Our team looks at a lot of research throughout the day. Here are a handful that we think are contributing to investor activity, from strength in foreign markets to correction talk to the economy and FOMC policy. Enjoy!

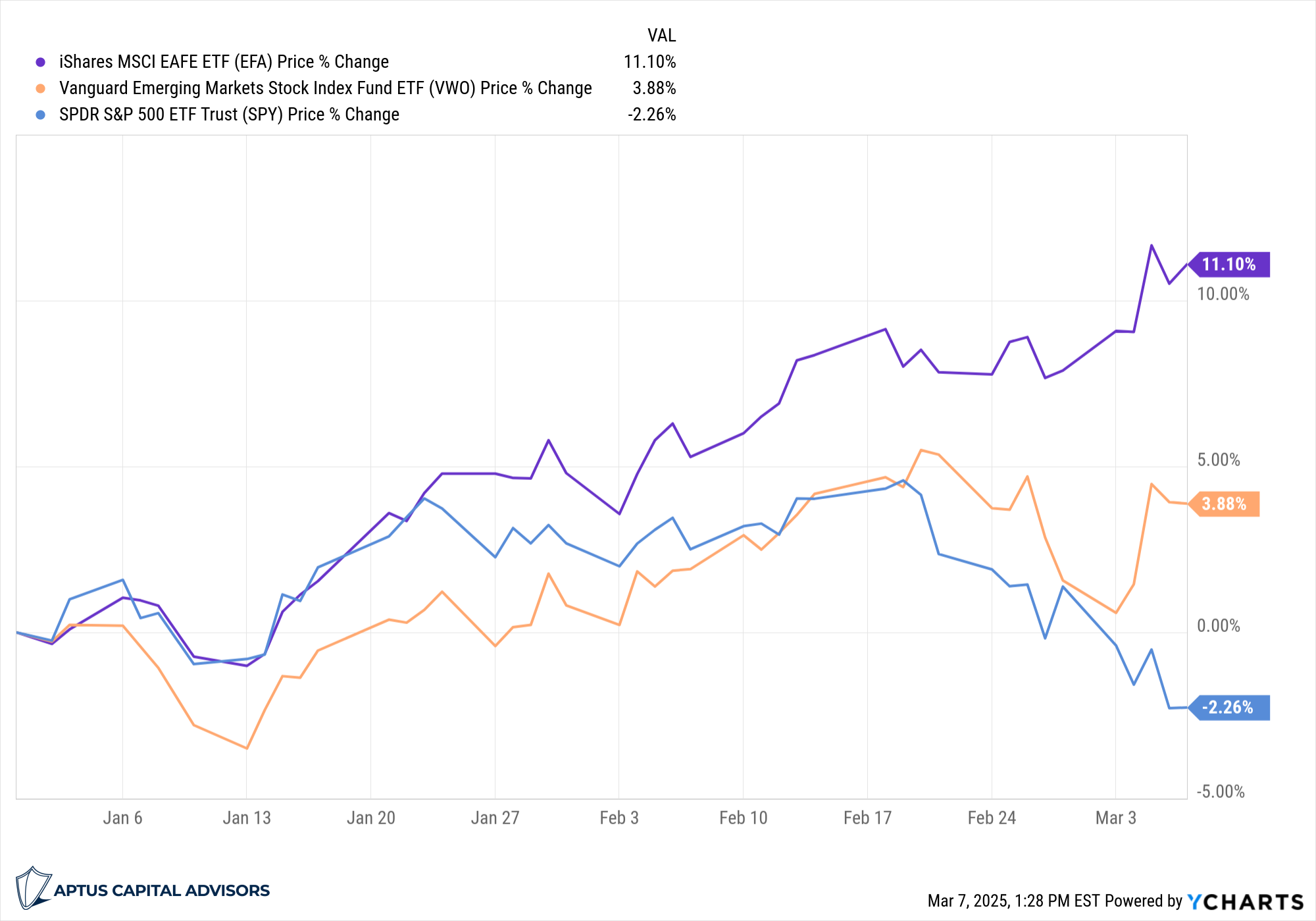

Brian: It’s been quite the year for stocks in developed markets outside of the US

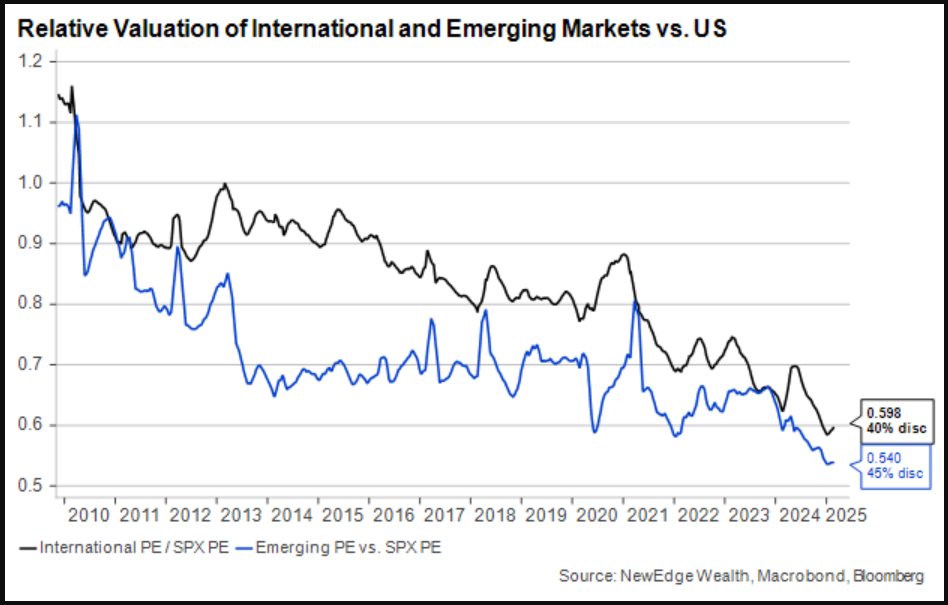

Brad: this comes after more than a decade of underperformance of both developed and developing markets relative to the US

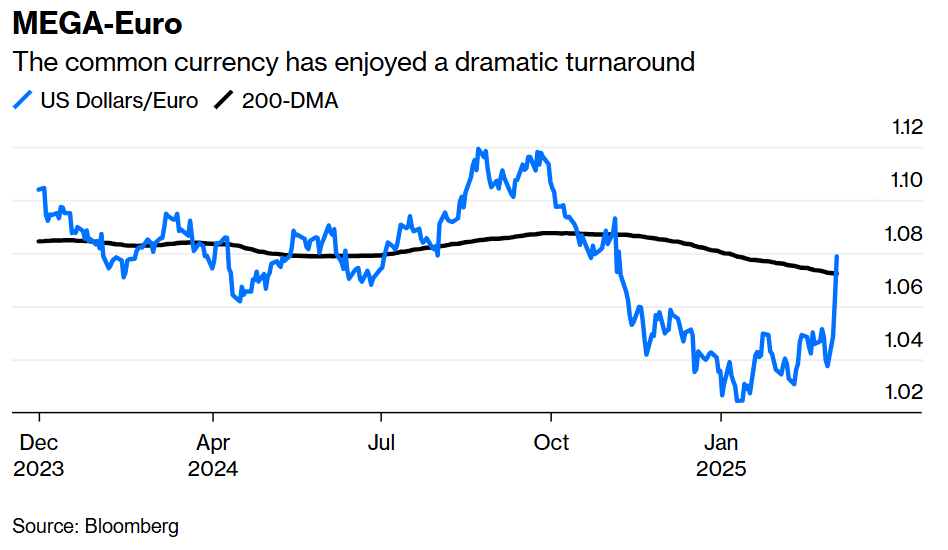

Beckham: and concurrent with strength in the much-maligned Euro currency, at the expense of the US Dollar

Data as of 03.05.2025

Data as of 03.05.2025

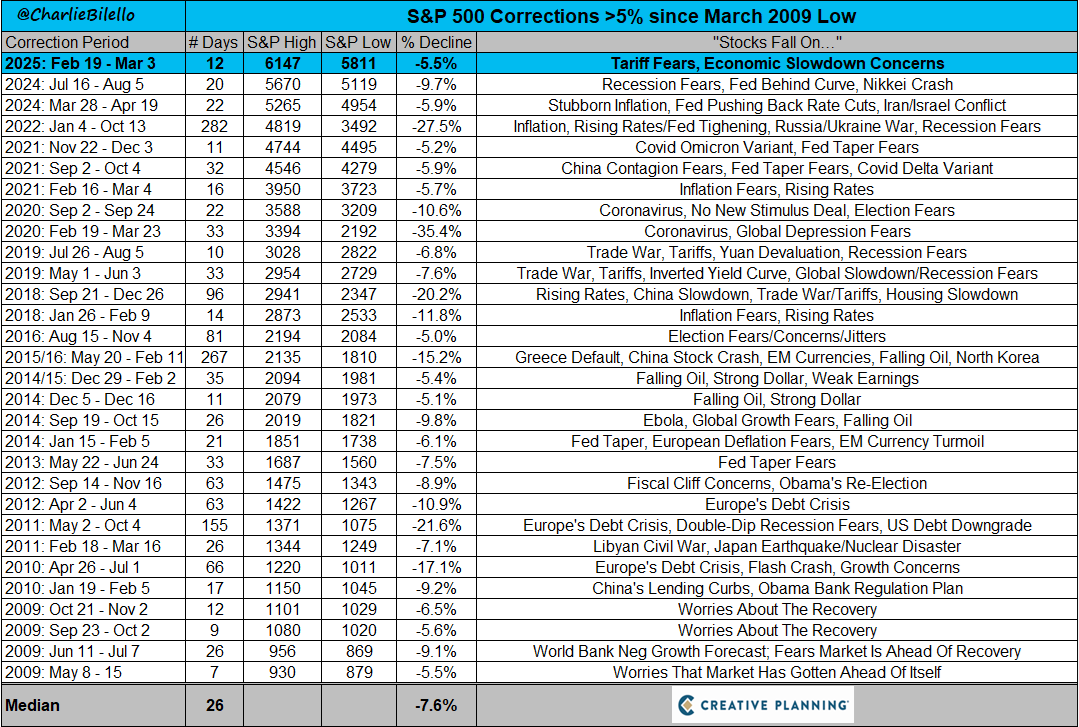

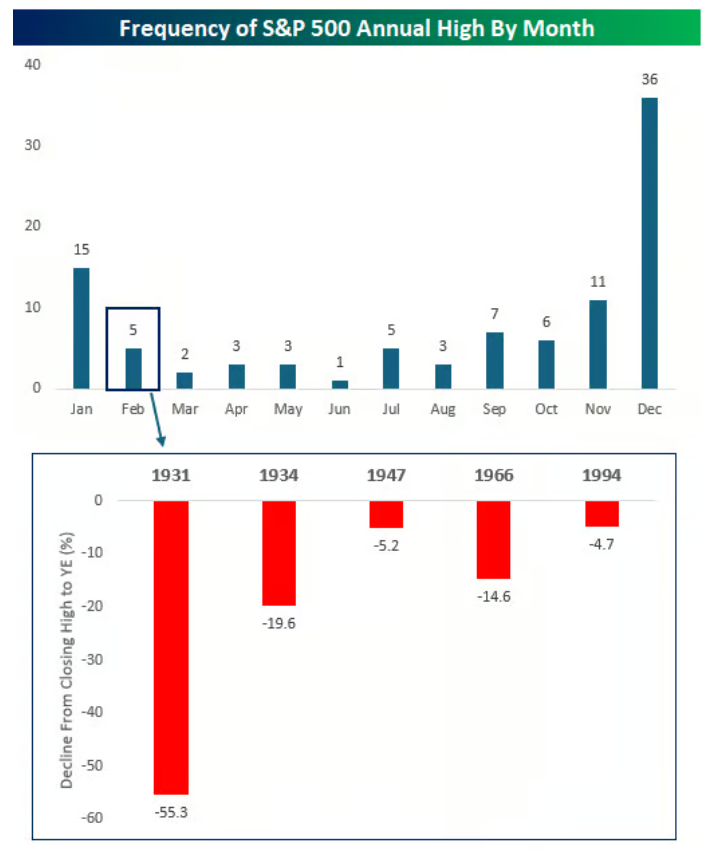

Brett: US stocks have pulled back over 5% since making highs two weeks ago, a common occurrence inside of a long bull market

Data as of 03.04.2025

Data as of 03.04.2025

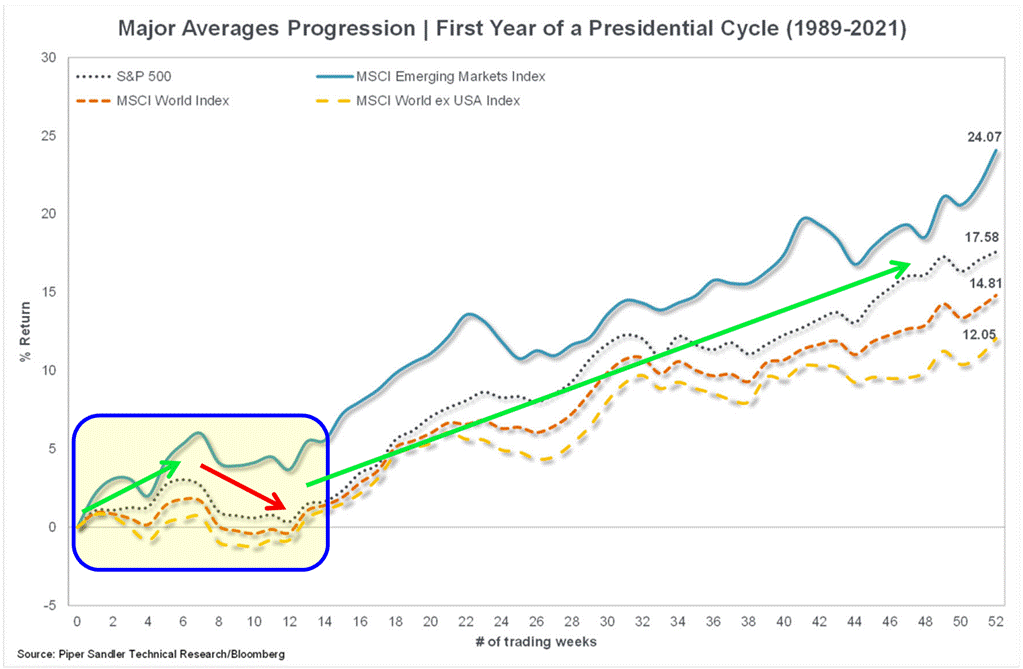

Arch: Just over two months into 2025, the year-to-date action has resembled typical patterns following a presidential election

Data as of 03.05.2025

Data as of 03.05.2025

Dave: and in general, market highs in February have rarely proven to be highs for the year

Source: Bespoke as of 03.04.2025

Source: Bespoke as of 03.04.2025

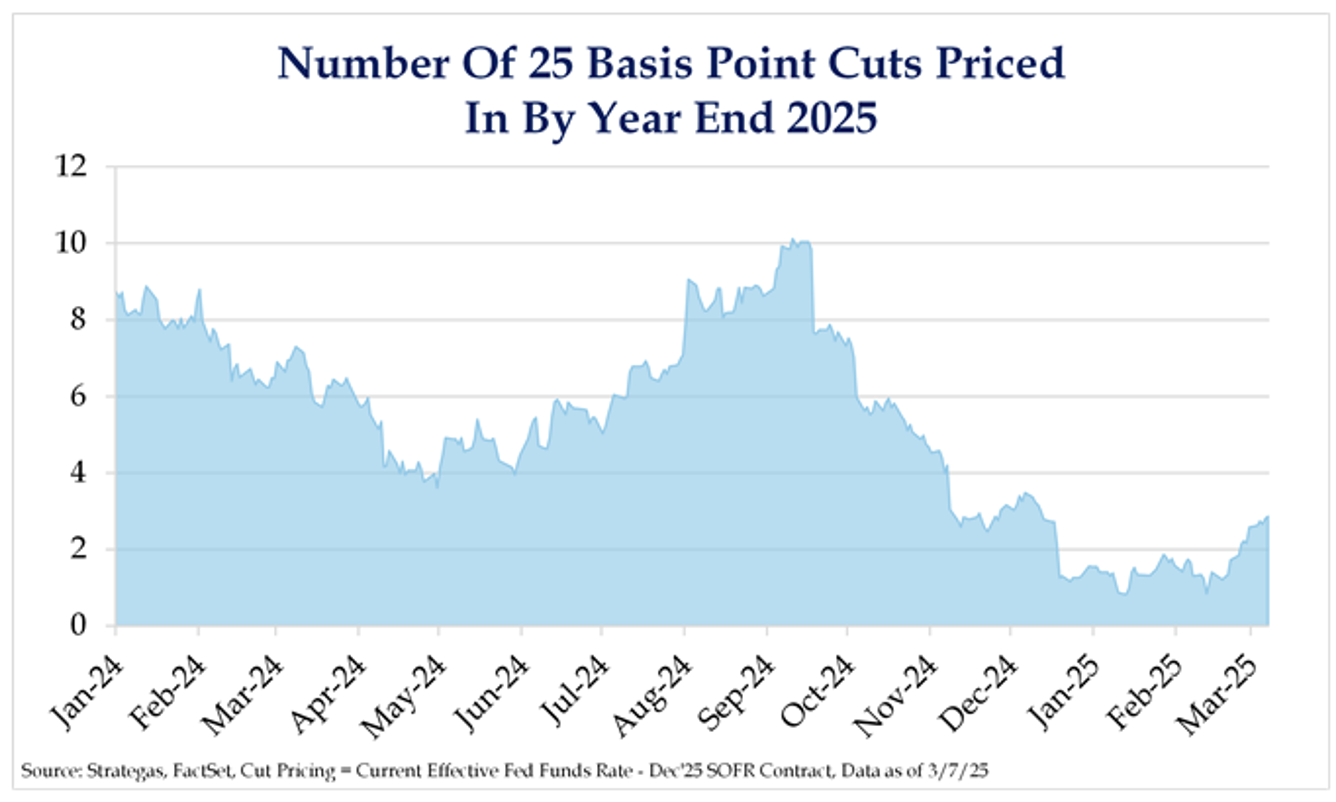

Brad:In the heat of tariffs and DOGE pushing up recession odds, investors have lifted expectations for the number of FOMC rate cuts, seemingly pricing in 3-4, that could come this year

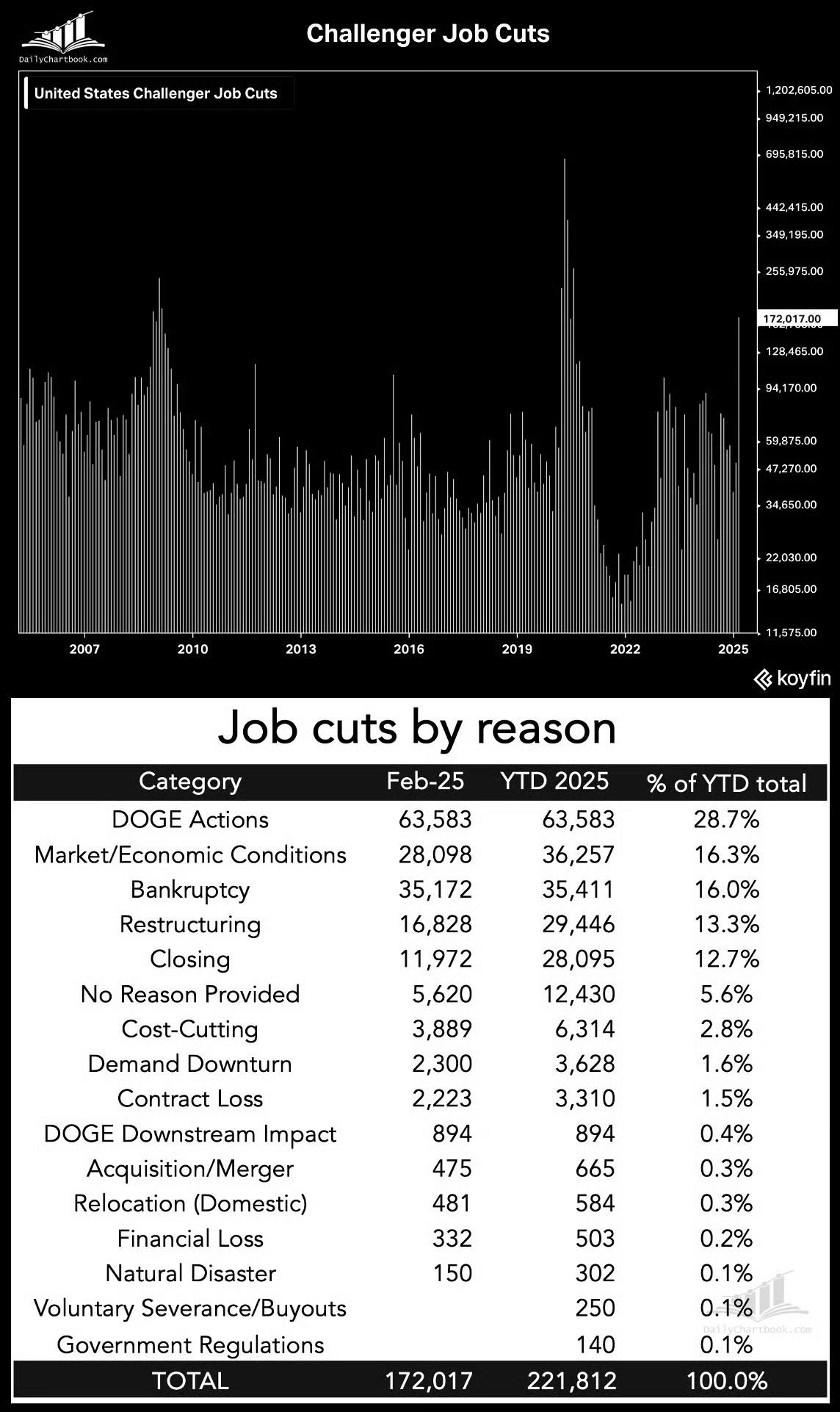

John Luke: as one would suspect, the Department of Government Efficiency(DOGE) was the primary driver of the cuts

Data as of 03.05.2025

Data as of 03.05.2025

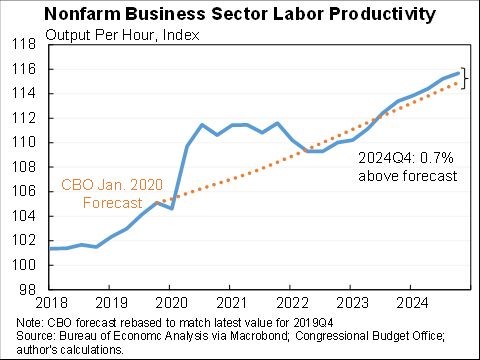

Joseph: On the positive side, productivity has remained high and this doesn’t yet include the possible benefits of artificial intelligence (AI)

Data as of 03.05.2025

Data as of 03.05.2025

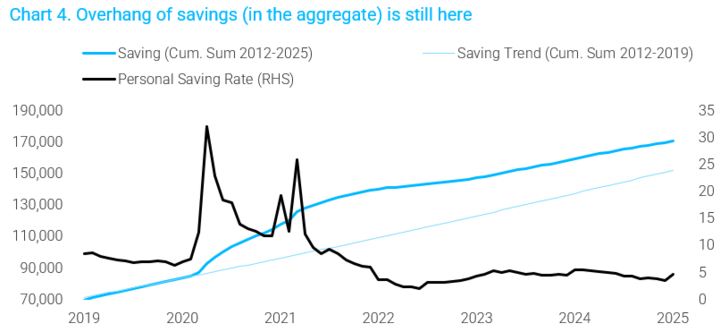

John Luke: and consumer savings remain high, for support if an economic slowdown kicks in

Source: TS Lombard as of February 2025

Source: TS Lombard as of February 2025

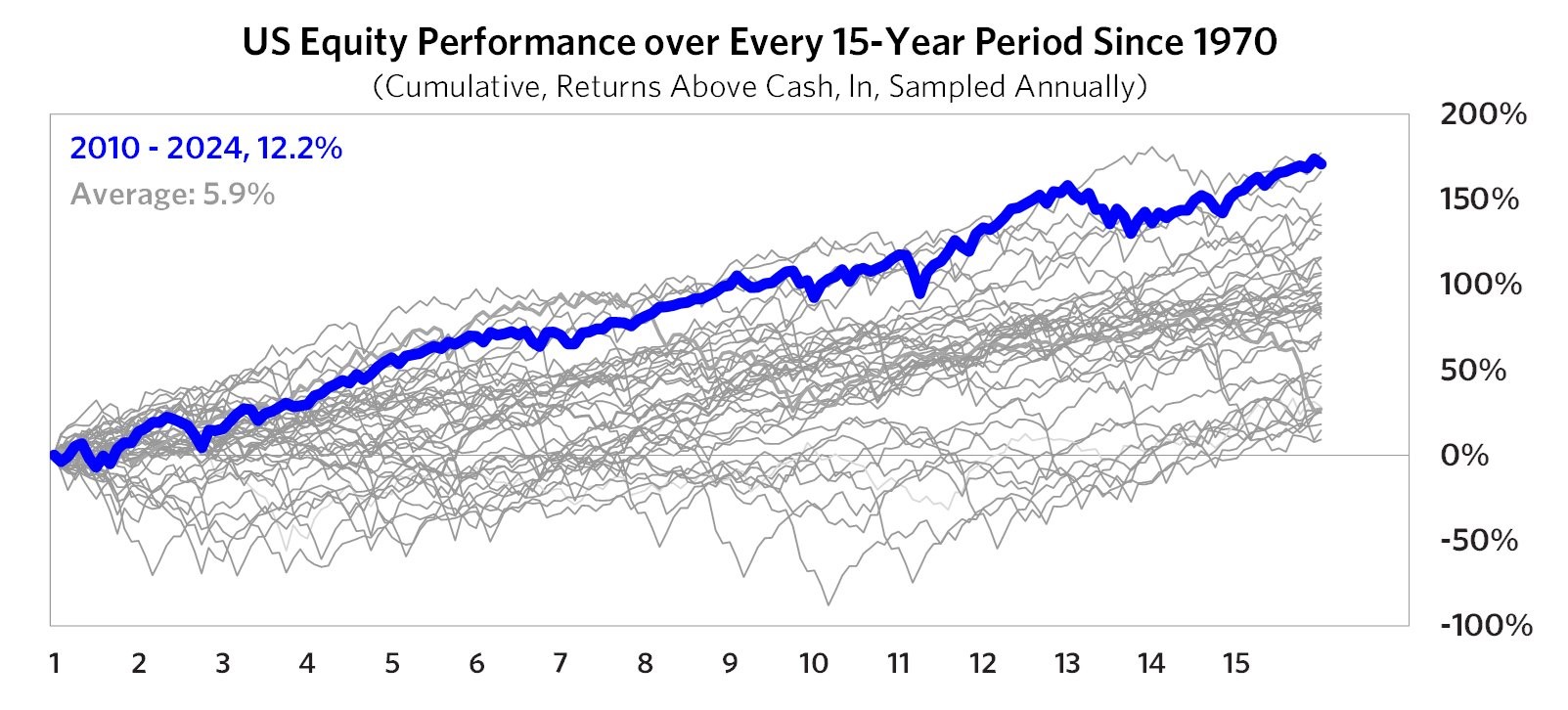

Arch: The years since the global financial crisis have been a great time to be a holder of US stocks

Source: Idea Farm via Bridgewater as of February 2025

Source: Idea Farm via Bridgewater as of February 2025

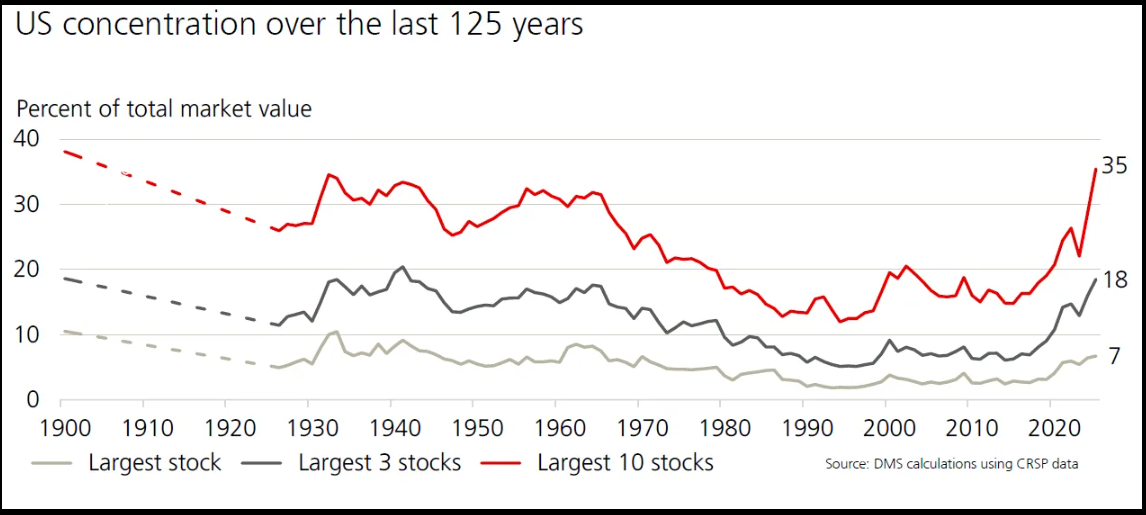

Dave: much of it a payoff of the positive operating leverage of our largest companies

Data as of January 2025

Data as of January 2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2503-13.