Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

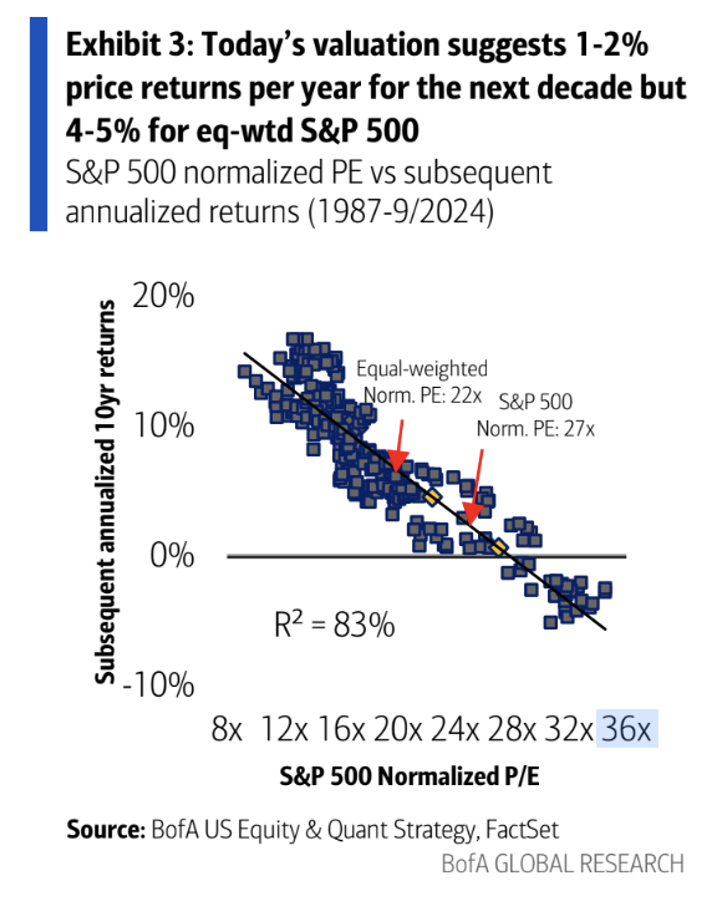

Arch: Are mega-cap valuations a caution signal?

Historically, when the largest stocks are this highly valued, it has often preceded periods of lower returns. Shifting away from market-cap weightings could present opportunities for long-term investors.

Source: BofA ML as of 09.30.2024

Source: BofA ML as of 09.30.2024

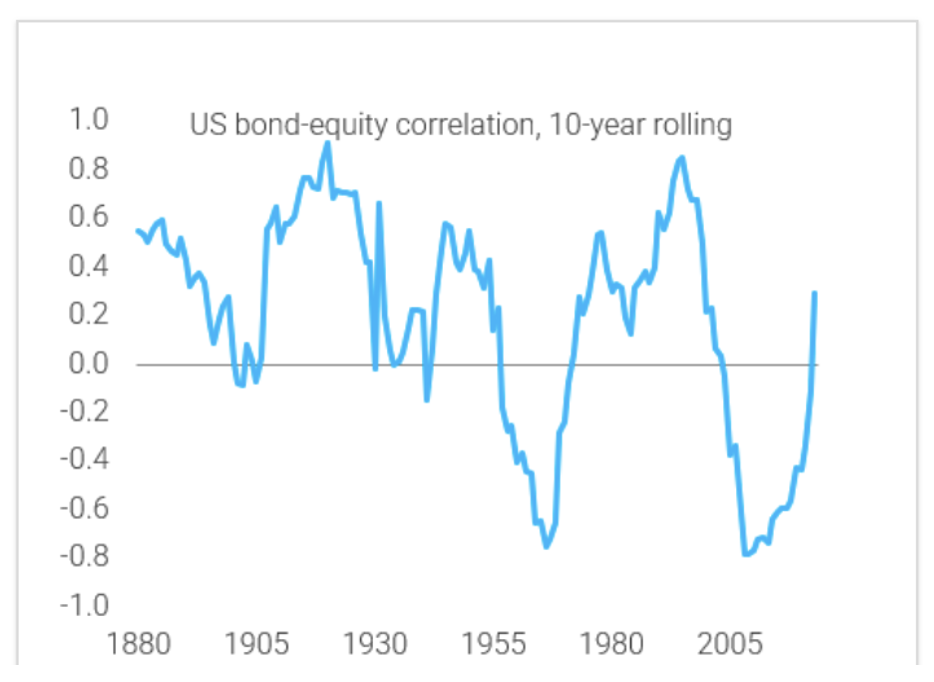

Joseph: Stock-bond correlation might be in a new era.

The negative correlation we saw in the 1990s and 2000s could be the anomaly, with recent higher correlations potentially becoming the new normal. This is a challenging shift for traditional portfolio diversification.

Source: TS Lombard as of 9/30/24

Source: TS Lombard as of 9/30/24

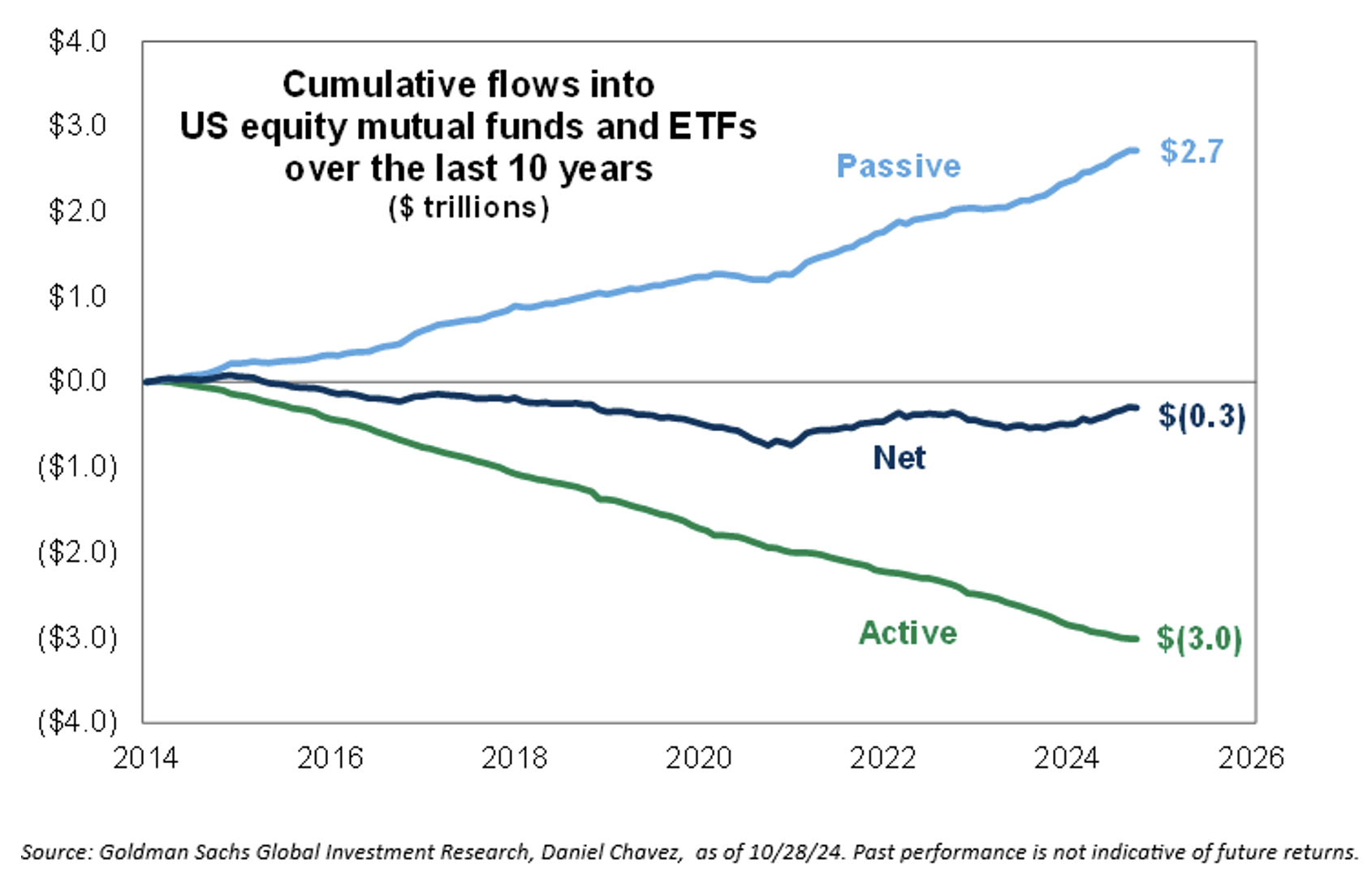

Brad: Passive flows dominate active, but opportunities remain.

The ongoing shift from active to passive investing may create potential alpha for those who still see value in an active approach. For discerning investors, this trend could reveal undervalued corners of the market.

Source: Goldman Sachs as of 10/28/24

Source: Goldman Sachs as of 10/28/24

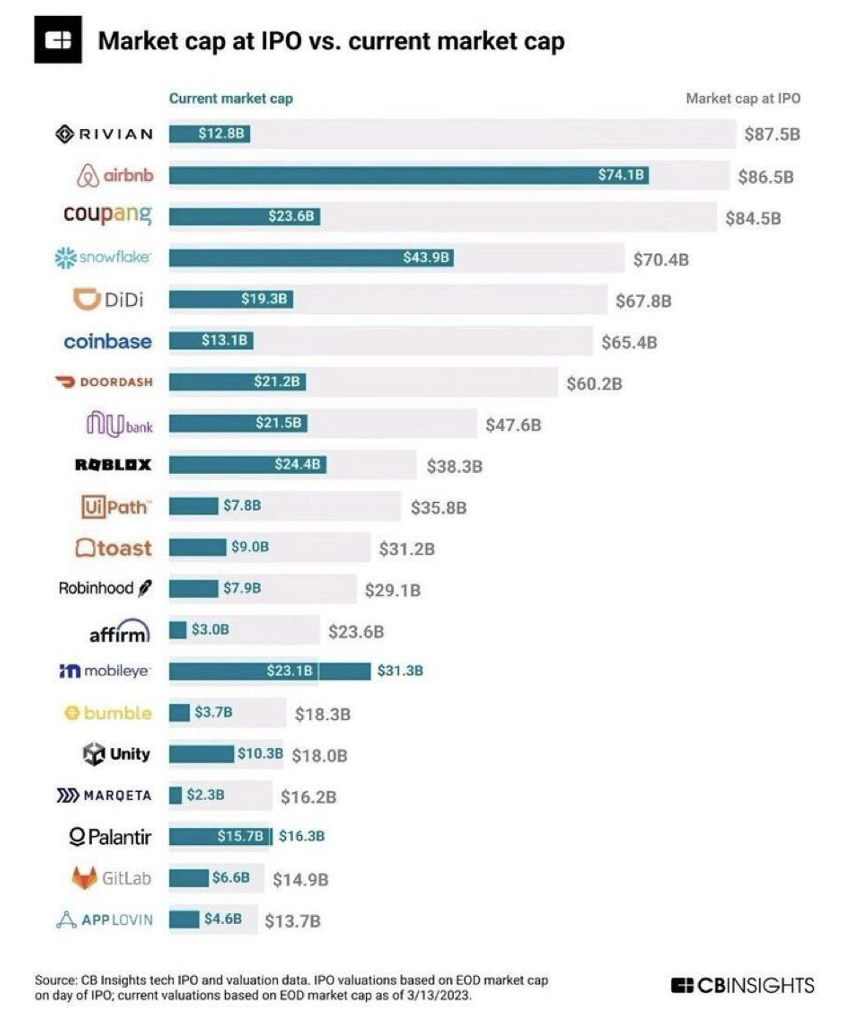

John Luke: Venture capital IPO hesitance – a missed opportunity?

Not long ago, VCs advised portfolio companies to avoid IPOs, viewing them as Wall Street’s gain. Now, looking back, those IPO windows may have marked peak valuations and missed exits.

Source: CB as of 3/13/23

Source: CB as of 3/13/23

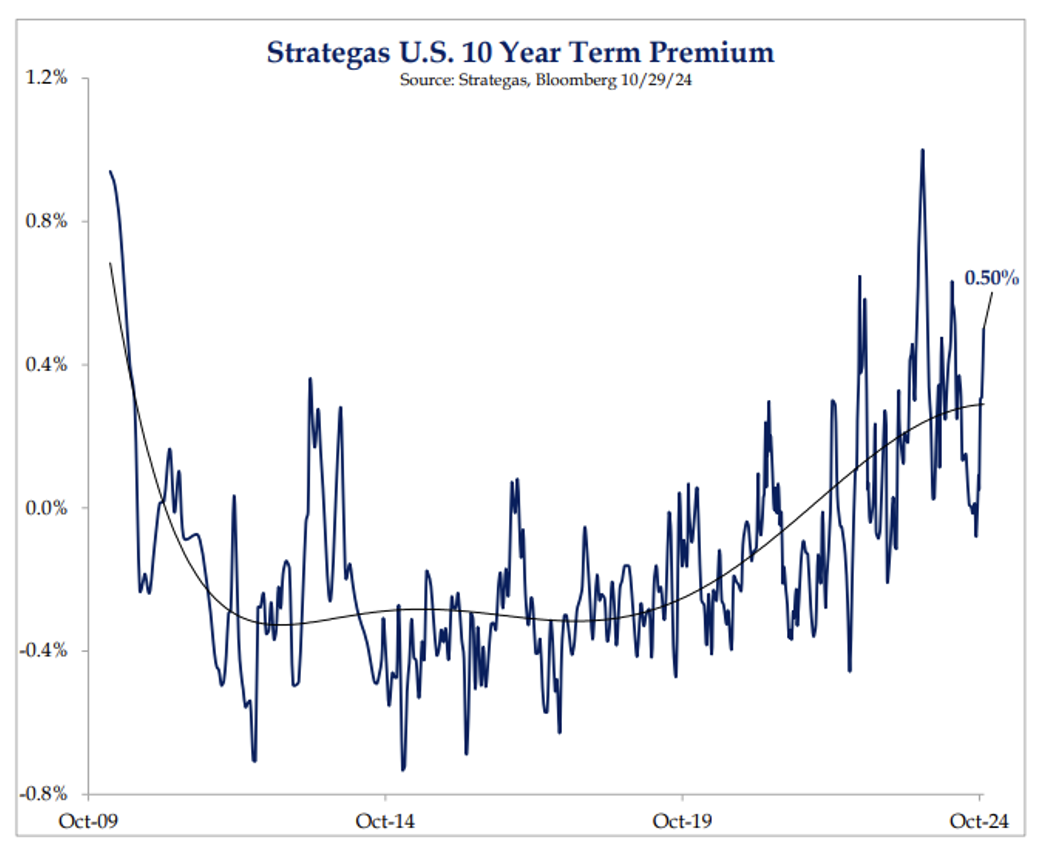

Dave: The 10-year Treasury yield has pushed the term premium to pre-2010 highs.

Rising yields signal tighter borrowing conditions and reset the term premium, adding a significant element to long-term portfolio risk and return forecasts.

Source: Strategas as of 10/29/24

Source: Strategas as of 10/29/24

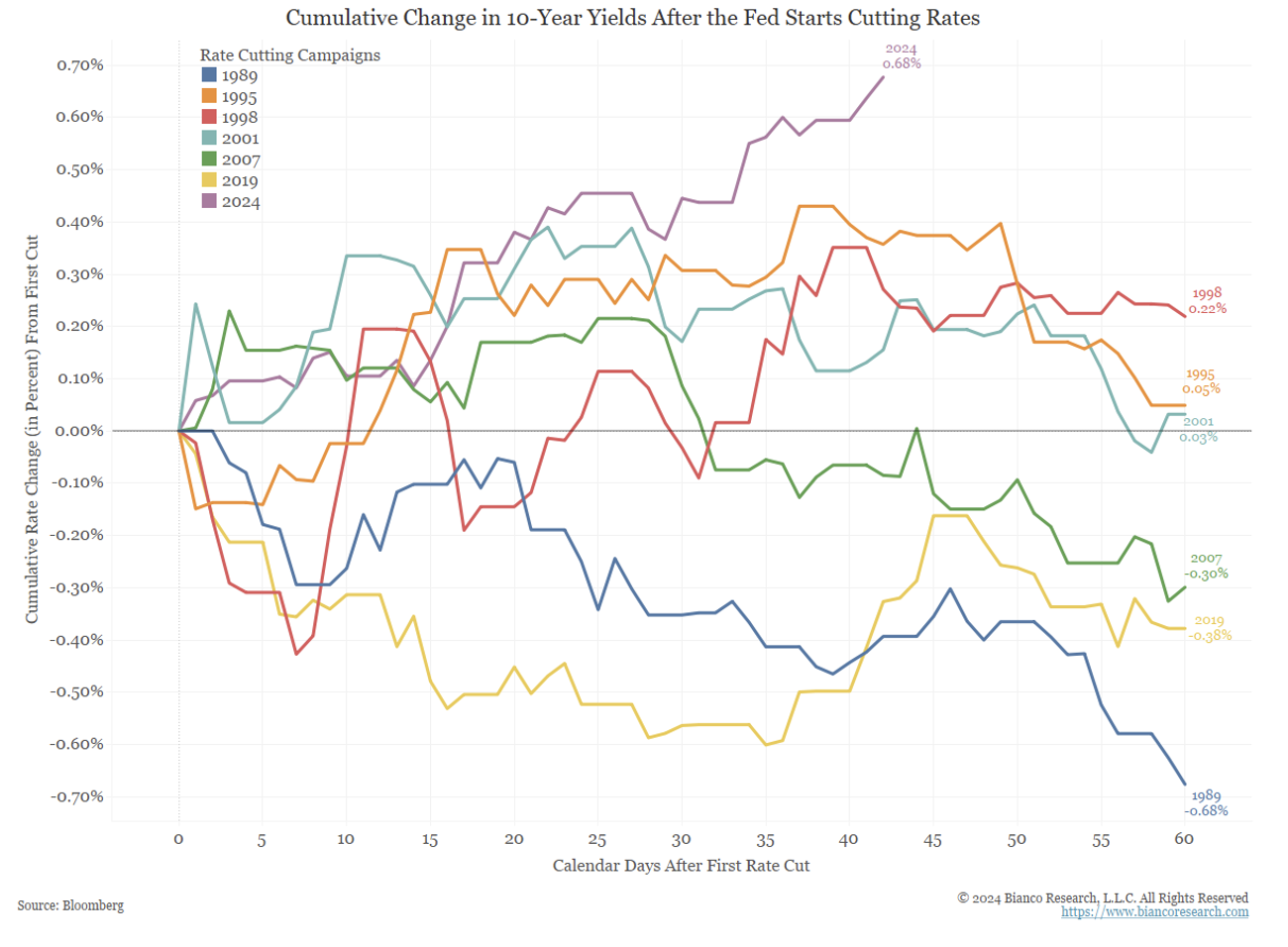

John Luke: Rate cuts have disappointed on the 10-year yield.

Those hoping that rate cuts would lower the 10-year Treasury yield have been let down. This impacts not only investors but anyone looking to borrow, particularly as high rates challenge affordability

Source: Bianco Research as of 10/28/24

Source: Bianco Research as of 10/28/24

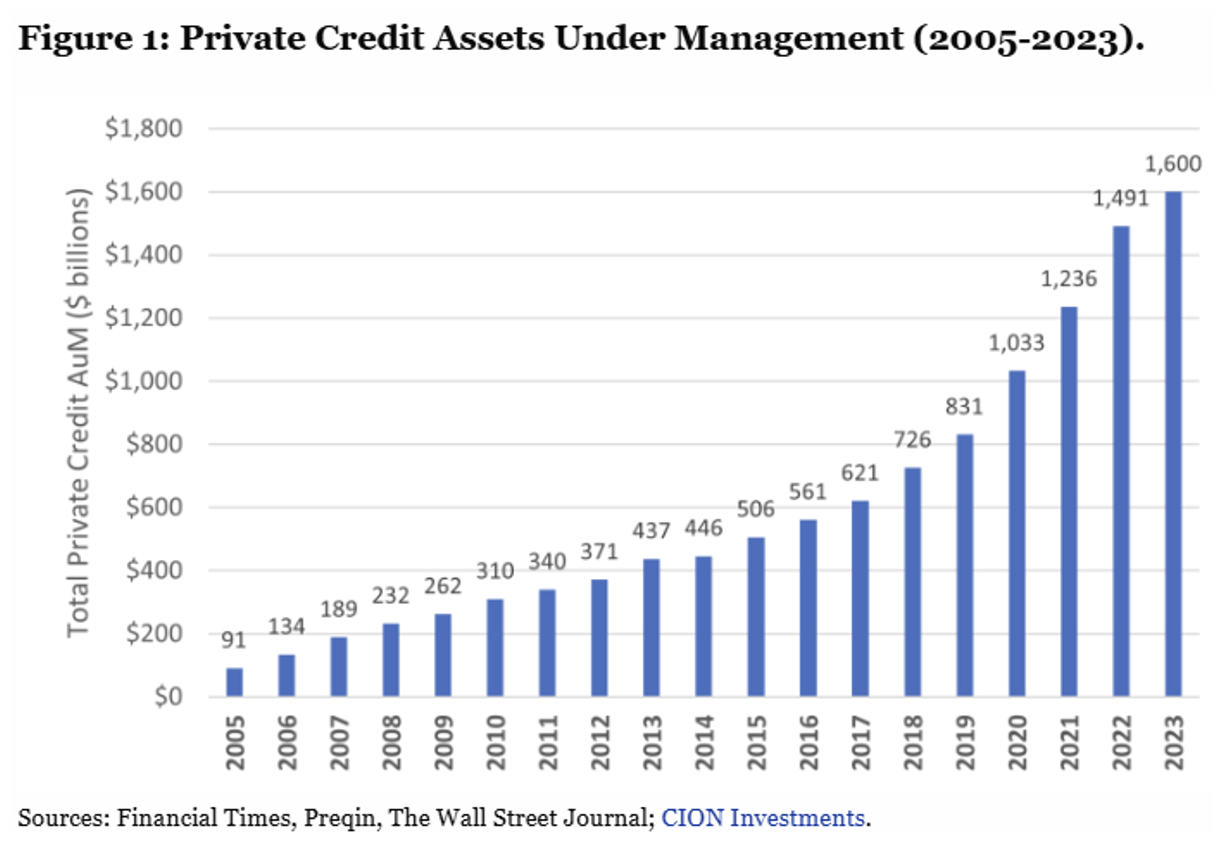

Joseph: Private credit sees continued inflows.

Amid market uncertainties, investors are turning to private credit as an alternative, enticed by the yields and stability it promises relative to traditional fixed income.

Source: CION Investments as of 12/31/23

Source: CION Investments as of 12/31/23

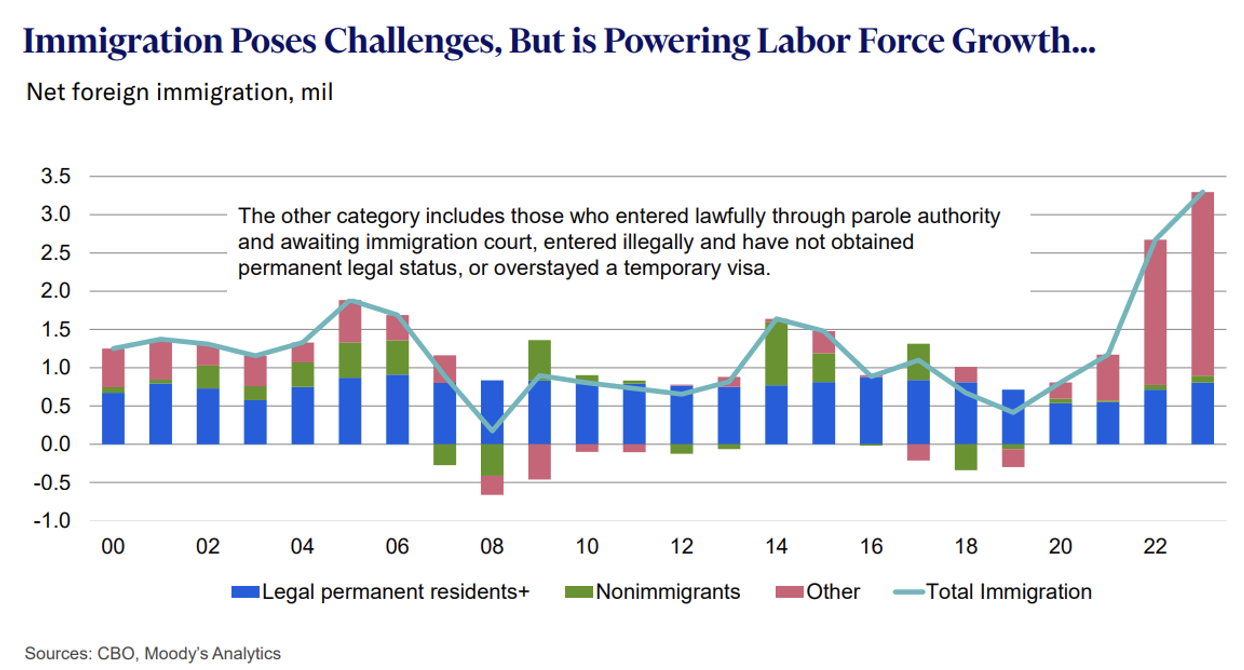

JL: Immigration shapes the labor market landscape.

Ignoring politics, immigration has both built and reshaped the U.S. labor force, presenting both challenges and opportunities for a balanced economy.

Source: CBO as of 12/31/23

Source: CBO as of 12/31/23

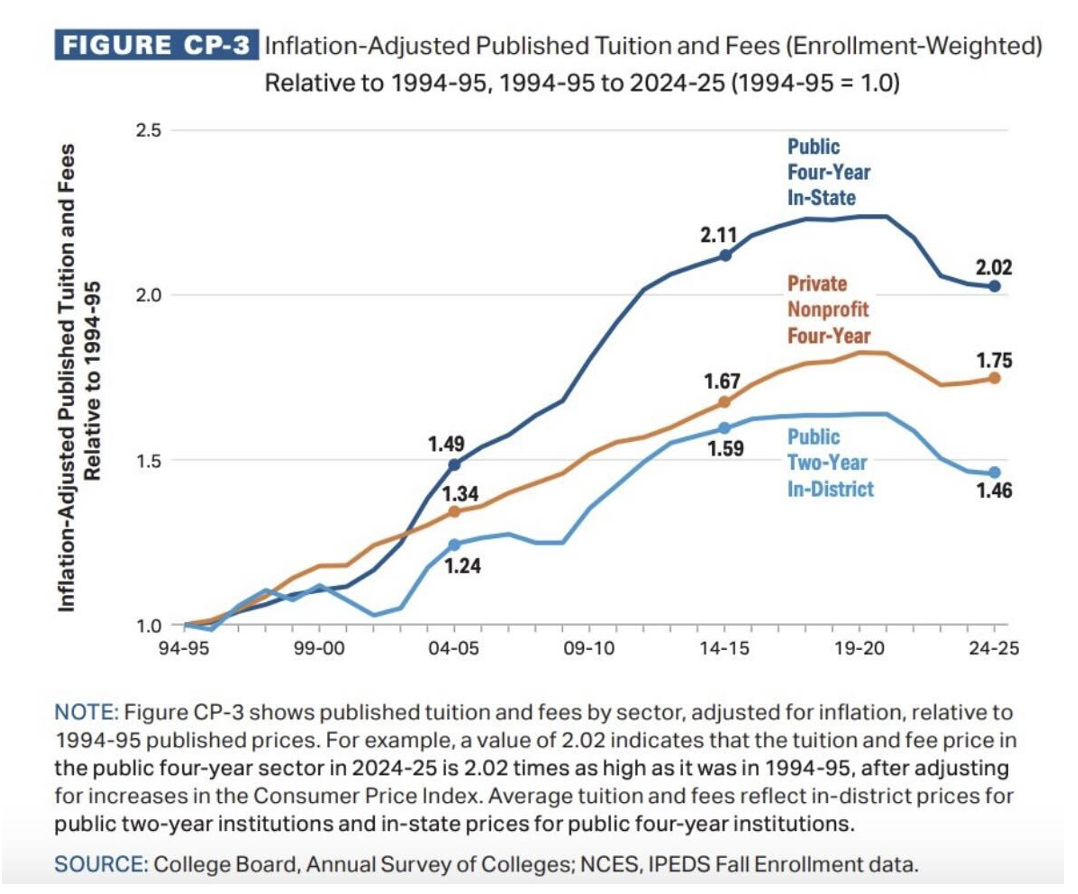

Brian: College costs may finally be leveling off.

After years of rising, the inflation-adjusted cost of college appears to be resetting to mid-2010s levels. A breath of relief for families and a signal that educational expenses could stabilize, at least for now.

Source: College Board as of 8/31/24

Source: College Board as of 8/31/24

Dave: Bull market – still early innings?

With only two years behind us in the current bull market, history suggests we might have more room to run. While caution is essential, a prolonged rally remains within the realm of possibility.

Source: Carson Investment Research as of 10.25.2024

Source: Carson Investment Research as of 10.25.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-1.