Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

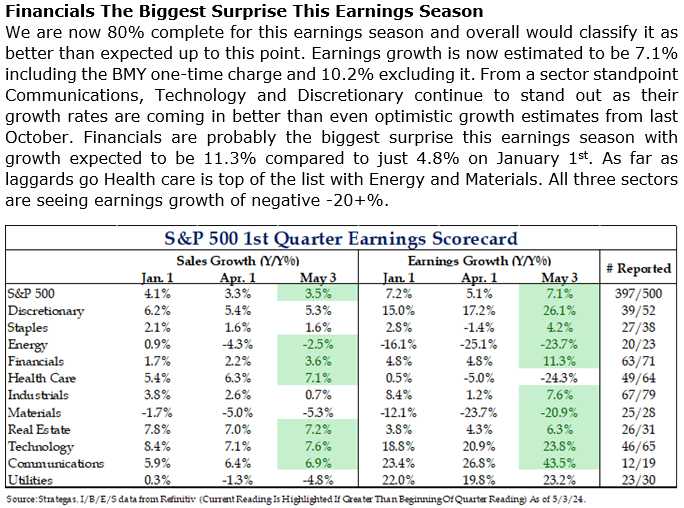

Brad: Earnings season is winding down, it’s been solid

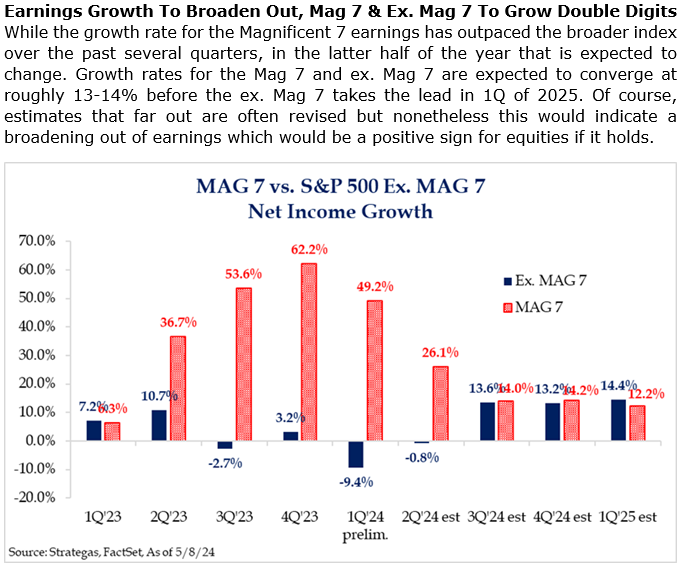

Brad: and we’re approaching the expected inflection point where we see a larger show of strength across the full S&P 500

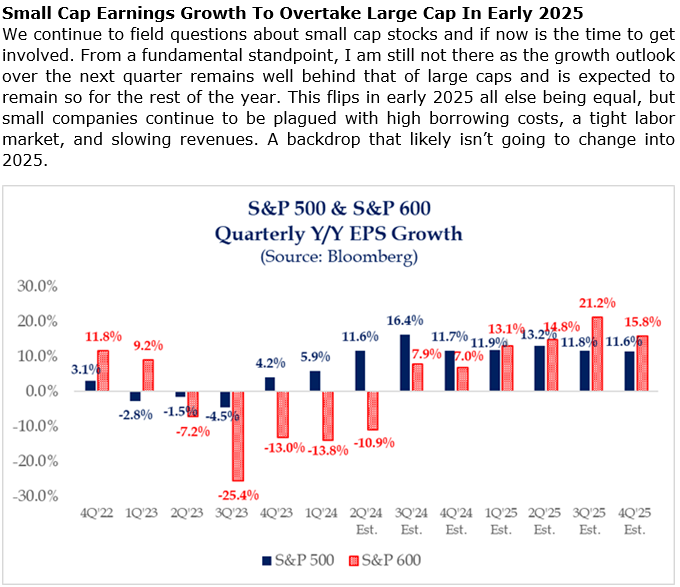

Brad: and eventually in 2025, into the small-cap universe

Source: Strategas as of 05.06.2024

Source: Strategas as of 05.06.2024

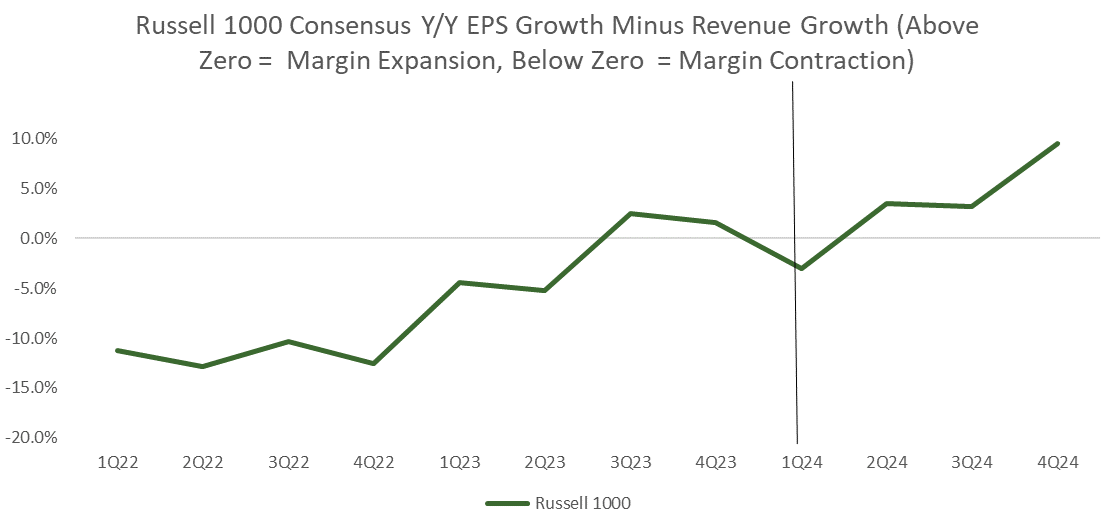

Joseph: with profit margins again expanding after a hit in 2022

Source: Raymond James as of 05.09.2024

Source: Raymond James as of 05.09.2024

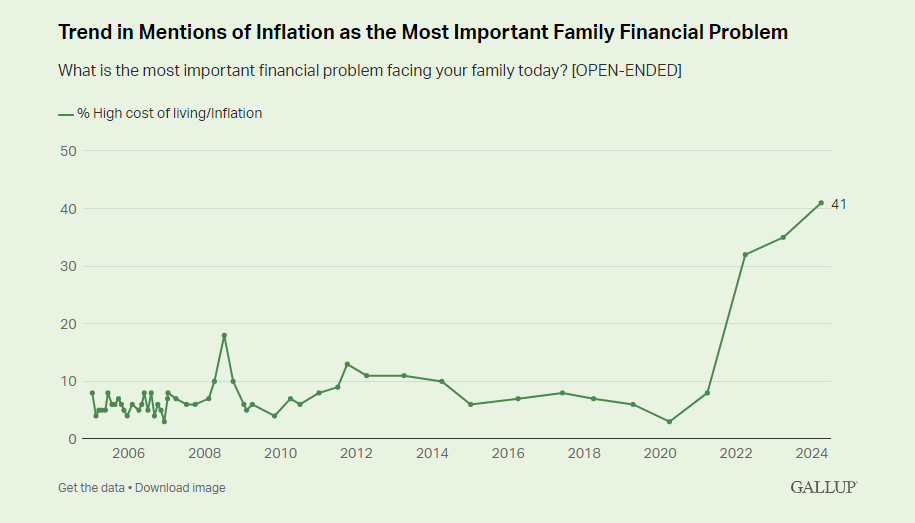

Beckham: Inflation is polling as the most impactful economic concern among consumers

Data as of April 2024

Data as of April 2024

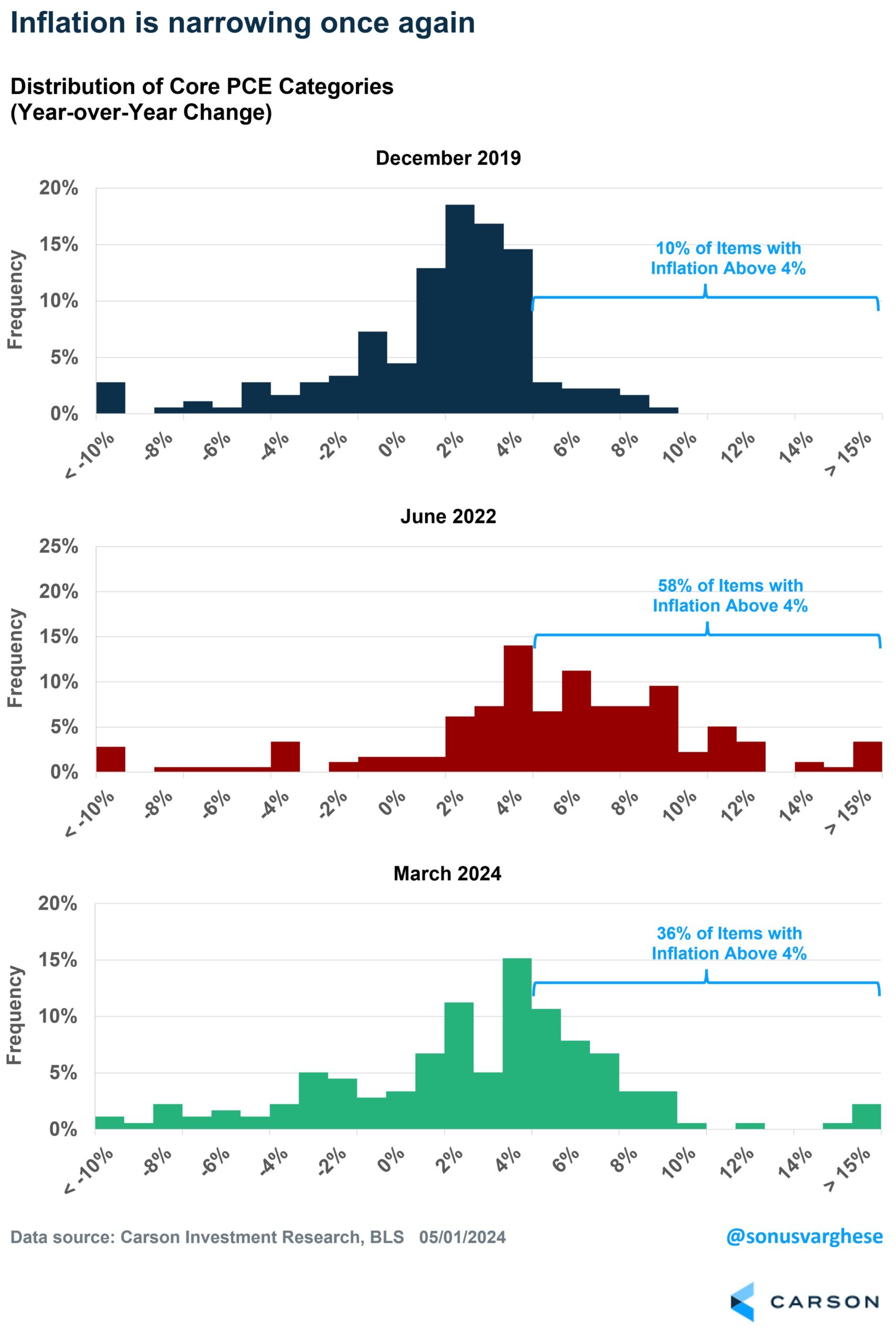

Brian: as the breadth of items experiencing price rises is settling into an area well above pre-COVID levels but well below the highs of summer 2022

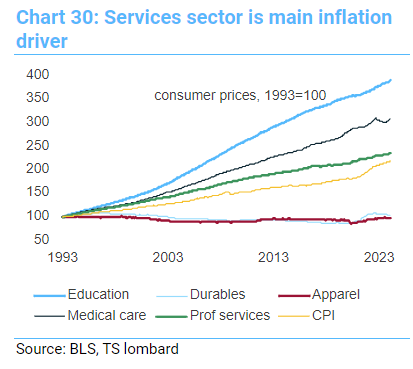

John Luke: Services as a whole have been the most consistent, sticky driver of inflation in recent years

Data as of March 2024

Data as of March 2024

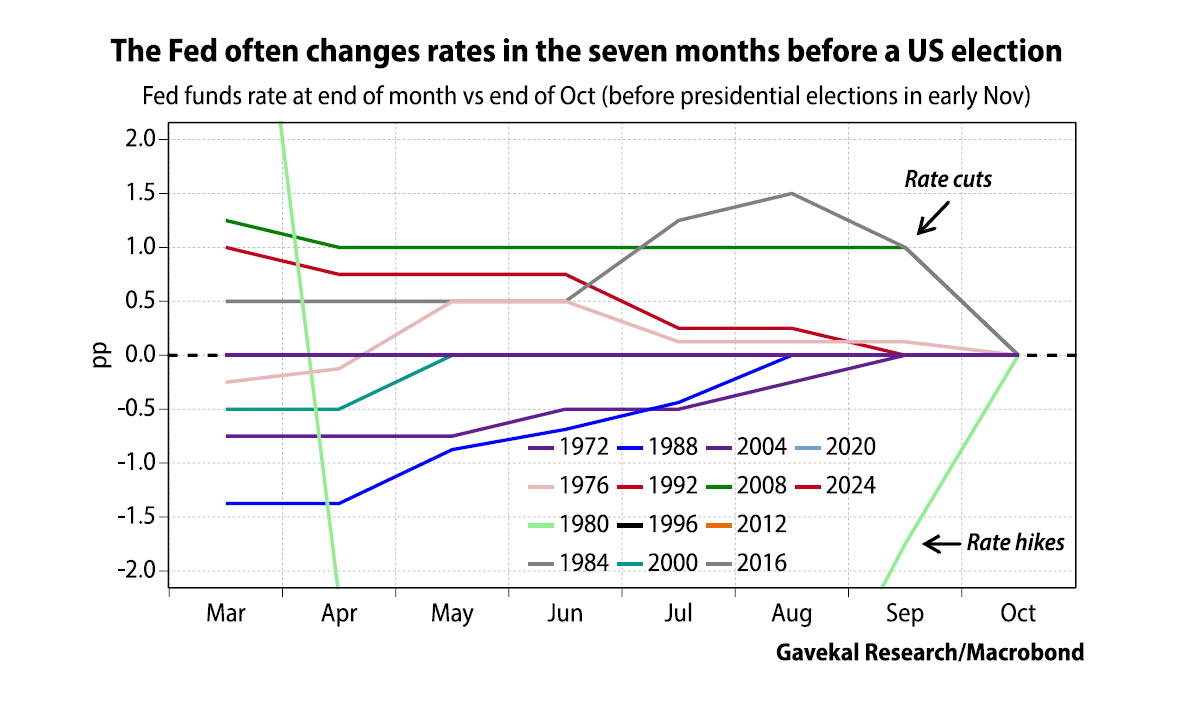

Brett: putting the Fed in a bit of a pickle heading into the 2024 election

Source: Bloomberg as of 05.08.2024

Source: Bloomberg as of 05.08.2024

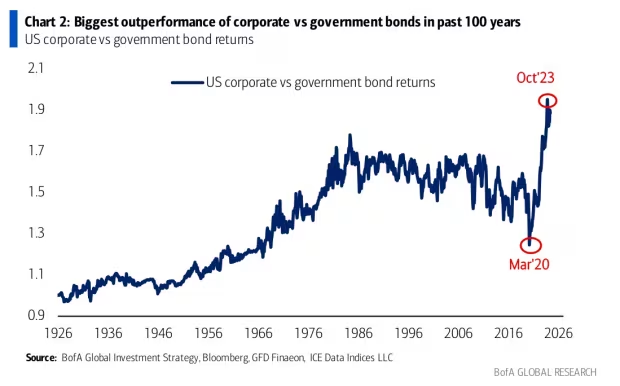

John Luke: The performance spread between corporate bonds and government bonds is as wide as it’s been

Data as of January 2024

Data as of January 2024

Dave: with credit spreads continuing to plunge lower

Source: Sandbox Daily as of 05.08.2024

Source: Sandbox Daily as of 05.08.2024

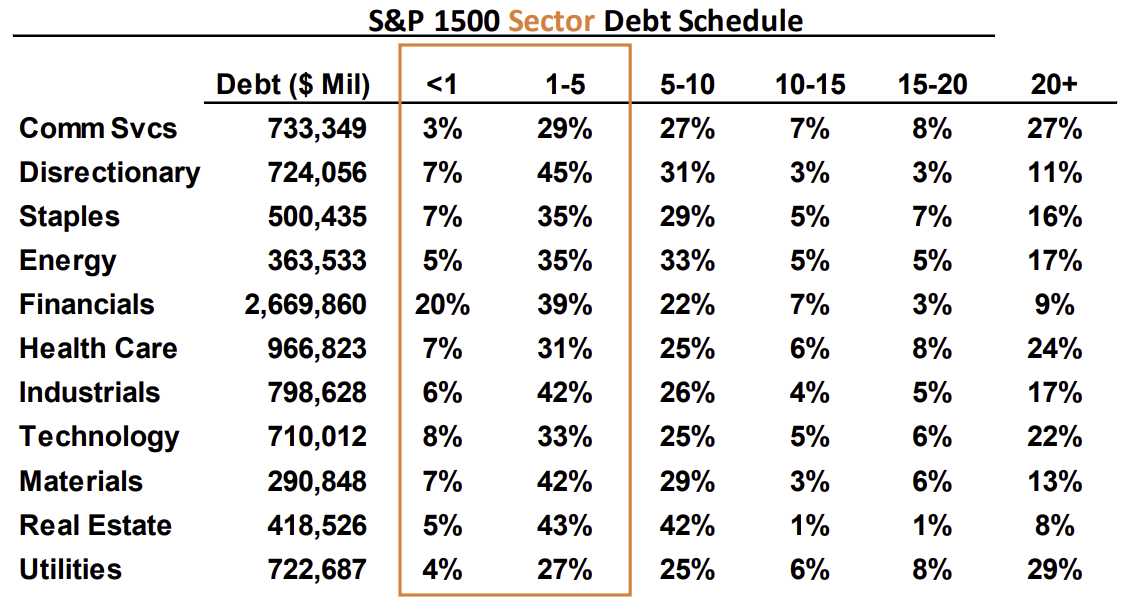

John Luke: against a wide range of refinancing plans for US corporations depending on size and sector

Source: Piper Sandler as of 05.06.2024

Source: Piper Sandler as of 05.06.2024

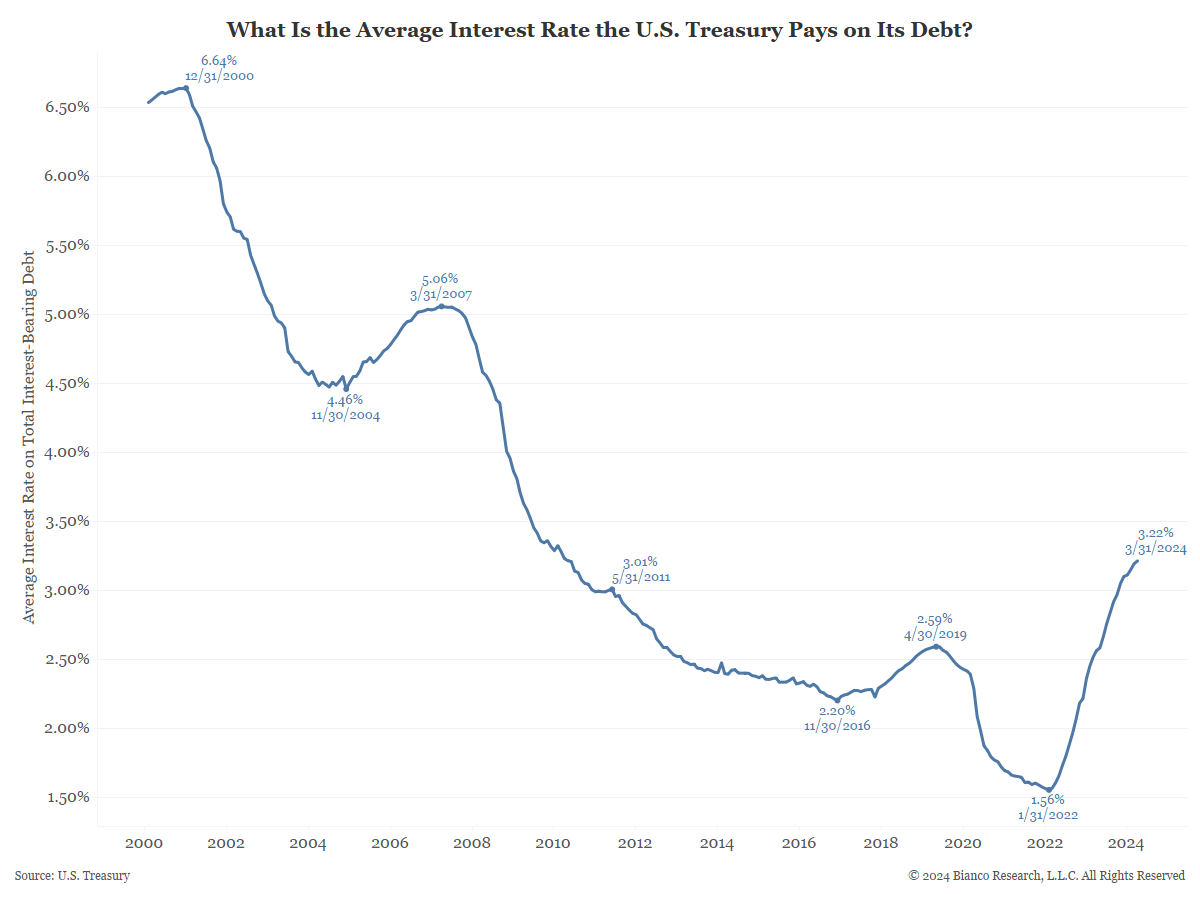

John Luke: Interest expense for the US government is rising quickly from multi-decade lows

Source: Bianco as of 03.31.2024

Source: Bianco as of 03.31.2024

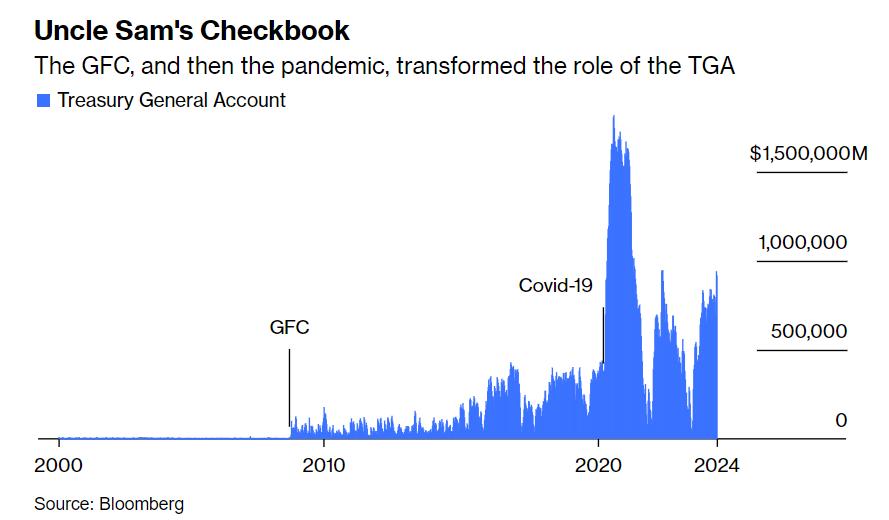

Beckham: as the Treasury becomes a larger backstop to the economy

Data as of March 2024

Data as of March 2024

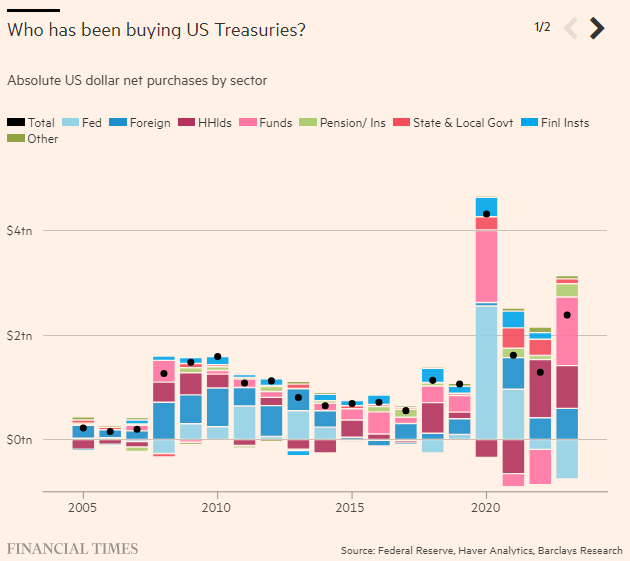

John Luke: and the mix of Treasury buyers is evolving towards individual households and the funds they own

Data as of March 2024

Data as of March 2024

Joseph: at a time when bonds are delivering less diversification to portfolios holding equities

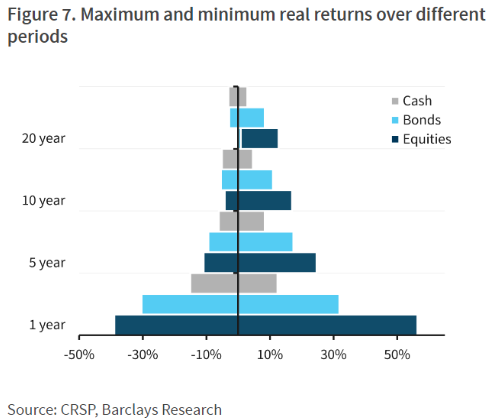

Joseph: Stocks for the long run is a real thing, when comparing to historical returns vs. bonds and cash

Data as of January 2024

Data as of January 2024

Joseph: and the same has been true in the UK despite the reduction in its importance relative to the global economy

Data as of January 2024

Data as of January 2024

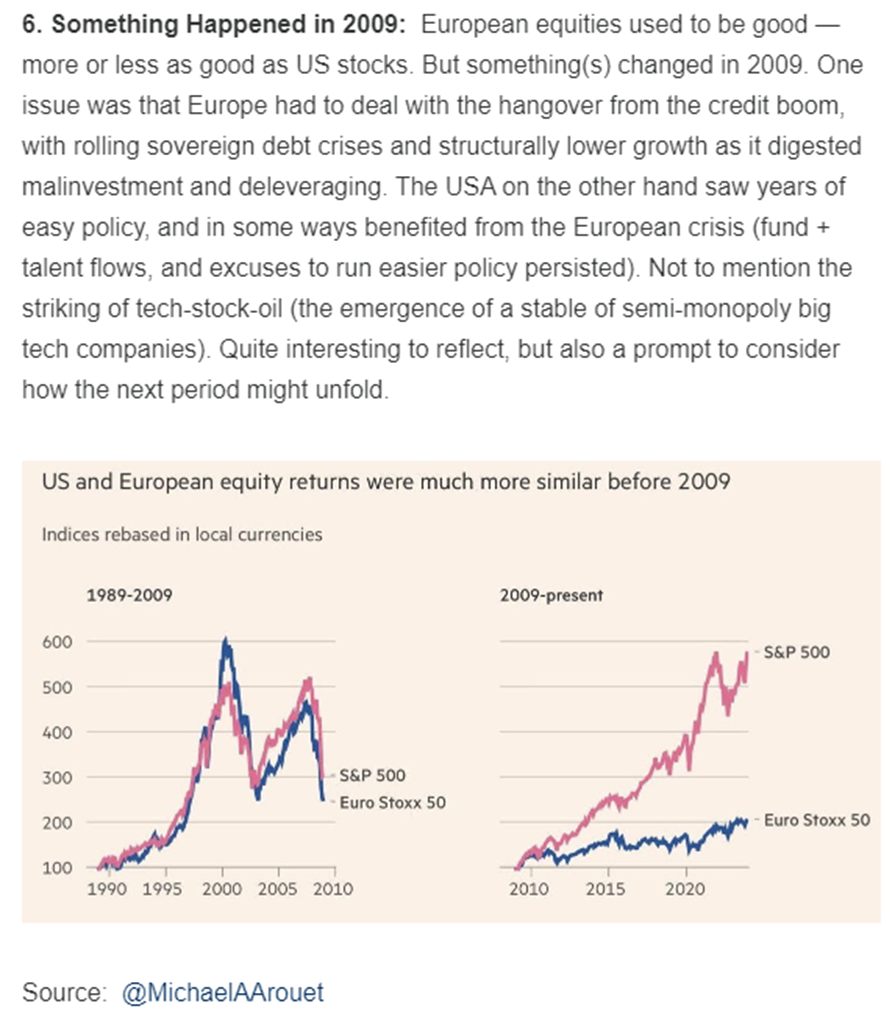

Brett: that said, the difference in central bank stimulus in the US vs. Europe has contributed to quite the difference in stock market outcomes

Data as of March 2024

Data as of March 2024

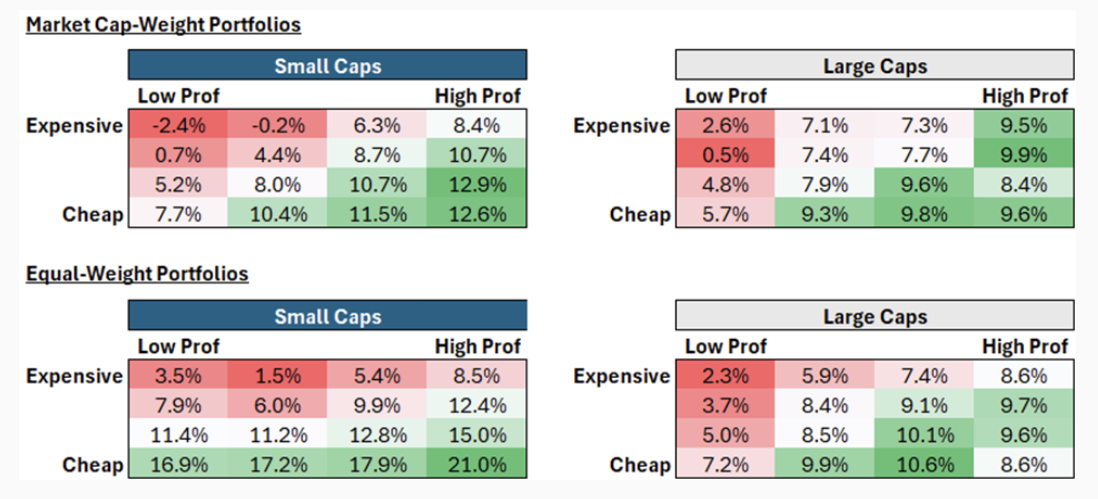

Dave: Cheap + quality can be elusive but has been a winning combo historically

Source: Verdad as of 05.06.2024

Source: Verdad as of 05.06.2024

Dave: and you can see the inefficient distribution of flows into companies falling in the “expensive and low profitability” group

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2405-12.