Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

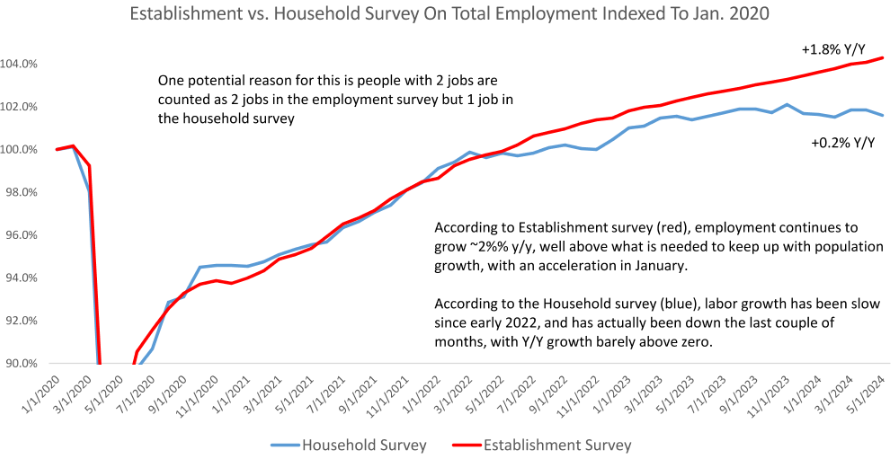

Dave: The divergence between non farm payroll data and the household survey continues to be an example of the divergent thinking regarding economic strength

Source: Raymond James as of 06.06.2024

Source: Raymond James as of 06.06.2024

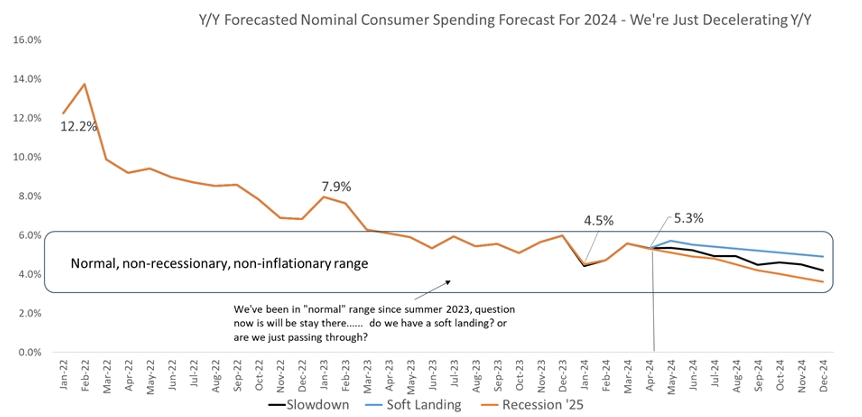

Dave: with the consumer continuing to spend at a decent pace

Source: Raymond James as of 06.03.2024

Source: Raymond James as of 06.03.2024

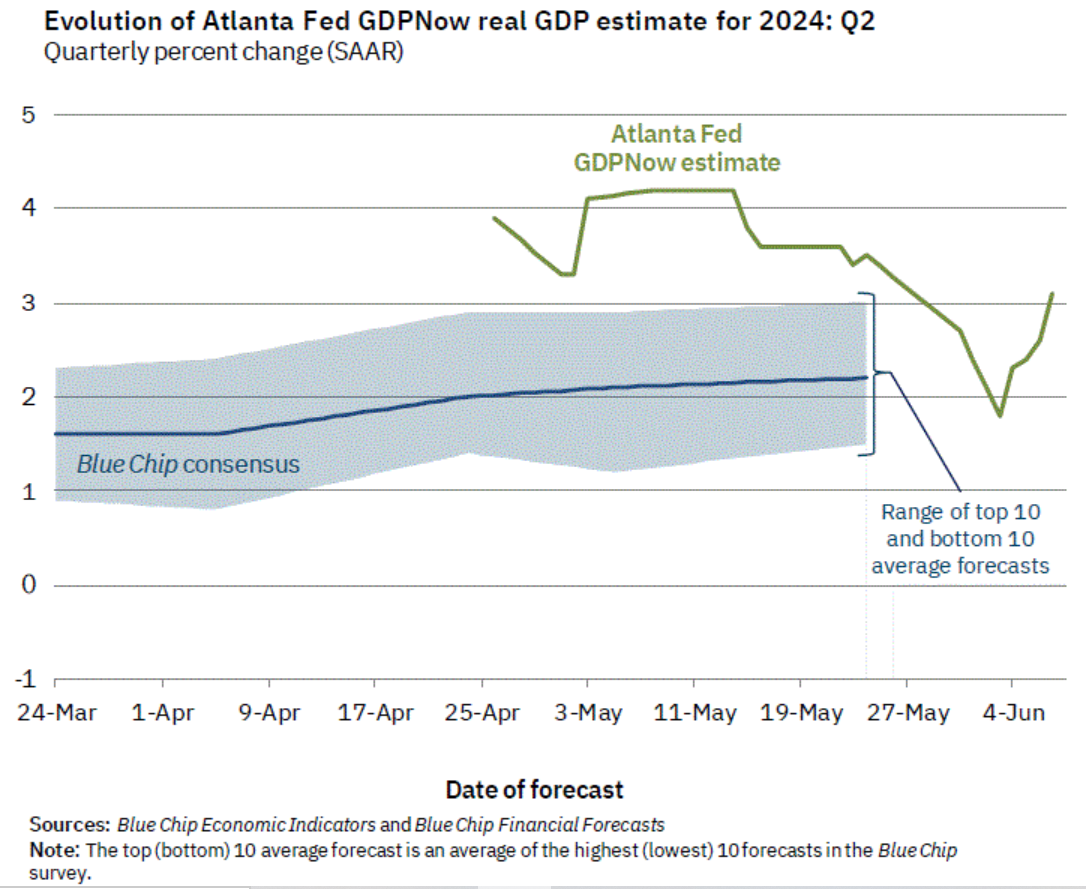

Brian: but GDP is tracking high or low depending on the week

Source: Aptus via Atlanta Fed

Source: Aptus via Atlanta Fed

Brett: and the odds of a recession fall

Source: Apollo as of 06.06.2024

Source: Apollo as of 06.06.2024

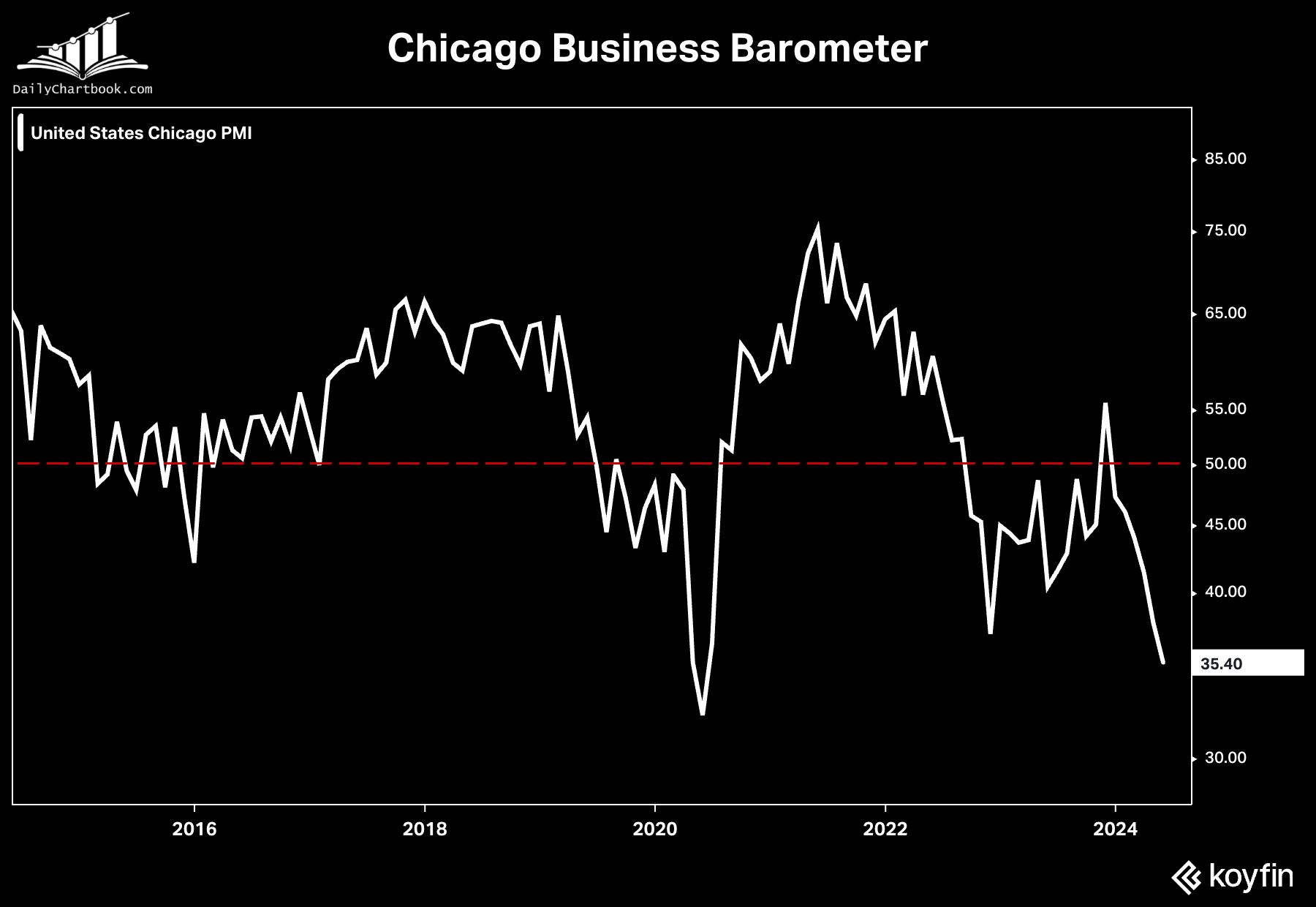

Arch: but some regional measures of manufacturing are falling deep into contraction territory

Data as of 05.31.2024

Data as of 05.31.2024

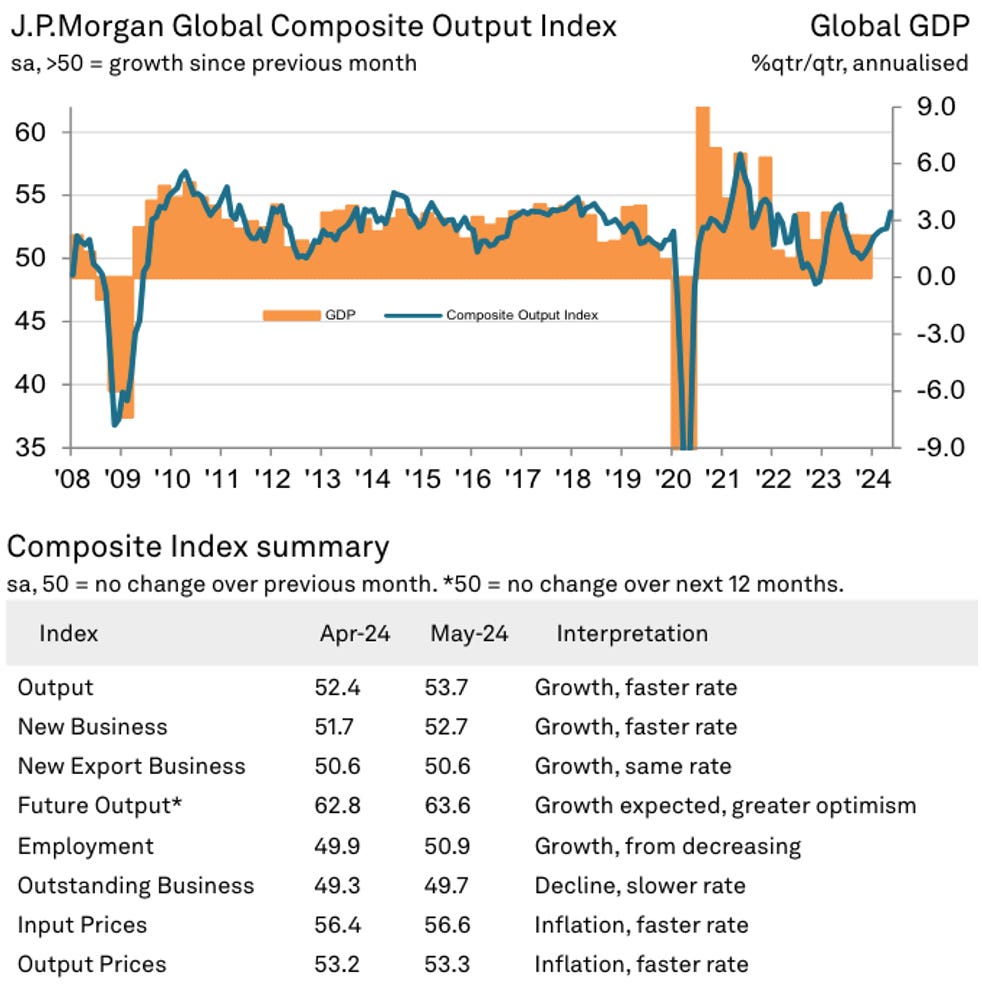

Beckham: and global measures are rising in unison

Source: S&P Global as of 06.03.2024

Source: S&P Global as of 06.03.2024

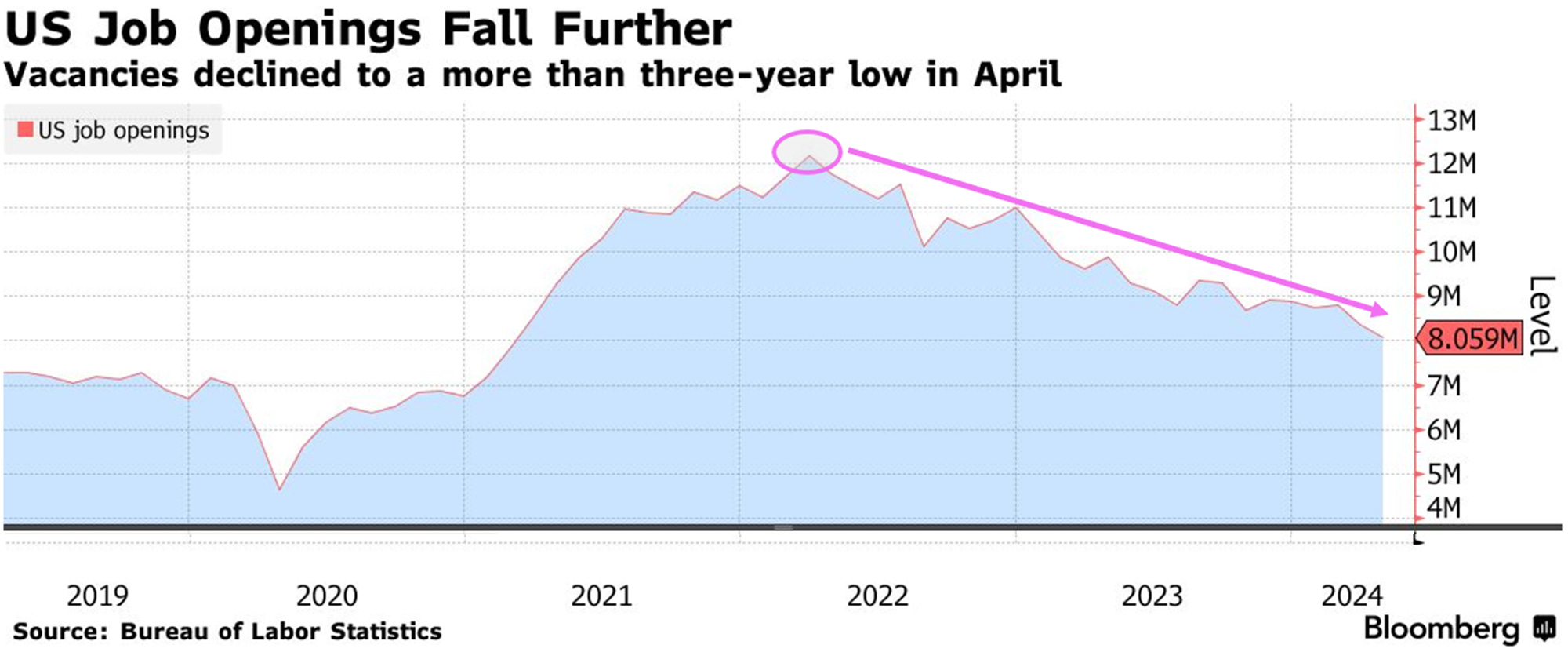

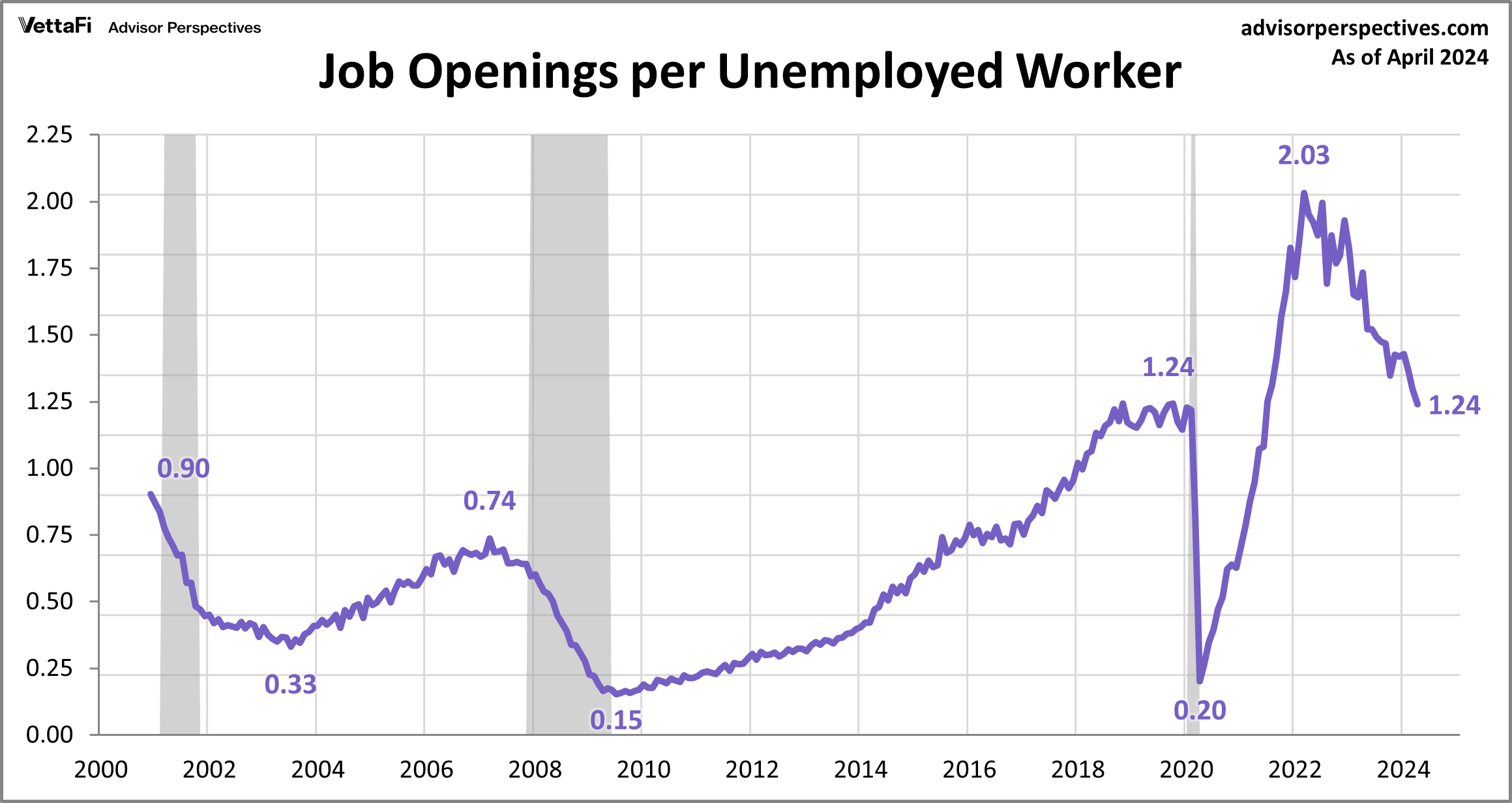

Joseph: but job openings in the US continuing to retreat from historic post-COVID highs

Data as of May 2024

Data as of May 2024

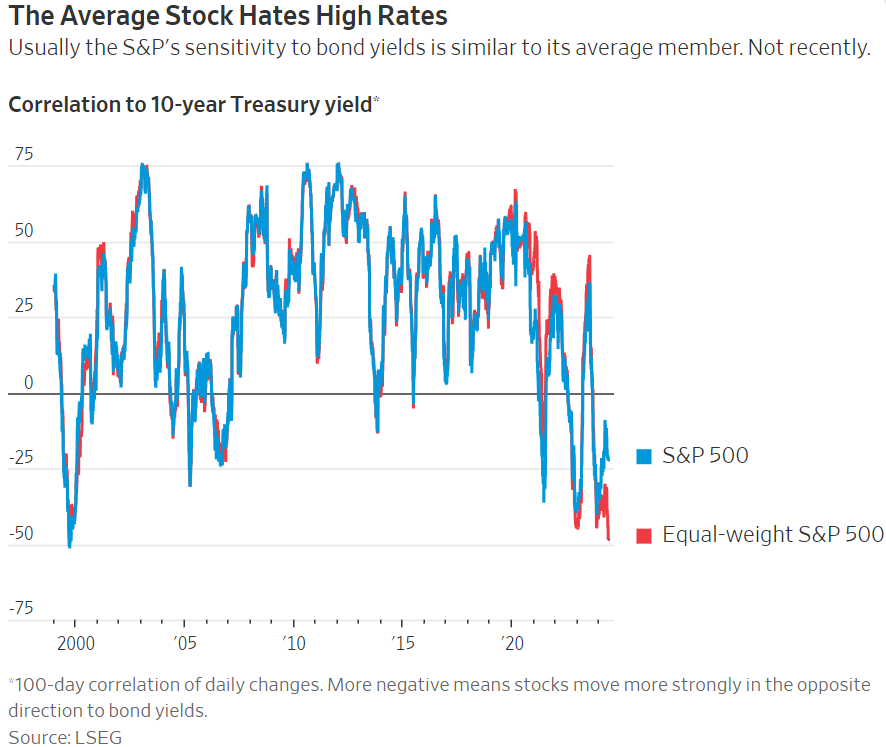

Brad: Another area of divergence is in the contrast between megacap tech stocks and the broader market

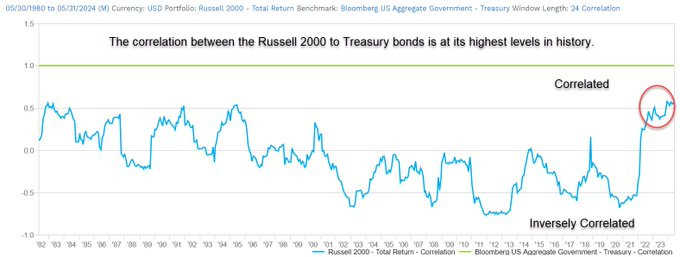

Joseph: partly due to the impact of rates on the broader list of companies

Source: WSJ as of 06.04.2024

Source: WSJ as of 06.04.2024

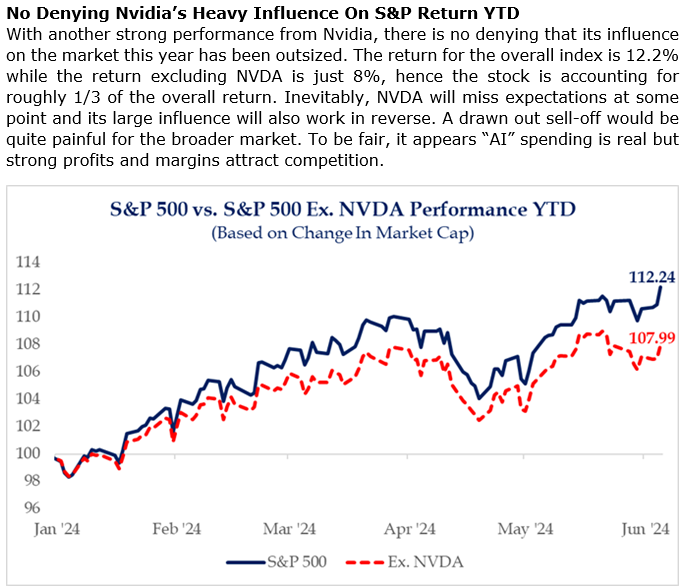

Brad: but also, just the incredible performance of NVDA and its contribution to S&P 500 returns

Source: Strategas as of 06.04.2024

Source: Strategas as of 06.04.2024

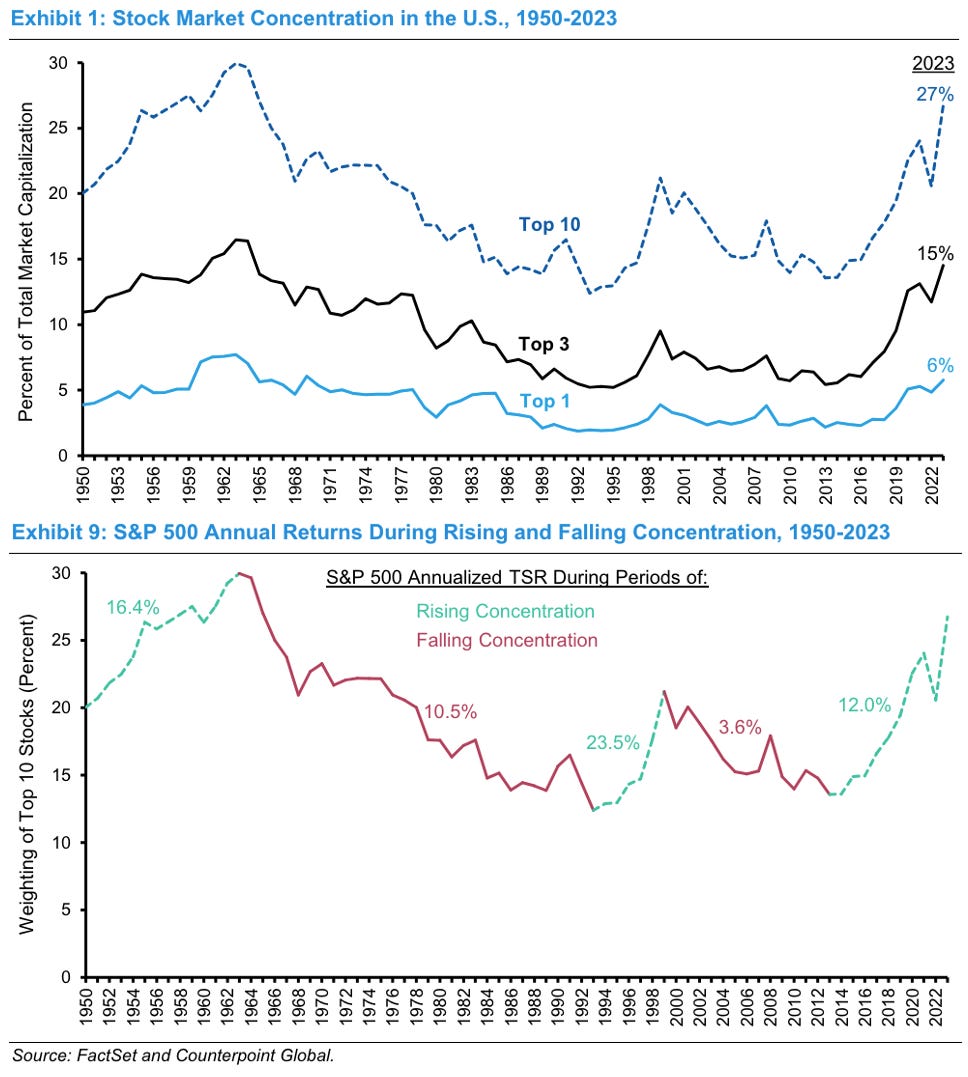

Brett: and while the concentration is approaching extremes, the risk in the past has been when that concentration retreats

Data as of January 2024

Data as of January 2024

Dave: Most important for stocks is that they grow their earnings, and trends are improving

Data as of 05.31.2024

Data as of 05.31.2024

Arch: which can hopefully start to offset the outsized impact rates have had on the broader market

Source: @matthew_miskin as of 06.03.2024

Source: @matthew_miskin as of 06.03.2024

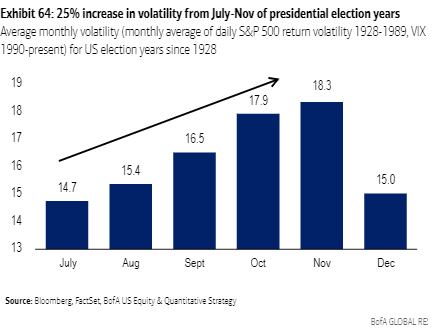

Dave: Presidential election years have generally been solid, but volatility has historically risen as the election approached

Data as of May 2024

Data as of May 2024

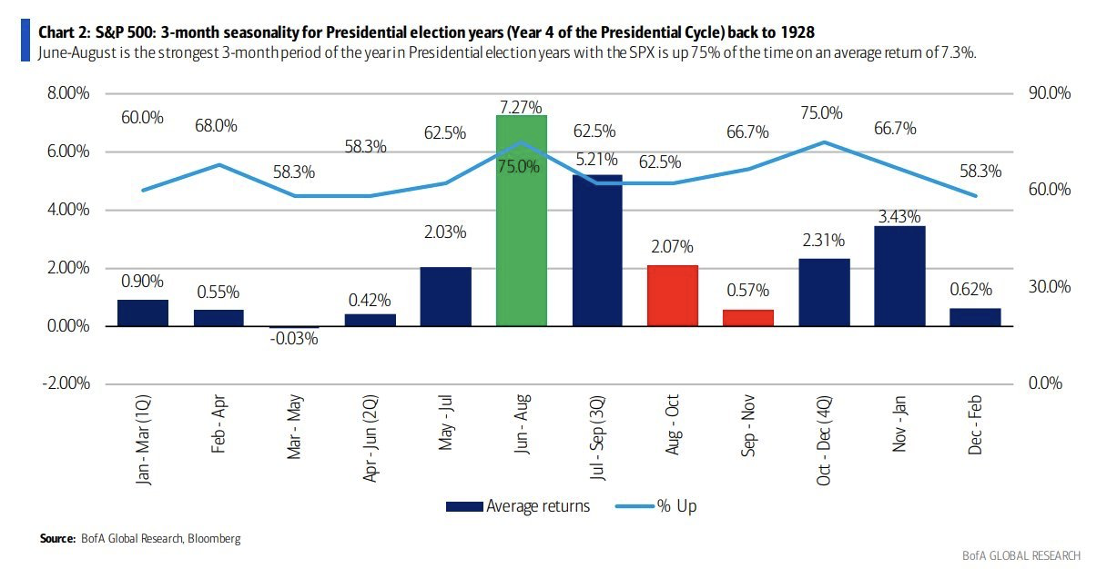

Brad: that said, we’ve just entered the most favorable 3-month window of past election years

Data as of May 2024

Data as of May 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2406-11.