Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

John Luke: Market hopes for imminent rate cuts continue to be dashed

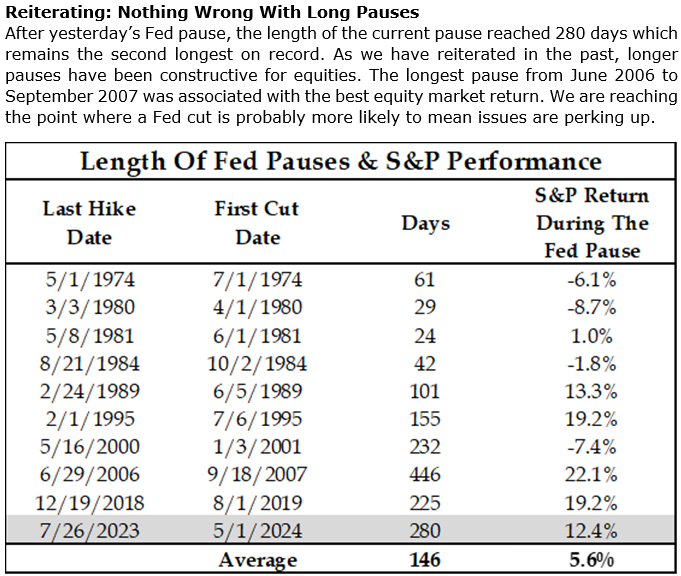

Brad: but historically a Fed “pause” has been just fine for stocks

Source: Strategas as of 05.01.2024

Source: Strategas as of 05.01.2024

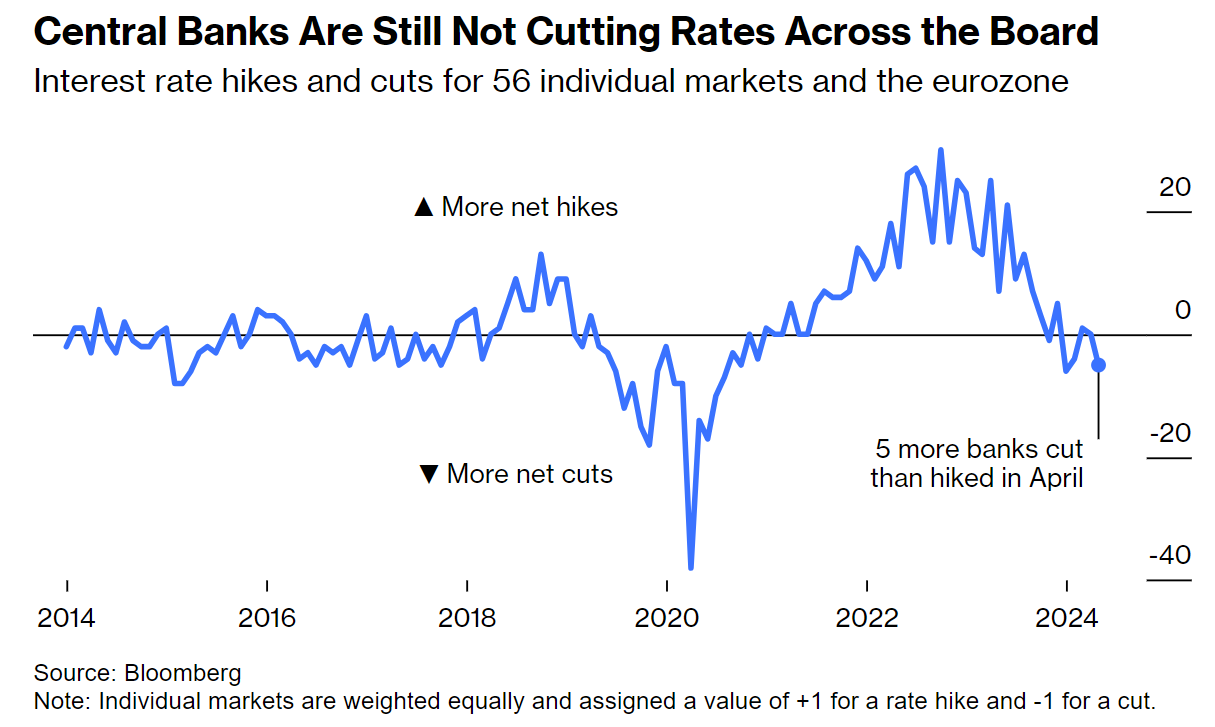

Brett: and rate policy around the world is a mixed bag

Data as of 05.01.2024

Data as of 05.01.2024

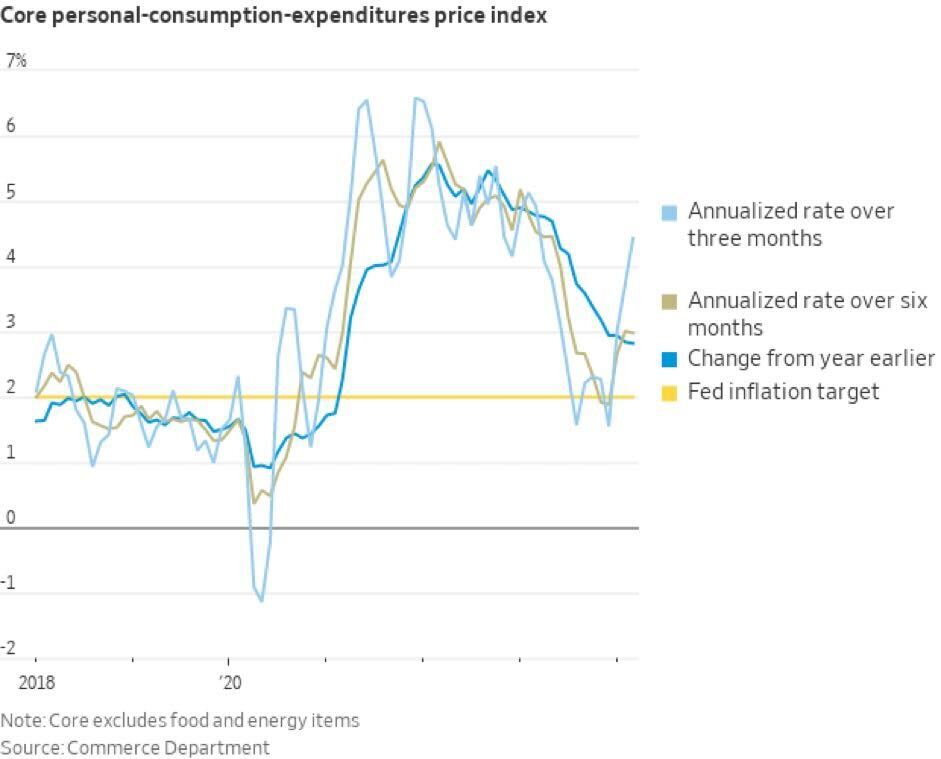

John Luke: The dilemma the Fed faces is that the Core Personal Consumption Expenditures (PCE) index is re-accelerating after a flat period

Source: WSJ as of 04.26.2024

Source: WSJ as of 04.26.2024

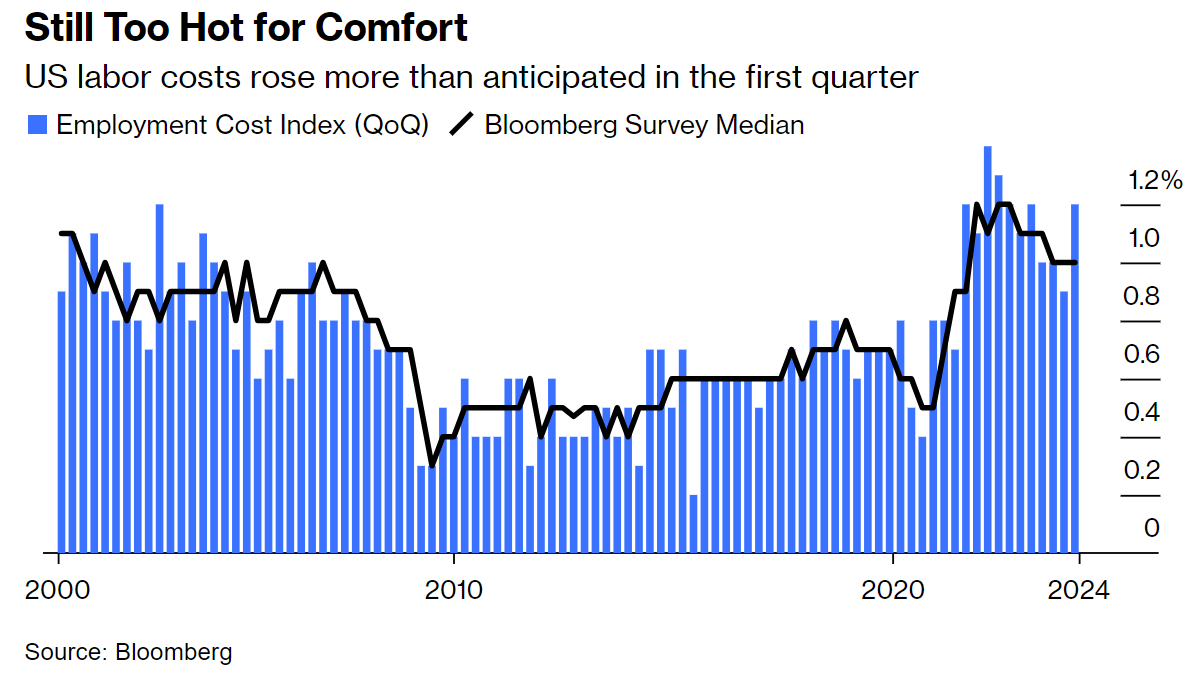

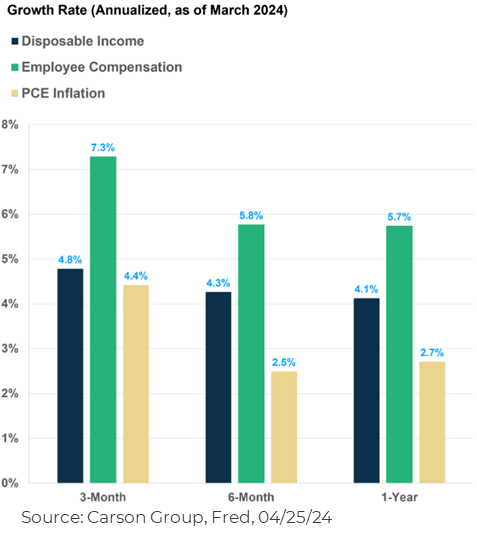

Beckham: with labor costs standing out as persistently strong

Data as of April 2024

Data as of April 2024

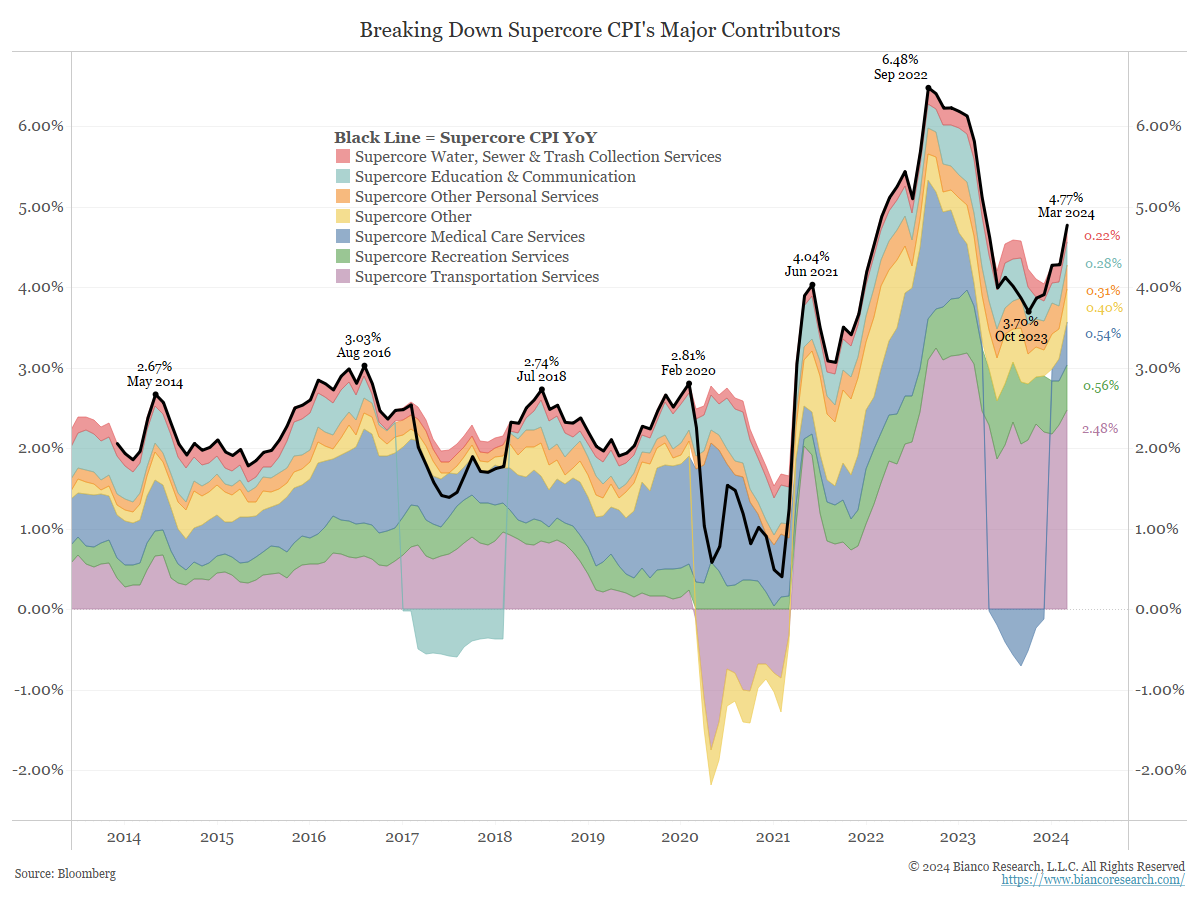

John Luke: and services costs staying high in general

Data as of April 2024

Data as of April 2024

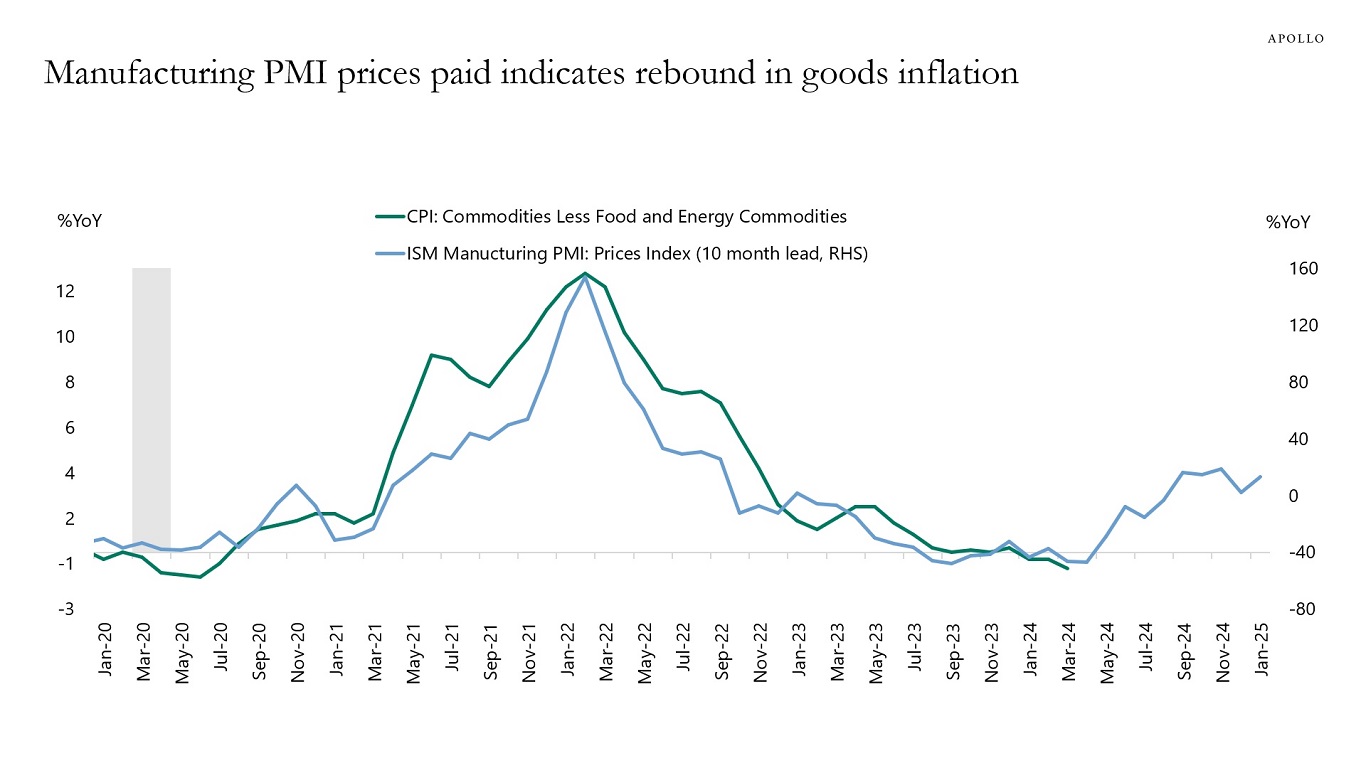

Brett: so what happens if the cost of goods resumes its earlier rise?

Source: Apollo as of 04.29.2024

Source: Apollo as of 04.29.2024

Dave: If the Fed is hoping for inflation relief from weaker consumer spending, it has no evidence so far

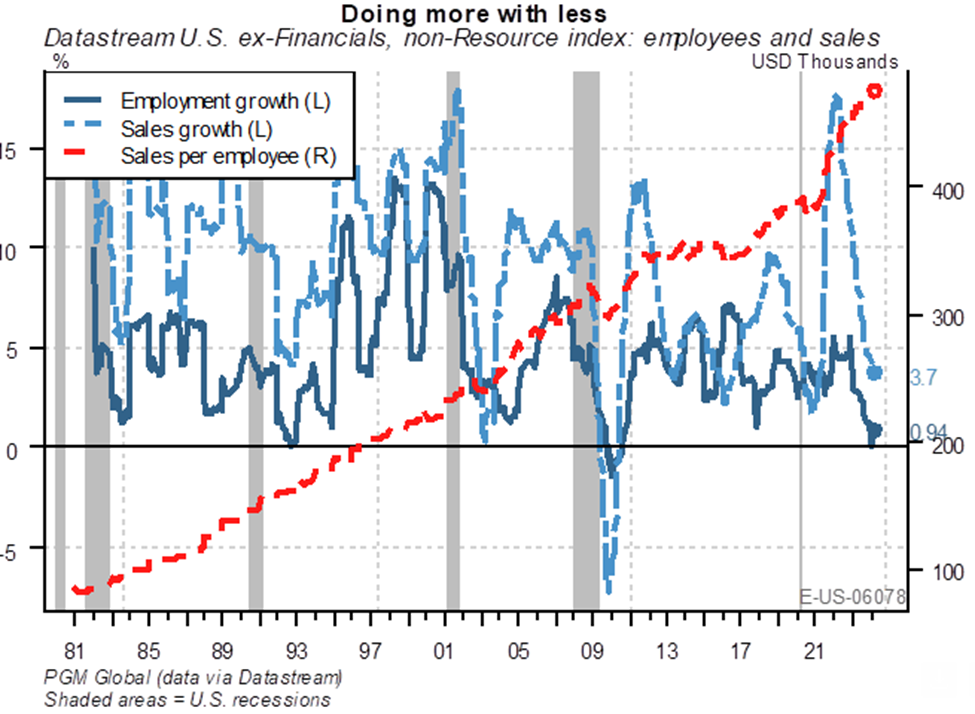

Joseph: but its secret weapon in getting out of this inflation cycle could be rising productivity

Source: PGM as of 04.29.2024

Source: PGM as of 04.29.2024

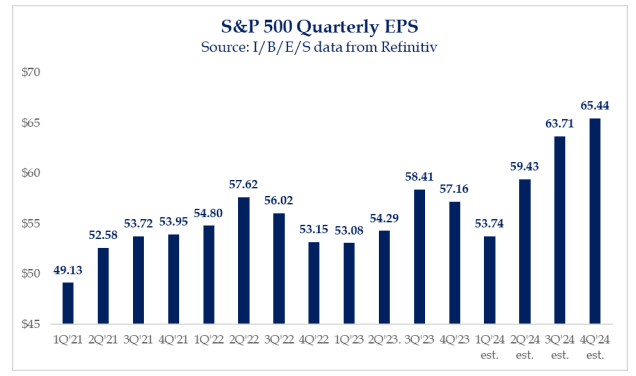

Dave: Earnings projections for 2024 are very back-end loaded

Source: Strategas as of 04.22.2024

Source: Strategas as of 04.22.2024

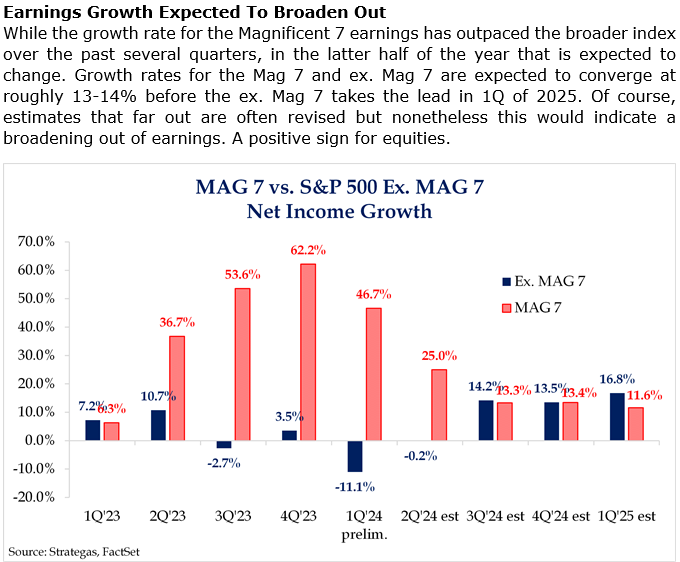

Brad: and until we get thru Q2, very “Mag 7” loaded

Data as of 05.01.2024

Data as of 05.01.2024

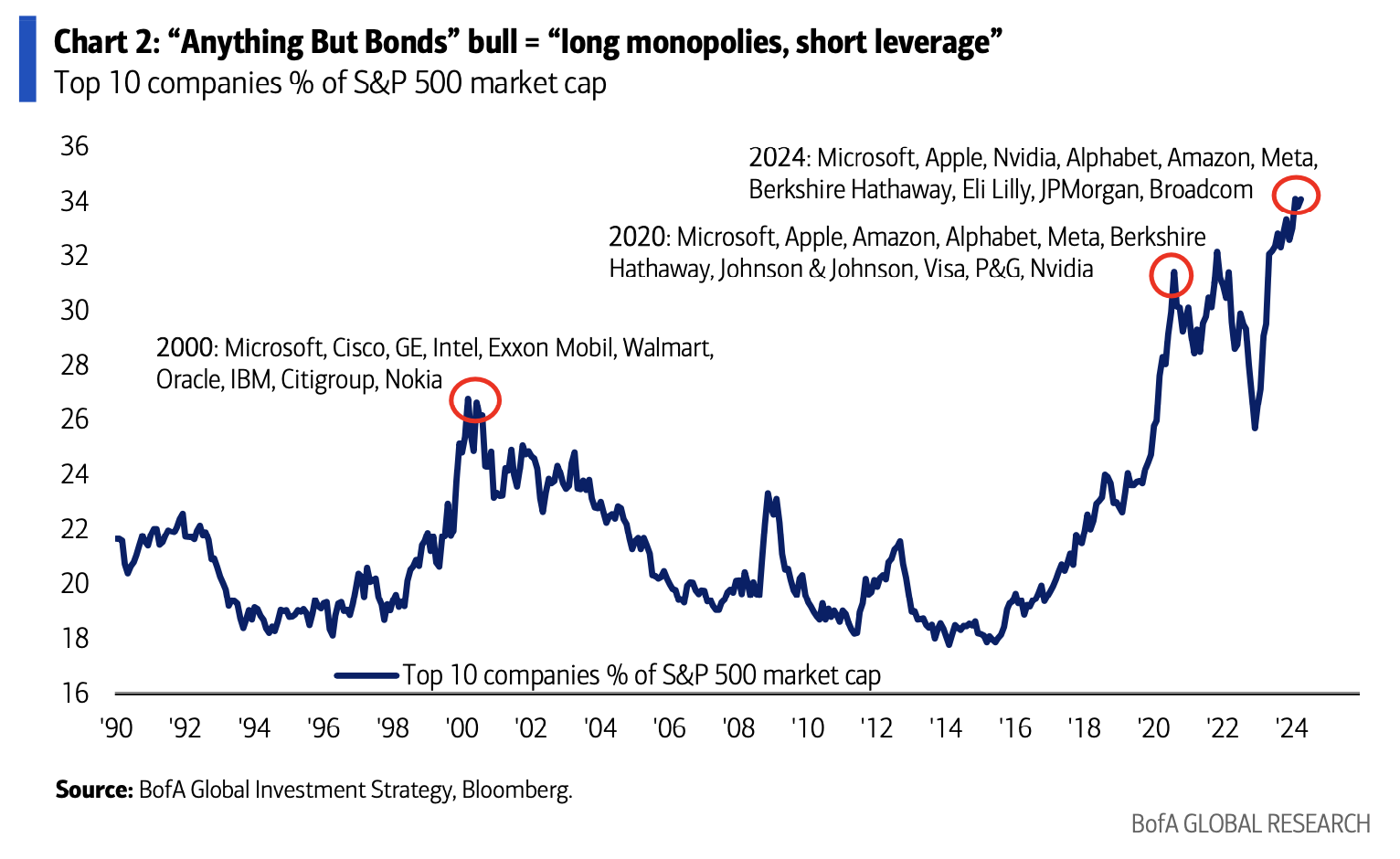

Brian: Speaking of the Mag 7 and beyond, this is as concentrated as we’ve seen it at the top

Data as of April 2024

Data as of April 2024

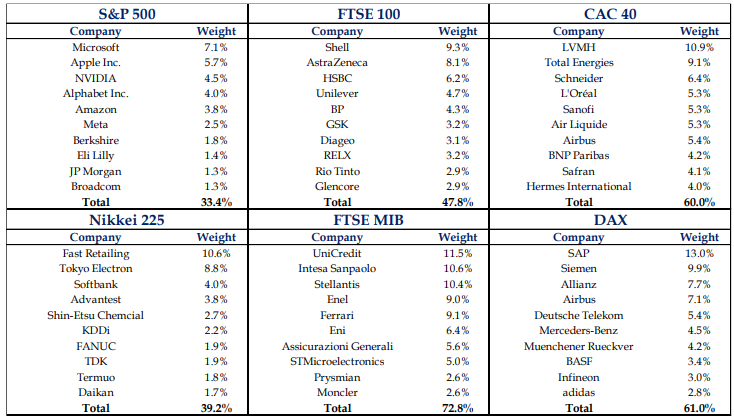

Dave: but other global markets show even more concentration

Source: Strategas as of 04.22.2024

Source: Strategas as of 04.22.2024

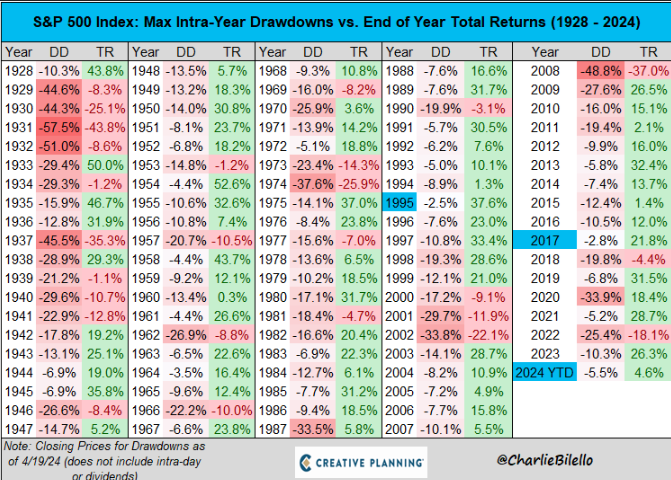

Dave: Your regular reminder that there can be no gain without some (temporary) pain

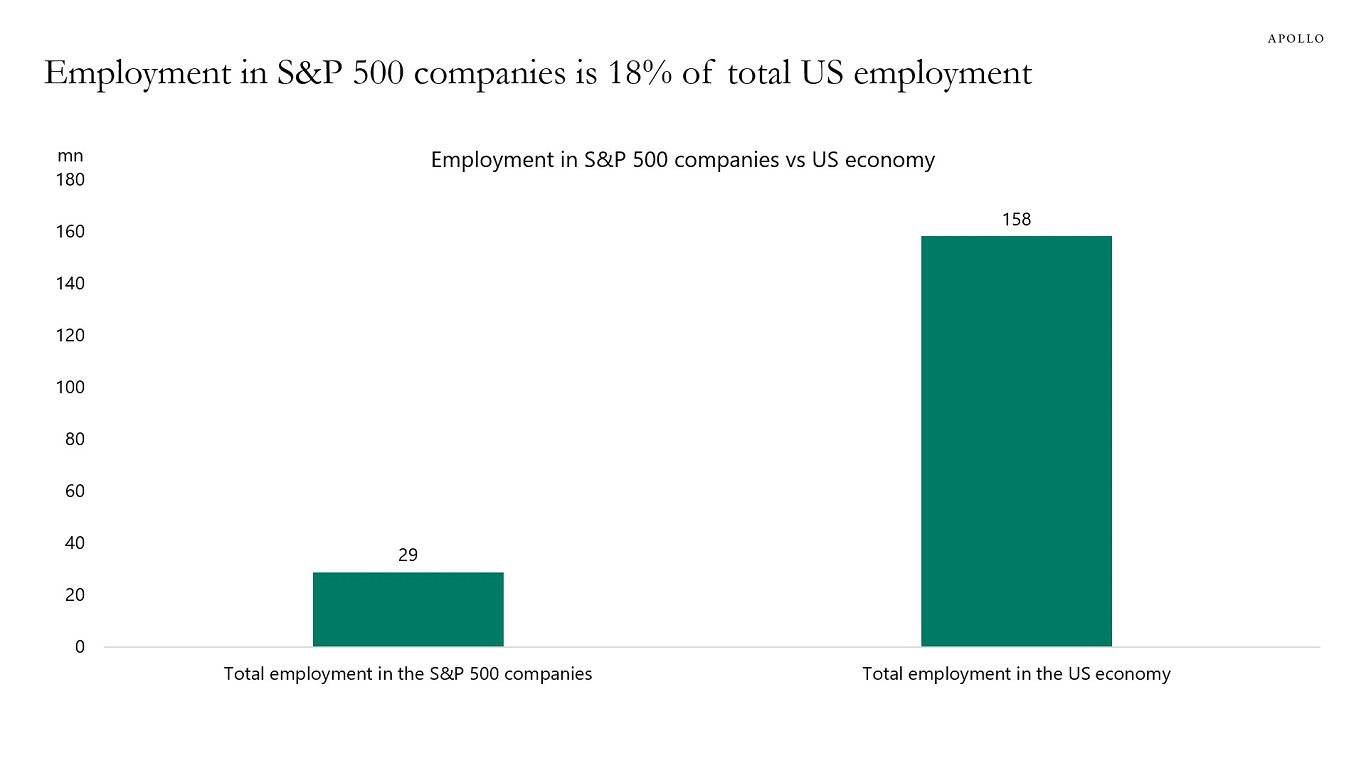

Brad: and while it might feel that way to those watching, the S&P 500 is not the economy

Source: Apollo as of 04.30.2024

Source: Apollo as of 04.30.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2405-7.