Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

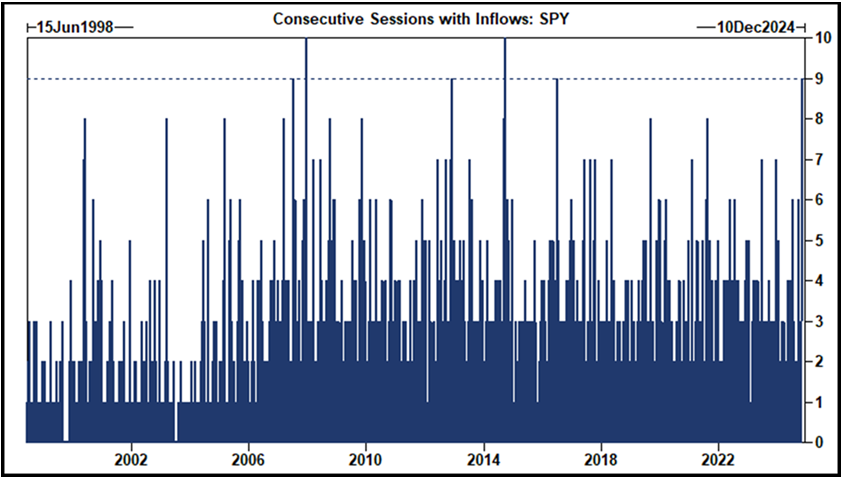

Brad: Stocks had a nice run of daily inflows coming into and out of the election

Source: Goldman Sachs as of 11.13.2024

Source: Goldman Sachs as of 11.13.2024

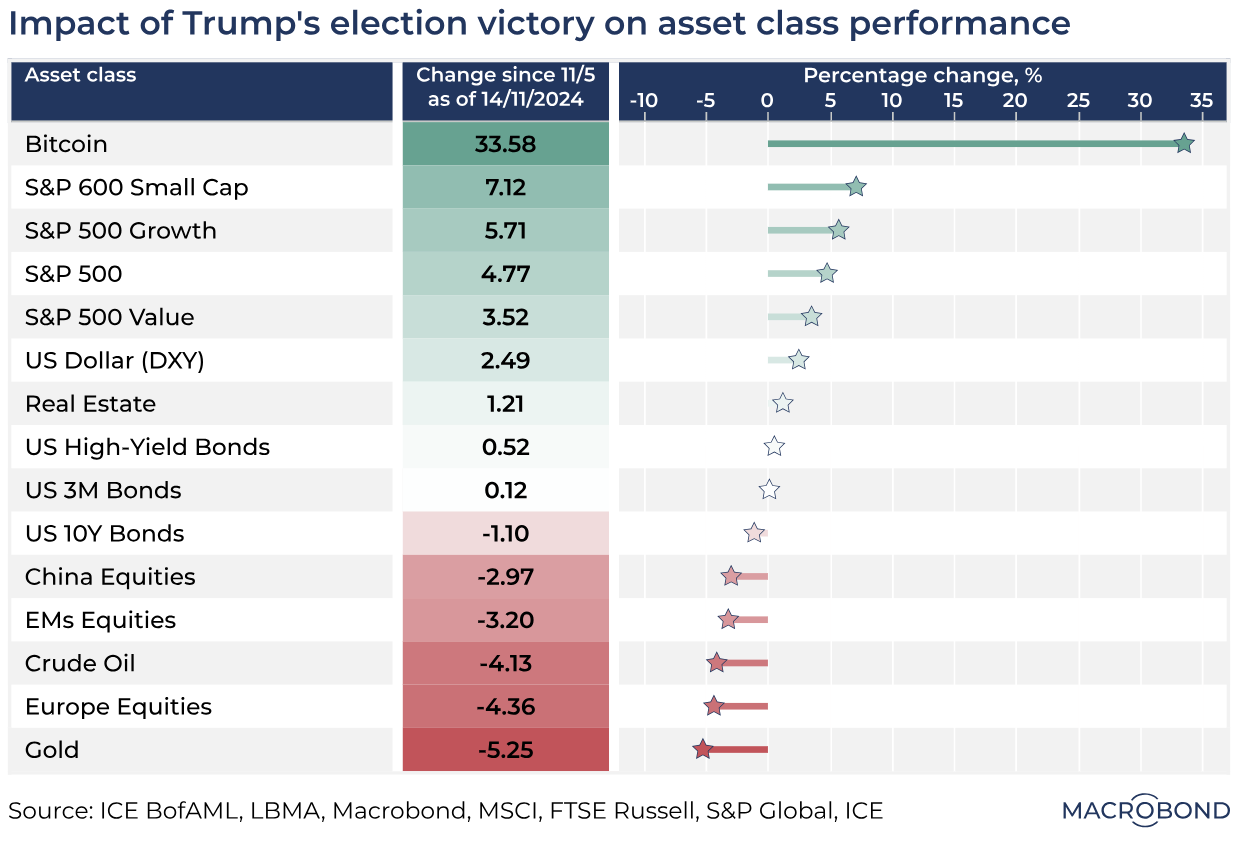

Brian: though after the past few days, Bitcoin is the standout post-election performer

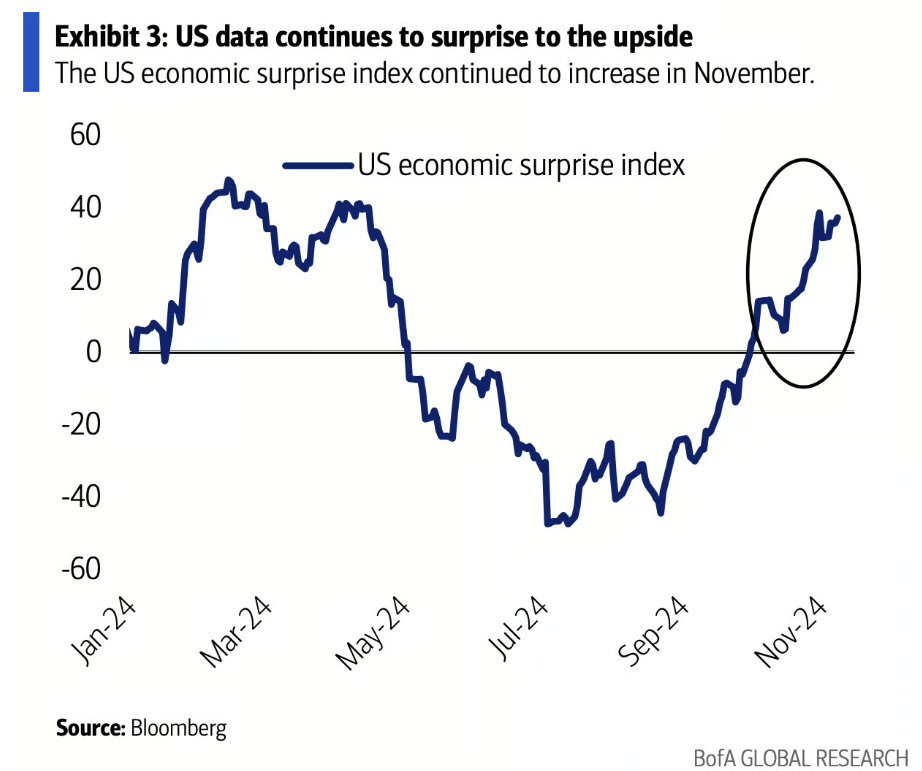

Beckham: The U.S. economy has been on a good run of exceeding expectations throughout the fall

Data as of 11.08.2024

Data as of 11.08.2024

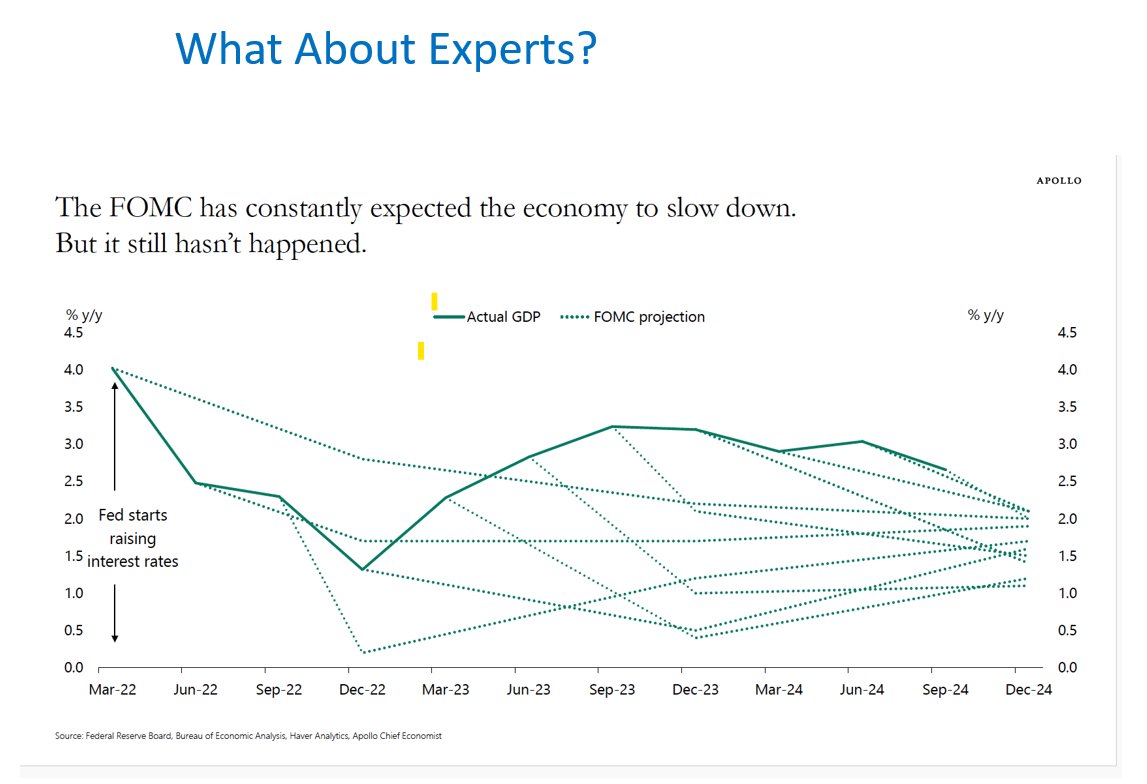

Brett: though it’s par for the course for the FOMC to underestimate the economic strength

Data as of 11.08.2024

Data as of 11.08.2024

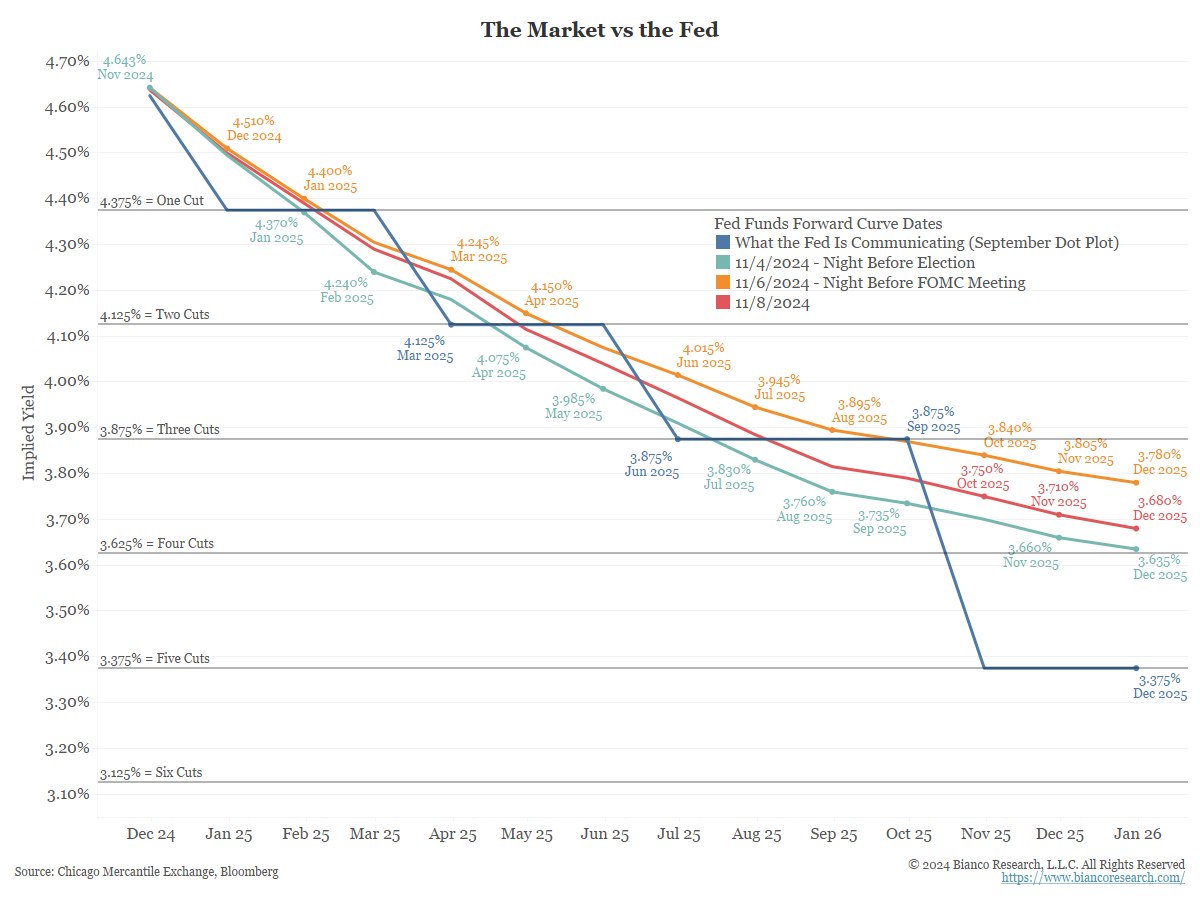

John Luke: and the market is again separating from the Fed’s published expectations

Data as of 11.08.2024

Data as of 11.08.2024

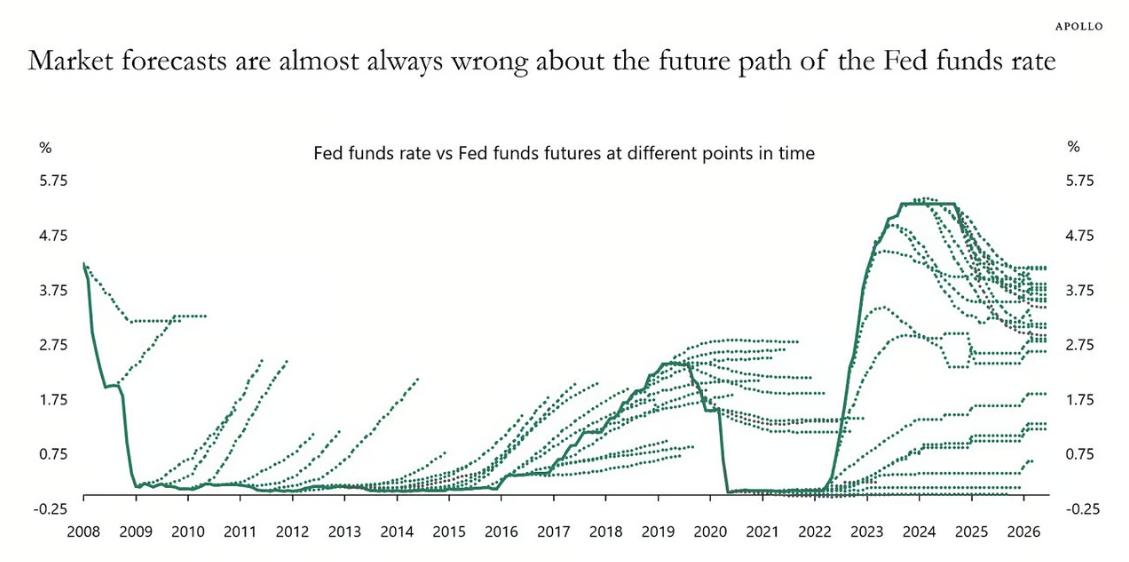

Arch: This continues a pattern of misalignment between market expectations and those of the Fed

Source: Apollo as of 11.09.2024

Source: Apollo as of 11.09.2024

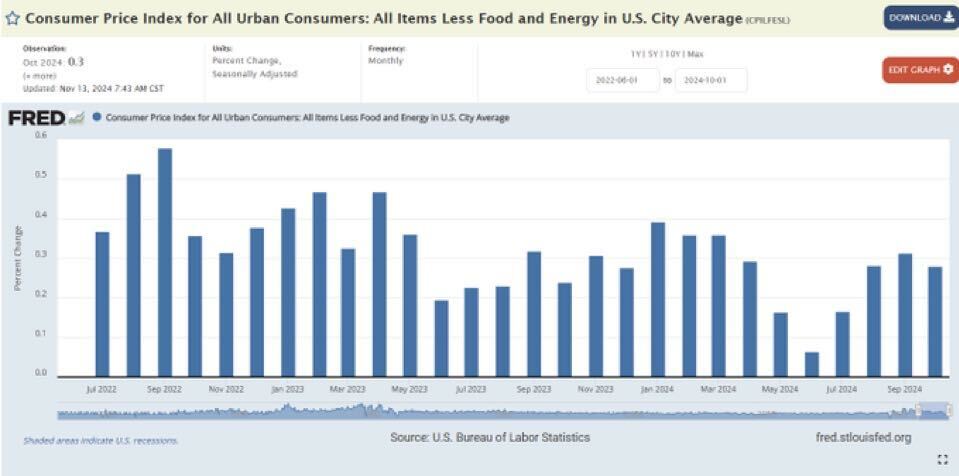

John Luke: and through all of the uncertainty, the Core Consumer Price Index (CPI) has actually been pretty steady

Data as of 11.13.2024

Data as of 11.13.2024

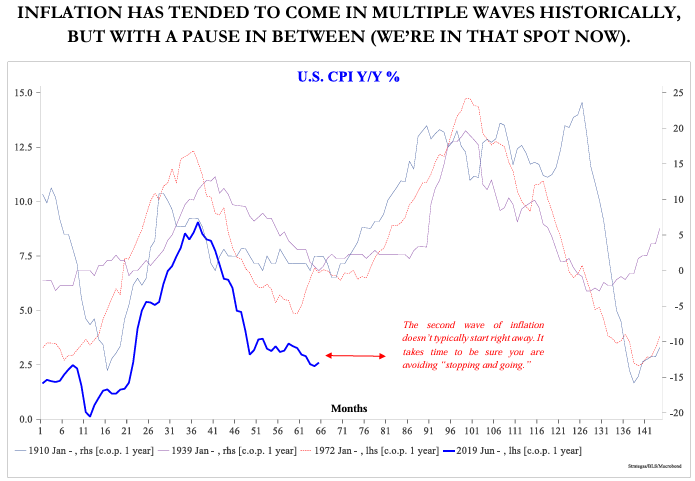

Brad: with the economic history books showing past patterns of inflation stabilizing at higher levels and then surging to even higher highs

Source: Strategas as of 11.13.2024

Source: Strategas as of 11.13.2024

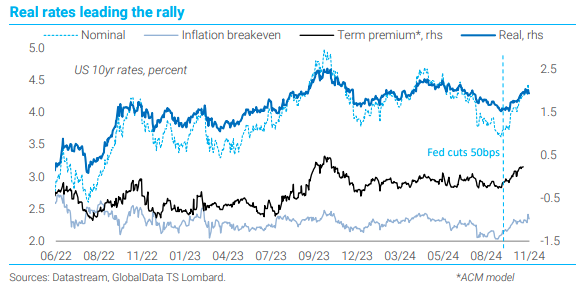

Joseph: The current move higher in bond yields looks tied to buyers demanding higher real rates for their dollars

Data as of 11.08.2024

Data as of 11.08.2024

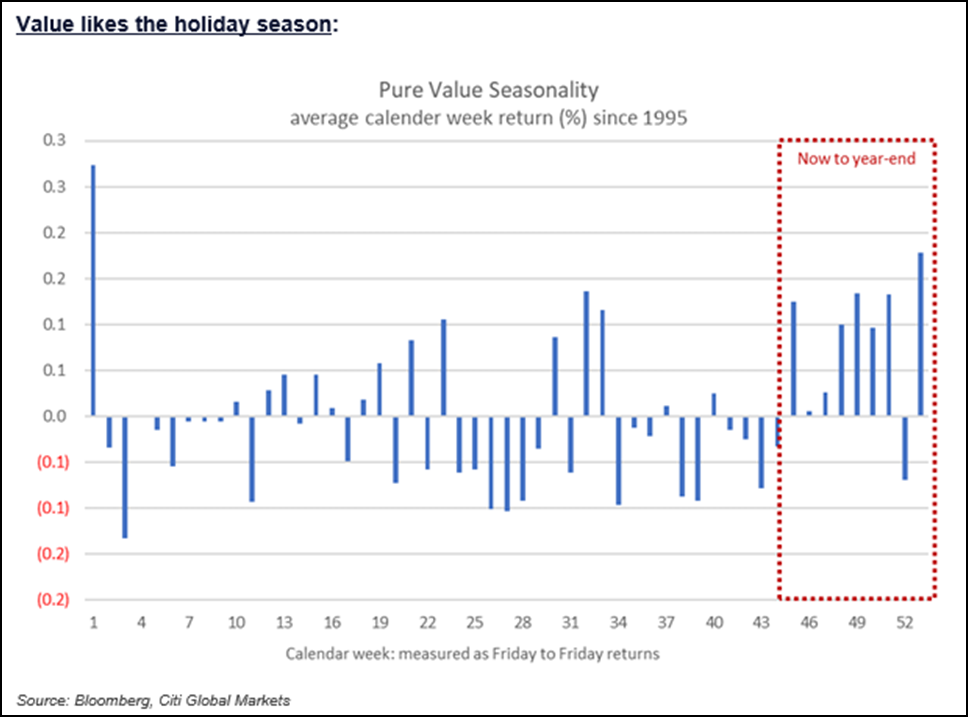

John Luke: and the economic strength implied by that type of move ties in with the seasonal tendency towards more value-oriented sectors

Data as of 11.09.2024

Data as of 11.09.2024

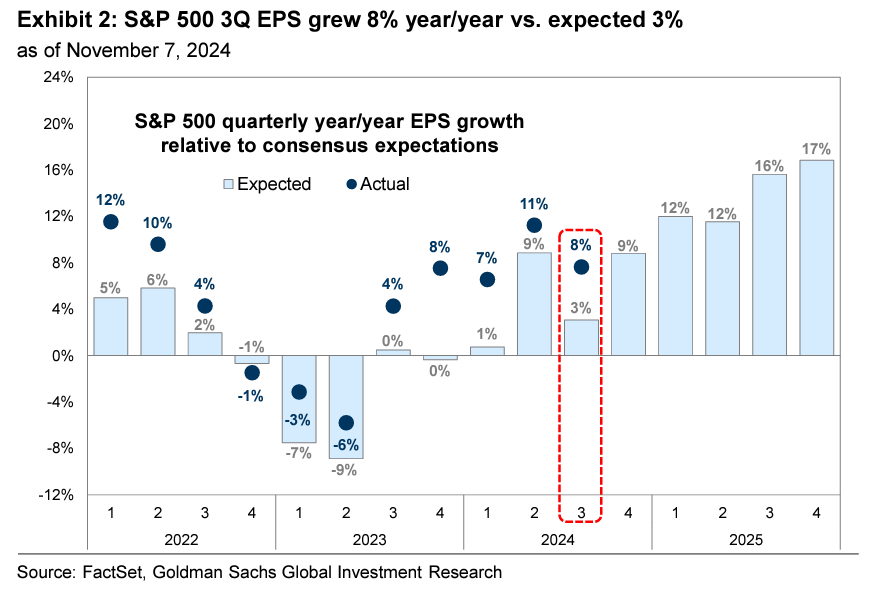

Dave: Earnings growth hasn’t been huge but for U.S. large caps it’s generally been higher than expectations

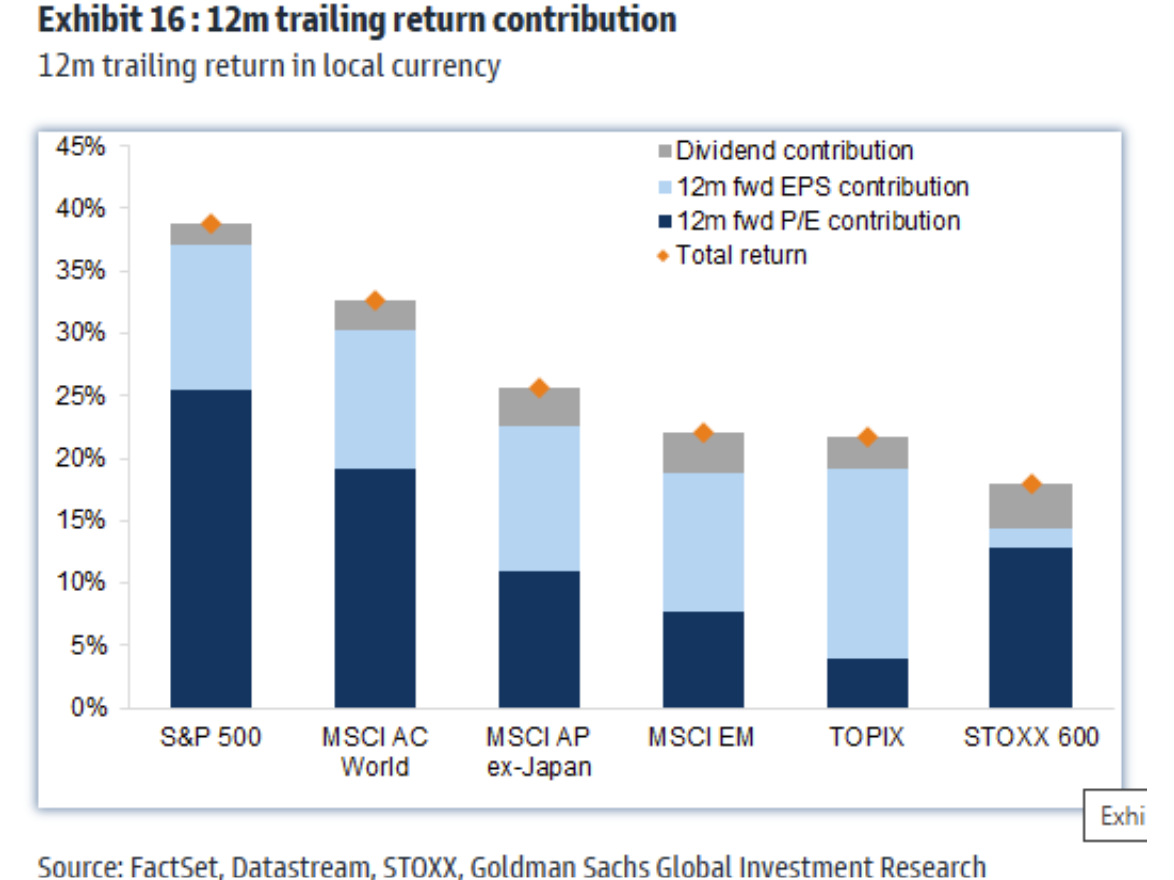

Dave: though the larger driver of the move higher in stocks has been higher valuations, presumably driven by optimism about future earnings

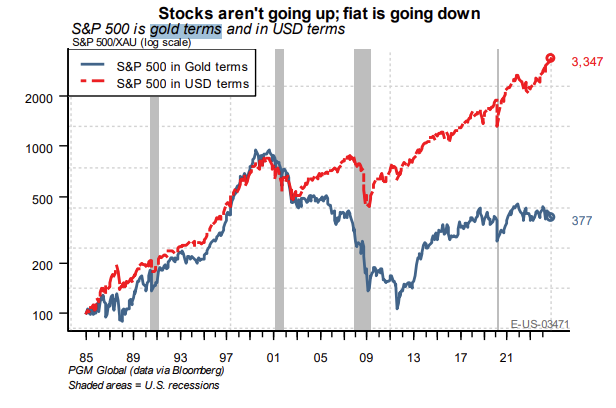

JD: Are stocks really that much more valuable, or is currency debasement simply being reflected in higher prices for risk assets?

Data as of 11.13.2024

Data as of 11.13.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-19.