Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

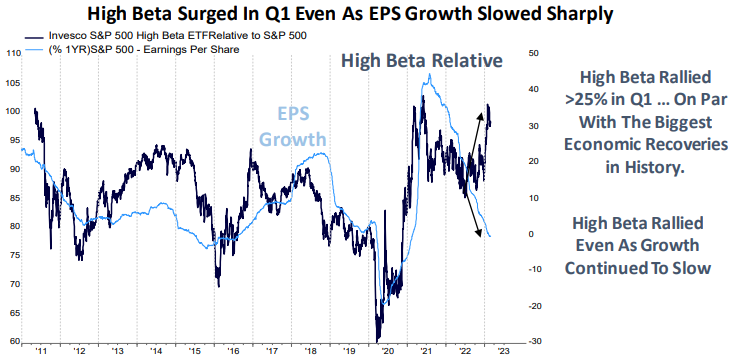

Beckham: The high-beta rally to start the year was really weird

Source: Piper as of 03.06.23

Source: Piper as of 03.06.23

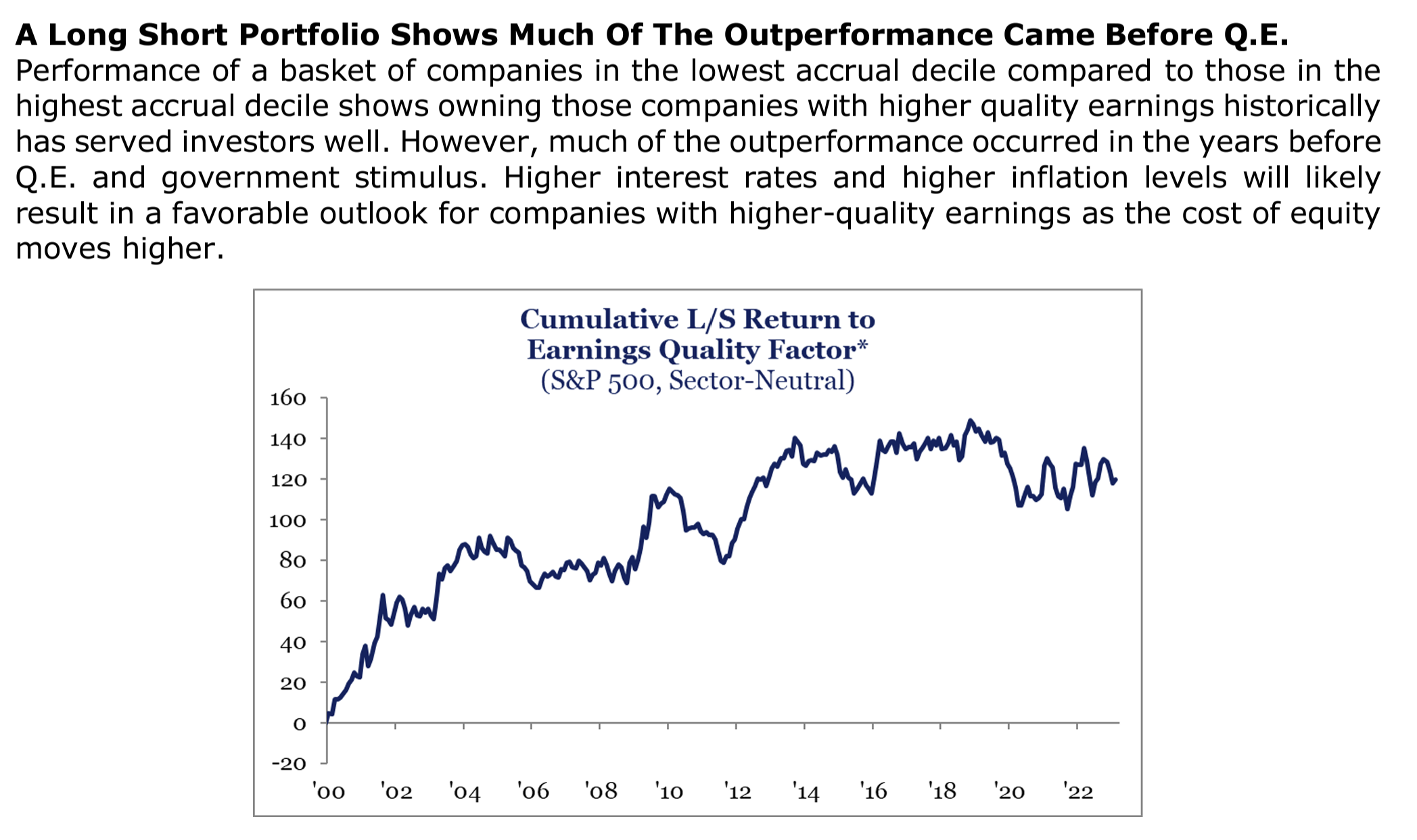

Dave: especially given the loss of quantitative easing as a source of funding

Source: Strategas as of 03.06.23

Source: Strategas as of 03.06.23

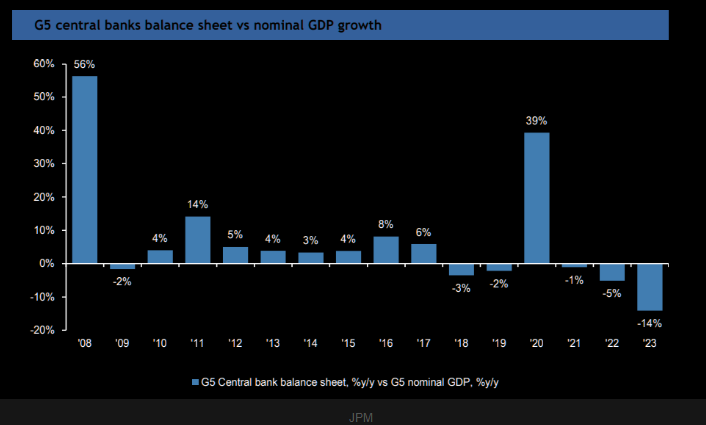

Beckham: as seen in the now-shrinking global balance sheets

Source: Market Ear as of 03.07.23

Source: Market Ear as of 03.07.23

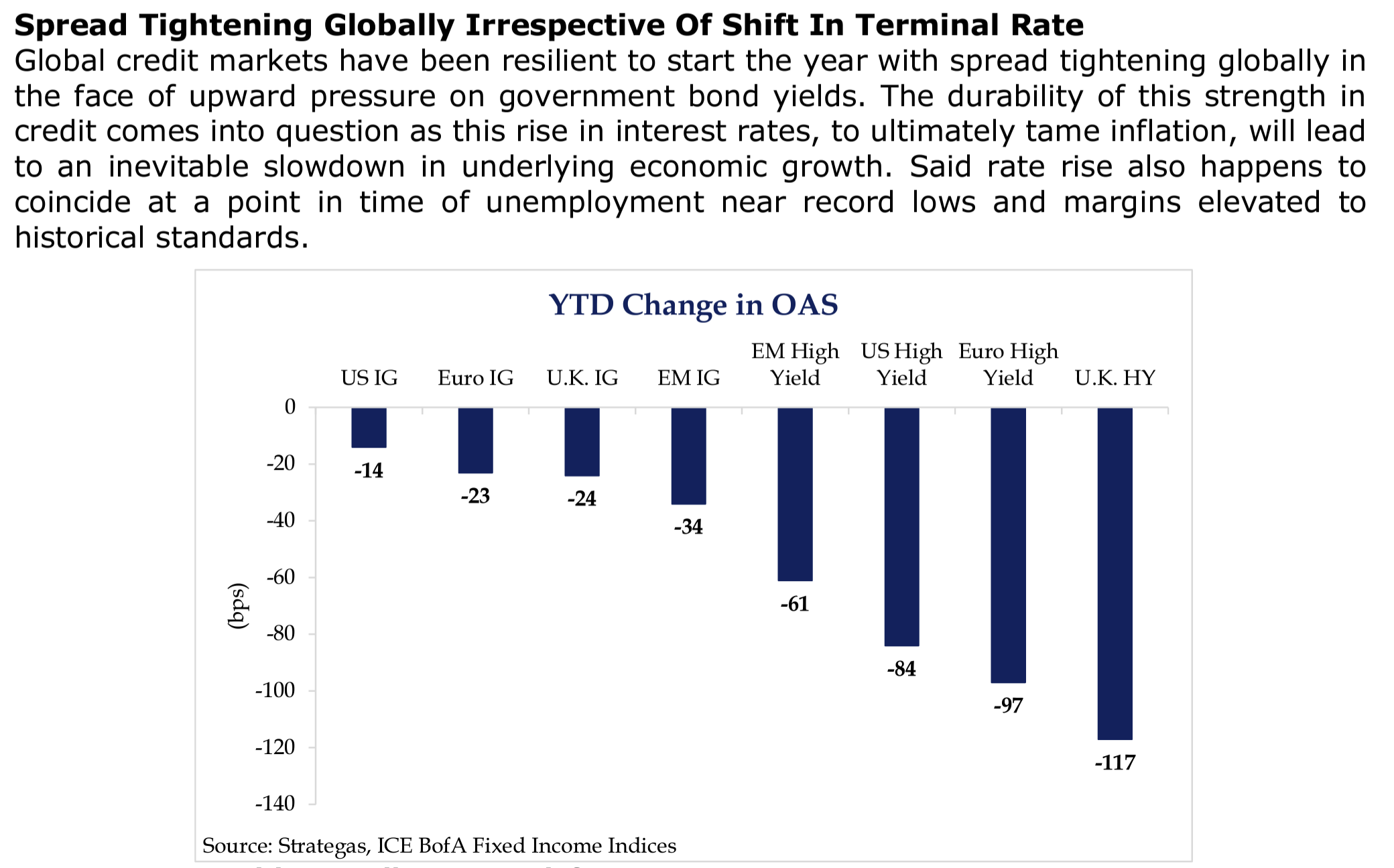

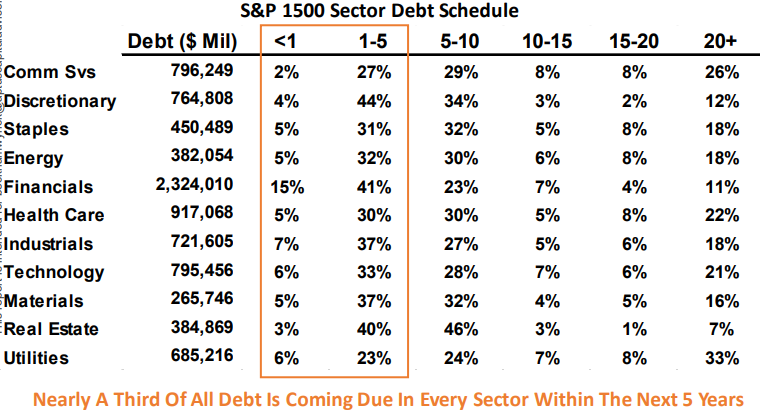

Dave: Corporations without long-term funding are really hoping credit spreads stay tight

Data as of 03.07.23

Data as of 03.07.23

Beckham: as there are a growing percentage of firms that may soon be seeking funding

Source: Piper as of 03.06.23

Source: Piper as of 03.06.23

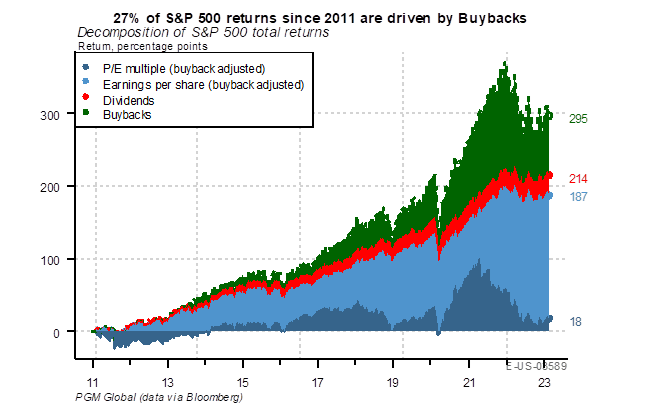

John Luke: Buybacks have been a huge tailwind to stocks. Will they maintain that role with the buyback tax chatter?

Data as of 03.01.23

Data as of 03.01.23

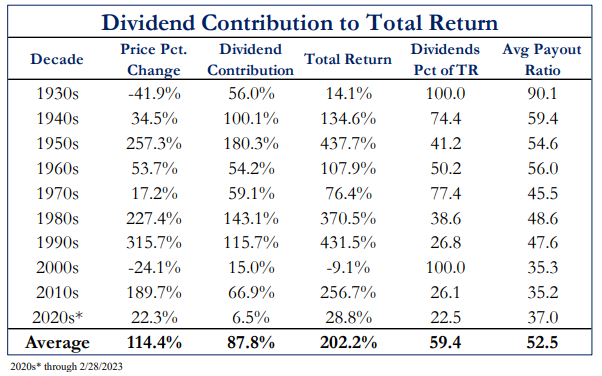

John Luke: or will dividends return to a preferred role for public companies and their investors?

Source: Strategas as of 02.28.23

Source: Strategas as of 02.28.23

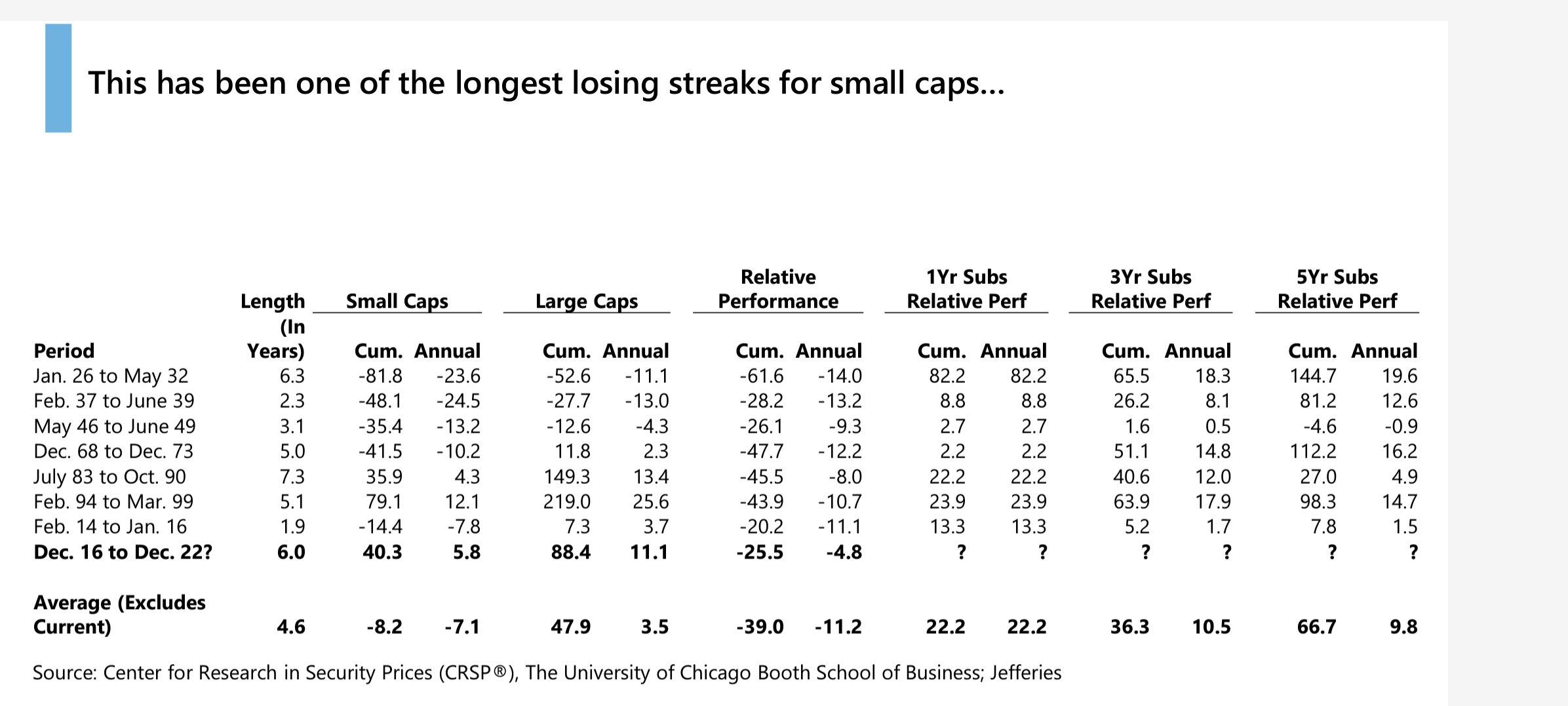

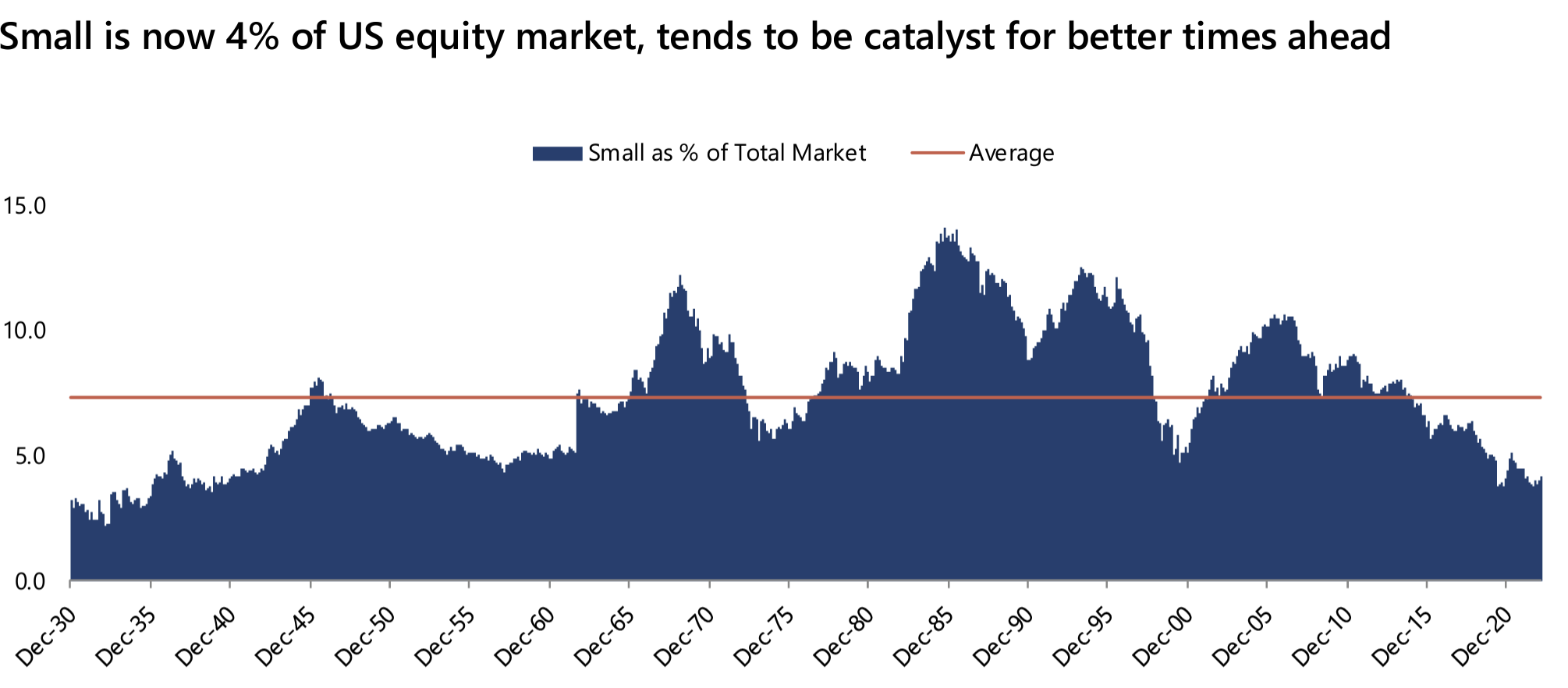

Dave: This small-cap losing streak relative to large-caps is getting old

Data as of 02.28.23

Data as of 02.28.23

Dave: and combined with the megacap tech run, has made small-caps a historically low percentage of total market cap

Source: BofA as of 03.08.23

Source: BofA as of 03.08.23

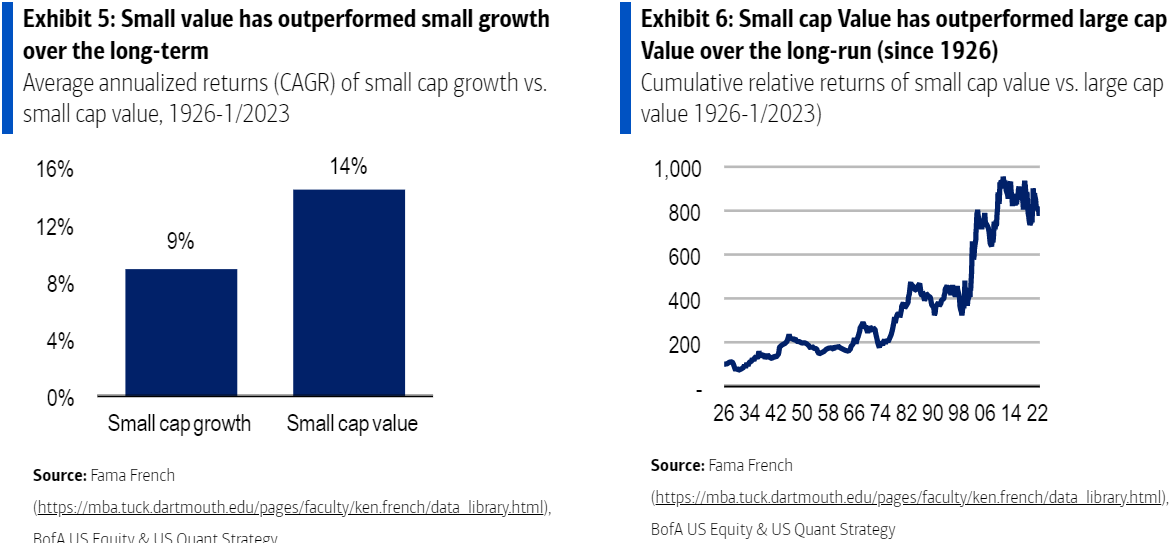

Brad: all of this despite the history of small value outperformance of both small growth and large value

Data as of 02.01.2023

Data as of 02.01.2023

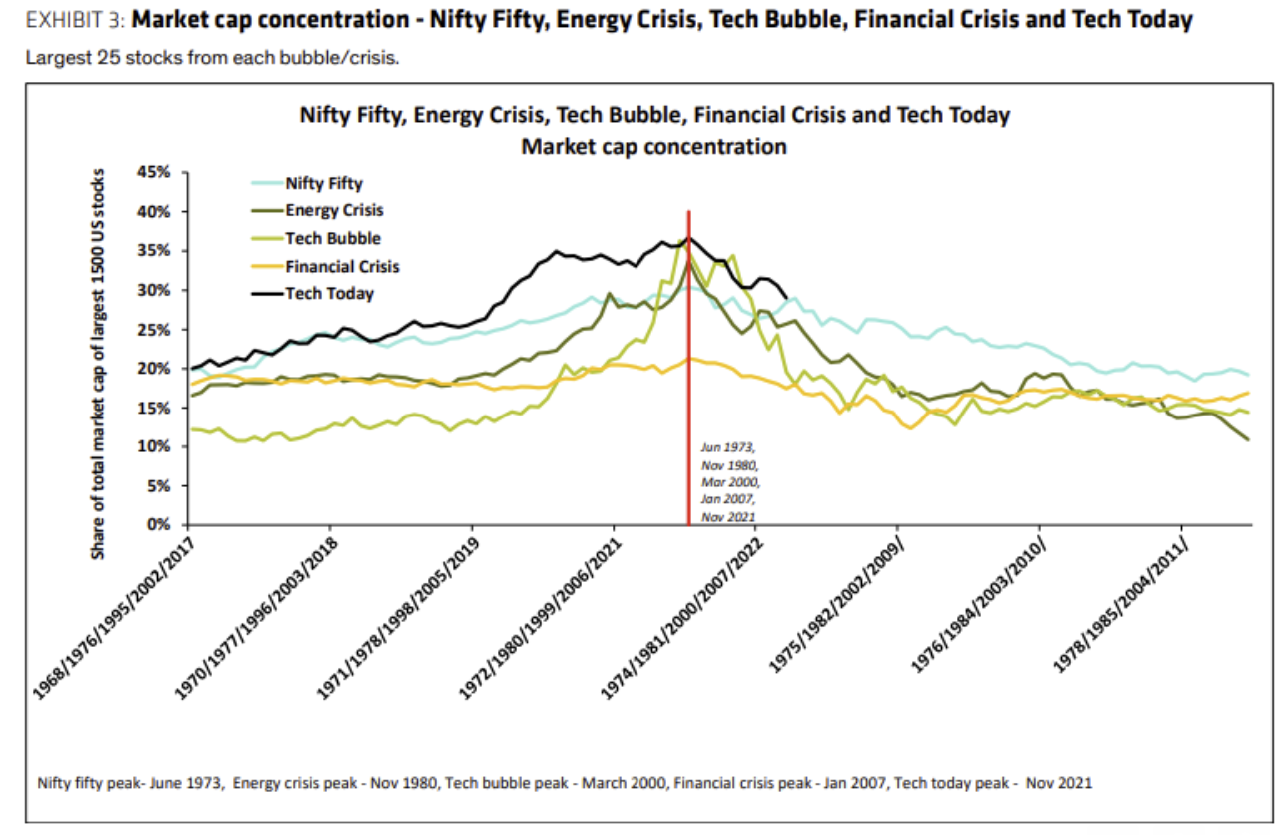

Dave: Speaking of megacap tech, the concentration remains quite high relative to the deflating of other bubbles

Source: Bernstein as of 03.01.23

Source: Bernstein as of 03.01.23

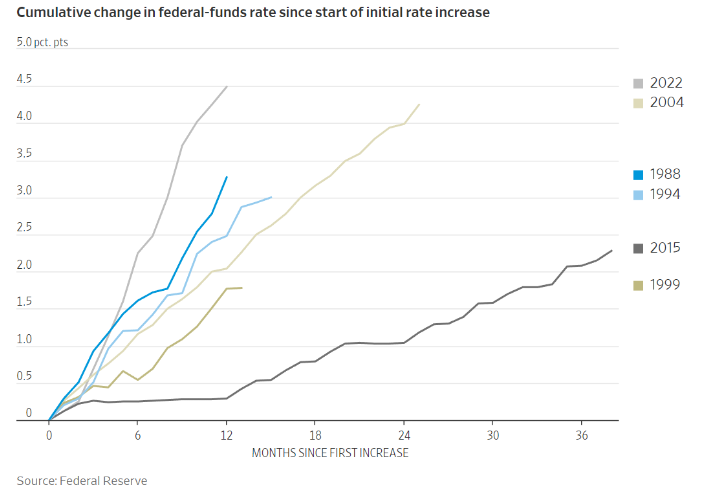

John Luke: This hiking cycle has been sharp relative to those in the past

Data as of 03.01.23

Data as of 03.01.23

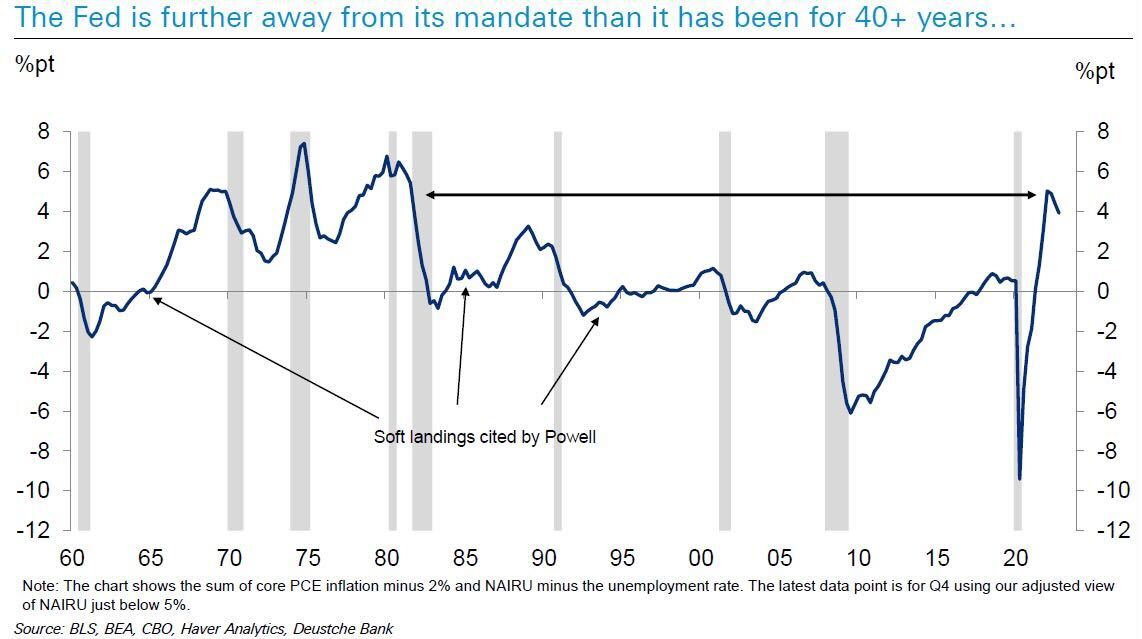

John Luke: but it’s going to be hard to exit without some type of economic damage, given the distance remaining from target

Data as of 03.06.23

Data as of 03.06.23

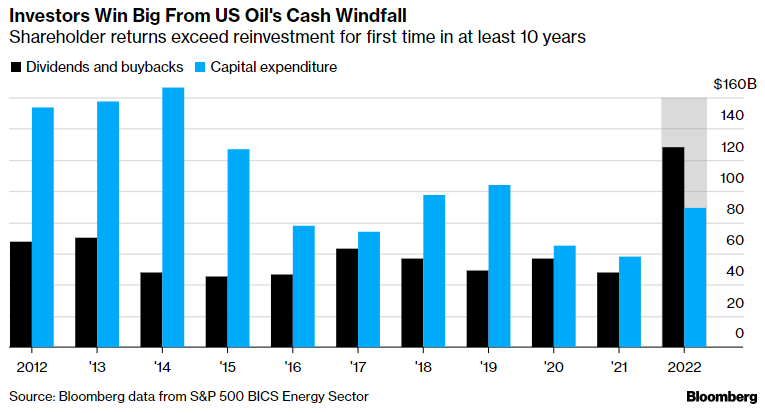

Joseph: Energy companies finally showing shareholders the money… but what about future energy supplies?

Data as of 02.01.2023

Data as of 02.01.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2303-15.

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2303-6.