Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

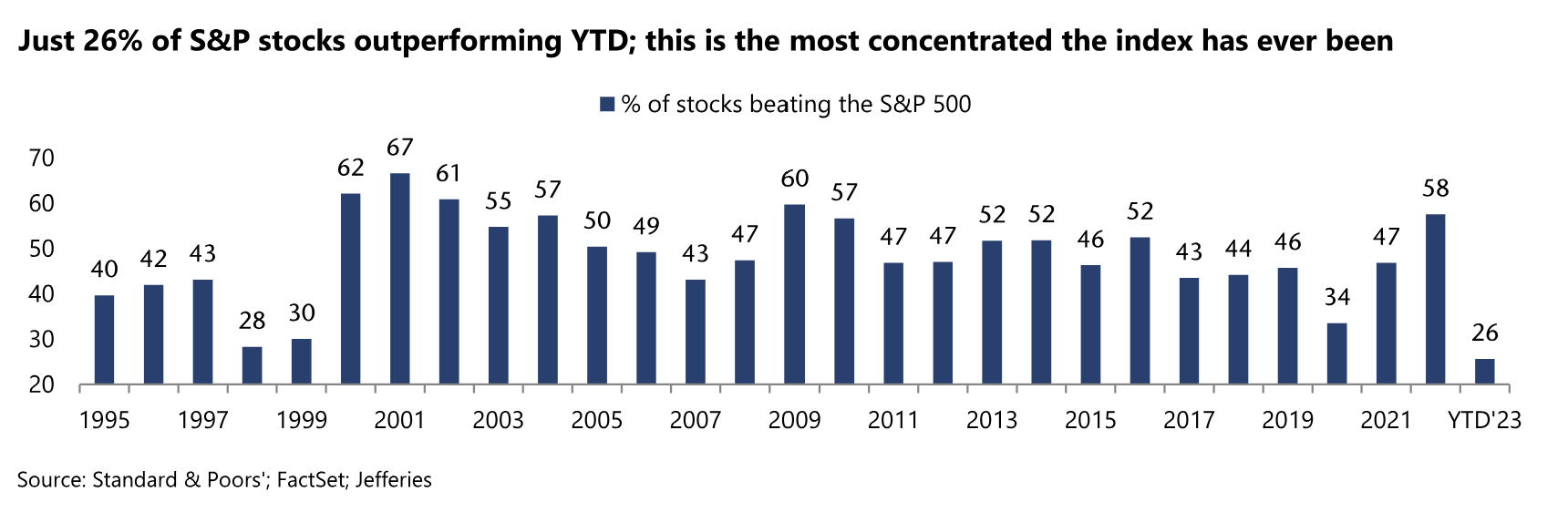

Dave: Advisors know this has been a challenging year for the typical stock relative to the S&P 500

Data as of 11.18.2023

Data as of 11.18.2023

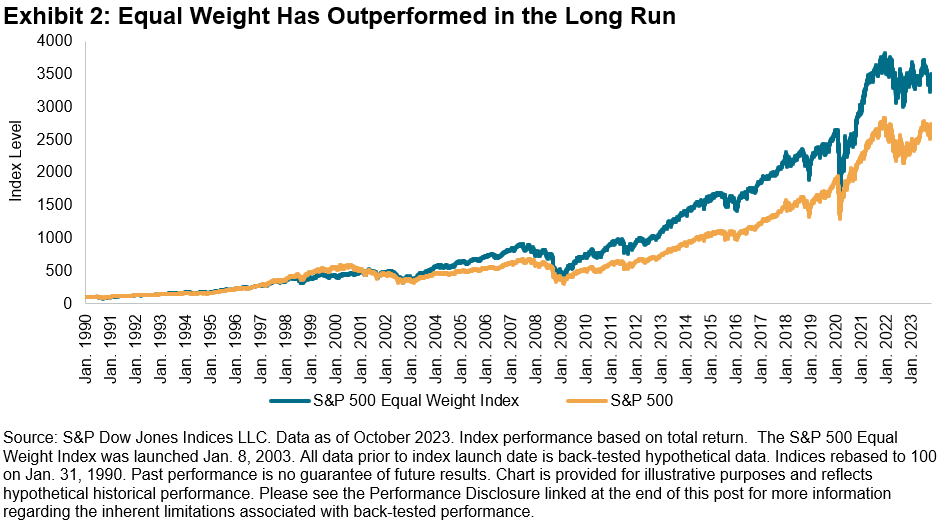

John Luke: but history shows the equal-weighted S&P has performed just fine head-to-head

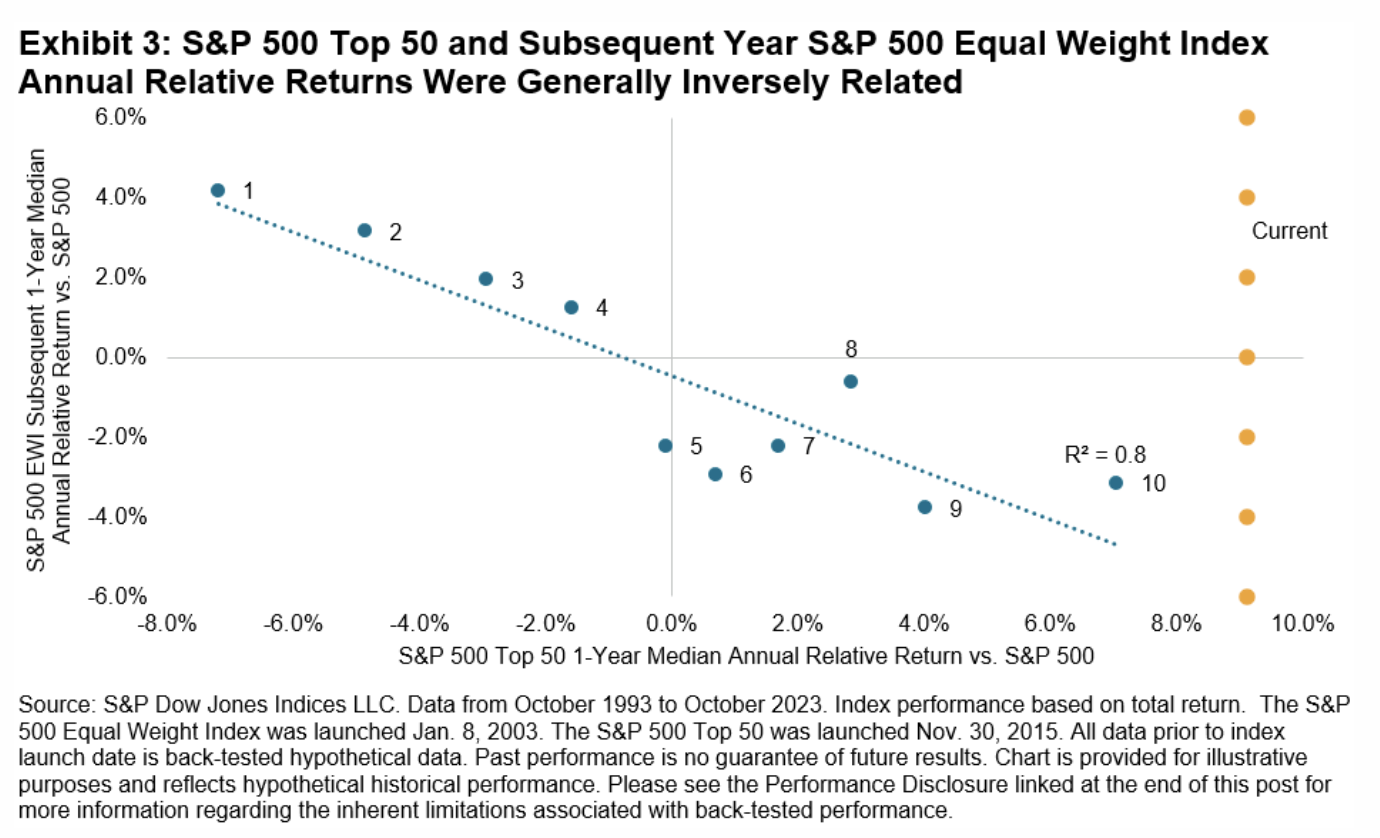

Beckham: and historically these larger divergences have been reversed in future years

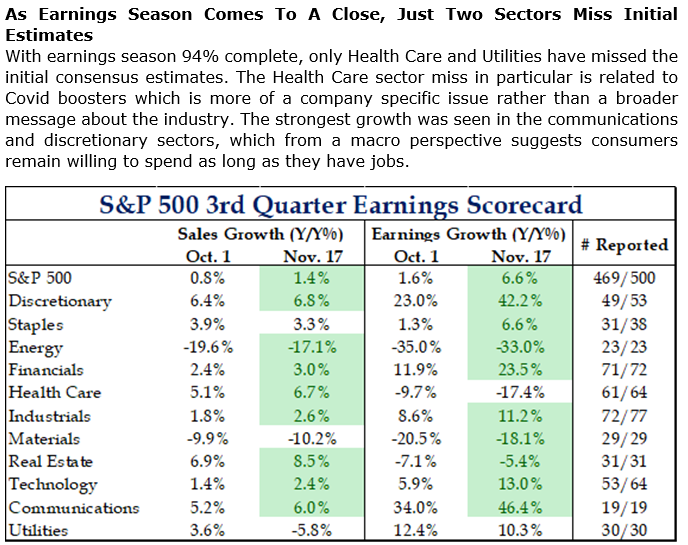

Brad: As they usually do, earnings managed to beat expectations, with a whole lot of variance by sector

Source: Strategas as of 11.21.2023

Source: Strategas as of 11.21.2023

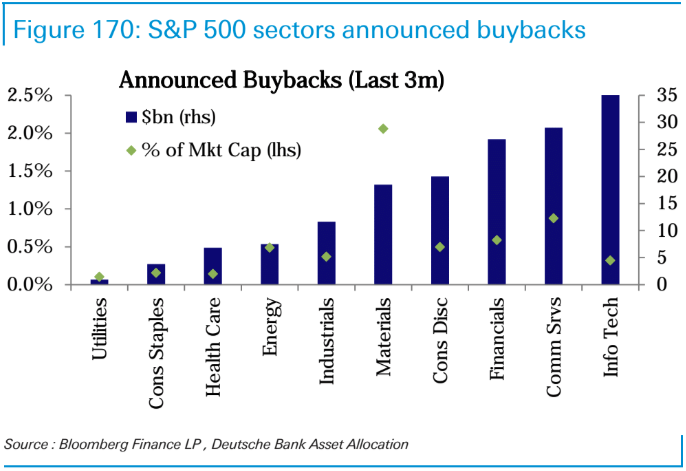

Joseph: and speaking of sectors, managements in this year’s laggards have been the most aggressive in announcing stock buybacks, led by materials

Source: Bloomberg Finance LP, Data as of November 2023

Source: Bloomberg Finance LP, Data as of November 2023

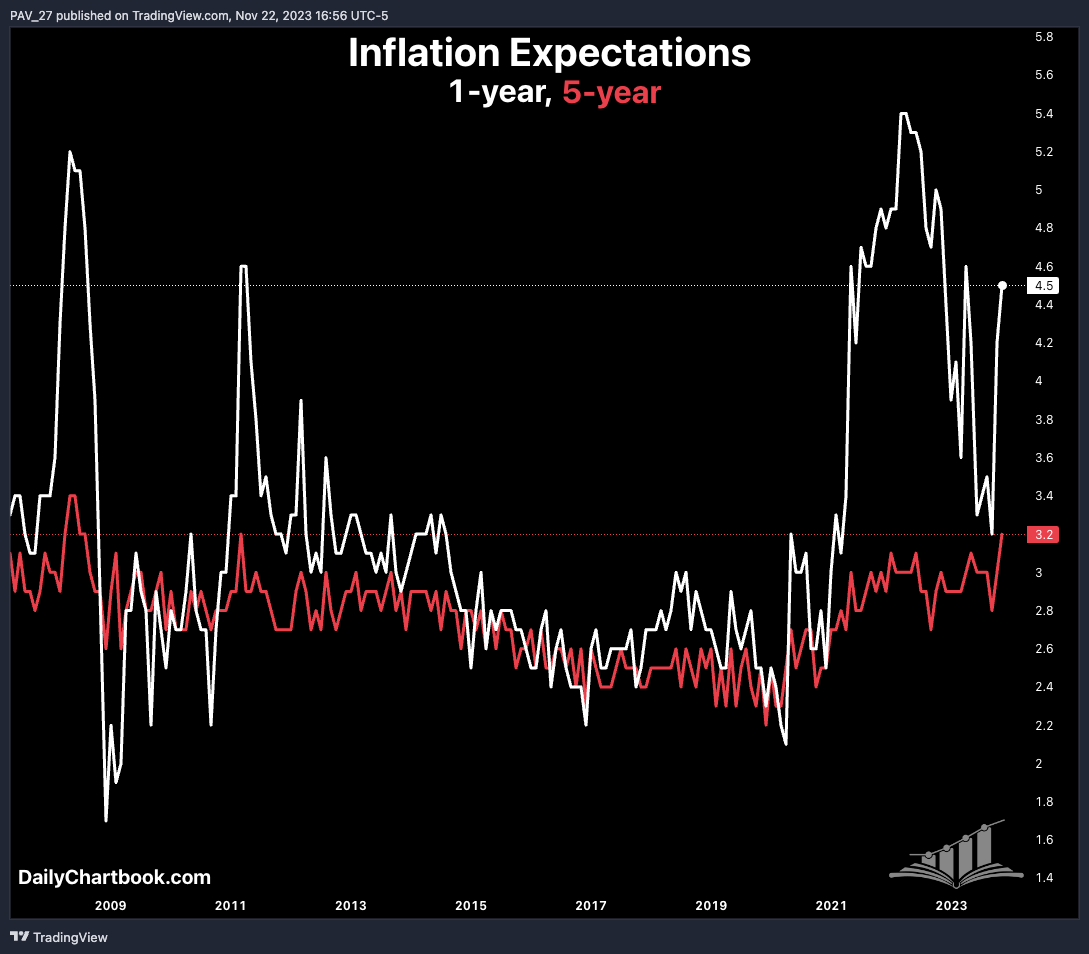

Joseph: Surveys show inflation expectations rising despite the sharp reduction in government inflation figures

Source: University of Michigan as of 11.21.2023

Source: University of Michigan as of 11.21.2023

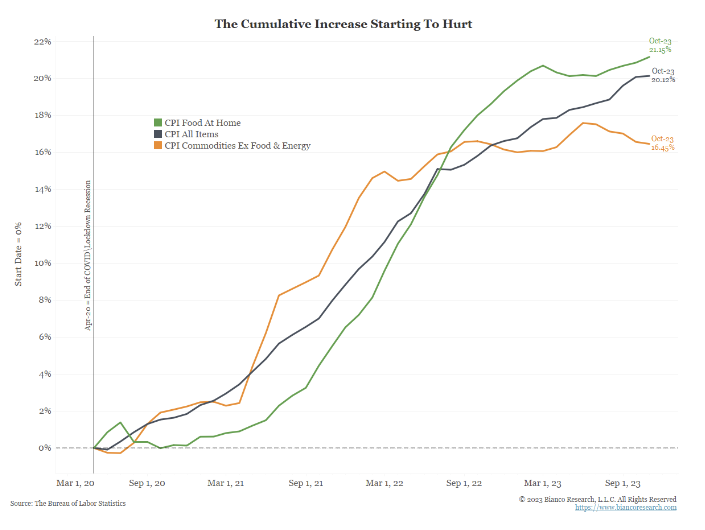

John Luke: as the cumulative reality of recent inflation sets in

Source: The Bureau of Labor Statistics, data as of October 2023

Source: The Bureau of Labor Statistics, data as of October 2023

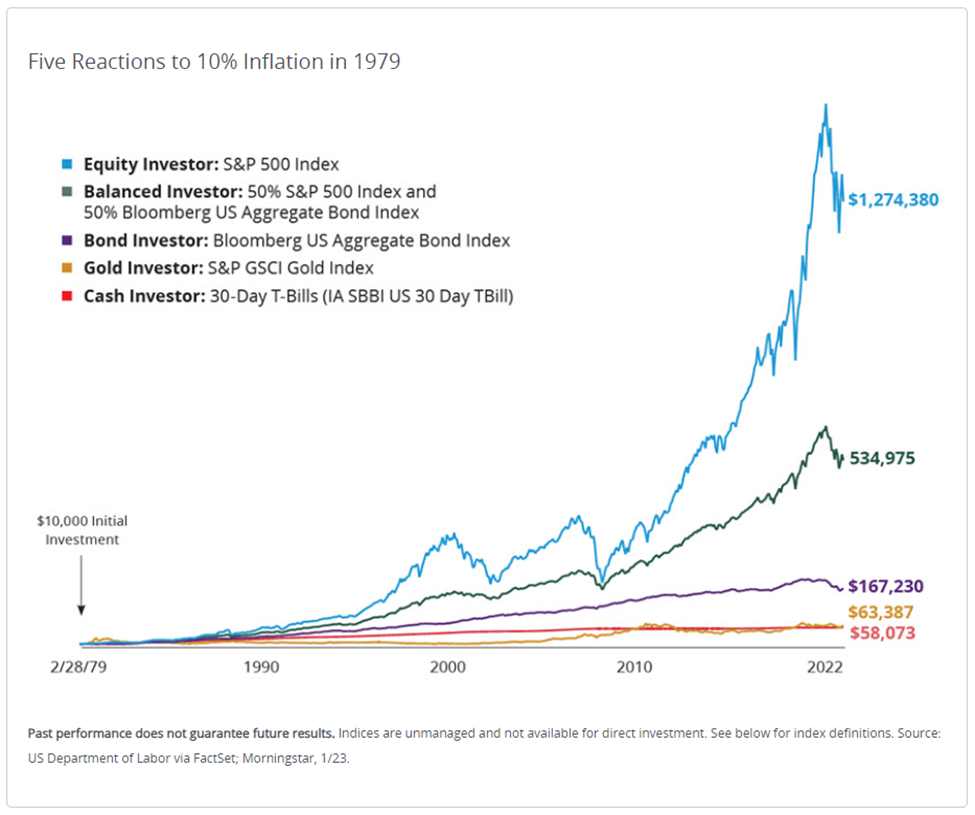

Brett: and investors flocking into money markets again put themselves at the risk of losing purchasing power

Source: Hartford Funds as of March 2023

Source: Hartford Funds as of March 2023

Beckham: No way around it, the U.S. consumer is in a pretty healthy state especially at the high end

Source: Goldman Sachs as of November 2023

Source: Goldman Sachs as of November 2023

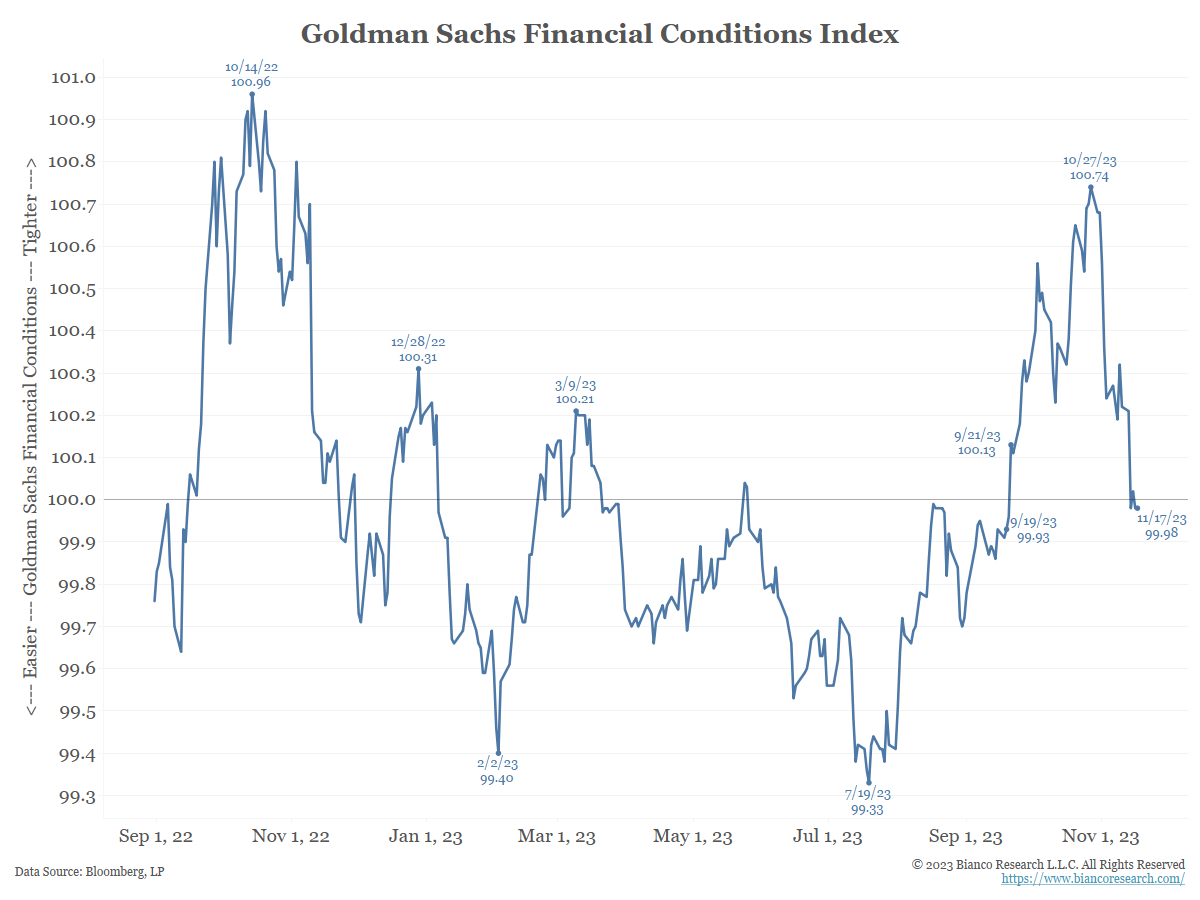

John Luke: which, combined with the recent equity bounce is offsetting much of the Fed’s rate hikes and quantitative tightening

Data as of 11.17.2023

Data as of 11.17.2023

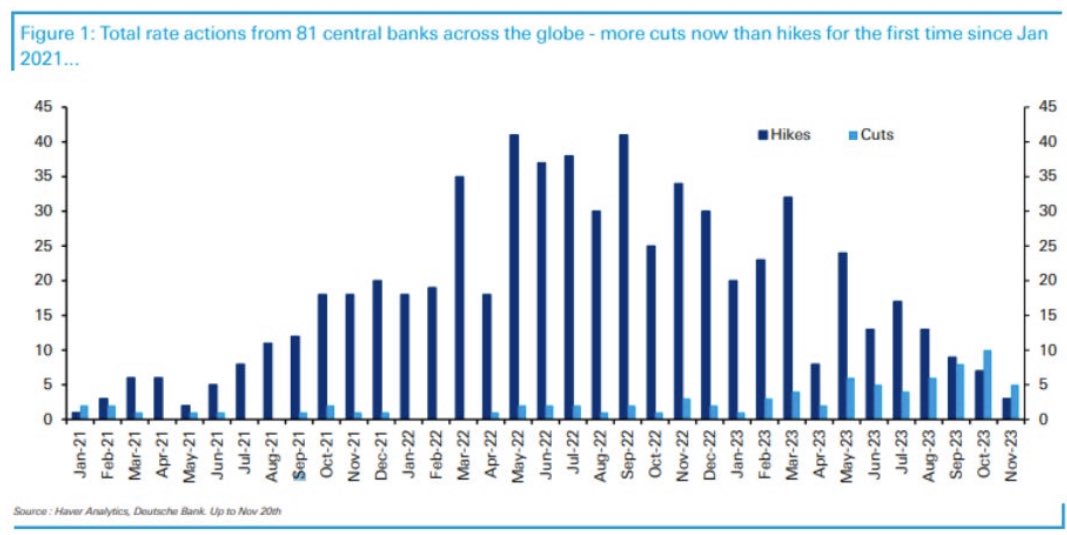

Joseph: While central banks across the world have generally ended their rate hikes

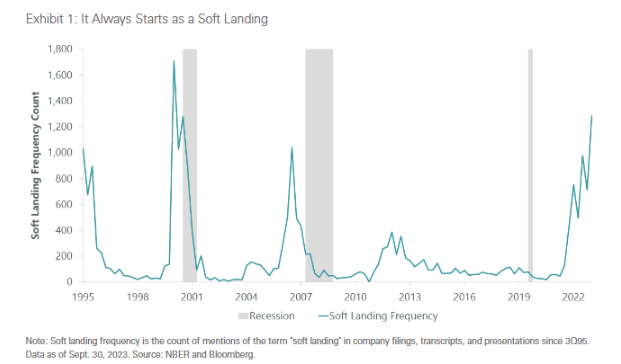

John Luke: and US investors are seemingly locked in on the always-elusive “soft landing”

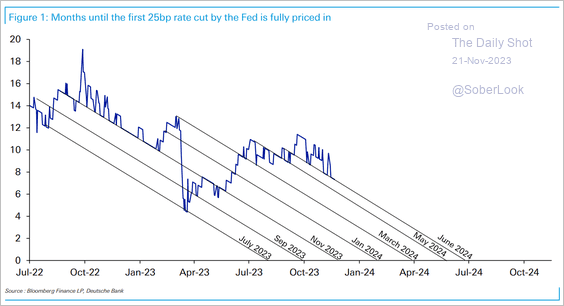

Brett: investors in this rate cycle have generally looked out at least two quarters before anticipating actual rate cuts

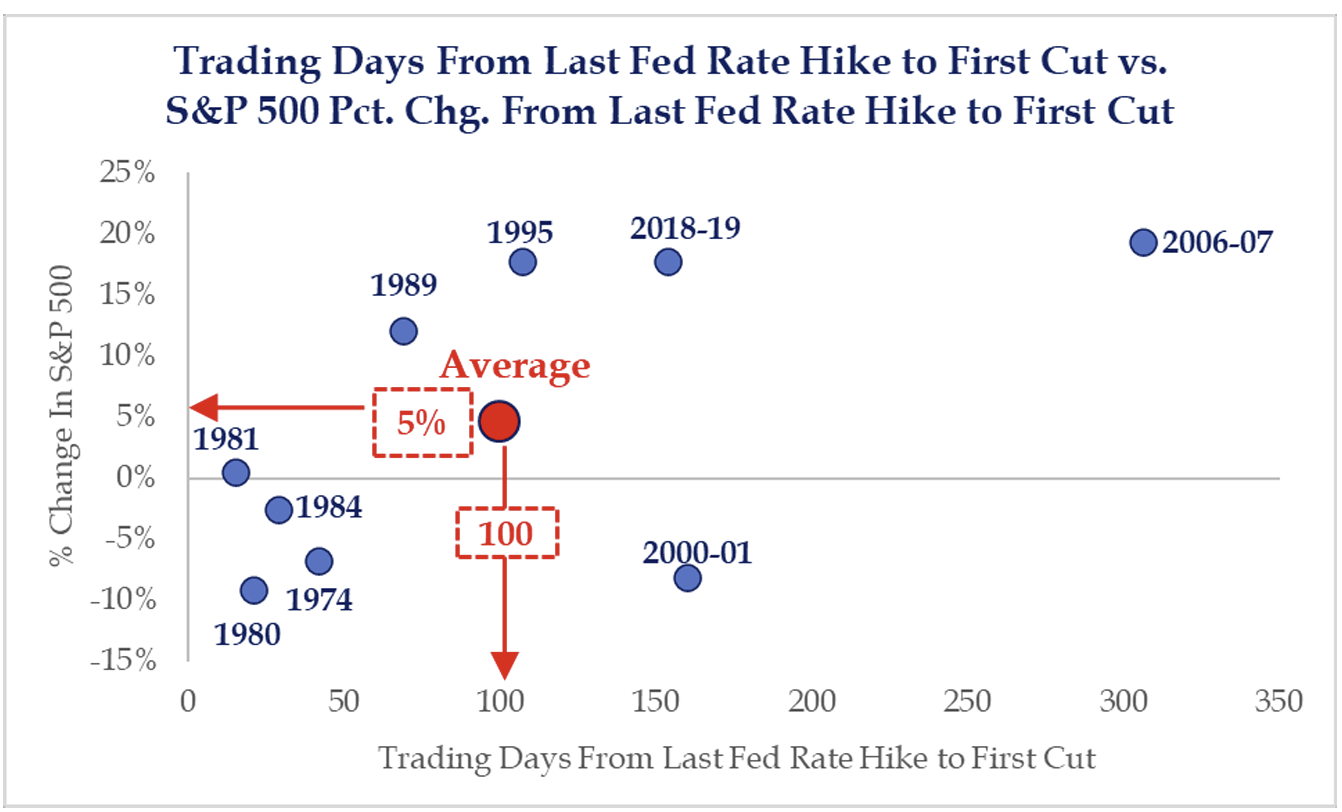

Dave: Even at that, stock market performance from the last hike to the first cut has historically been driven by the prevailing inflation regime

Source: Strategas as of 11.20.2023

Source: Strategas as of 11.20.2023

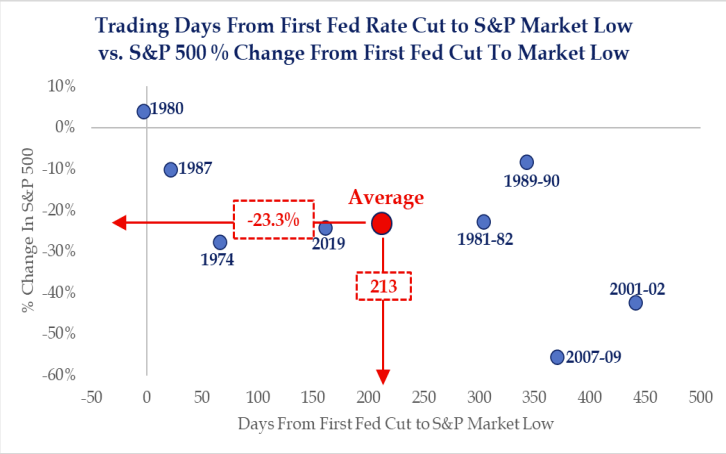

Dave: with even the first rate cut showing itself to be no easy path to market gains

Source: Strategas as of 11.20.2023

Source: Strategas as of 11.20.2023

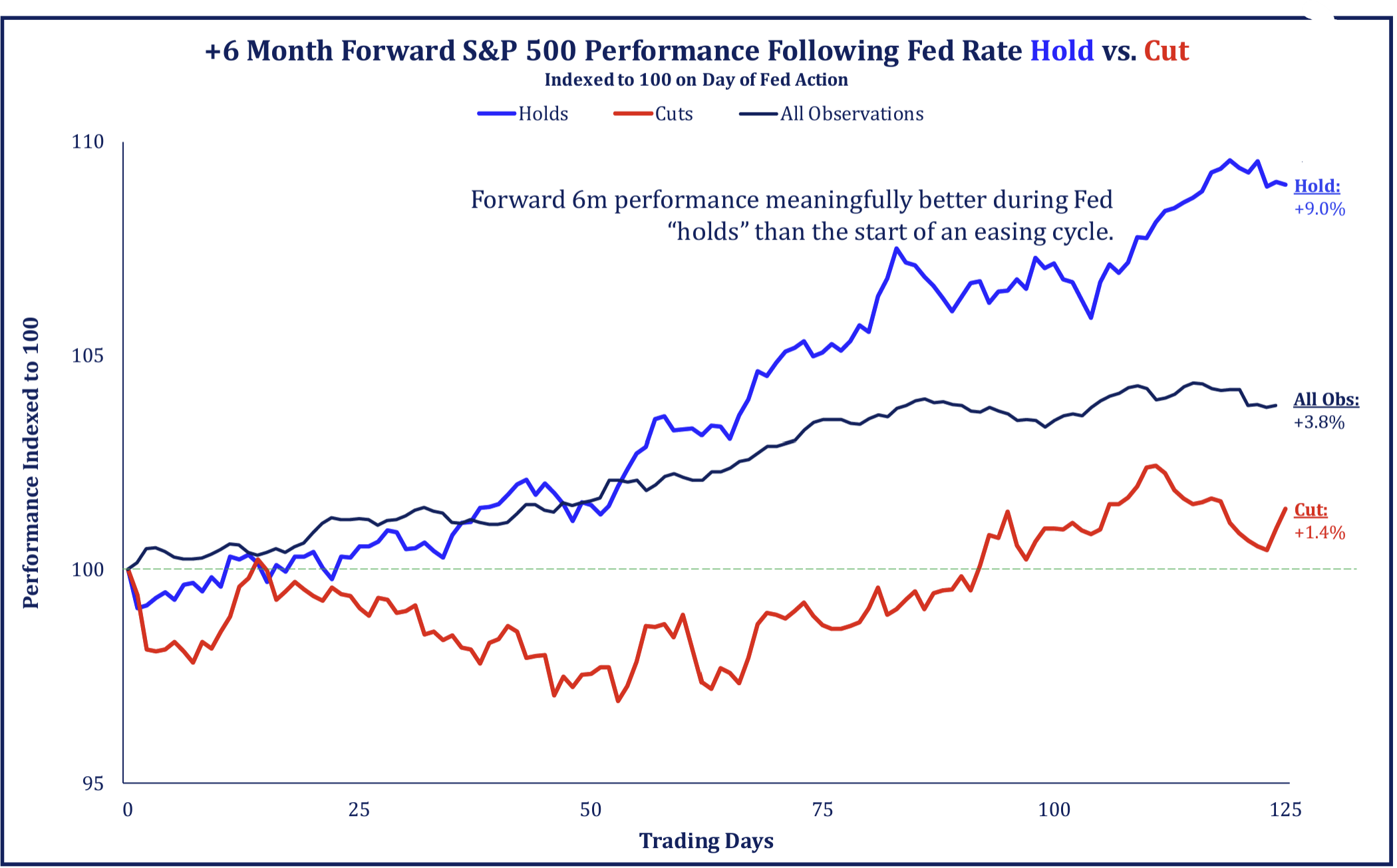

Dave: so in the end, history says we’re better off with more “holding” than we are with cutting

Source: Strategas as of 11.20.2023

Source: Strategas as of 11.20.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2311-17.