Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

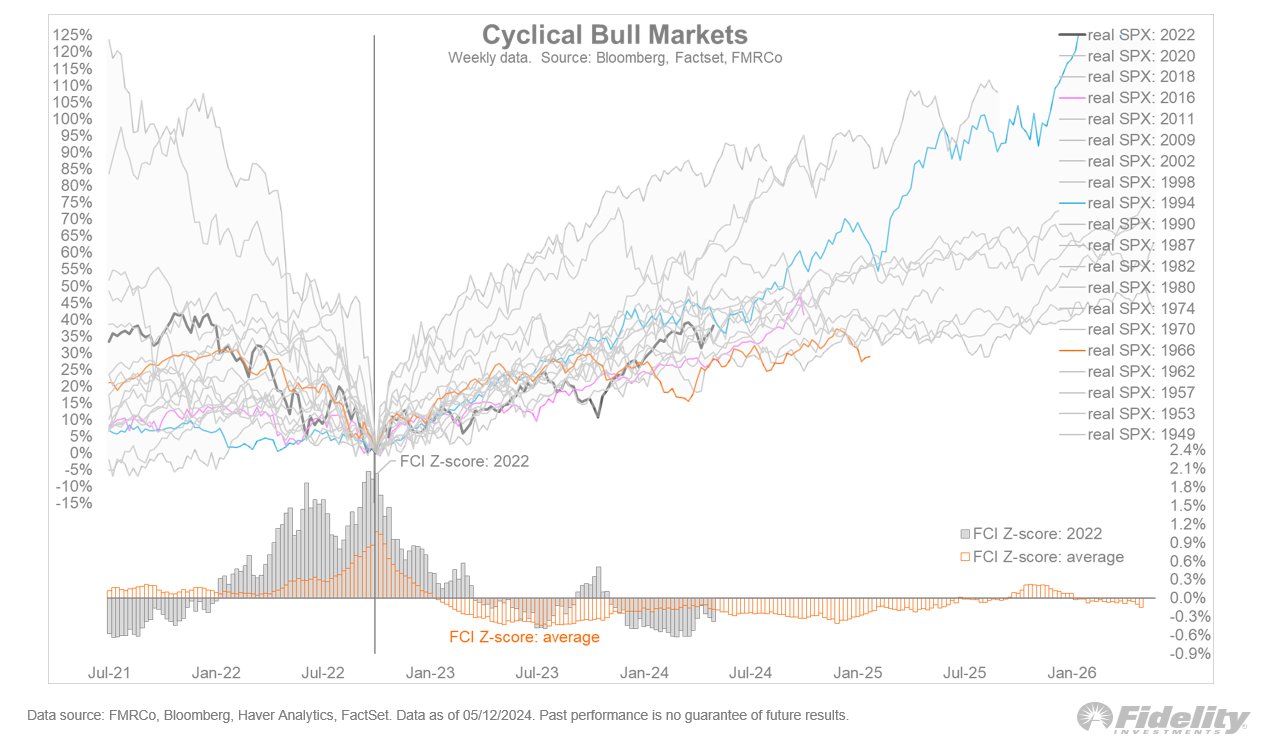

Brian: It’s been a pretty average bull run from the lows of Fall 2022

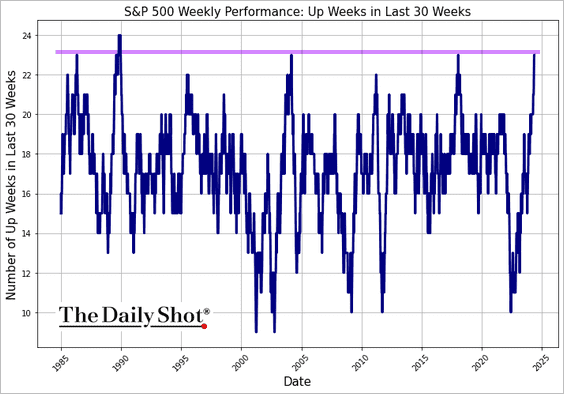

John Luke: but the last 6 months has been historically persistent

Source: Daily Shot as of 05.29.2024

Source: Daily Shot as of 05.29.2024

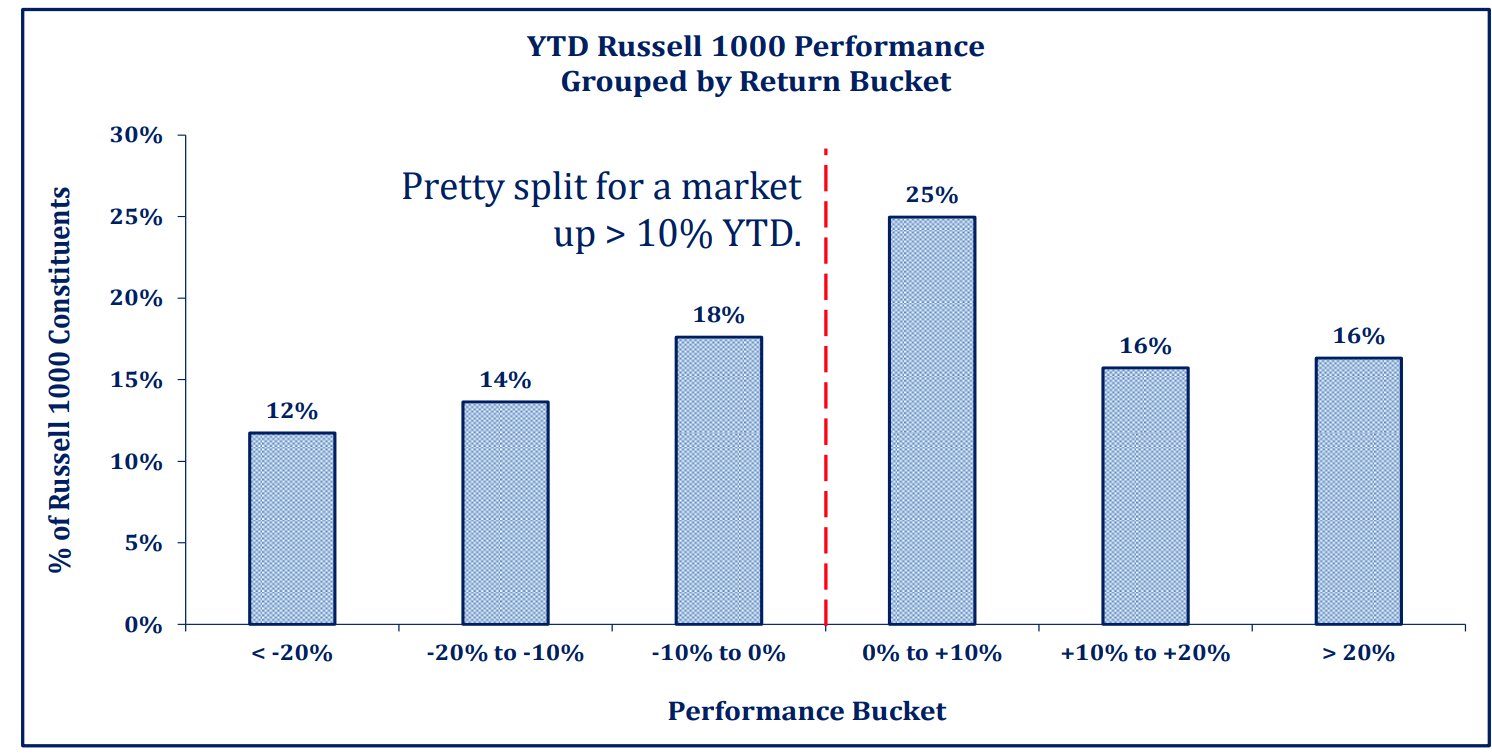

Dave: Despite the great start to 2024 for the S&P 500, nearly half of the large-cap universe is negative for the year

Source: Strategas as of 05.30.2024

Source: Strategas as of 05.30.2024

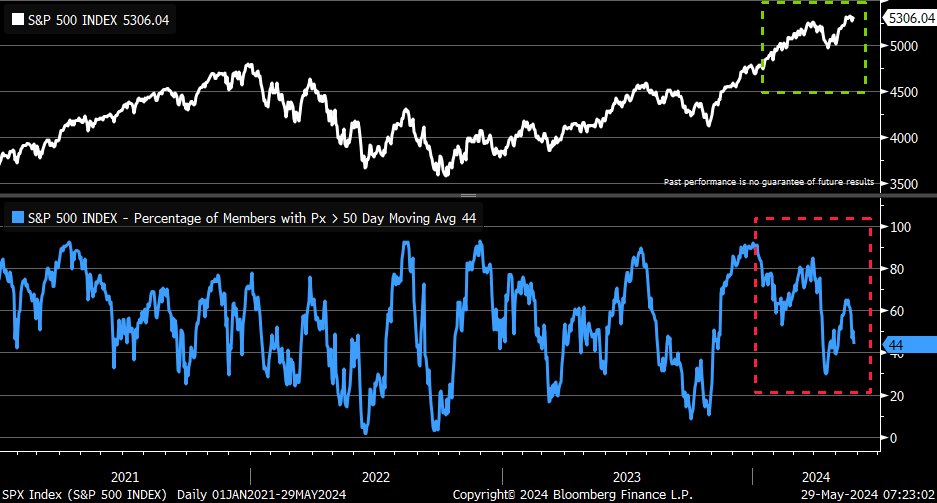

Brett: and weakness in the broader market has accelerated in recent weeks

Source: Schwab as of 05.29.2024

Source: Schwab as of 05.29.2024

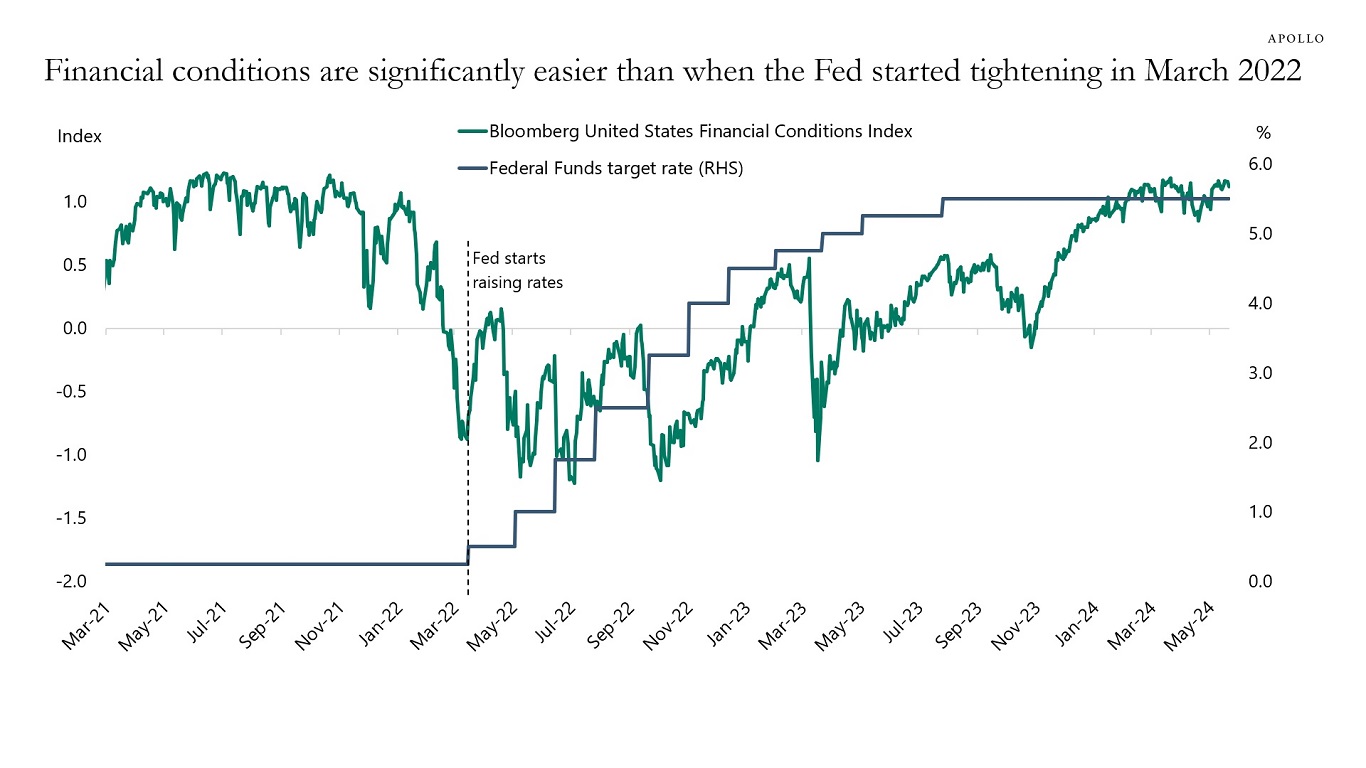

Joseph: Rates haven’t been cut, but we appear to be far removed from tight monetary conditions

Source: Apollo as of 05.29.2024

Source: Apollo as of 05.29.2024

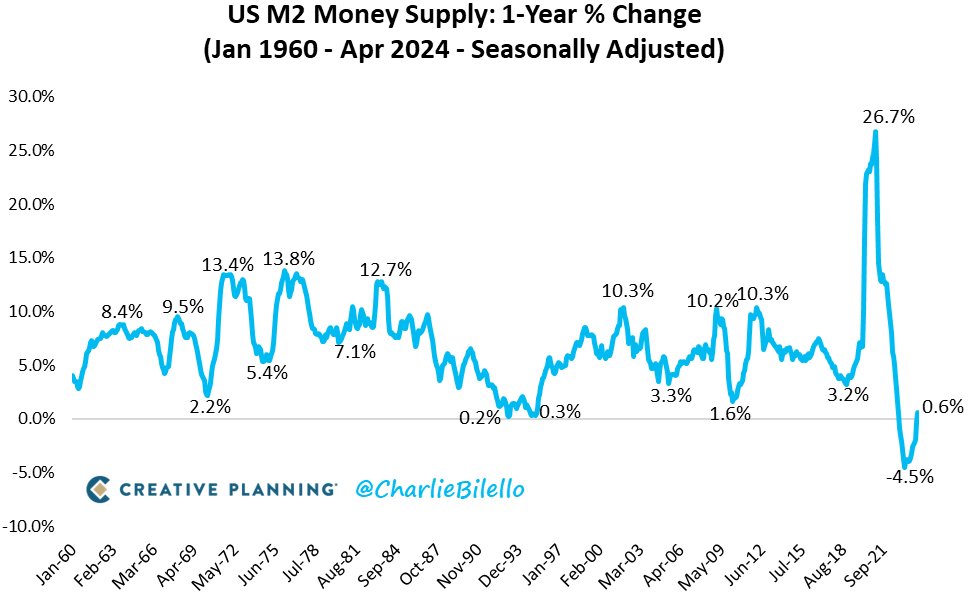

John Luke: with money supply rising again after retracing the massive stimulus of the COVID period

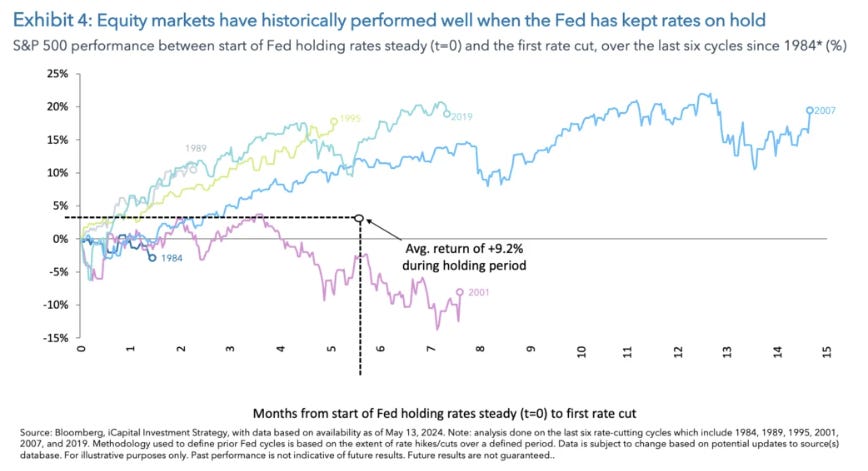

Dave: Even if not cutting rates, stocks have historically fared well during pauses like we’re seeing now

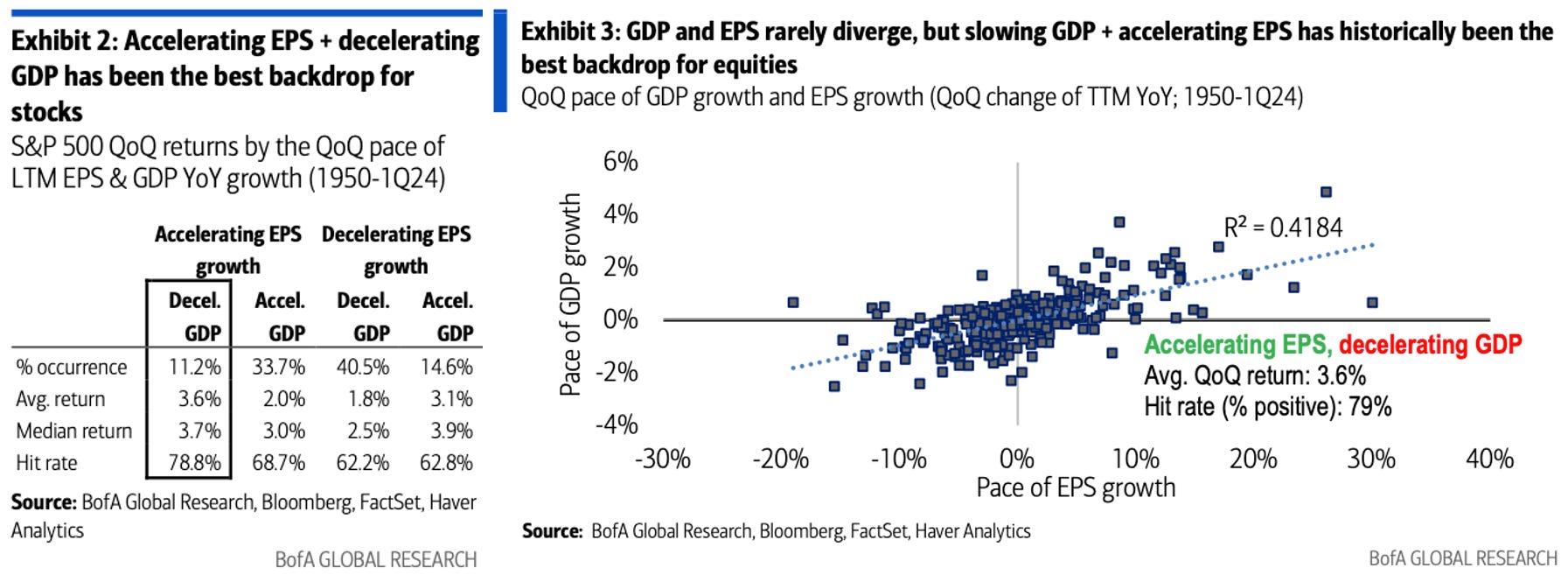

Arch: and the combo of slowing economic growth and rising earnings growth has been a historically positive backdrop

Data as of April 2024

Data as of April 2024

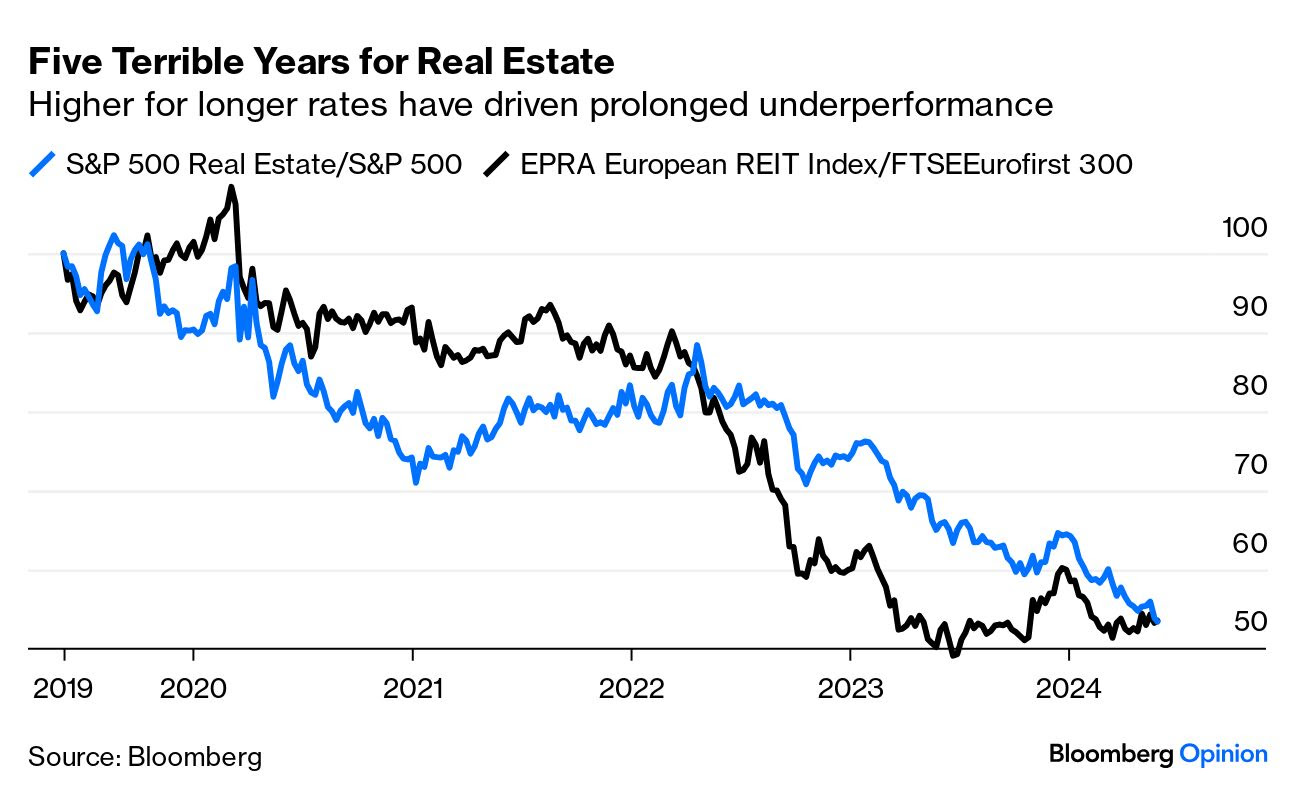

Joseph: One asset that has not fared so well is real estate investment trusts (REITs)

Data as of 05.30.2024

Data as of 05.30.2024

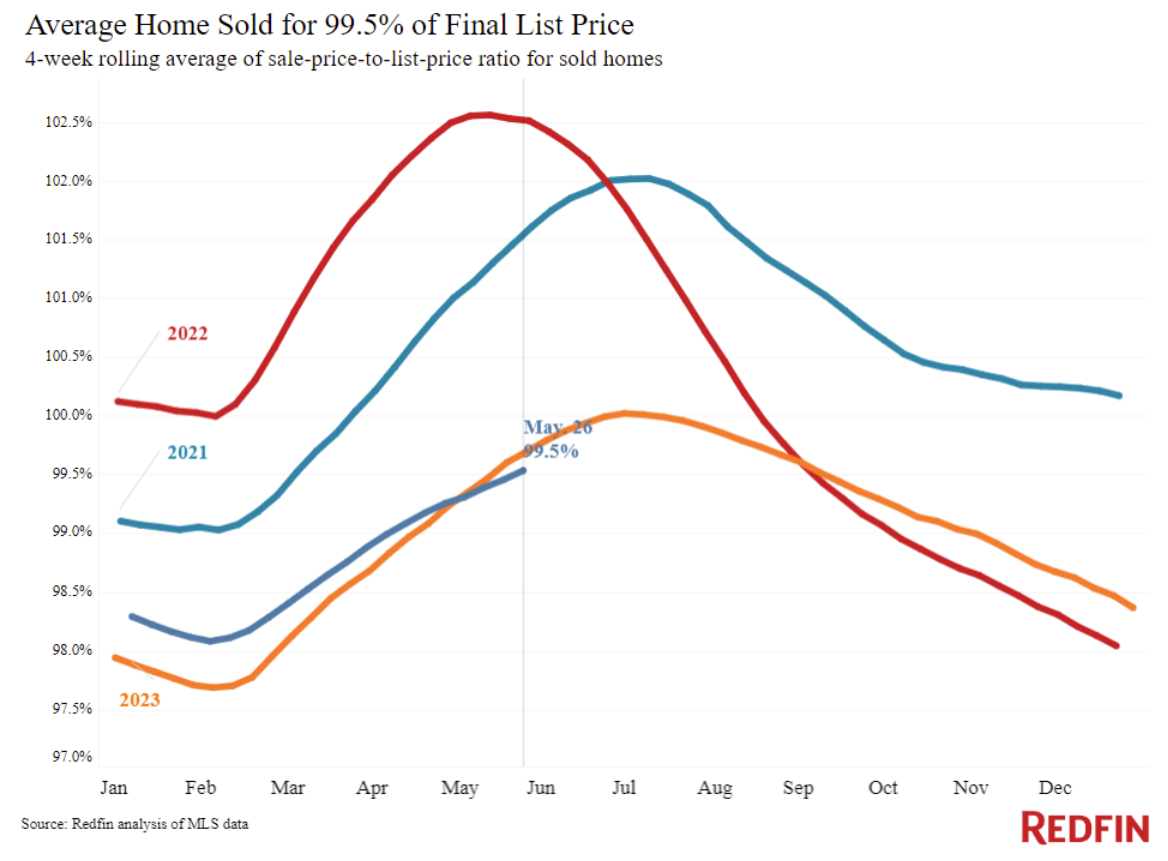

Beckham: and while we’ve not seen home prices suffer a similar fate, we’re seeing the frenzied bidding of 2021-2022 fade

Data as of 05.26.2024

Data as of 05.26.2024

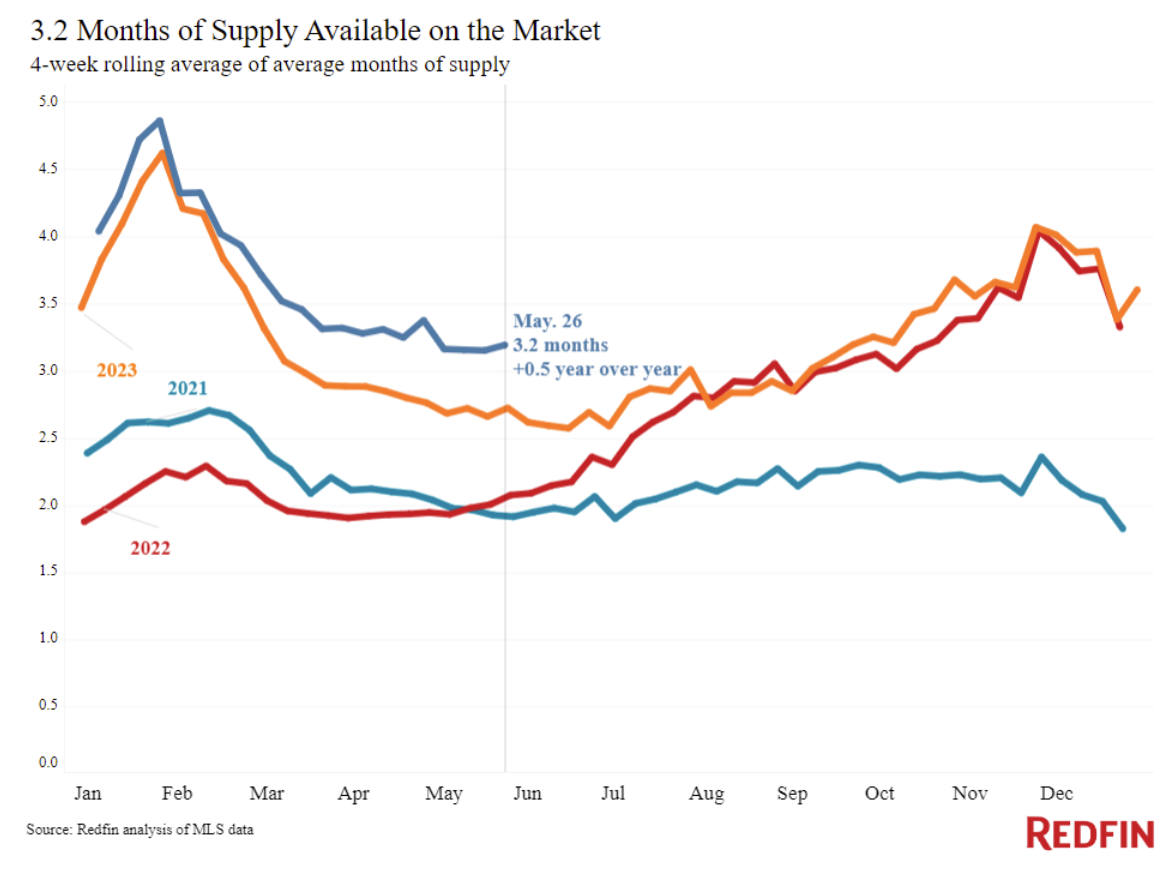

Beckham: and supply is rebuilding a bit from historic lows

Data as of 05.26.2024

Data as of 05.26.2024

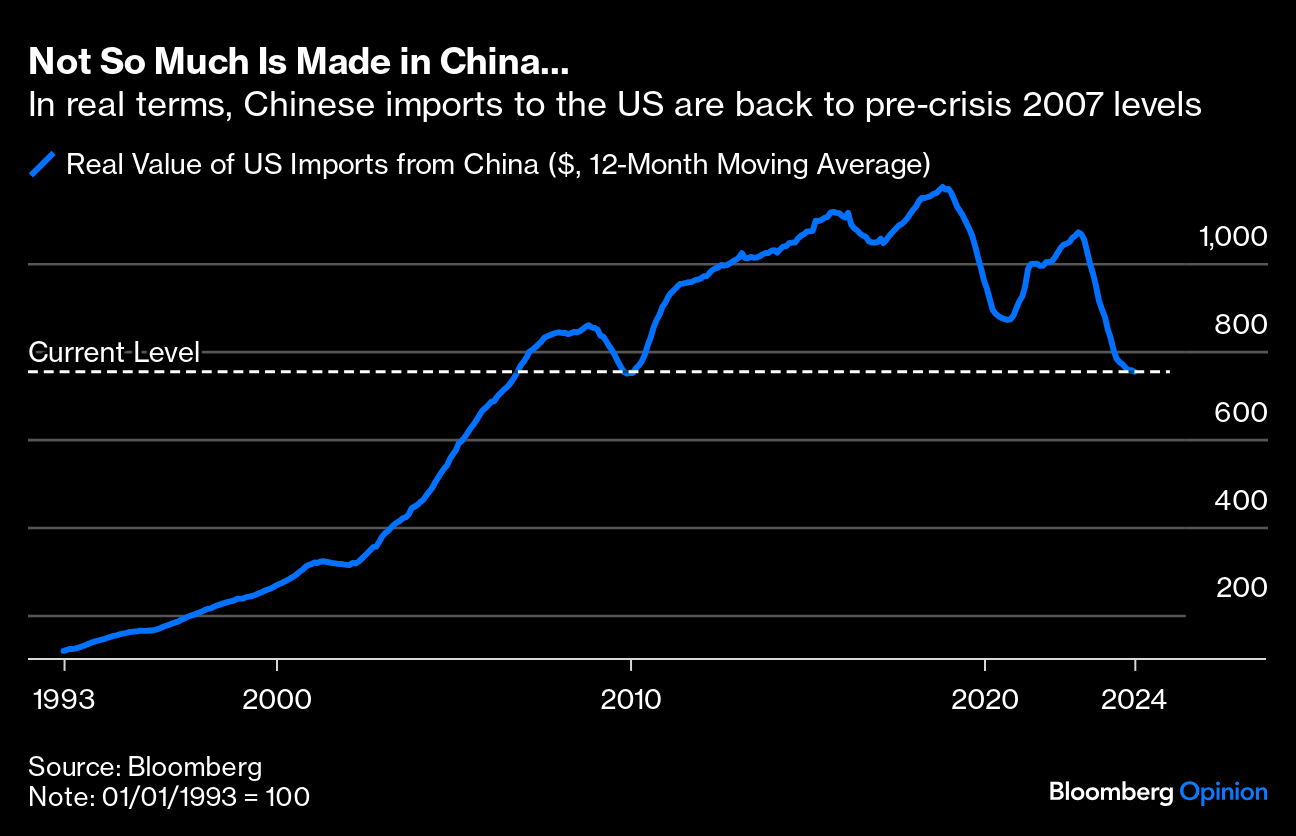

Brett: China is a huge economy, but our reliance on them for imports continues to fall

Data as of 05.13.2024

Data as of 05.13.2024

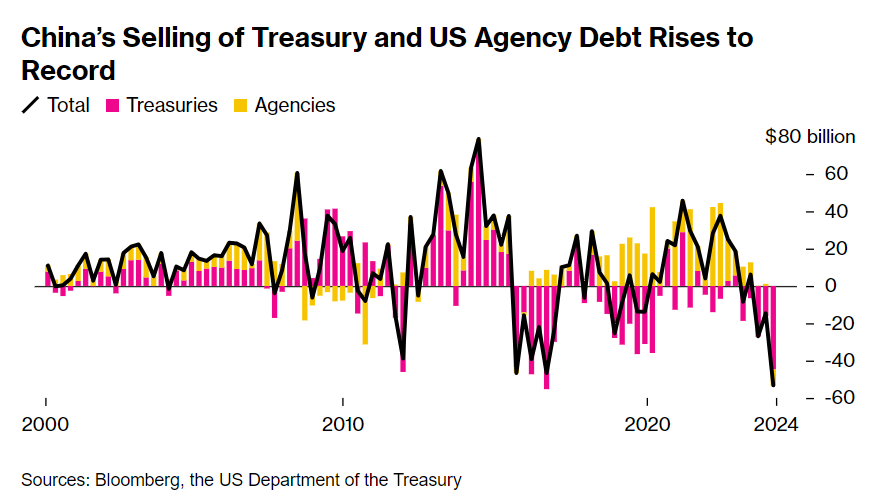

John Luke: but they’re having an impact on the cost of funding for US debt

Data as of 05.16.2024

Data as of 05.16.2024

Arch: with some of those proceeds going to buy gold?

Data as of 05.16.2024

Data as of 05.16.2024

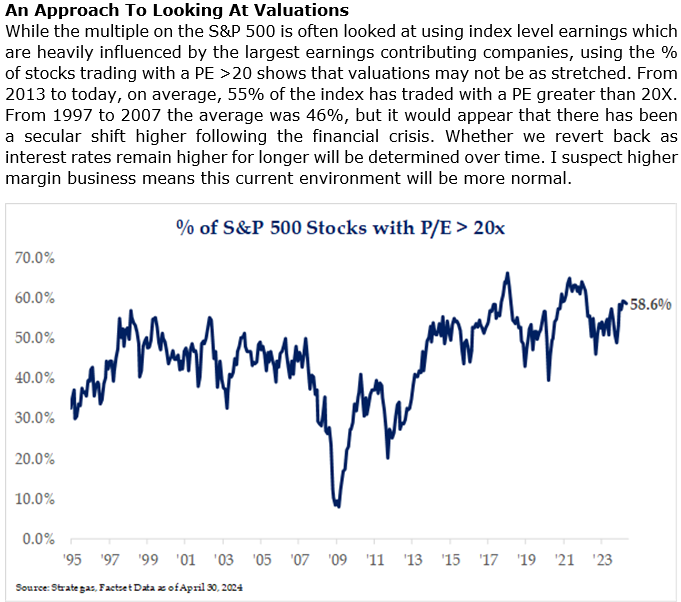

Brad: Valuation is a constant discussion among investors and pundits, perhaps we can gain added perspective through a micro lens vs. macro?

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2405-23.