Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from investor sentiment to the US market correction to earnings and, of course, tariffs. Enjoy!

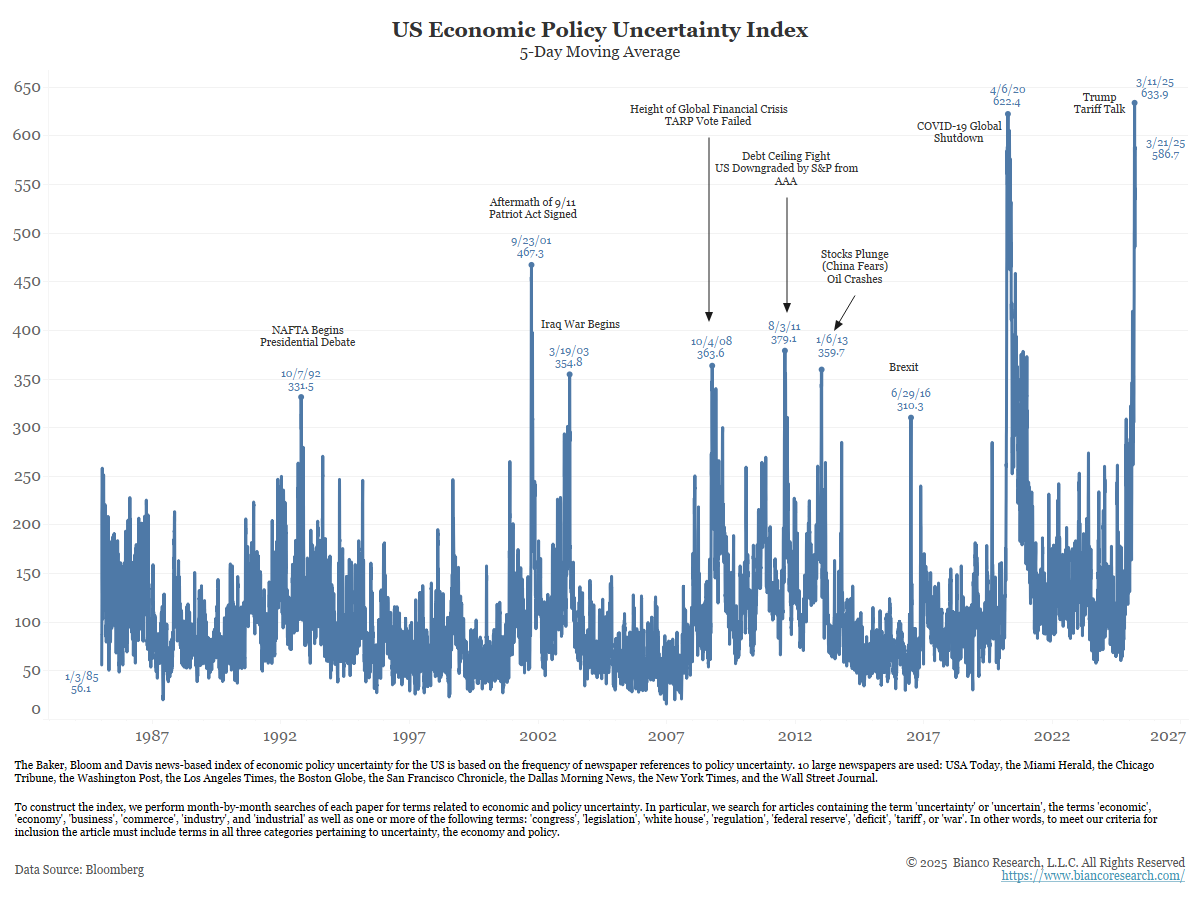

John Luke: Hard to know the proper reaction for stocks, but hard to believe this episode is up there with the biggest “uncertainty” windows of the past 40 years

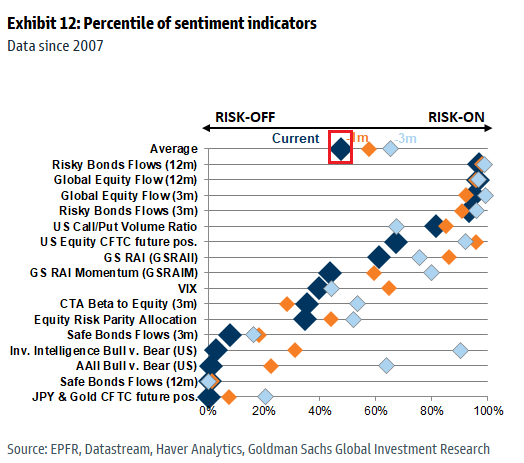

Brad: but there is no single measure of sentiment capable of confirming whether markets have overreacted

Data as of 03.26.2025

Data as of 03.26.2025

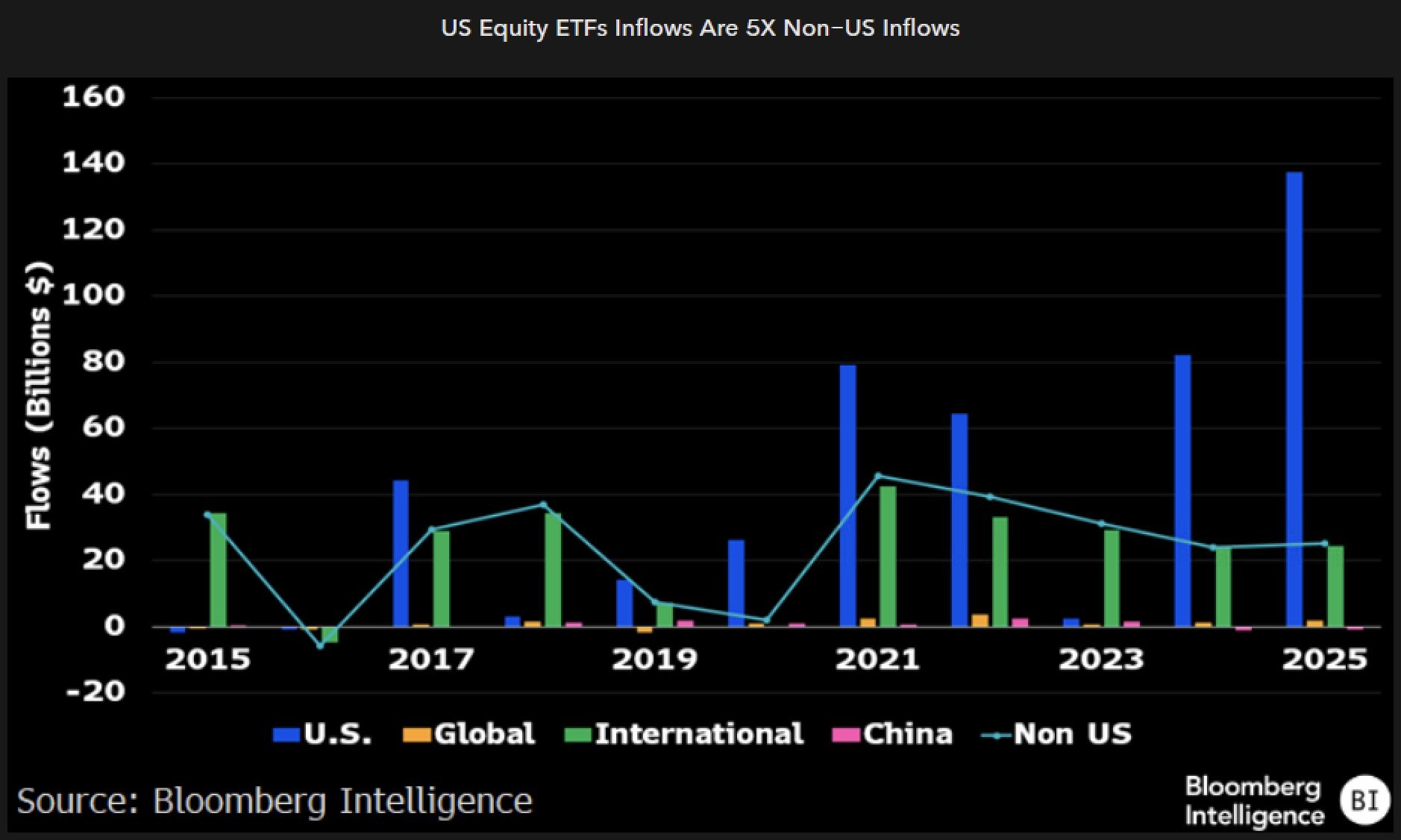

Beckham: one thing we know is that US equities have still attracted the lion’s share of ETF inflows

Data as of 03.26.2025

Data as of 03.26.2025

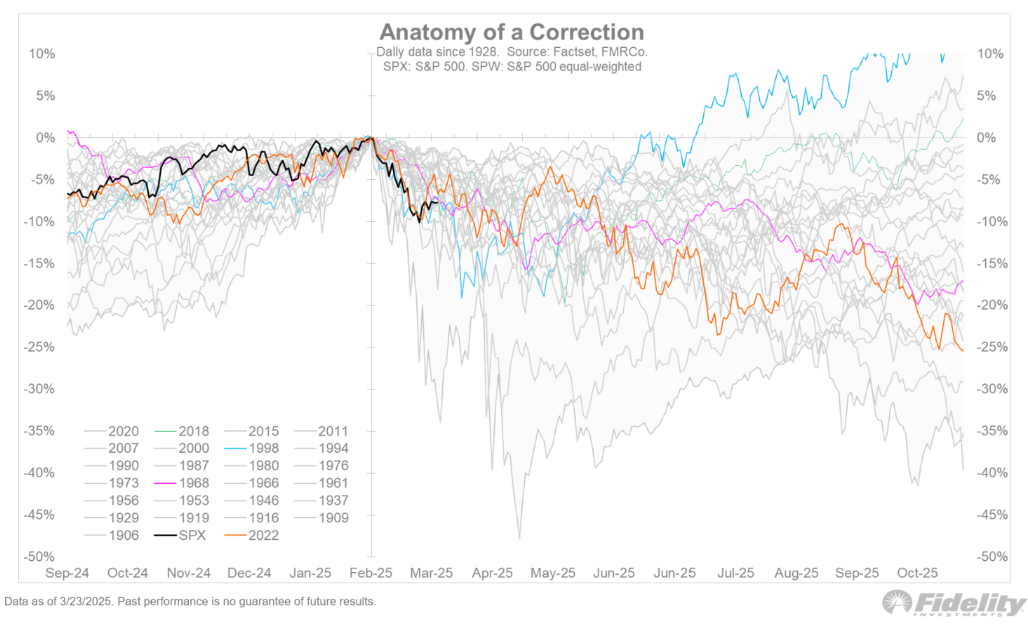

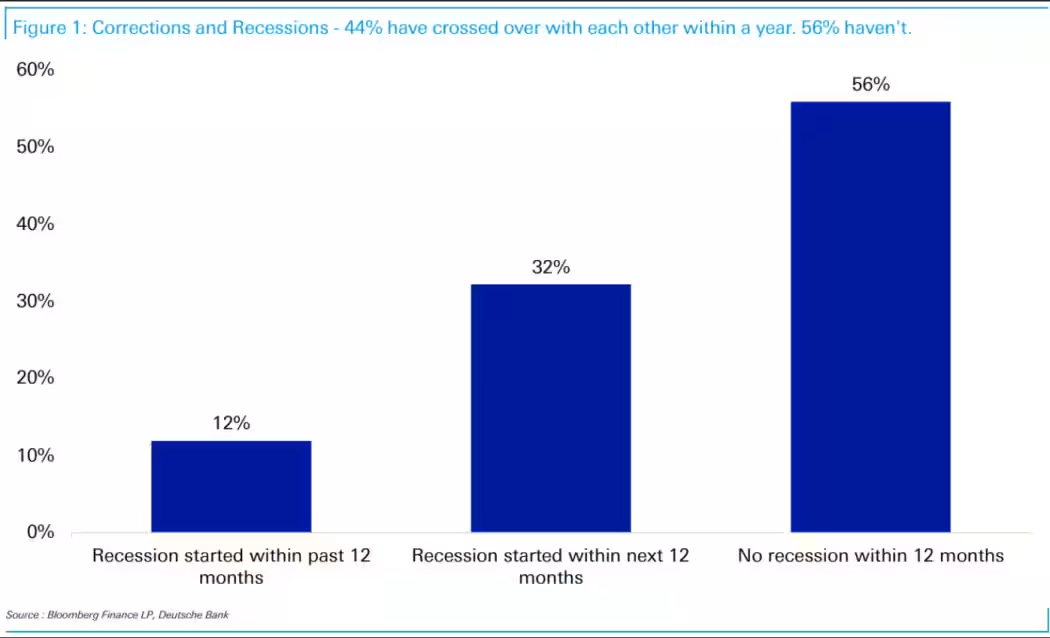

Arch: Stocks have hit the 10% correction marker. History has shown a wide range of outcomes from that level.

John Luke: there’s not only a range of market outcomes, but a split between recessionary environments vs. non-recessionary

Data as of 03.25.2025

Data as of 03.25.2025

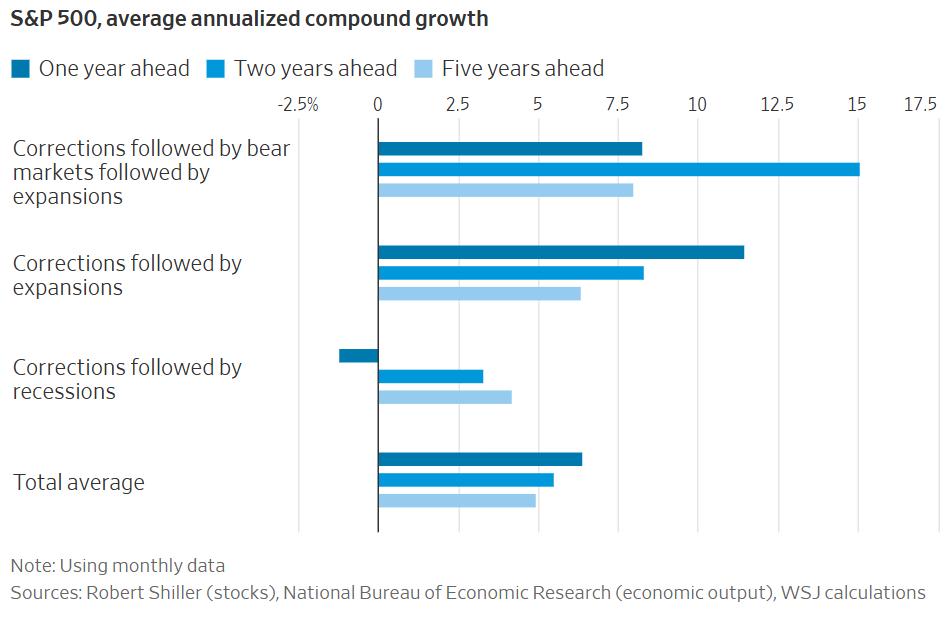

John Luke: with economic expansions being a distinguishing factor in fostering better equity performance in future years

Data as of February 2025

Data as of February 2025

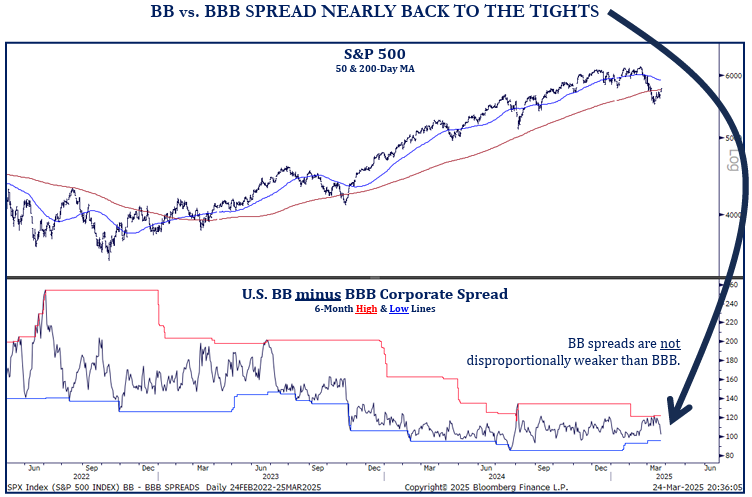

Brad: Regarding the economy, we’ve yet to see signs of credit markets forecasting any severe risks

Source: Strategas

Source: Strategas

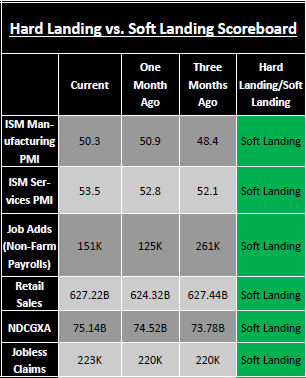

Brad: and a look at a broader set of economic data currently confirms the same underlying strength

Source: Sevens Report as of 03.26.2025

Source: Sevens Report as of 03.26.2025

Brett: The valuation of the median S&P 500 stock is right at its 10 year average

Source: @kevrgordon as of 03.24.2025

Source: @kevrgordon as of 03.24.2025

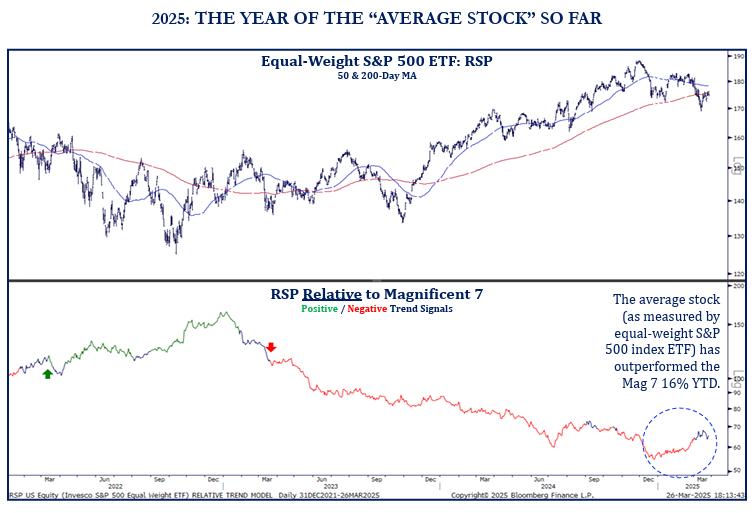

John Luke: and the “average” stock has finally been showing strength relative to the formerly leading Mag 7 megacap tech stocks

Source: Strategas

Source: Strategas

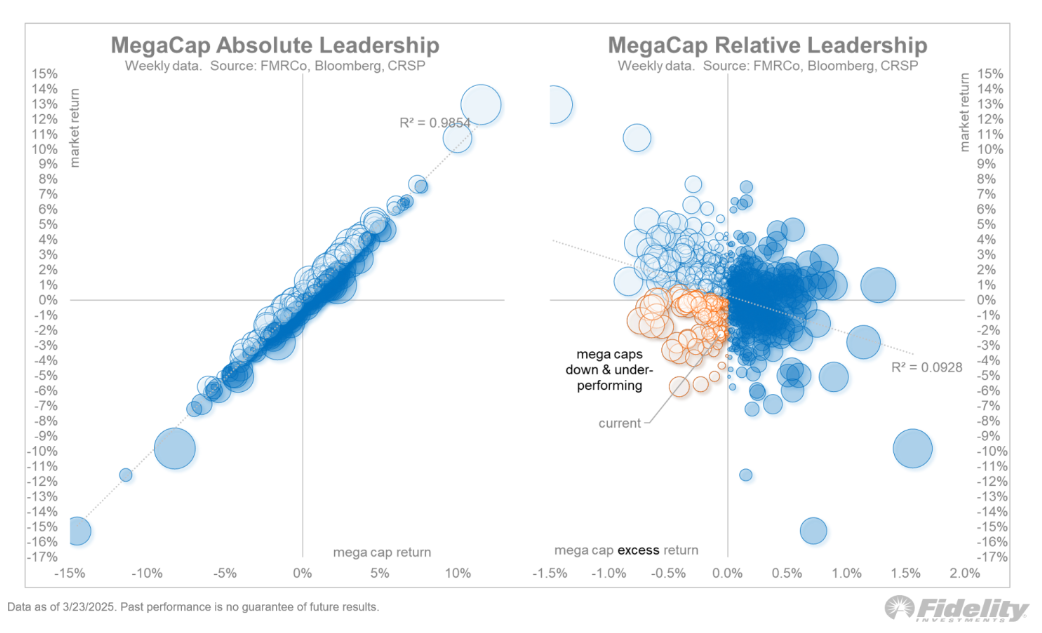

Brian: that said, it’s hard for a market as concentrated as the S&P 500 to make significant headway without stabilization of its biggest components

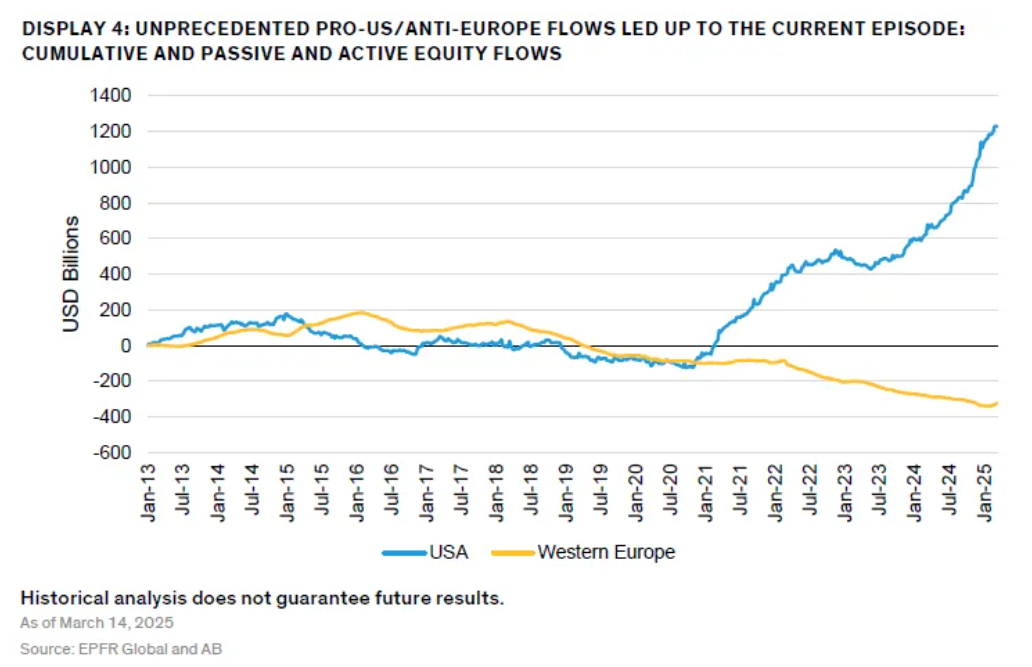

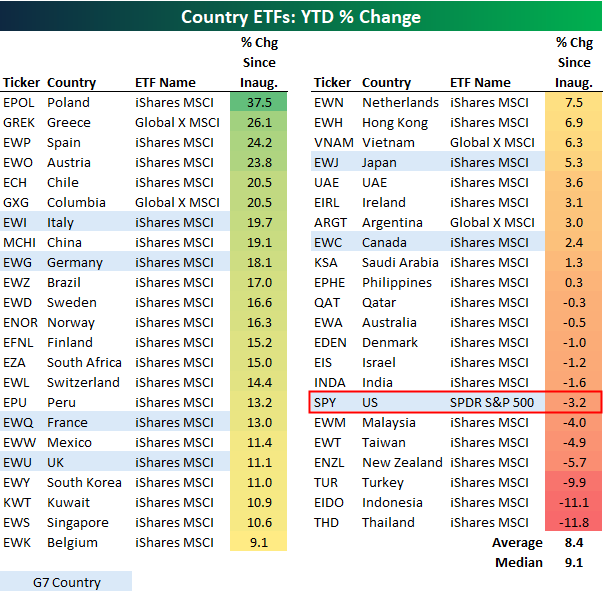

Joseph: It’s no secret that US stocks have dominated European stocks for years, and investor flows since COVID have only accelerated the split

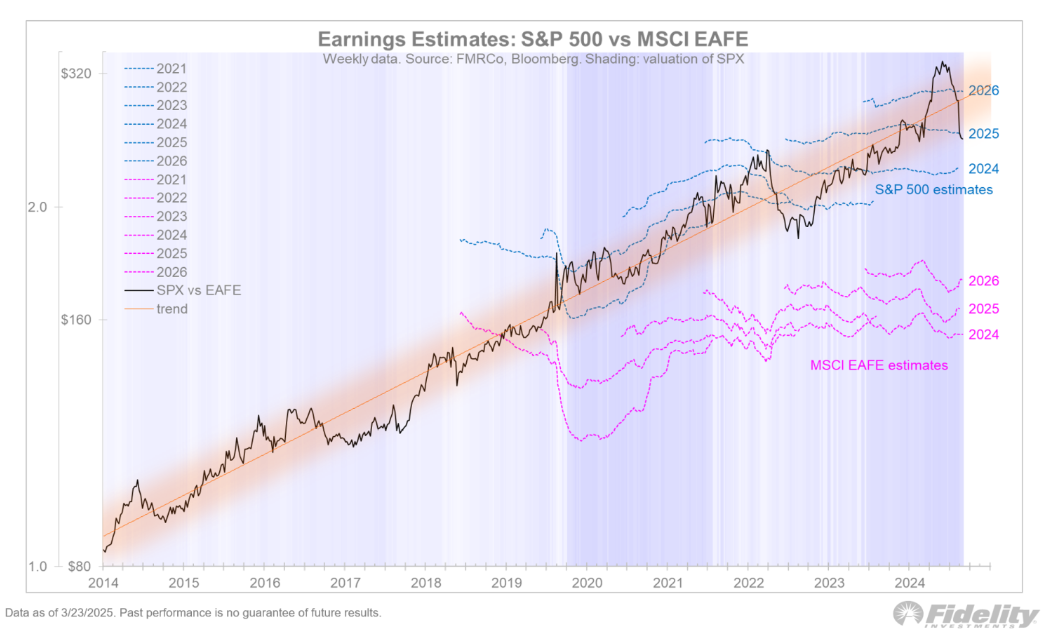

Dave: but we’ve recently seen improvement in the earnings outlook for foreign companies relative to US companies

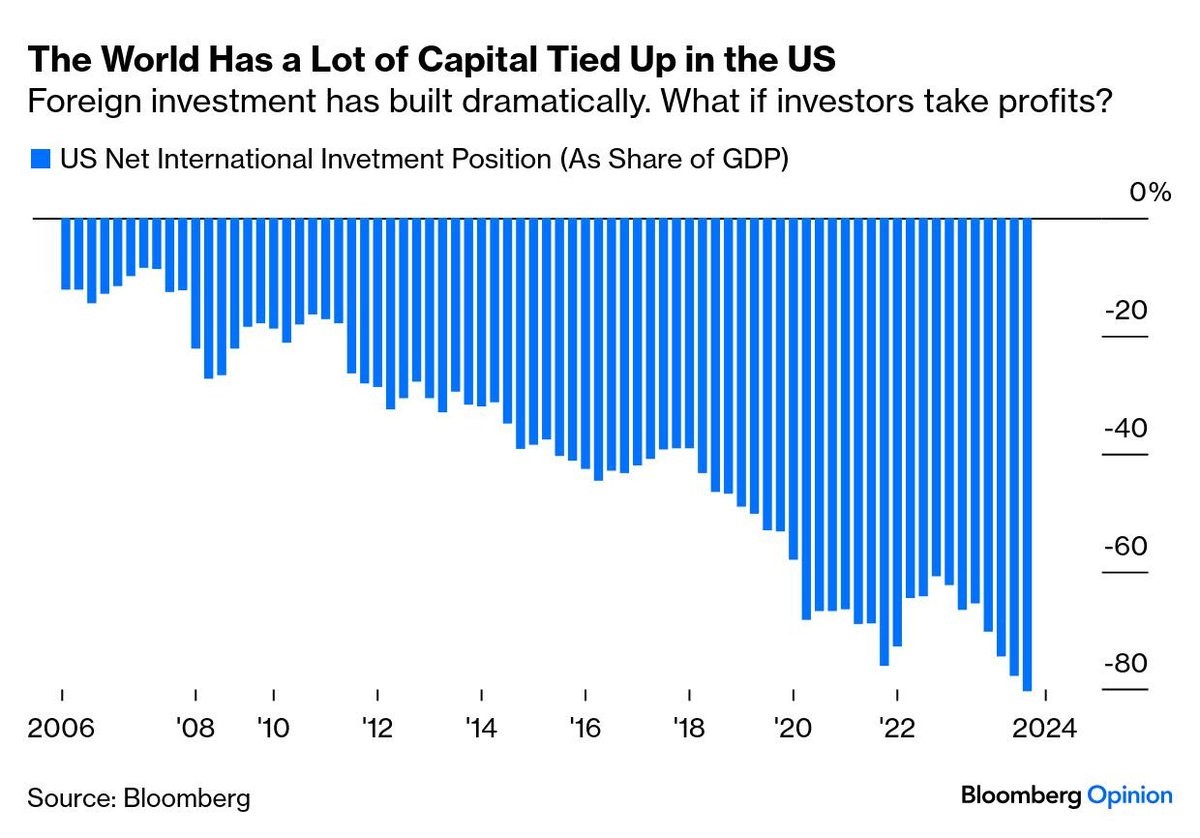

Brian: The years since the global financial crisis have seen massive investment in US markets at the expense of most regions around the globe

Brett: but whether it’s fundamentals or just a mean-reversion trade, winners and losers have totally flipped in Q1

Source: Bespoke as of 03.27.2025

Source: Bespoke as of 03.27.2025

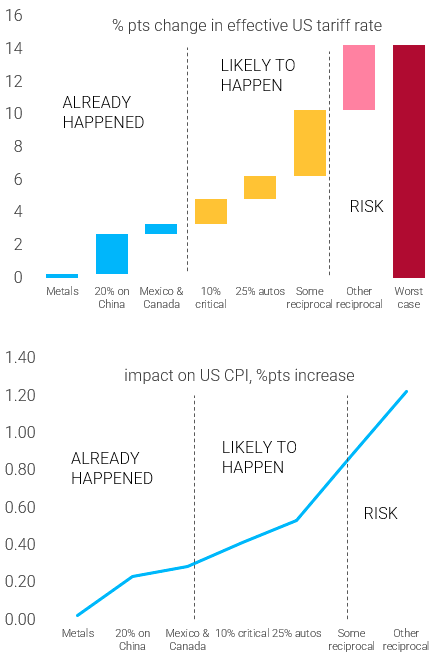

Joseph: It seems like we’re at the point where the impact of potential tariffs can start to be quantified

Source: TS Lombard as of 03.24.2025

Source: TS Lombard as of 03.24.2025

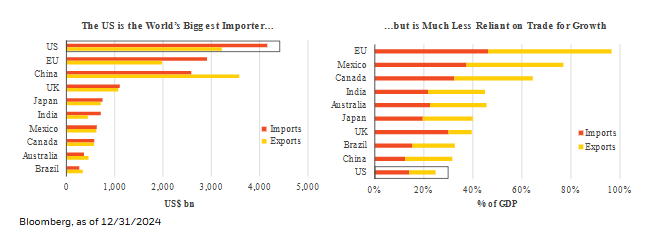

John Luke: but for all of the hysteria surrounding tariffs, the US economy is far less tied to trade than most countries

Source: Strategas

Source: Strategas

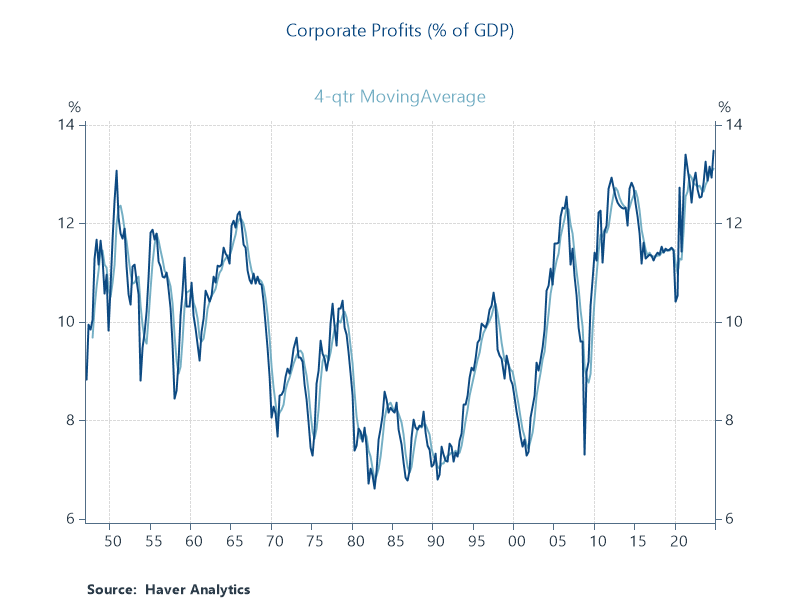

Dave: What’s ultimately going to matter for stocks is the growth of earnings, and how strong margins can remain

Data via RenMac as of January 2025

Data via RenMac as of January 2025

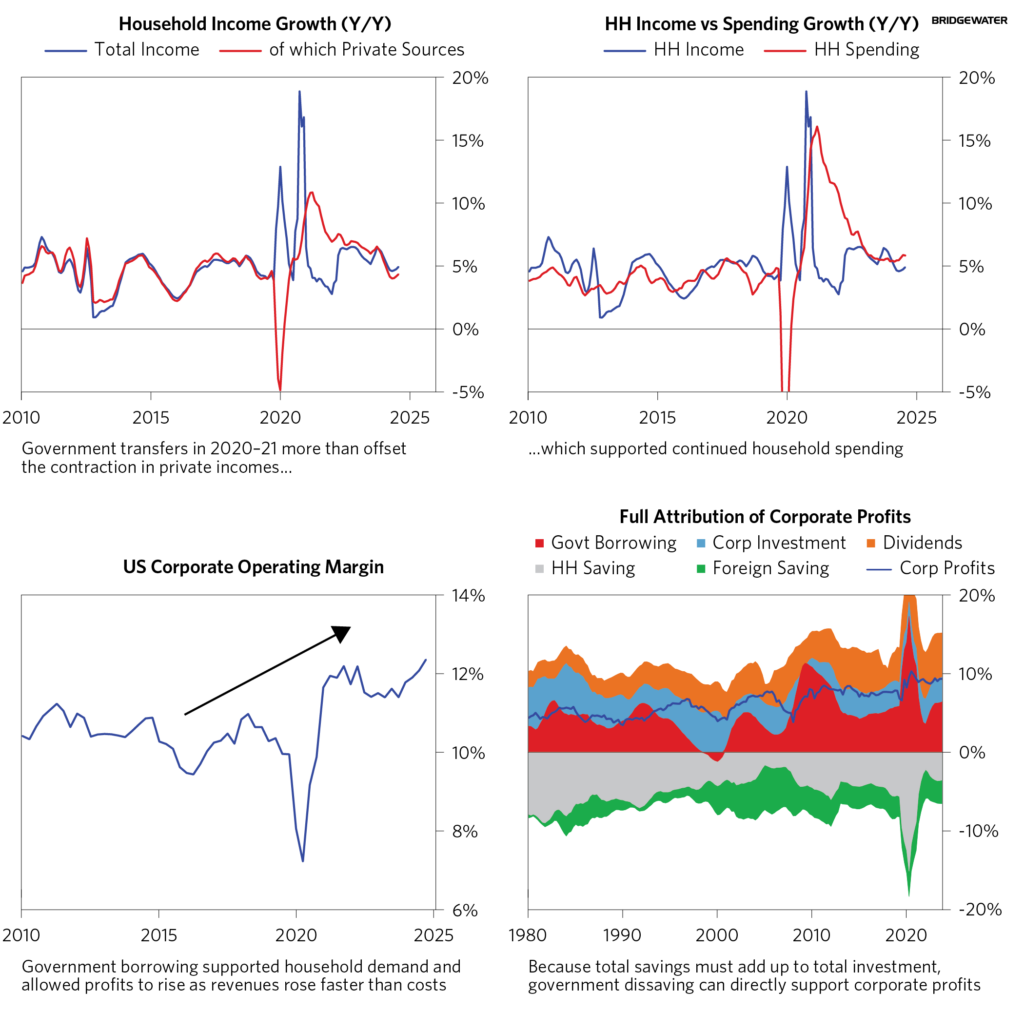

John Luke: and investors seem to be questioning this, given how much of the US growth and profit dominance has been tied to government spending

Source: Bloomberg as of January 2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2503-28.