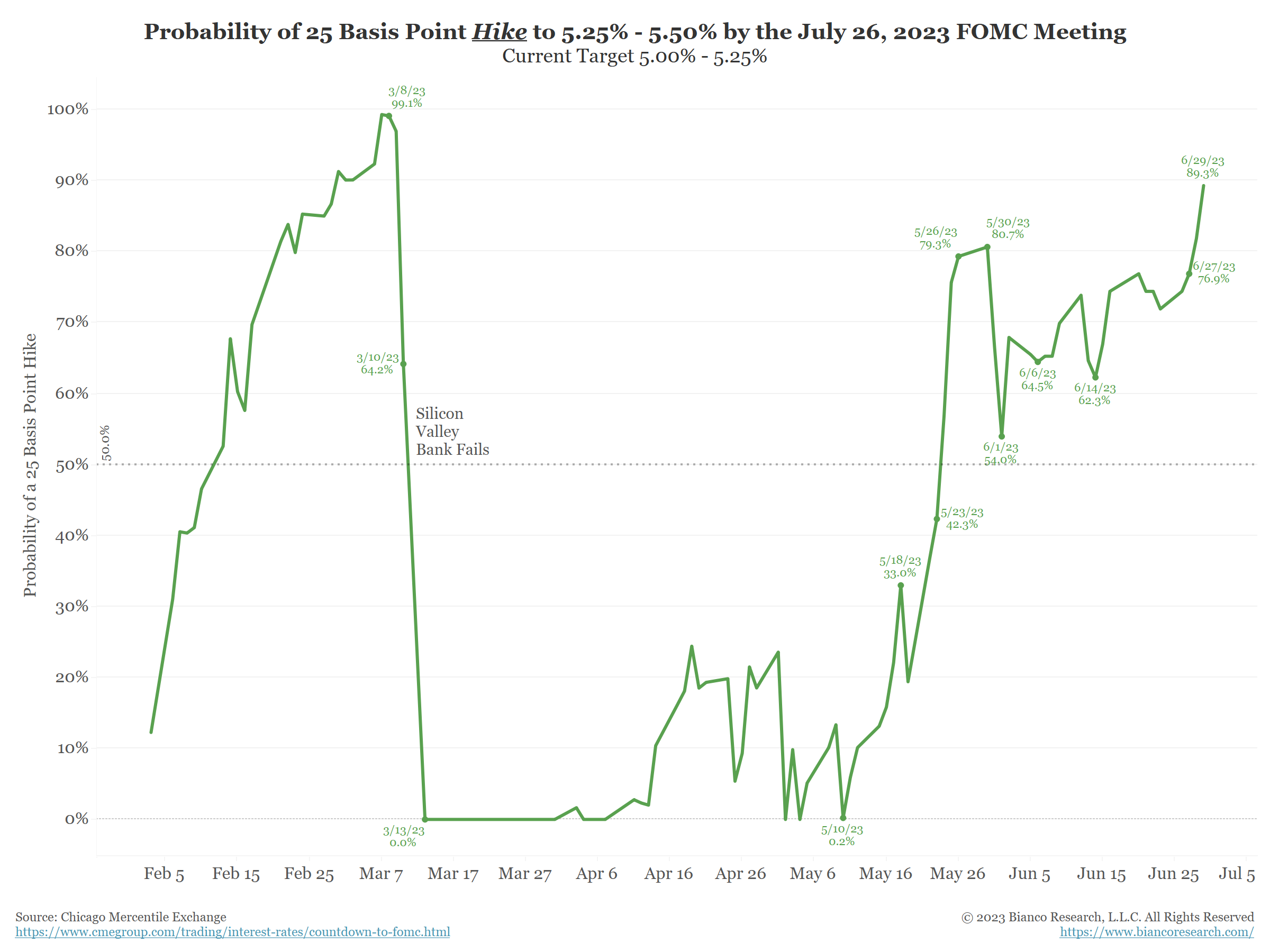

John Luke: as the idea of a July rate hike went completely away but is now commonly accepted again

Source: Bianco as of 06.29.2023

Source: Bianco as of 06.29.2023

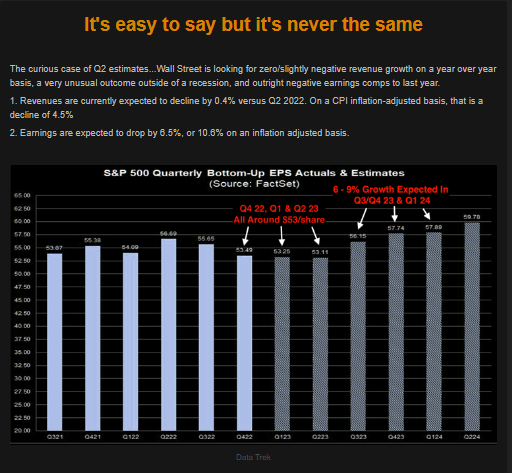

John Luke: Consensus earnings have flatlined awaiting direction, both in YOY change and in direction of estimates

Source: The Market Ear as of 06.26.2023

Source: The Market Ear as of 06.26.2023

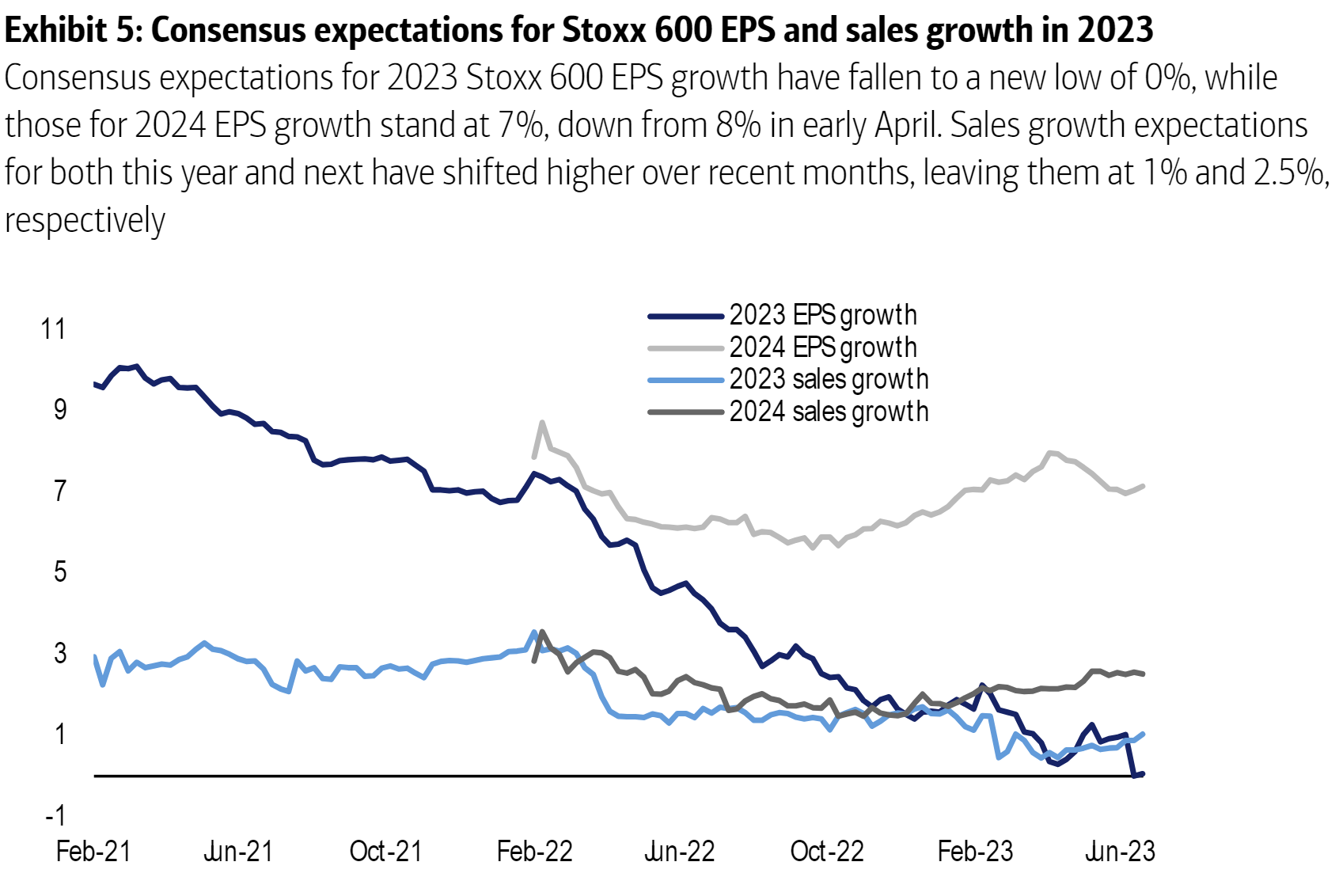

Dave: with a similarly mixed outlook in Europe

Source: Morgan Stanley as of 06.26.2023

Source: Morgan Stanley as of 06.26.2023

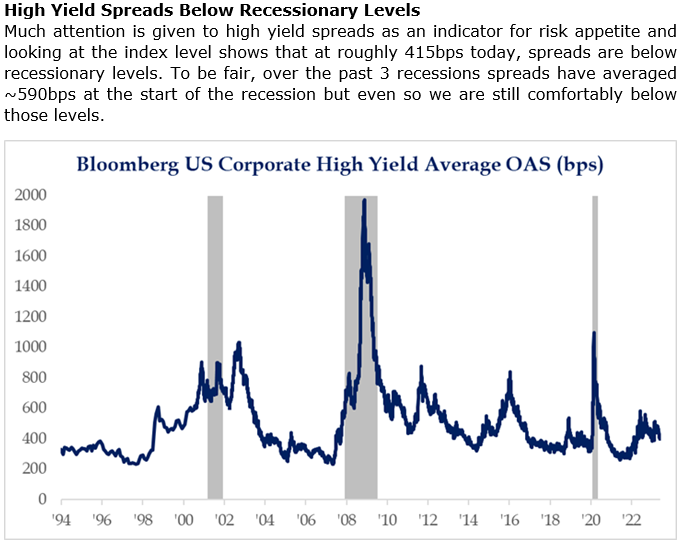

Brad: High yield spreads remain tight despite calls for a recession

Source: Strategas as of 06.26.2023

Source: Strategas as of 06.26.2023

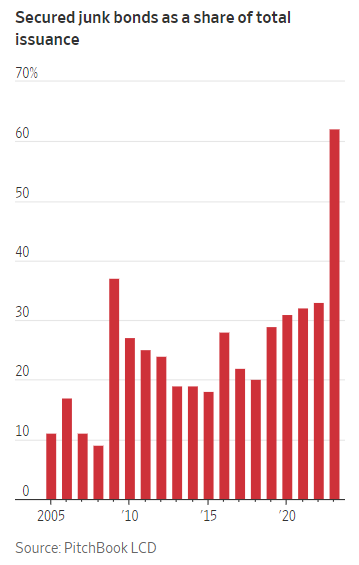

Derek: perhaps due to more discriminating lending standards

Data as of June 2023

Data as of June 2023

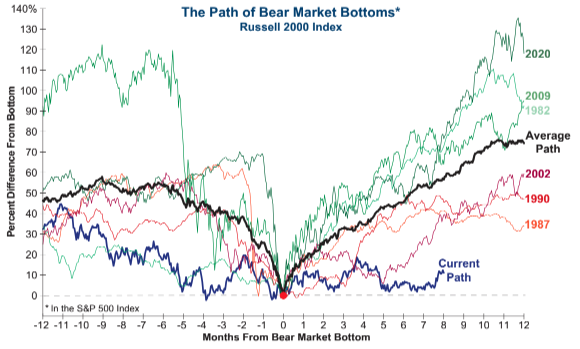

James: The broader market of stocks is still far short of typical rallies from bear market lows

Source: Investech as of 06.12.2023

Source: Investech as of 06.12.2023

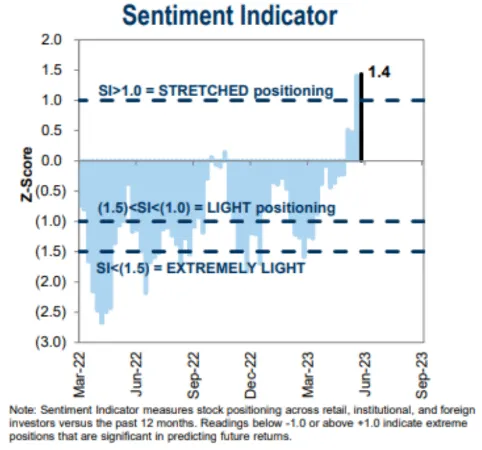

Derek: but the bounce has been enough to finally pull a large number of bears from the sidelines

Source: Goldman Sachs as of June 2023

Source: Goldman Sachs as of June 2023

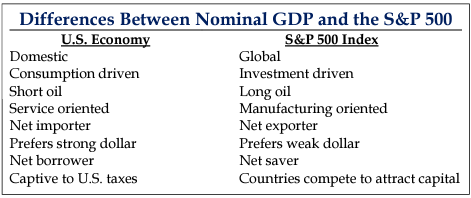

Brad: It’s important to remember that the stock market is not the economy, especially when thinking about large-cap multinationals

Source: Strategas as of June 2023

Source: Strategas as of June 2023

Dave: but pundits still spend the bulk of their time trying to match the two

Source: Sevens Report as of 06.26.2023

Source: Sevens Report as of 06.26.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2306-23.