Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

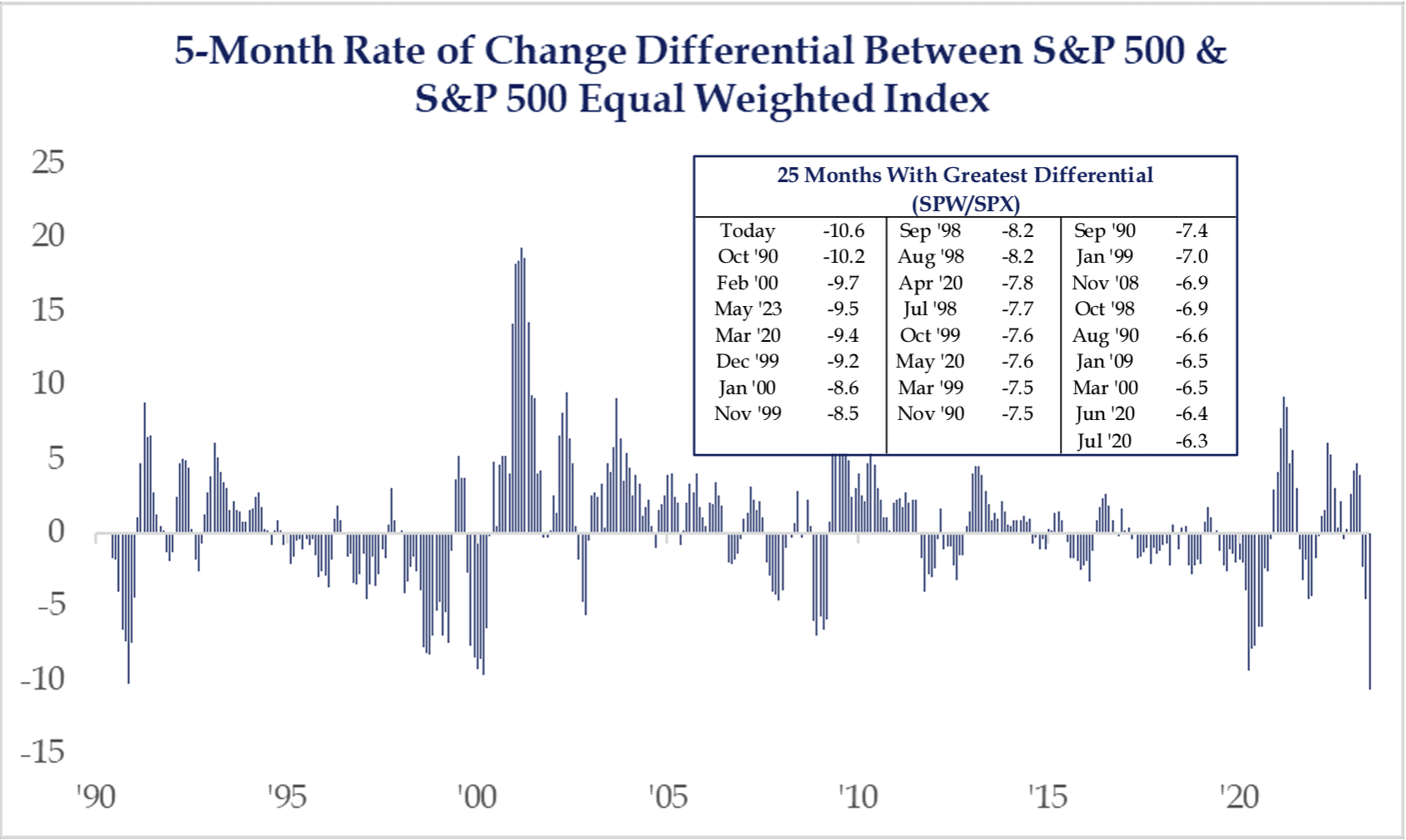

Dave: As everyone knows, a tiny group of megacap tech carried stocks on their back into early June

Source: Strategas as of 06.02.2023

Source: Strategas as of 06.02.2023

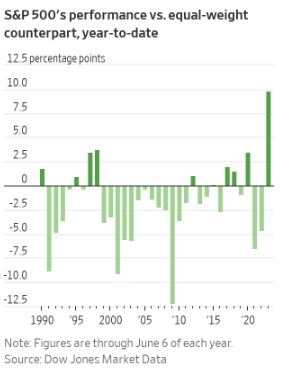

Beckham: with a massive performance disparity between the top few names and the rest

Source: WSJ as of 06.07.2023

Source: WSJ as of 06.07.2023

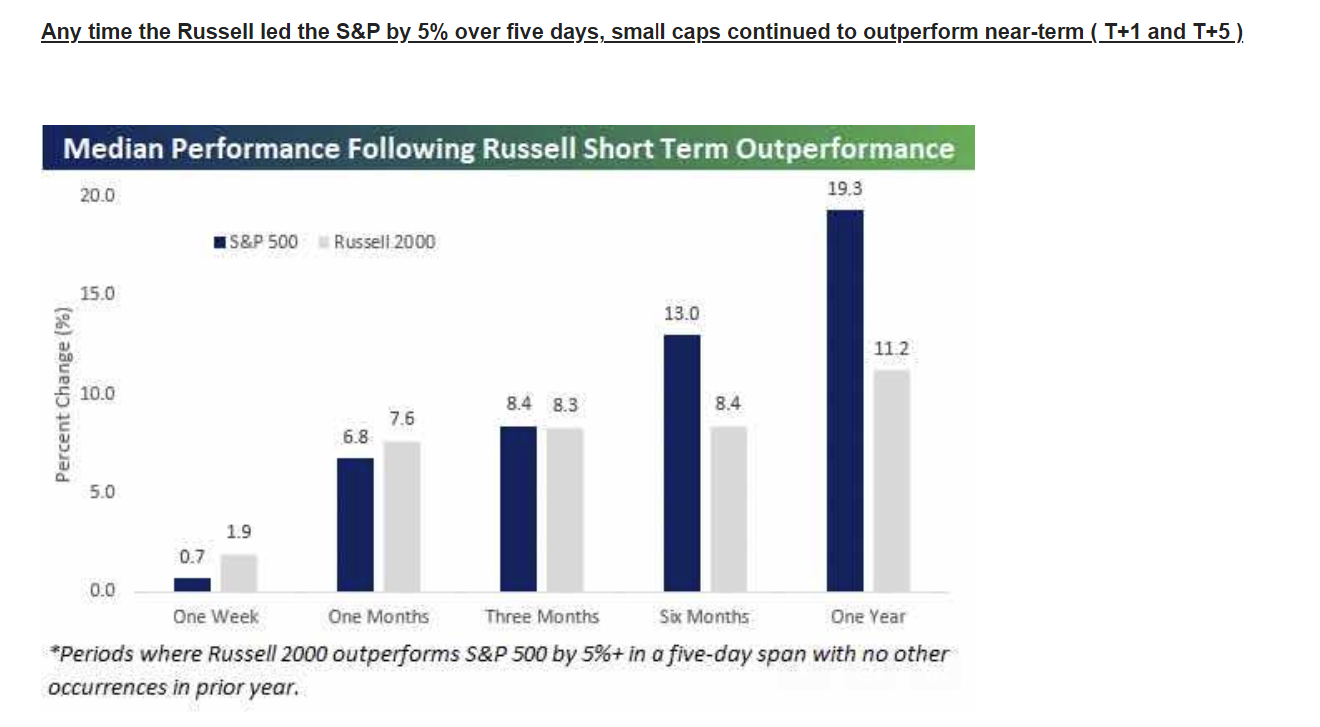

Dave: but could the divergence just get worked off through a broader advance, vs. a major S&P decline?

Source: Mizuho as of 06.08.2023

Source: Mizuho as of 06.08.2023

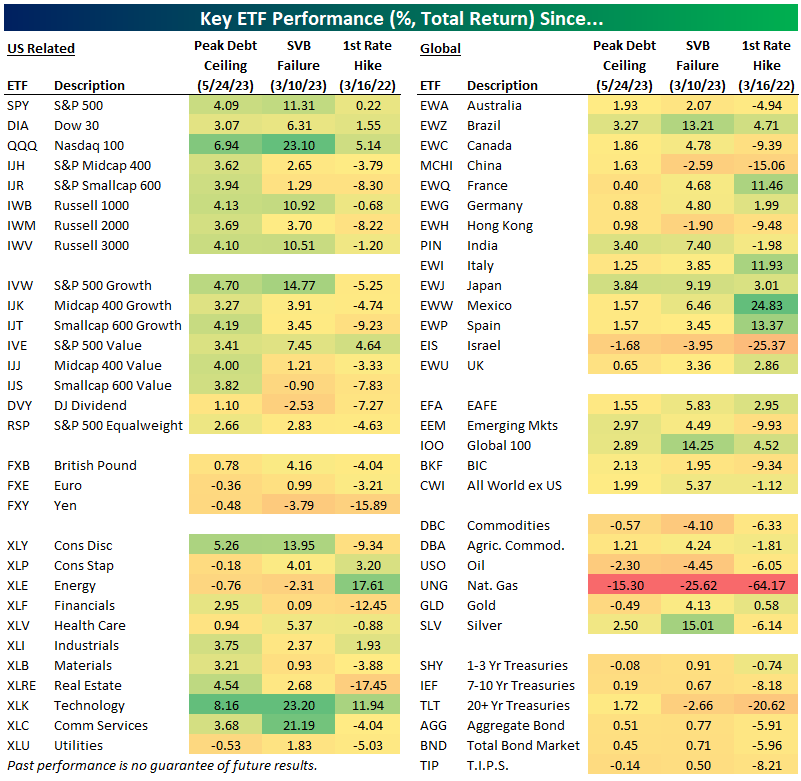

Joseph: The rate hiking cycle since early 2022 has seen pockets of performance differences

Source: Bespoke as of 06.02.2023

Source: Bespoke as of 06.02.2023

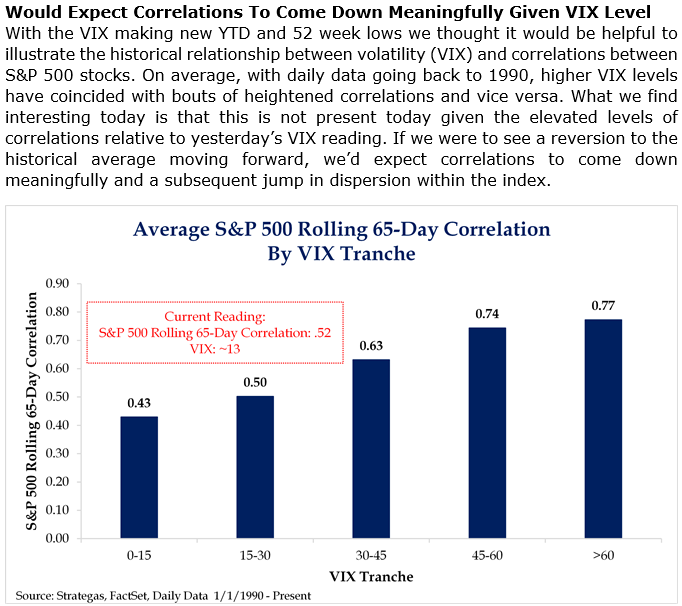

Brad: but it’s in lower volatility environments where we’ve historically seen even larger disparities

Source: Strategas as of 06.06.2023

Source: Strategas as of 06.06.2023

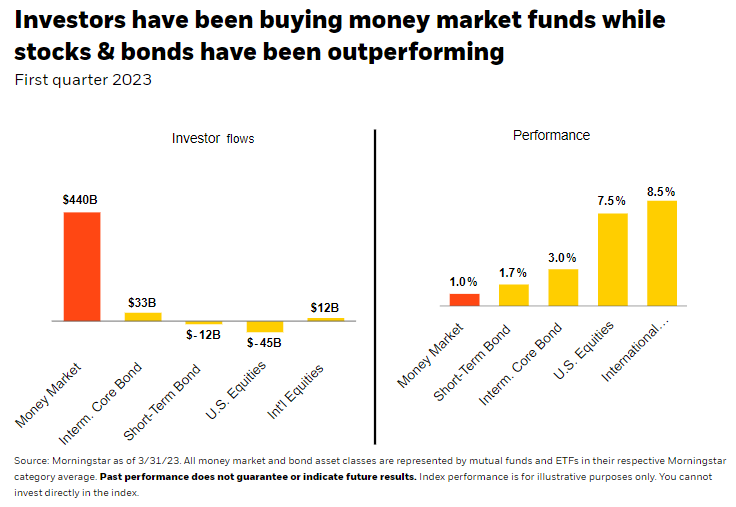

John Luke: Money has been flying into the safest areas of markets

Source: BlackRock as of April 2023

Source: BlackRock as of April 2023

Derek: which may set up some conflicts if investors get confident enough to start shoveling that money back into stocks

Data as of April 2023

Data as of April 2023

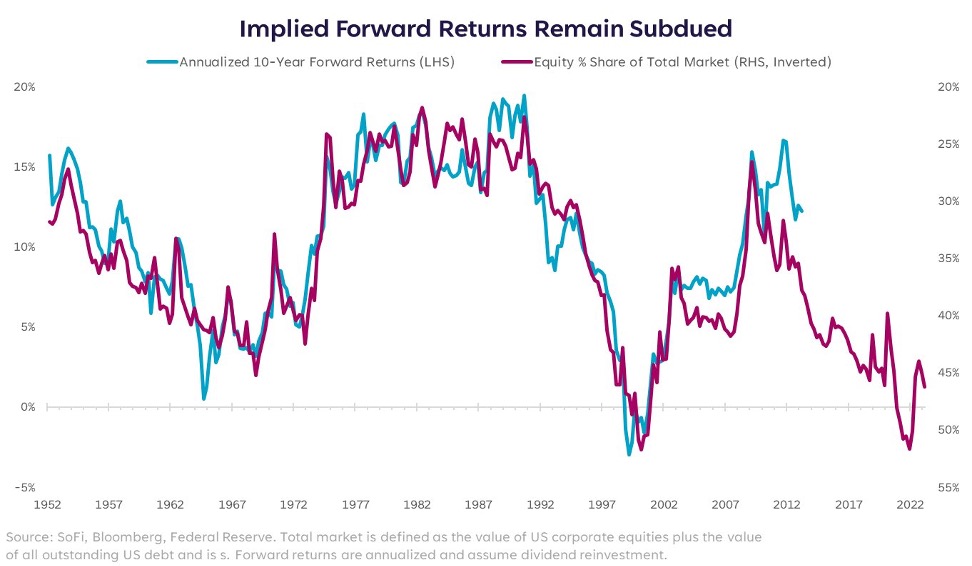

Brad: S&P 500 valuations aren’t overly inspiring from an index level of 4300

Source: Sevens Report as of 06.05.2023

Source: Sevens Report as of 06.05.2023

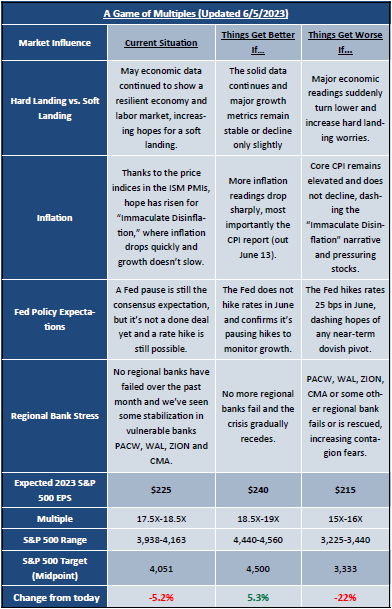

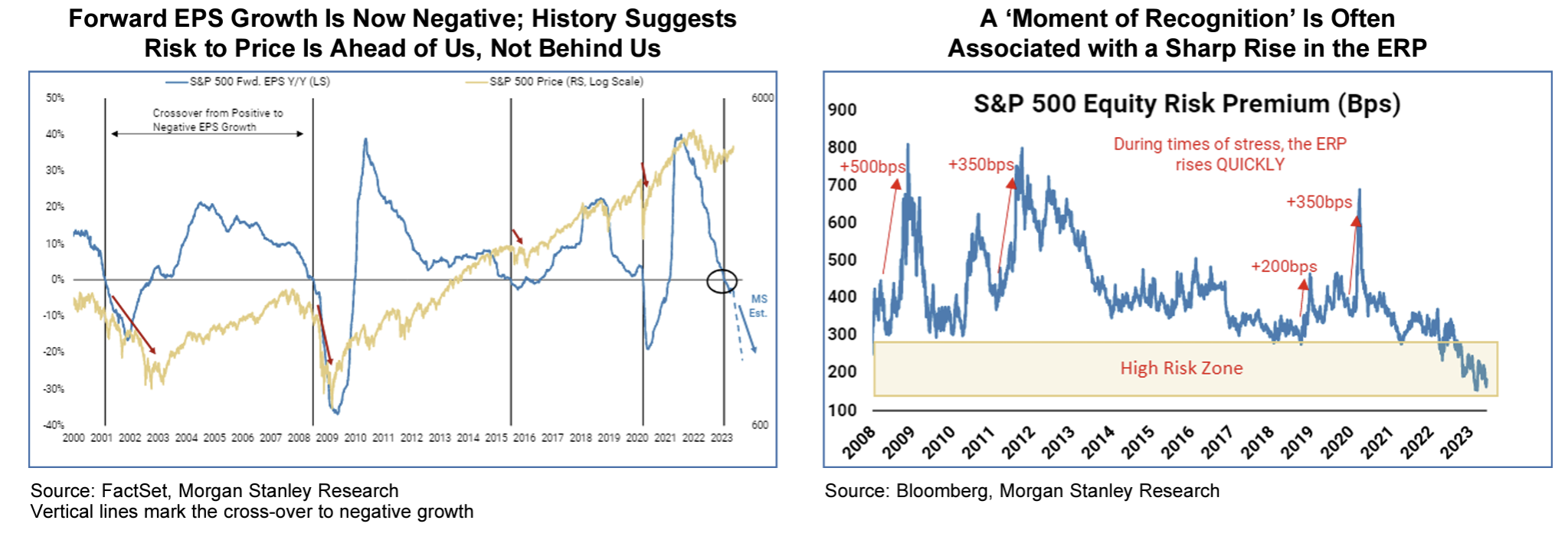

Dave: particularly if Morgan Stanley’s concerns about earnings come through

Data as of 06.05.2023

Data as of 06.05.2023

John Luke: fortunately, excessive valuations are mostly tied up in the tech sector, with the rest of the market historically reasonable

Source: Barclays as of 06.07.2023

Source: Barclays as of 06.07.2023

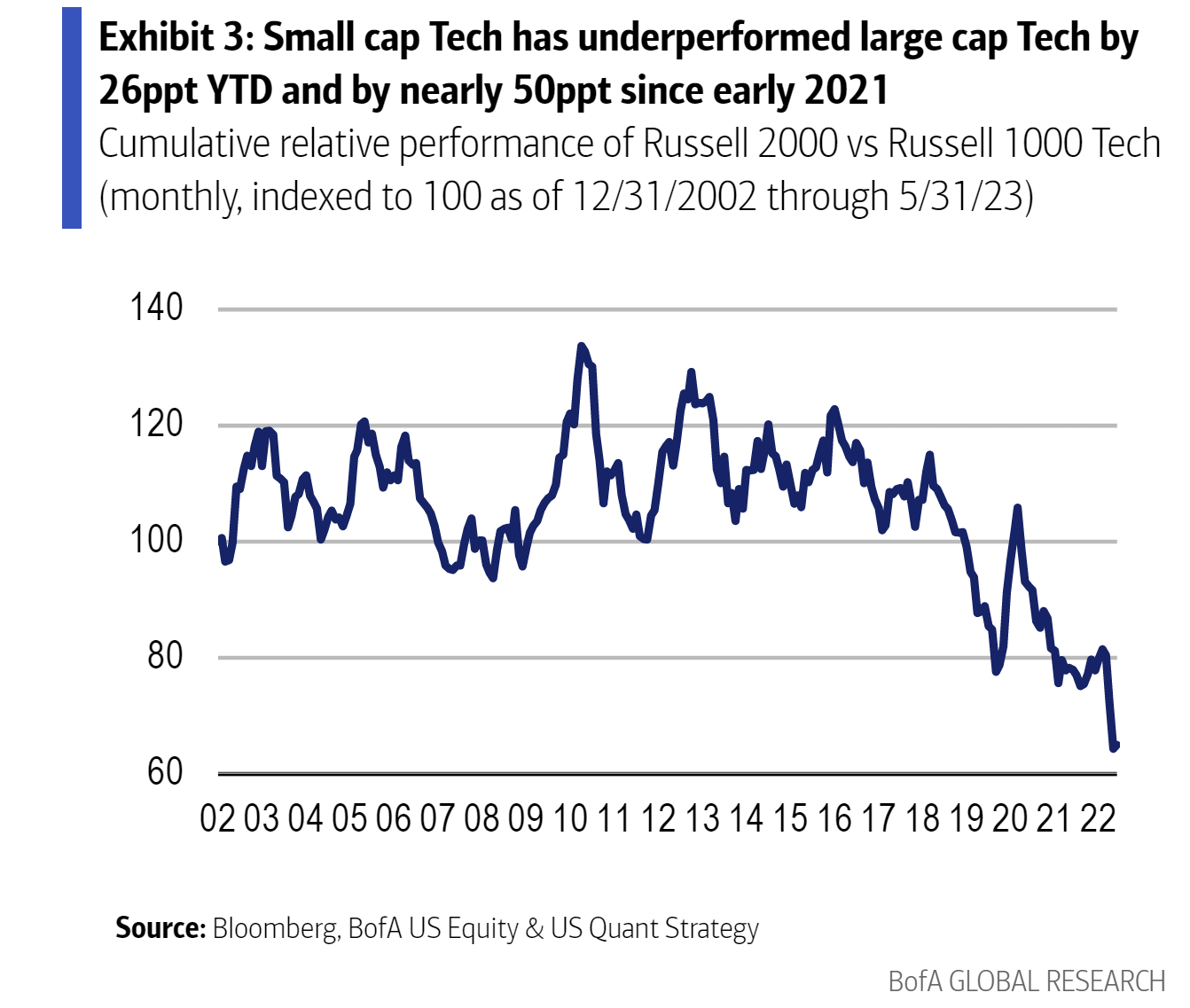

Dave: with a contrast even from large cap tech vs. small cap tech

Source: BofA as of 06.02.2023

Source: BofA as of 06.02.2023

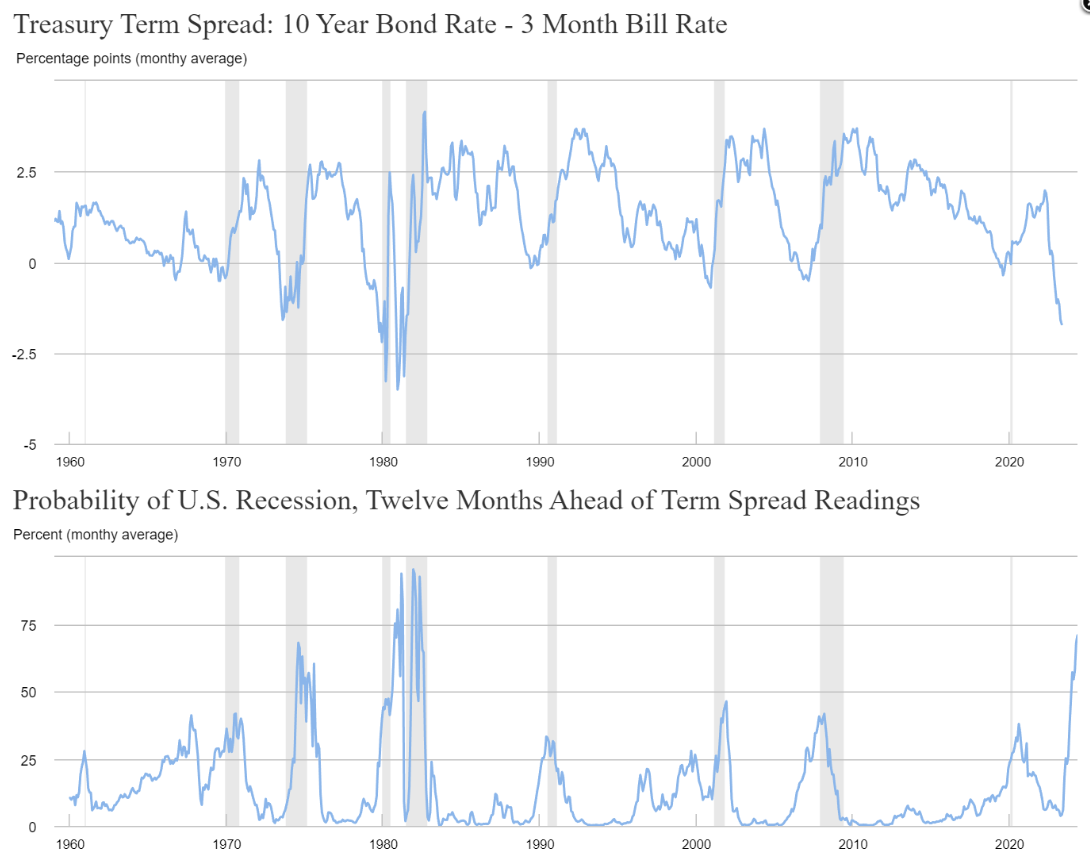

John Luke: It’s our job to continue taking note of the economic warnings being signaled by the yield curve

Source: Federal Reserve Bank of NY as of 06.05.2023

Source: Federal Reserve Bank of NY as of 06.05.2023

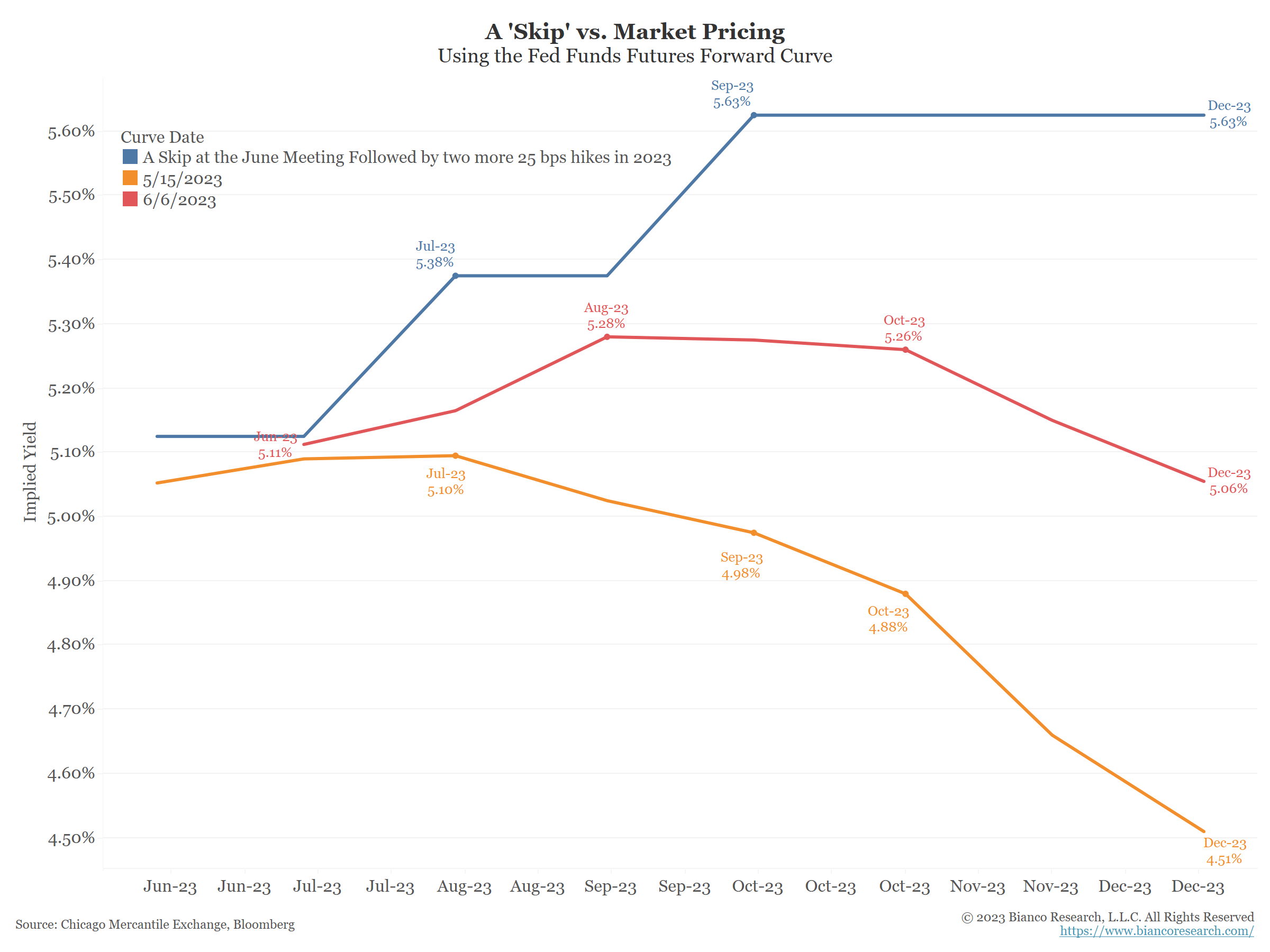

John Luke: but also note that markets are moving away from their rate cut expectations and towards the Fed’s view

Source: Bianco as of 06.06.2023

Source: Bianco as of 06.06.2023

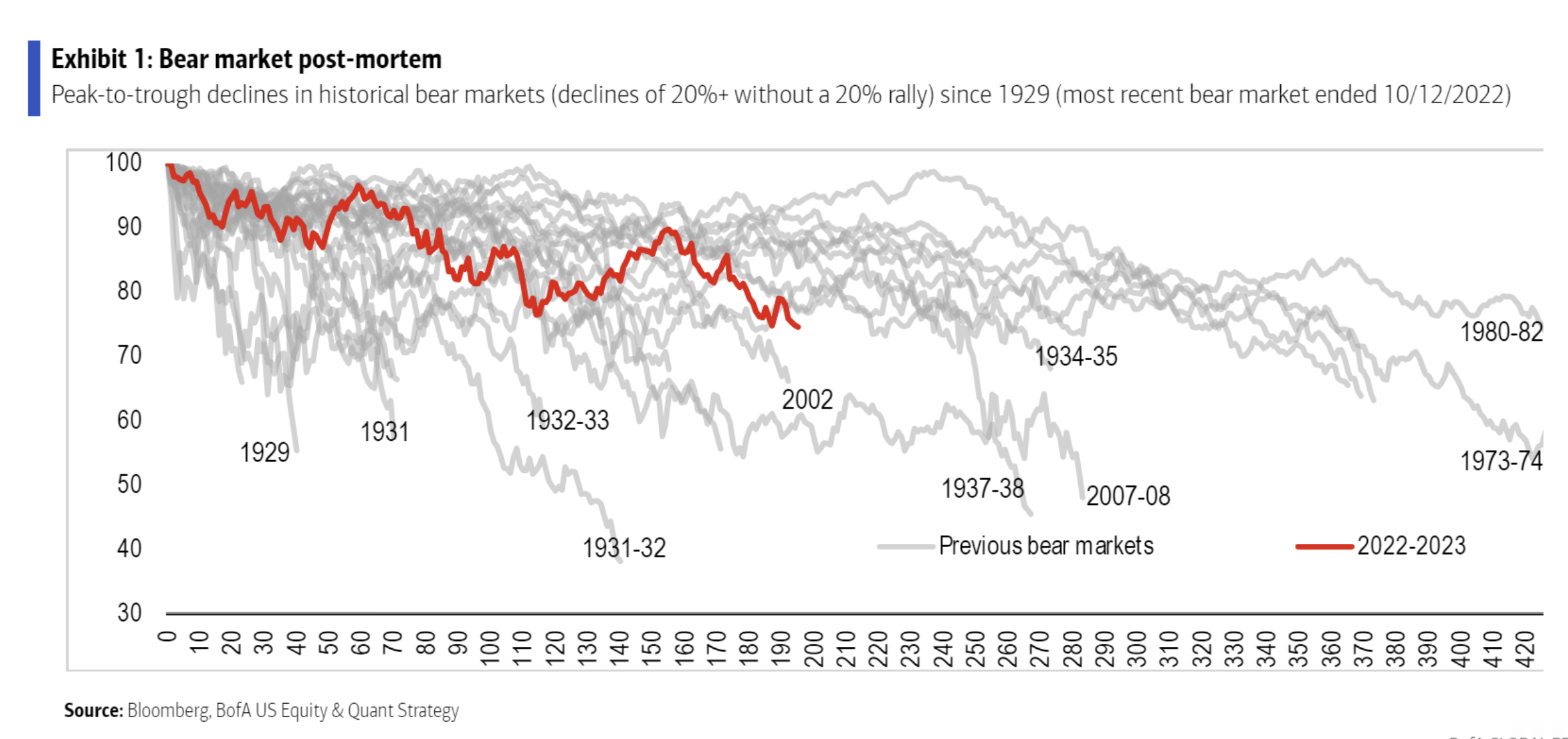

Dave: 20% is an arbitrary marker but If this bear market is truly over, it falls about in the middle of average length and drawdown

Data as of 06.08.2023

Data as of 06.08.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2306-10.