Dave: Tuesday’s reaction to the tame CPI report was the ripper of the year

Source: Strategas as of 11.14.2023

Source: Strategas as of 11.14.2023

John Luke: as markets have more confidence that the Fed will move rates lower in the first half of 2024

Source: CME Fed Watch Tool as of 11.14.2023

Source: CME Fed Watch Tool as of 11.14.2023

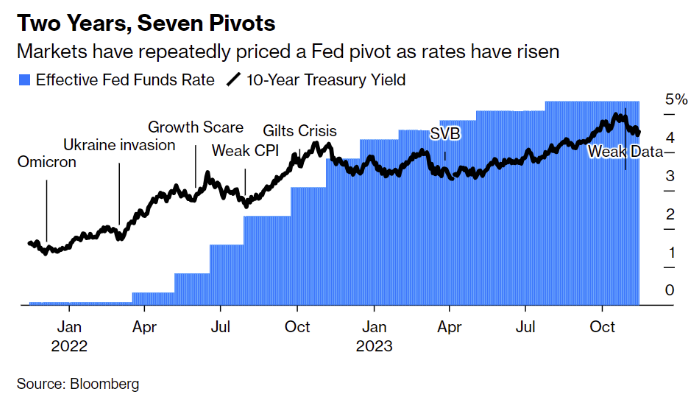

John Luke: BUT, we’ve seen this movie before in the past 18 months

Data as of 11.15.2023

Brett: and markets are still reluctant to price in imminent rate cuts

Data as of 11.15.2023

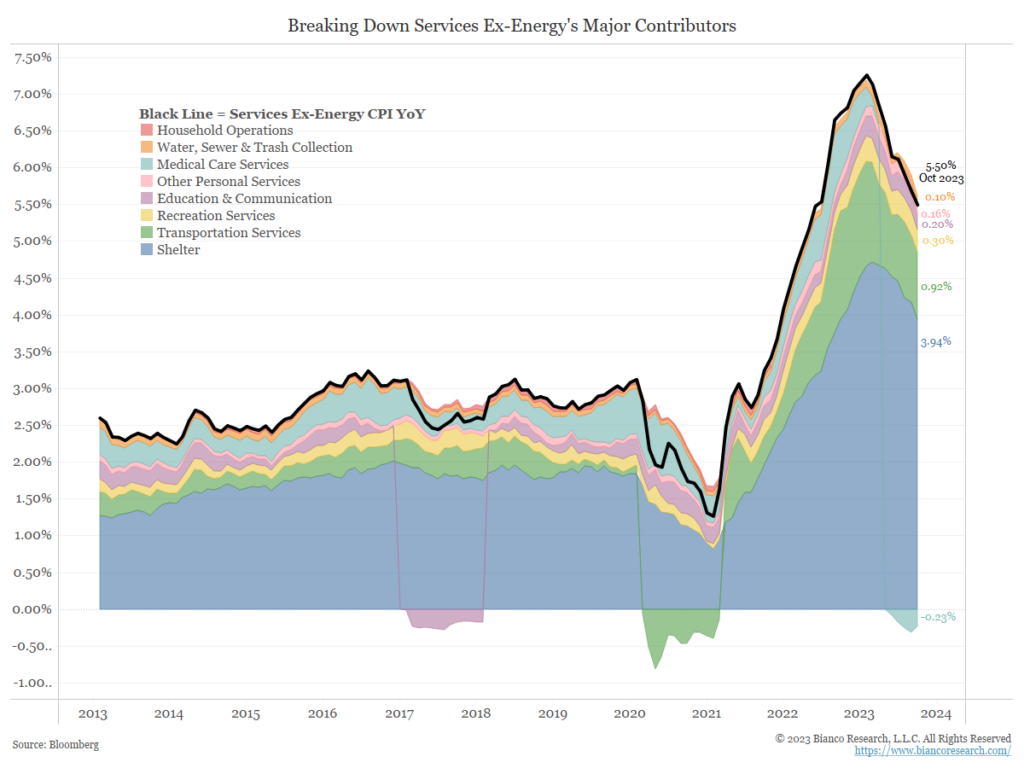

John Luke: Services is the component keeping inflation above the Fed’s comfort level

Data as of October 2023

John Luke: and specifically shelter as the one area comprising the bulk of the services impact

Data as of October 2023

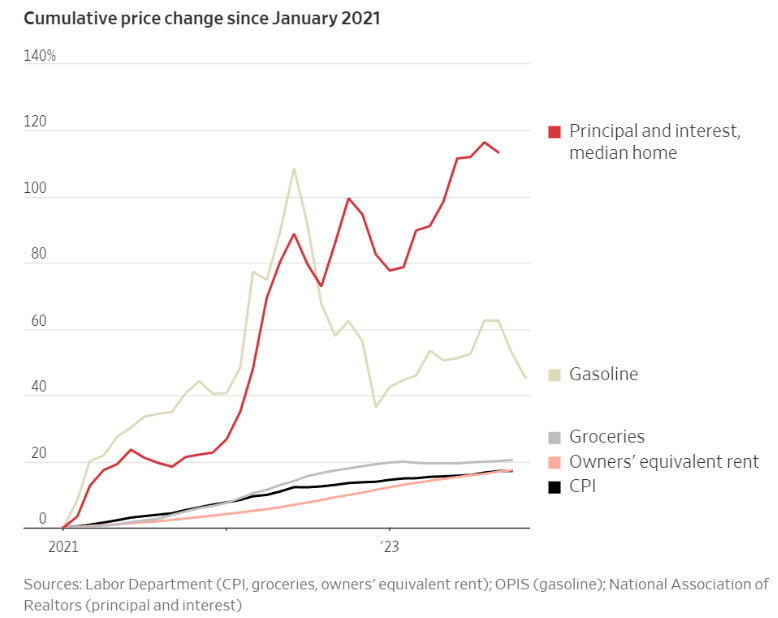

Joseph: and you can really see the significant build-up in housing costs over the past few years

Source: Bianco as of October 2023

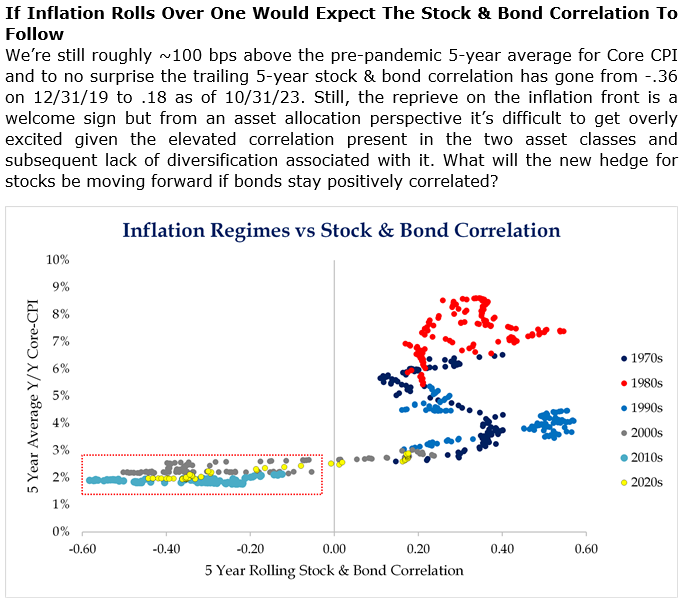

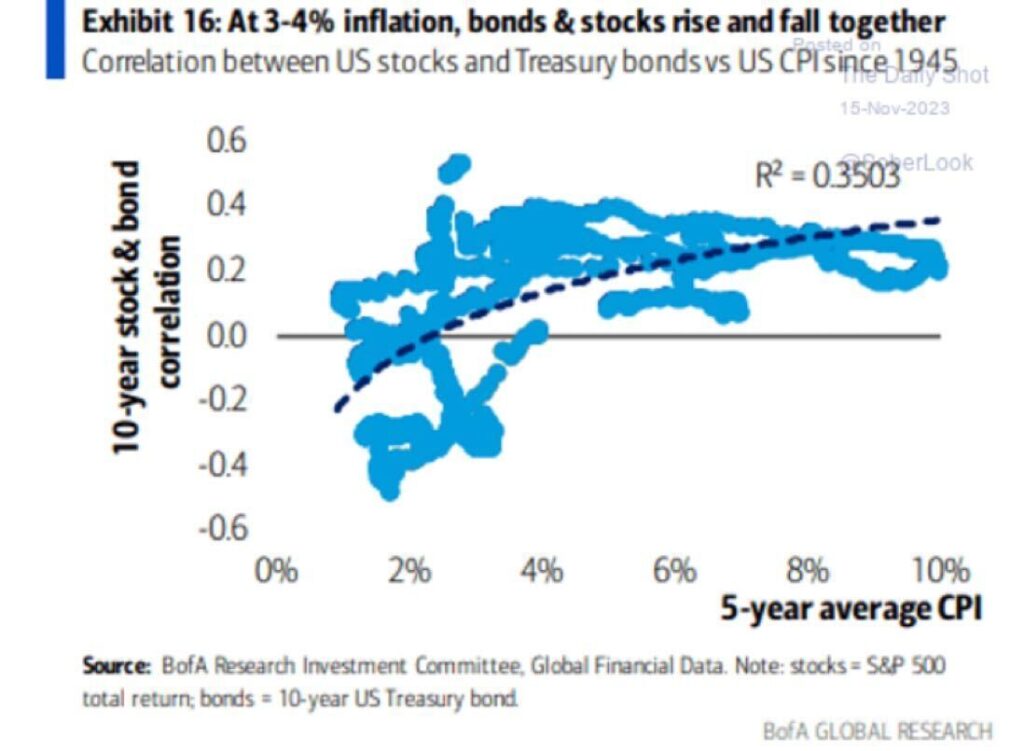

Brad: Reminder that stock-bond correlations are not a number you can just plug into planning software, they float in a wide range depending on inflation

Source: Strategas as of October 2023

John Luke: and right now, we’re in the inflation range where correlation is clearly positive

Data as of October 2023

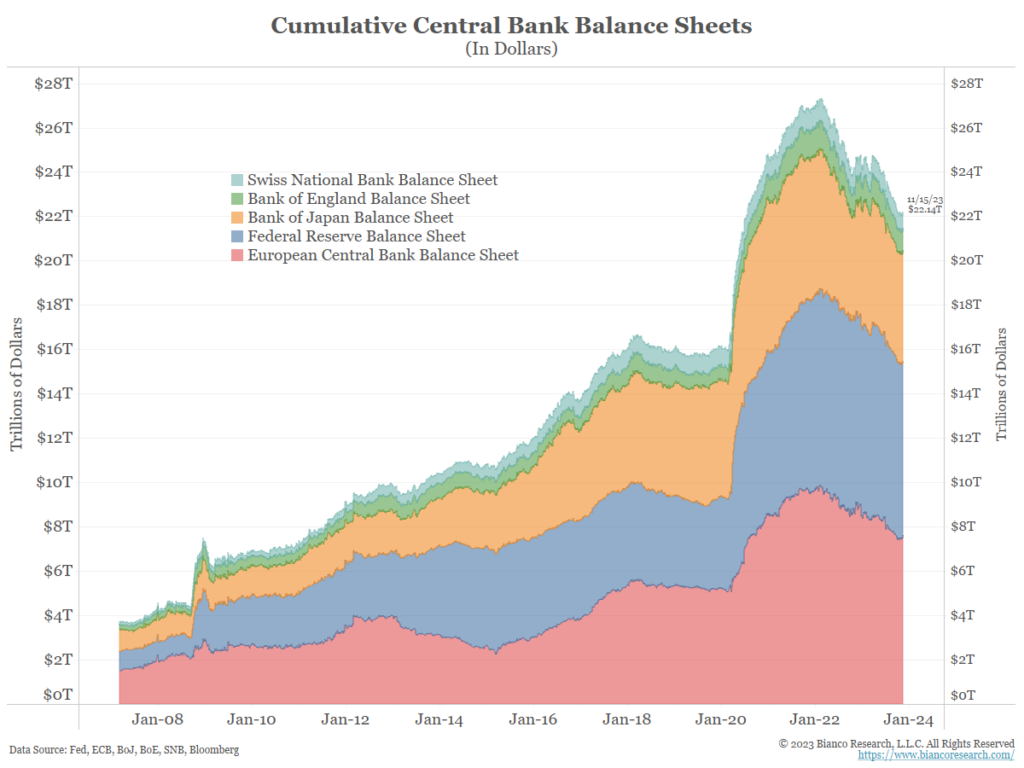

John Luke: Even with recent contractions, central banks around the world are still sitting on large balance sheet debts

Data as of 11.15.2023

John Luke: and the US government fiscal picture is not exactly helping the Treasury’s ability to reduce borrowing needs

Source: Stifel as of October 2023

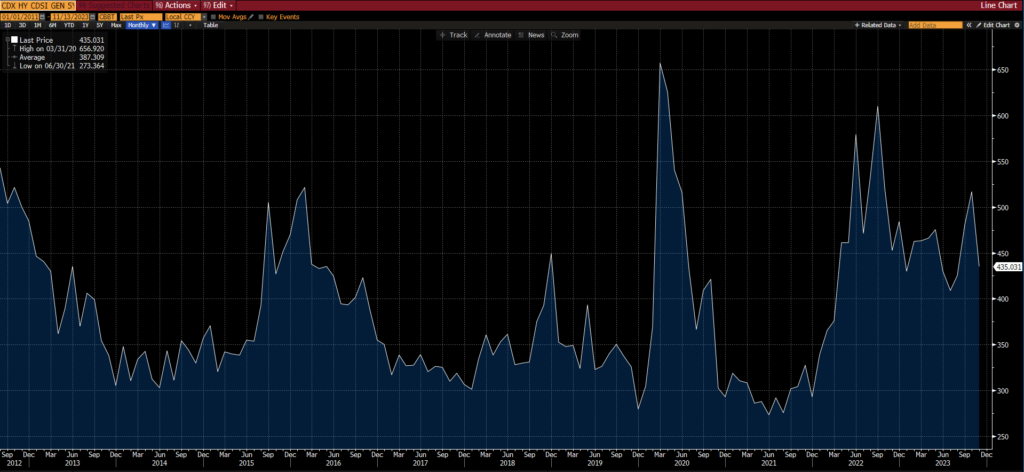

John Luke: despite that picture on the government side, investors aren’t overly concerned about the repayment ability of US corporations

Source: Bloomberg as of 11.13.2023

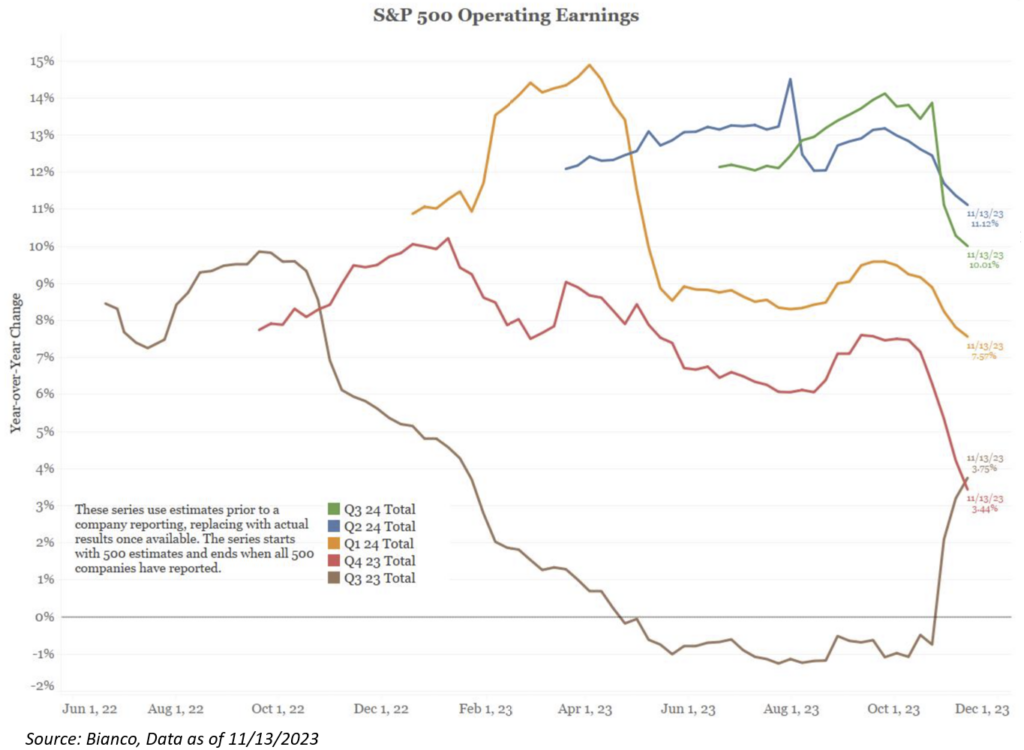

Beckham: On the earnings front, consensus estimates are factoring in a serious boost from profit margins

Data as of 11.13.2023

Dave: but we’re seeing incremental cuts in forward earnings estimates as we go through the Q3 earnings season

John Luke: It seems like megacap tech has been the consensus trade forever, but it’s actually been hot and cold based on recent performance

Data as of 11.13.2023

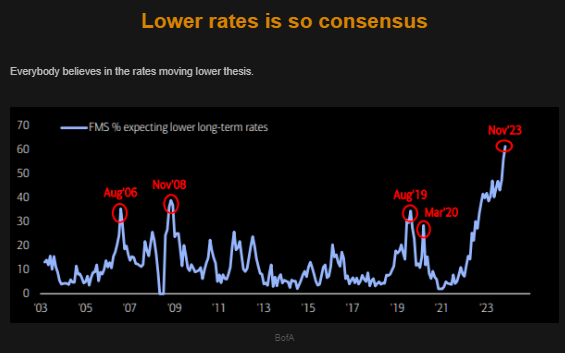

John Luke: and the sentiment towards the future course of bonds has completely flipped this year as investors think we’ve seen the highs of this cycle

Source: Market Ear as of 11.13.2023

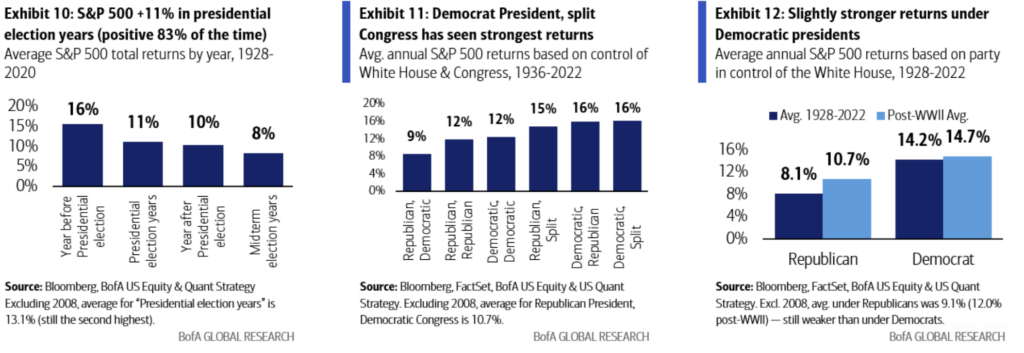

Dave: Looking ahead to an election year, as we’ve historically seen decent performance with the current electoral makeup

Data as of October 2023

Dave: and the weak election years have historically come when there is no incumbent in office to promote a re-election agenda

Source: Strategas as of 11.13.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2311-15.