Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

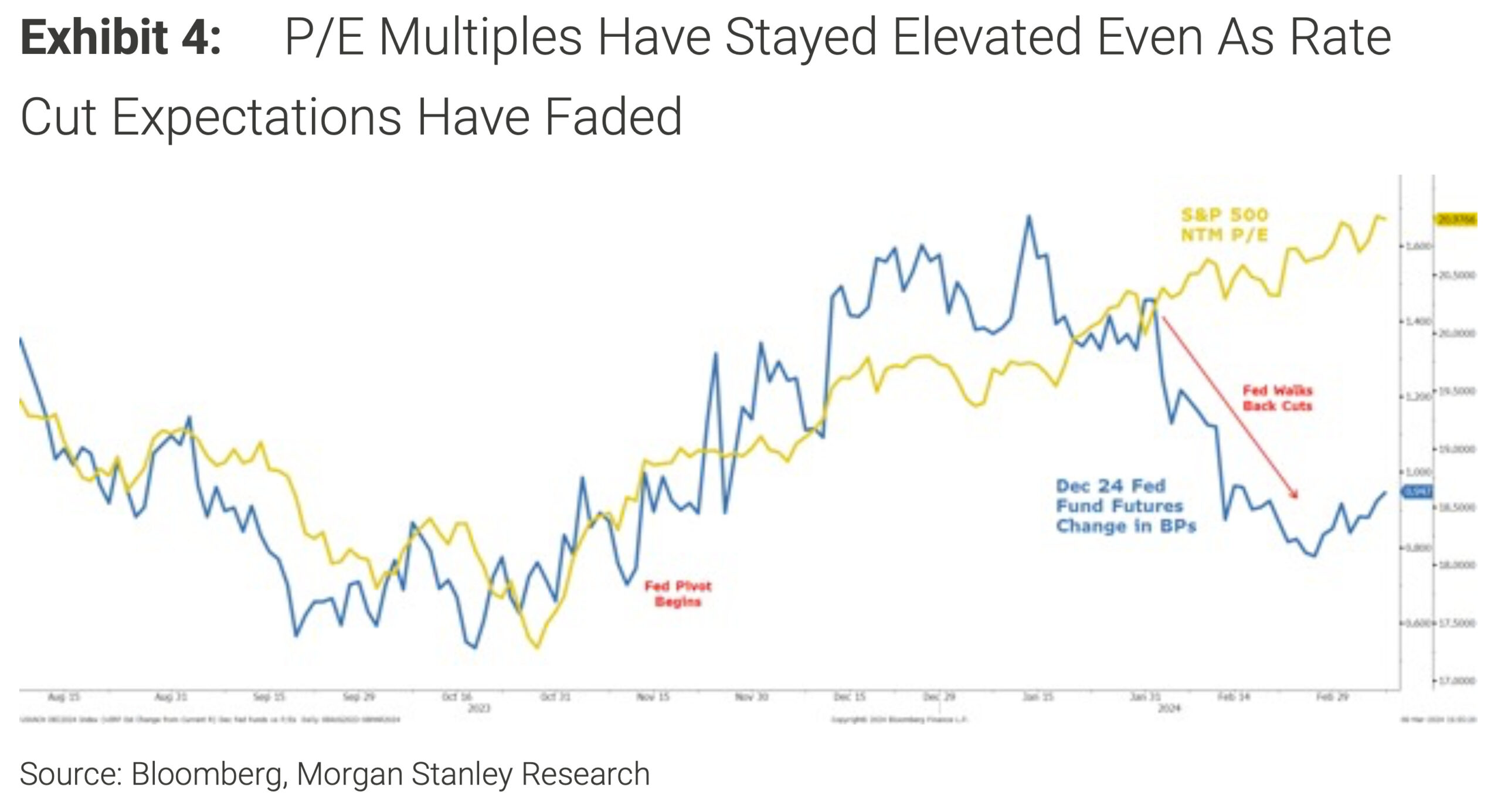

Brett: Equity valuations had been tied to interest rates in this cycle, but they’ve separated in recent weeks

Data as of 03.11.2024

Data as of 03.11.2024

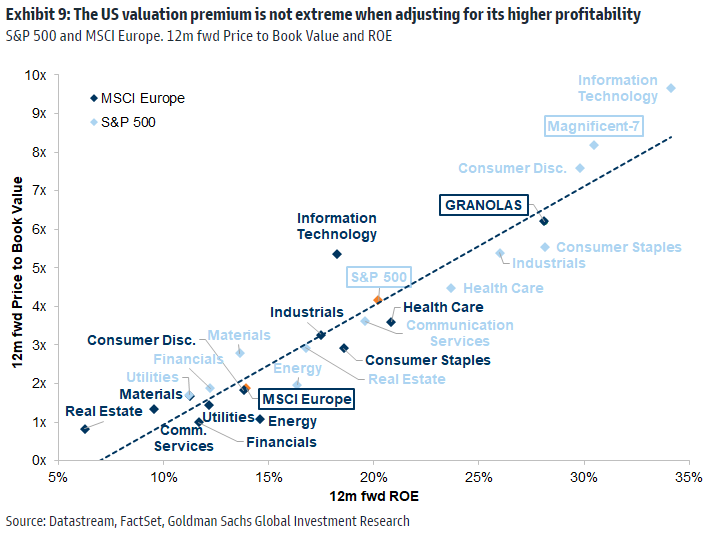

Brad: perhaps tied to investor recognition that business performance is a more important driver of long-term performance

Data as of March 2024

Data as of March 2024

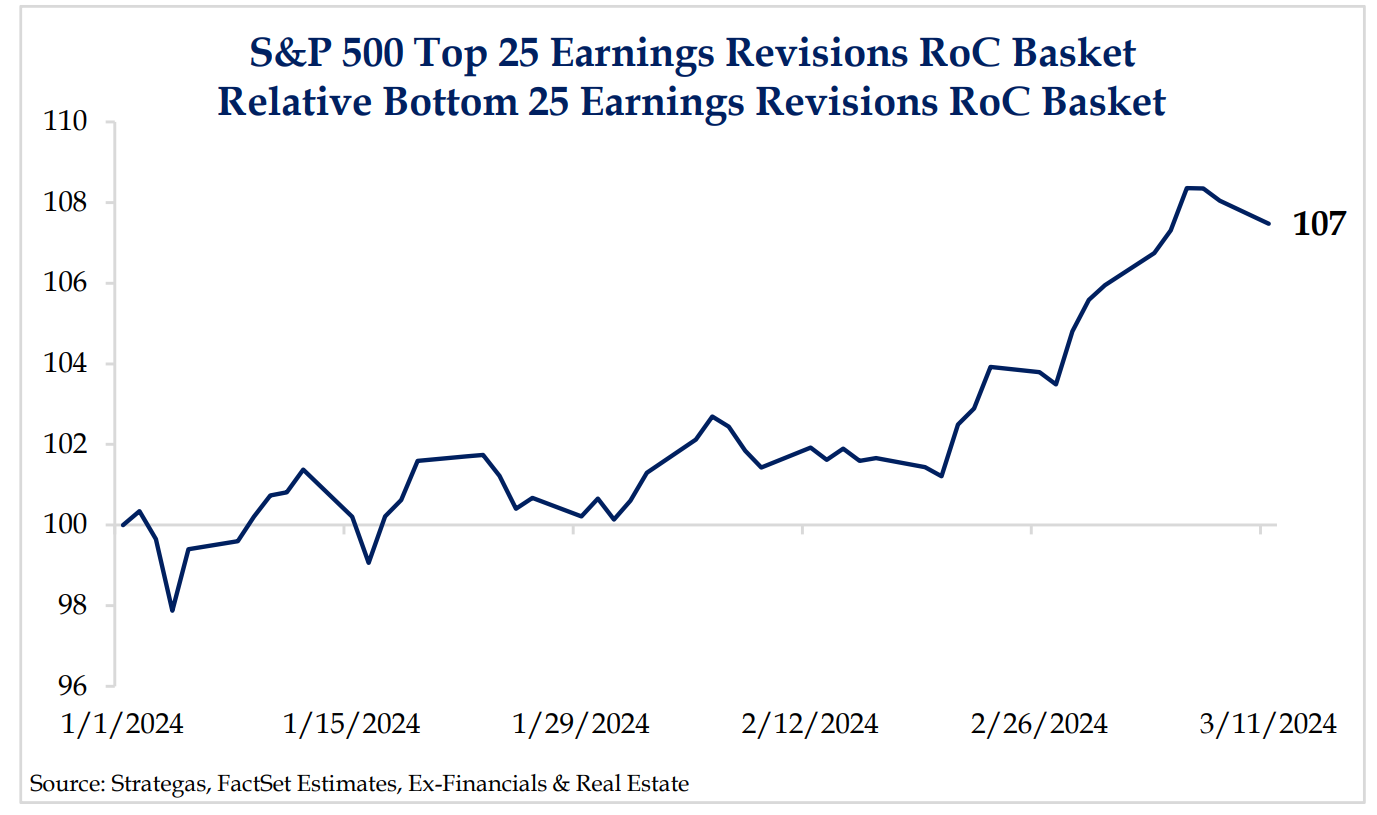

Dave: As opposed to valuations, the market of late has been more focused on company earnings outlooks

Data as of 03.11.2024

Data as of 03.11.2024

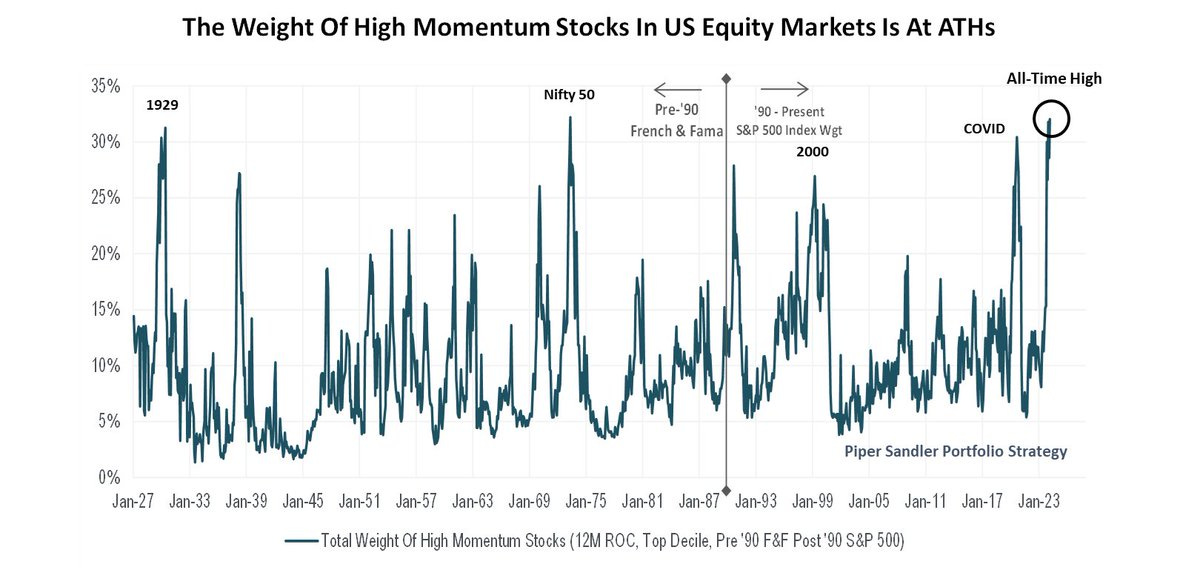

Joseph: leading us into a market driven by a handful of stocks with persistent price movements

Source: Piper Sandler as of February 2023

Source: Piper Sandler as of February 2023

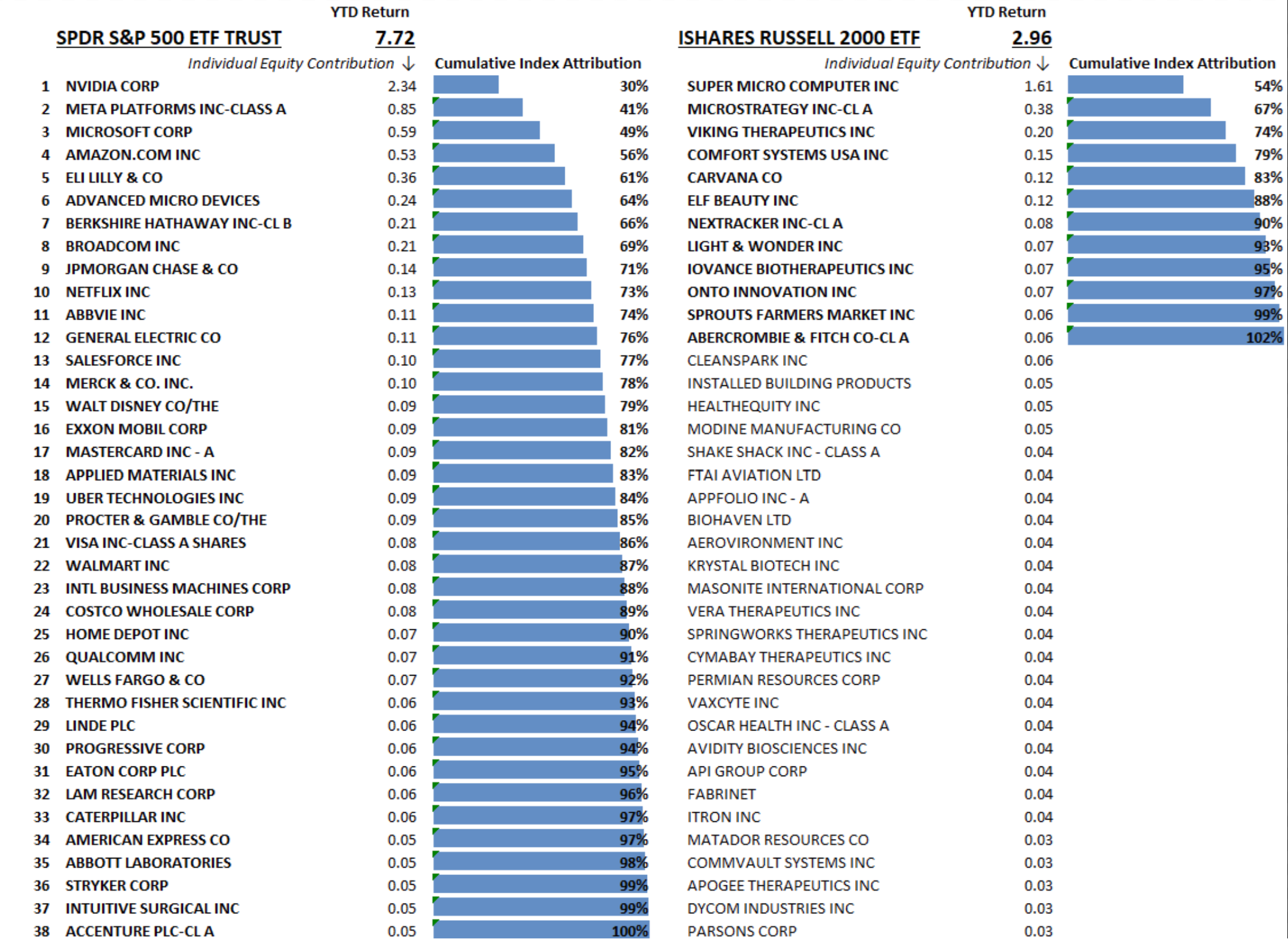

Dave: and personified by popular artificial intelligence (AI) stocks like NVDA and SMCI

Source: Piper Sandler as of 03.11.2024

Source: Piper Sandler as of 03.11.2024

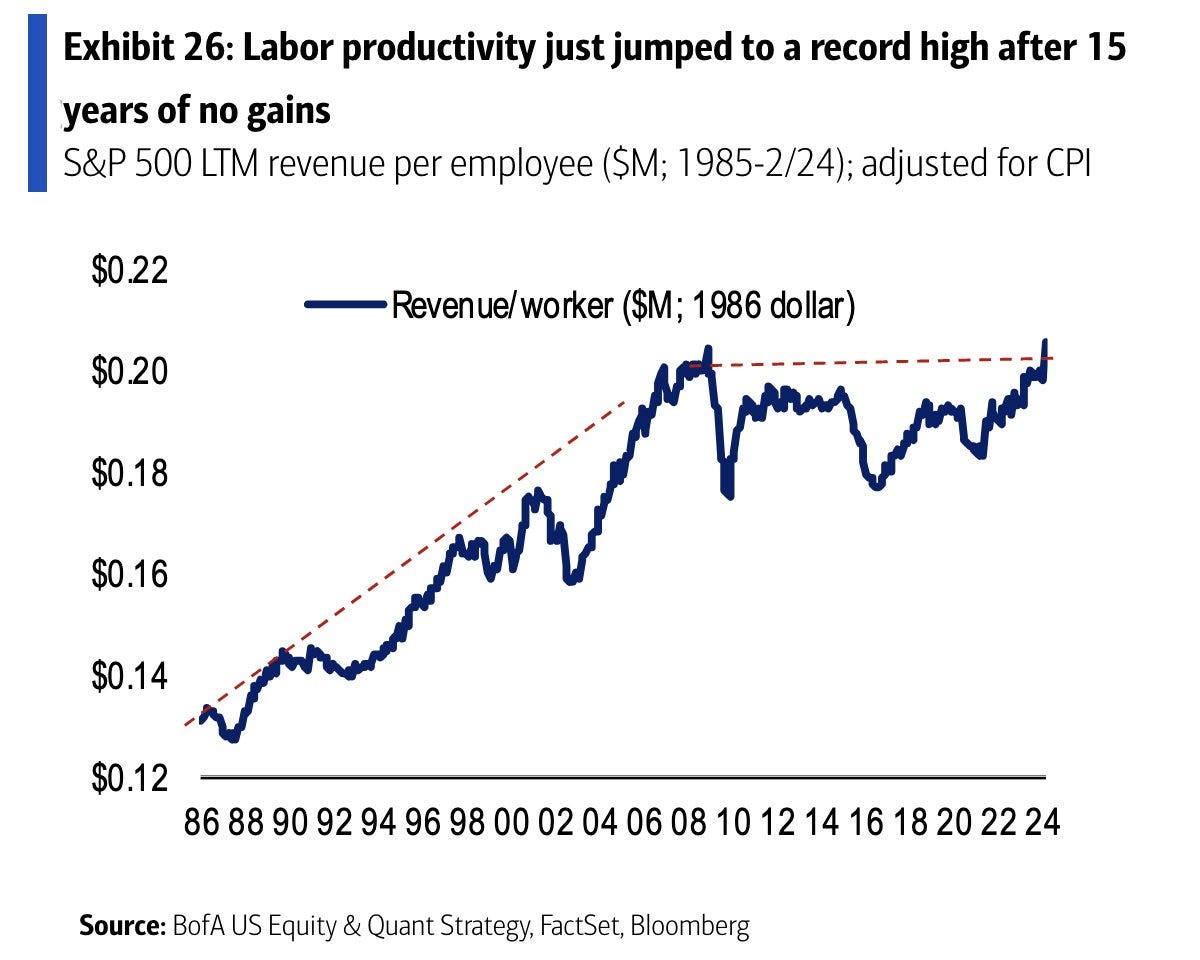

Beckham: Speaking of AI, the hope is that productivity can rise across the economy. Are we starting to see an impact?

Data as of February 2024

Data as of February 2024

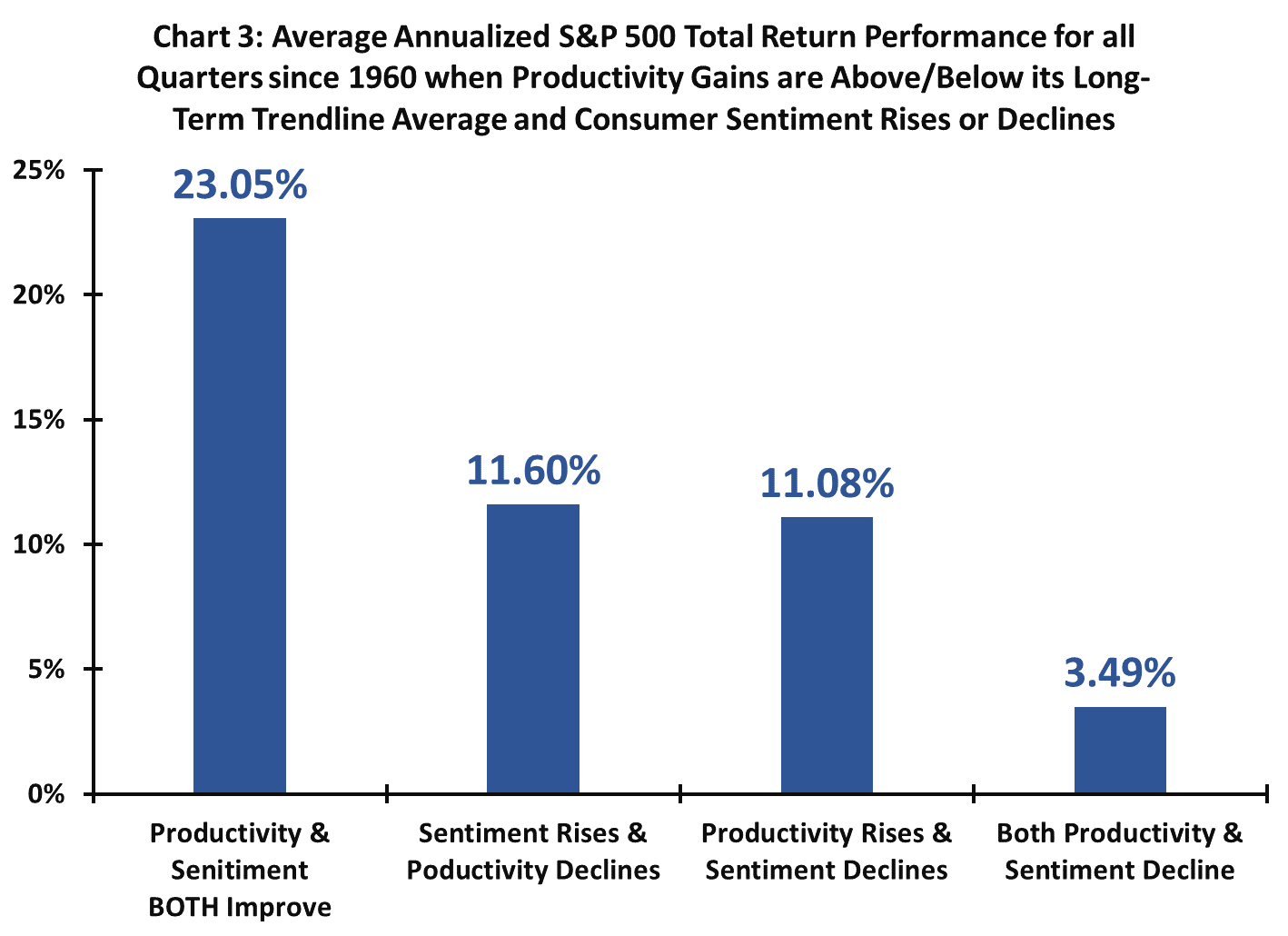

Brett: historically, stocks have been seen better performance in times of higher productivity

Source: Paulsen’s Perspectives as of 03.14.2024

Source: Paulsen’s Perspectives as of 03.14.2024

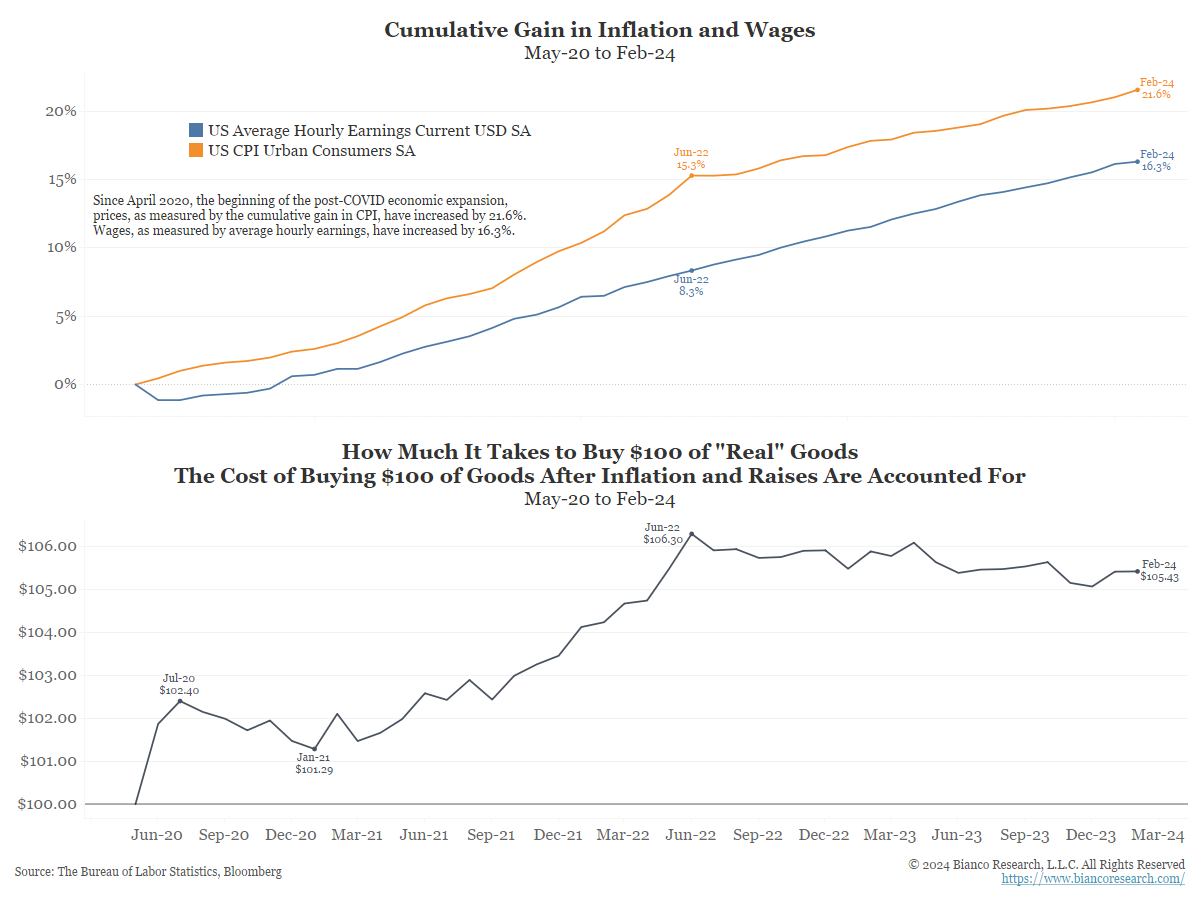

John Luke: The FOMC will meet next week to discuss policy, with inflation and wages on their mind

Data as of February 2024

Data as of February 2024

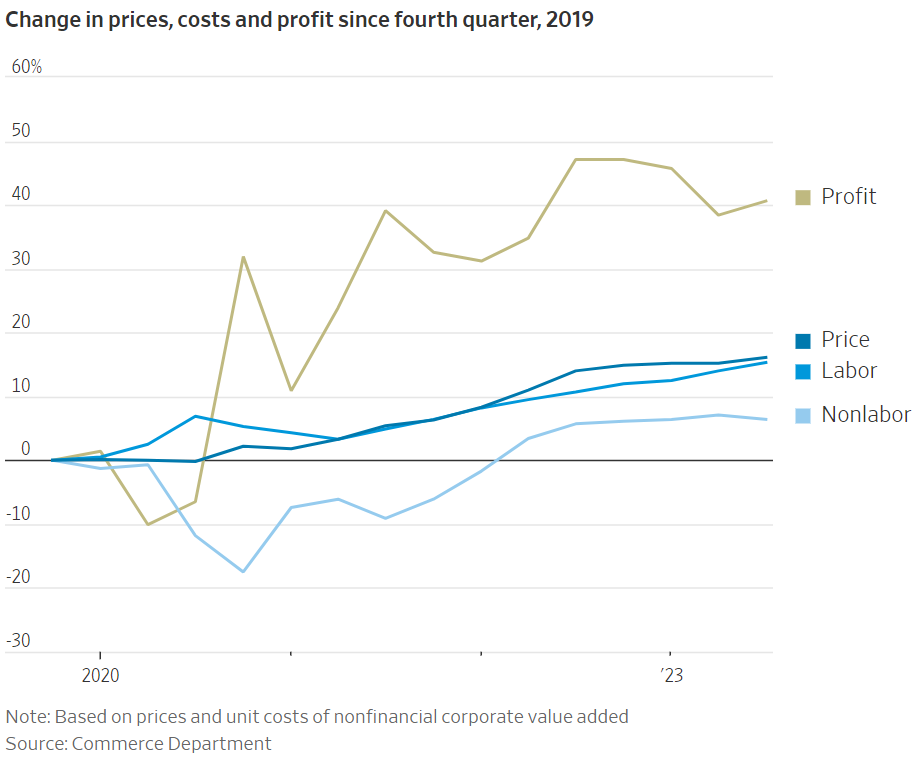

John Luke: while a handful of politicians will surely point to evil corporate profits as the source of inflation

Data as of February 2024

Data as of February 2024

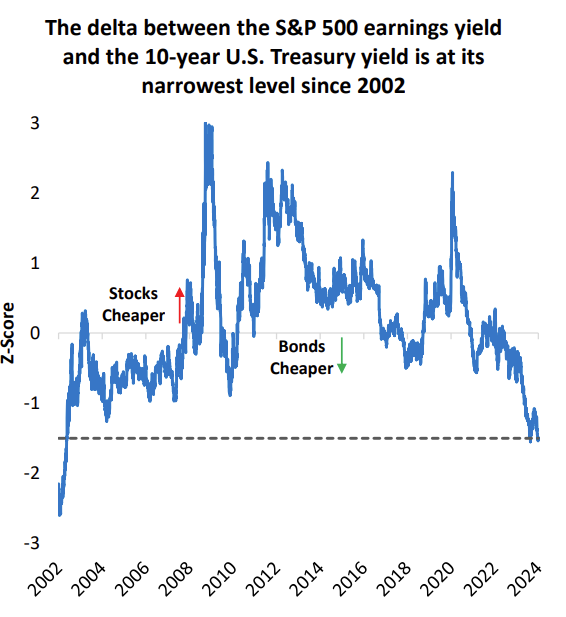

John Luke: Treasury yields are priced as relatively cheap vs. equity yields as they’ve been since the dot-com bust

Source: DoubleLine as of February 2024

Source: DoubleLine as of February 2024

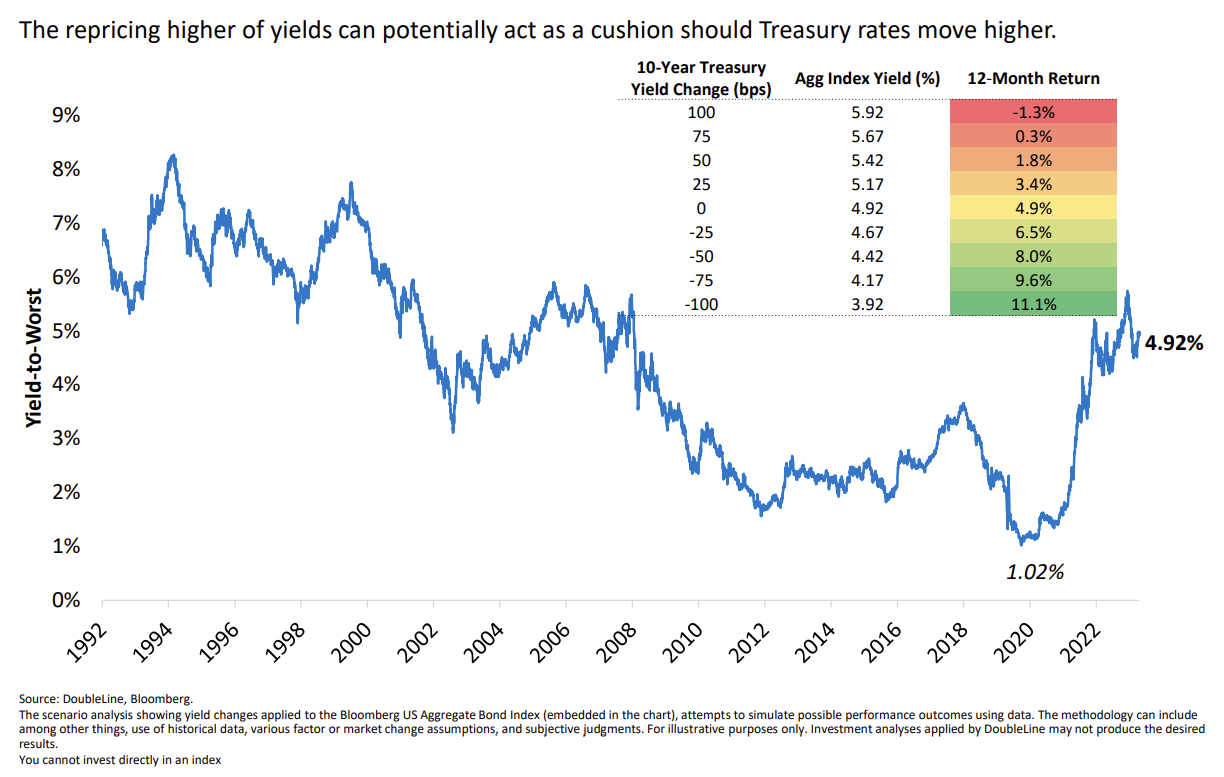

John Luke: and the cushion from higher Treasury yields is certainly more helpful than it’s been in recent years

Data as of February 2024

Data as of February 2024

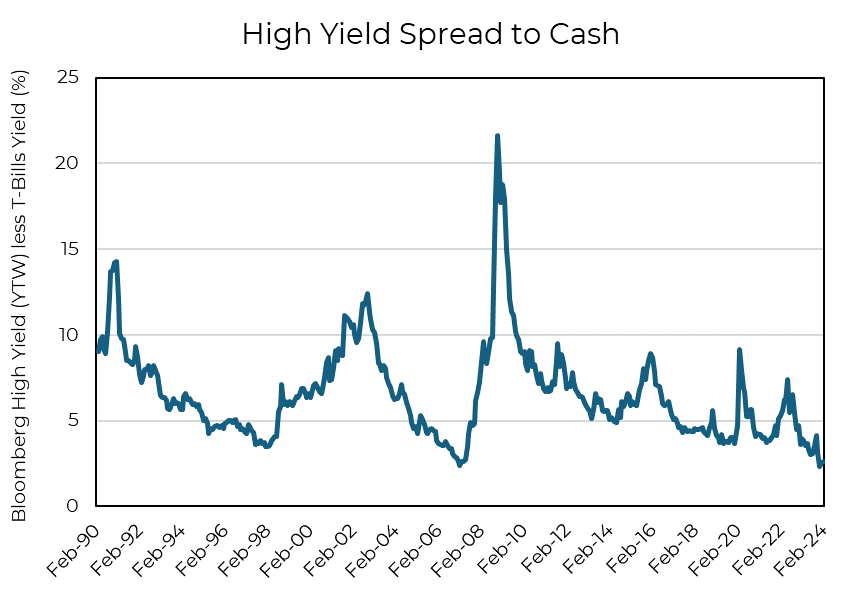

Brian: that said, there seems to be little incentive for taking on credit risk at current pricing

Source: Aptus as of 03.13.2024

Source: Aptus as of 03.13.2024

Brad: As regularly noted, small-cap stocks are trading at a significant discount to large-caps

Data as of 02.29.2024

Data as of 02.29.2024

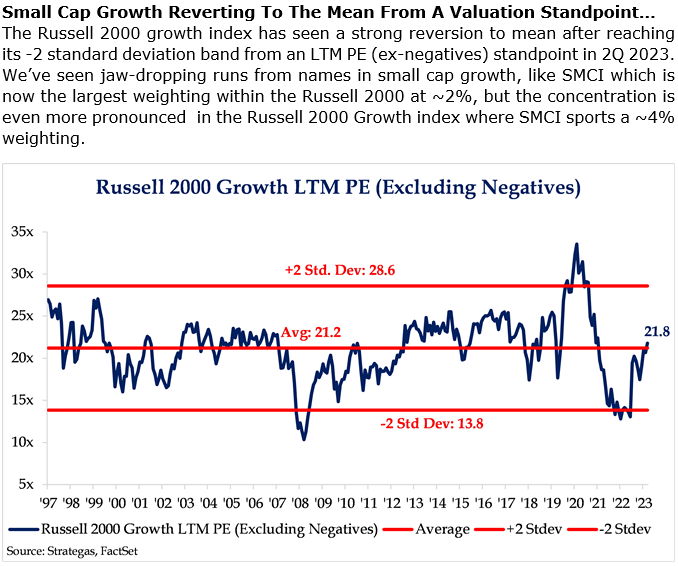

Brad: and while small-cap growth stocks have closed the historic valuation discount

Data as of February 2024

Data as of February 2024

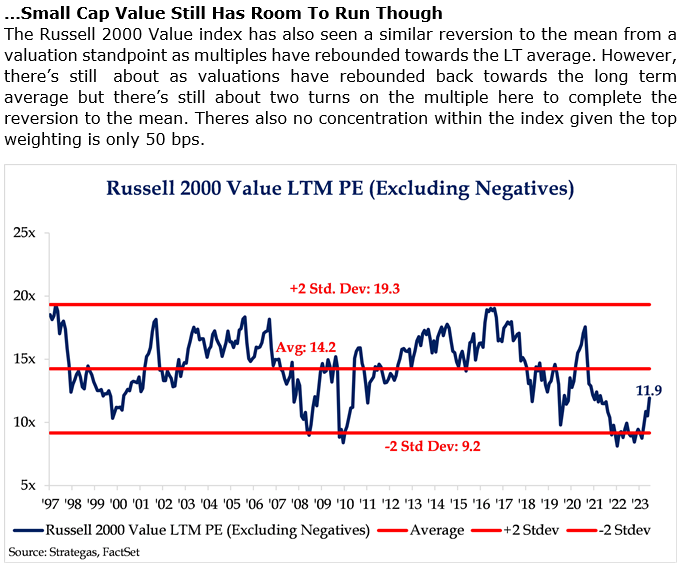

Brad: small-cap value stocks continue to trade at a discount to their long-term average valuation

Data as of February 2024

Data as of February 2024

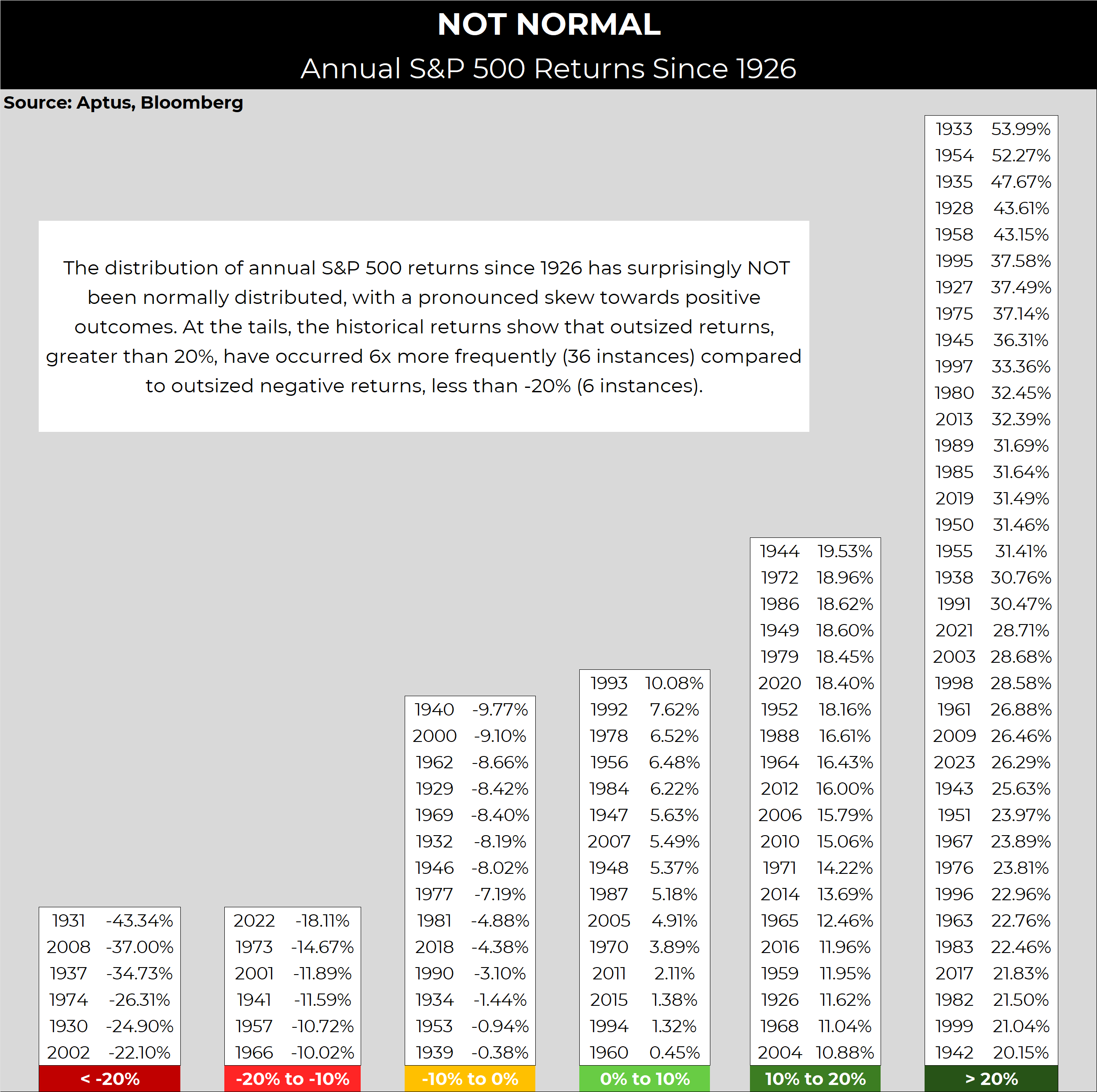

Brian: Reminder that annual stock market returns not only have a bias to the upside, but that surviving left (down) tails to capture right (up) tails is a path to compounding wealth

Source: Aptus as of March 2024

Source: Aptus as of March 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2403-24.