Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

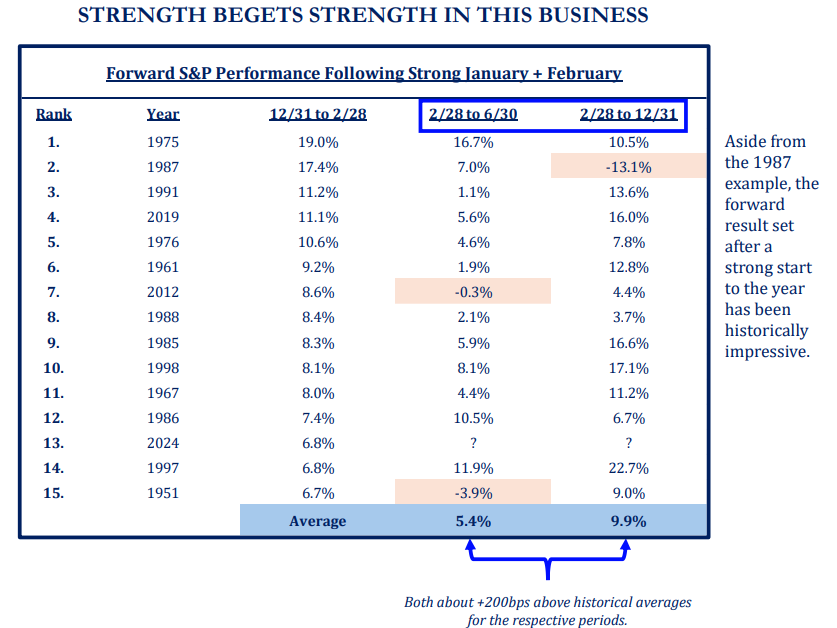

Dave: Early-year strength in stocks has tended to lead to healthy performance

Source: Strategas as of 03.04.2024

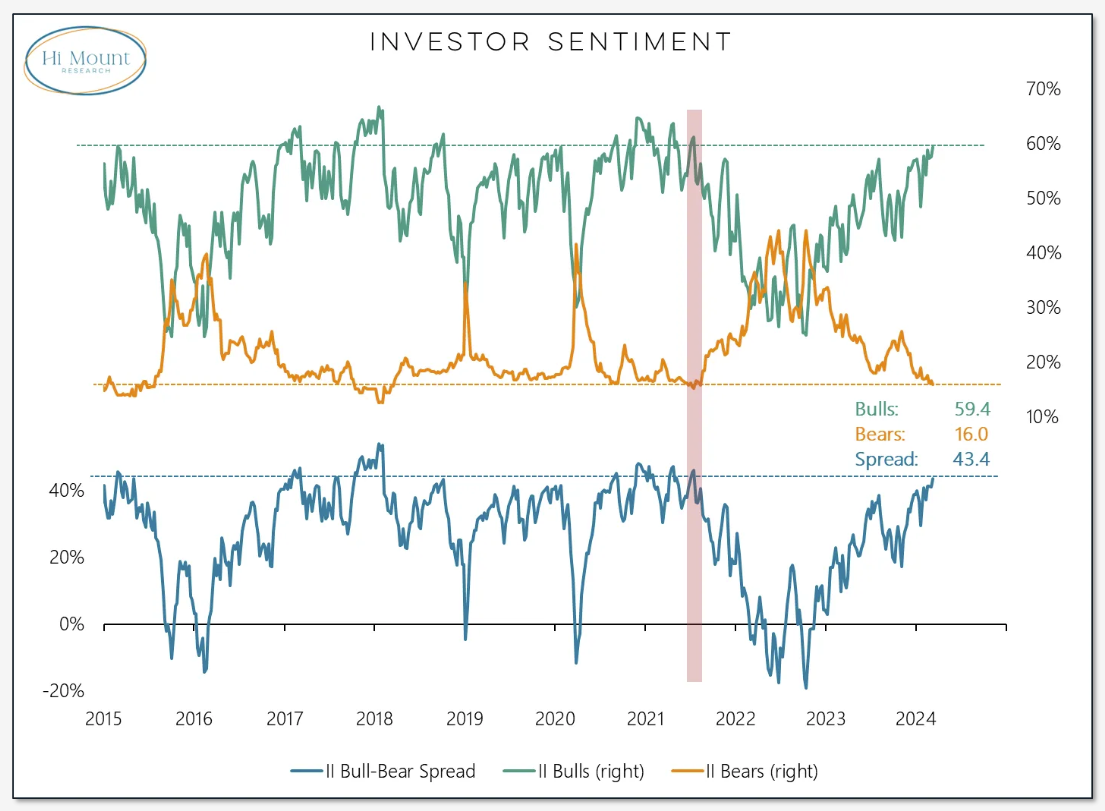

Brett: though that pattern has not gone unnoticed

Source: Hi Mount as of 03.06.2024

Source: Hi Mount as of 03.06.2024

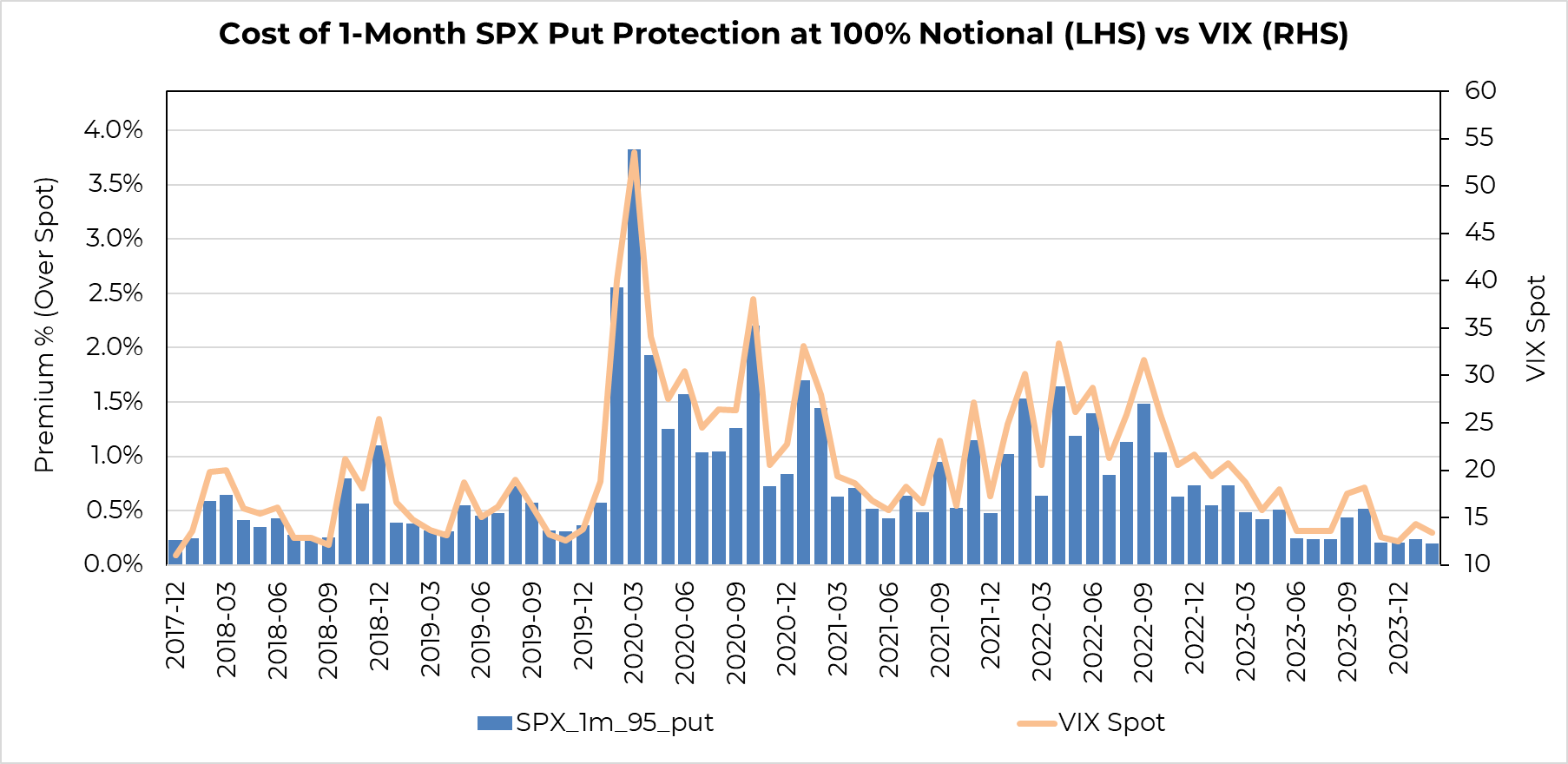

Brian: and the cost of taking the other side of that pattern has fallen to pre-Volmageddon levels

Source: Aptus as of 03.06.2024

Source: Aptus as of 03.06.2024

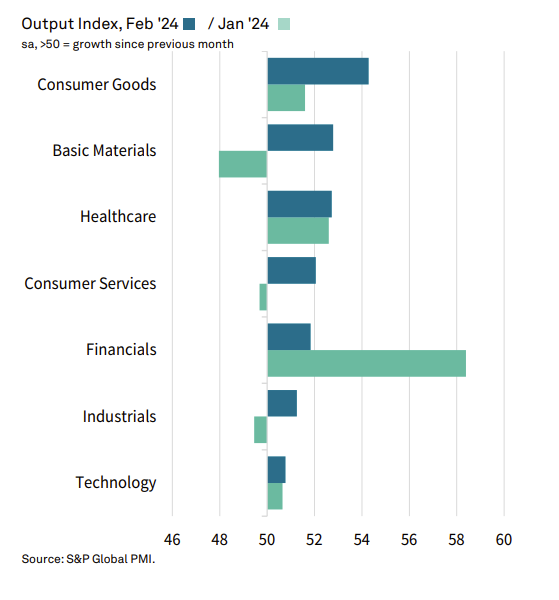

Beckham: We’ve seen business conditions strengthen across all sectors for the first time since April 2022

Data as of 03.04.2024

Data as of 03.04.2024

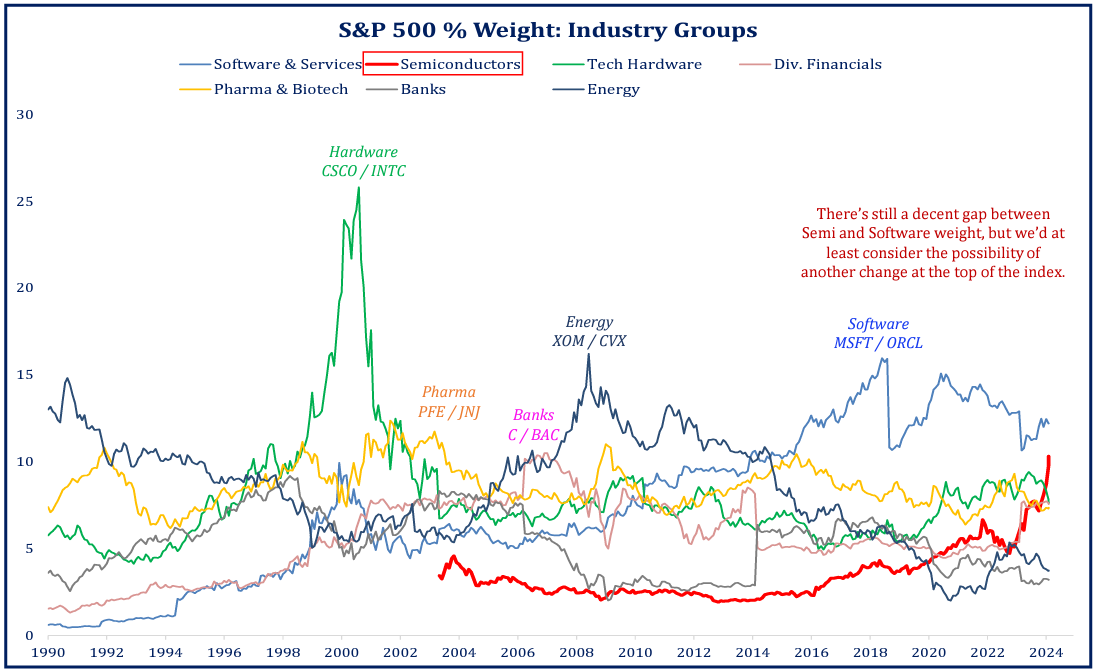

Brad: though when it comes to stocks it’s a semiconductor party and everyone else is just hoping to join along

Source: Strategas as of 03.05.2024

Source: Strategas as of 03.05.2024

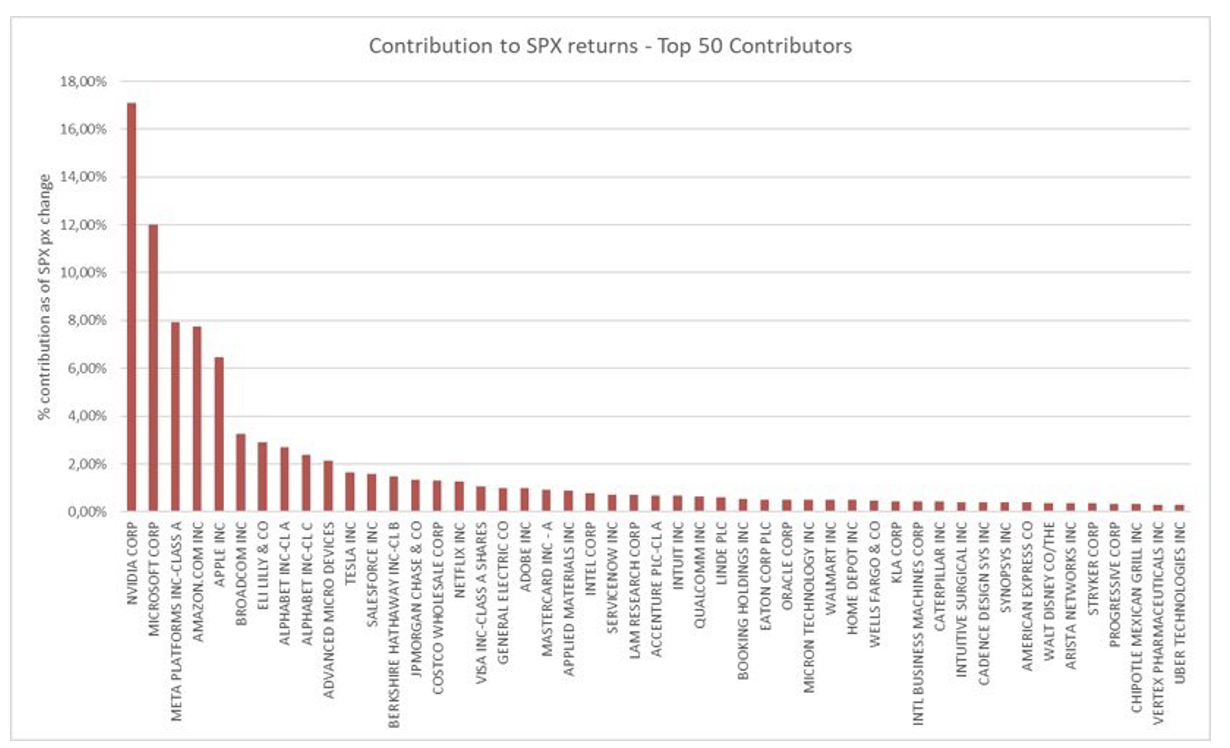

John Luke: with Nvidia by far the belle of the ball

Source: @dampedspring as of 03.07.2024

Source: @dampedspring as of 03.07.2024

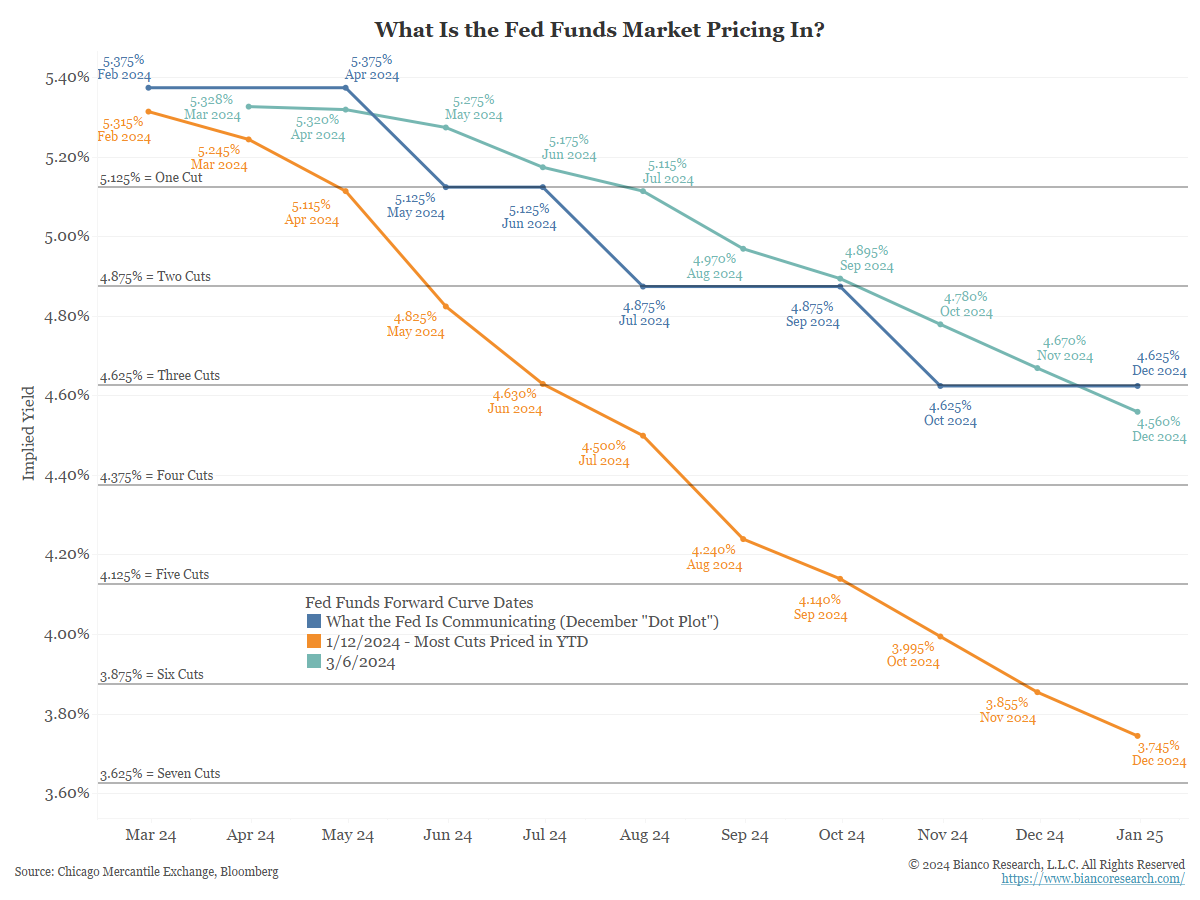

John Luke: The market finally seems to be about in gear with Fed expectations of delayed rate cuts

Data as of 03.06.2024

Data as of 03.06.2024

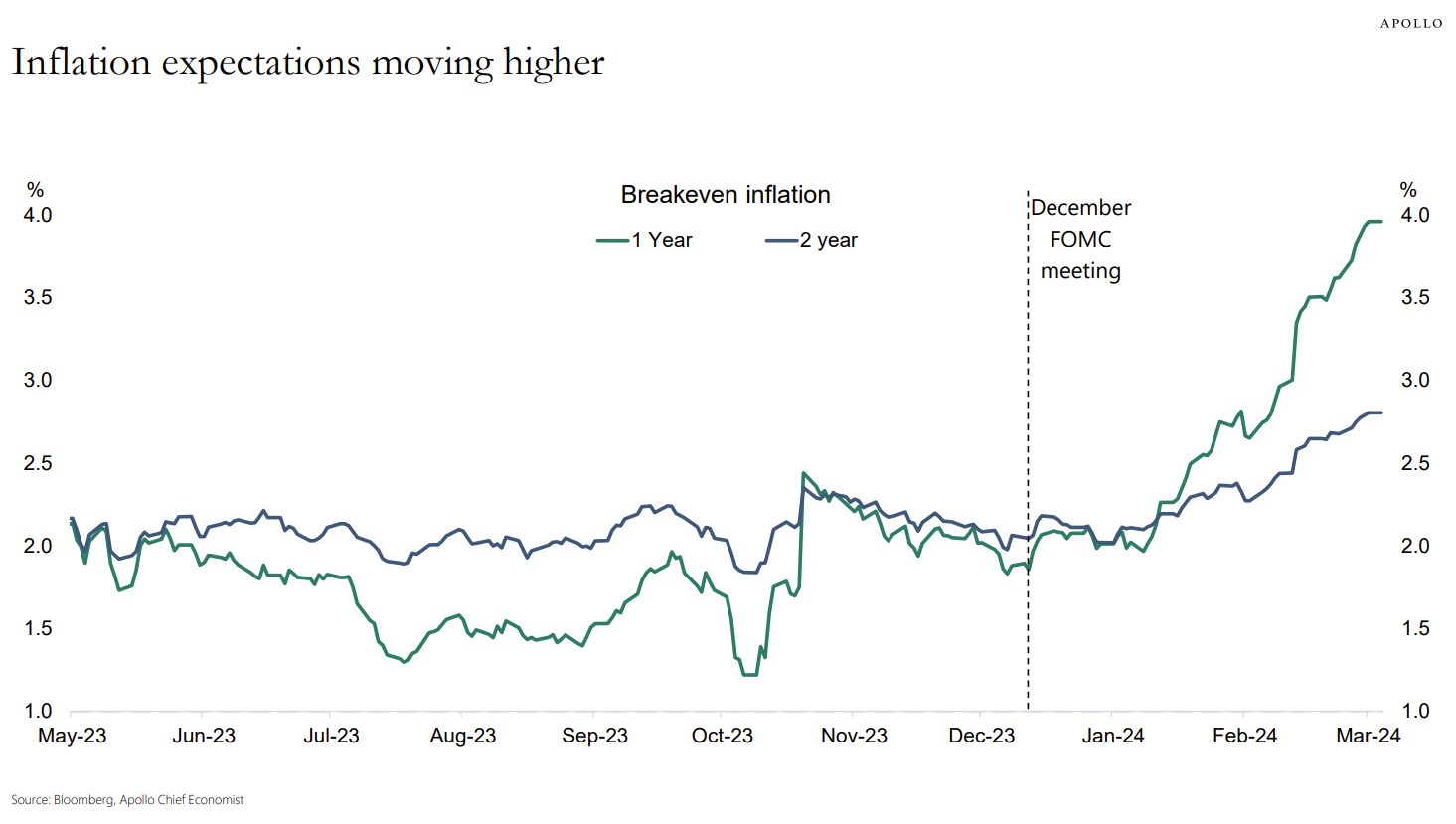

Joseph: as near-term inflation expectations move well above the Fed’s target rate

Data as of 03.06.2024

Data as of 03.06.2024

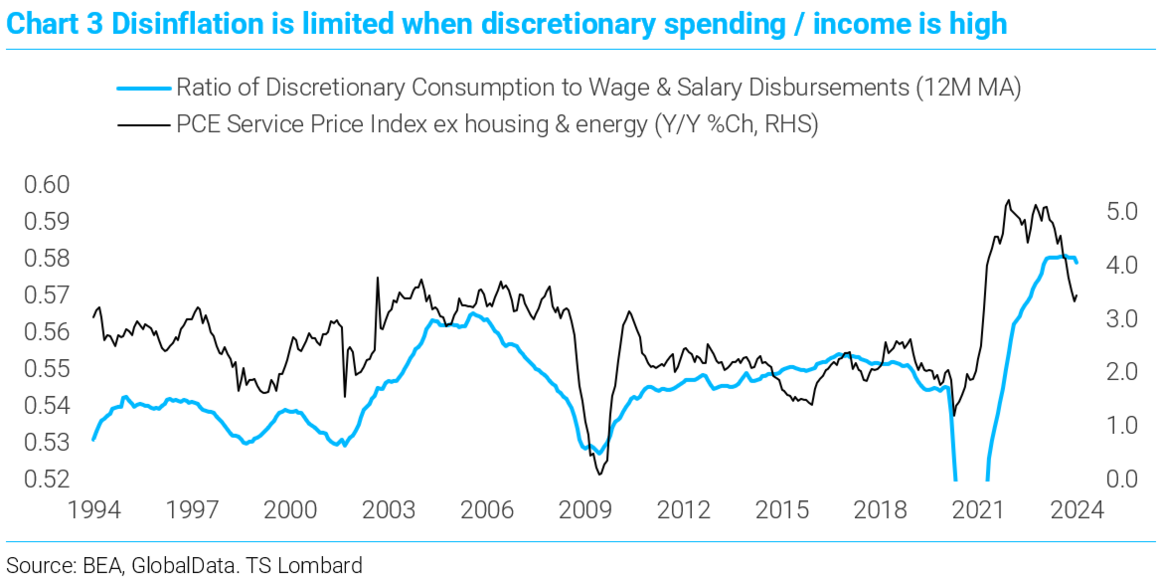

John Luke: which is a hard thing to reverse when spending is as strong as it’s been

Data as of 03.05.2024

Data as of 03.05.2024

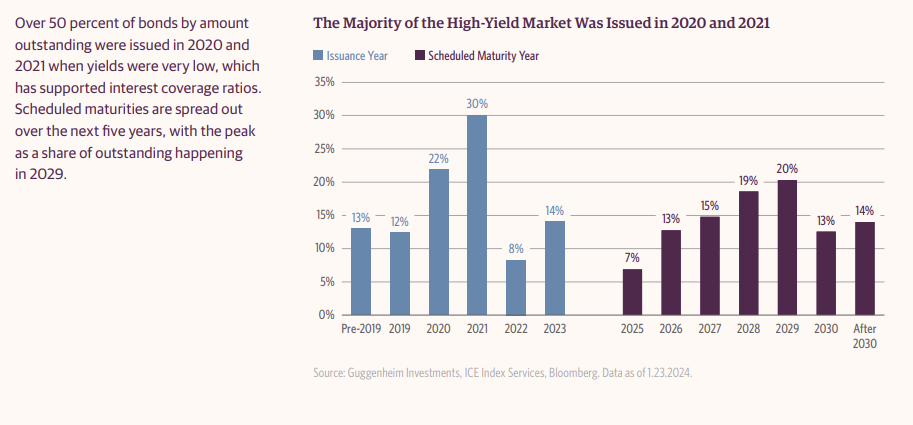

John Luke: Corporations loaded the boat on high-yield bond issuance when rates were at the historic COVID lows

Data as of February 2024

Data as of February 2024

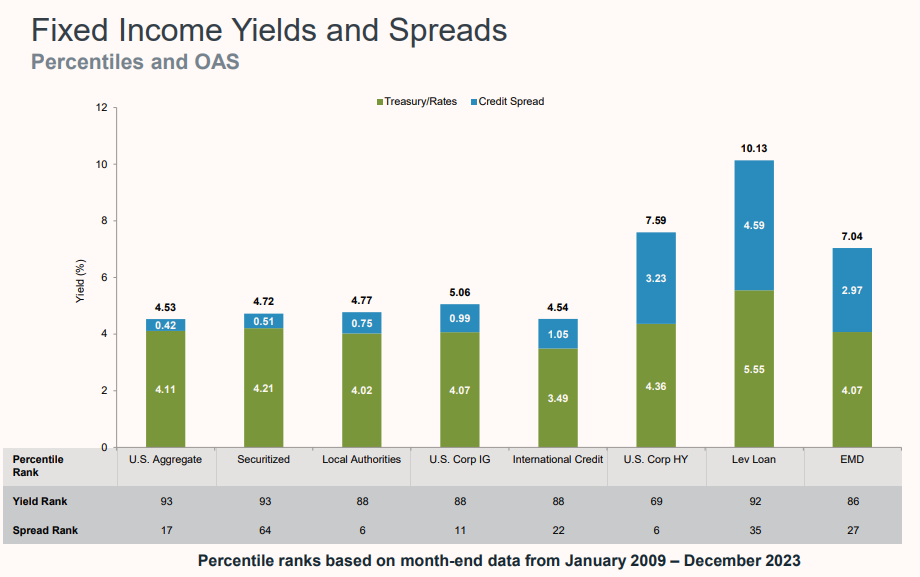

John Luke: and while yields are higher today, new buyers aren’t demanding much compensation for credit risk

Source: Fidelity as of January 2024

Source: Fidelity as of January 2024

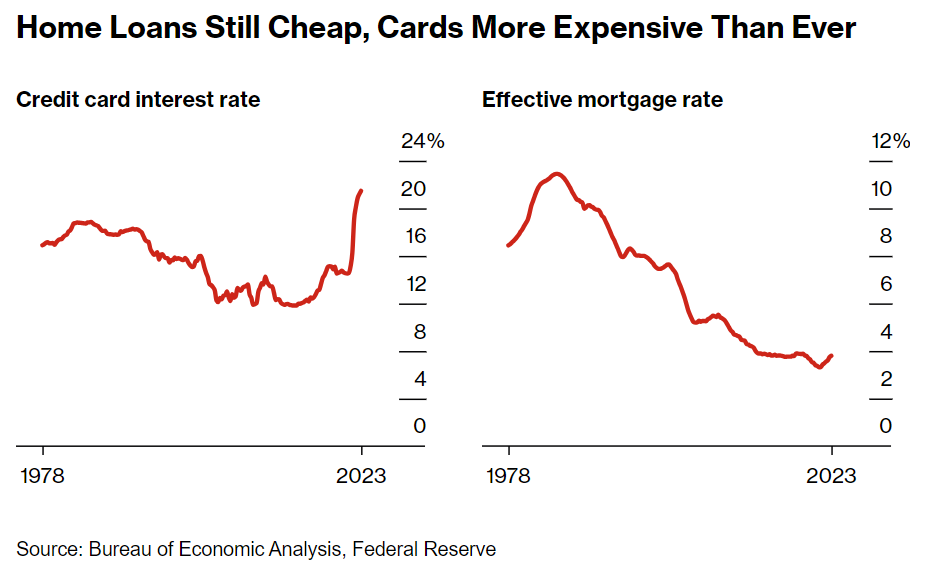

Beckham: Like corporations, individuals with mortgages are generally sitting pretty with low fixed rates

Data via Bloomberg as of February 2024

Data via Bloomberg as of February 2024

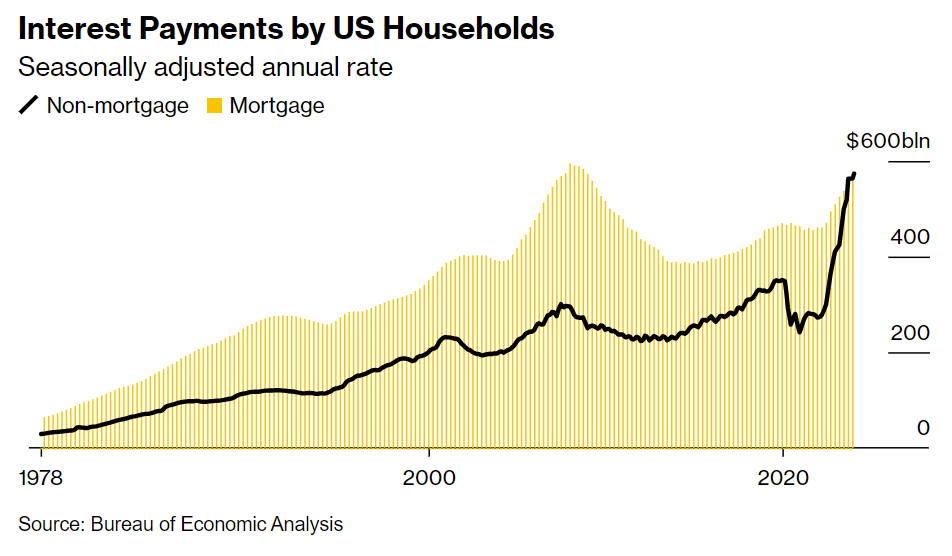

Beckham: but non-mortgage debt is starting to grab a larger portion of consumer interest payments

Data via Bloomberg as of February 2024

Data via Bloomberg as of February 2024

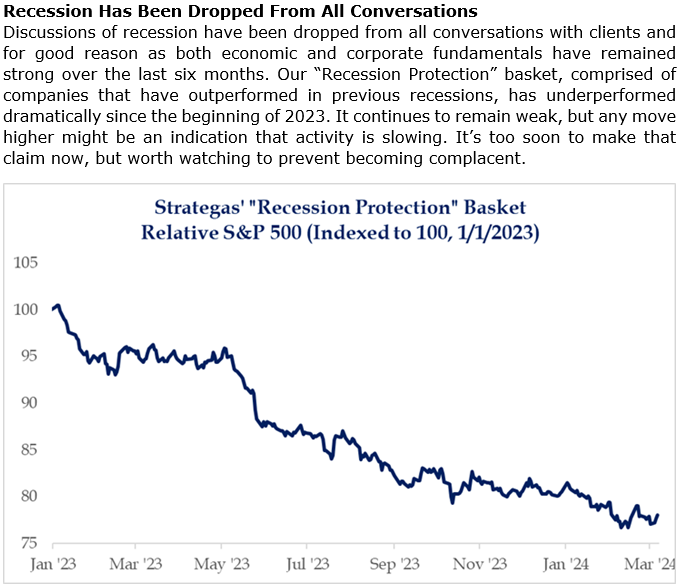

Brad: If a recession is coming, it’s not being reflected in the performance of normally defensive sectors

Source: Strategas as of 03.07.2024

Source: Strategas as of 03.07.2024

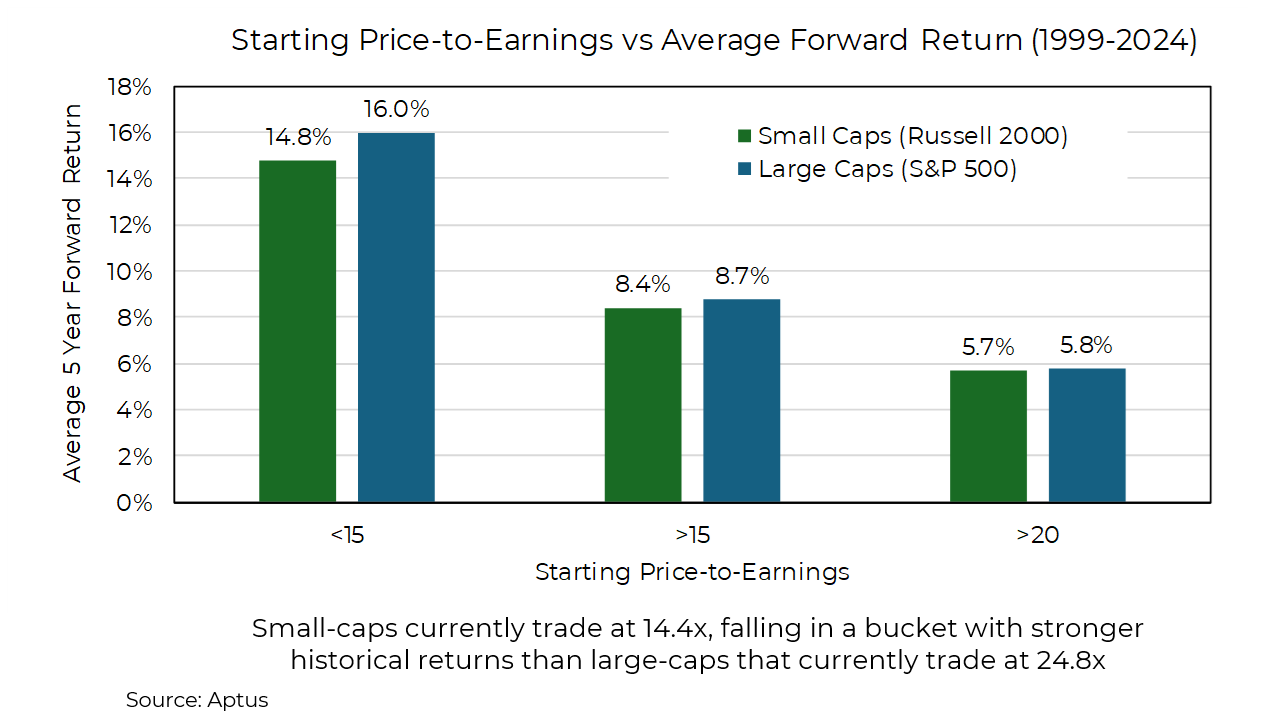

Brian: Buying “cheaper” stocks hasn’t delivered much value in recent years, but smaller stocks are in what has historically been an area from which better returns can take place

Data as of 03.07.2024

Data as of 03.07.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2403-16.