Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

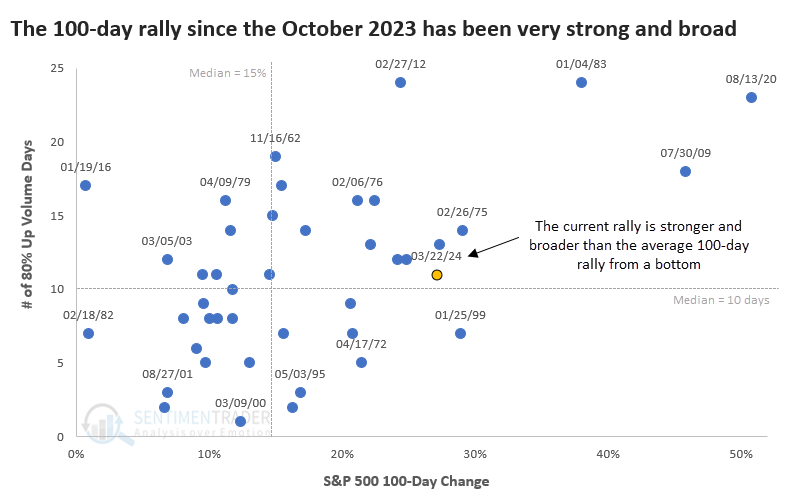

Brett: It’s been a historic equity rally these past few months, here’s where this one sits relative to others

Source: SentimenTrader as of 03.26.2024

Source: SentimenTrader as of 03.26.2024

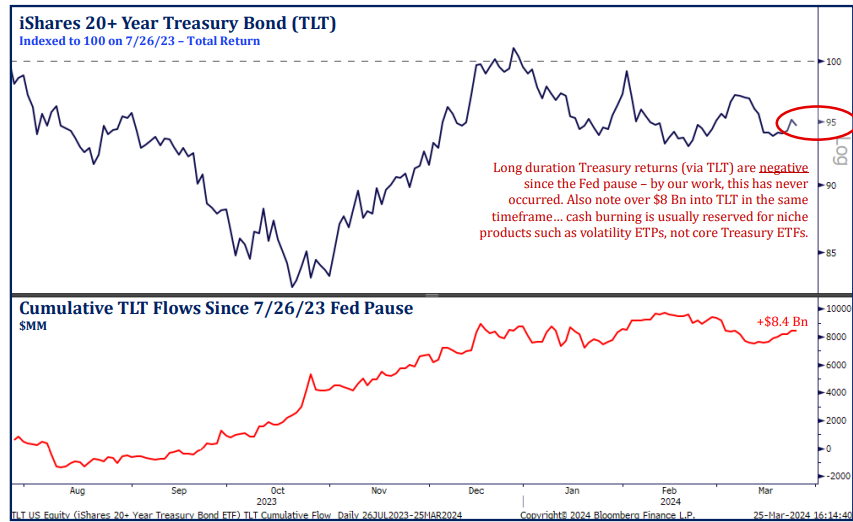

Dave: ironically, against that equity rally it’s been bond funds attracting a good chunk of inflows

Source: Strategas as of 03.25.2024

Source: Strategas as of 03.25.2024

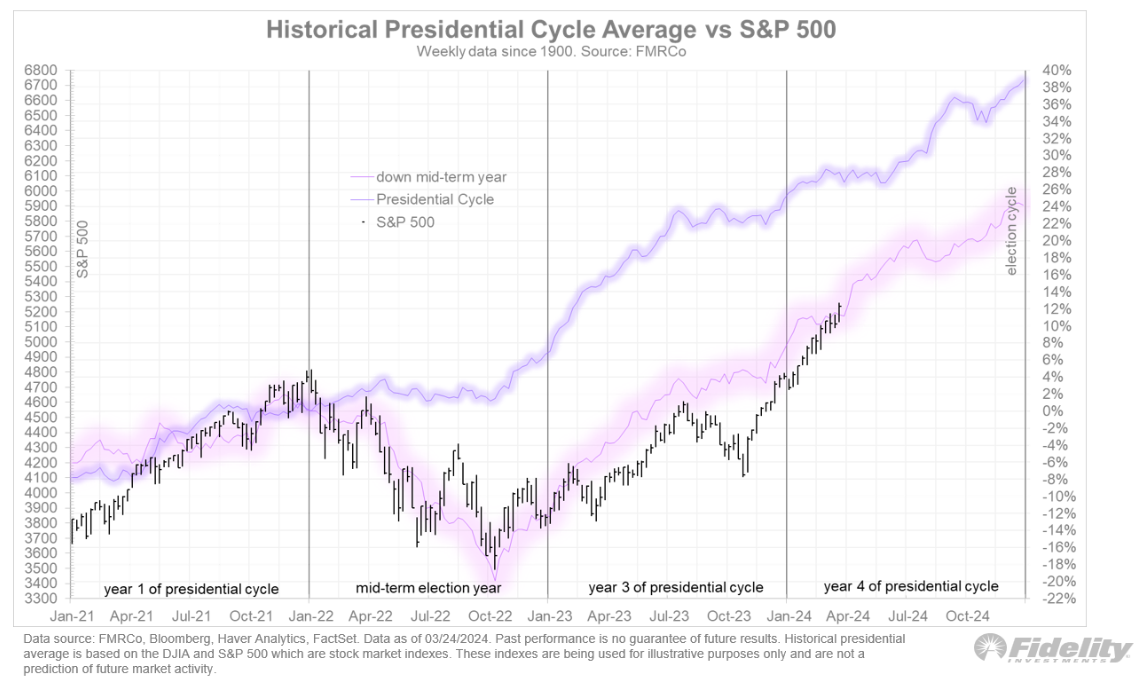

Beckham: Also interesting, this equity cycle lines up pretty tightly to the history of past election cycles

Data as of 03.25.2024

Data as of 03.25.2024

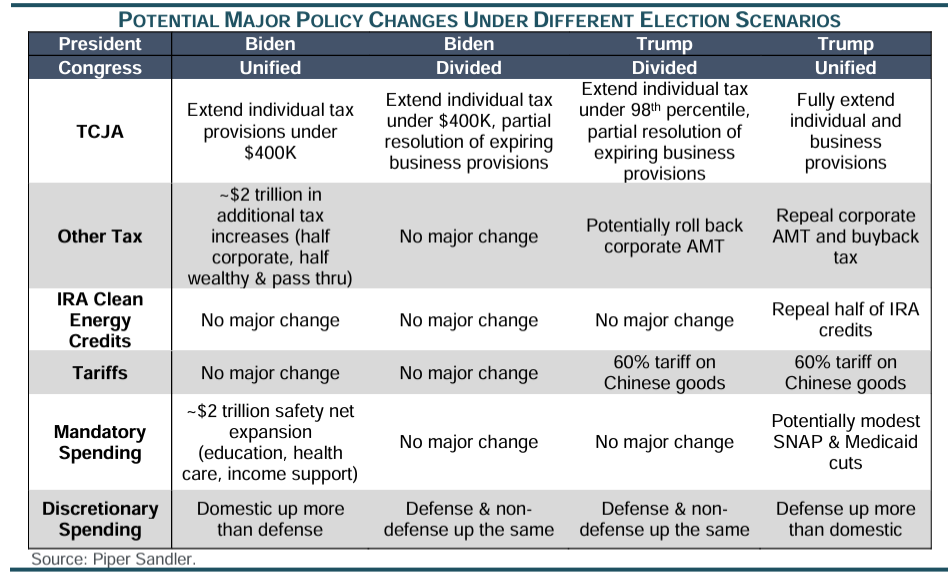

Dave: and while party winner rarely drives market outcomes, there are a handful of issues that could play a role in separating winners and losers

Data as of March 2024

Data as of March 2024

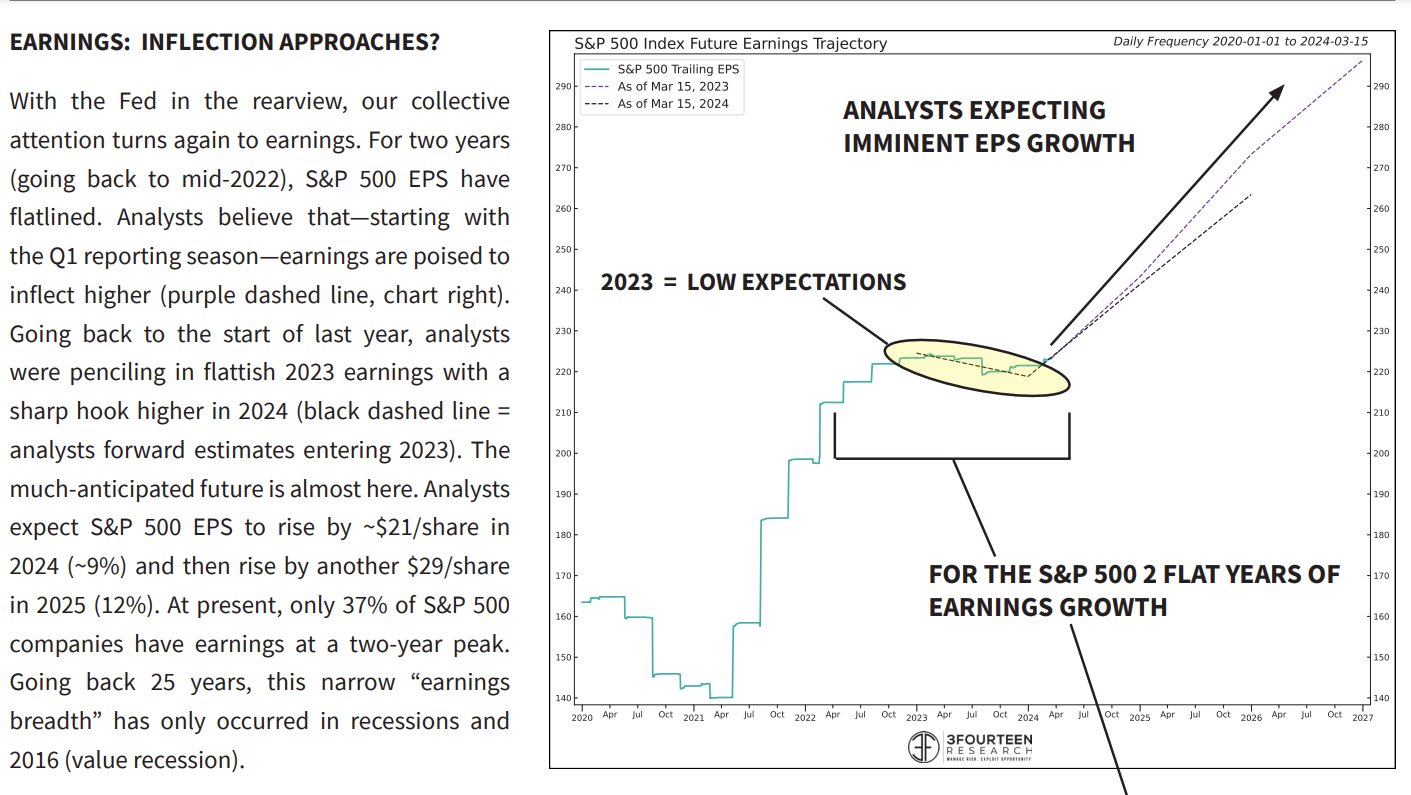

Brad: The other cycle that’s bringing optimism to stocks is the earnings cycle, which to this point has been pretty narrow just like sector performance

Source: 3Fourteen Research as of 03.15.2024

Source: 3Fourteen Research as of 03.15.2024

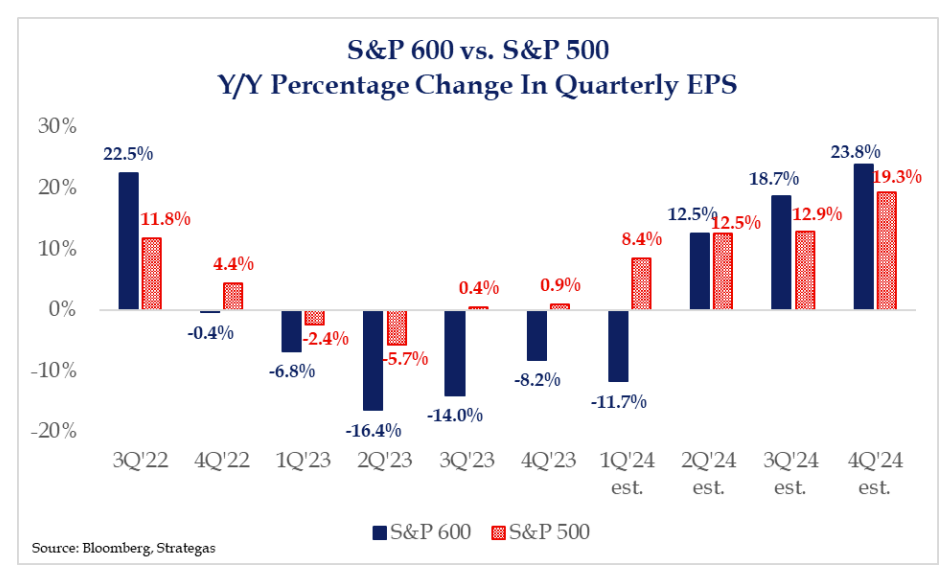

Dave: with the expected earnings inflection particularly sharp for small-caps

Data as of 03.18.2024

Data as of 03.18.2024

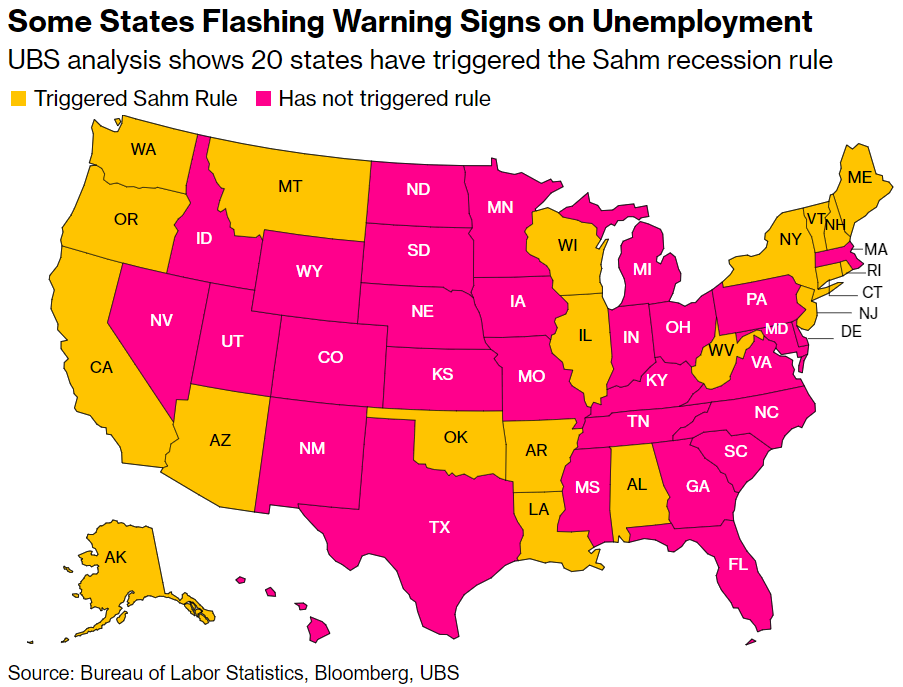

John Luke: We’re seeing a steady increase in the number of states seeing employment weakness

Data as of 03.26.2024

Data as of 03.26.2024

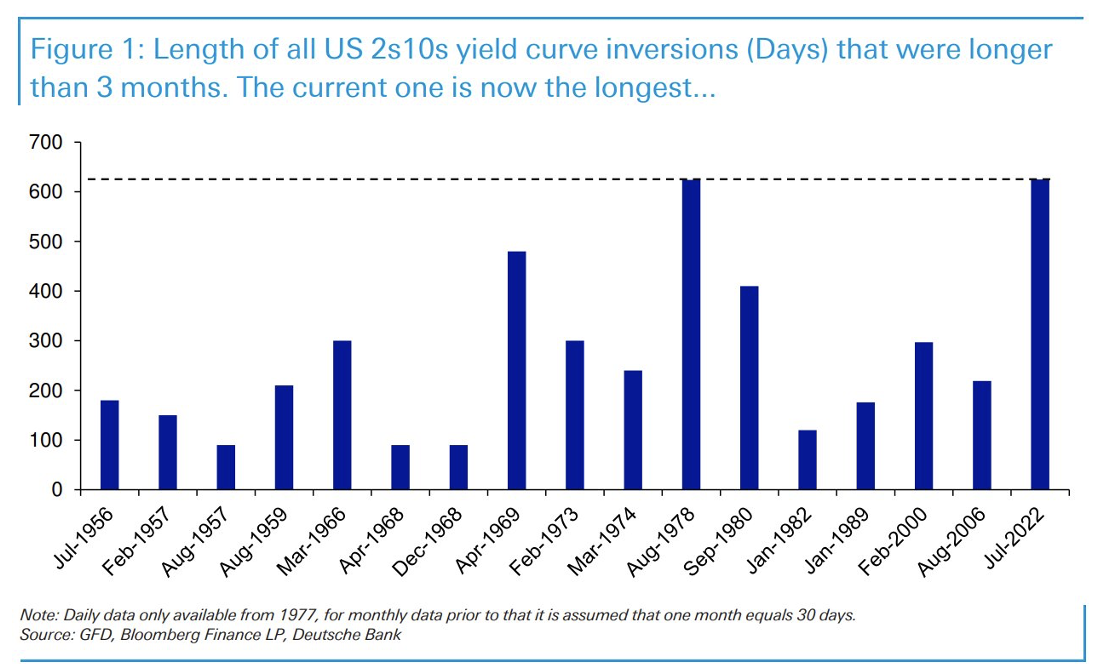

Joseph: and we know the yield curve has been inverted far longer than normal, which in the past has tipped off recessions

Data as of 03.16.2024

Data as of 03.16.2024

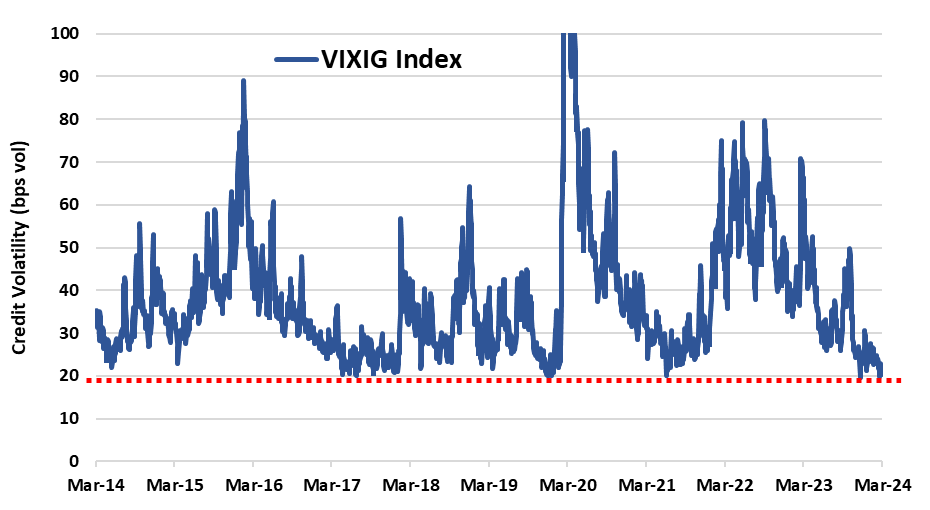

John Luke: but for all of the worries, there has been no indication in the credit market, where one would expect trouble to first appear

Source: CBOE as of 03.25.2024

Source: CBOE as of 03.25.2024

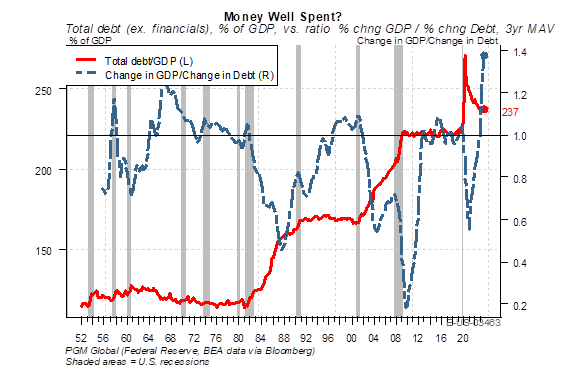

John Luke: Despite the explosion of government debt, U.S. GDP has so far managed to outpace the growth of that debt

Data as of 03.20.2024

Data as of 03.20.2024

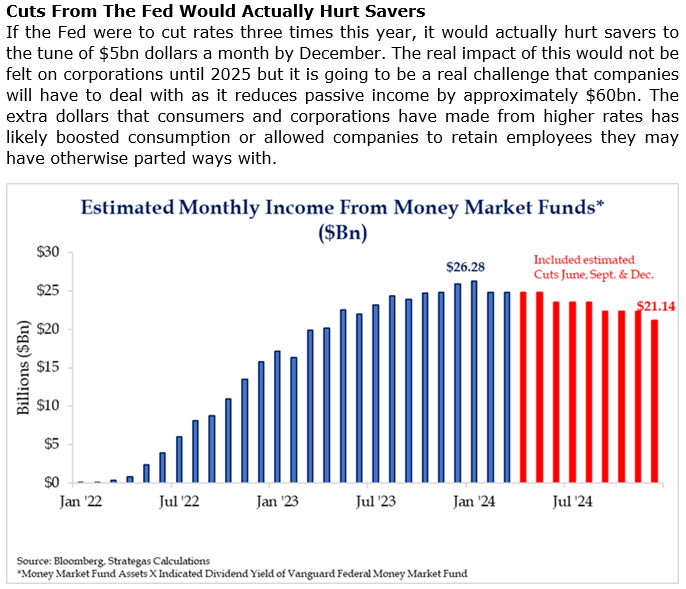

Brad: with that GDP supported by the strength of the consumer, and their (low) fixed-rate debt and high rates earned on savings during this hiking cycle

Data as of 03.22.2024

Data as of 03.22.2024

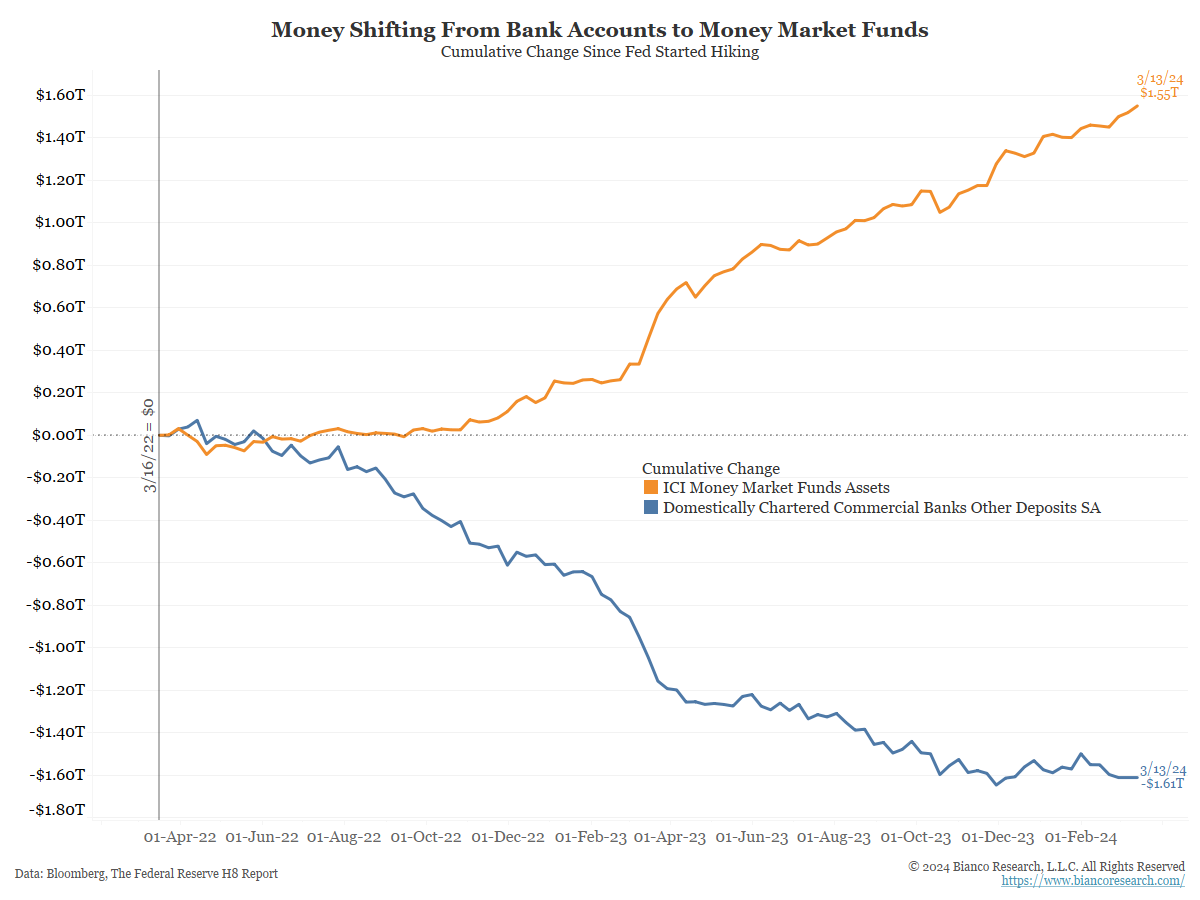

John Luke: One area that doesn’t seem to be seeing the same positive impact is the banking sector

Data as of 03.13.2024

Data as of 03.13.2024

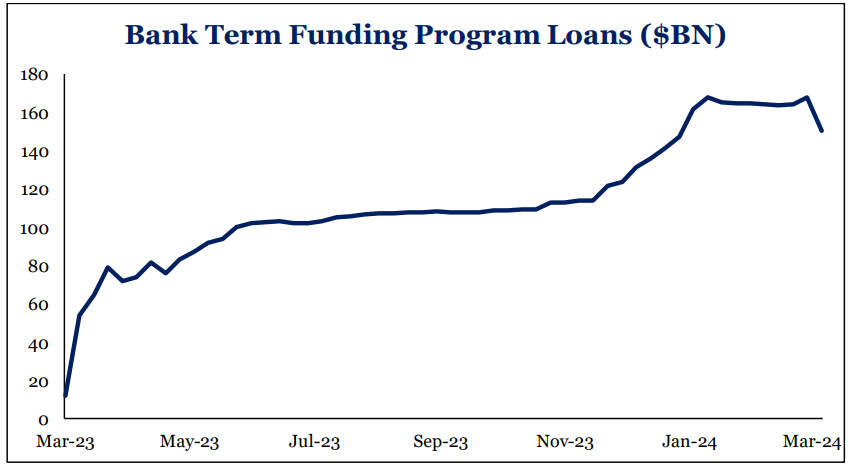

Dave: and they’ll now see a borrowing window close on them, one that was opened during the Silicon Valley Bank crisis

Source: Strategas as of 03.25.2024

Source: Strategas as of 03.25.2024

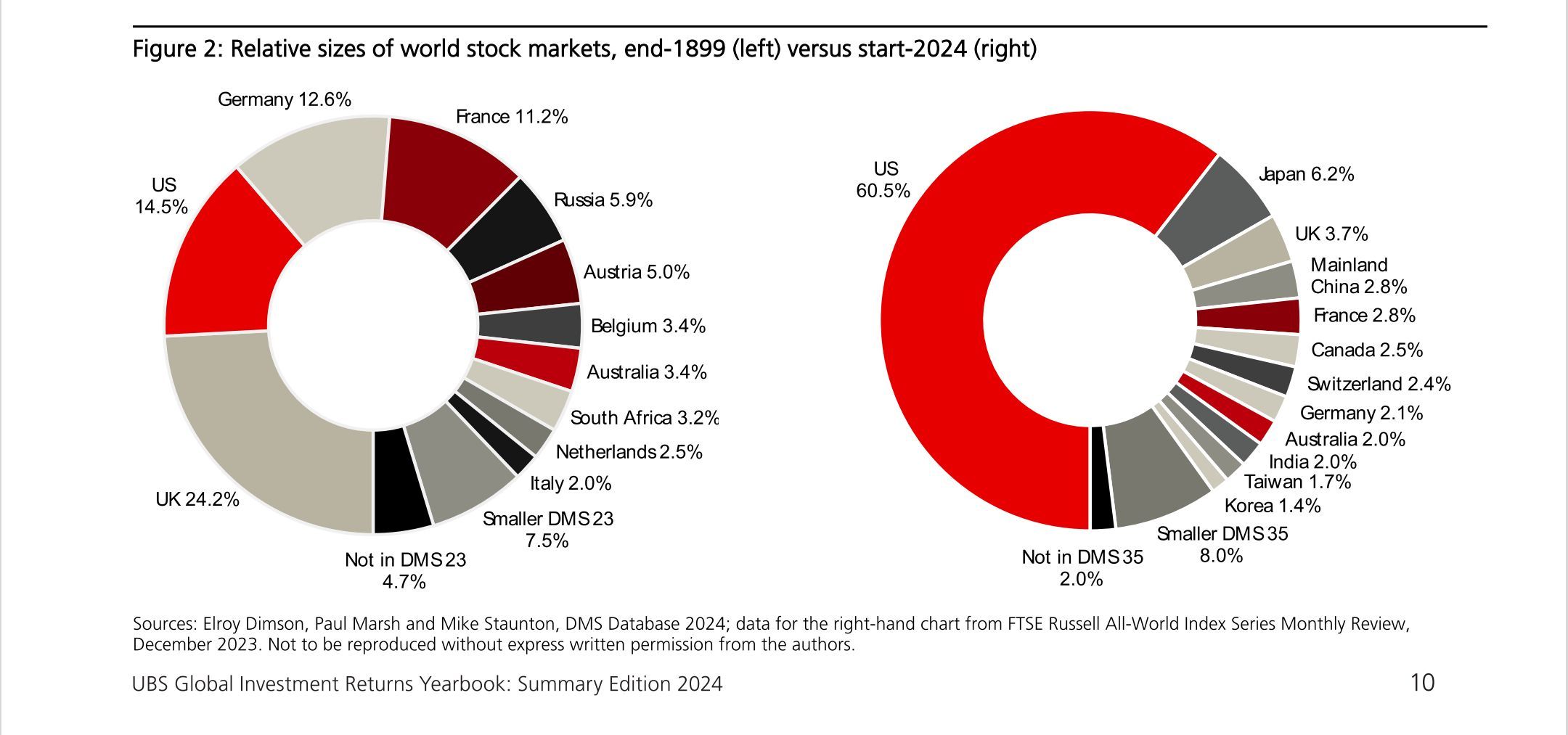

Brian: Global benchmarks look a whole lot different than they did a century ago

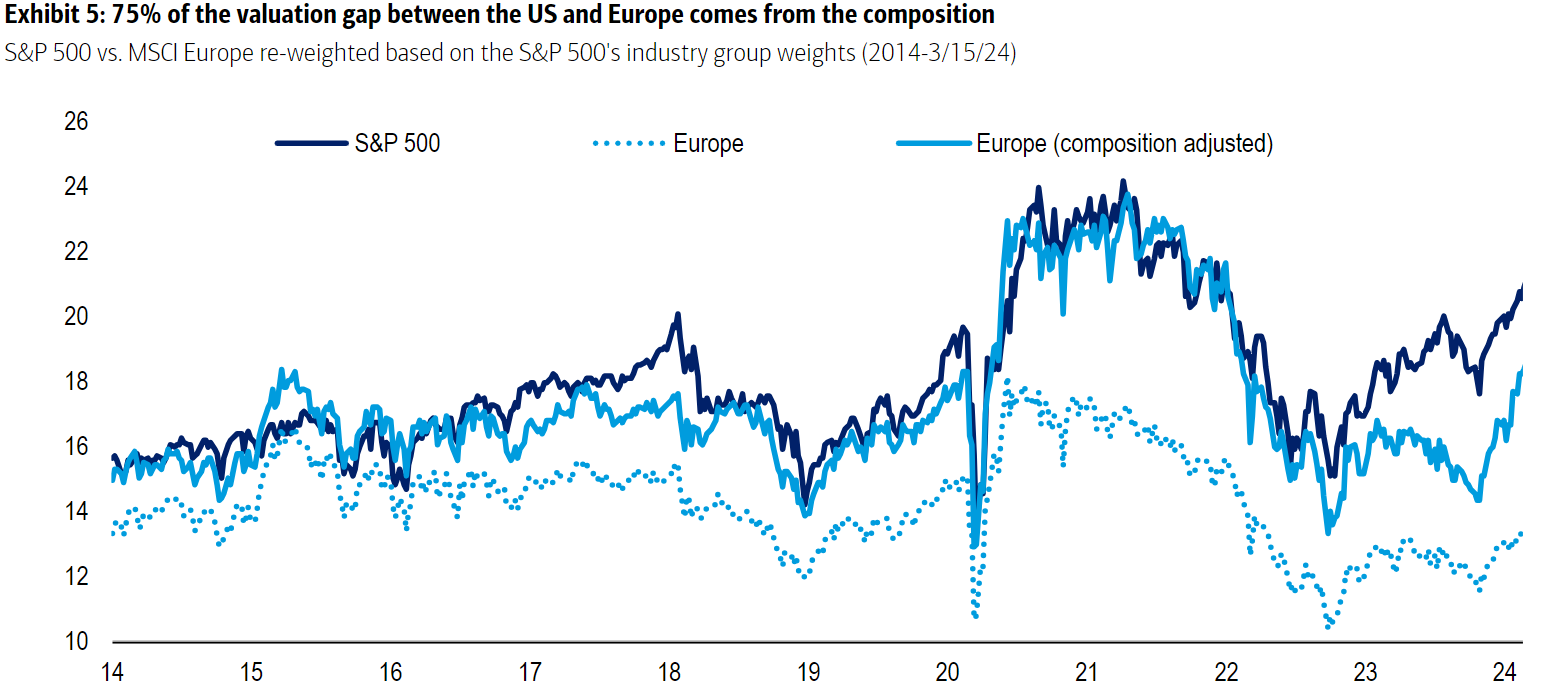

Dave: and a lot of the “valuation discount” is simply a function of other countries lacking the higher-valued tech companies that make the U.S. their home

Source: BofA as of 03.15.2024

Source: BofA as of 03.15.2024

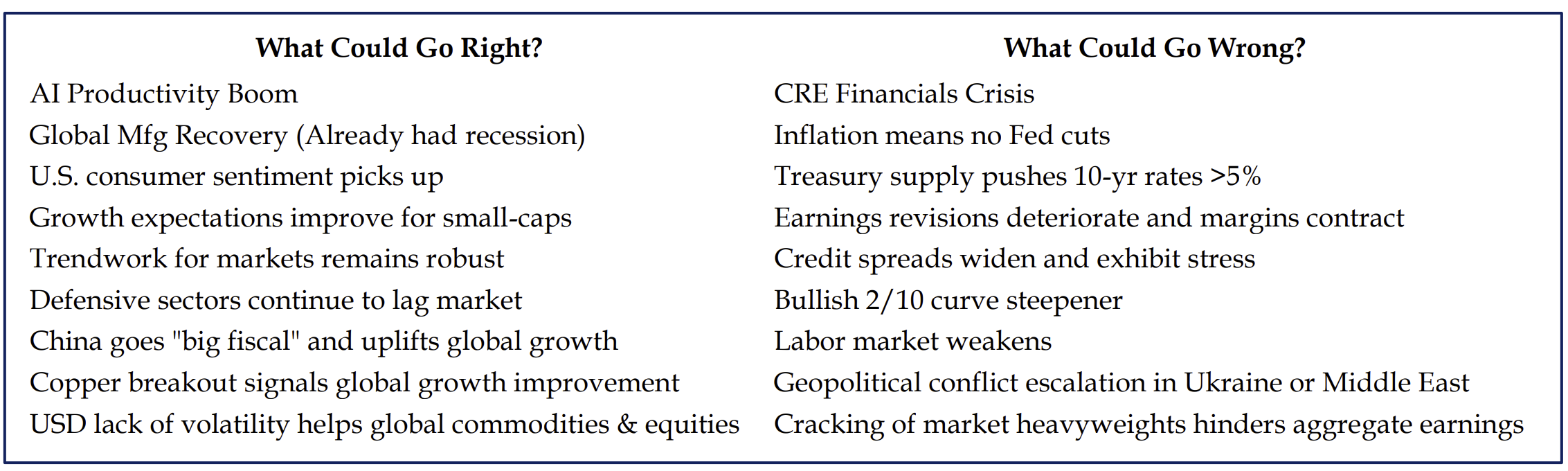

Dave: It’s important for investors to keep an open mind while also remembering that more things can happen than will happen

Source: Strategas as of 03.16.2024

Source: Strategas as of 03.16.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2404-35.