Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

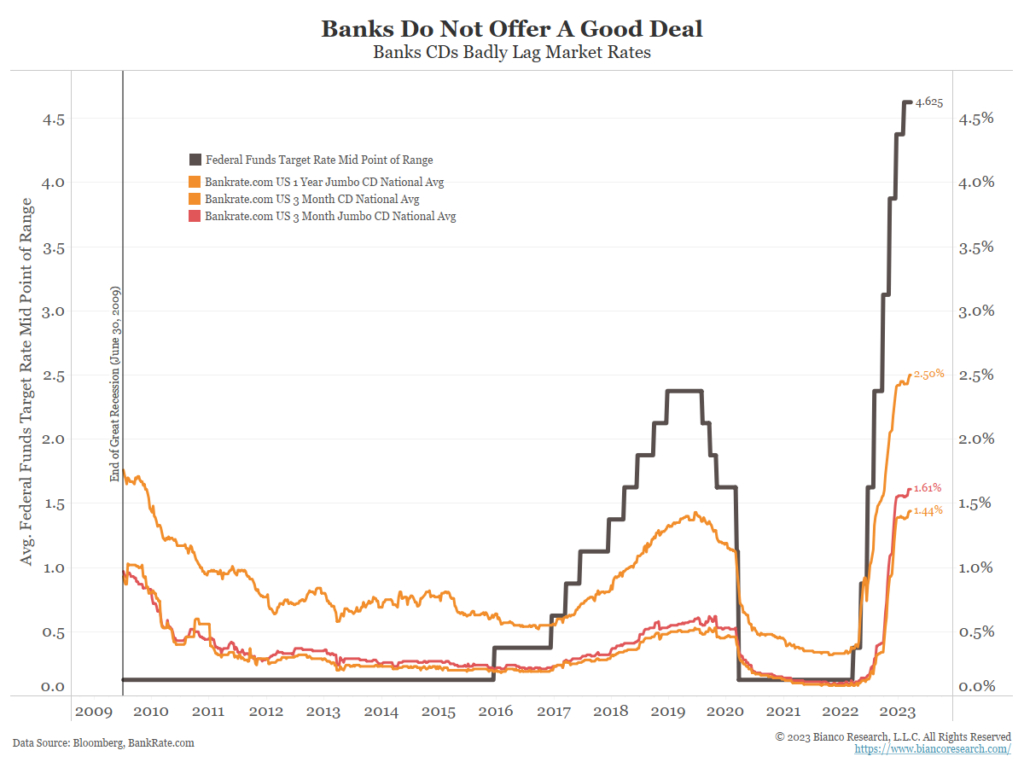

John Luke: Yields on deposits are still laughably behind at many banks

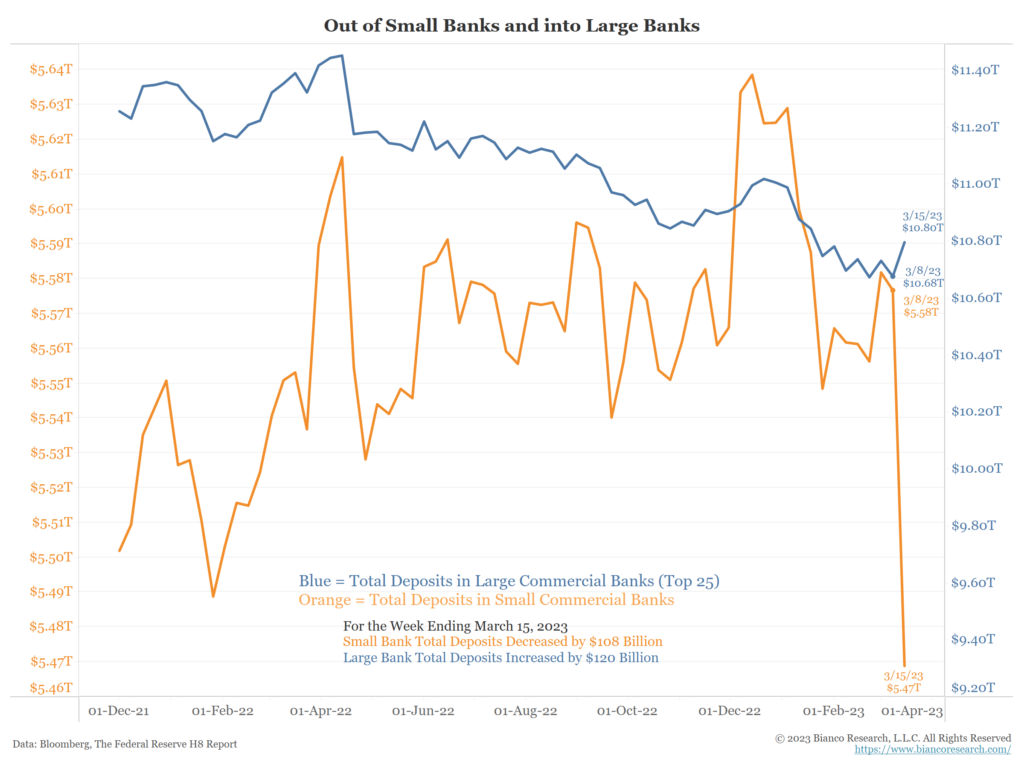

John Luke: and with the recent “crisis”, large banks have little incentive to offer market rates

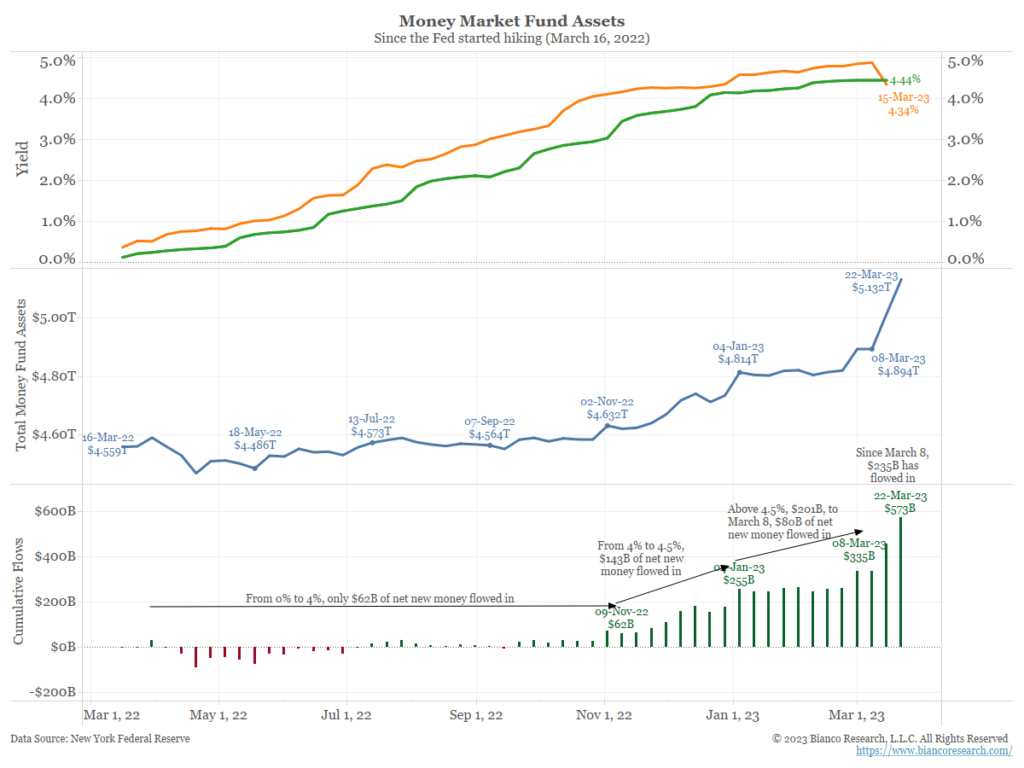

John Luke: And while it took awhile for money to take advantage of higher money market yields

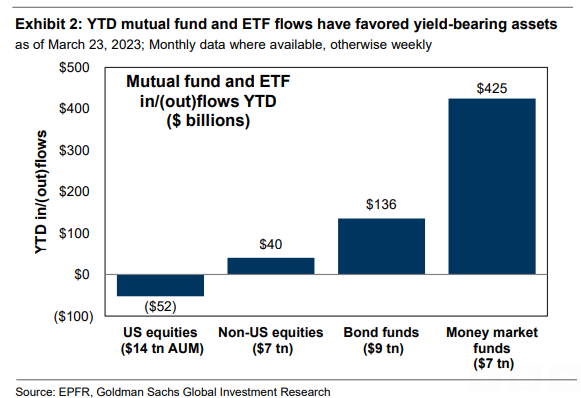

Beckham: money is definitely moving to where it’s being compensated relative to the risk

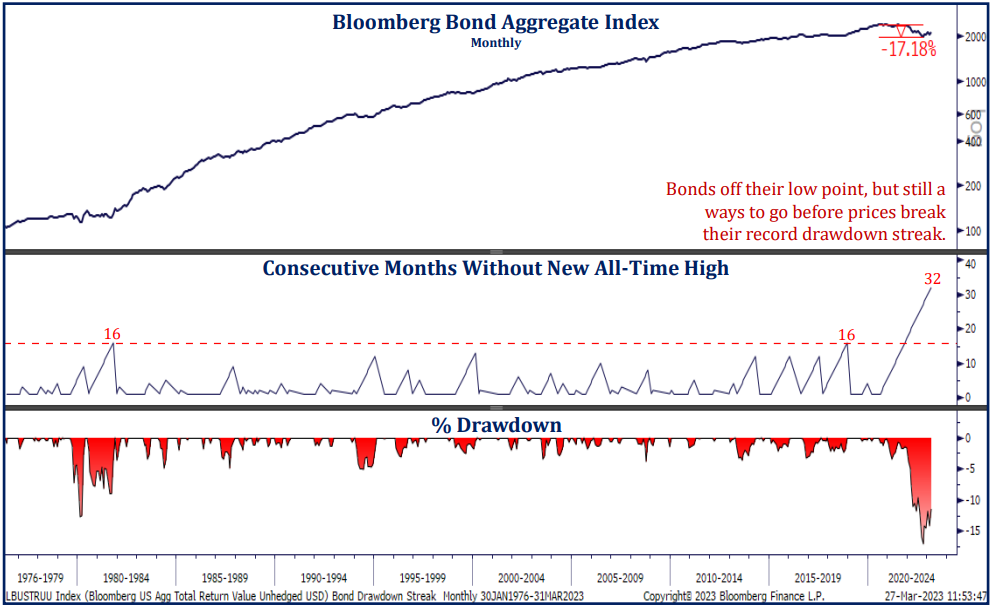

Brad: And while this bond bear market has been persistent in its damage

Source: Strategas as of 03.27.23

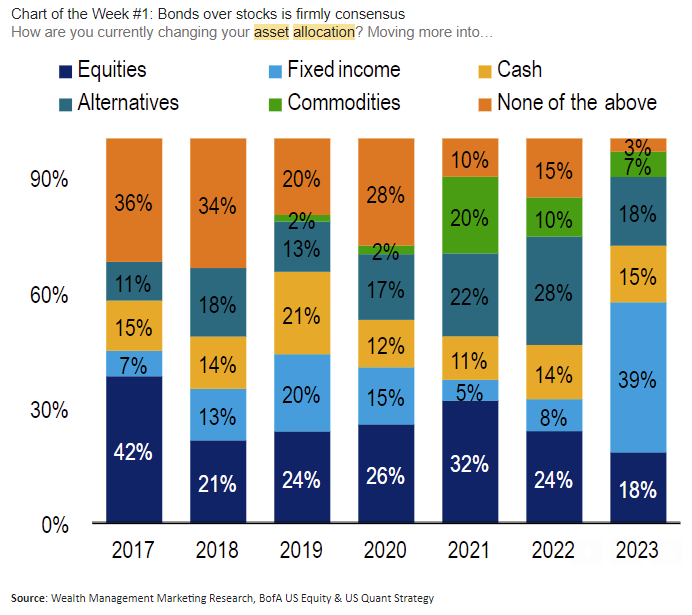

John Luke: allocators are moving fast to adjust their allocations given the higher yields now available in bonds

Data as of 03.24.23

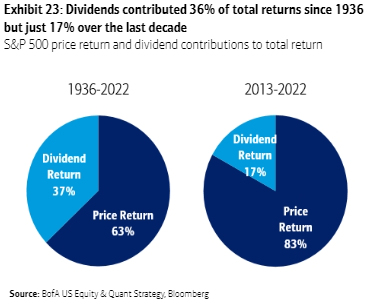

Brad: One return driver that’s been historically absent in recent years has been equity dividends

Data as of 03.24.23

Data as of 03.24.23

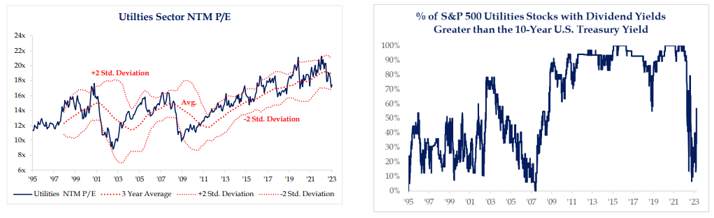

Joseph: and valuations on dividend havens like utilities have suffered as relative yields have fallen

Source: Strategas as of 03.27.2023

Source: Strategas as of 03.27.2023

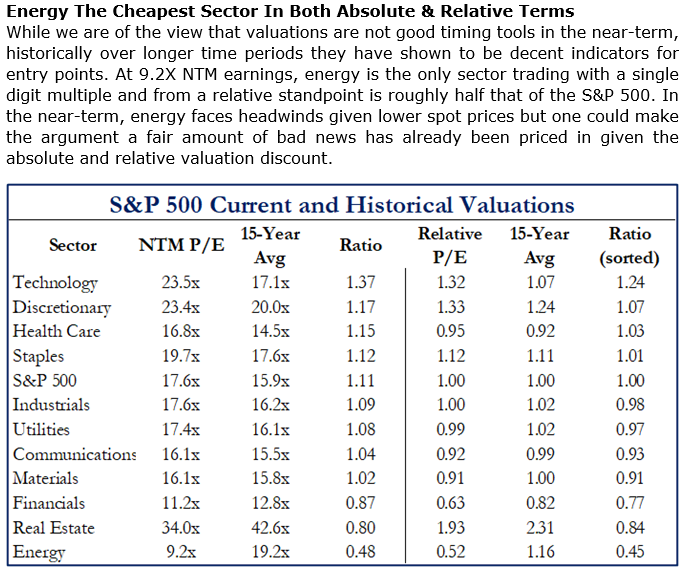

Brad: When it comes to sector valuations, energy sits in a different universe than the rest of the market

Source: Strategas as of 03.27.2023

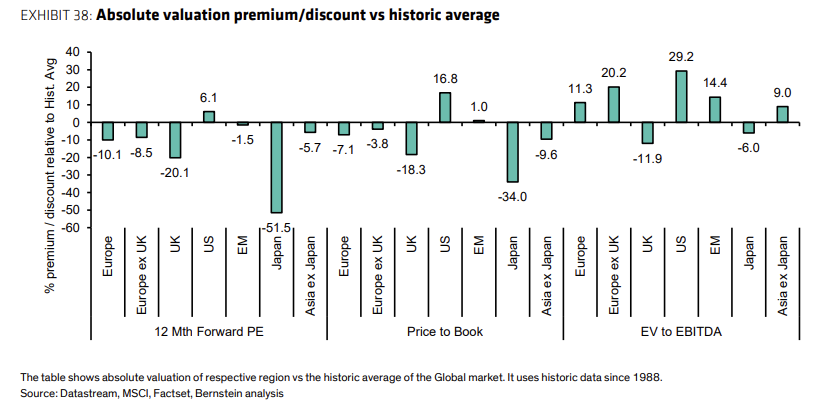

John Luke: which explains a good chunk of the discounted valuations in other global markets

Source: Bernstein as of 03.28.2023

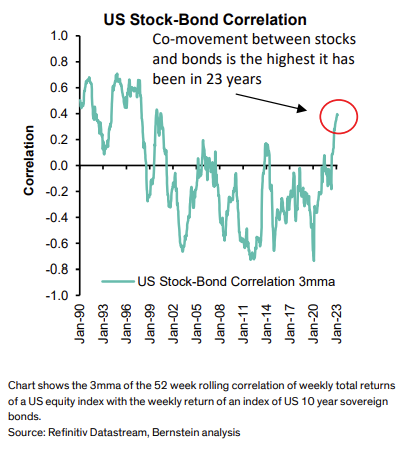

John Luke: Correlations between stocks and bonds are as high as they’ve been in decades

Data as of 03.27.2023

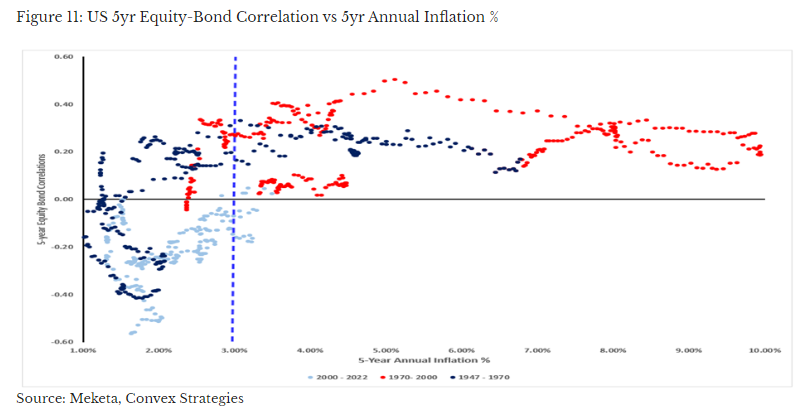

John Luke: with CPI regimes historically a big driver in the diversification potential of bonds vs. stocks

Data as of 03.17.2023

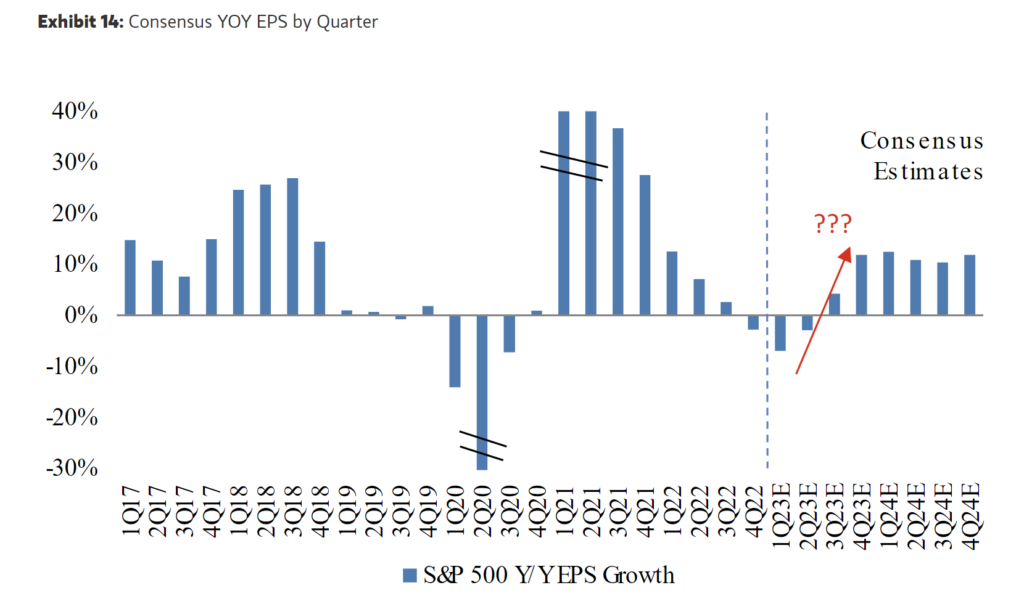

Dave: Wall Street strategists are counting on strong growth in order to achieve consensus earnings estimates

Source: Morgan Stanley as of 03.28.2023

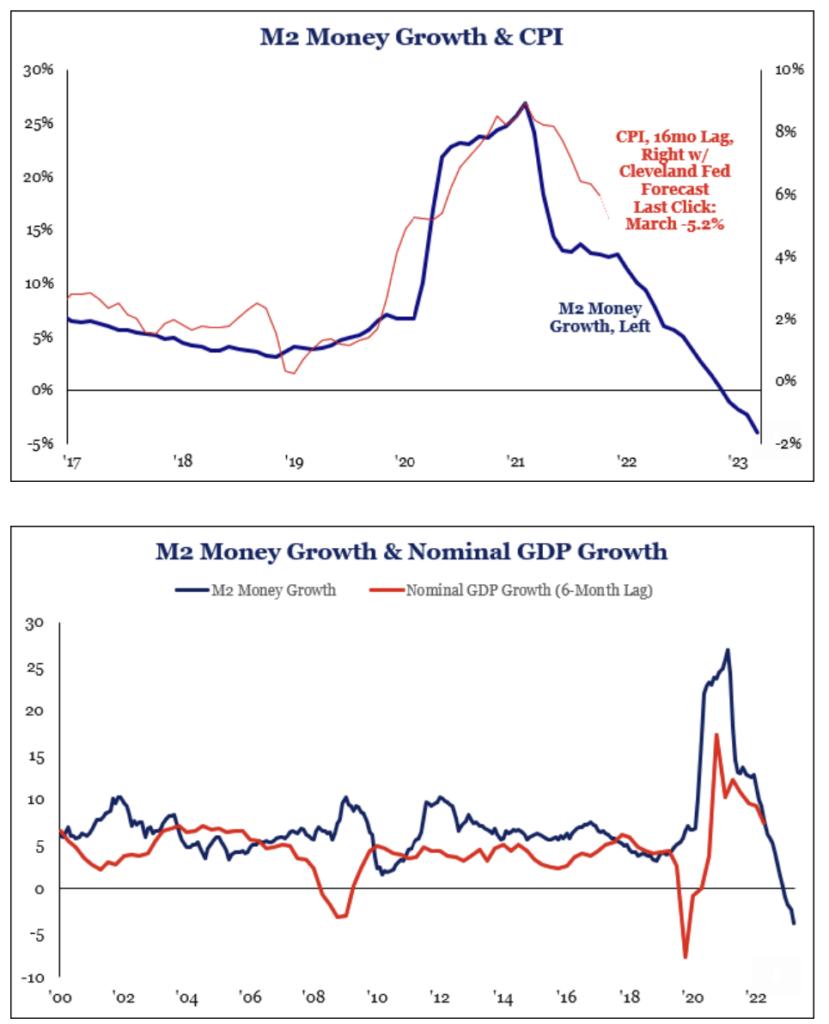

Dave: perhaps at odds with the historical outcomes when M2 money supply is falling sharply

Source: Strategas as of 03.24.2023

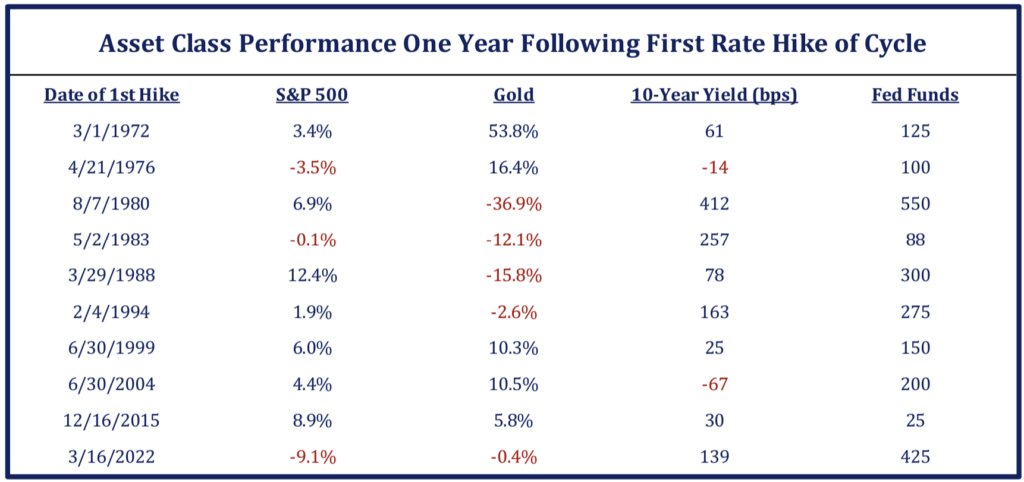

Dave: One year in, a look at how this FOMC rate cycle has impacted major assets compared to previous cycles

Source: Strategas as of 03.17.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2303-30.