Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

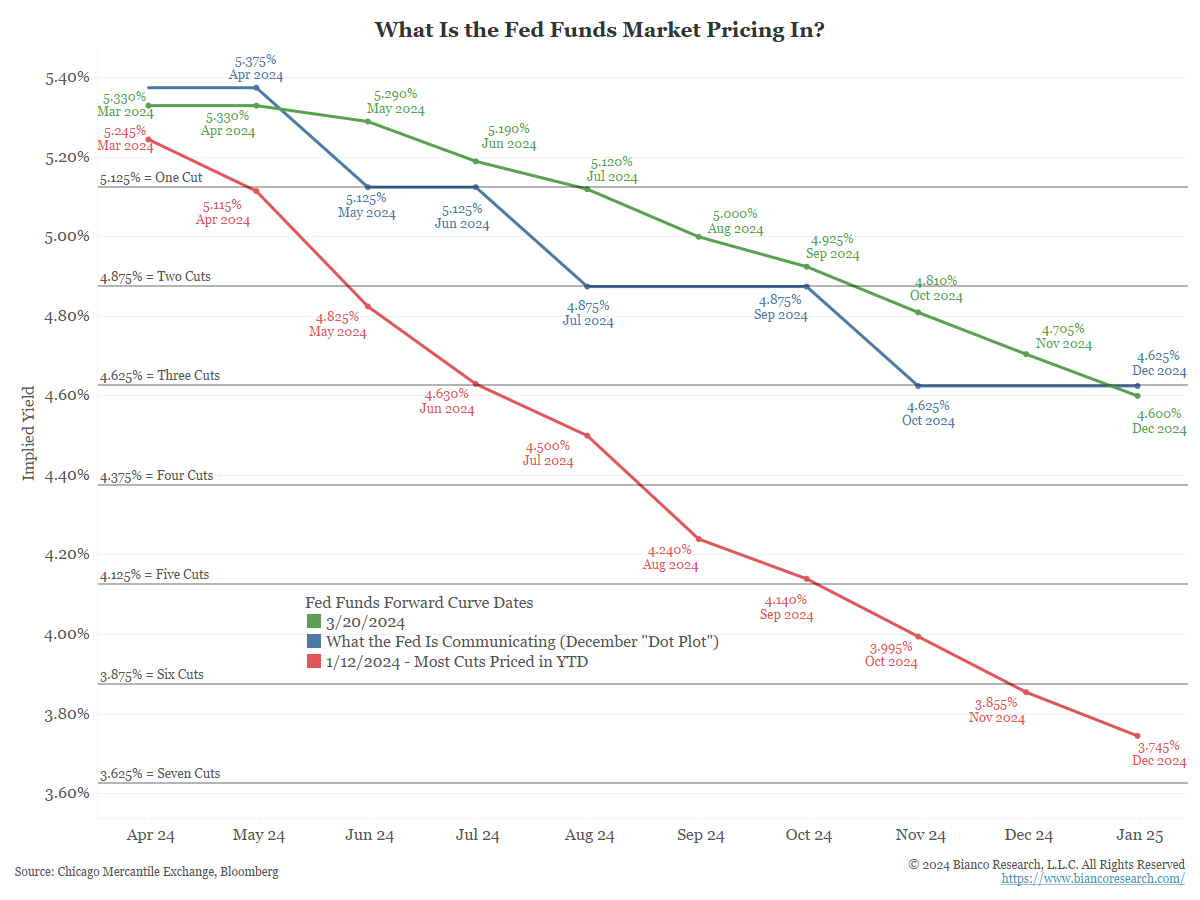

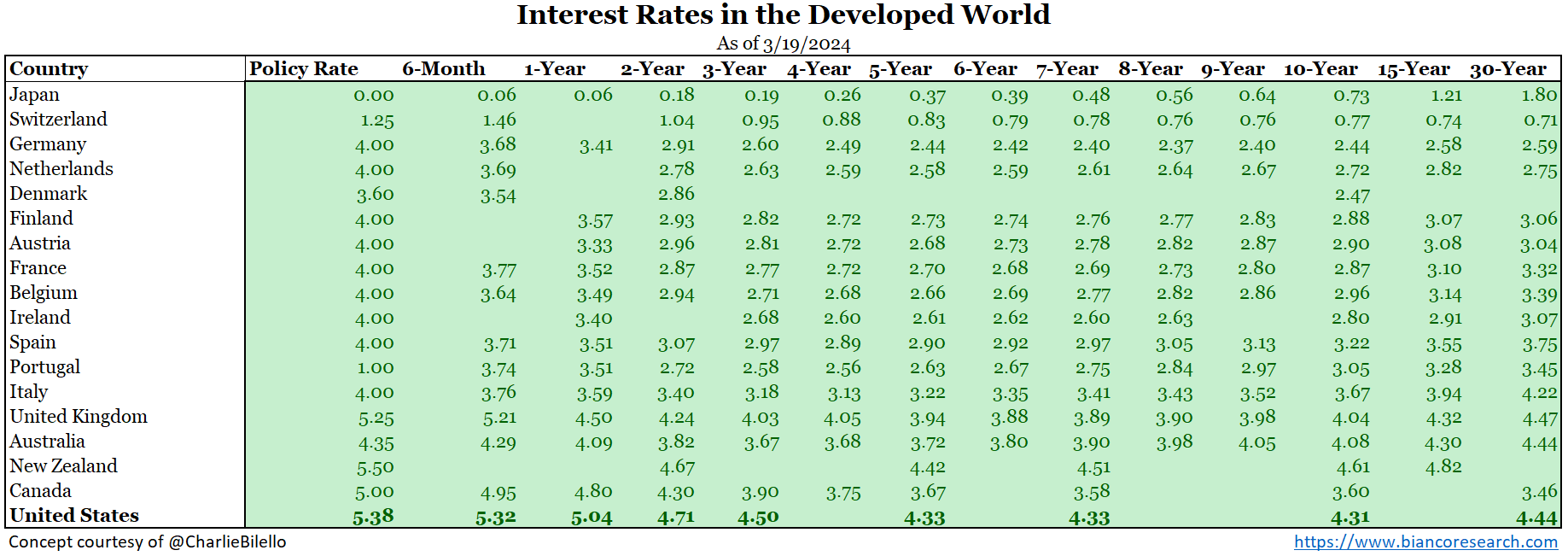

John Luke: The market is finally in gear with the FOMC’s actual plans

Source: Bianco as of 03.20.2024

Source: Bianco as of 03.20.2024

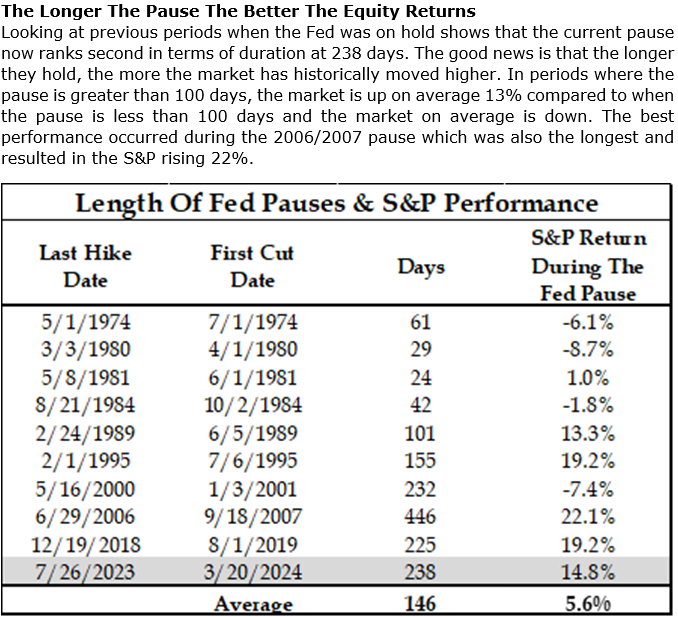

Brad: and this longer “pause” period has seen strong equity performance, similar to past episodes

Source: Strategas as of 03.20.2024

Source: Strategas as of 03.20.2024

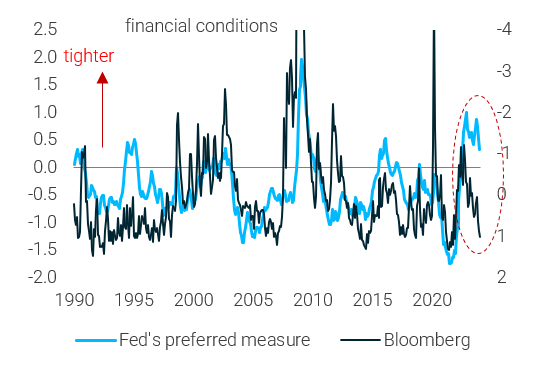

John Luke: what’s interesting is that the FOMC seems to think they’re imposing fairly tight policy while market measures say they aren’t

Source: TS Lombard as of 03.18.2024

Source: TS Lombard as of 03.18.2024

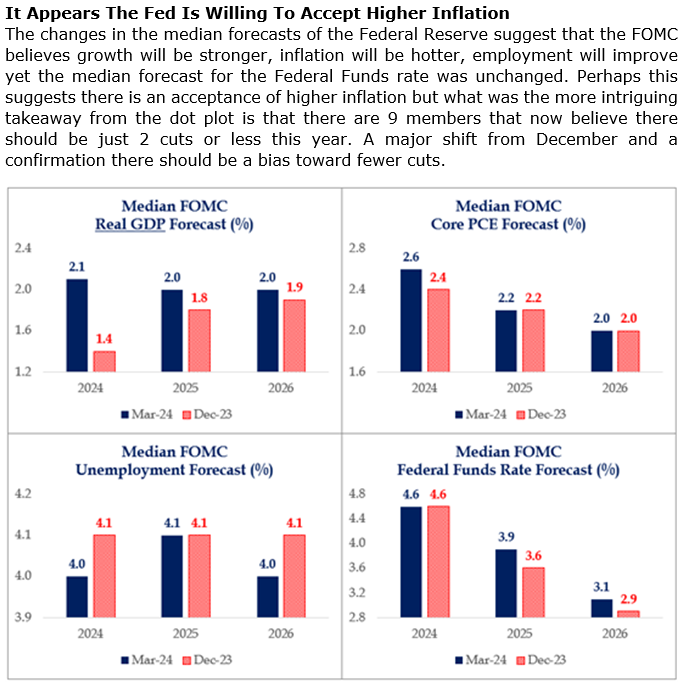

Brad: It does seem that vigilance against inflation is a bit less than where they’ve talked in the past

Source: Strategas as of 03.20.2024

Source: Strategas as of 03.20.2024

Dave: possibly contributing to why near-term inflation expectations are back on the rise

Source: Strategas as of 03.18.2024

Source: Strategas as of 03.18.2024

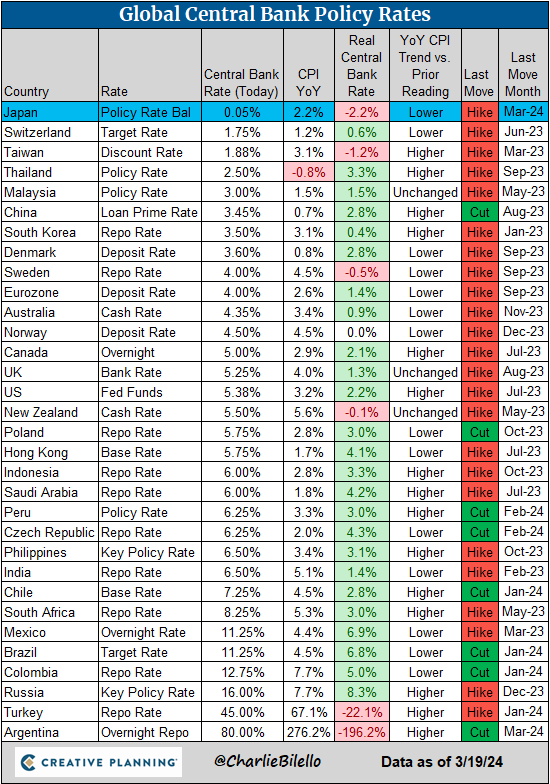

John Luke: Central banks around the world are generally tightening but there are exceptions

John Luke: and with the Bank of Japan’s hike, we finally have all major nations back out of that odd negative rate policy experiment

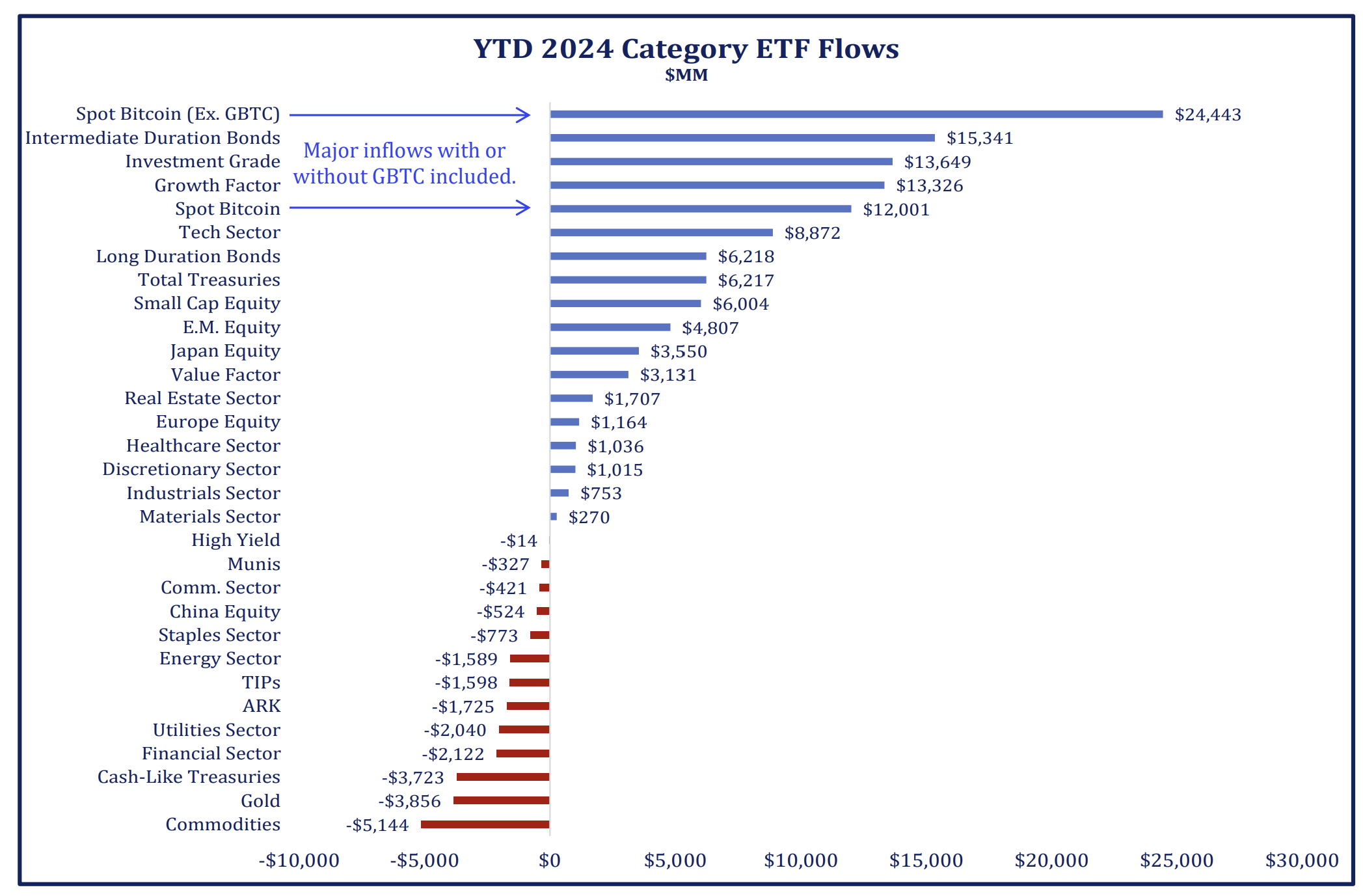

Dave: It’s interesting to see (weak) bond funds continue to capture so many assets

Source: Strategas as of 03.18.2024

Source: Strategas as of 03.18.2024

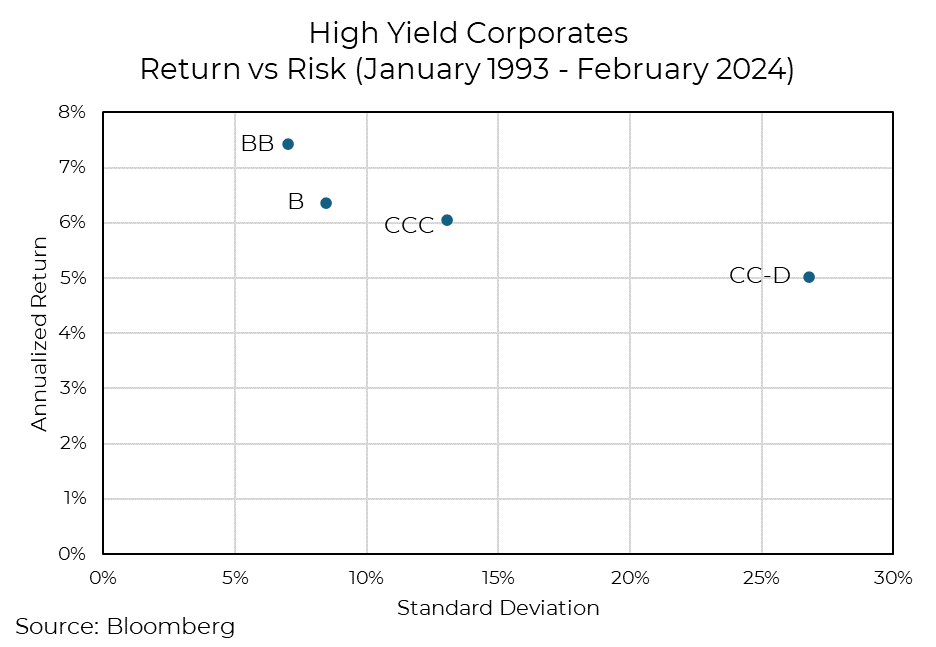

Brian: but somewhat encouraging to see investors avoiding the historically lame high-yield asset class

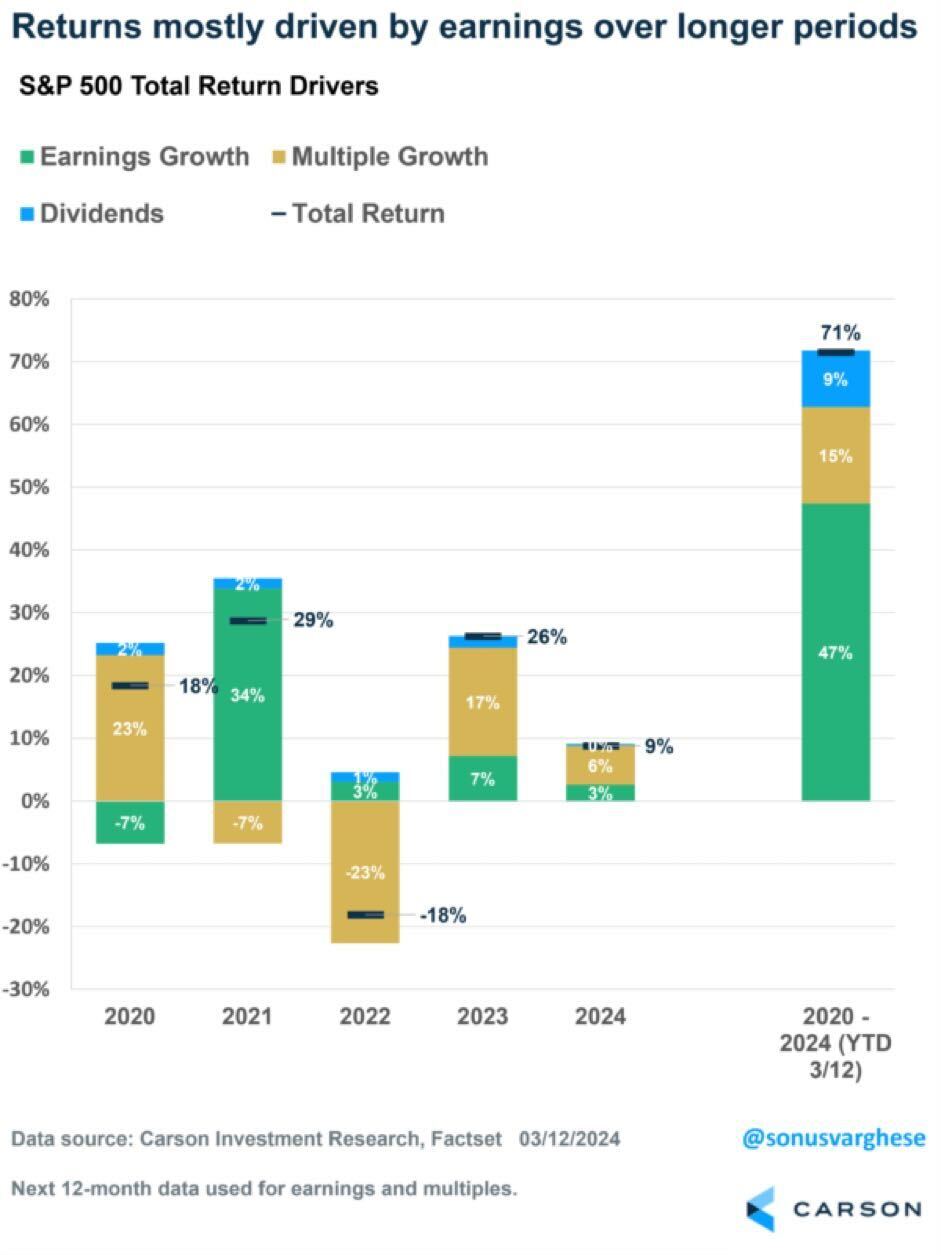

John Luke: As we often note, valuations can matter in the short-term but stocks ultimately move in the direction of earnings

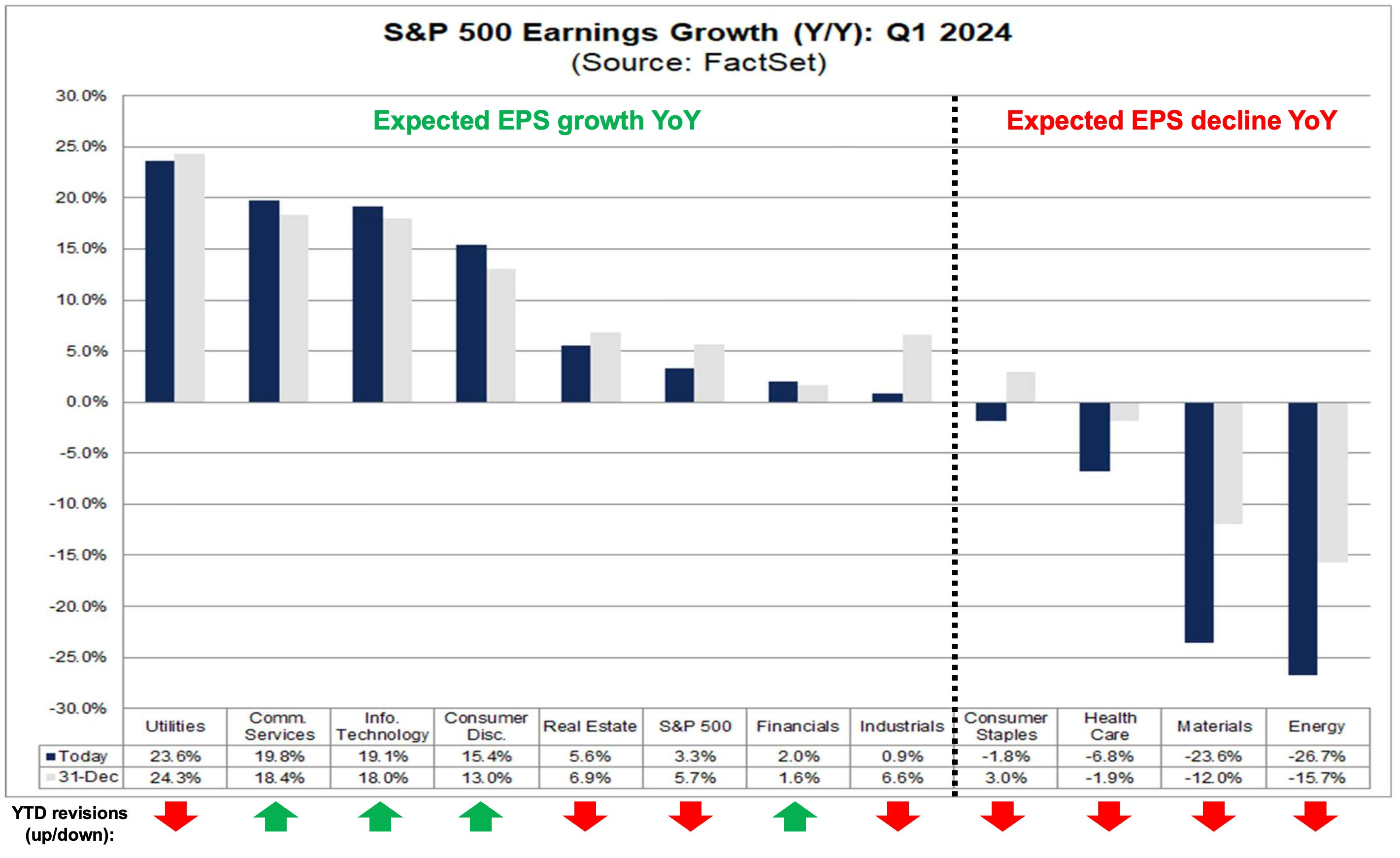

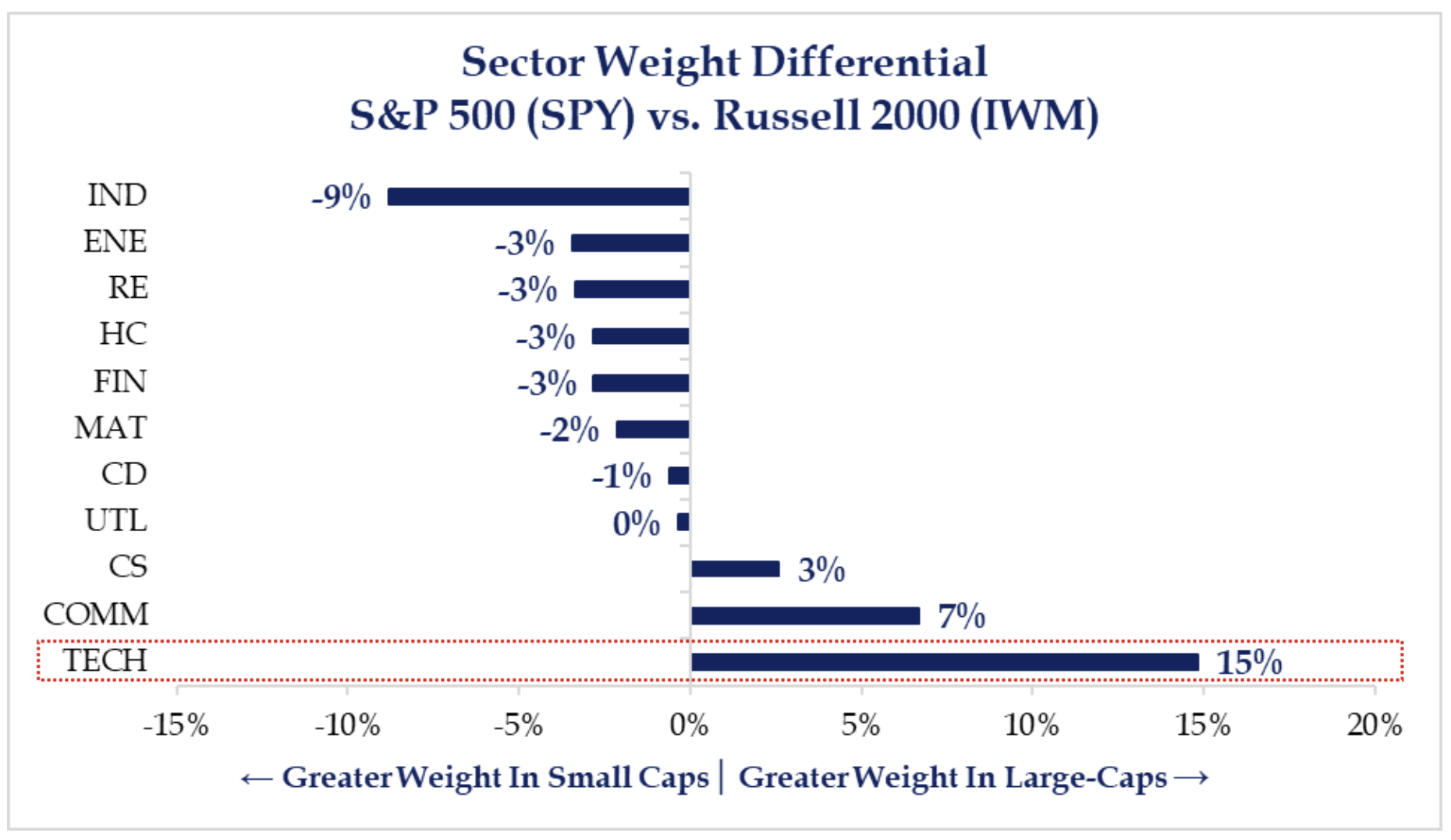

Beckham: and technology continues to earn its place of leadership, with earnings as good as anyone into Q1

Source: Data as of 03.20.2024

Source: Data as of 03.20.2024

Dave: with a clear impact on the divergent price histories of the S&P 500 and Russell 2000 in recent years

Source: Strategas as of 03.18.2024

Source: Strategas as of 03.18.2024

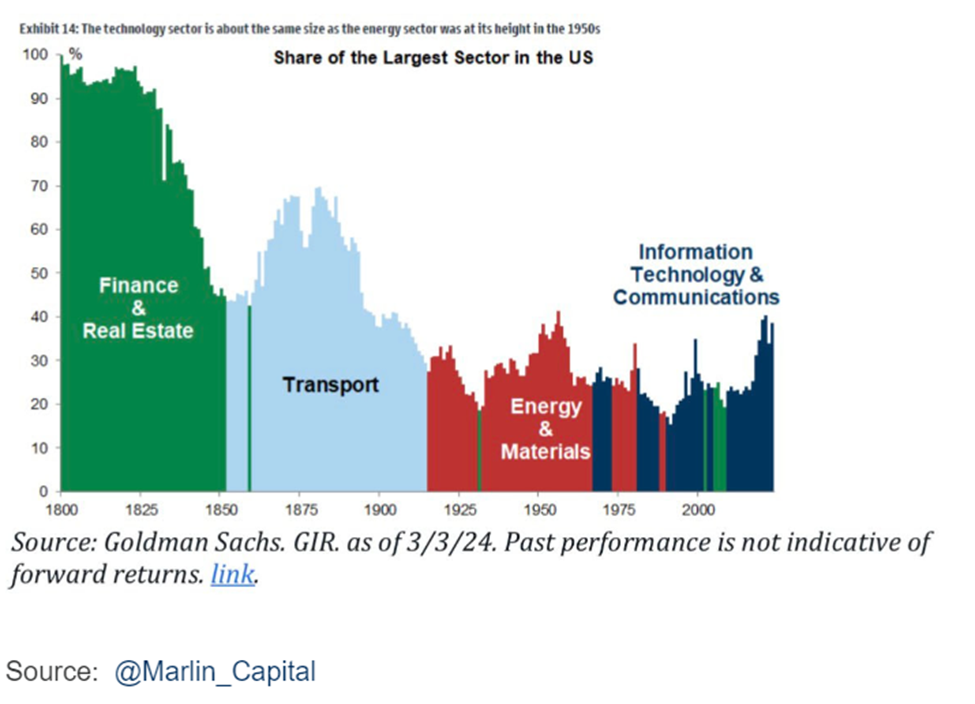

Brett: Speaking of sectors, technology is king but over time leadership has always eventually changed hands

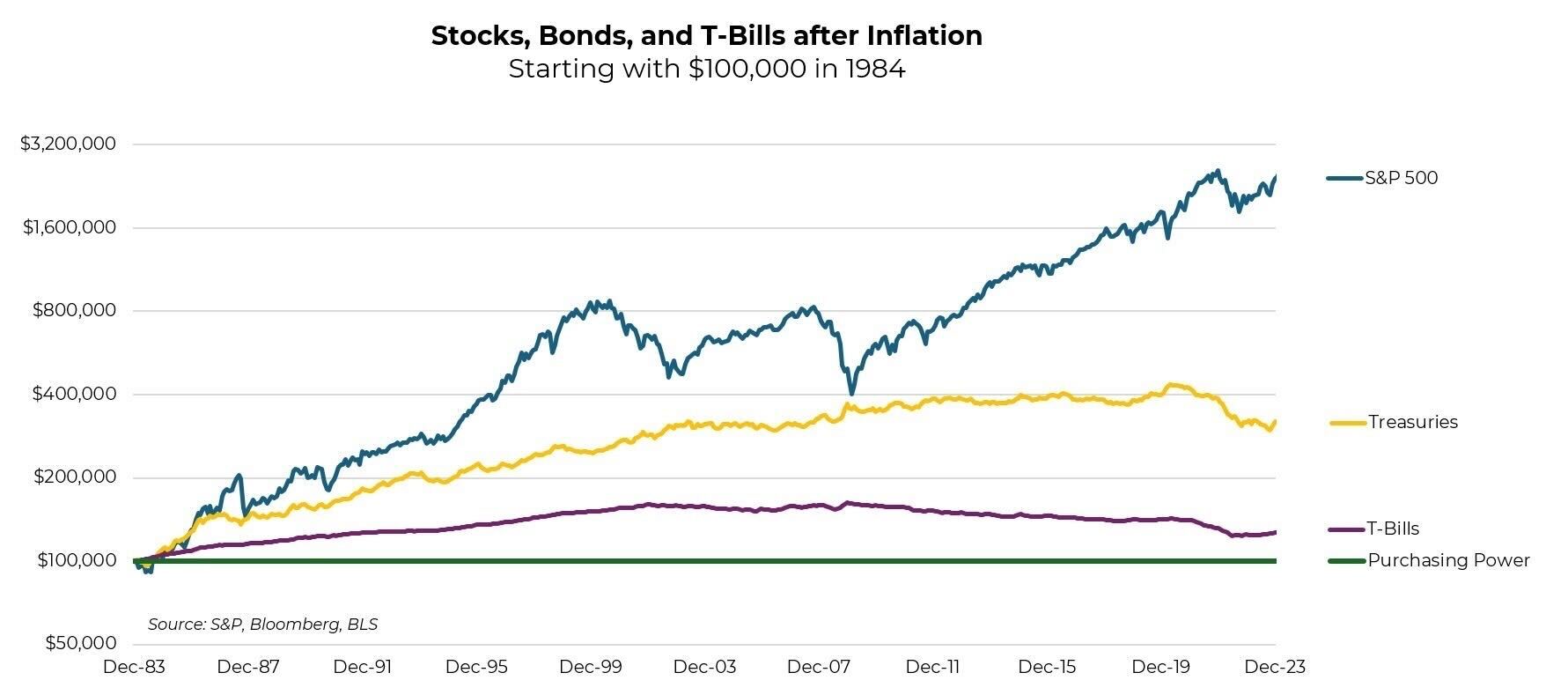

Brian: but regardless of leadership, it’s paid to own the S&P 500 no matter which sector was leading the way

Source: Aptus as of 03.18.2024

Source: Aptus as of 03.18.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2403-29.