Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from the US market correction to the economy to sentiment and tariffs and global money flows. Enjoy!

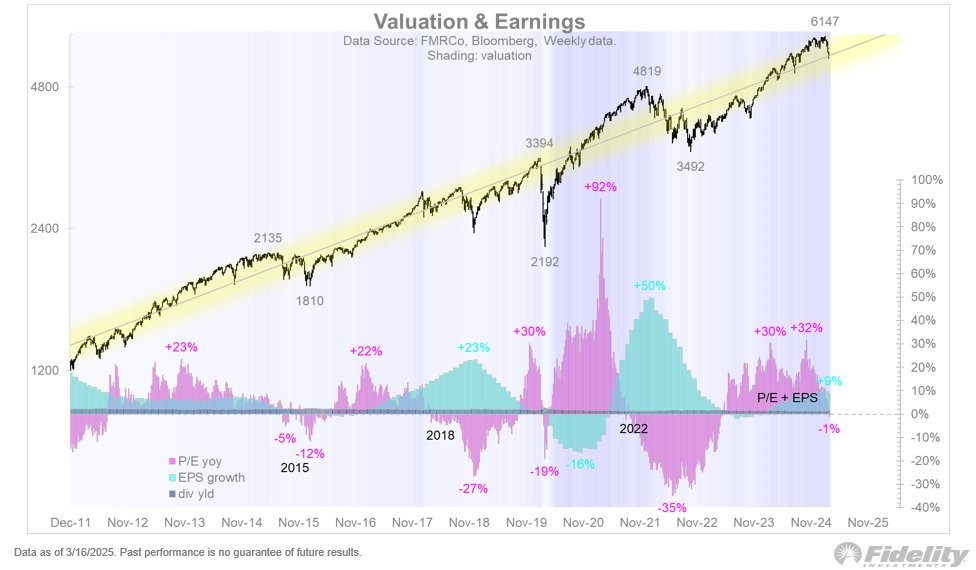

Brett: After two years of supporting prices, the willingness of investors to pay up for stocks looks increasingly reliant on earnings growth in the period ahead

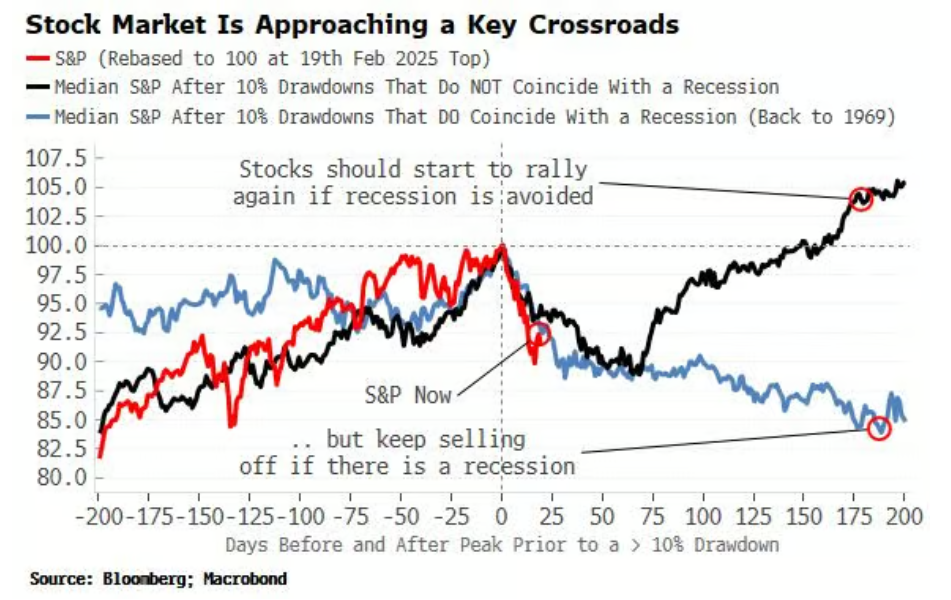

Beckham: and the direction of stocks after 10% corrections looks heavily tied to whether or not the economy goes into a recession

Source: Daily Chartbook as of 03.19.2025

Source: Daily Chartbook as of 03.19.2025

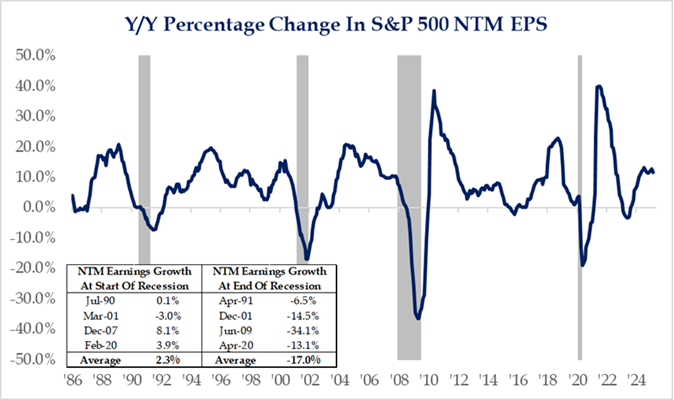

Brad: “Correction without a recession” seems to be the evidence-based call, as past recessions had already seen earnings deteriorate while today we still have solid earnings growth

Source: Strategas as of 03.17.2025

Source: Strategas as of 03.17.2025

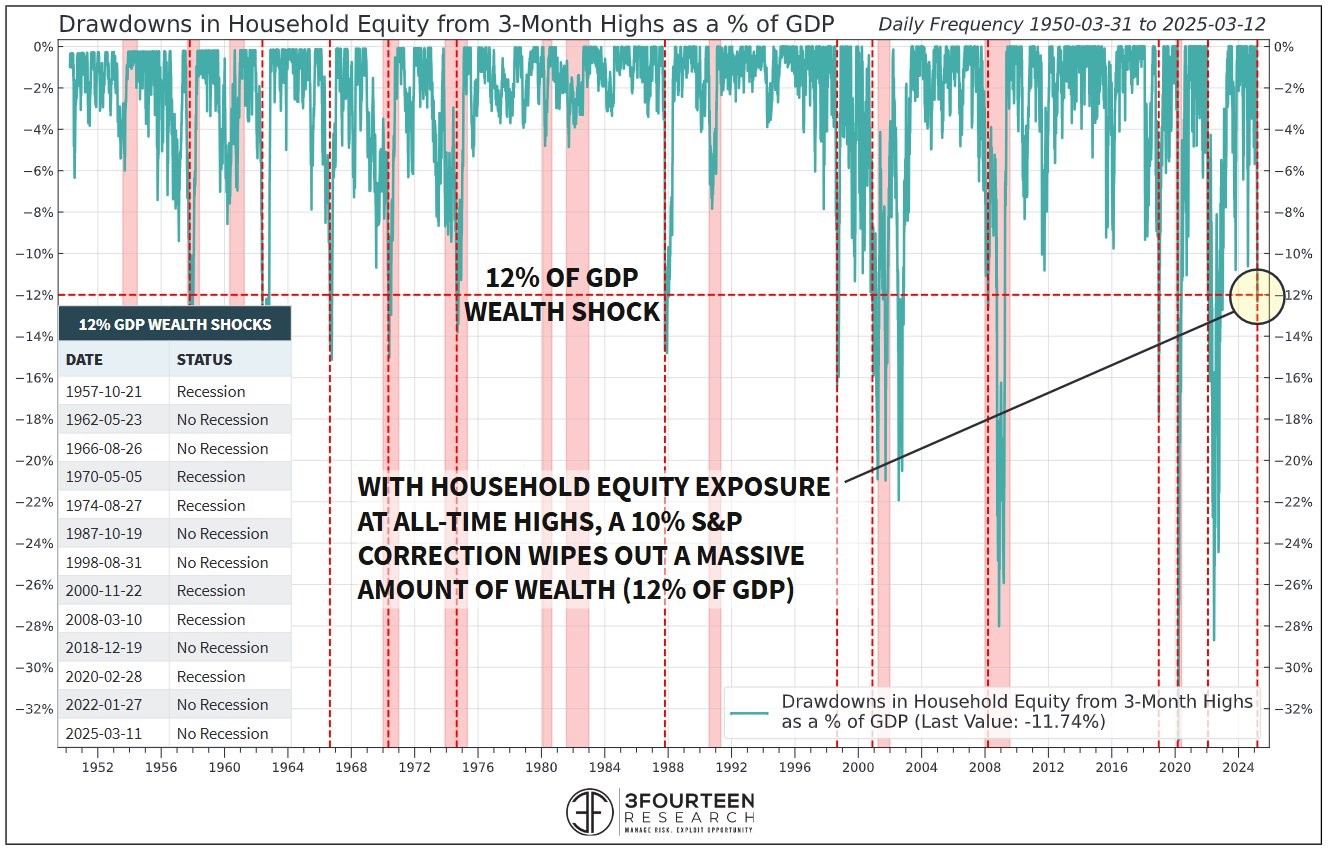

John Luke: that said, stock market conditions could play a higher role in damaging spending

Data as of 03.14.2025

Data as of 03.14.2025

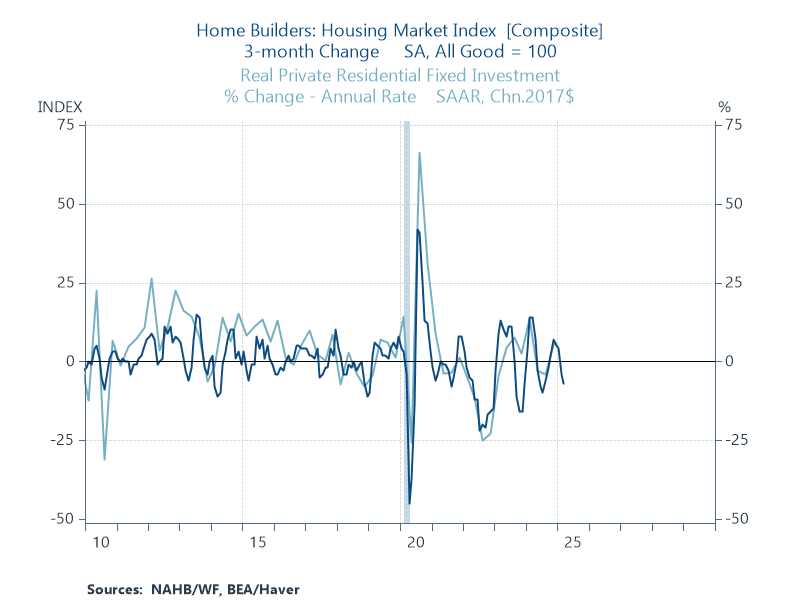

Joseph: and housing shows no signs of driving growth

Data as of 03.17.2025

Data as of 03.17.2025

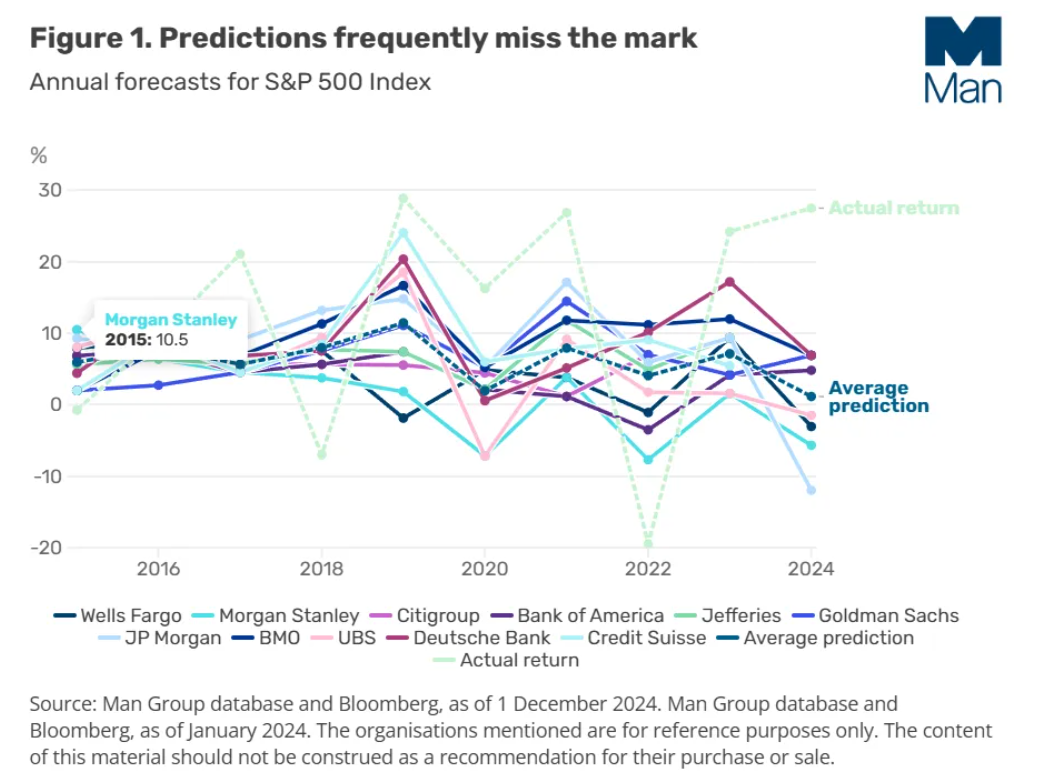

JD: Strategists generally hug the middle and skip the tails when forecasting year-ahead market levels

Jake: and right now the S&P 500 sits just above the lower end of the range of forecasts

Source: @kevrgordon via Daily Chartbook

Source: @kevrgordon via Daily Chartbook

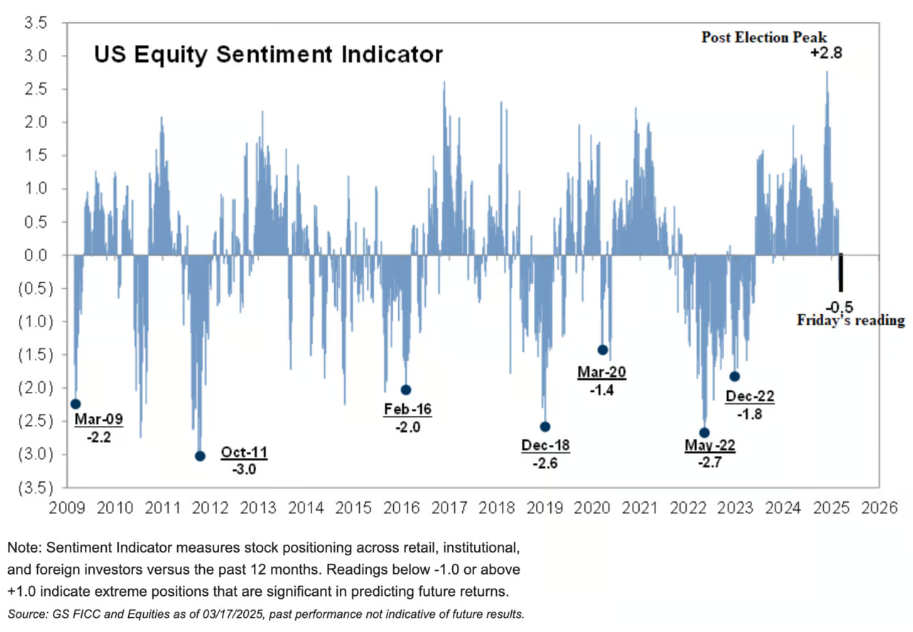

Mark: For some near-term encouragement, by sentiment measures we may have washed out much of the excess optimism

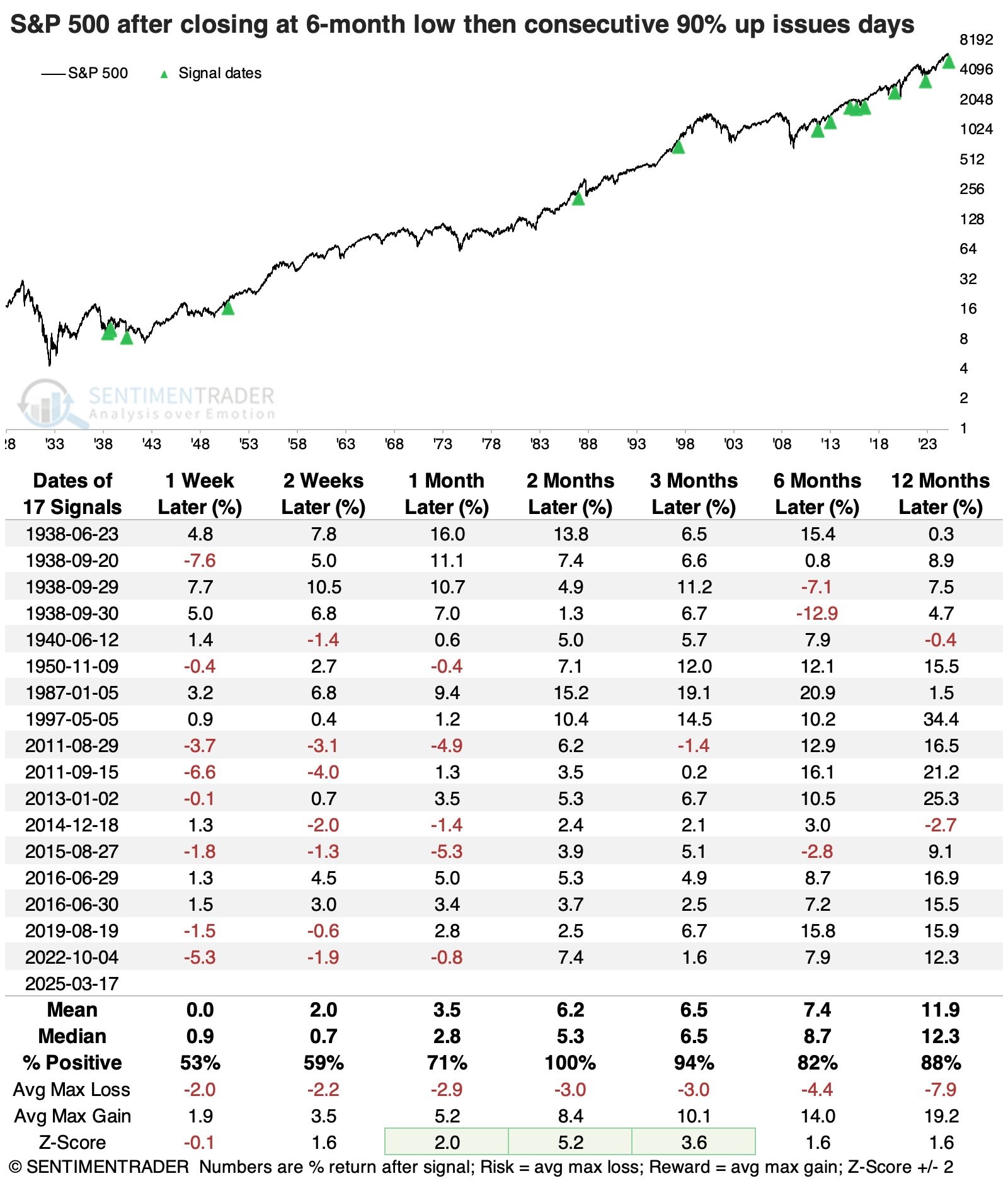

Dave: and strung together some signs of strength after hitting the 10% correction marker

Data as of 03.17.2025

Data as of 03.17.2025

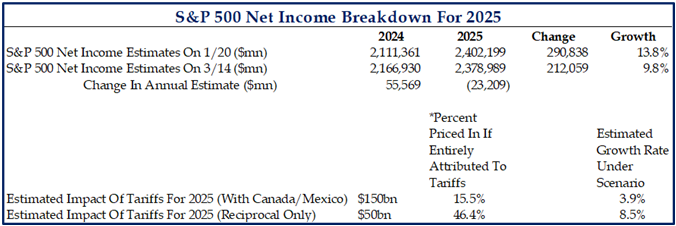

Brad: There’s no denying that tariffs will have some level of impact on U.S. corporate earnings in the year ahead

Source: Strategas as of 03.18.2025

Source: Strategas as of 03.18.2025

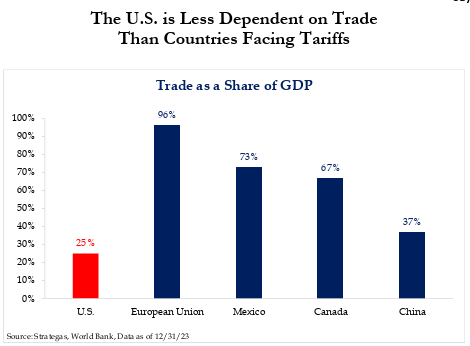

Brad: but despite year-to-date market activity, the direct impact on the U.S. economy is far less than the other regions involved

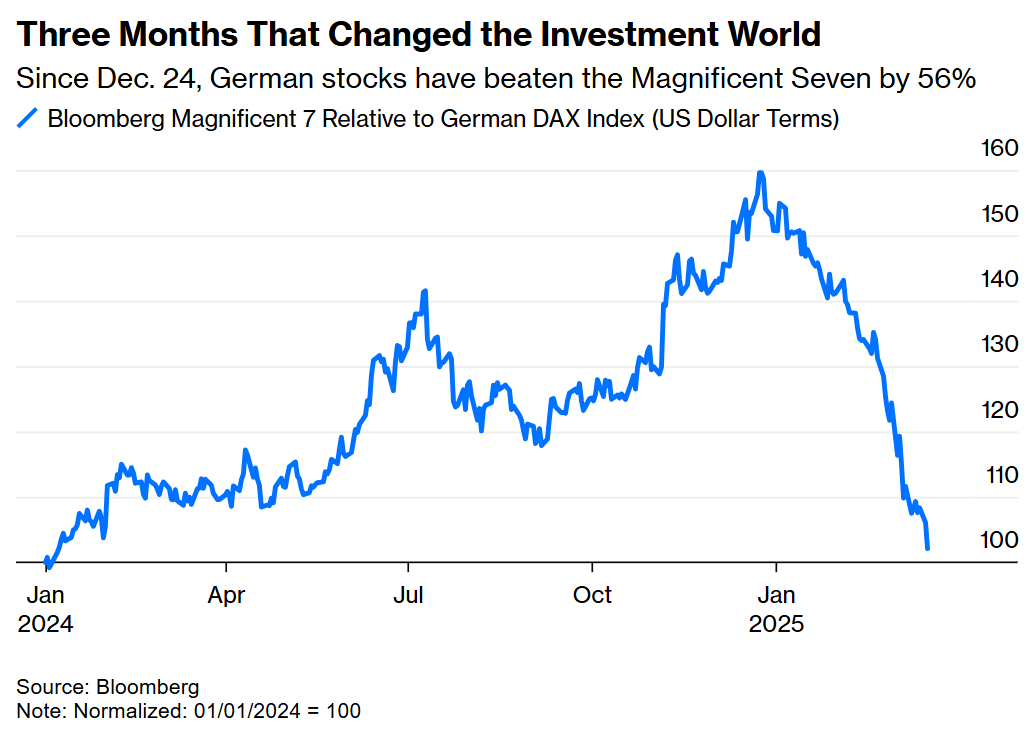

Brian: The global move from popular to unpopular names has been amazing

Data as of 03.20.2025

Data as of 03.20.2025

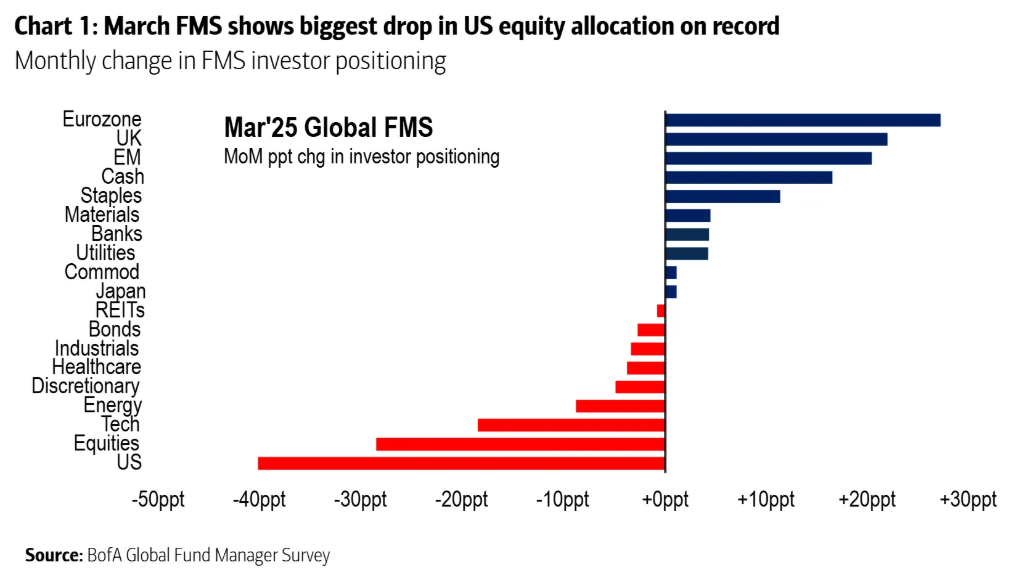

Arch: but at this point, not exactly a secret

Data as of 03.14.2025

Data as of 03.14.2025

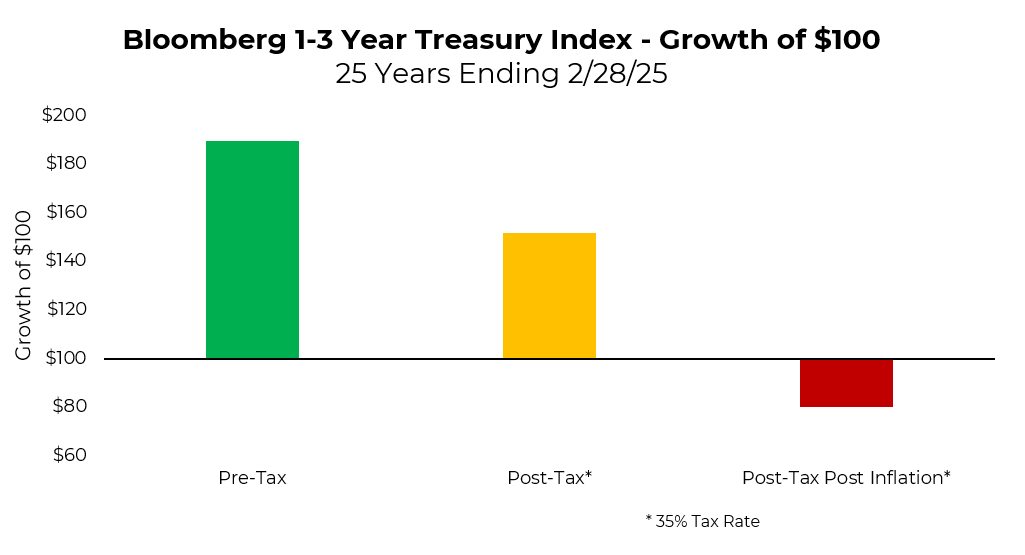

Brian: Friendly reminder, the short-term safety of cash can become a real risk if held

Source: Aptus Data via Bloomberg

Source: Aptus Data via Bloomberg

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2503-23.