Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from earnings vs. the economy, inflation expectations, economic contributors and detractors, and the challenges of owning quality stocks in 2025. Have a great weekend!

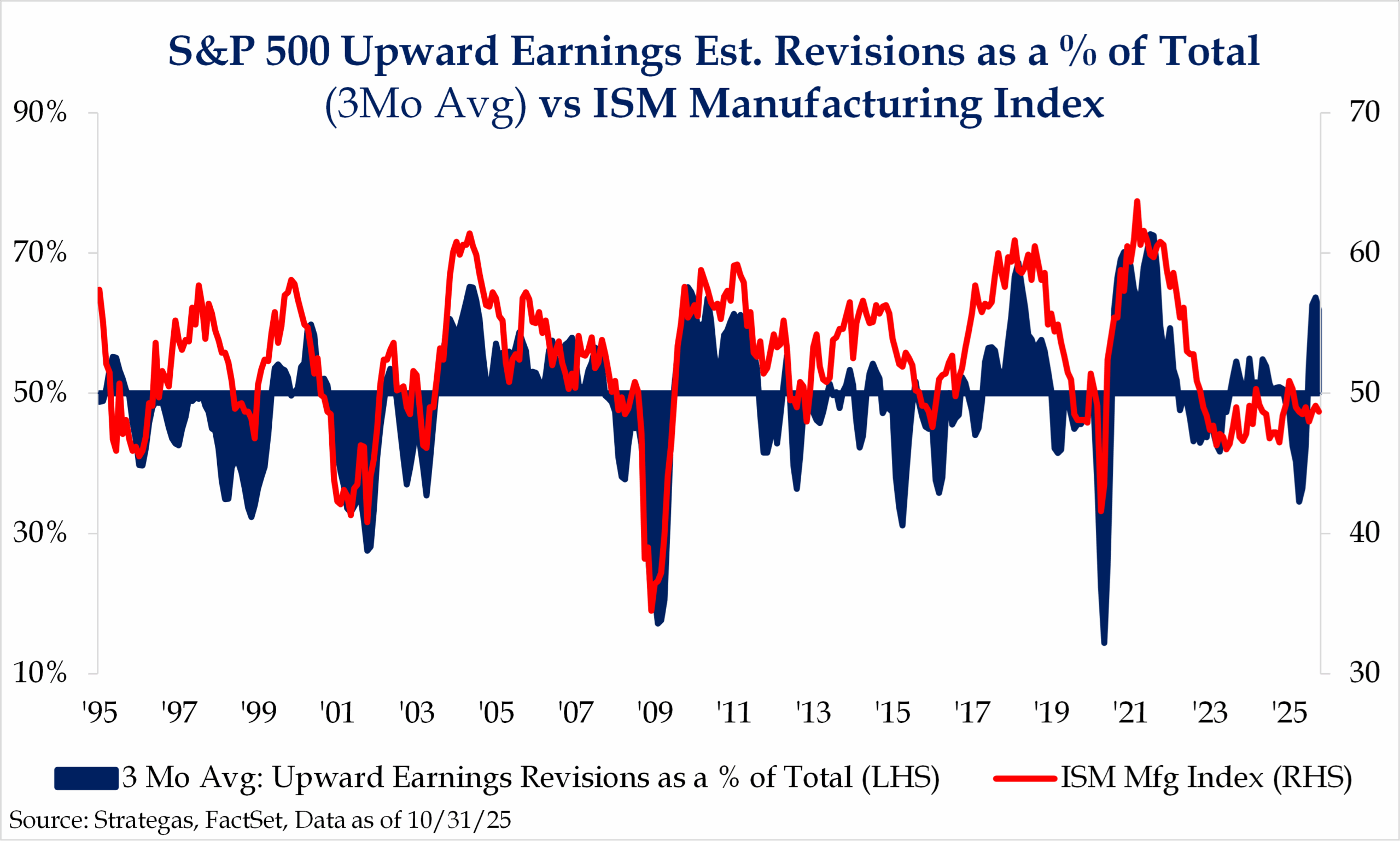

Brad: Corporate earnings and business surveys have split apart after years of running in tandem

Jake: but it’s hard to deny the hard data of a higher trend in earnings

Data as of 11.10.2025

Data as of 11.10.2025

Brian: Another area where surveys are showing divergent results is inflation, with the University of Michigan survey methods more prone to headlines

Data as of 11.10.2025

Data as of 11.10.2025

Ten: and it’s clear that corporations are less focused on inflation than they were in recent years

Data as of 11.10.2025

Data as of 11.10.2025

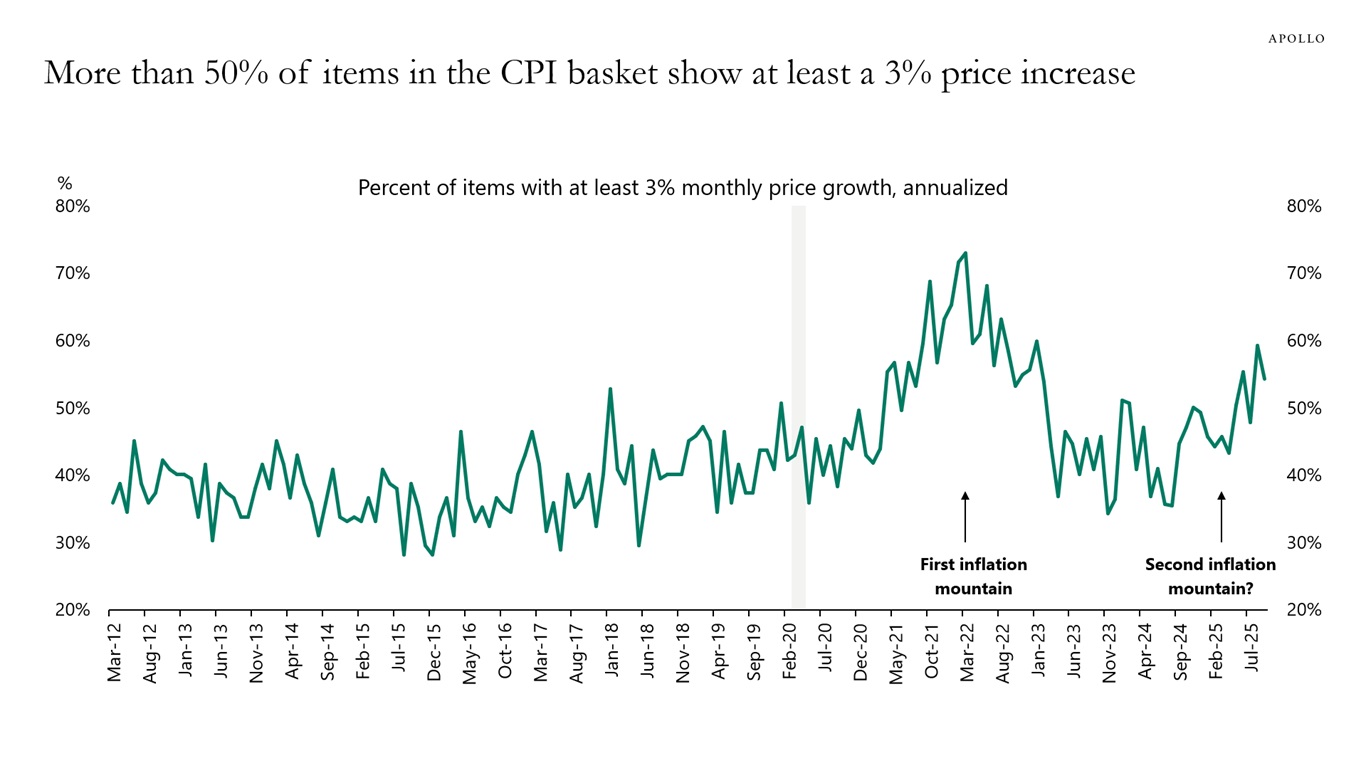

Beckham: From a broader standpoint, the number of individual components rising at a 3% annualized pace has been increasing since bottoming in early 2024

Source: Apollo as of 11.13.2025

Source: Apollo as of 11.13.2025

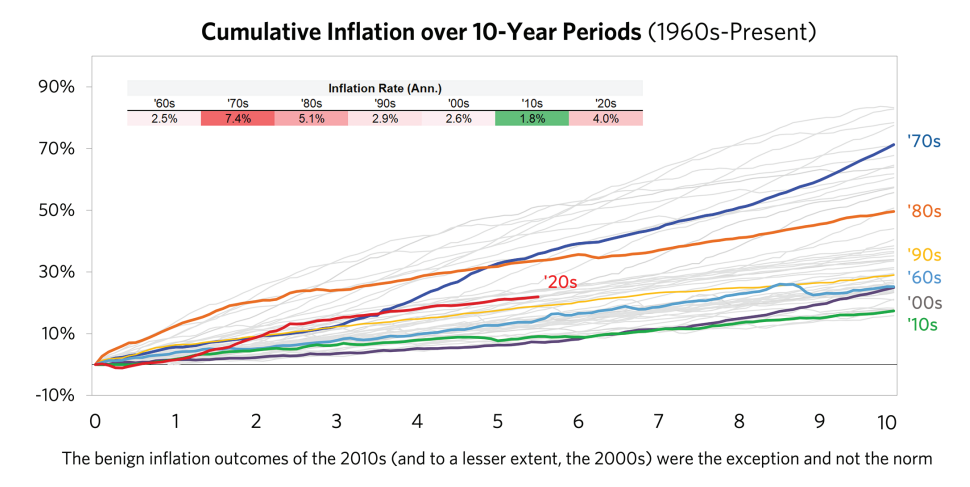

John Luke: and the real focus should be the cumulative impact of a persistent rise in prices

Source: Bridgewater Associates as of September 2025

Source: Bridgewater Associates as of September 2025

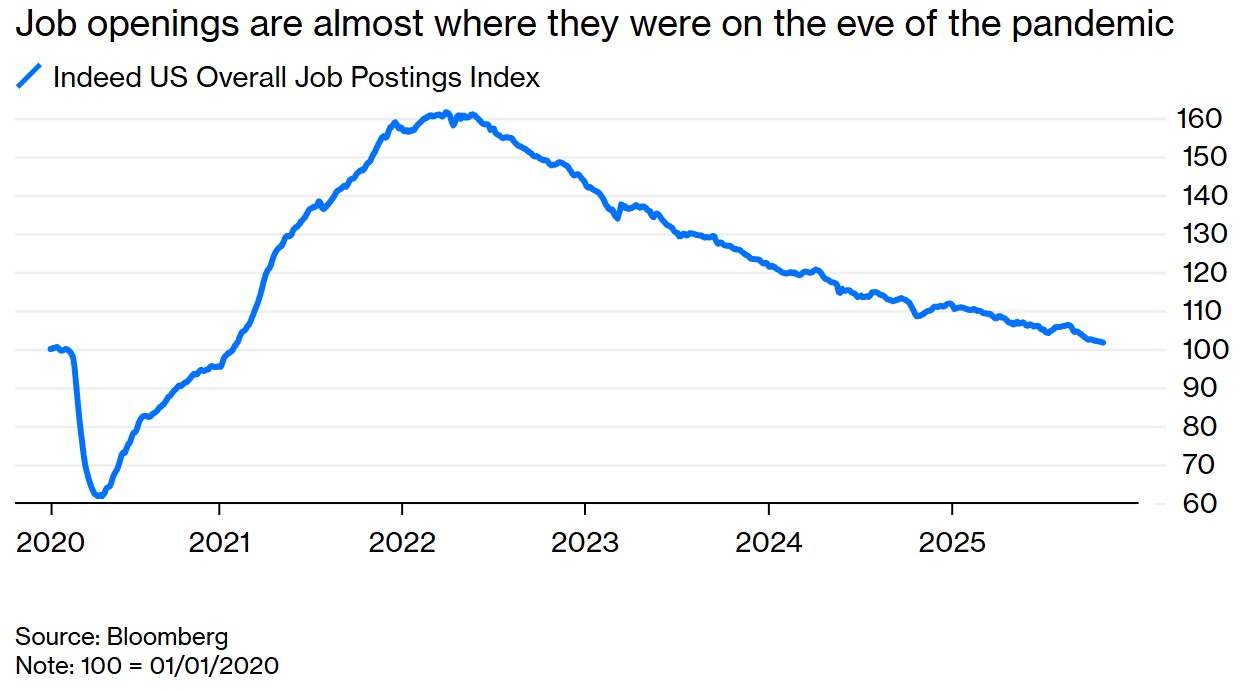

Joseph: A large contributor to weak consumer sentiment is likely the steady decline in job opportunities since peaking in 2022

Data as of 11.11.2025

Data as of 11.11.2025

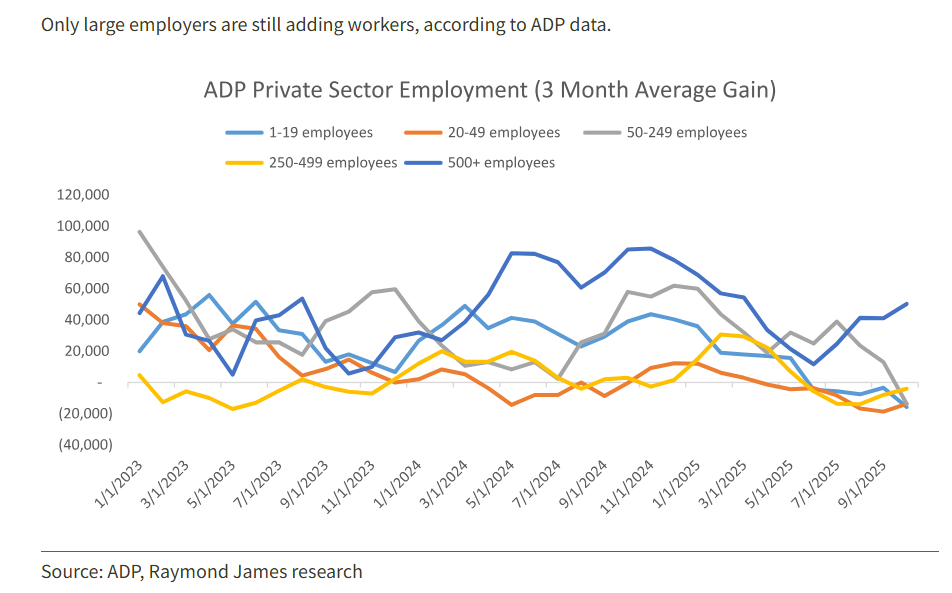

Dave: and the job openings that exist have been mostly at large companies

Data as of 11.09.2025

Data as of 11.09.2025

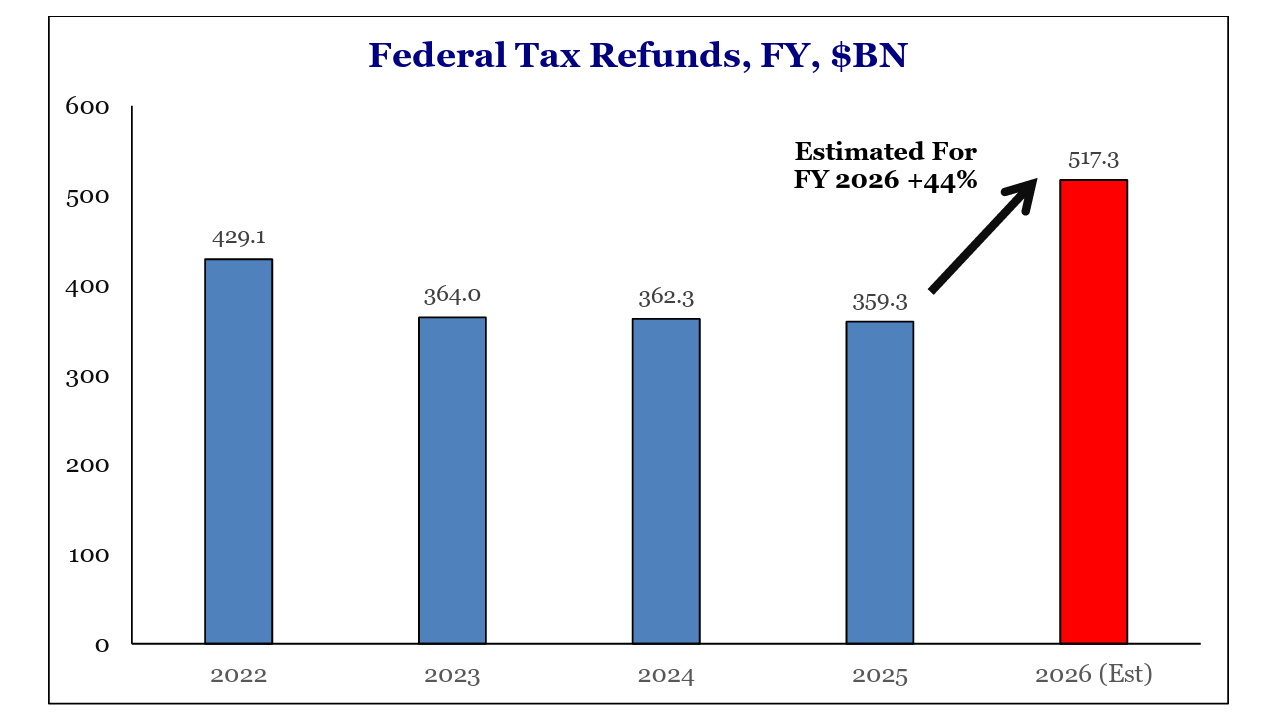

Dave: Economic bulls can point to coming tax refunds as a source of stimulus

Source: Strategas as of 11.10.2025

Source: Strategas as of 11.10.2025

Brett: and maybe the persistent strength in economically sensitive copper prices lends some support to the growth thesis

Data as of 11.12.2025

Data as of 11.12.2025

JD: On the topic of sentiment, even the smallest pullbacks trigger worry among individual investors

Source: AAII as of 11.12.2025

Source: AAII as of 11.12.2025

John: and that wall of worry has historically been a positive tailwind for stocks

Data as of 11.10.2025

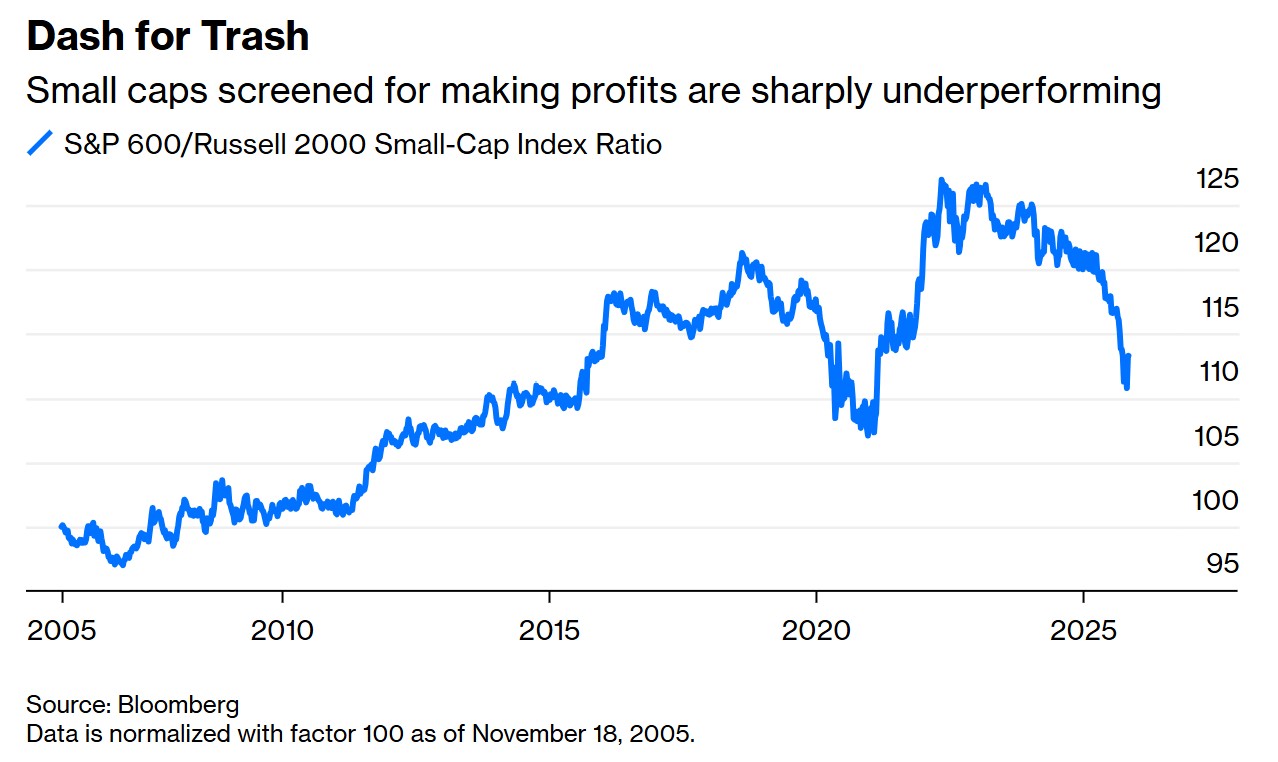

Dave: The fitful rally in speculative stocks has continued longer than normal

Data as of 11.12.2025

Data as of 11.12.2025

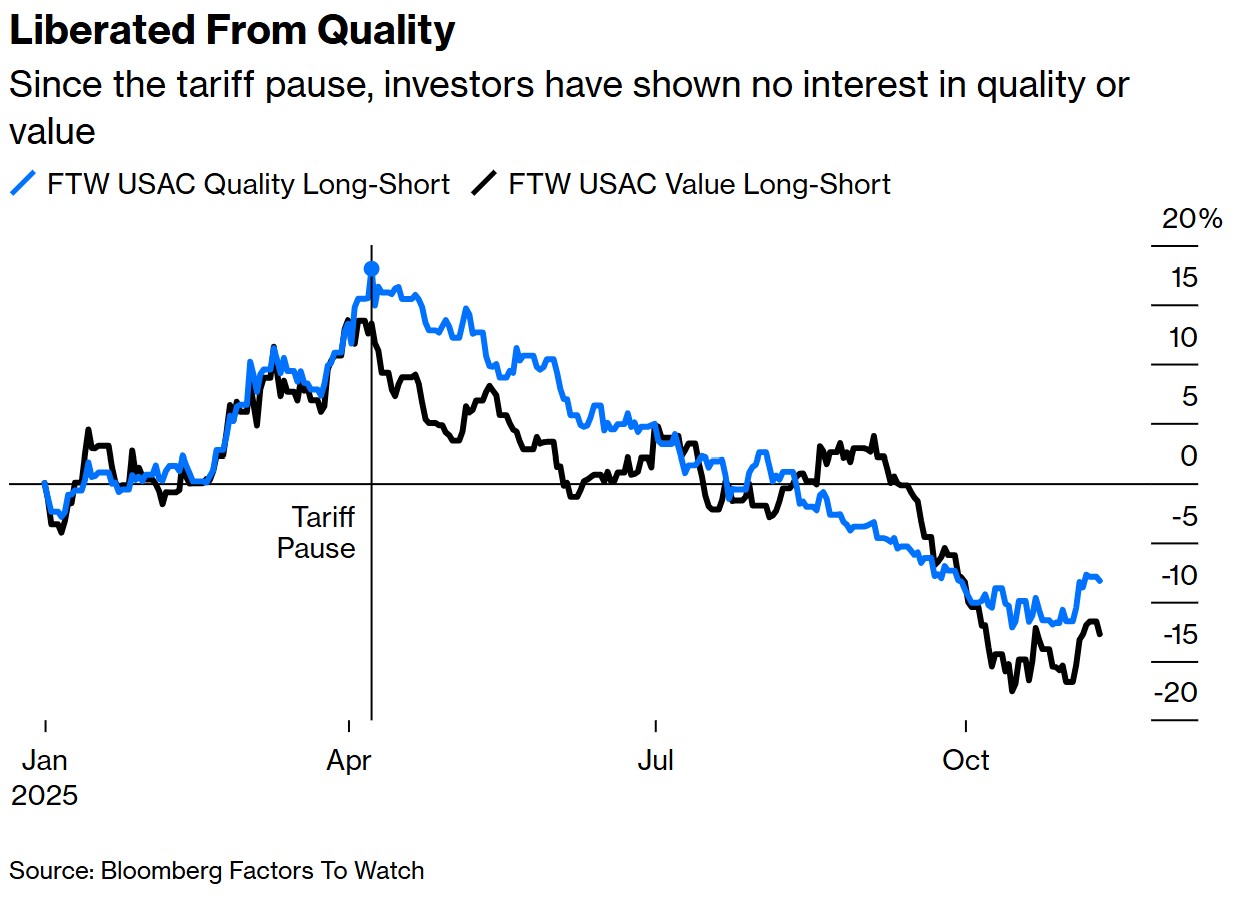

Brad: wiping out years of an earned premium for higher-quality stocks

Data as of 11.12.2025

Data as of 11.12.2025

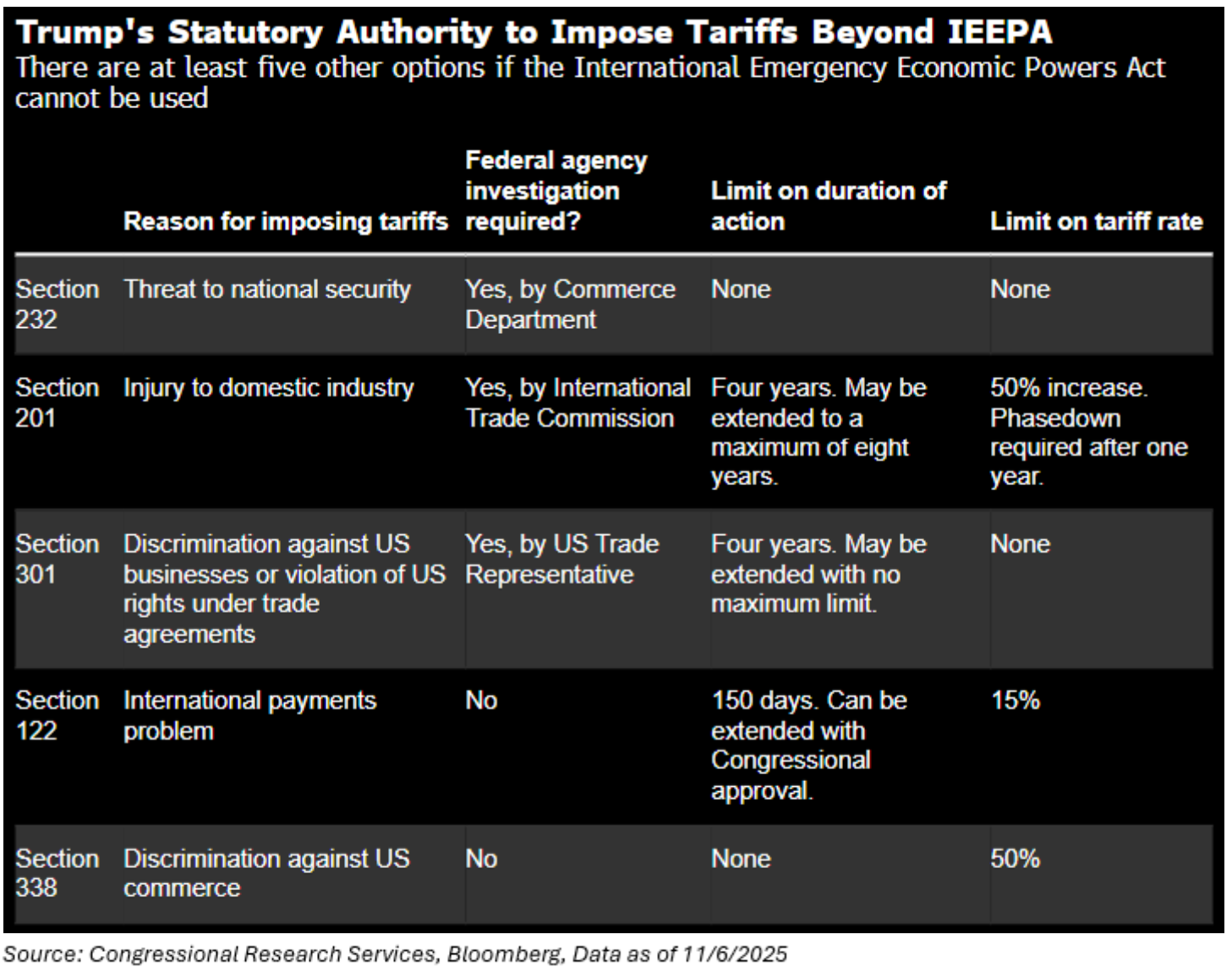

John Luke: The legal status of existing tariffs is being challenged, but the administration has a number of ways to adapt if needed

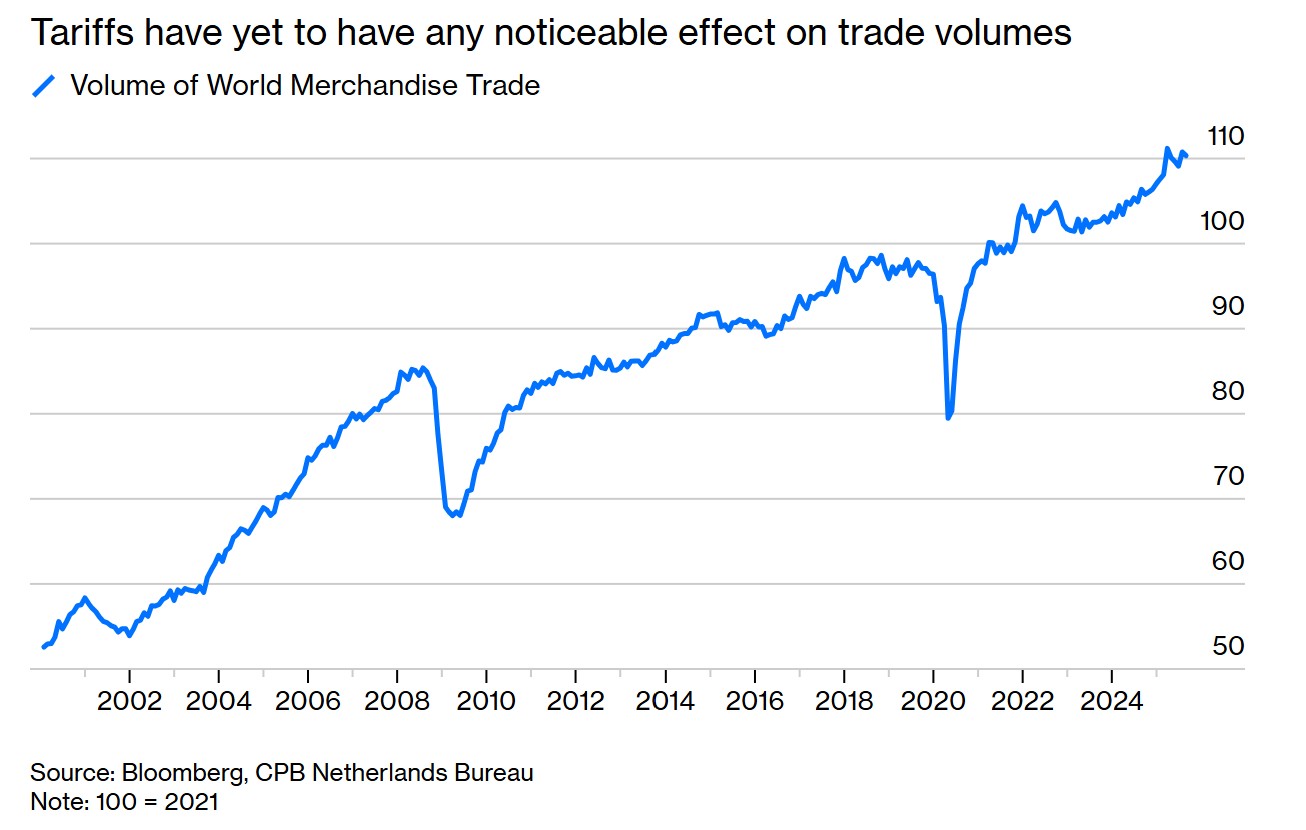

Beckham: and the overall economic impact seems to be minimal to this point

Data as of 11.12.2025

Data as of 11.12.2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2511-13.