Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

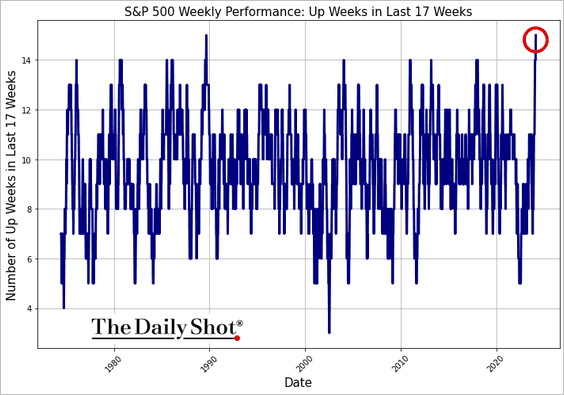

John Luke: On the way to 16 of 18 weeks up for the S&P 500, it seems

Source: Daily Chartbook as of 02.28.2024

Source: Daily Chartbook as of 02.28.2024

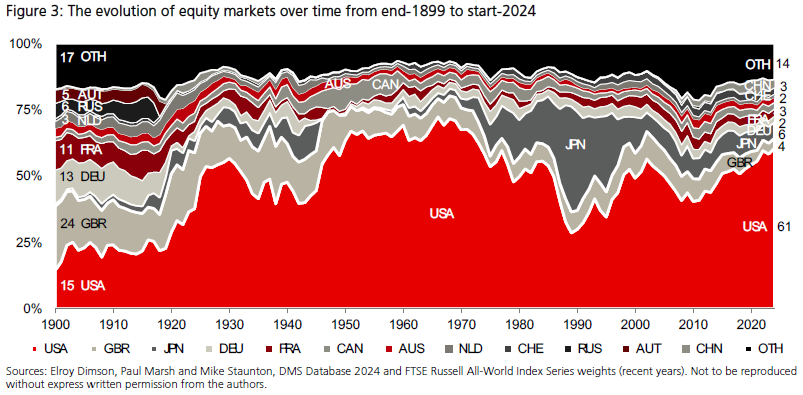

John Luke: We all know US stocks have been dominating foreign stocks in recent years, approaching global influence not seen since the 1960s

Data as of January 2024

Data as of January 2024

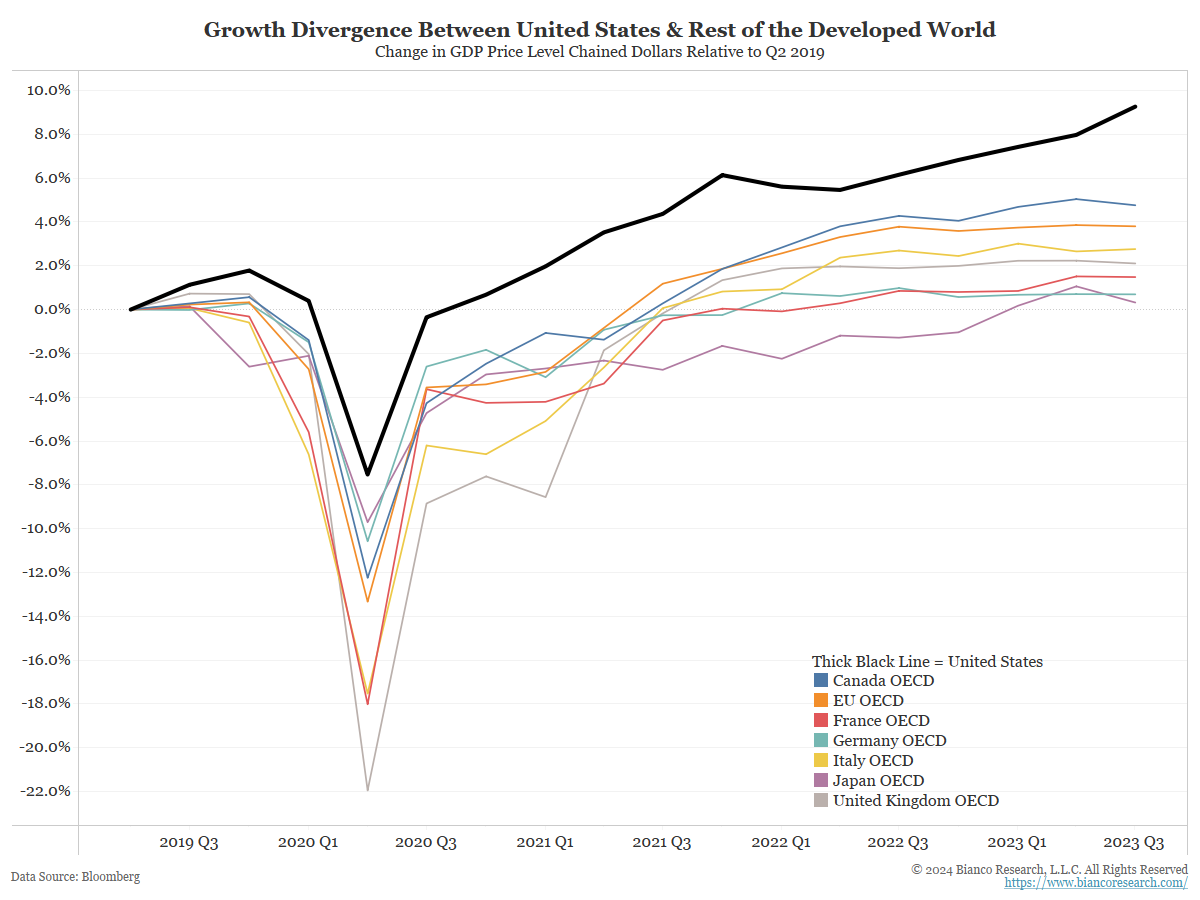

Dave: accelerating in recent years due to a better economy

Data as of January 2024

Data as of January 2024

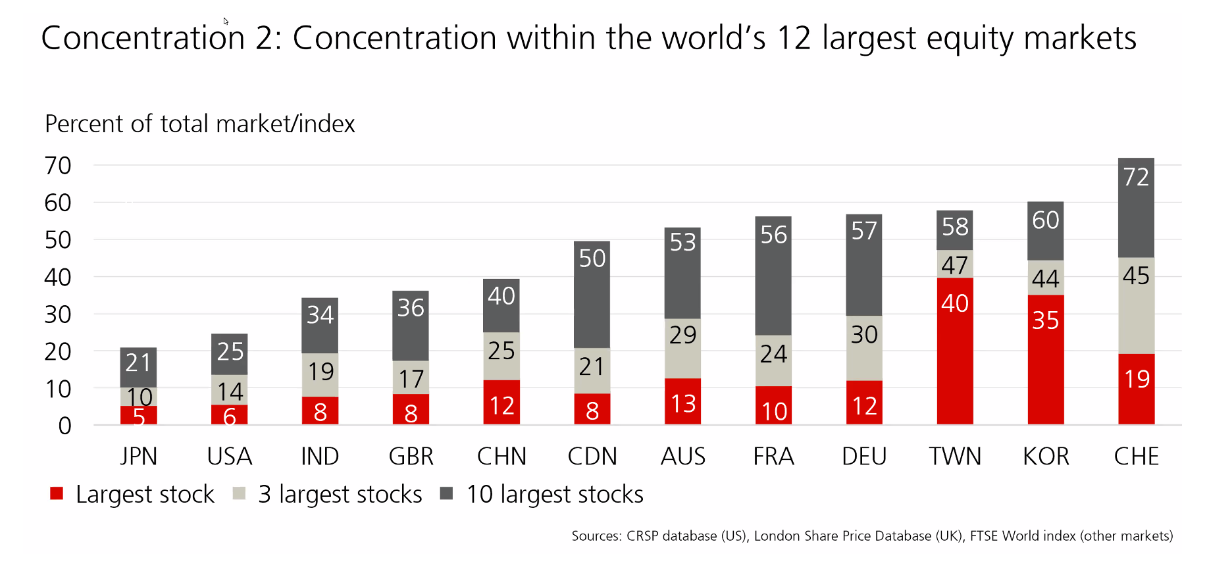

Beckham: and while many complain about the reliance on a handful of megacap tech stocks, our market is no more concentrated than any other large country

Source: Bloomberg as of 02.29.2024

Source: Bloomberg as of 02.29.2024

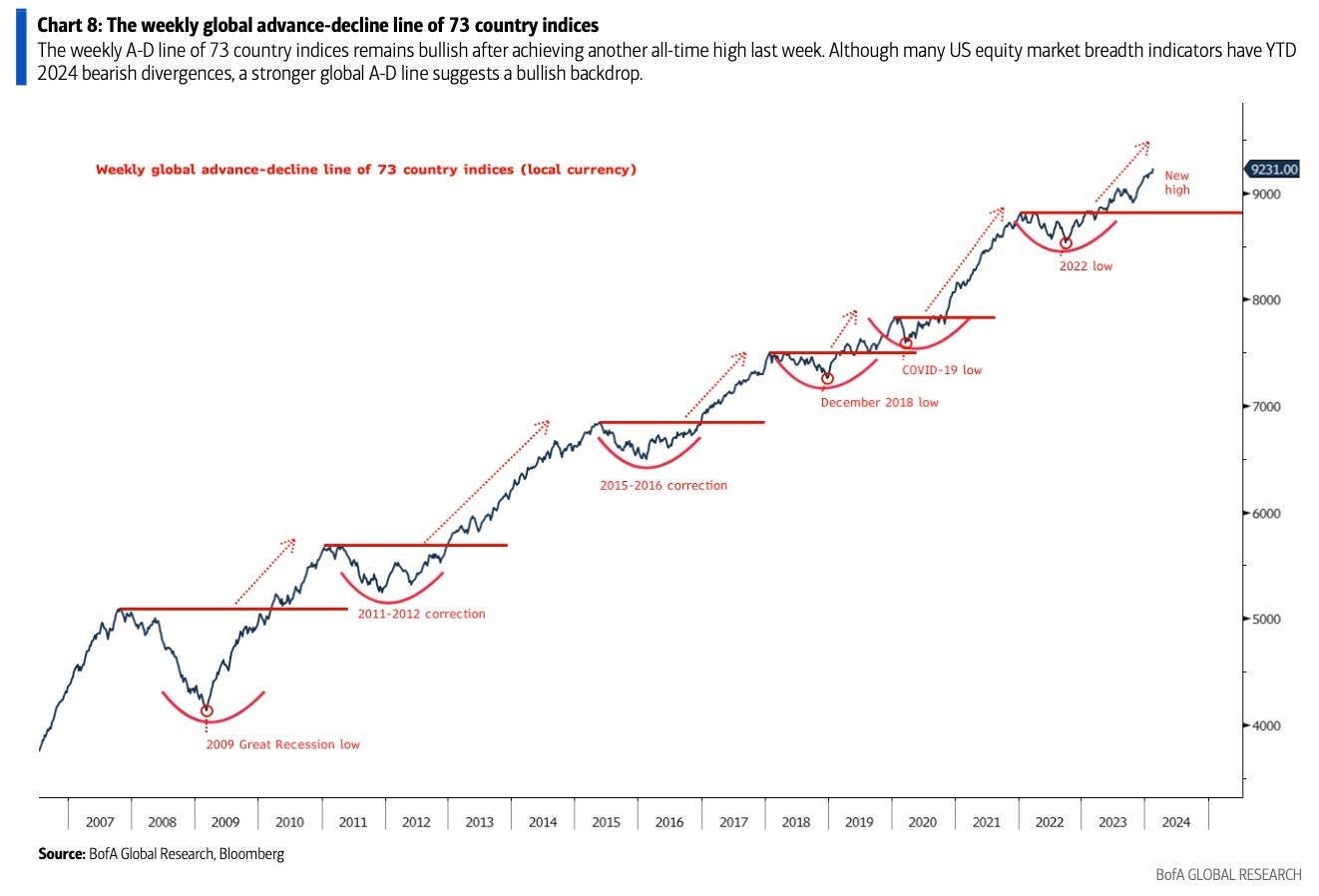

Brett: and don’t miss the global advance underway while others fret about a few big US tech stocks

Data as of 02.23.2024

Data as of 02.23.2024

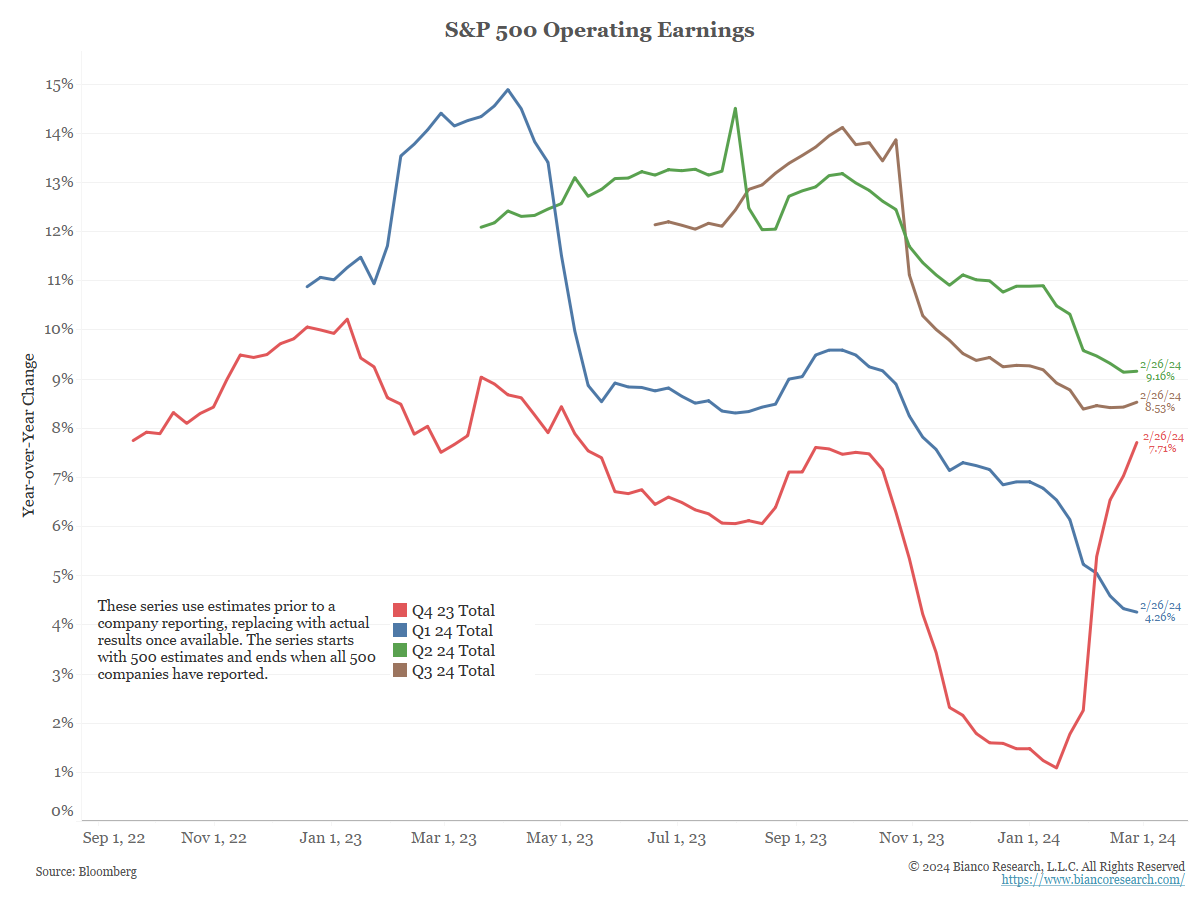

Dave: Q4 earnings results have yet to flow through into the outlook for future quarters

Data as of February 2024

Data as of February 2024

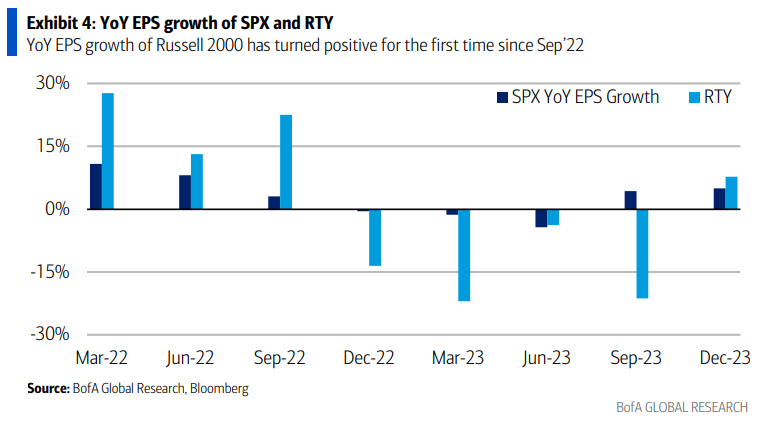

Brian: but the worst for smaller companies seems to be in the rearview mirror

Data as of 02.27.2024

Data as of 02.27.2024

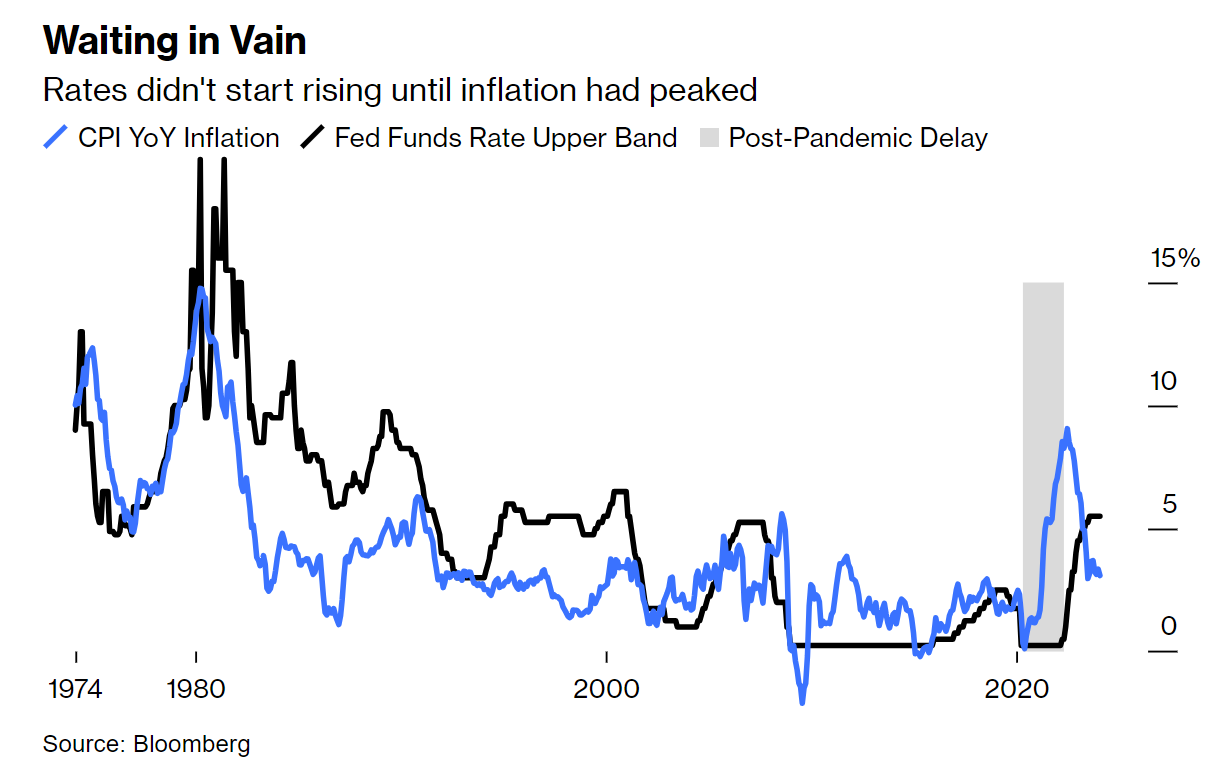

Joseph: The rate-hike cycle of 2022-23 was different than prior cycles, with hikes coming mostly after official inflation figures were peaking

Data as of February 2024

Data as of February 2024

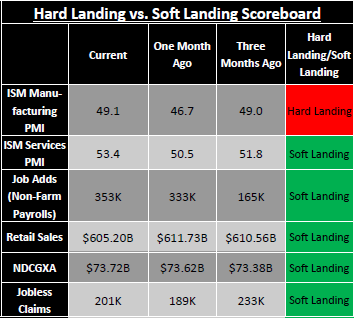

Brad: and perhaps that timing has contributed to postponing the recession that everyone knew was coming

Source: Sevens Report as of 02.27.2024

Source: Sevens Report as of 02.27.2024

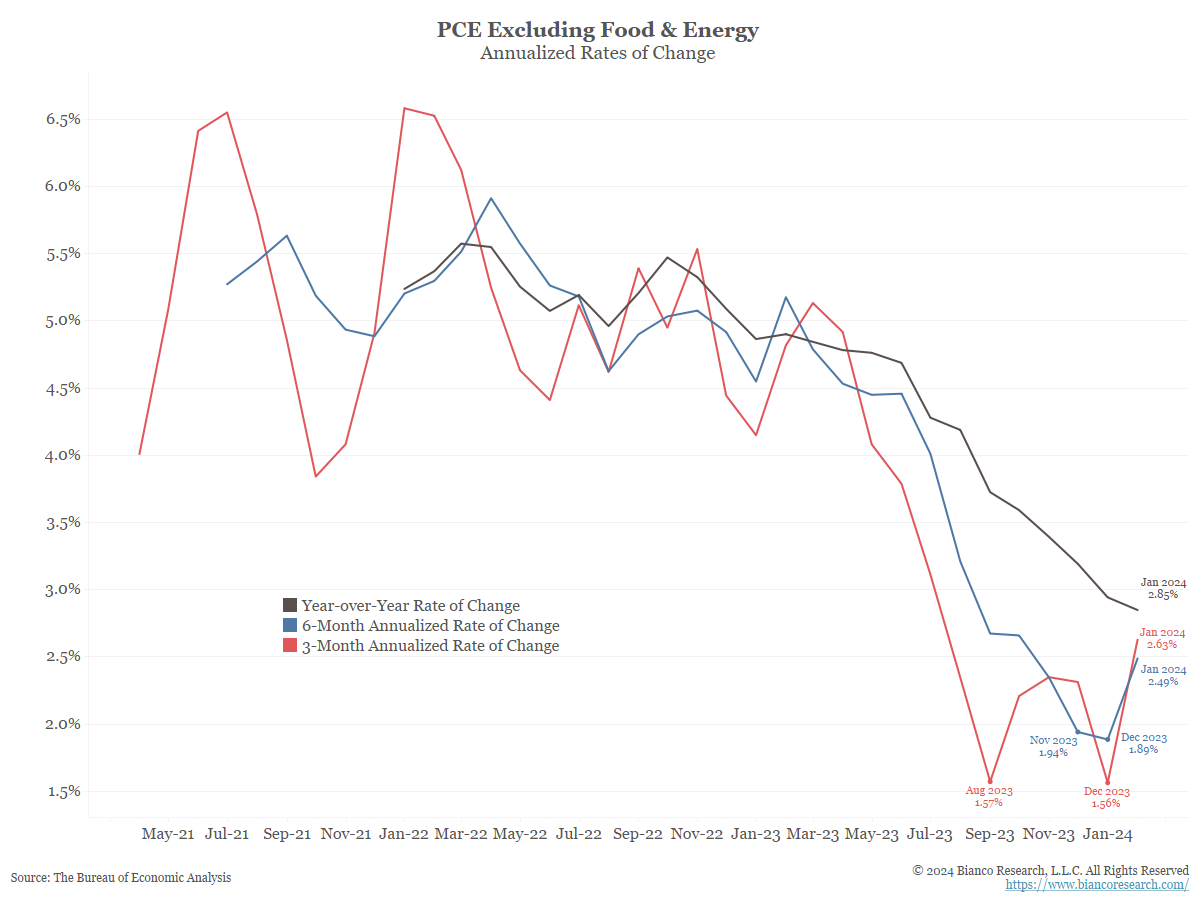

Dave: The lack of a slowdown will likely keep near-term Personal Consumption Expenditures (PCE) from taking year-over-year measure much lower

Data as of 02.29.2024

Data as of 02.29.2024

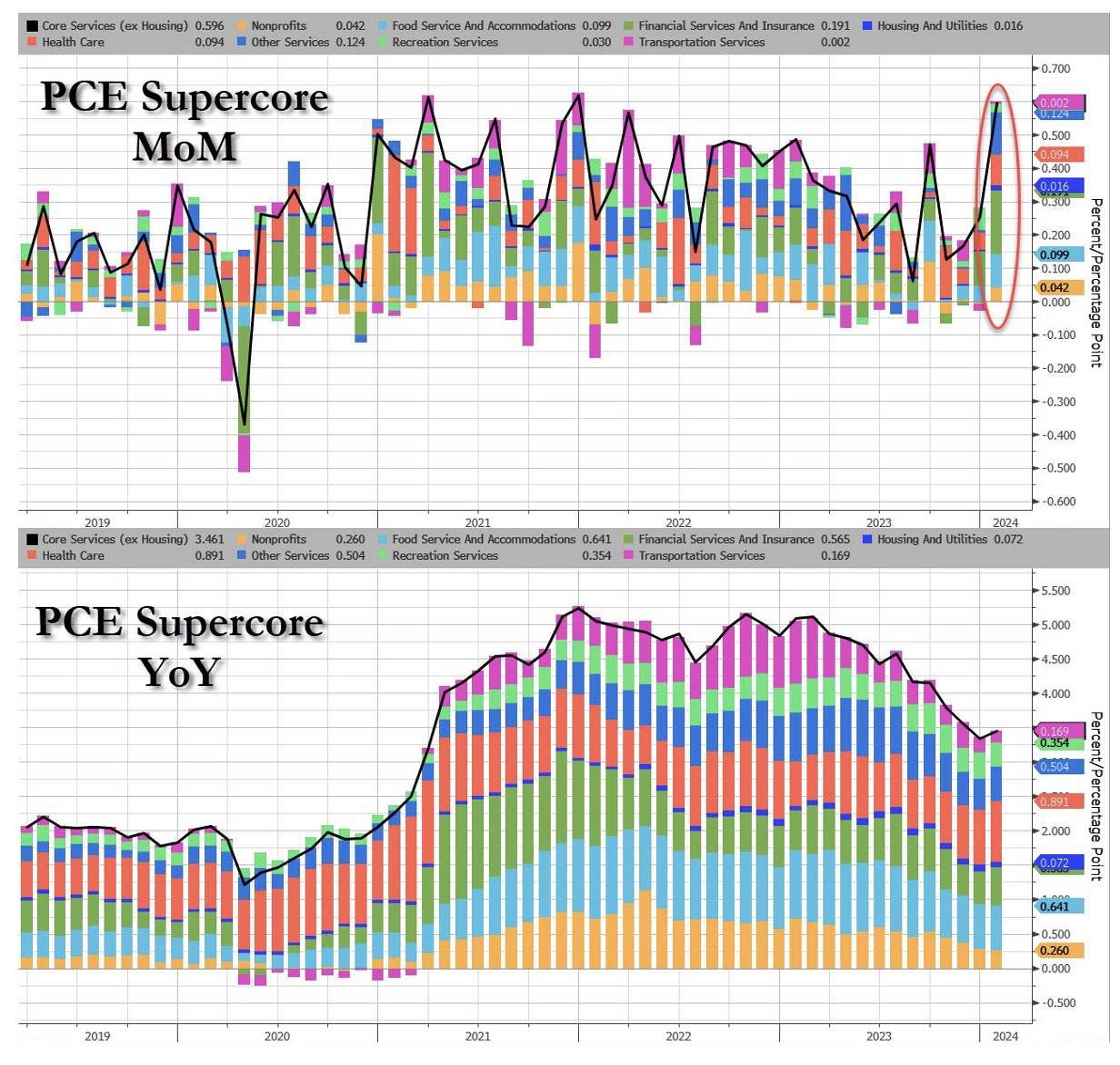

John Luke: with the PCE’s “Supercore” measure especially sticky at higher levels

Source: Zerohedge as of 02.29.2024

Source: Zerohedge as of 02.29.2024

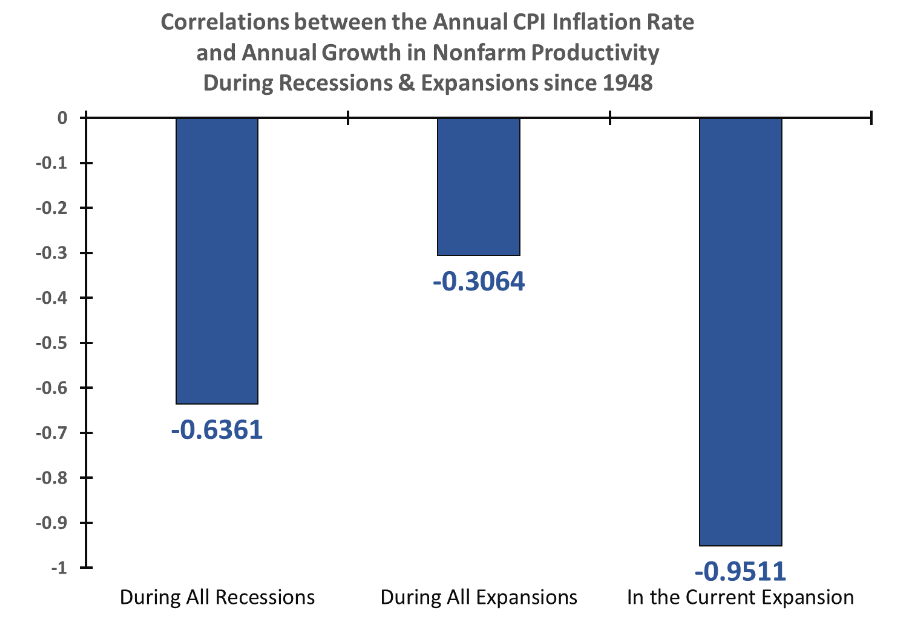

Beckham: with improving productivity seemingly our most sustainable path out of higher inflation

Source: Paulsen Perspectives as of 02.28.2024

Source: Paulsen Perspectives as of 02.28.2024

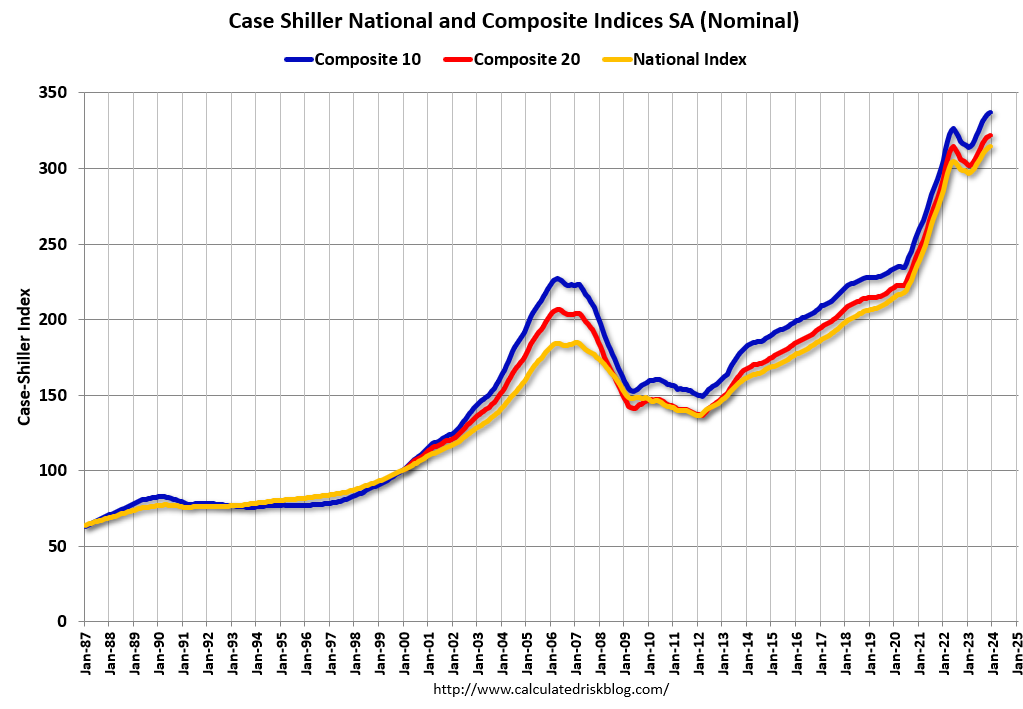

Joseph: The piece of the economy that most of the public can understand is housing; despite much higher mortgage rates we’ve seen barely a blip in prices

Data as of 02.28.2024

Data as of 02.28.2024

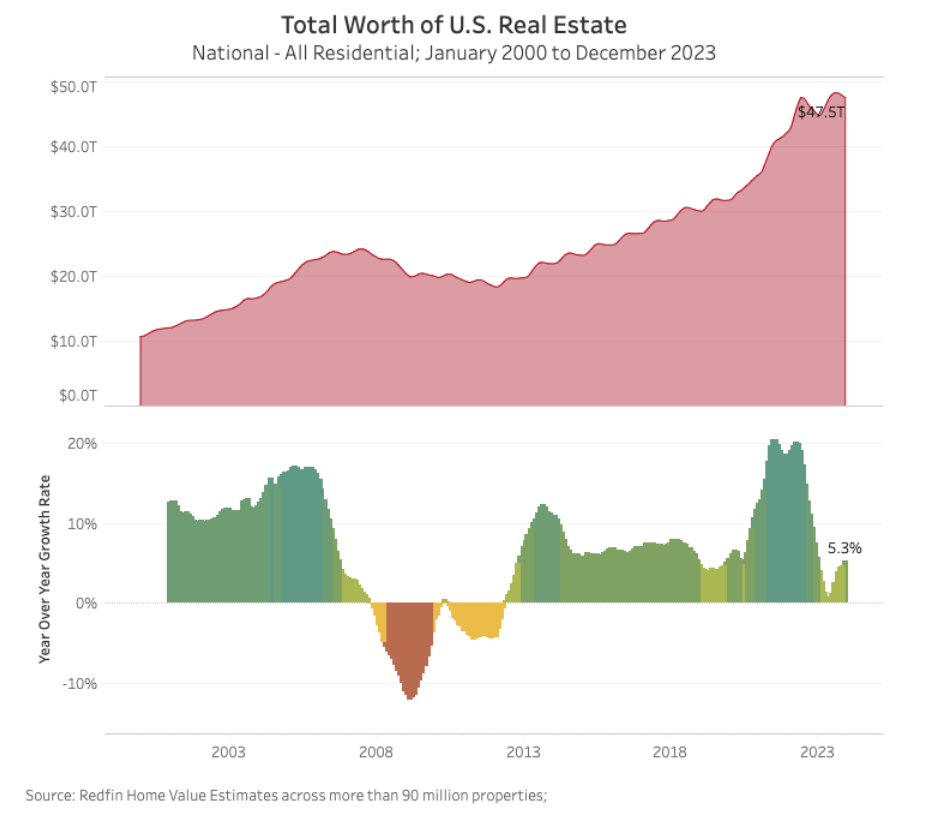

Brett: continuing the wealth effect experienced by most homeowners since the Global Financial Crisis

Data as of February 2024

Data as of February 2024

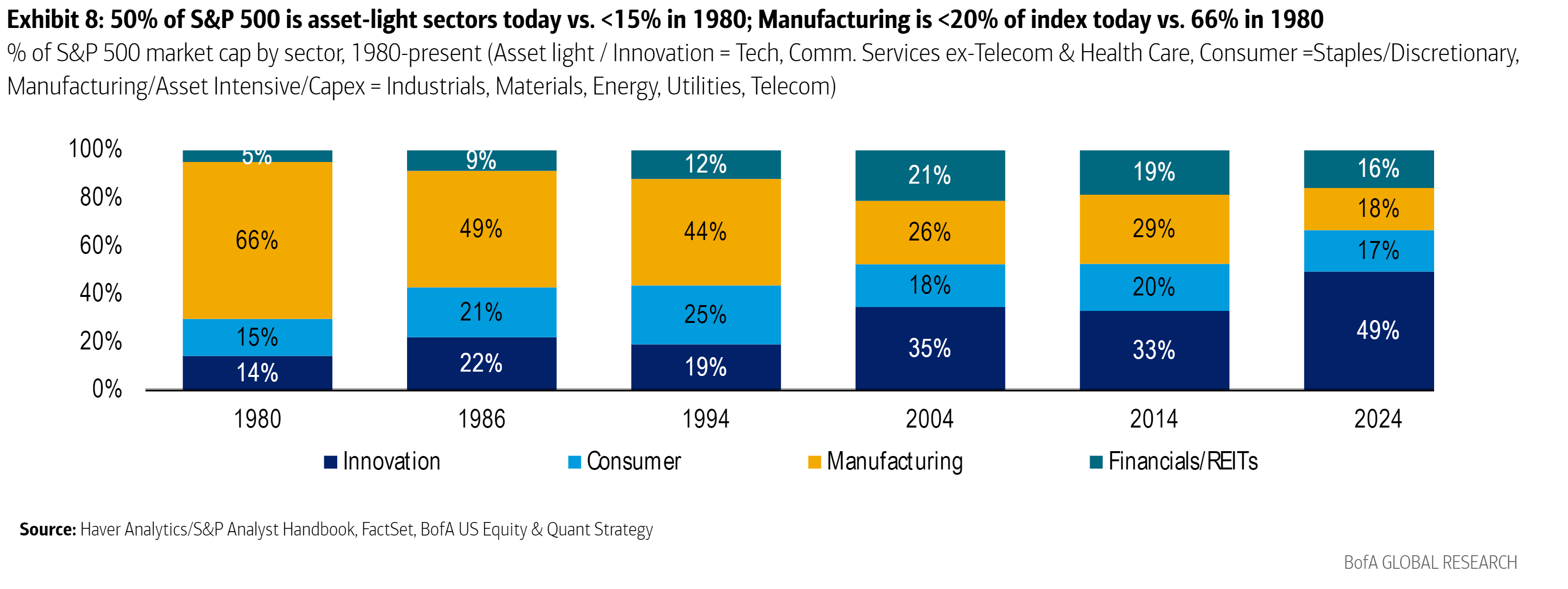

Dave: Traditional valuation measures continue to be less reliable, as more of our businesses are growing without a large investment in tangible inventory

Data as of February 2024

Data as of February 2024

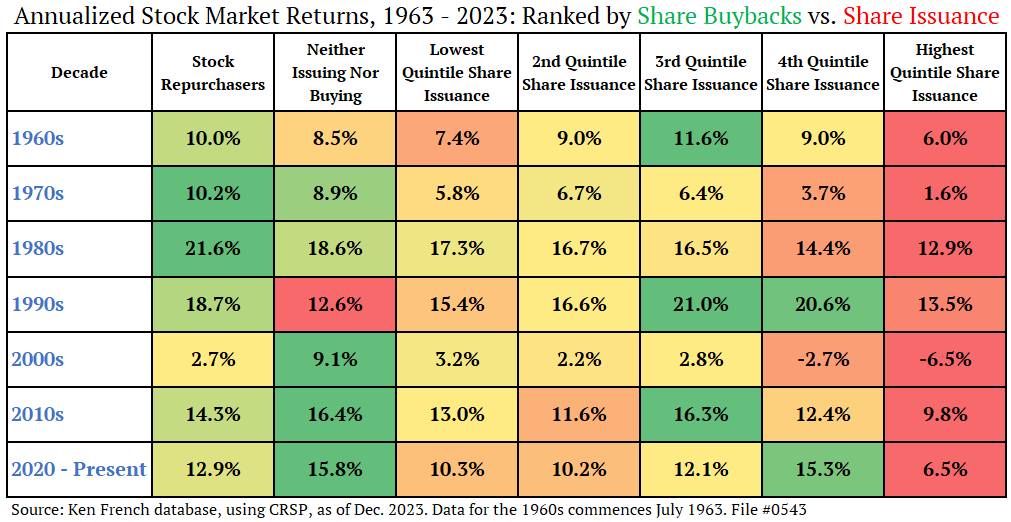

Brad: and those who go back to investors for more equity ultimately see share prices lag others who can grow without ownership dilution

Source: @JeffWeniger as of 02.23.2024

Source: @JeffWeniger as of 02.23.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2403-01.