Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from the US market correction to investor sentiment to tariffs and relative strength in foreign markets. Enjoy!

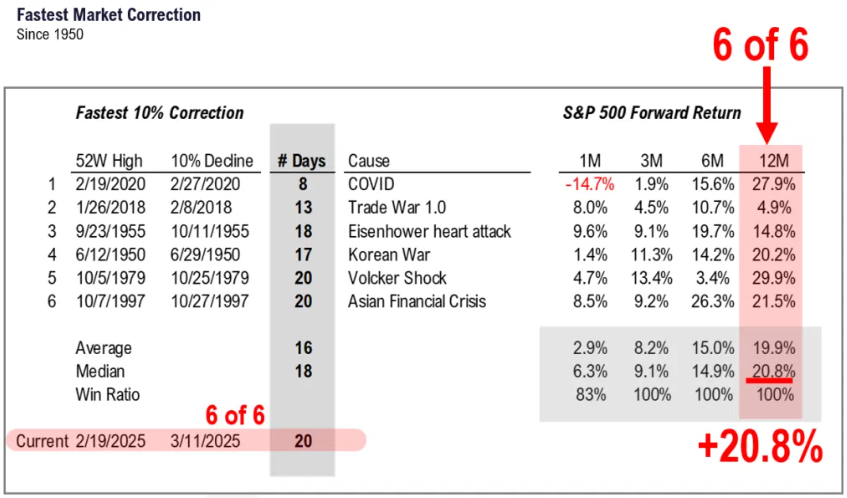

Brett: 10% market corrections have historically happened every year or so, but only 4 in the past 75 years fell faster than this one

Source: FS Insight as of 03.13.2025

Source: FS Insight as of 03.13.2025

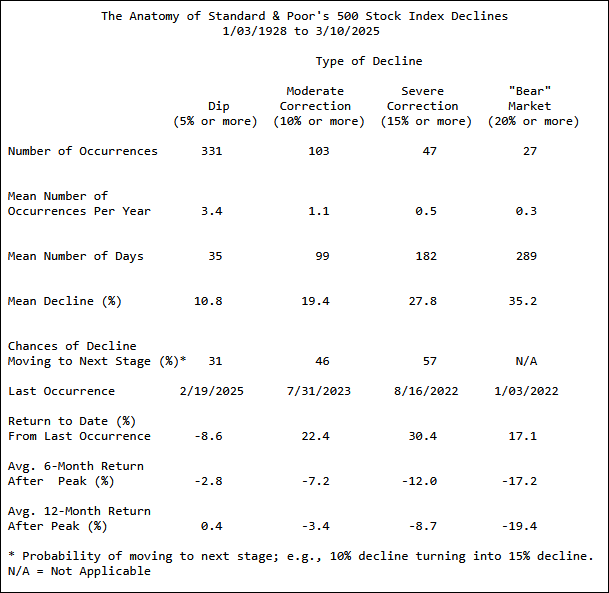

John Luke: Looking further back in history, just one in four 10% corrections turns into an actual bear market drop of 20% or more

Source: Day Hagan as of 03.11.2025

Source: Day Hagan as of 03.11.2025

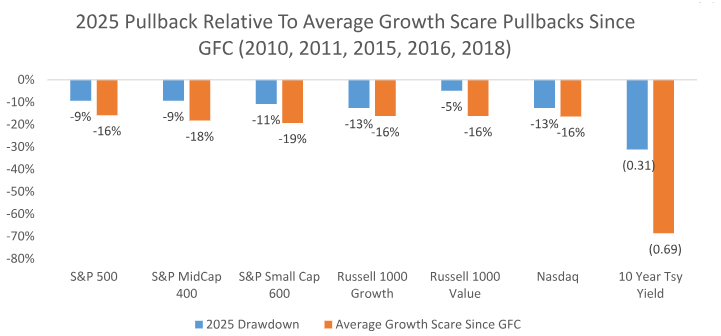

Brad: You can see how this selloff ranks among recent growth scares, tame to this point

Source: Raymond James as of 03.12.2025

Source: Raymond James as of 03.12.2025

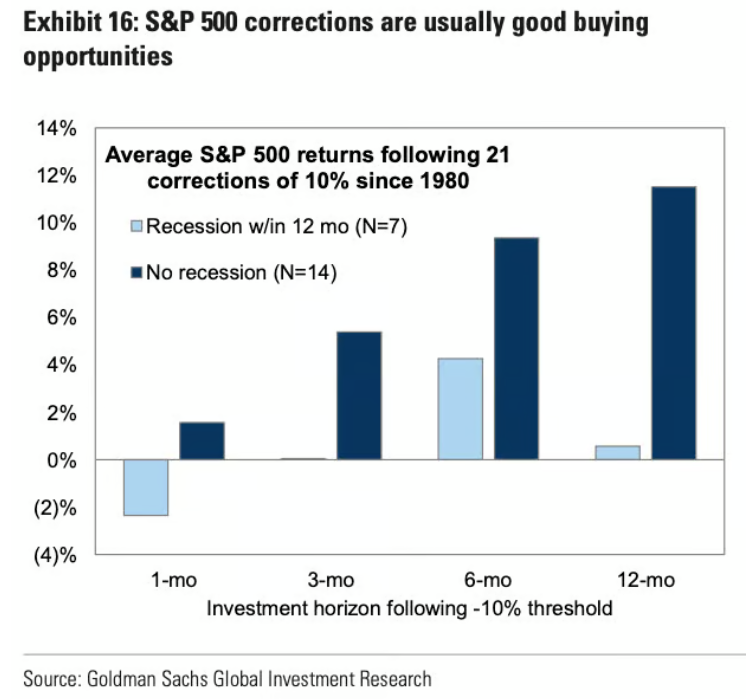

Beckham: and absent recession, stocks have had decent intermediate-term responses to 10% corrections

Data as of 03.11.2025

Data as of 03.11.2025

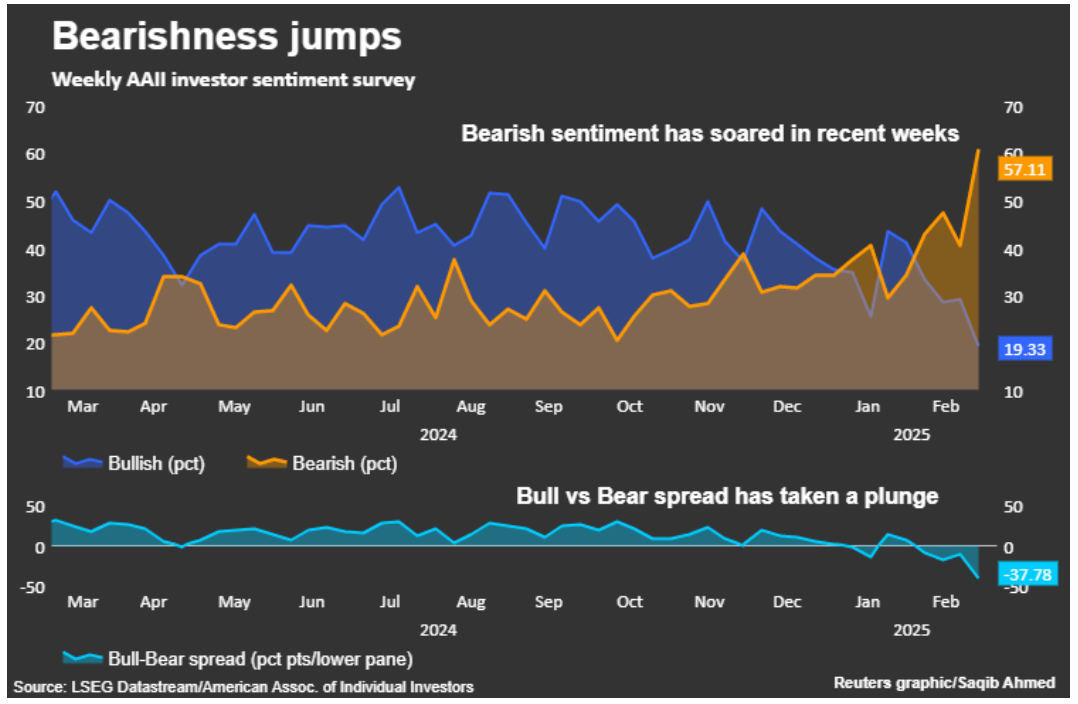

Jake: This correction has been marked by what seems to be historically high bearish sentiment among individual investors

Data as of 03.12.2025

Data as of 03.12.2025

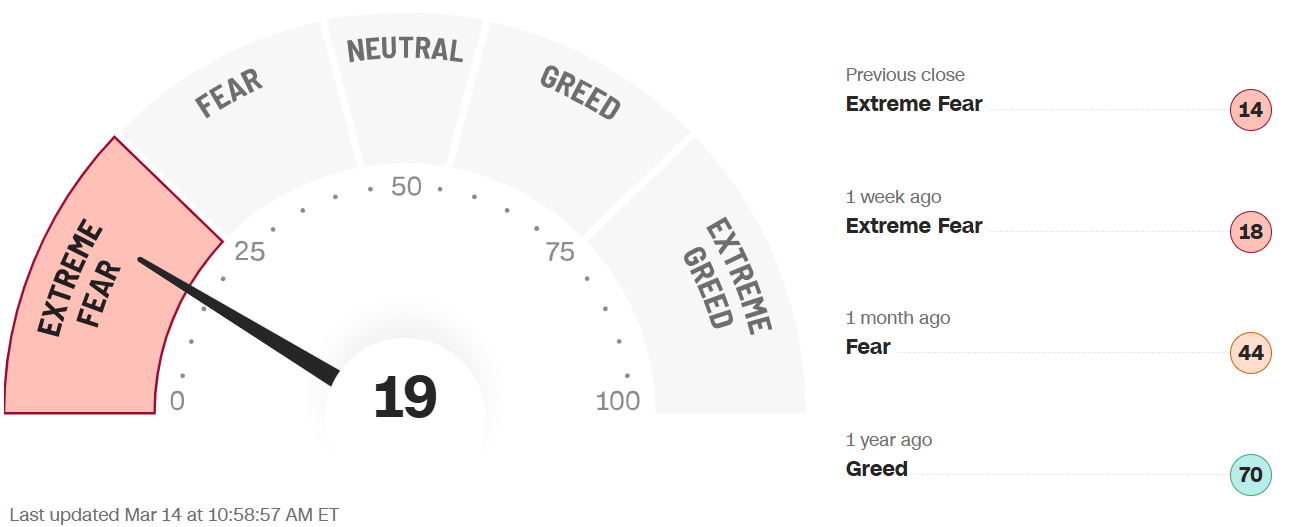

Arch: which is showing up in mainstream measures of sentiment as well

Source: CNN

Source: CNN

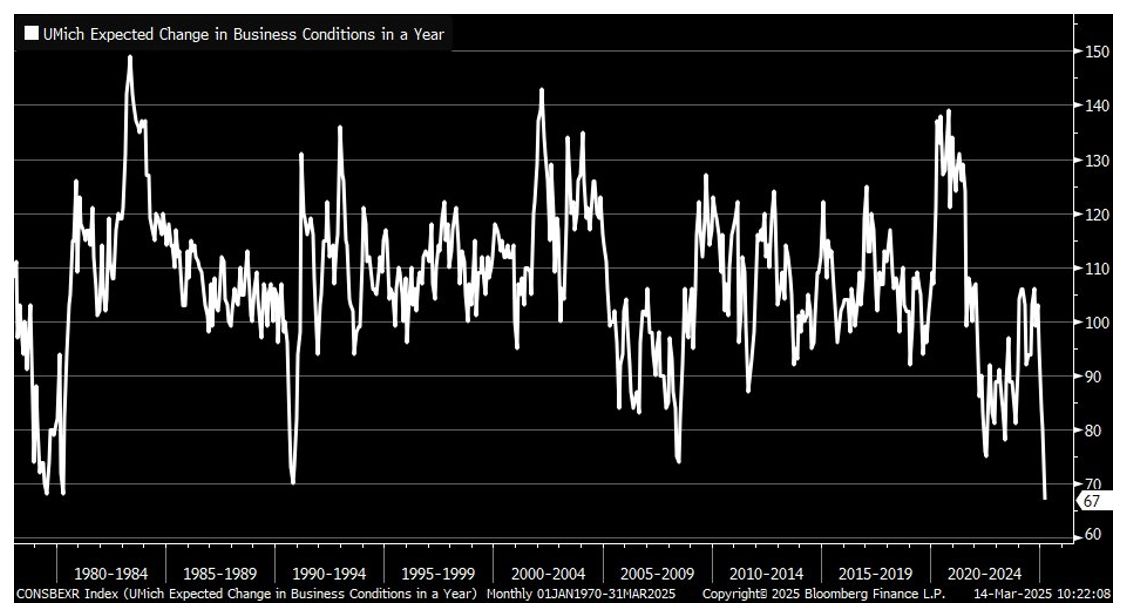

Joseph: Speaking of sentiment, it’s not just investors but Main Street folks that are being swayed by the daily barrage of headlines

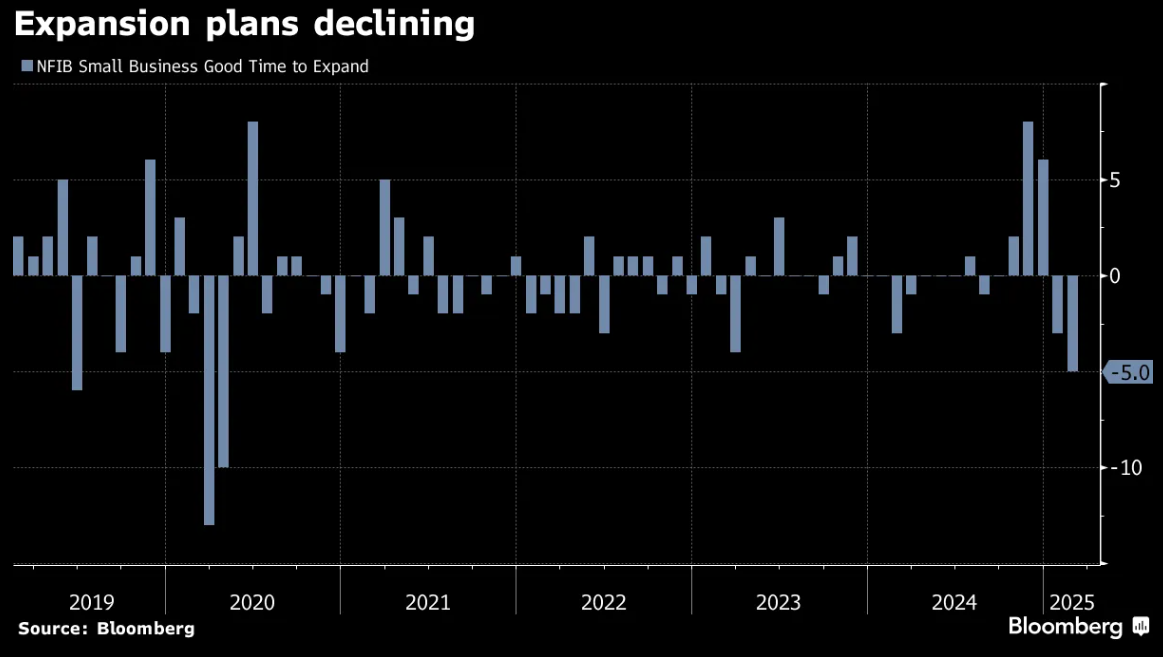

Arch: with business owners seemingly waiting for some policy clarity before committing to new growth plans

Data as of 03.12.2025

Data as of 03.12.2025

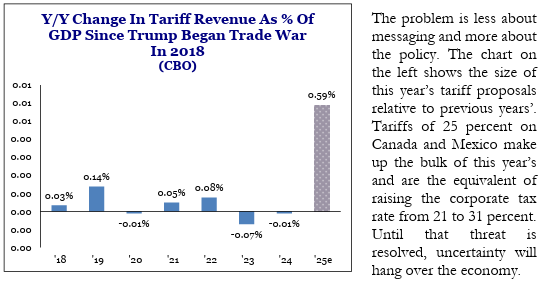

Brad: The bite of tariff impact may well end up less impactful than the bark, but still a potential drag on growth

Source: Strategas as of 03.12.2025

Source: Strategas as of 03.12.2025

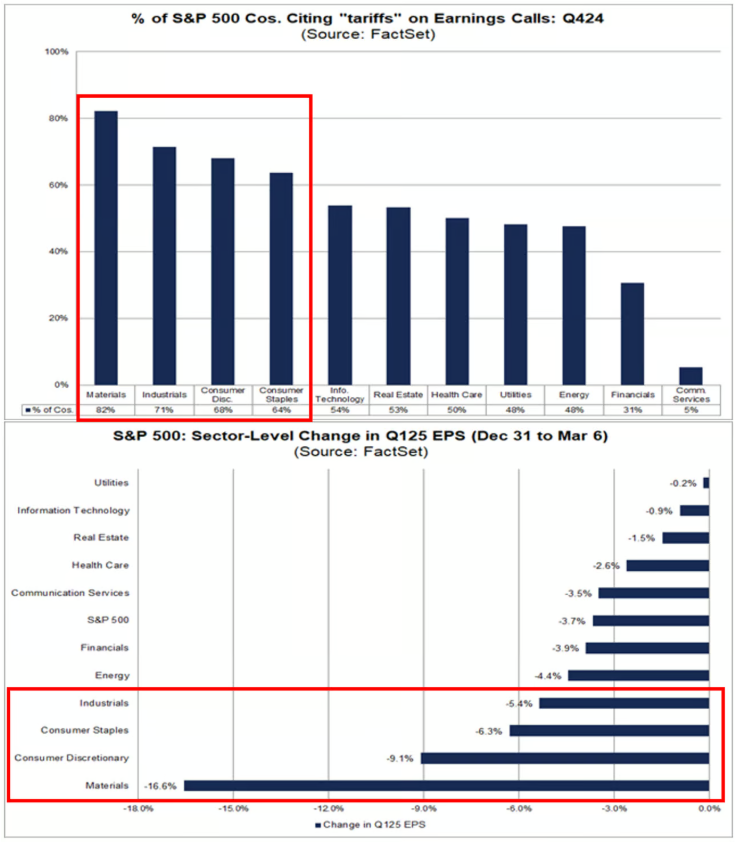

Dave: and we’ve seen analysts extrapolate tariff mentions into lower earnings estimates for the first part of this year

Data via Daily Chartbook as of 03.07.2025

Data via Daily Chartbook as of 03.07.2025

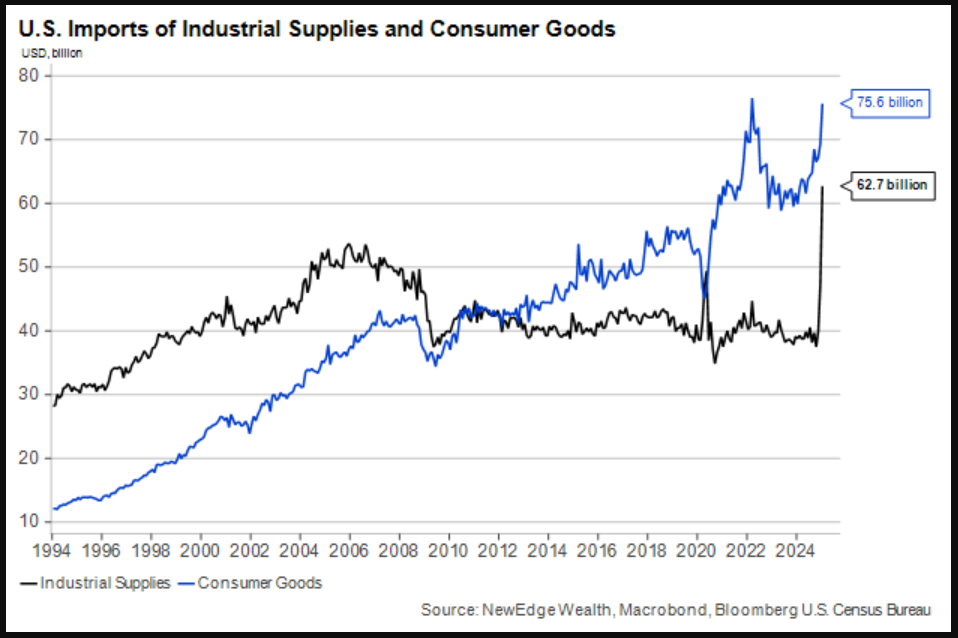

John Luke: Not surprisingly, one thing we do know is that buyers stocked up on potentially tariffed items ahead of expected start dates

Data as of 03.07.2025

Data as of 03.07.2025

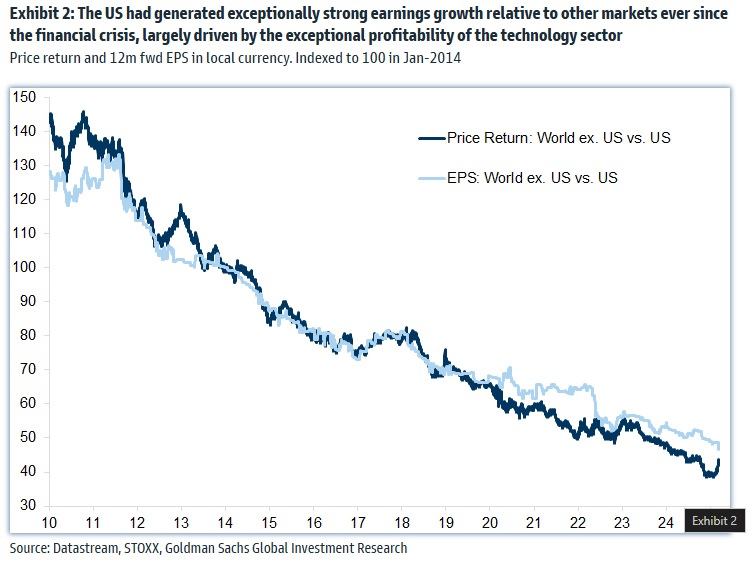

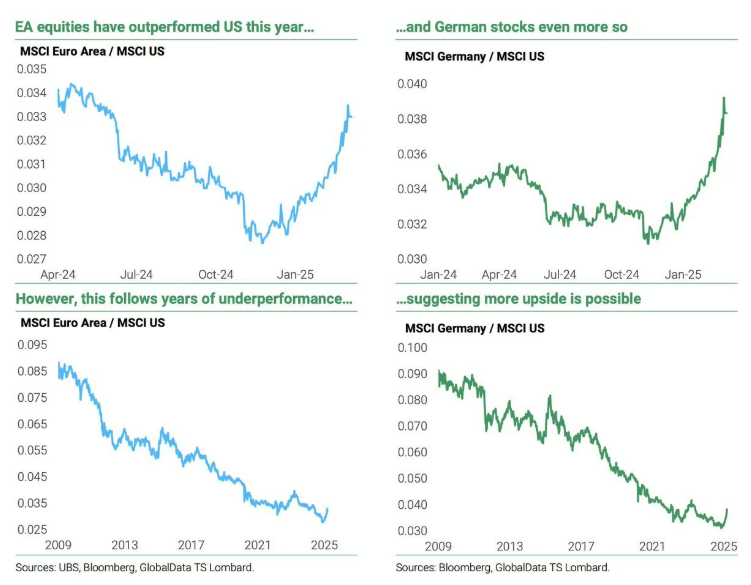

Brian: US stocks have enjoyed a 15-year advantage over foreign stocks, mostly tied to superior earnings growth

Data as of 03.10.2025

Data as of 03.10.2025

Joseph: which makes this year’s flip barely a speck in the long-term comparisons

Data as of 03.12.2025

Data as of 03.12.2025

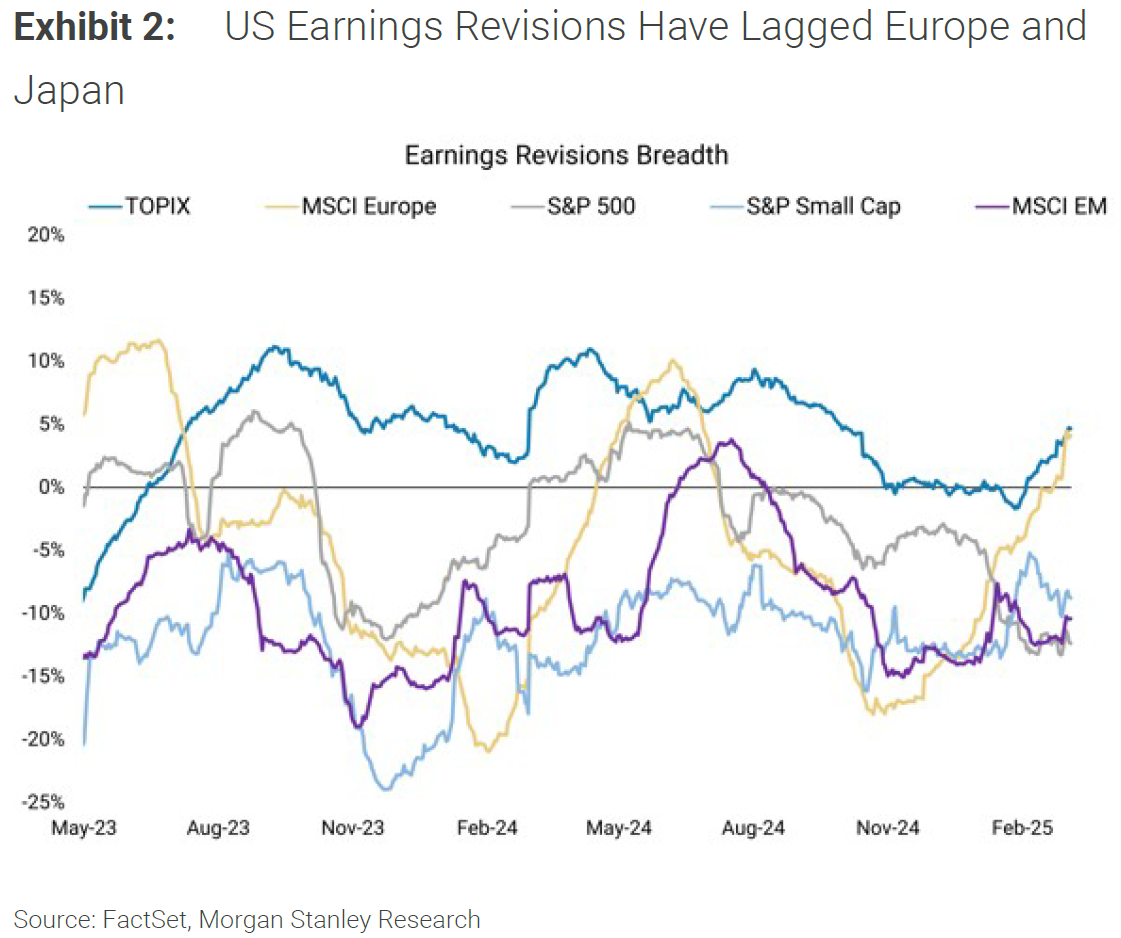

Brad: That said, recent earnings revisions are actually showing signs that there could be more than just a sentiment flip behind the recent foreign market strength

Data as of 03.12.2025

Data as of 03.12.2025

Brian: and if you’ve been an investor in what was probably the least-favored idea (European value), the performance difference vs. US growth has been eye-popping

Data as of 03.12.2025

Data as of 03.12.2025

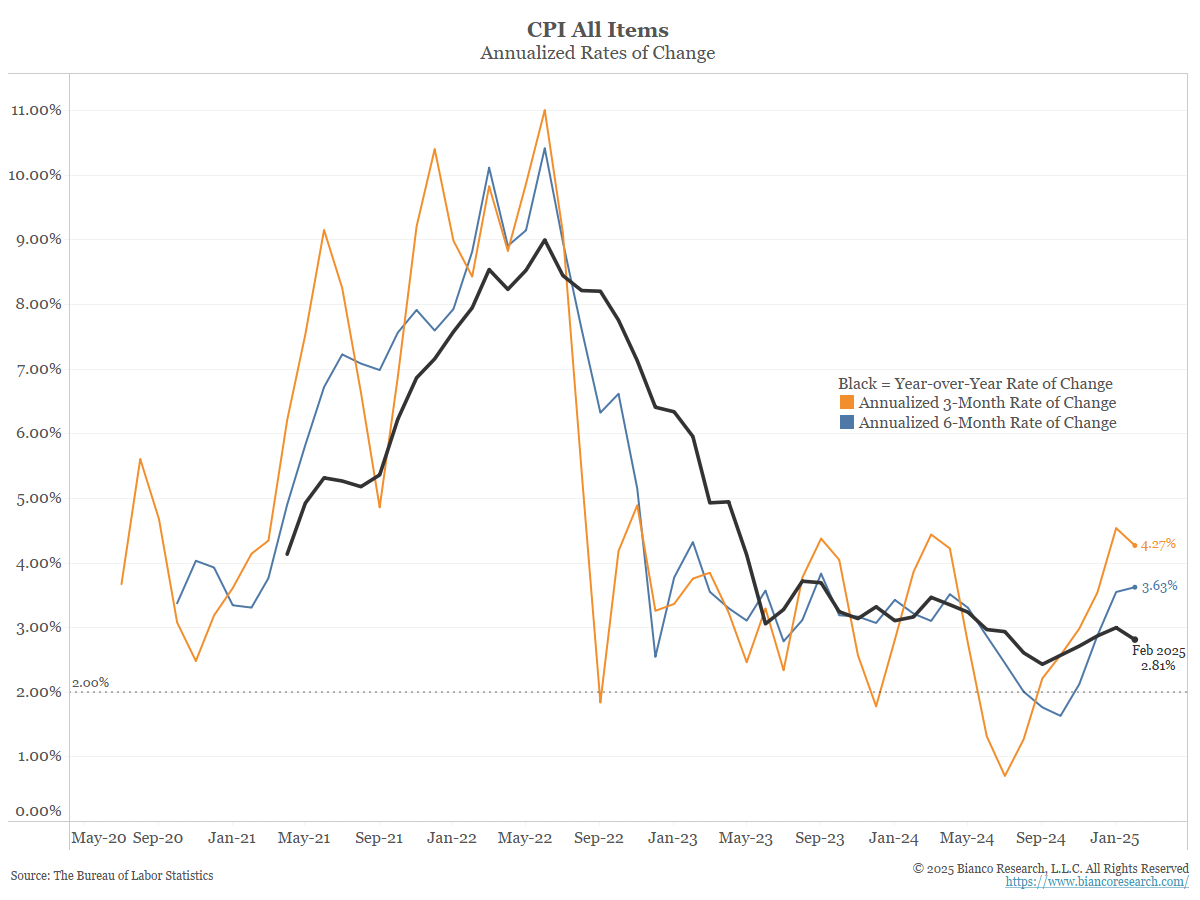

John Luke: FOMC policy has taken a rare backseat during this correction, but they’ll be meeting next week and sharing plans for their approach to inflation that seems to have settled above their stated target

Data as of 03.12.2025

Data as of 03.12.2025

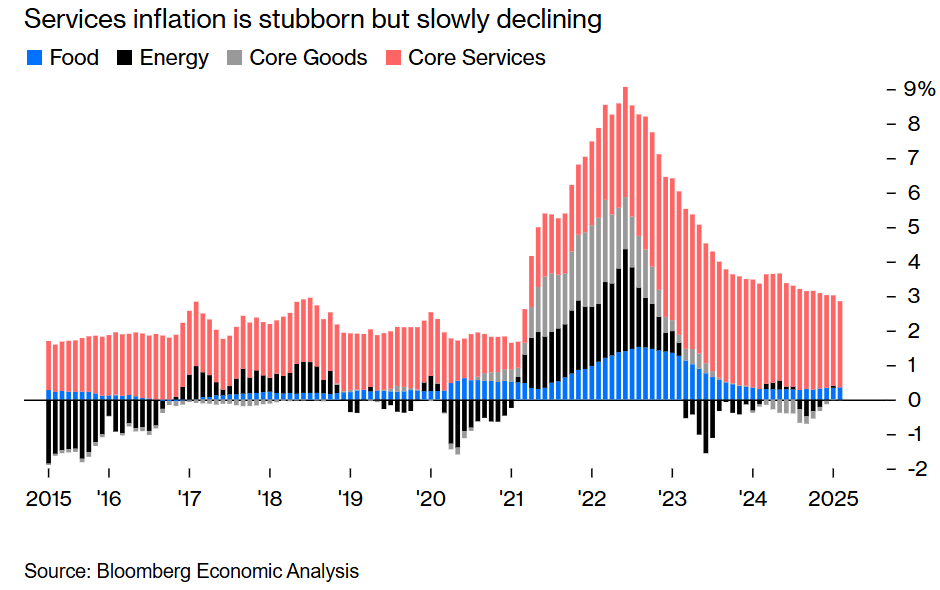

JD: and a longer-term look at the cost of services may be growing slower than the 2022 peak, but remains a constant drag on purchasing power

Data as of 03.12.2025

Data as of 03.12.2025

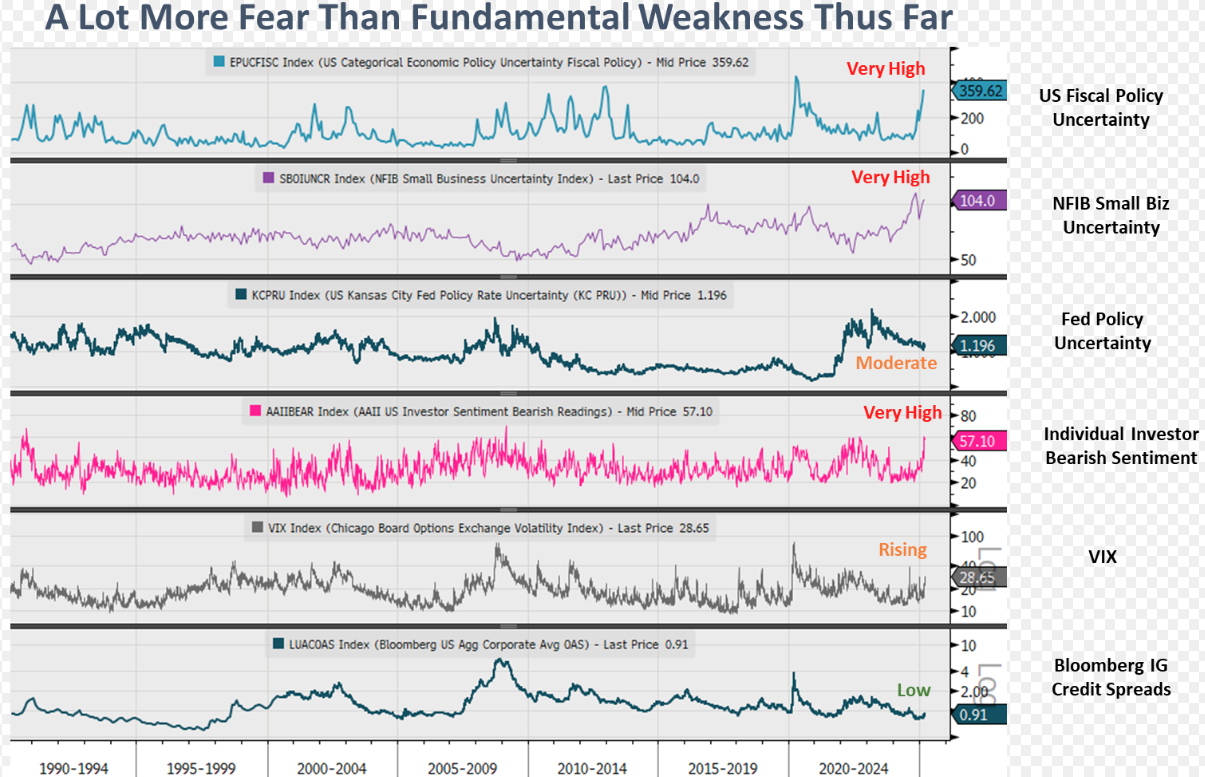

Joseph: To this point of the correction, actual business fundamentals have taken a backseat to fear and uncertainty

Source: Piper Sandler as of 03.11.2025

Source: Piper Sandler as of 03.11.2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2503-18.