Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from market selloffs to winners and losers, strong earnings to AI capex, and different ways to view the “K-shaped” economy. Hope you had a great Thanksgiving and a relaxing weekend ahead!

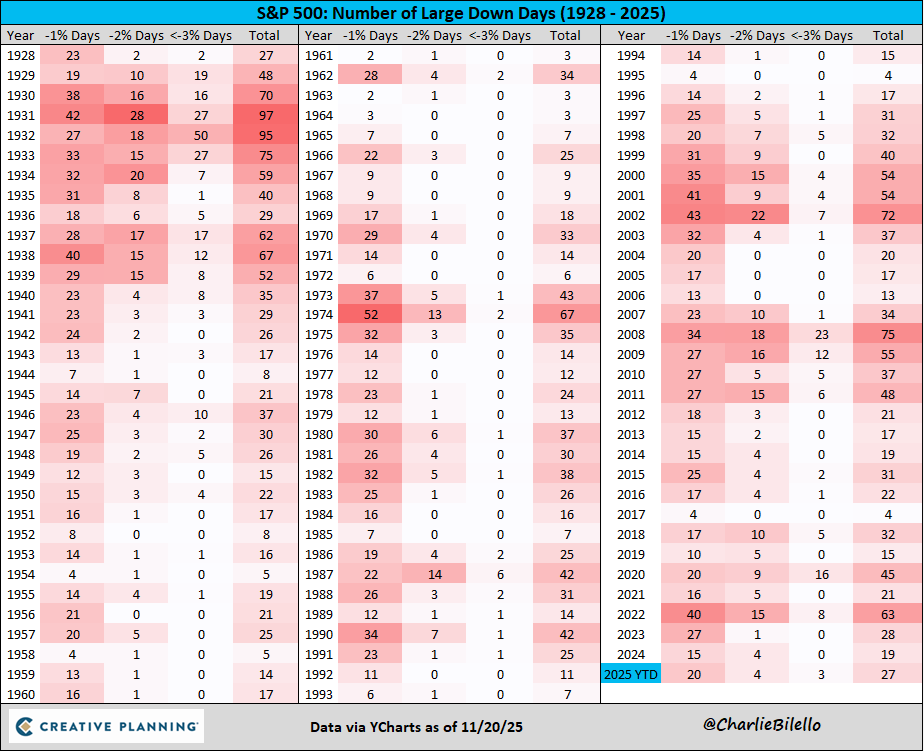

Brett: Big down days are a feature of equity investing, whether the environment is healthy or unhealthy

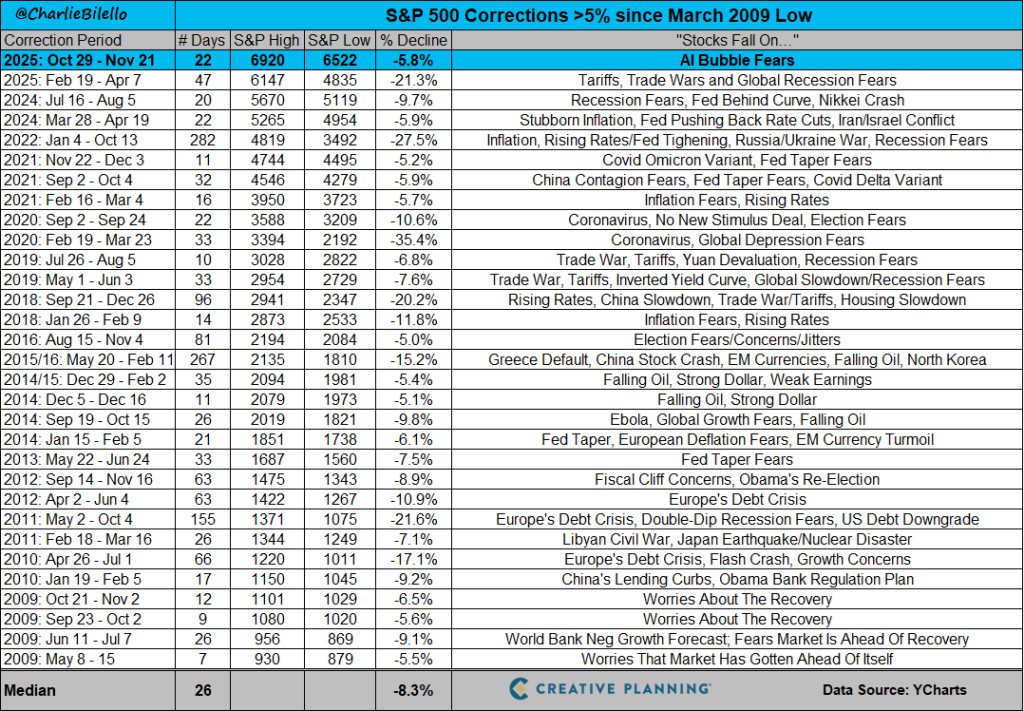

Brad: and another 5% correction has come and gone

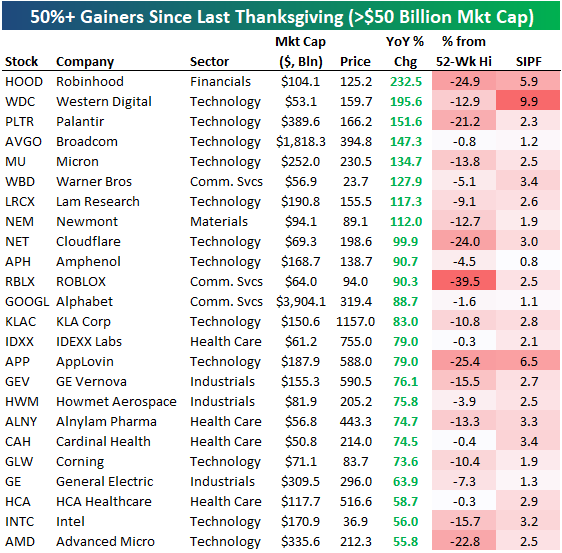

Data as of 11.24.2025

Data as of 11.24.2025

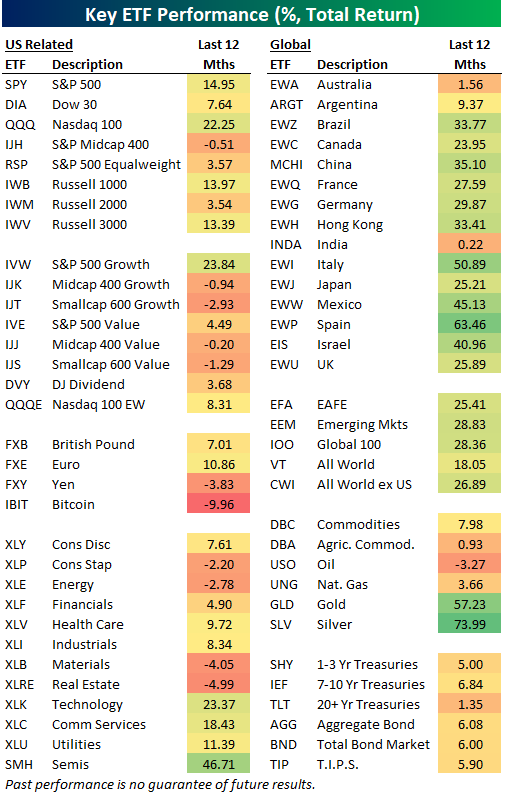

Ten: Will be interesting to look at this list next Thanksgiving and see where surprises occurred

Source: Bespoke as of 11.26.2025

Source: Bespoke as of 11.26.2025

Jake: and while a handful of (mostly) tech stocks ran away from the many investors

Source: Bespoke as of 11.27.2025

Source: Bespoke as of 11.27.2025

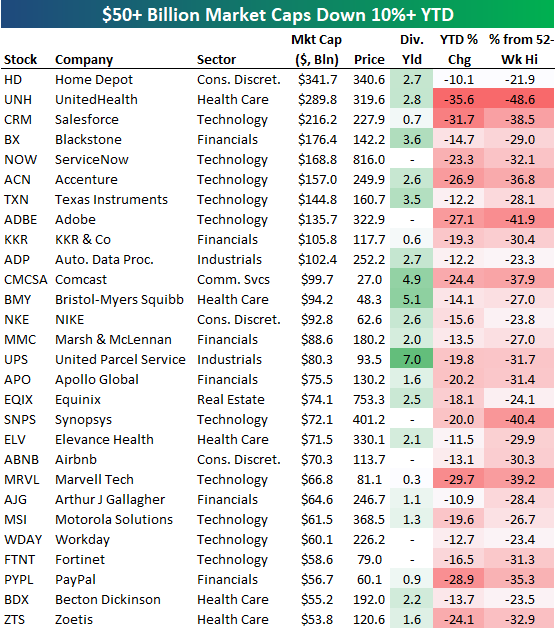

Jake: there are a number of well-known names that have languished well away from their highs

Source: Bespoke as of 11.27.2025

Source: Bespoke as of 11.27.2025

Brad: It was another great quarter for large company earnings

Data as of 11.25.2025

Data as of 11.25.2025

Joseph: and forward expectations have recovered from the tariff tantrum

Data as of 11.25.2025

Data as of 11.25.2025

John: leading to an earnings backdrop that has been able to keep its momentum in gear with the run in stocks

Dave: Hyperscaler capital spending continues to be a key source of economic support

Source: Goldman Sachs as of 11.21.2025

Source: Goldman Sachs as of 11.21.2025

Beckham: with the only obvious constraint being a limited amount of power to meet the CapEx spending

Data as of October 2025

Data as of October 2025

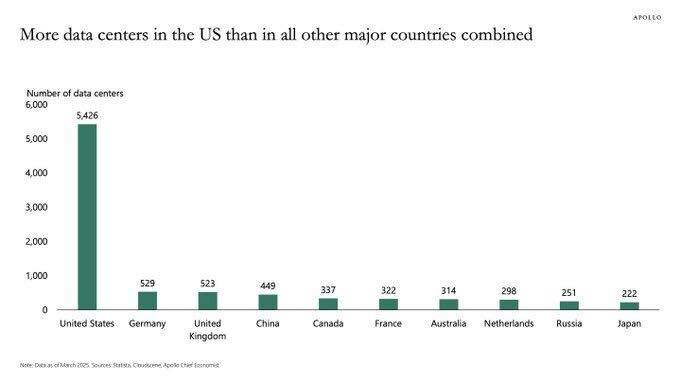

JD: which is leading to an endless appetite for places to help meet the demand

Source: Apollo as of 11.18.2025

Source: Apollo as of 11.18.2025

Mark: We hear a lot about the affordability challenges facing new homebuyers

Data as of October 2025

Data as of October 2025

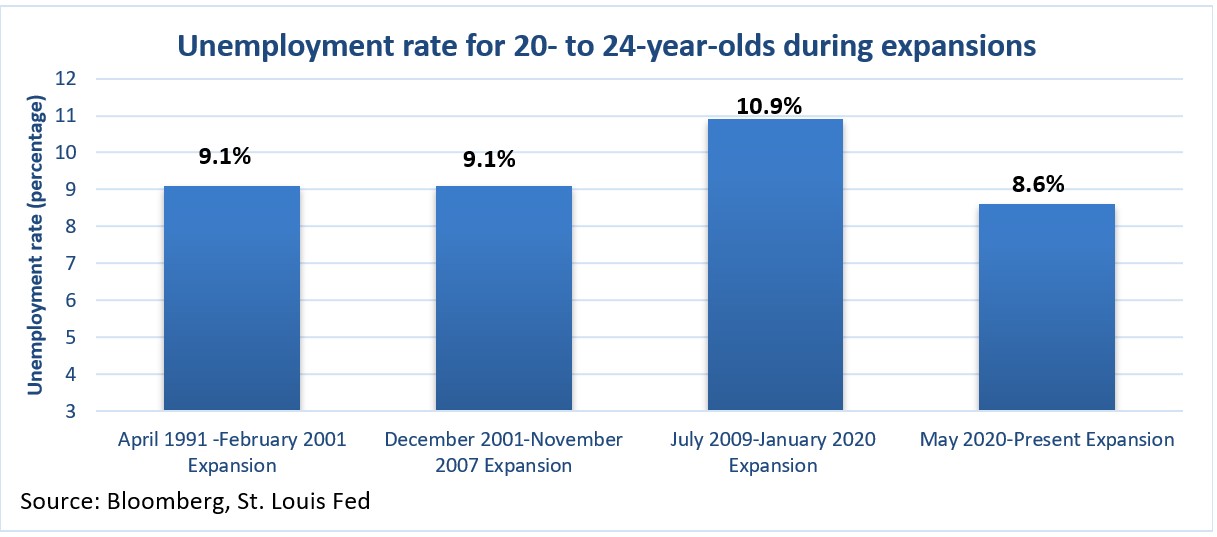

Brian: but it doesn’t seem to stem from any unusually difficult employment environment

Graphic via RSM as of 11.20.2025

Graphic via RSM as of 11.20.2025

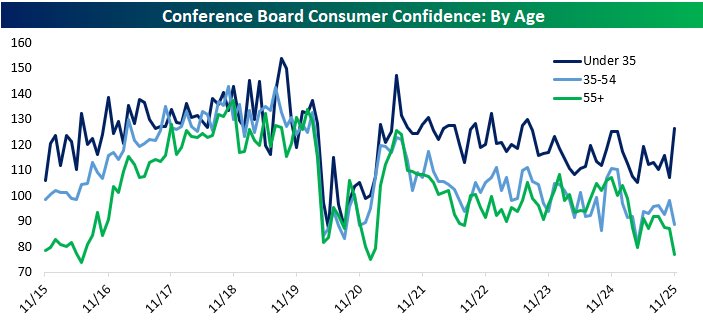

Beckham: Seems at odds with headlines but the younger people in these surveys don’t seem to be a source of gloom

Source: Bespoke as of 11.26.2025

Source: Bespoke as of 11.26.2025

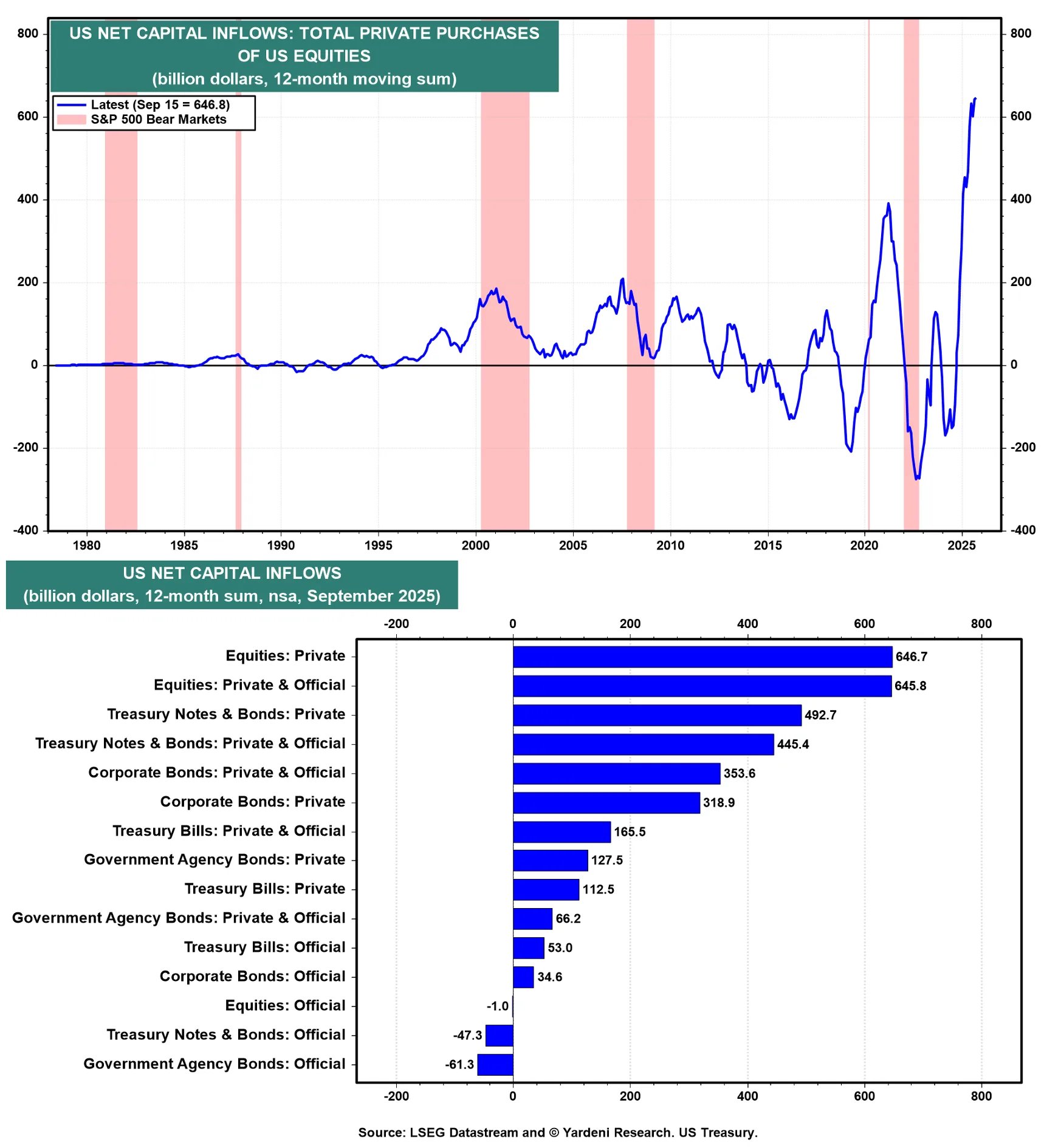

Jake: also not gloomy about US conditions? Foreign investors, who continue to shovel money into US stocks

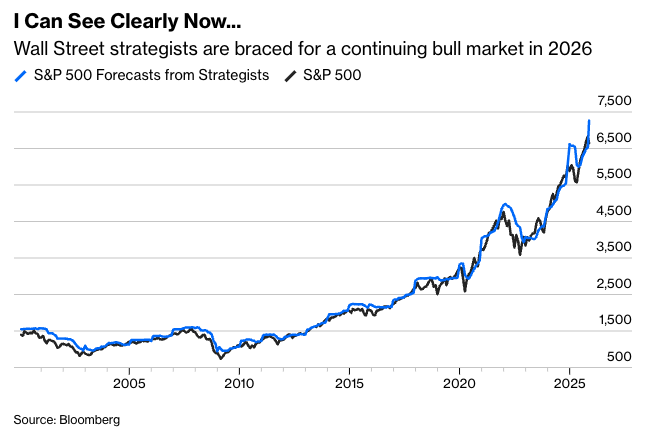

Joseph: It’s the most wonderful time of the year…where Wall Street strategists look at current price levels and decide to add 6-12% for their next year forecast

Data as of 11.26.2025

Data as of 11.26.2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2511-21.