Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

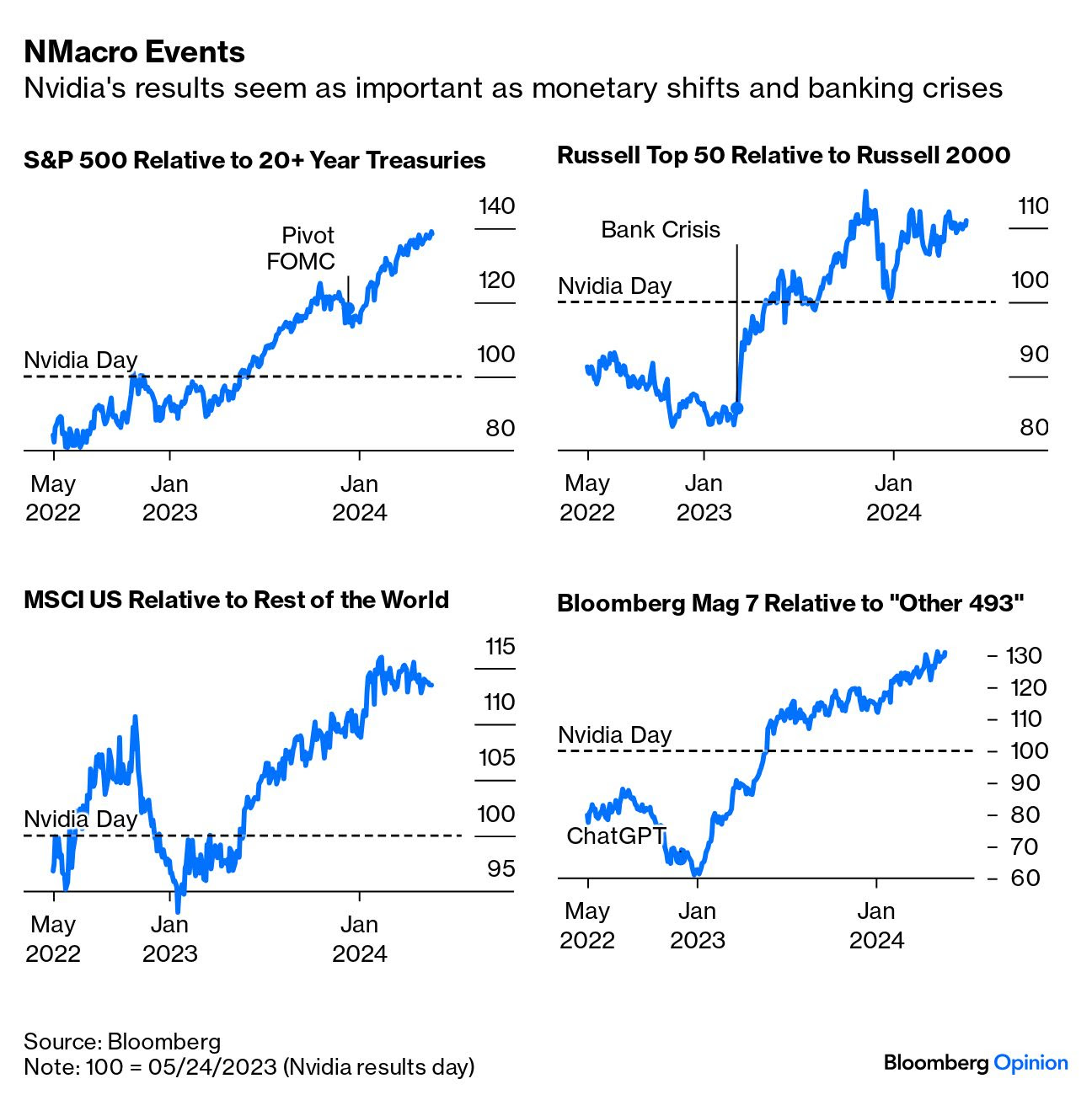

Beckham: It’s been a year since “NVDA Day” when stocks broke out of their SIVB-driven funk and turned their eyes toward artificial intelligence

Data as of 05.21.2024

Data as of 05.21.2024

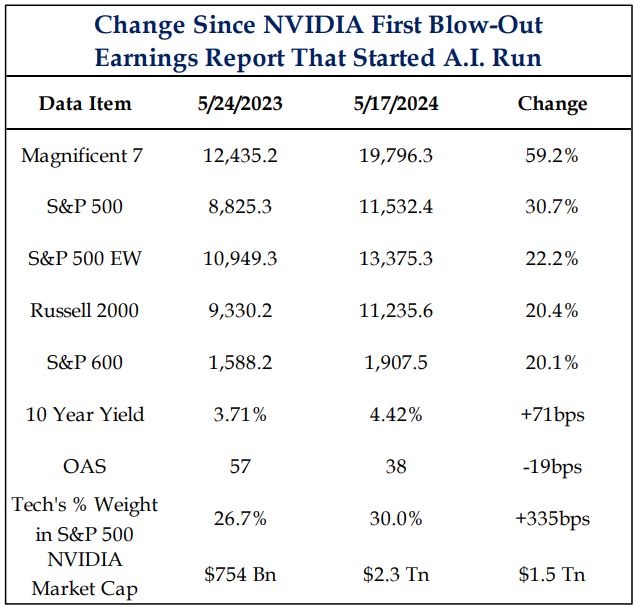

Dave: and the shift has led to big changes from that first mass recognition

Source: Strategas as of 05.20.24

Source: Strategas as of 05.20.24

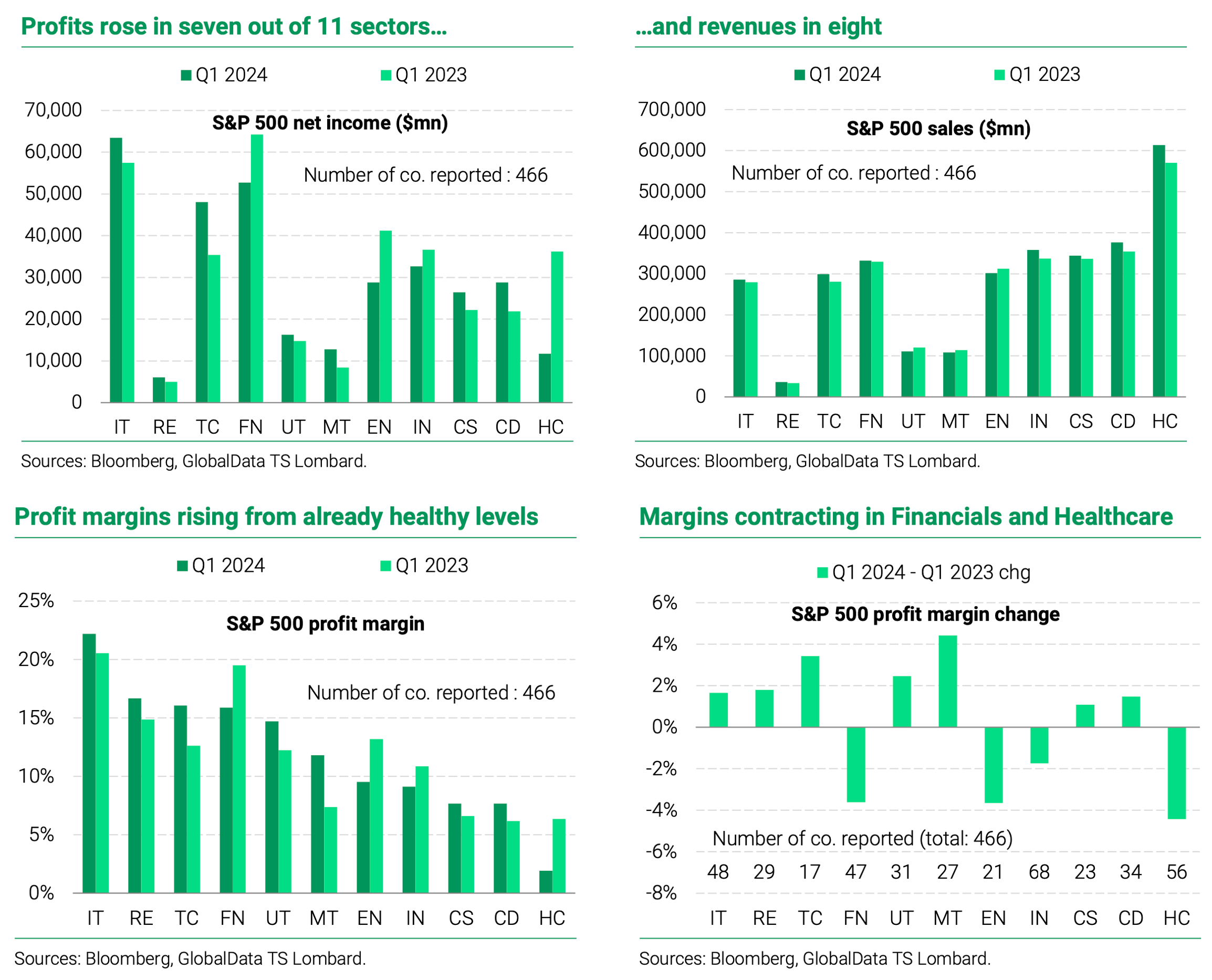

Brett: In general, Q1 earnings were solid for large US companies

Data as of 05.20.2024

Data as of 05.20.2024

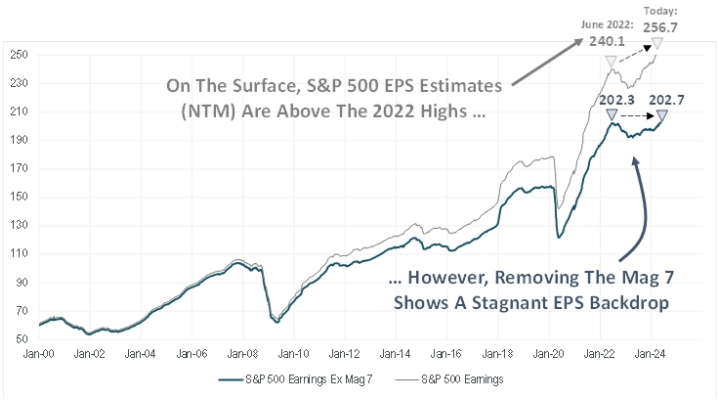

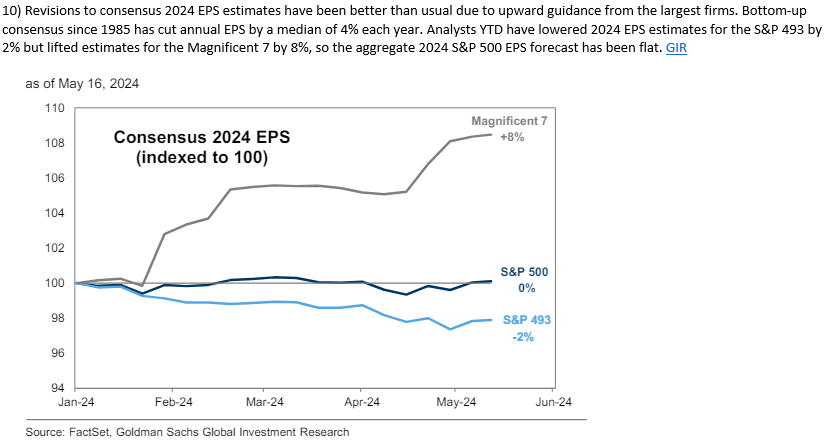

Joseph: with a continued dominance by the large megacap tech companies

Source: Piper Sandler as of 05.20.2024

Source: Piper Sandler as of 05.20.2024

Brad: and no sign yet of a shift to the broader market

Data as of 05.17.2024

Data as of 05.17.2024

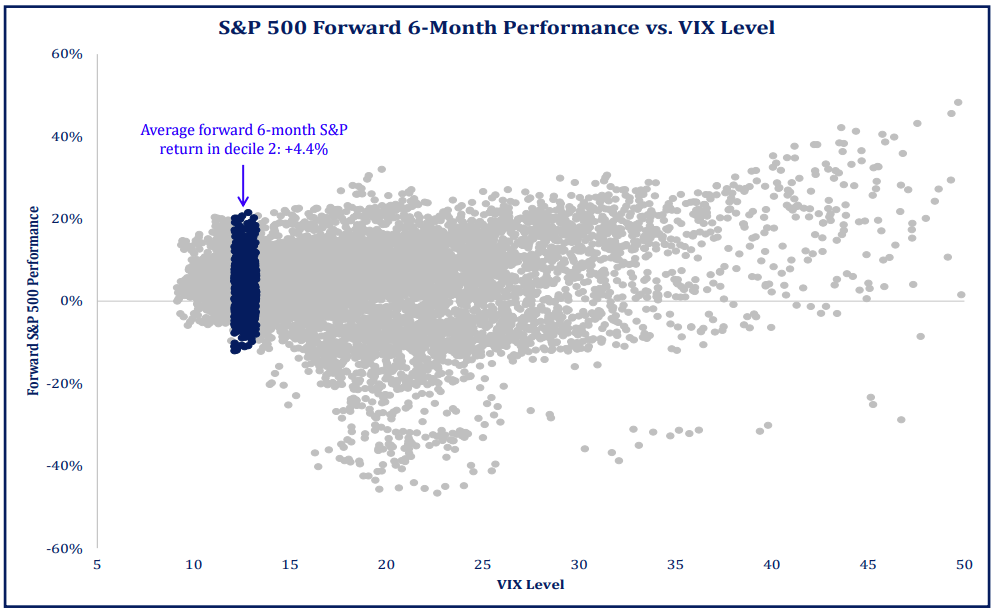

Joseph: Even with mini-spikes like Thursday, VIX readings have fallen into a historically low range that has generally led to a narrow range of slightly positive outcomes

Source: Strategas as of 05.21.2024

Source: Strategas as of 05.21.2024

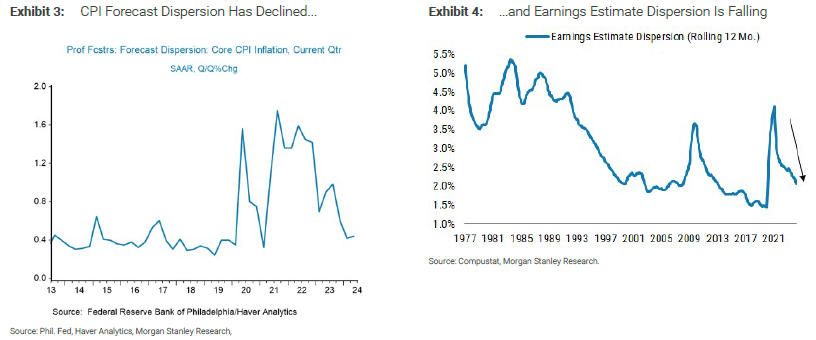

John Luke: partly a result of investors converging towards a common expectation of the outlook for earnings and inflation

Data as of 05.21.2024

Data as of 05.21.2024

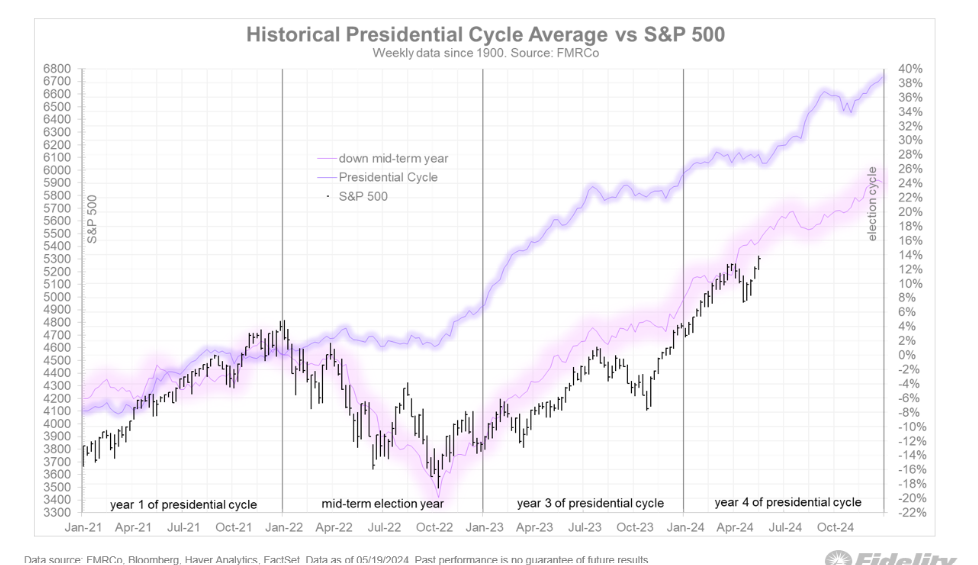

Brett: and stocks have generally moved along with the typical pre-election pattern

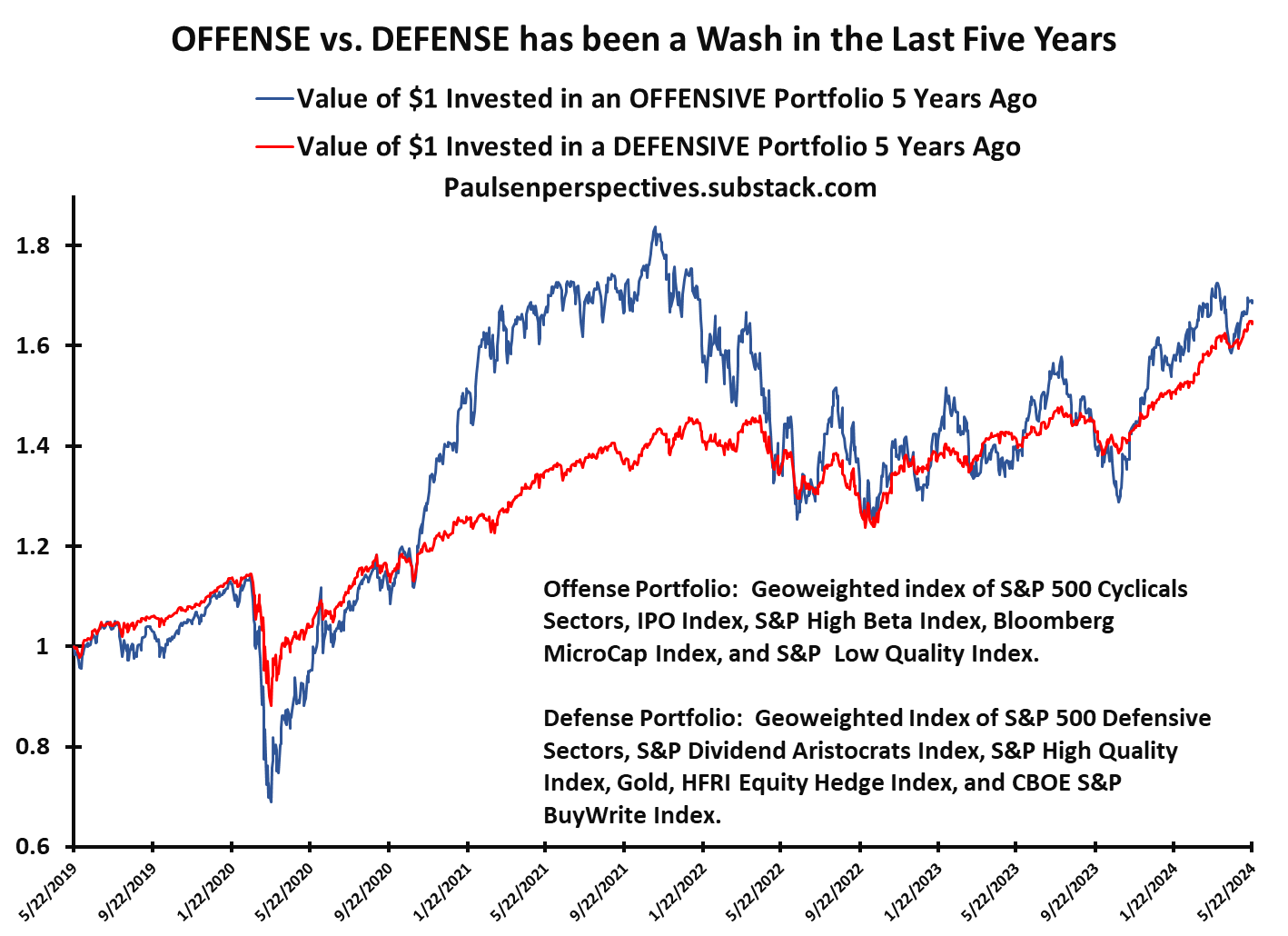

JD: Whether an investor got to this point via tortoise or hare, the 5-year endpoint has been about the same

Source: Paulsen Perspectives as of 05.22.2024

Source: Paulsen Perspectives as of 05.22.2024

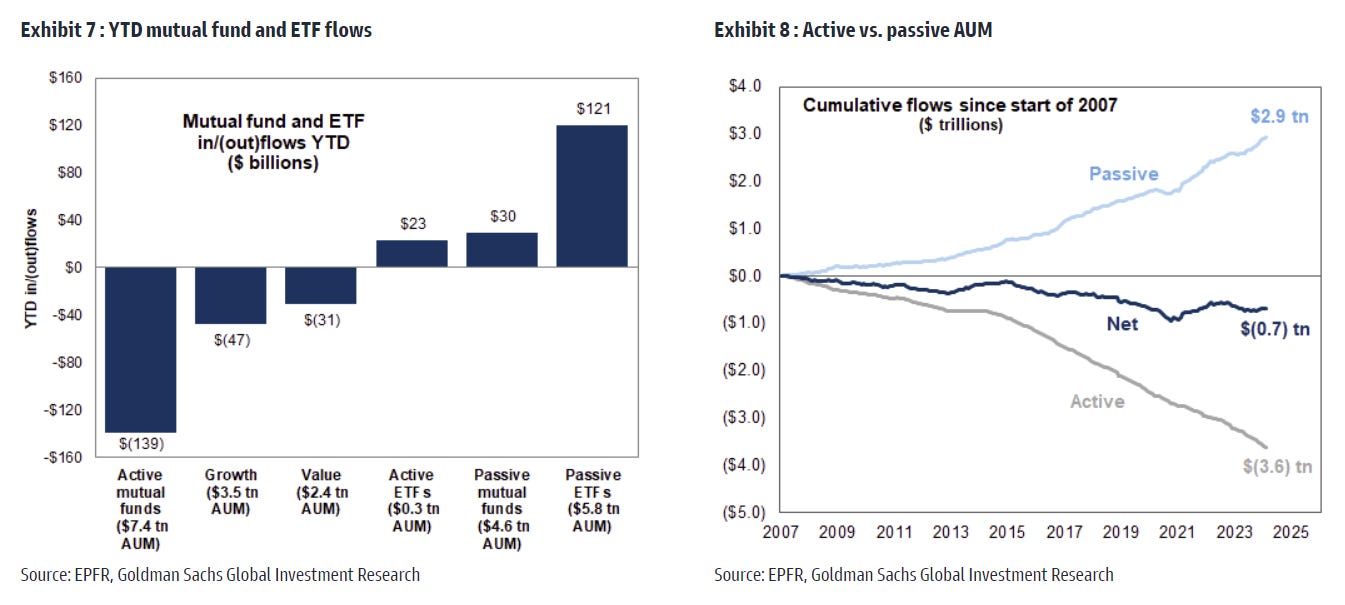

Arch: with investors moving from mutual funds to ETFs, and from active to passive

Source: Sandbox Daily as of 05.20.2024

Source: Sandbox Daily as of 05.20.2024

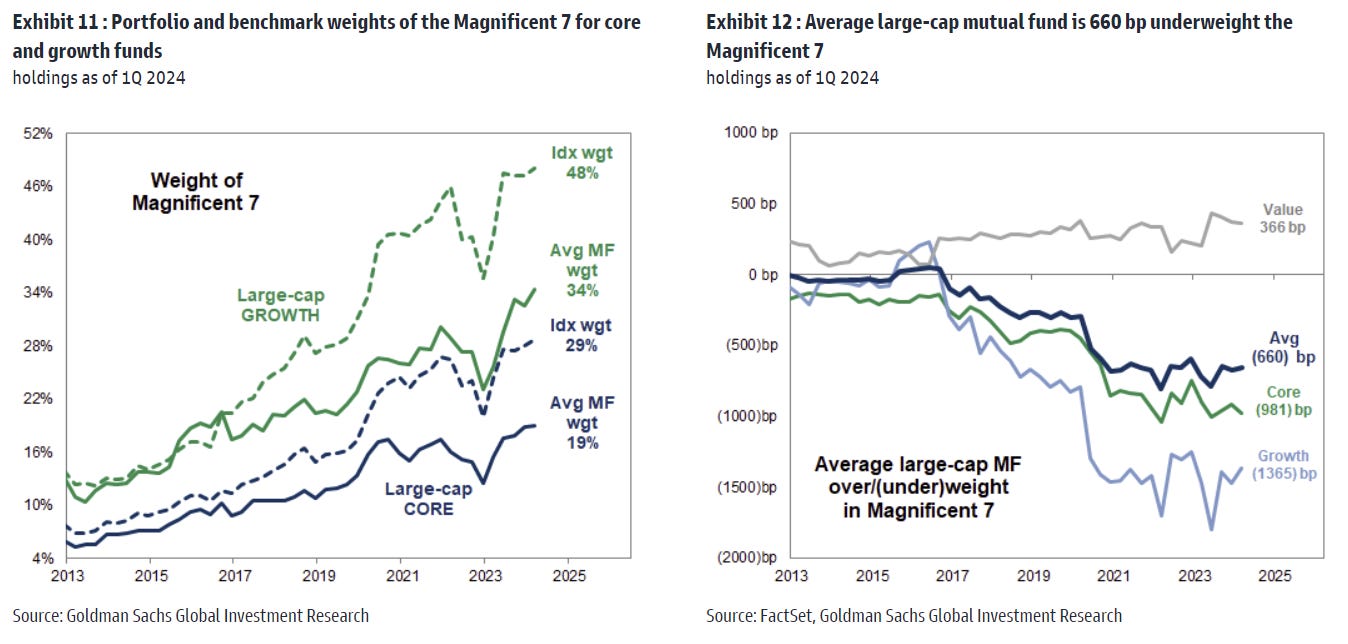

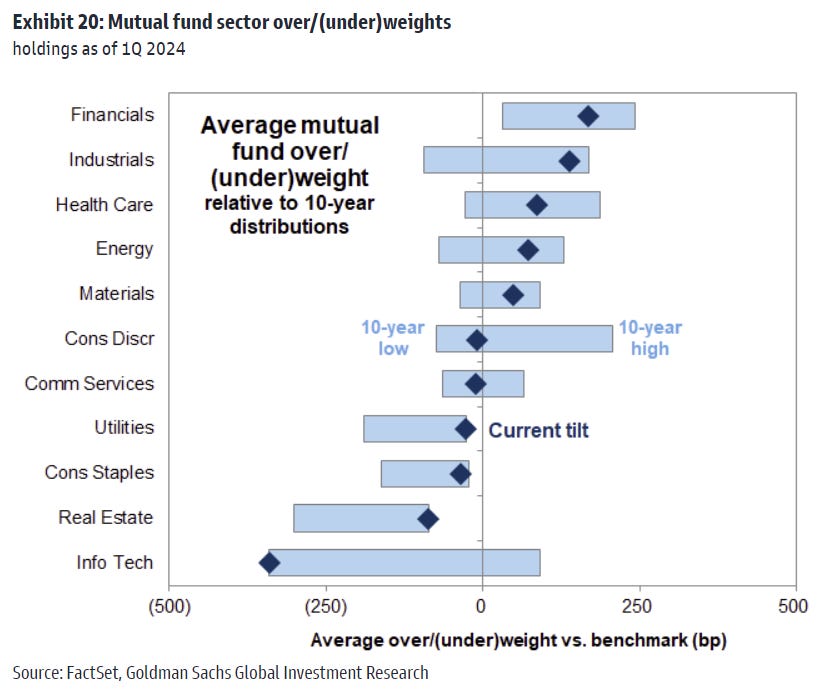

Arch: and active managers betting that markets will broaden out beyond the Mag 7

Sandbox Daily as of 05.20.2024

Sandbox Daily as of 05.20.2024

Brad: It doesn’t feel like it, but active funds are generally not the ones benefitting from the big tech run

Data as of 05.17.2024

Data as of 05.17.2024

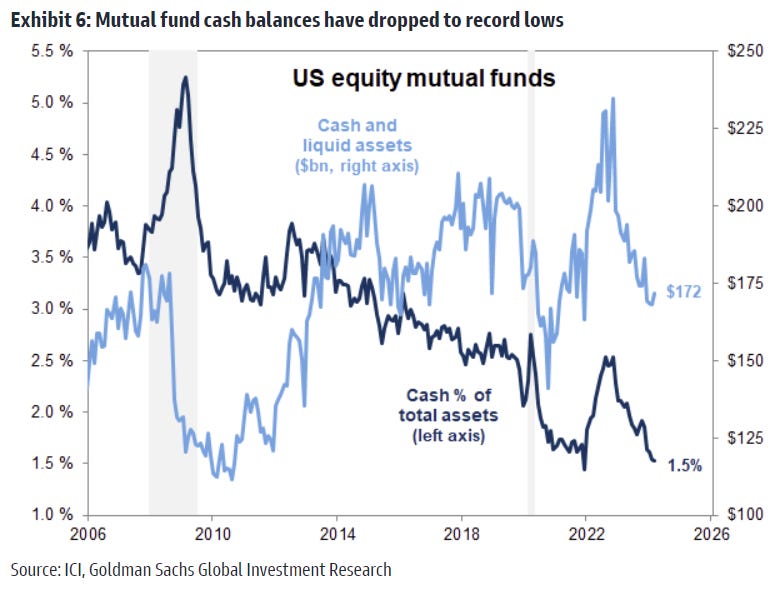

Joseph: but there has been a general trend to stay fully invested instead of holding cash

Data as of 05.17.2024

Data as of 05.17.2024

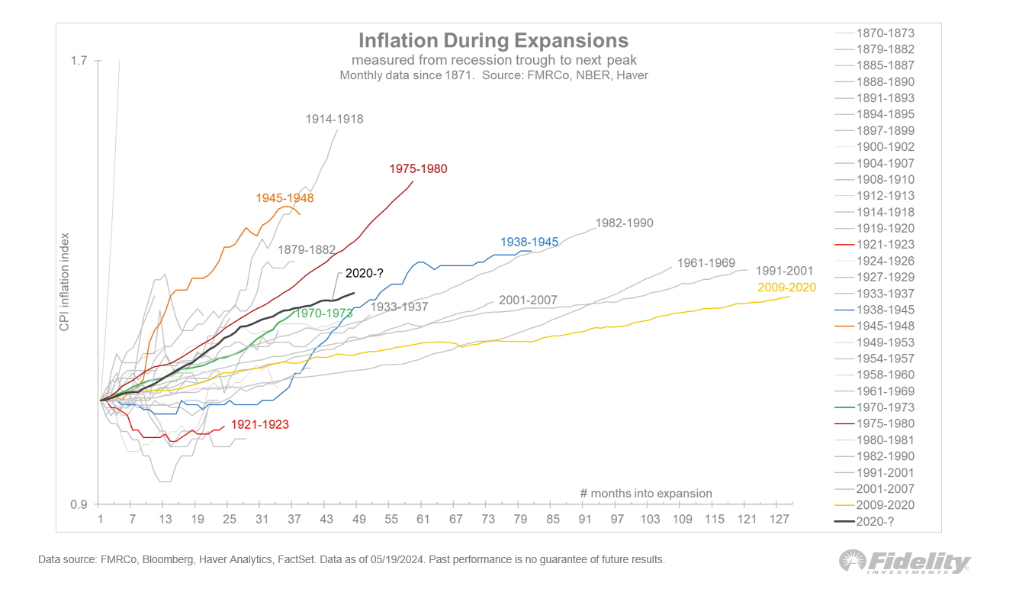

John Luke: This inflation cycle is running hotter than the ones in the recent past

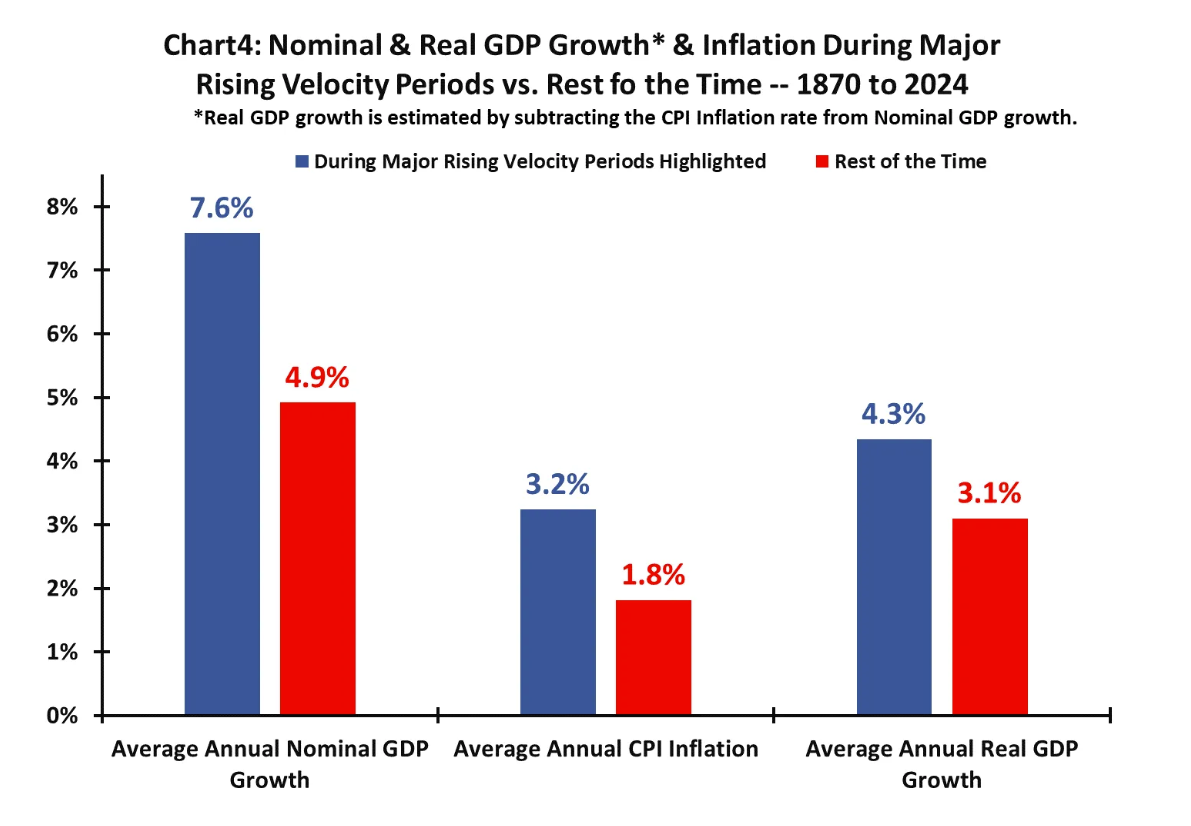

Dave: and higher inflation has historically been accompanied by higher GDP, even when measured in real terms

Source: Paulsen Perspectives as of 05.20.2024

Source: Paulsen Perspectives as of 05.20.2024

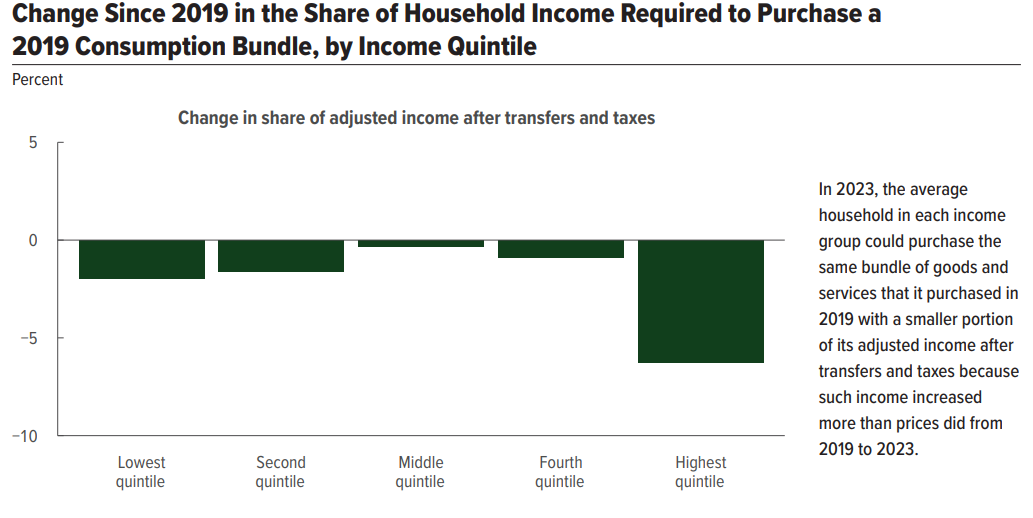

Joseph: and has had little effect on consumers, especially at the higher end of the income scale

Source: A Wealth of Common Sense as of March 2024

Source: A Wealth of Common Sense as of March 2024

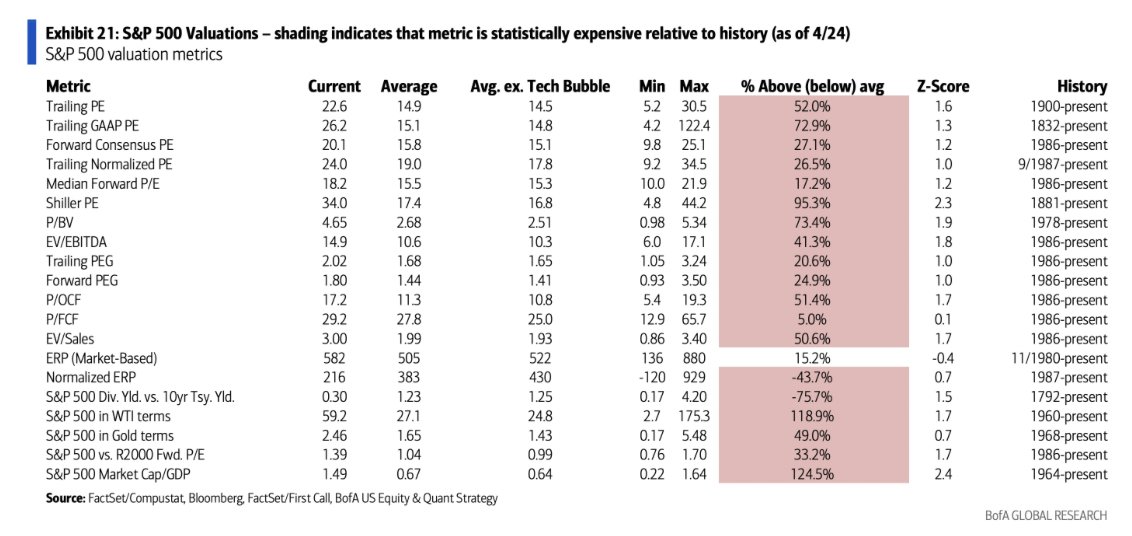

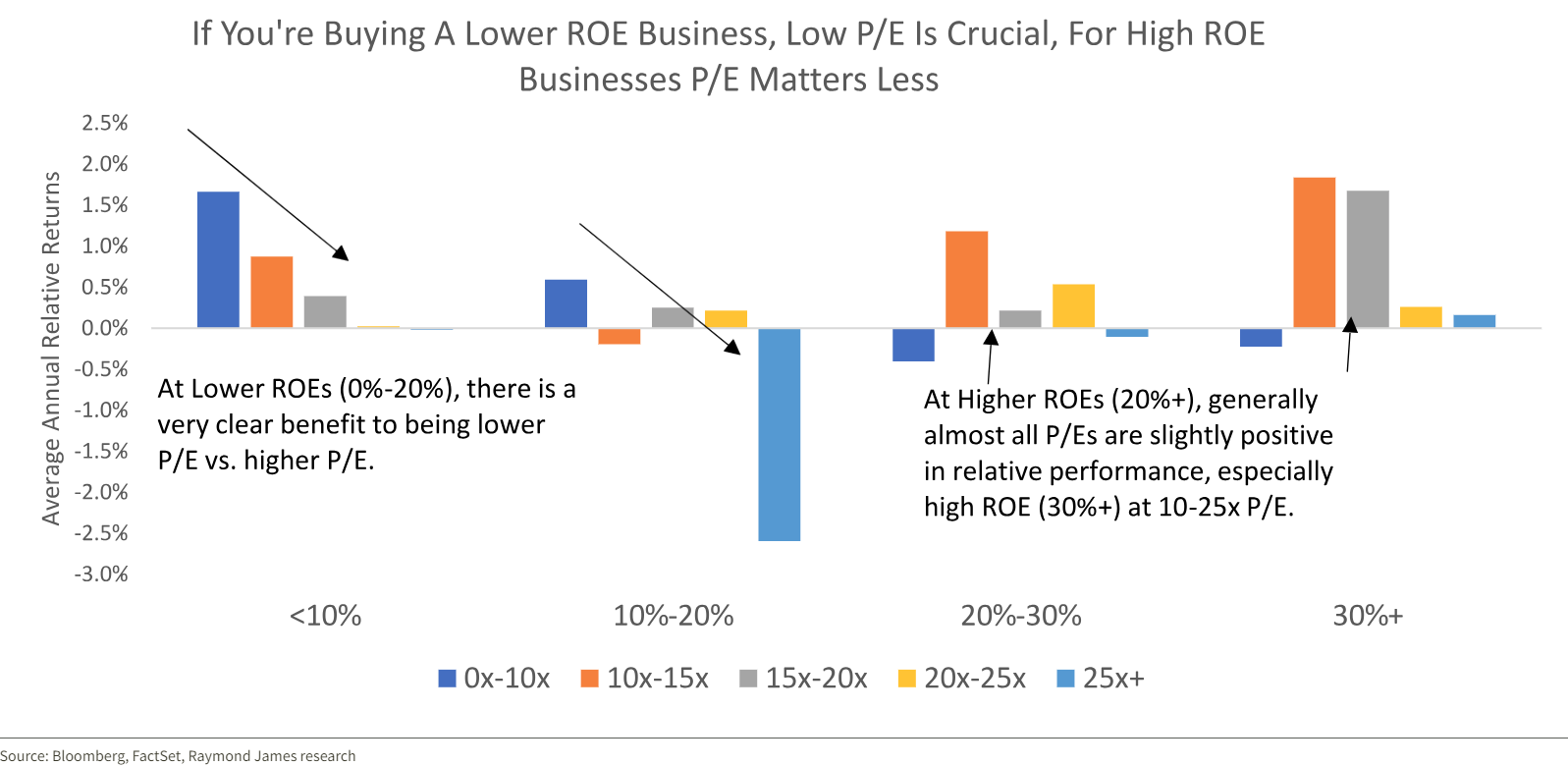

Brad: By most historical measures, the S&P 500 as a whole is very expensive

Joseph: but when you consider the more efficient business models its increasingly “asset-lite” makeup, it makes sense that more profitable businesses will trade above historical norms

Data as of 05.22.2024

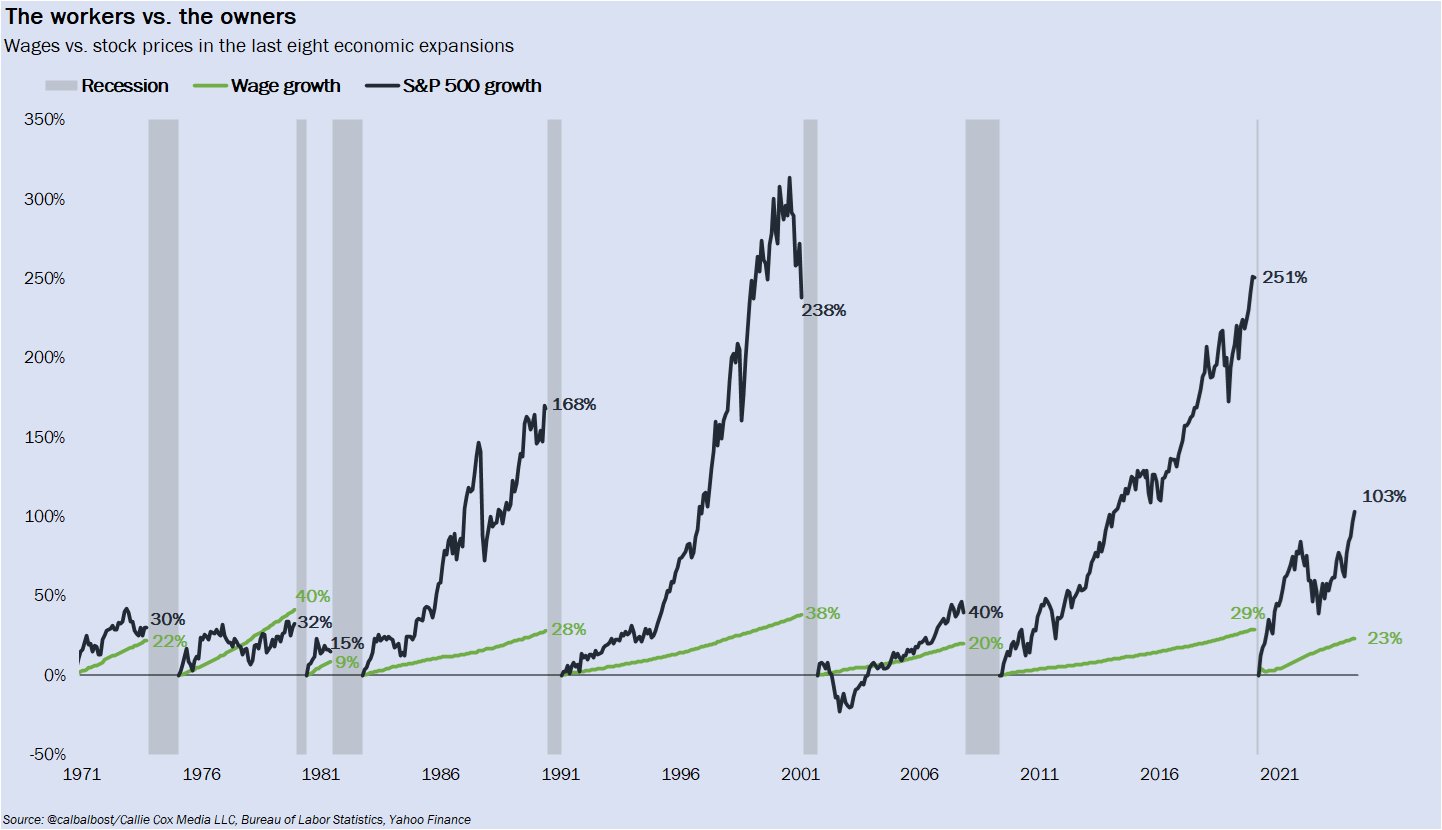

Brett: and long-term, it has paid to participate in ownership not just work for wages!

Data as of April 2024

Data as of April 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2405-21.