Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

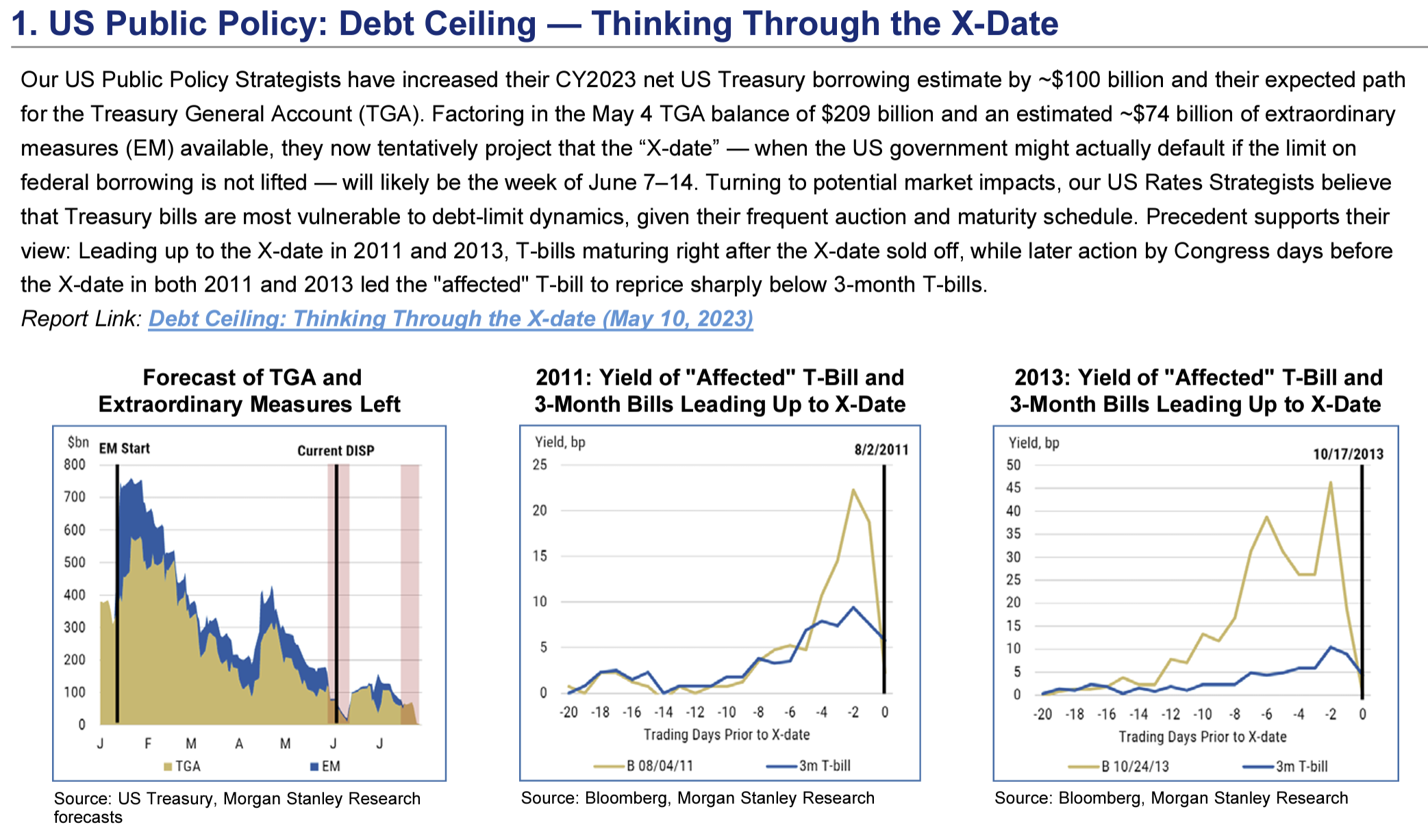

Dave: The debt ceiling remains a story for markets, here’s Morgan Stanley’s walkthrough of prior showdowns

Source: Morgan Stanley as of 05.15.2023

Source: Morgan Stanley as of 05.15.2023

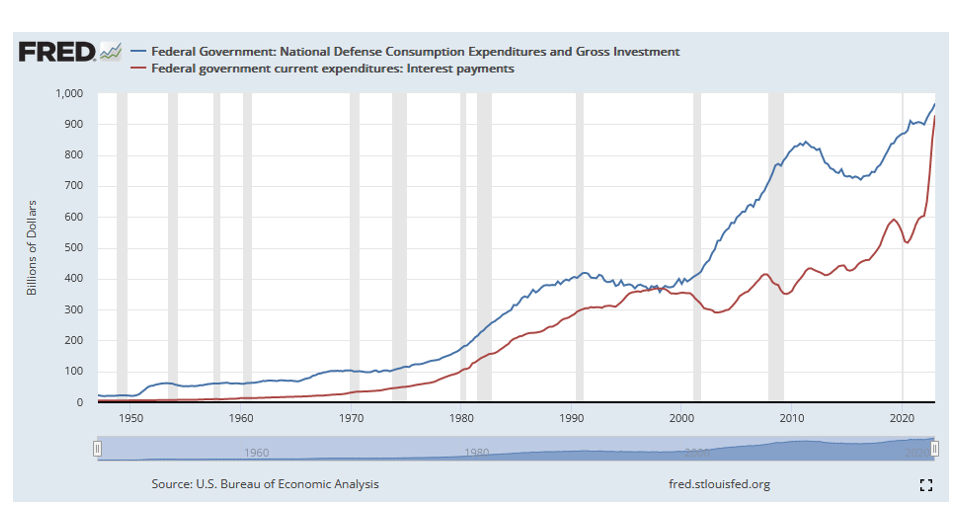

John Luke: this occurring at a time when the government’s interest expense is exploding

Data as of 05.12.2023

Data as of 05.12.2023

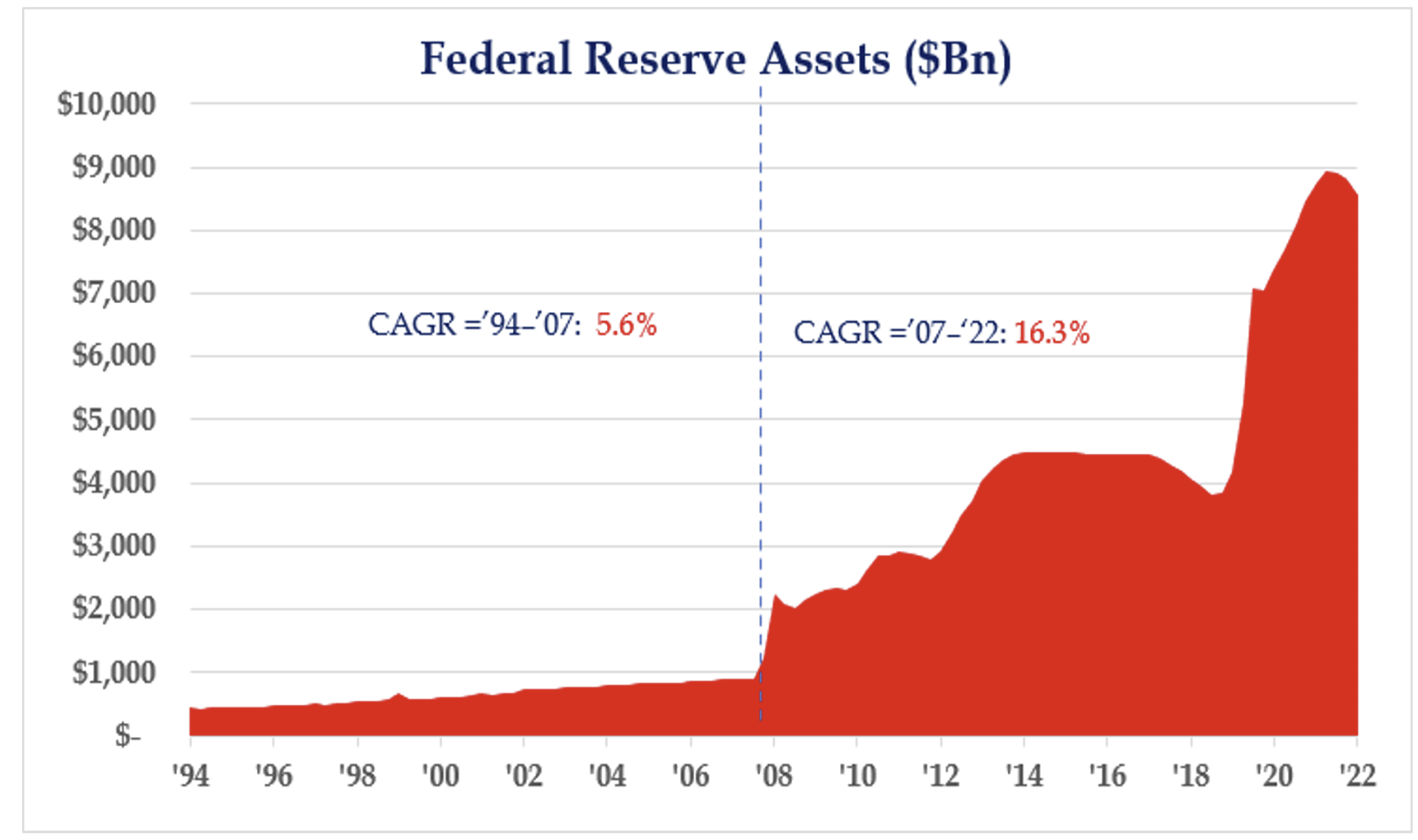

Dave: as a period of relentless liquidity from the Federal Reserve into the economy is ending

Source: Strategas as of 05.12.2023

Source: Strategas as of 05.12.2023

John Luke: We’re seeing government economic data surprise to the upside after a rough stretch

Data as of 05.17.2023

Data as of 05.17.2023

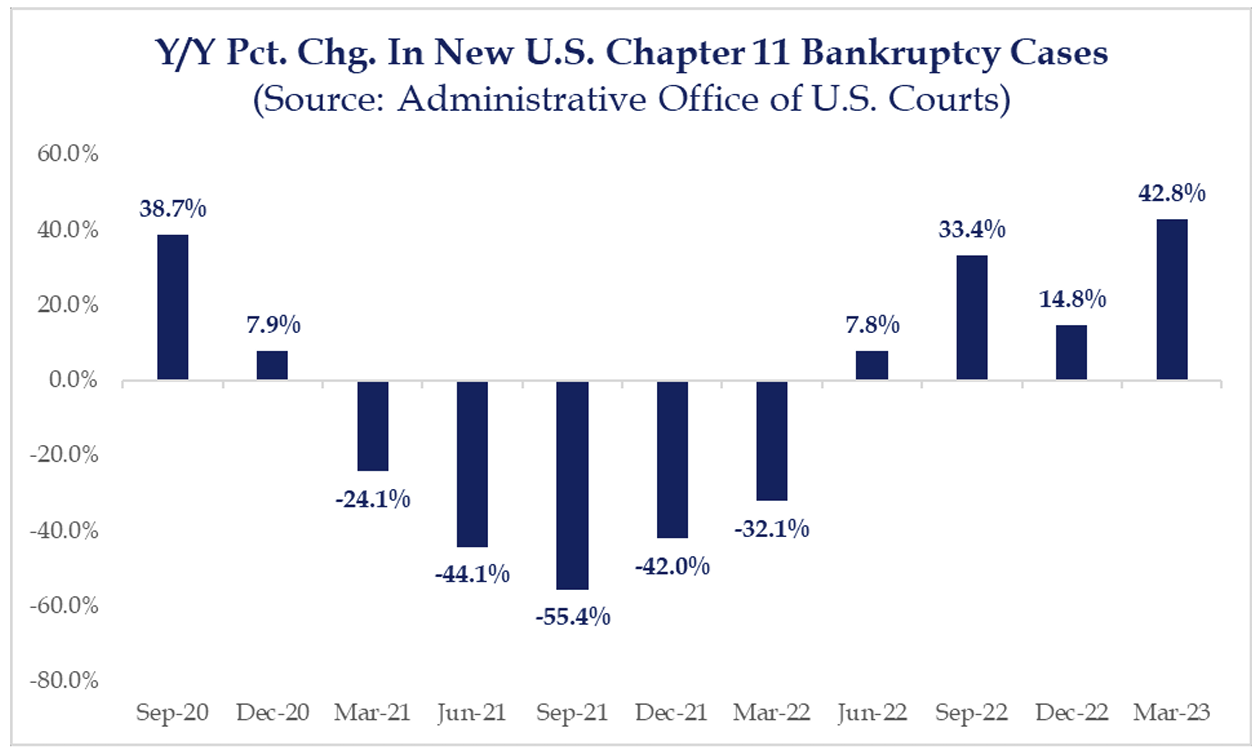

Dave: yet bankruptcies are climbing

Source: Strategas as of 05.16.2023

Source: Strategas as of 05.16.2023

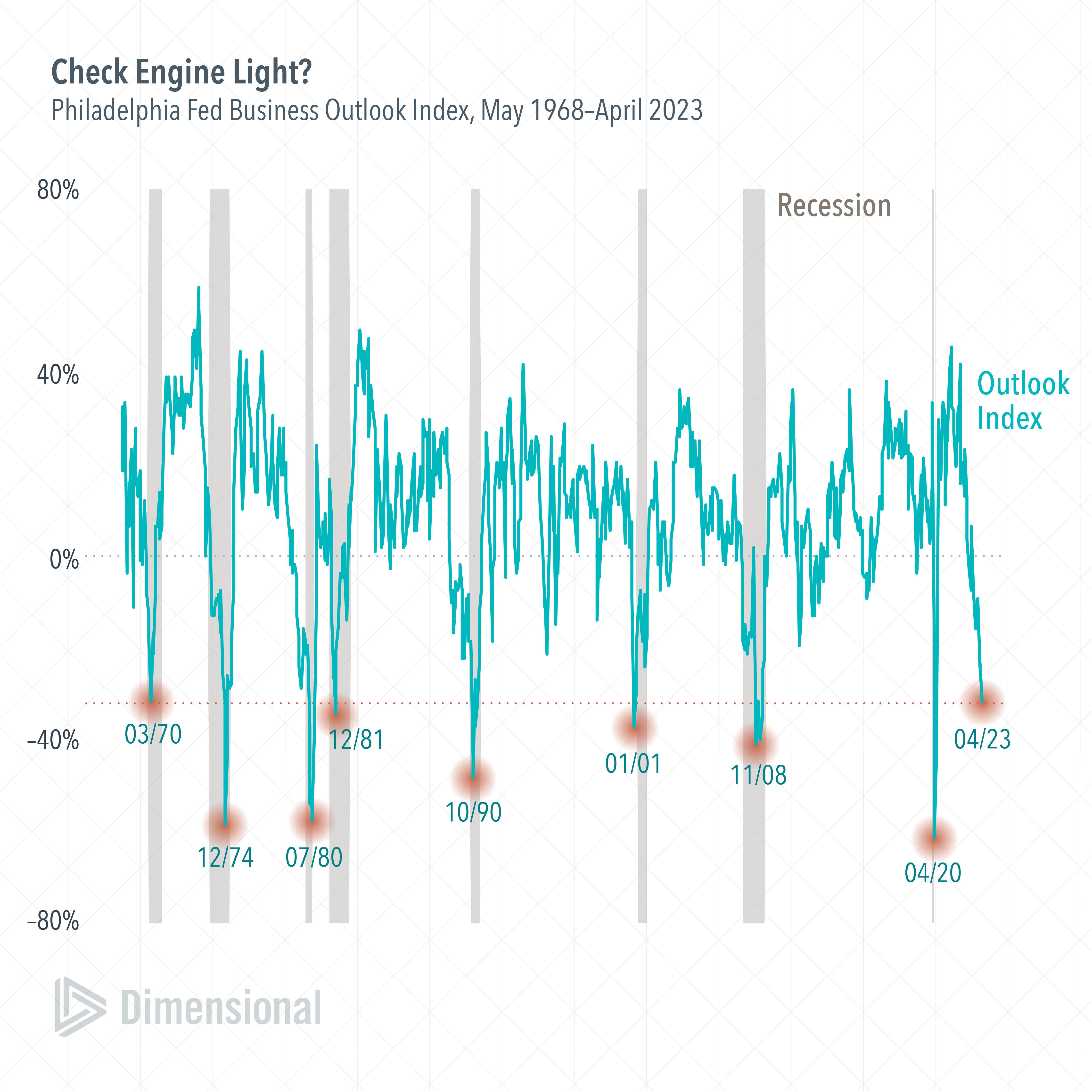

John Luke: and the Philly Fed is plunging, seeming to signal a coming recession

Data as of 05.17.2023

Data as of 05.17.2023

John Luke: Tightening lending standards at banks have historically led to widening credit spreads, again summarizing the disconnect between business sentiment and markets

Data as of 05.16.2023

Data as of 05.16.2023

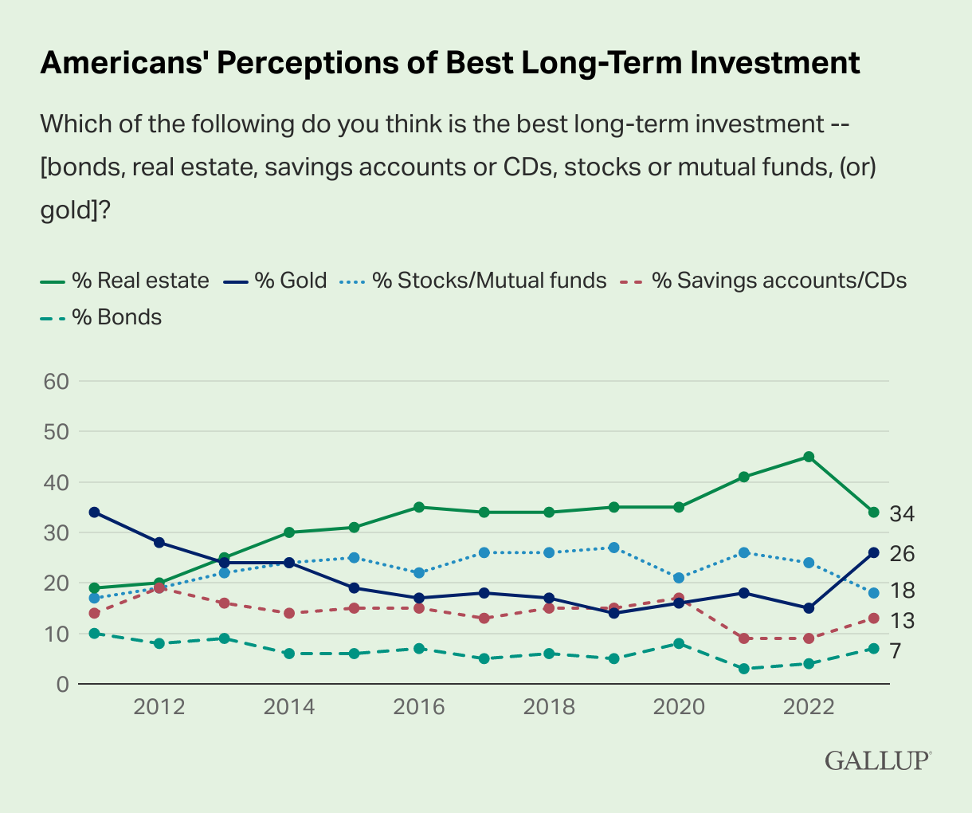

Beckham: Speaking of sentiment, it’s funny to see such a spike in public belief in gold as an investment

Data as of 05.12.2023

Data as of 05.12.2023

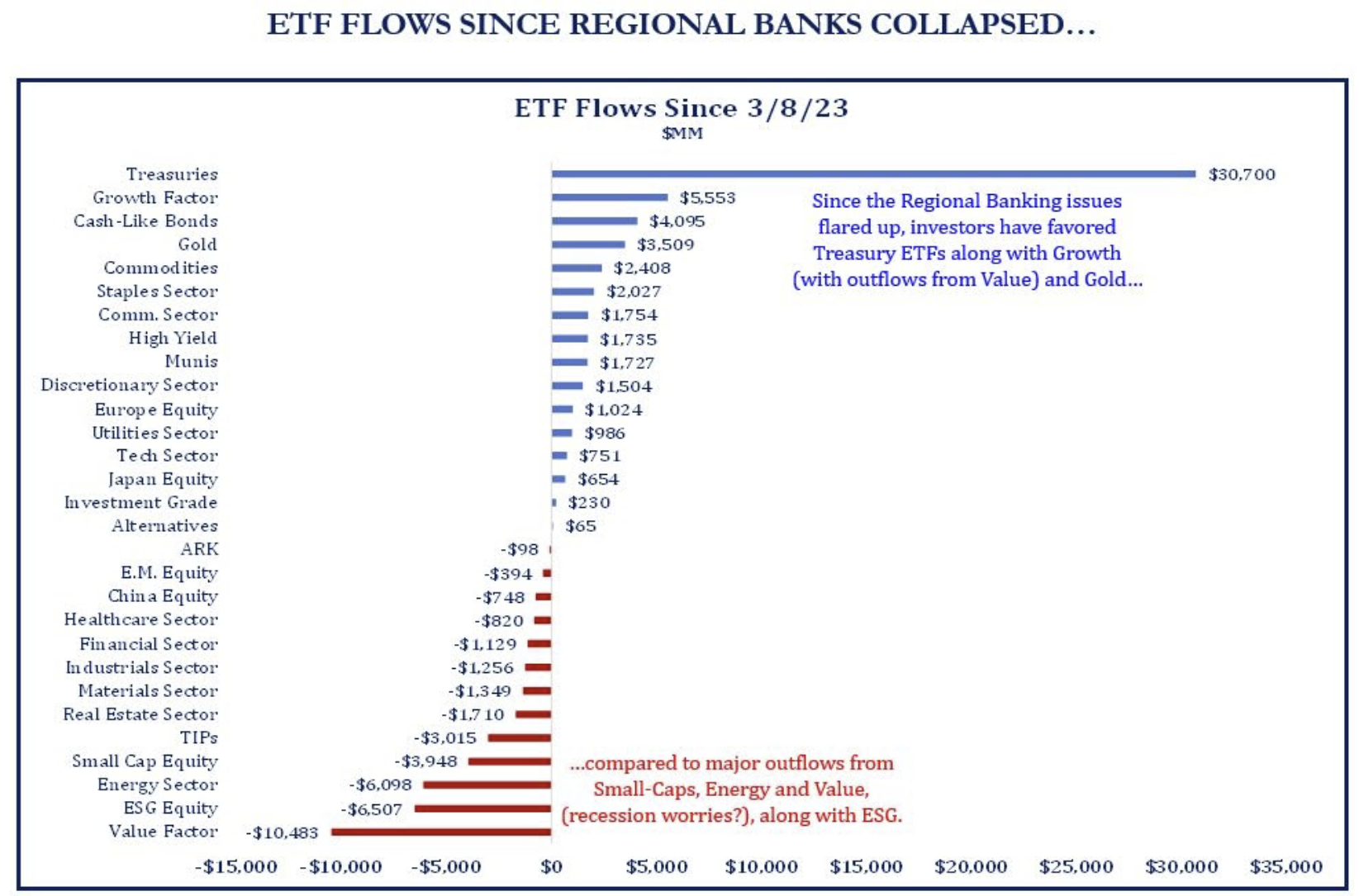

Dave: but flows drive performance (and vice versa), and we’re seeing a real flip from what attracted money in 2022

Source: Strategas as of 05.15.2023

Source: Strategas as of 05.15.2023

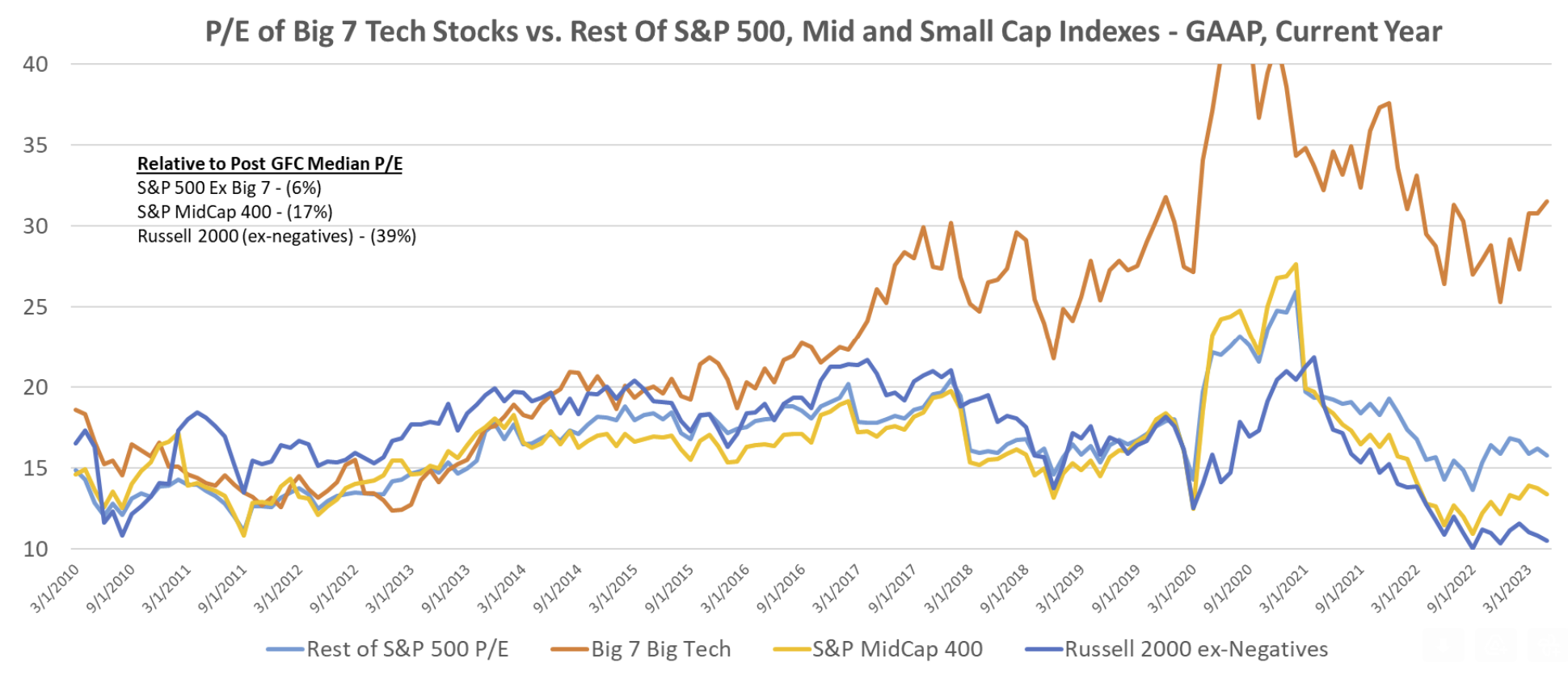

Dave: Stocks are not crazy expensive once you look past the glamour names that trade at nosebleed levels

Source: Raymond James as of 05.15.2023

Source: Raymond James as of 05.15.2023

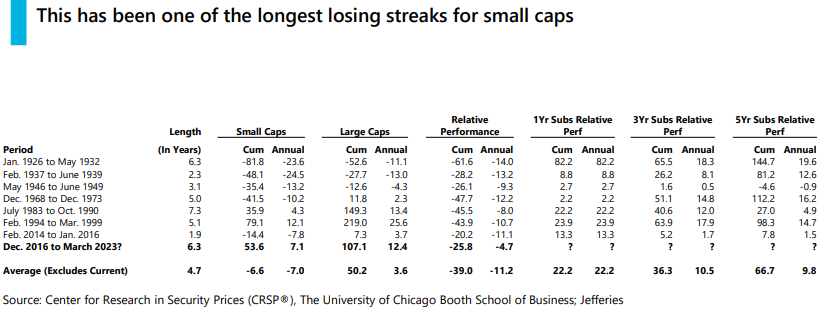

Brad: as evidenced by the extensive discount at which small-cap stocks are trading

Data as of April 2023

Data as of April 2023

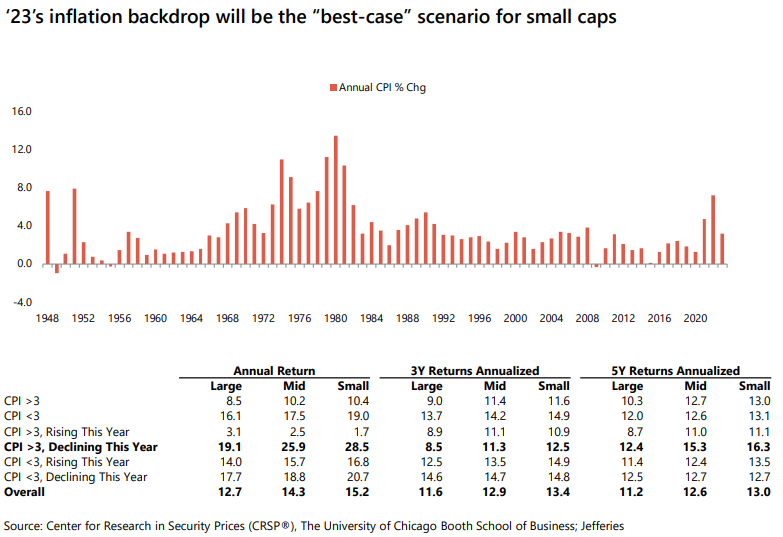

Brad: maybe the macro setup finally falls into place for a reversal of fortunes?

Data as of April 2023

Data as of April 2023

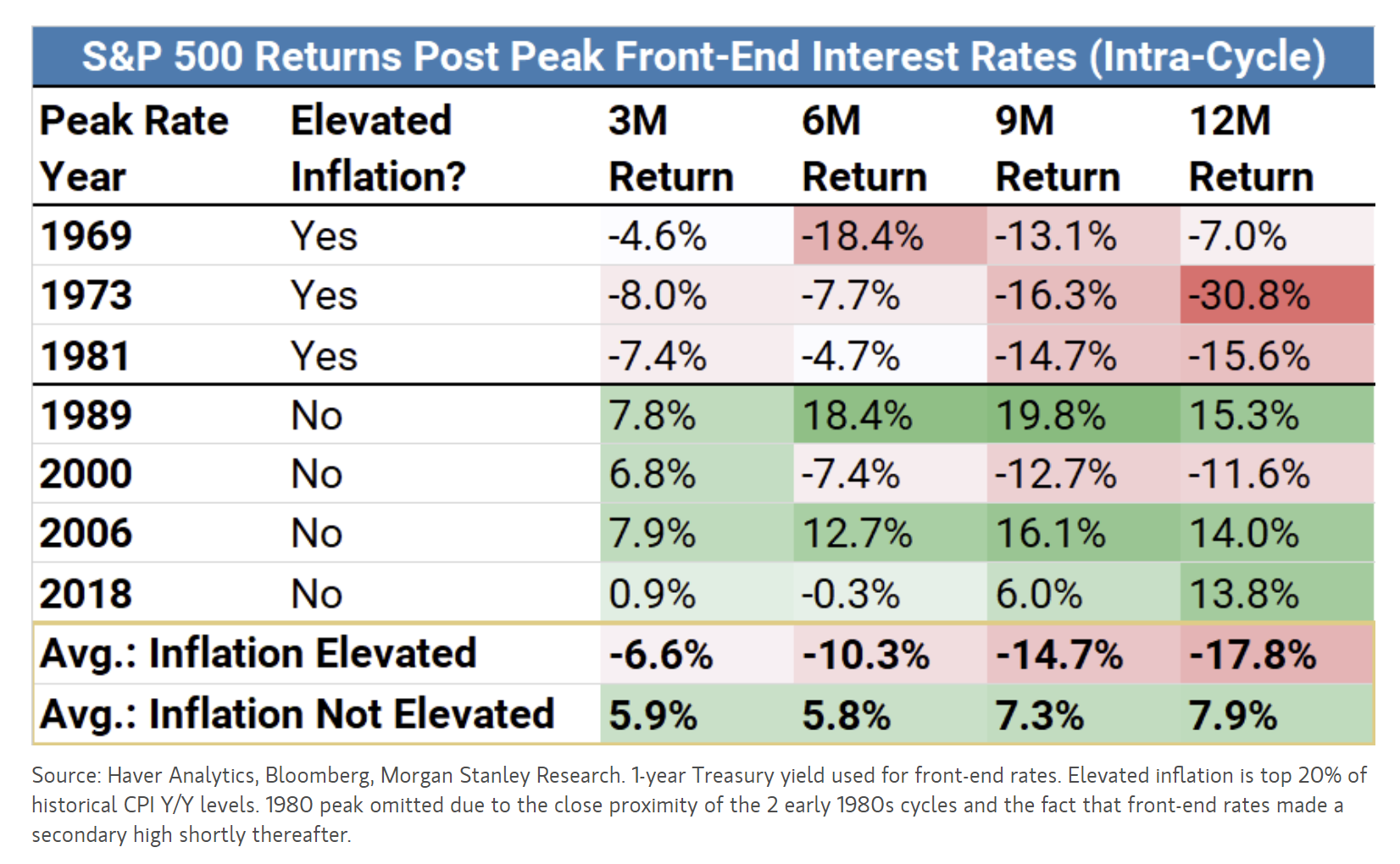

Dave: Historically, the level of inflation has also played a role in how the S&P has traded following the end of rate hike cycles

Data as of May 2023

Data as of May 2023

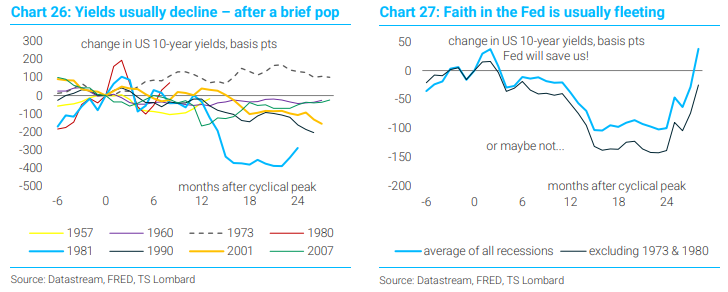

John Luke: and belief in the Fed’s success against inflation will also dictate how the rates market plays out

Data as of May 2023

Data as of May 2023

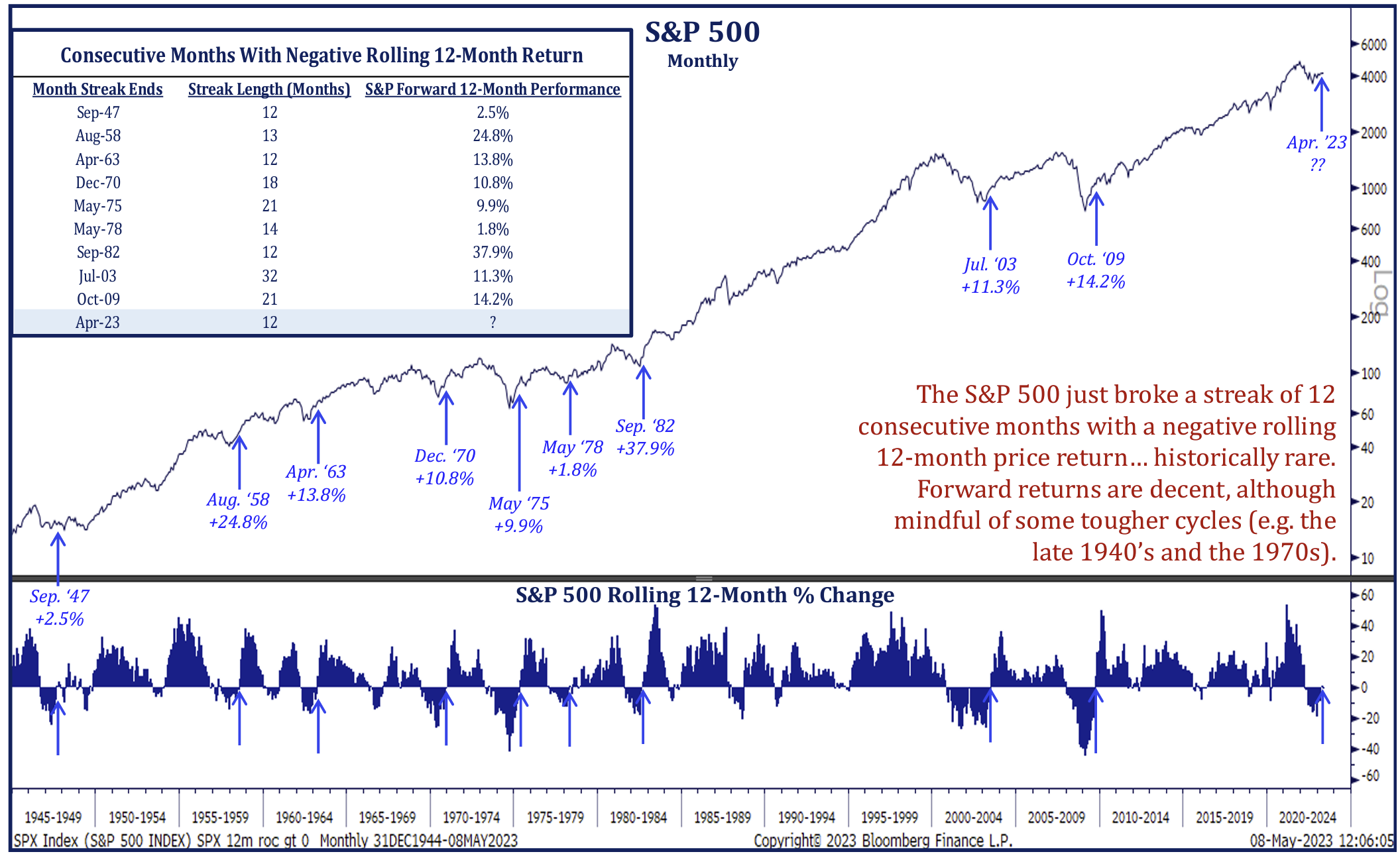

Dave: Since it’s hard to find fundamental justification for a continuation of the S&P’s bounce, here’s one anecdote in favor of stocks

Source: Strategas as of 05.15.2023

Source: Strategas as of 05.15.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2305-24.