Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from November weakness to AI impact, to the inflation/employment discussion and its impact on FOMC expectations. Have a great weekend!

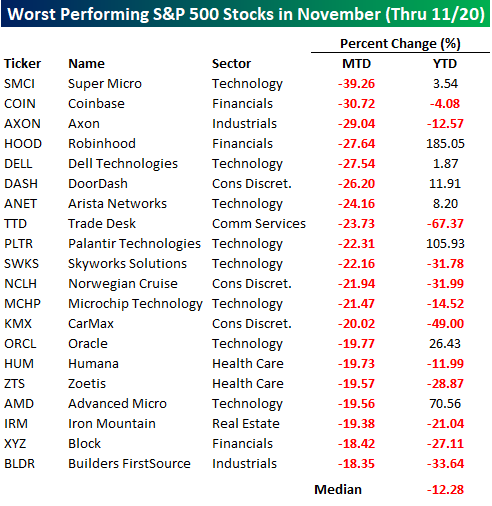

Jake: Many of this year’s popular trading stocks have been hit hard in November

Source: Bespoke as of 11.20.2025

Source: Bespoke as of 11.20.2025

Brett: and the broad list of stocks was weak before the index leaders finally caved in a bit

Data as of 11.20.2025

Data as of 11.20.2025

John: historically, November selloffs have been less common than other months and have generally not followed through into additional weakness

Data as of 11.20.2025

Data as of 11.20.2025

Joseph: In a year of frenetic headlines, where do we go next?

Data as of 11.19.2025

Data as of 11.19.2025

Ten: Nvidia has been the poster child for artificial intelligence (AI) investing, with good reason

Source: Bespoke as of 11.18.2025

Source: Bespoke as of 11.18.2025

Brad: but the impact is filtering through to businesses of all types

Data as of 11.14.2025

Data as of 11.14.2025

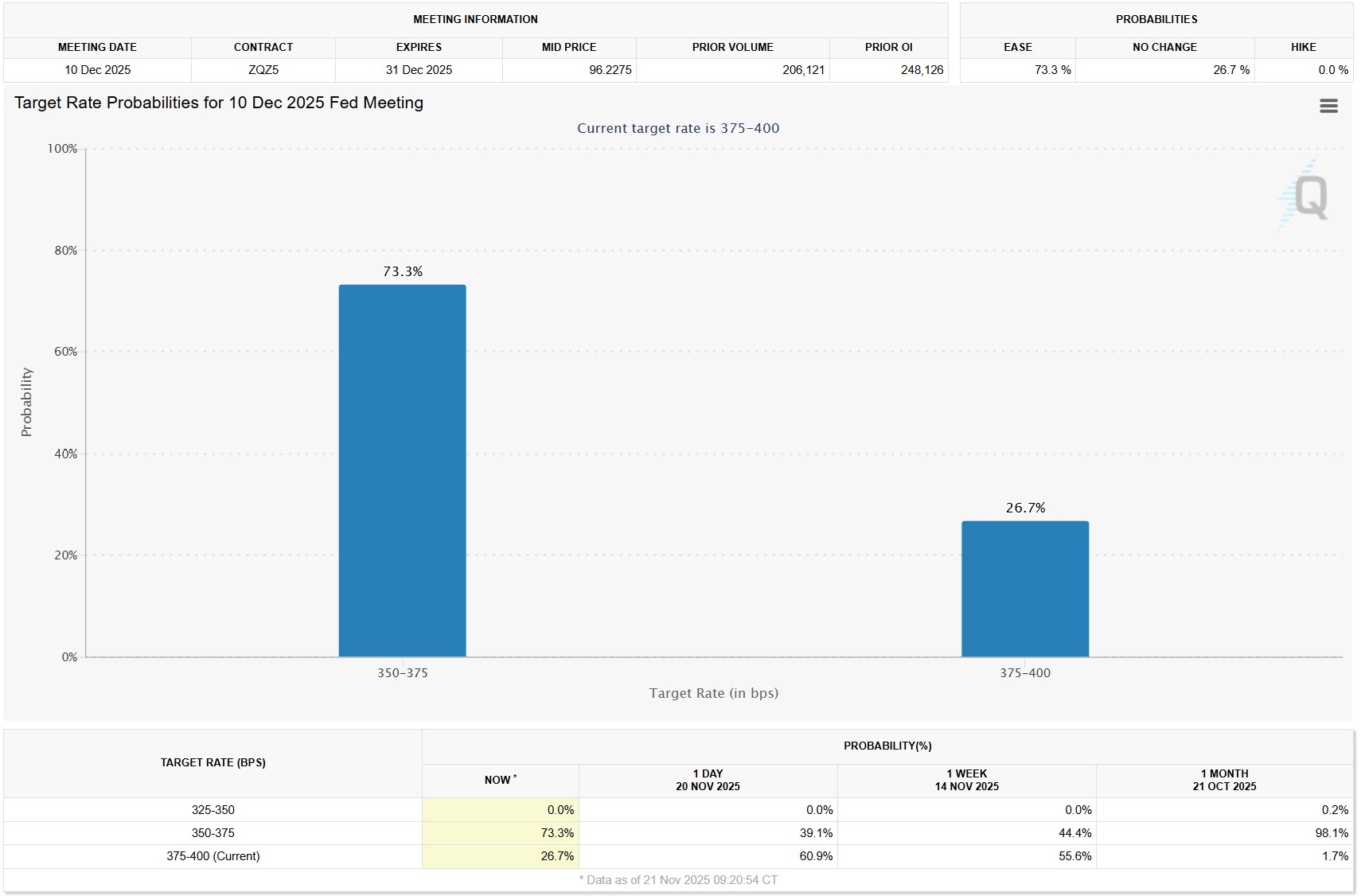

John Luke: The other big story this week was the on/off/on confidence in a December rate cut

Source: CME FedWatch Tool

Source: CME FedWatch Tool

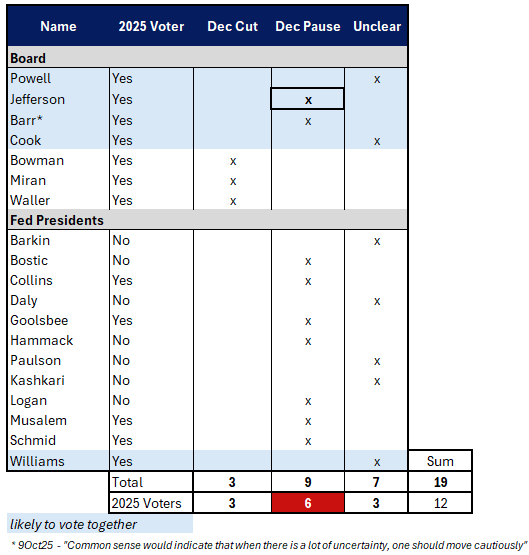

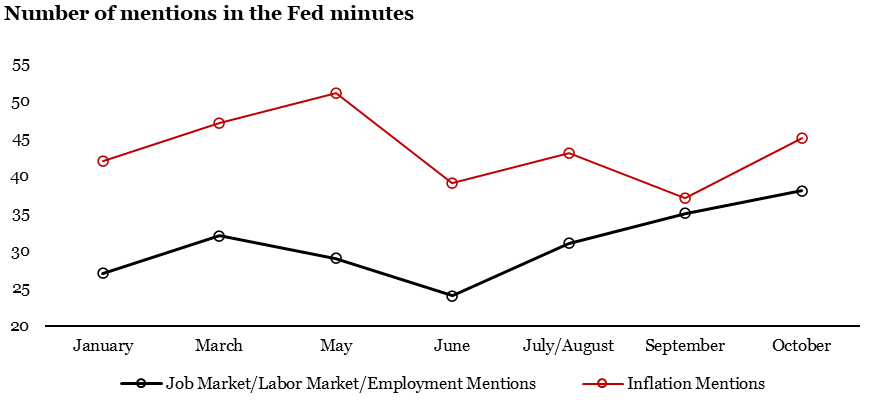

Joseph: as a host of Fed speakers gave differing views on outlooks for inflation and employment

Source: Citadel as of 11.15.2025

Source: Citadel as of 11.15.2025

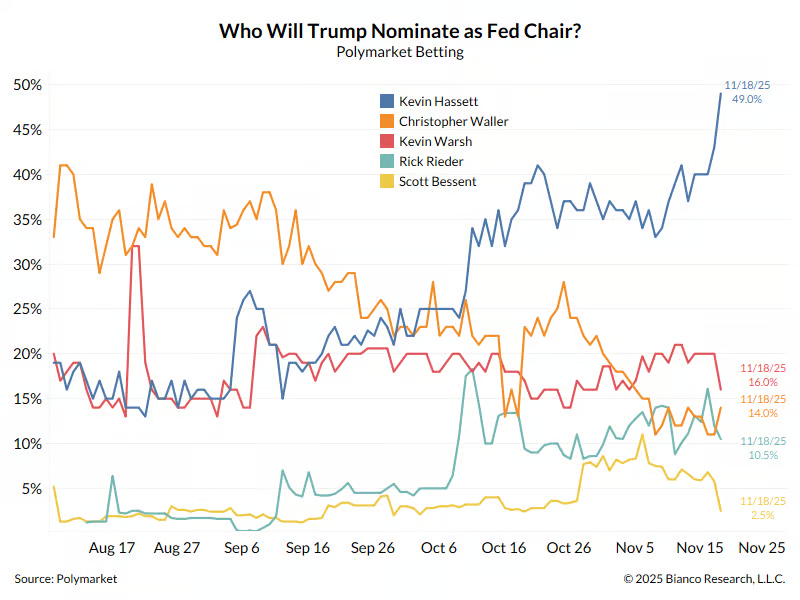

John Luke: and ironically, the clearest emerging consensus may be in candidates to replace Powell as Fed chairman

Data as of 11.19.2025

Data as of 11.19.2025

Dave: Despite perceived economic weakness, US consumer spending remains strong

Beckham: and global growth expectations have stabilized, after a shaky spring

Source: Apollo as of 11.20.2025

Source: Apollo as of 11.20.2025

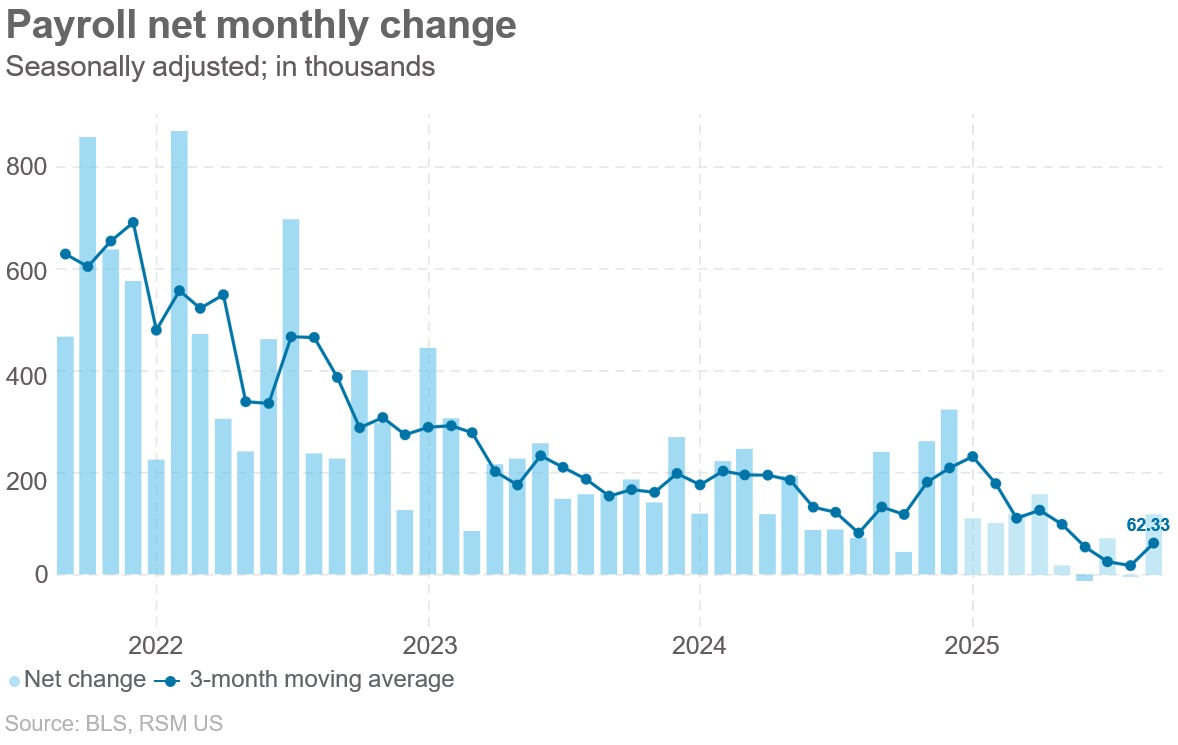

Brian: While not exactly a hot employment market, US hiring has at least stabilized above the flat line

Data as of 11.20.2025

Data as of 11.20.2025

Dave: This is probably the central datapoint in all of the rate debate. Will the trend in pay be higher, lower, or more of the same?

Source: Raymond James as of 11.20.2025

Source: Raymond James as of 11.20.2025

Brad: and what will be the impact of that outcome on future FOMC policy?

Source: Lombard Odier as of 11.20.2025

Source: Lombard Odier as of 11.20.2025

John Luke: The cost of everything will probably be a topic at many Thanksgiving gatherings

Source: Luke Gromen as of 11.18.2025

Source: Luke Gromen as of 11.18.2025

JD: and it should, as those price rises and subpar replacements quietly eat away at purchasing power

Source: Bridgewater as of September 2025

Source: Bridgewater as of September 2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2511-16.