Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

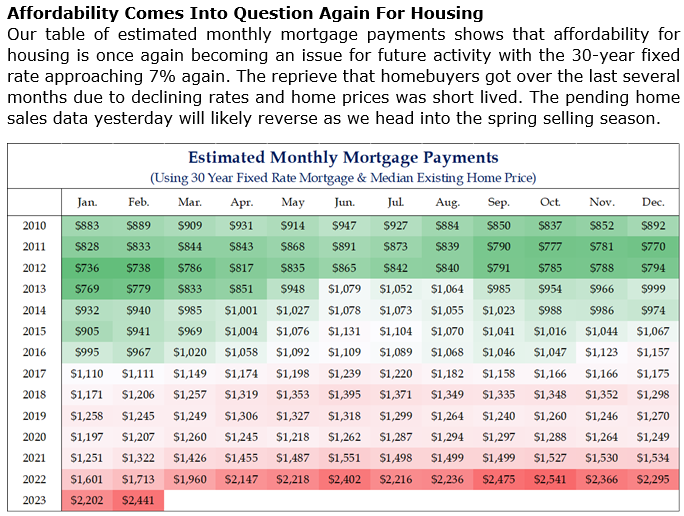

Brad: Without a corresponding price drop, the rise in mortgage rates is making it real hard on prospective buyers

Source: Strategas as of 02.28.2023

Source: Strategas as of 02.28.2023

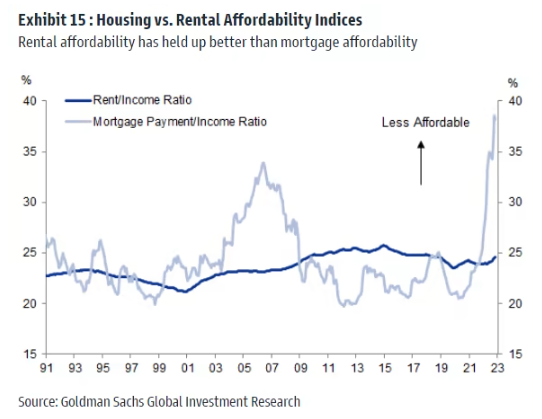

John Luke: as the math starts to favor prospective renters over buyers

Data as of 02.27.2023

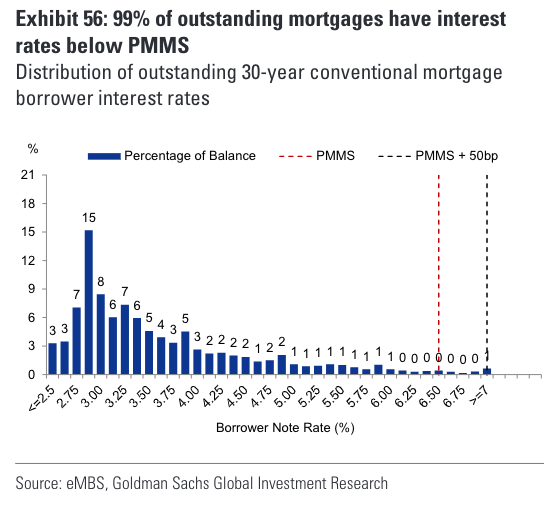

John Luke: and current owners sit pretty with low rates locked in

Data as of 02.27.2023

Data as of 02.27.2023

Joseph: Owners of office buildings, however, are more likely to have loans coming due into harsh pricing

Data as of 02.27.2023

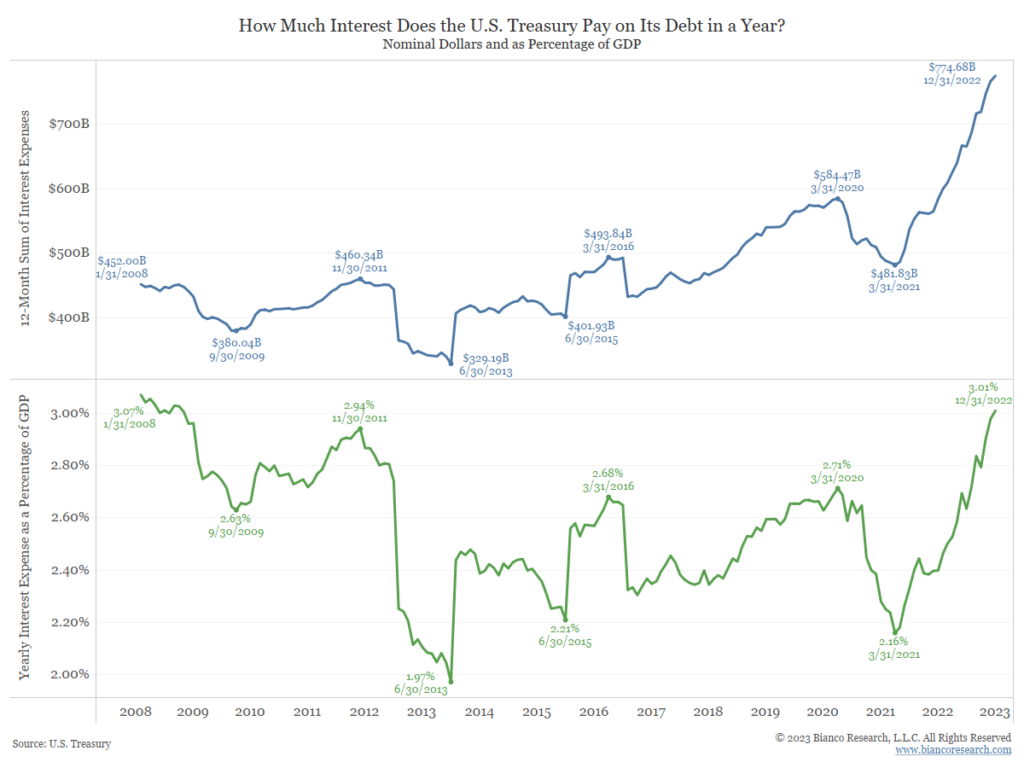

John Luke: and our own Treasury faces the same steep repricing of debt

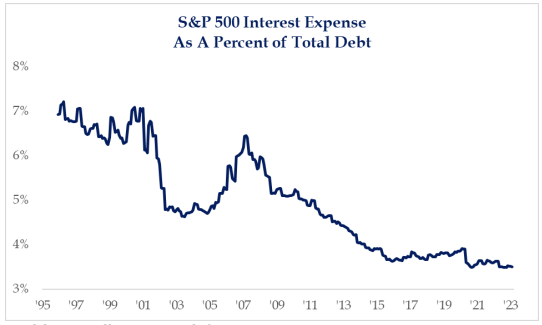

Joseph: and even well-financed corporations will lose the tailwind of lower rates

Source: Strategas as of 02.27.2023

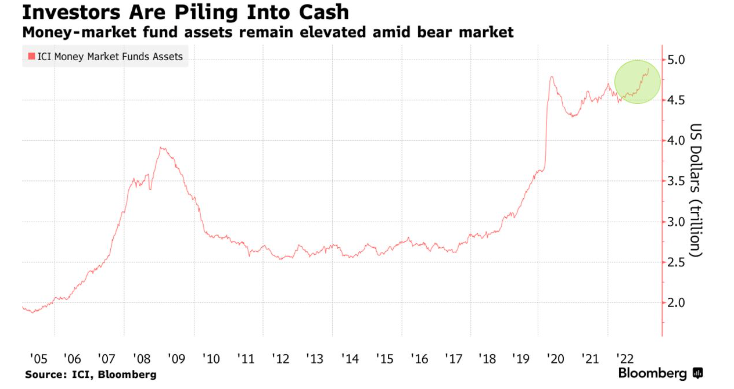

John Luke: Flush homeowners have zero incentive to pay down mortgages, with money market yields exceeding their mortgage rates

Data as of 02.28.2023

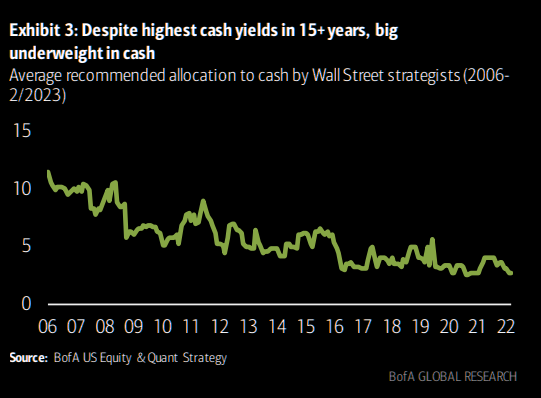

John Luke: while Wall Street strategists remain inexplicably low in their suggested allocations to cash

Data as of 03.01.2023

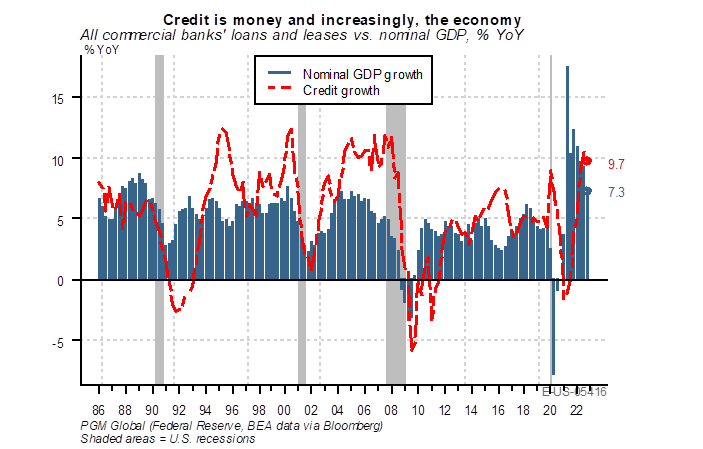

John Luke: Credit has grown right alongside nominal GDP

Source: Pavilion as of 02.28.2023

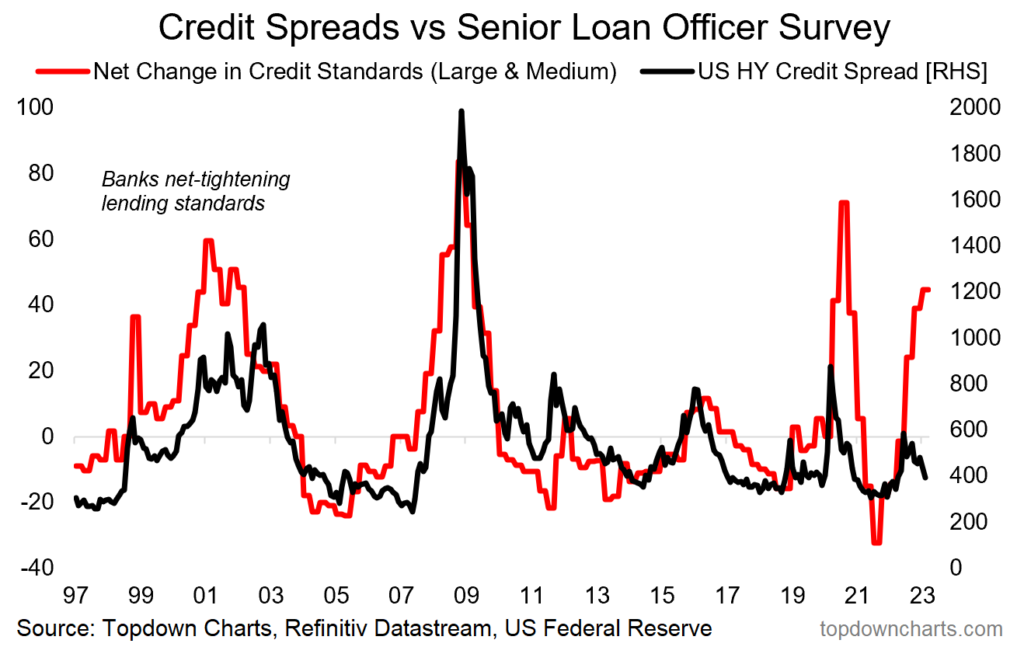

John Luke: And investors aren’t really being compensated for risk seemingly seen by loan officers

Data as of 03.01.2023

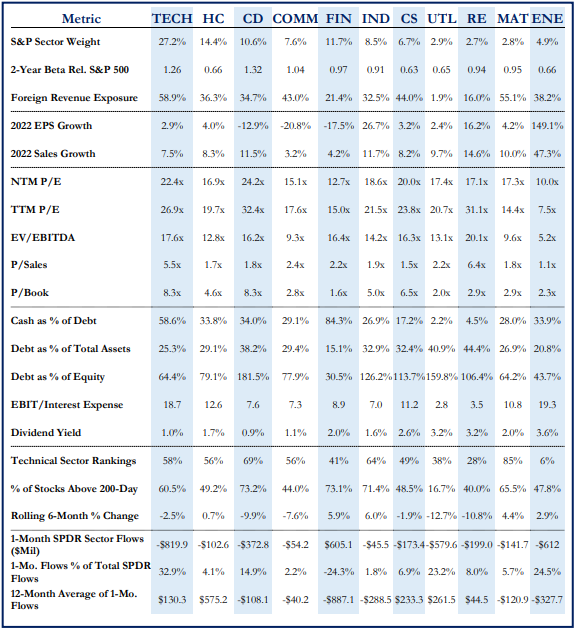

Brad: People refer to the stock market, but under the hood it really is a “market of stocks” with wildly varying industry conditions

Source: Strategas as of 02.28.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2303-6.