Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

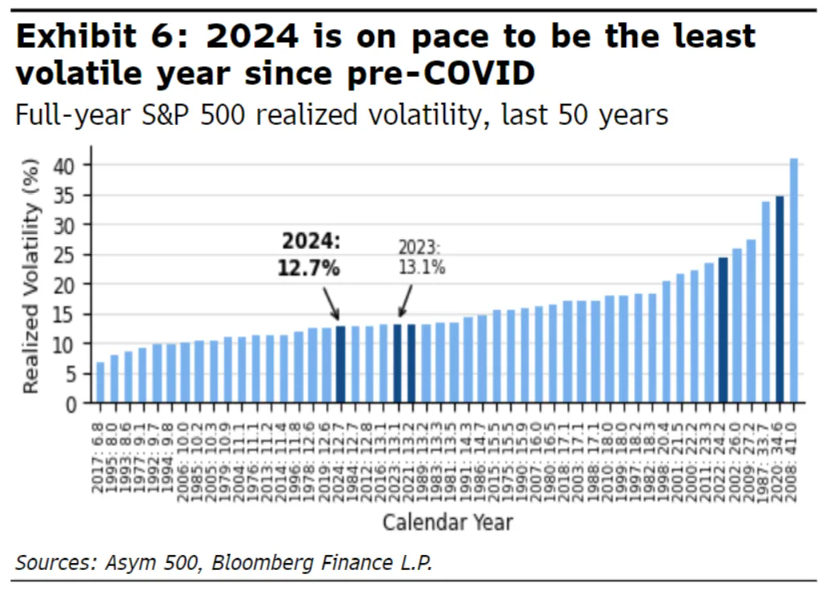

Beckham: This year’s S&P 500 has been one of the steadier rises in recent history

Data as of 11.27.2024

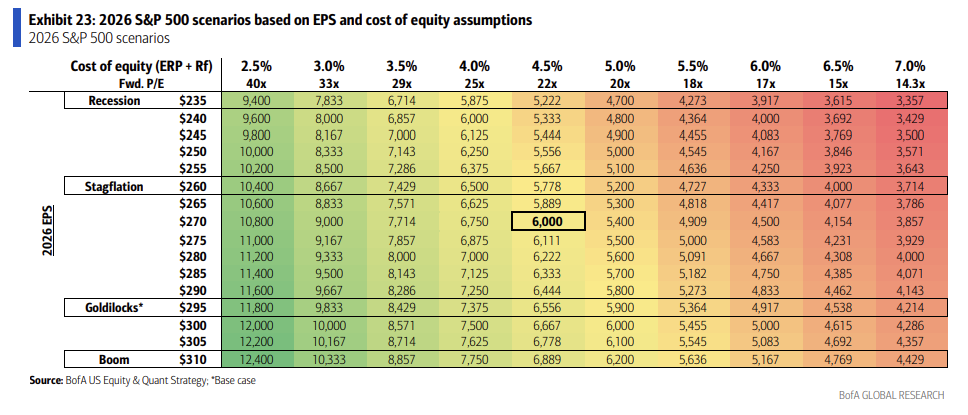

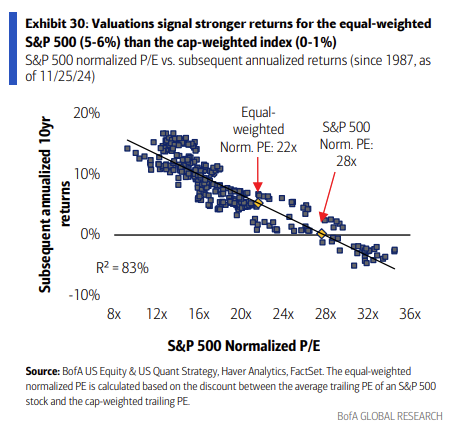

John Luke: leaving the index in need of help from earnings and/or rates to justify significant progress over the next year or two

Data as of 11.22.2024

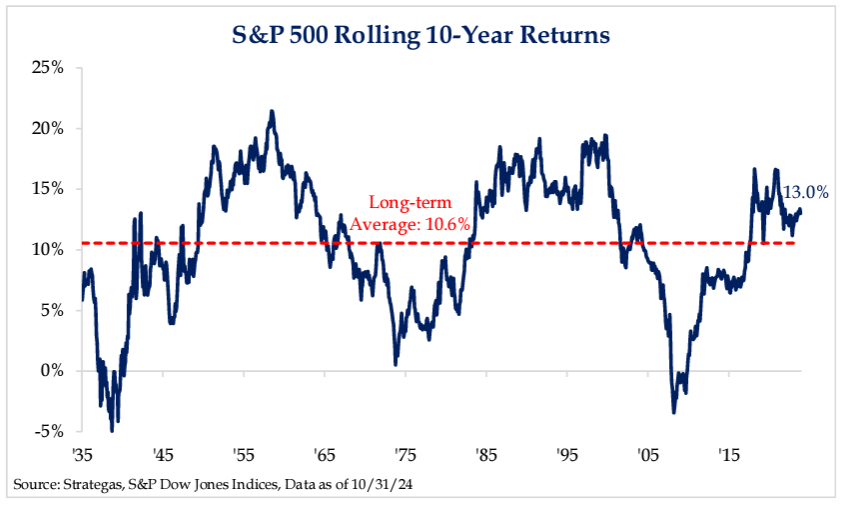

Dave: that said, history tells us that long-term optimism for stocks is the best outlook

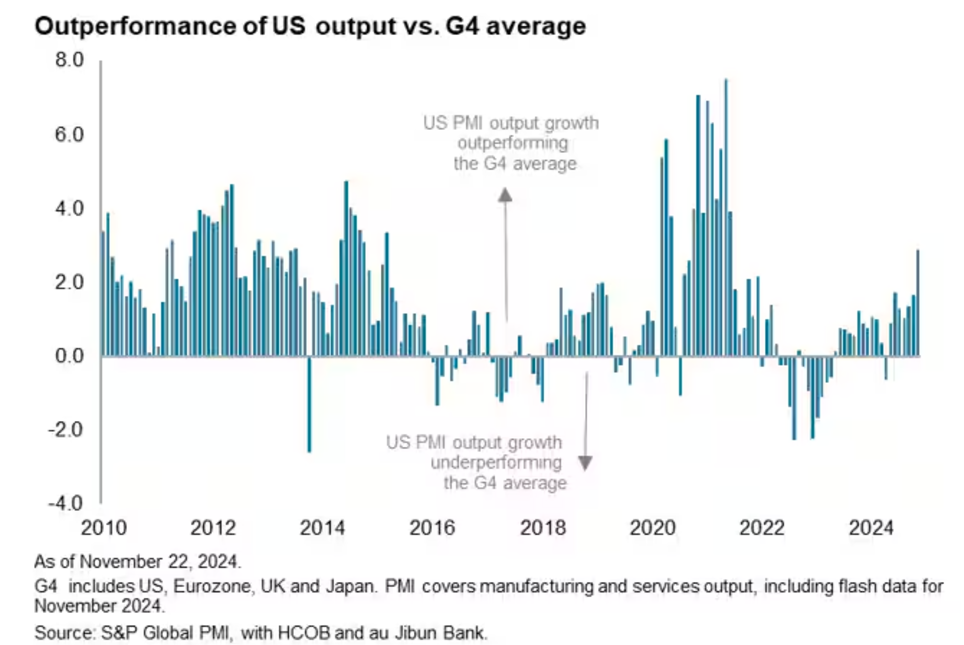

Joseph: Other than a few fleeting moments, the US economy has dominated its developed peers

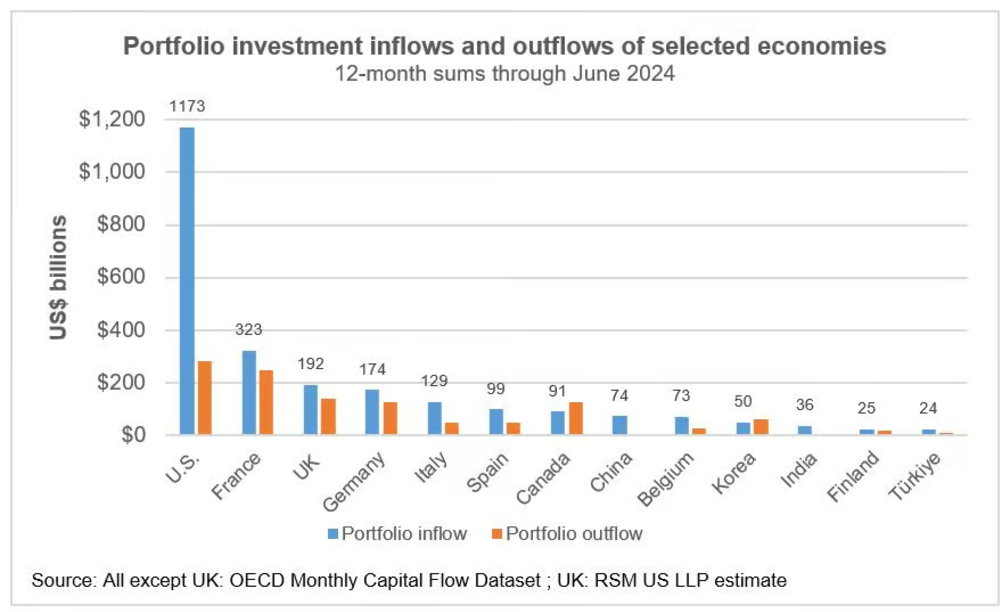

Brett: and corporations around the world have recognized the advantages of the U.S. market by making significant investments in their US operations

Data as of October 2024

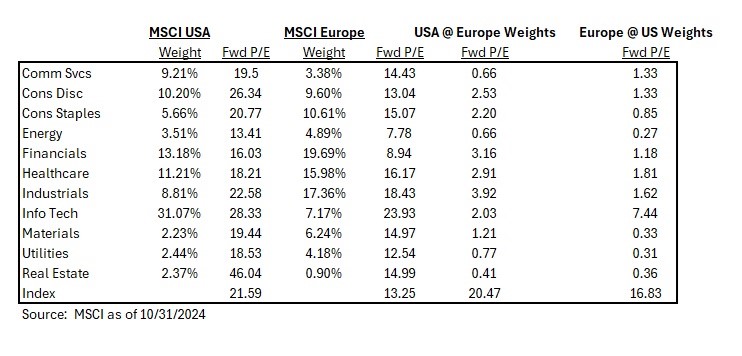

Brian: and while foreign indices trade at lower valuations, they’re not cheap enough to offset the U.S. fundamental advantages, once you put the comparisons on the same playing field

Source: @lhamtil as of 11.24.2024

JD: Expanding out to a longer timeframe, the compounding of the US advantage stands out with a strong uptrend in earnings

Data as of 11.22.2024

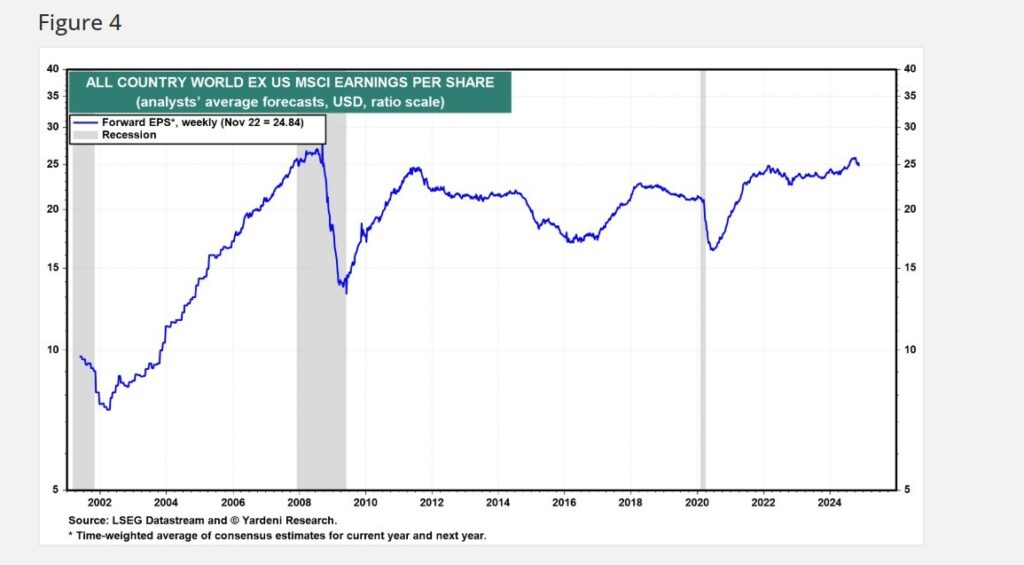

JD: versus the long-term stagnation outside the US

Data as of 11.22.2024

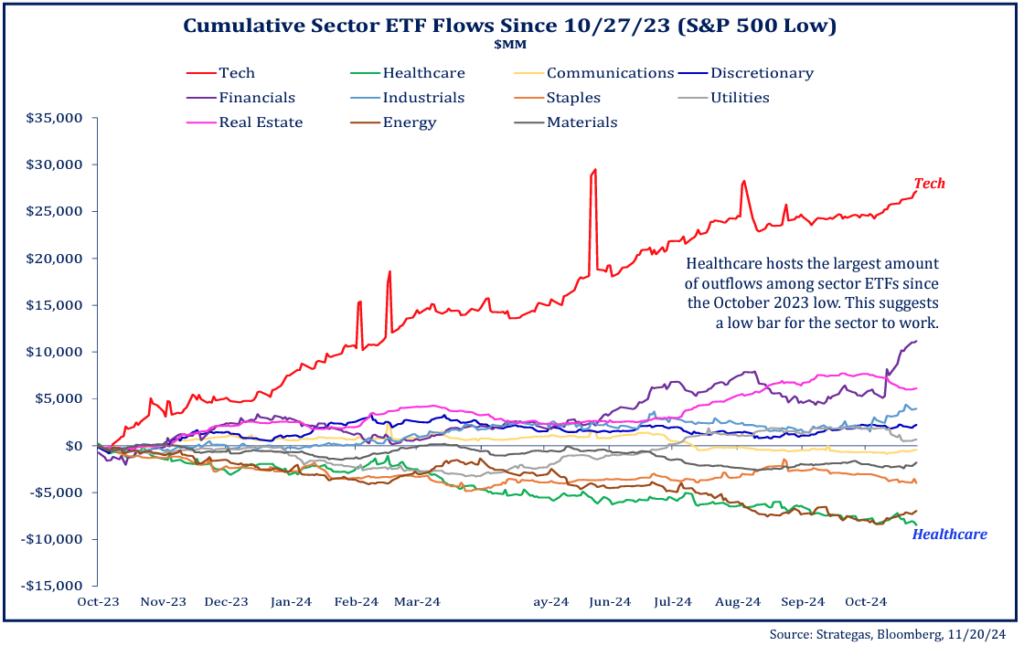

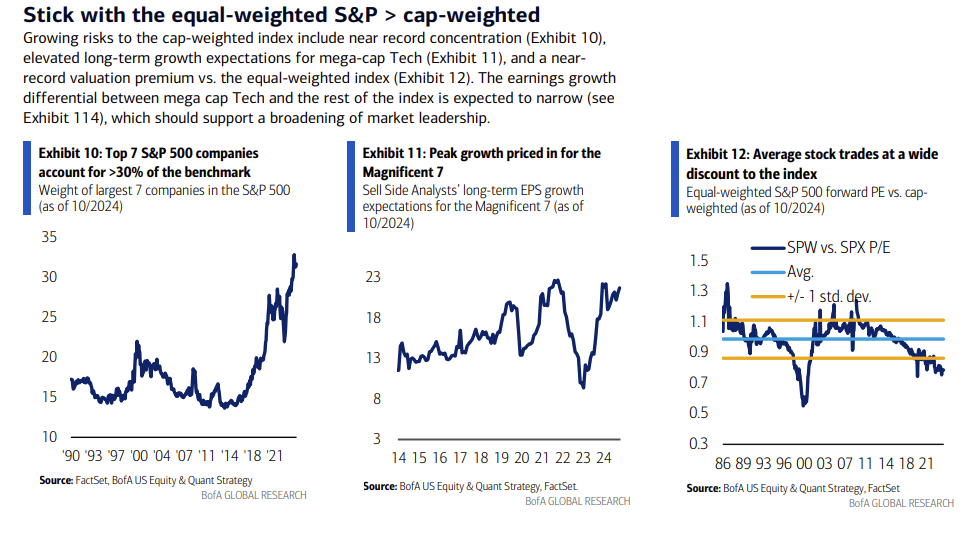

Brad: Technology has dominated investor flows in this year’s rally, and presumably large cap over small

John Luke: but the fundamentals seem to be working toward a closing of the performance gap

Data as of 11.26.2024

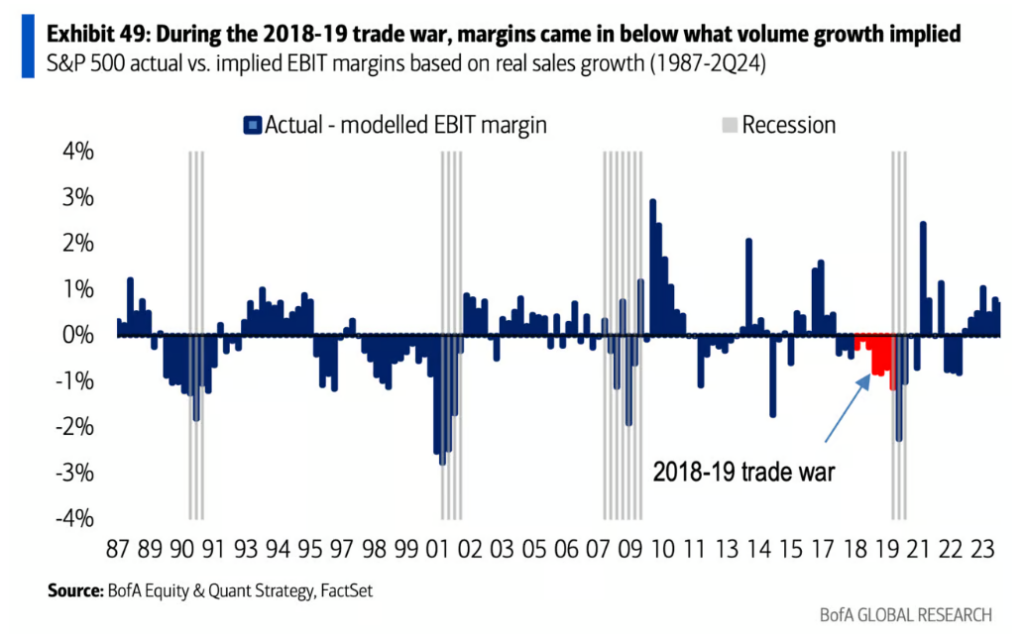

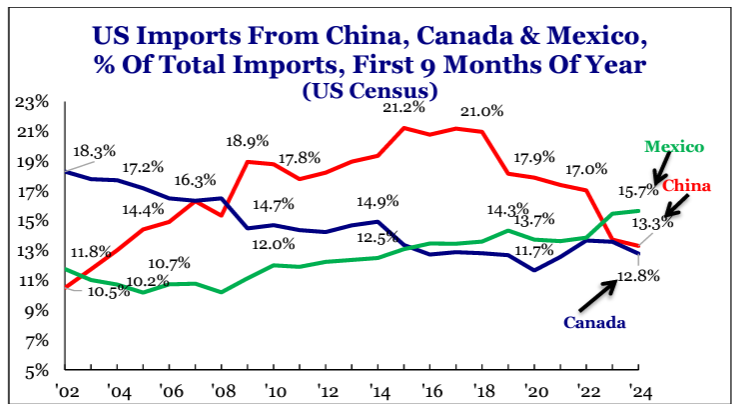

Arch: Tariffs loom as a possible threat to US profit margins

Data as of 11.27.2024

Dave: but corporations are flexible enough to adjust to where their business gets treated best

Source: Strategas as of 11.26.2024

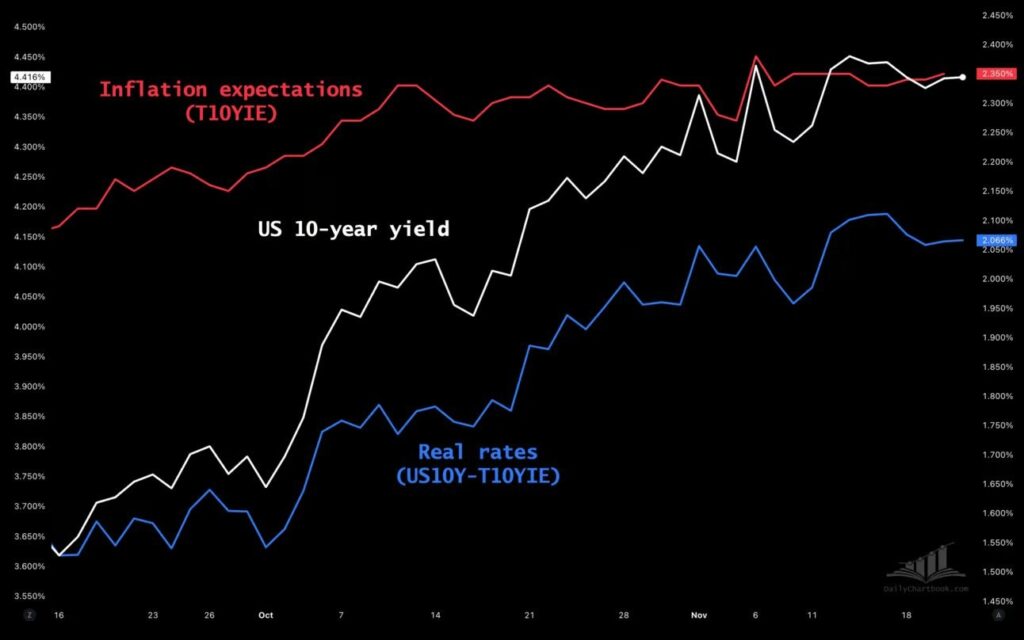

Joseph: The other area of investor concern is interest rates, whose recent rise has thus far been driven by higher growth expectations

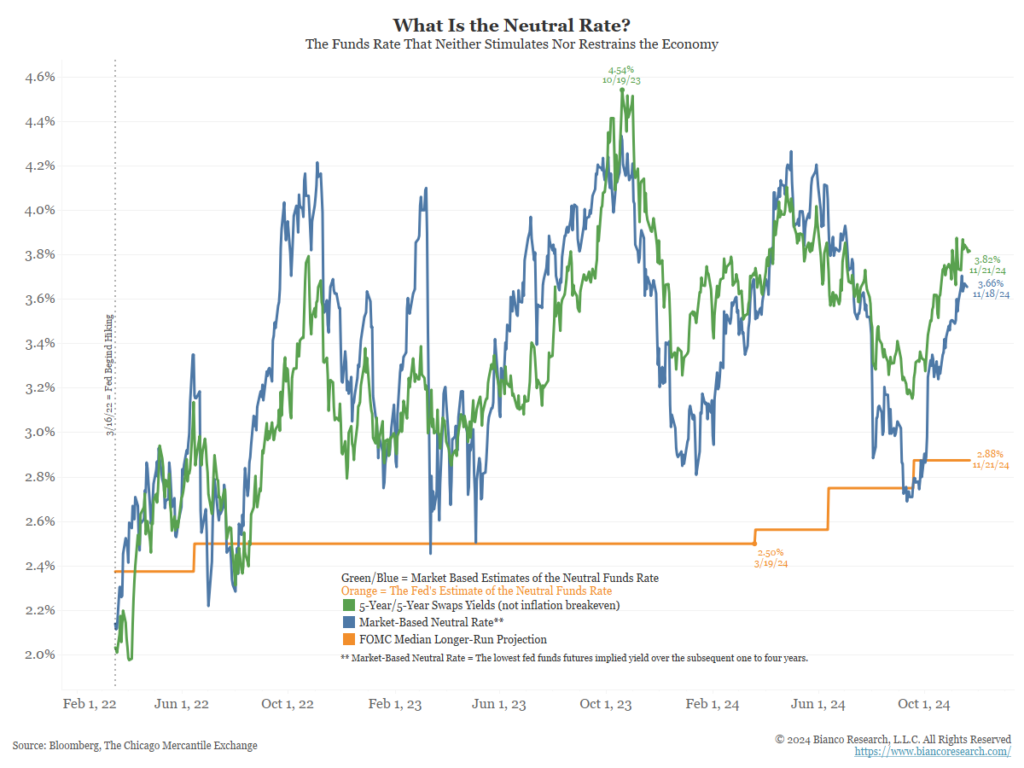

Source: DataTrek as of 11.21.2024

John Luke: and uncertainty regarding the eventual rate that keeps investors and the Fed comfortable

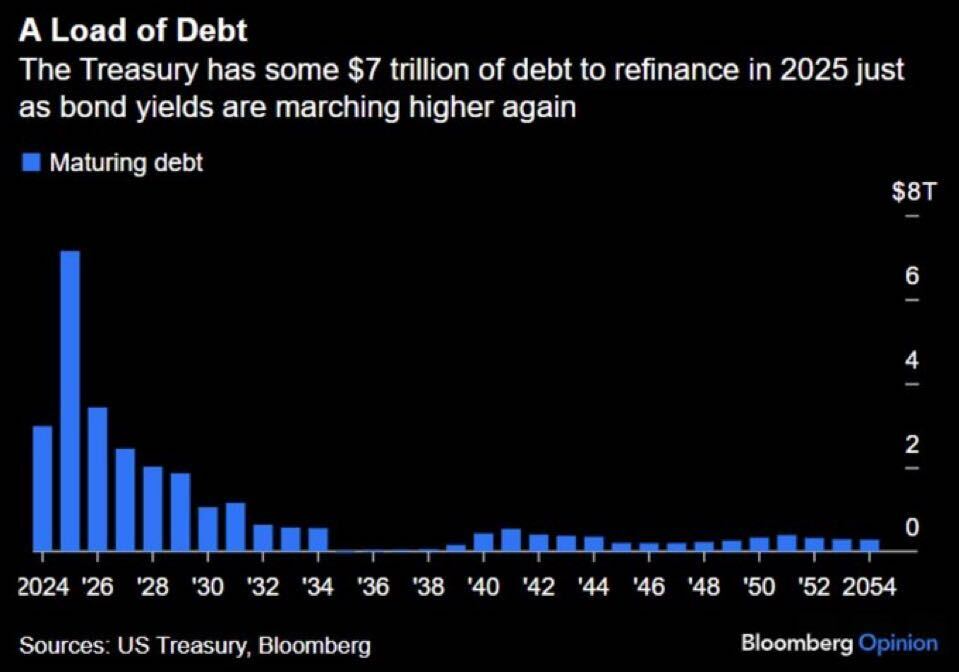

John Luke: and of course, a whole lot of US federal government debt maturing and in need of replacement

Data as of 11.27.2024

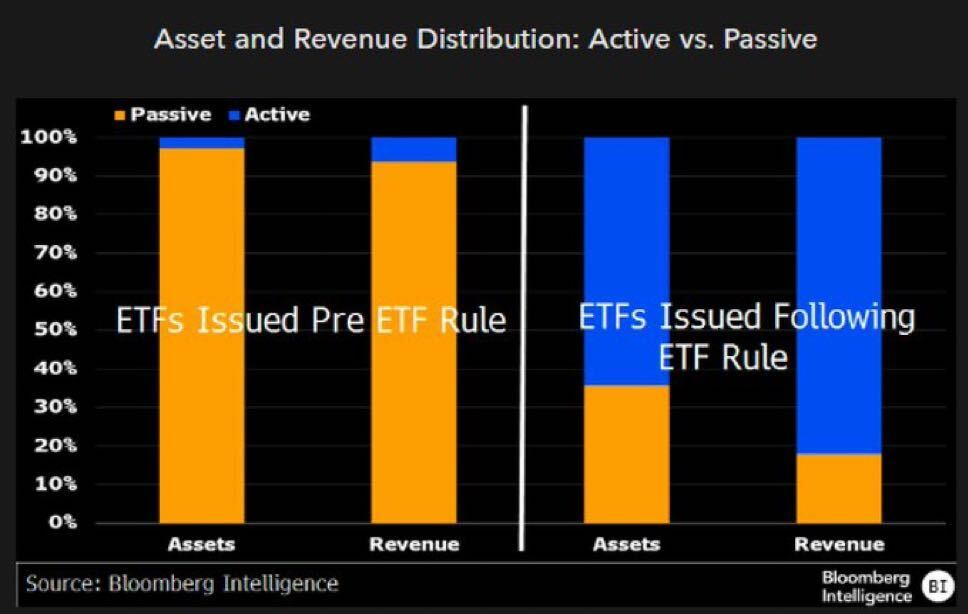

Brian: Active ETFs have been the center of innovation since they were included in the preferential ETF tax treatment starting in 2019

Data as of 11.25.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2411-24.