Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

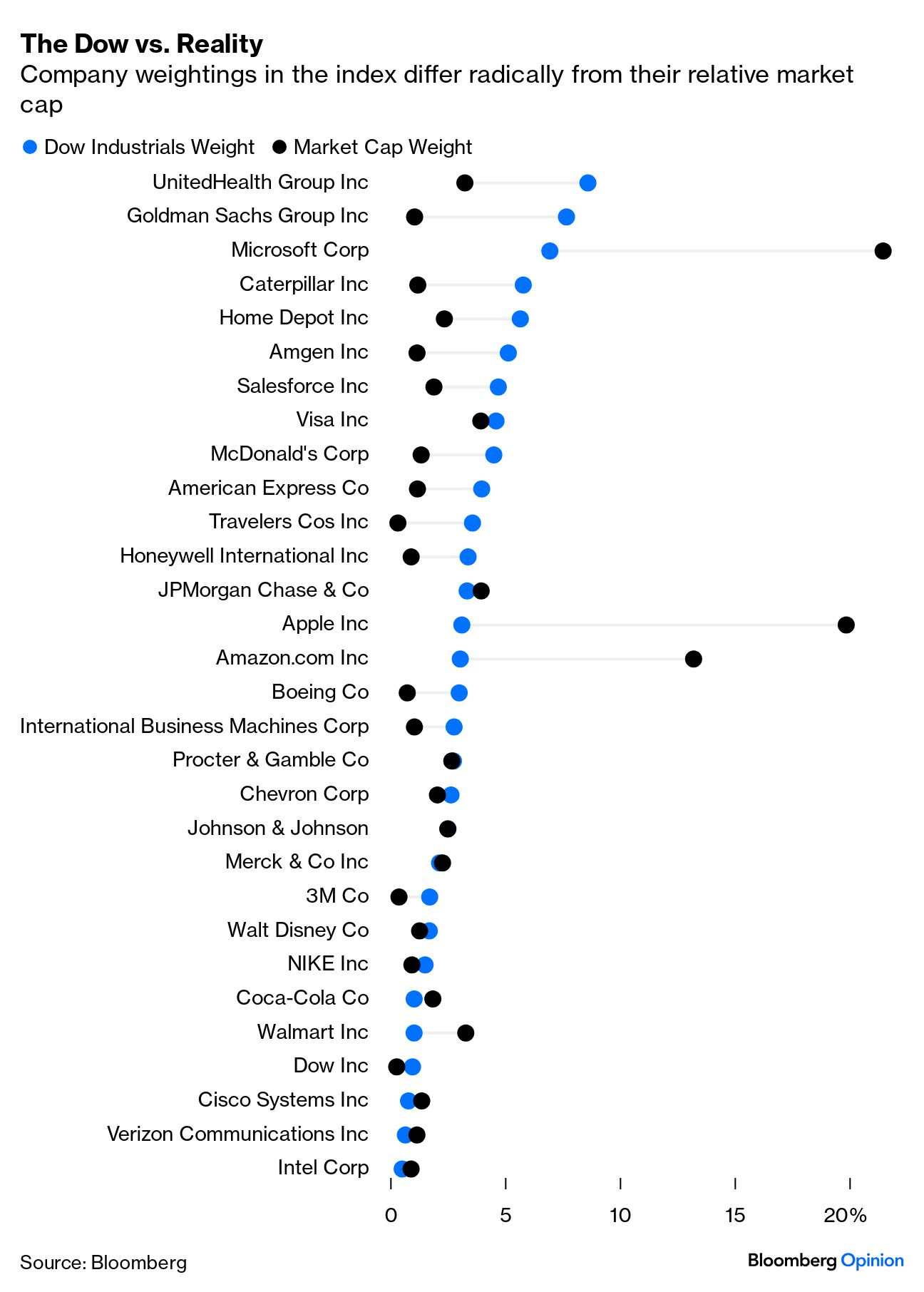

Brett: DJIA hitting 40,000 will draw attention, but the dollar-weighting gives it some notable quirks relative to the S&P 500

Data as of 05.10.2024

Data as of 05.10.2024

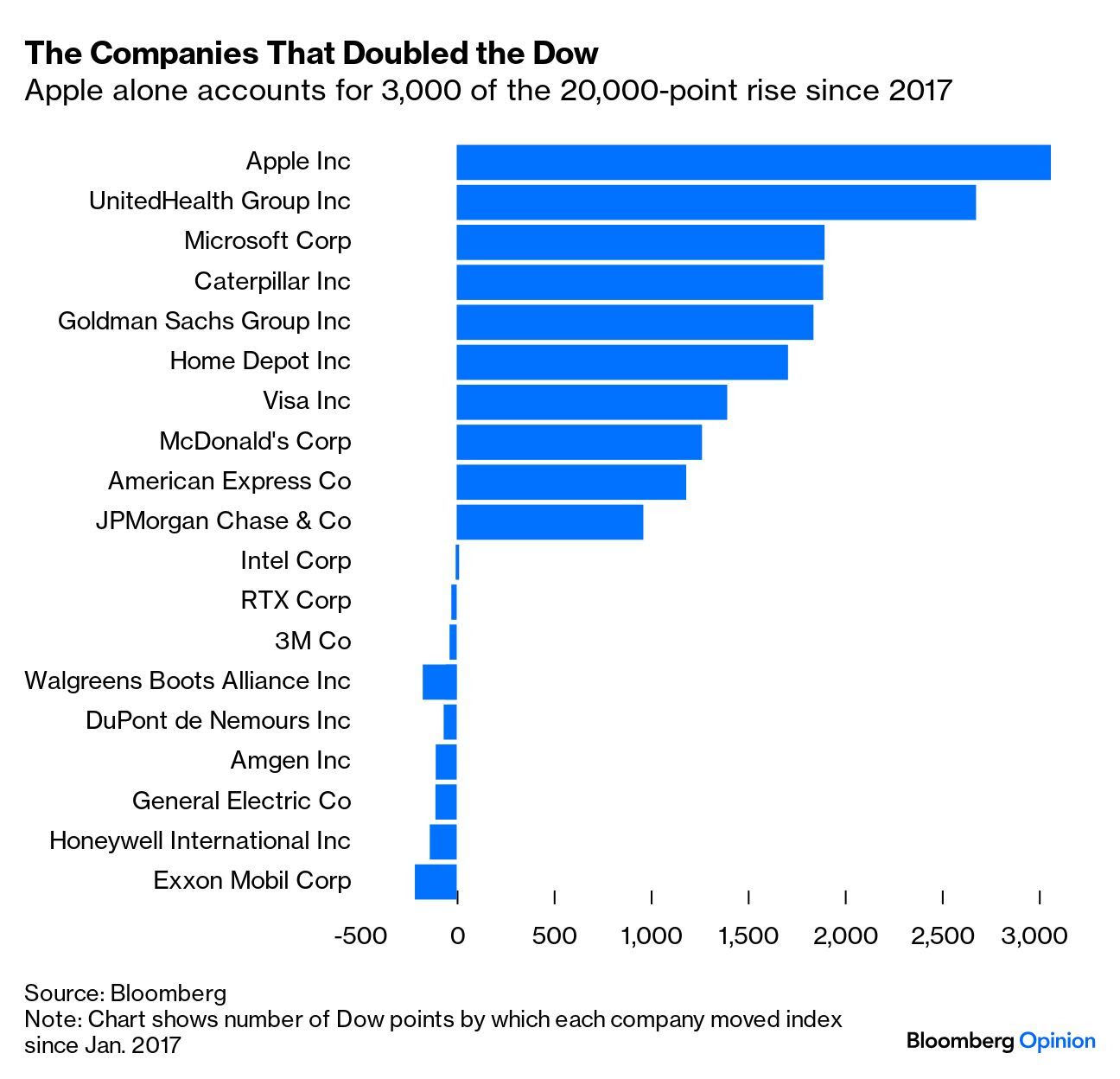

Beckham: with some heavy contributions from a handful of notable names

Data as of 05.10.2024

Data as of 05.10.2024

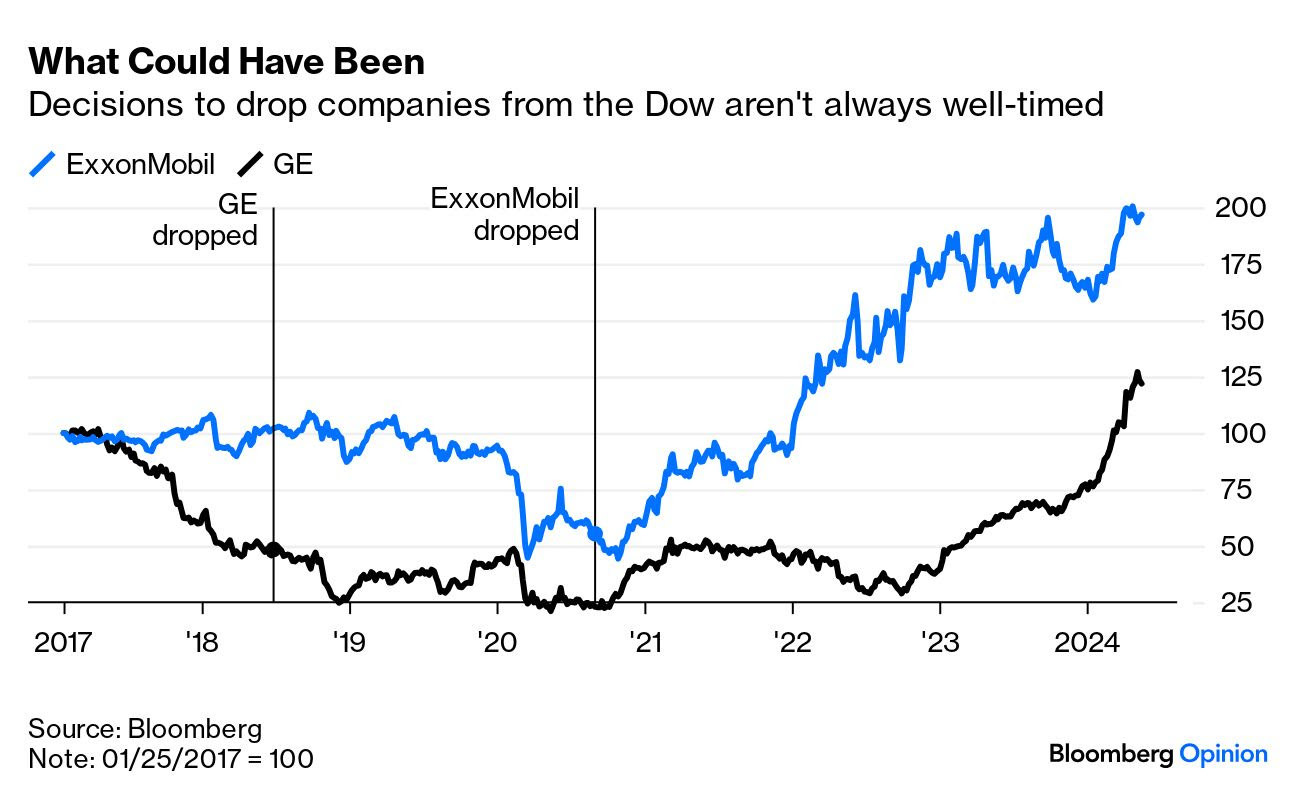

Brett: and some notable arbitrary judgments by the DJIA committee

Data as of 05.10.2024

Data as of 05.10.2024

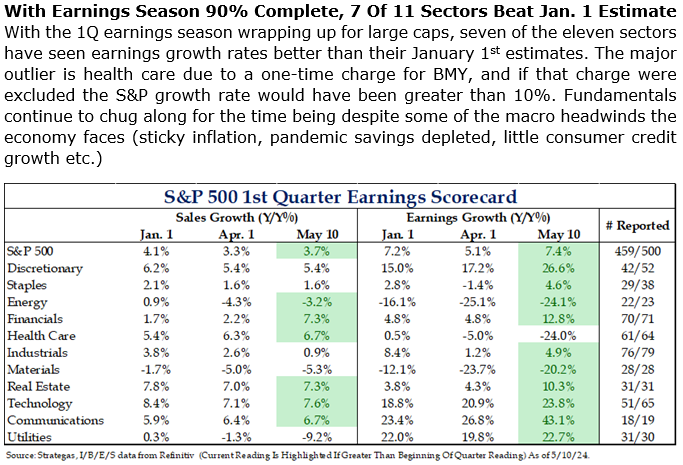

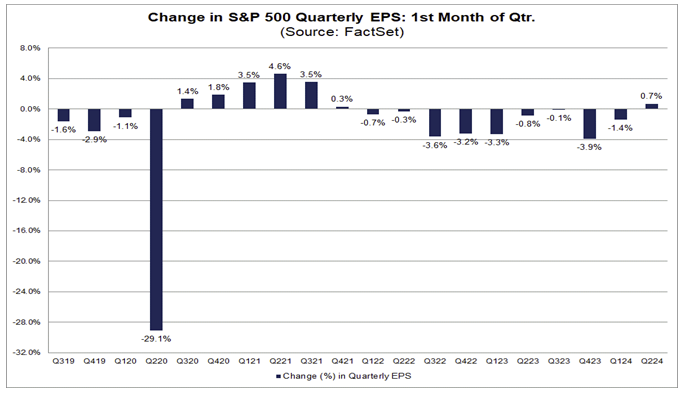

Brad: It was a strong quarter for earnings

Brian: with the first instance of rising estimates in the 1st month of a quarter since 2021

Data as of 05.10.2024

Data as of 05.10.2024

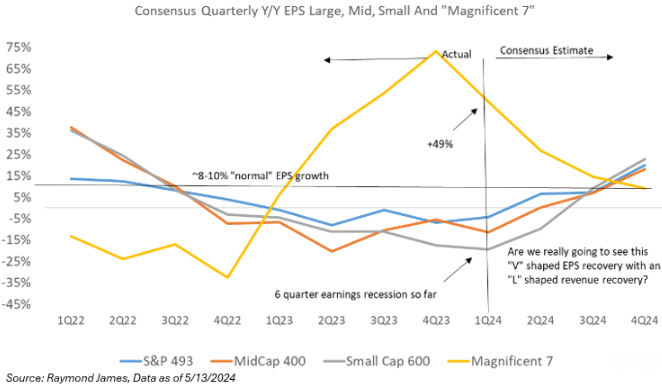

Dave: and we’ll need more of that to deliver the significant lift in earnings currently factored into consensus estimates

Source: Raymond James as of 05.10.2024

Source: Raymond James as of 05.10.2024

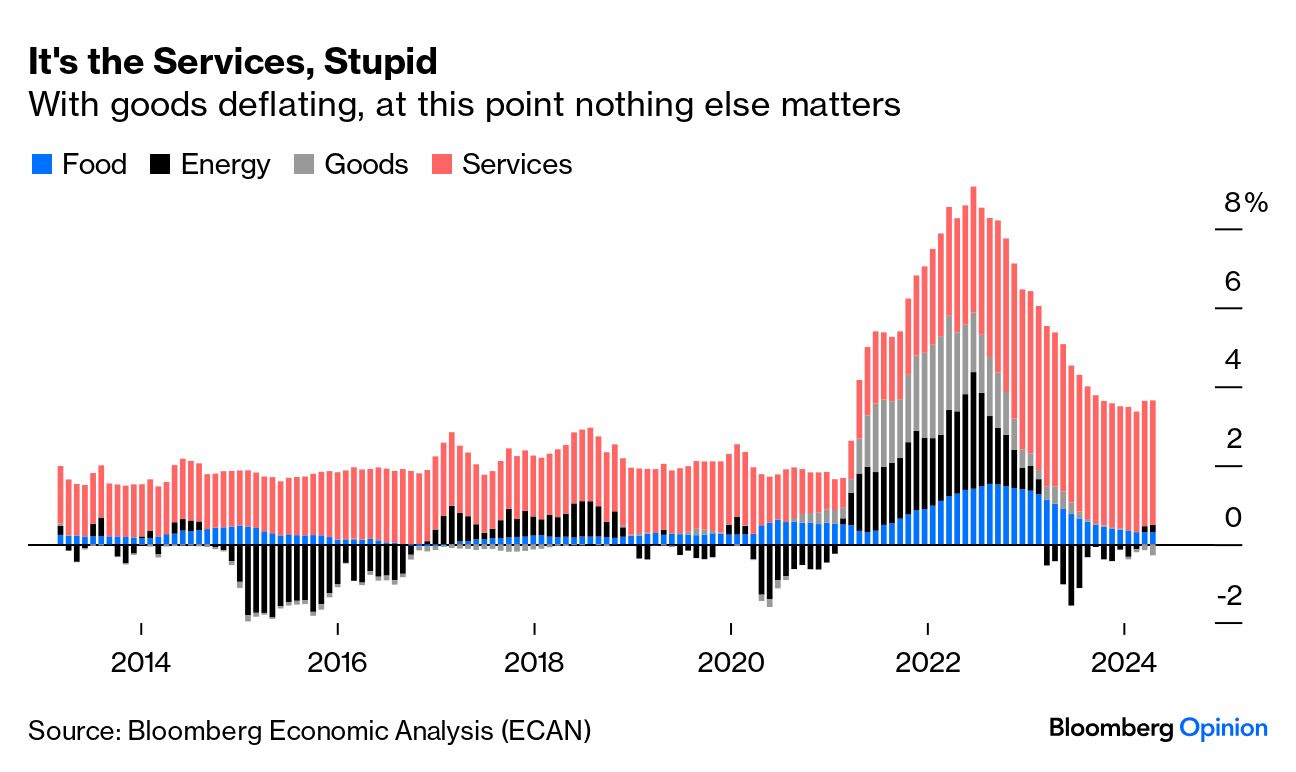

Joseph: Services have completely taken over from goods as the driver of inflation

Data as of 05.15.2024

Data as of 05.15.2024

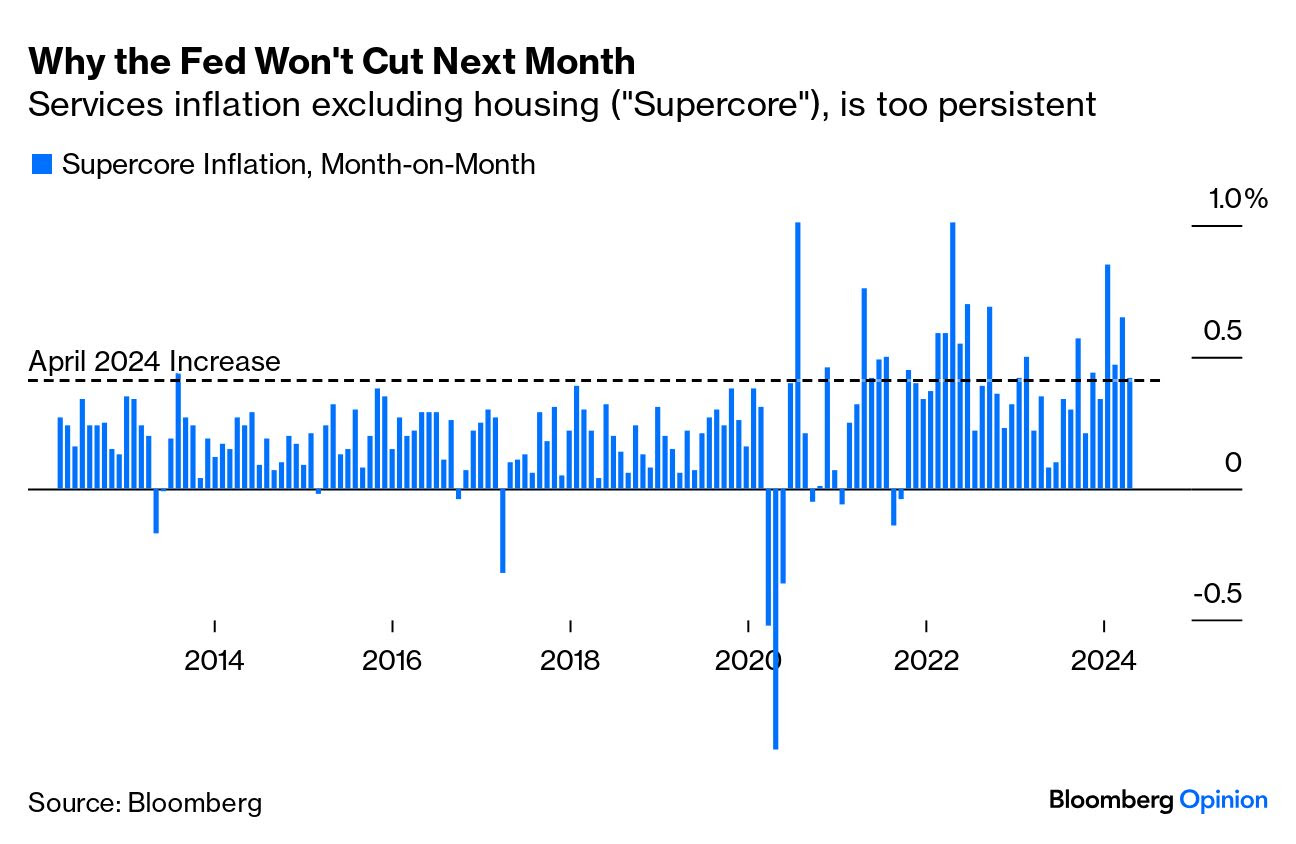

John Luke: and specifically, the “Supercore” measure remains higher than the Fed’s comfort level

Data as of 05.15.2024

Data as of 05.15.2024

John Luke: with the stickiest components well off of the highs but stabilizing at a “too high” level as well

Data as of 05.10.2024

Data as of 05.10.2024

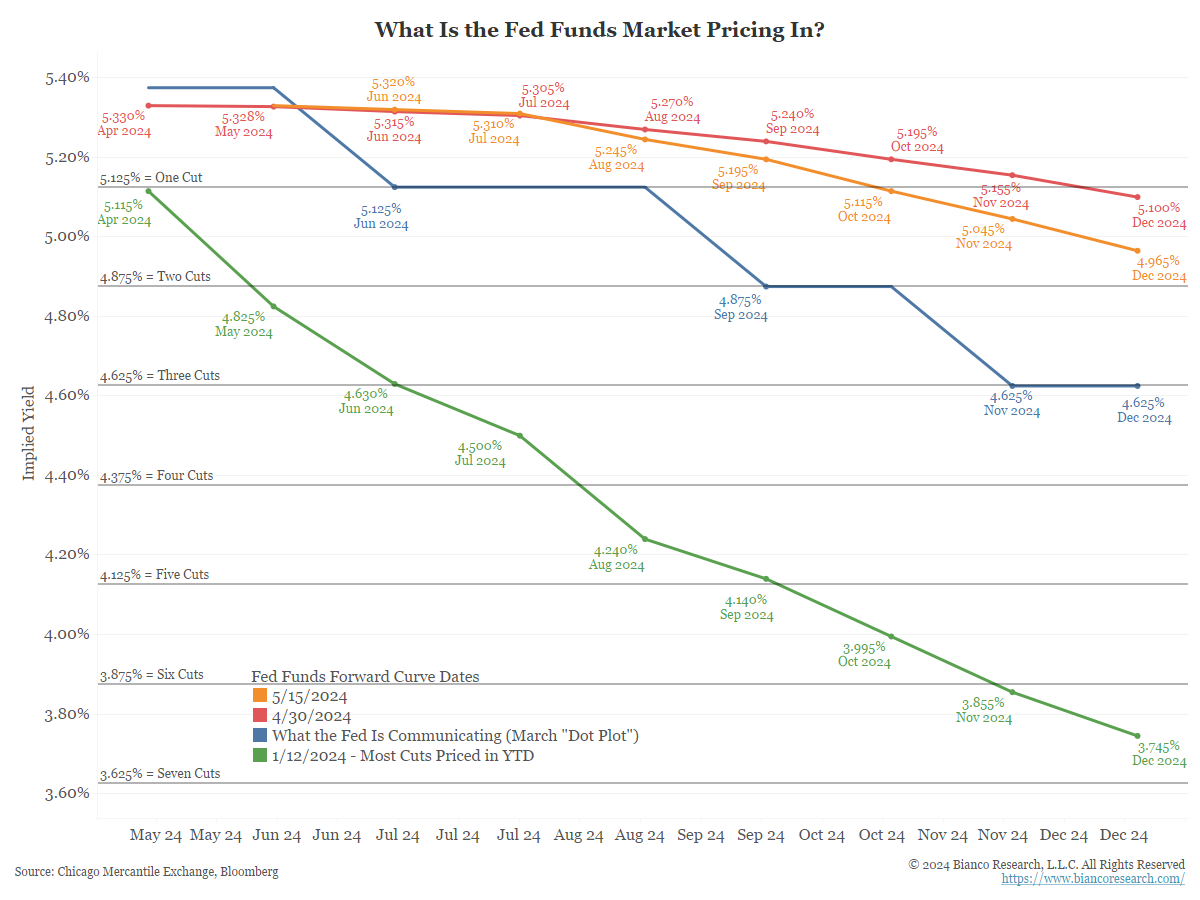

John Luke: Rate cut expectations have been pushed out all year, but finally relented a bit with some of the recent FOMC comments

Data as of 05.15.2024

Data as of 05.15.2024

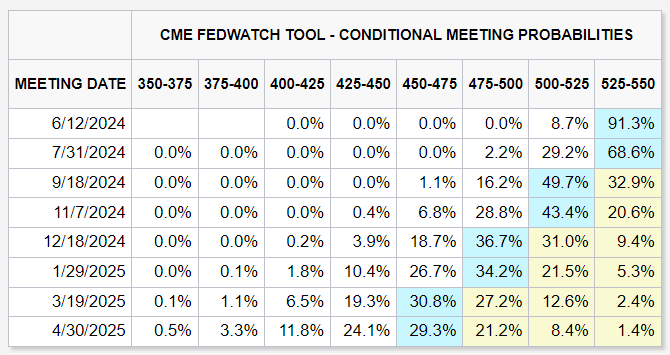

Brian: with the initial 4-6 cuts now down to only a September rate cut factored in before the November 5 election

Source: CME as of 05.17.2024

Source: CME as of 05.17.2024

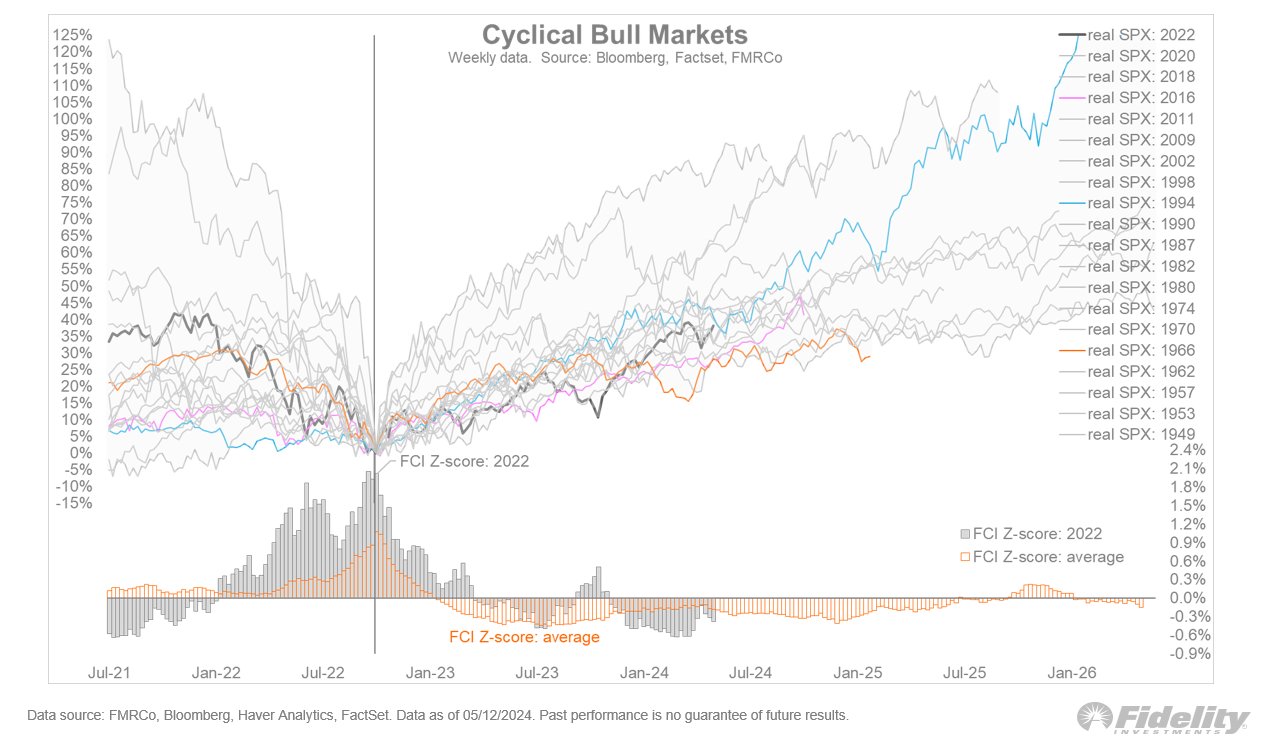

JD: To this point, the move from the Fall 2022 lows has been a middle-of-the-road rally for the S&P 500

Data as of 05.12.2024

Data as of 05.12.2024

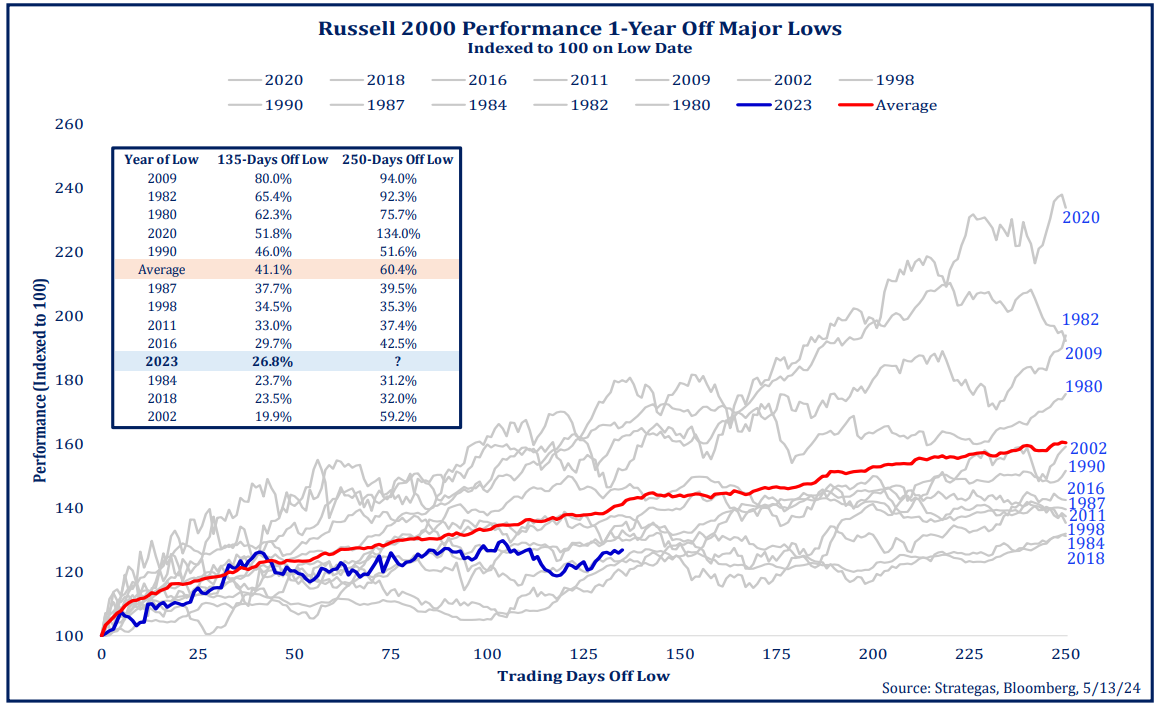

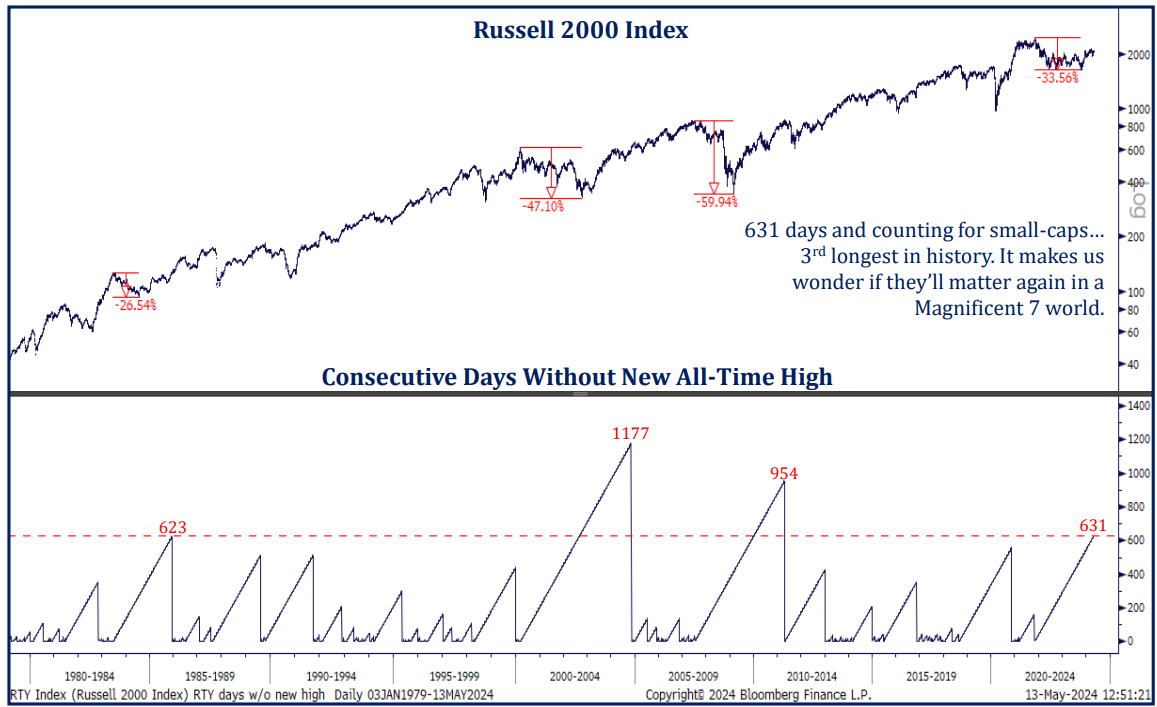

Dave: with small-cap stocks lagging significantly from the lows

Brad: creating one of the longer periods without highs for the widely-watched Russell 2000

Source: Strategas

Source: Strategas

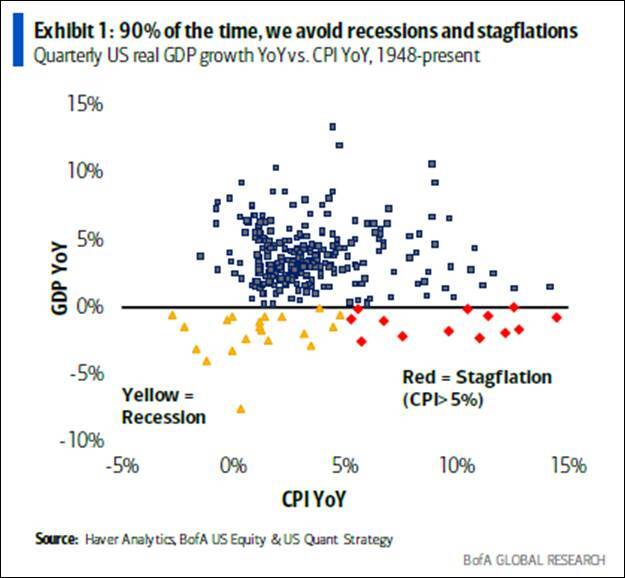

John Luke: Pundits have thrown stagflation into the scenario discussion, but Fed Chair Powell said recently he doesn’t see the “stag” or the “flation” and history shows it’s pretty rare

Data as of April 2024

Data as of April 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2405-16.