Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

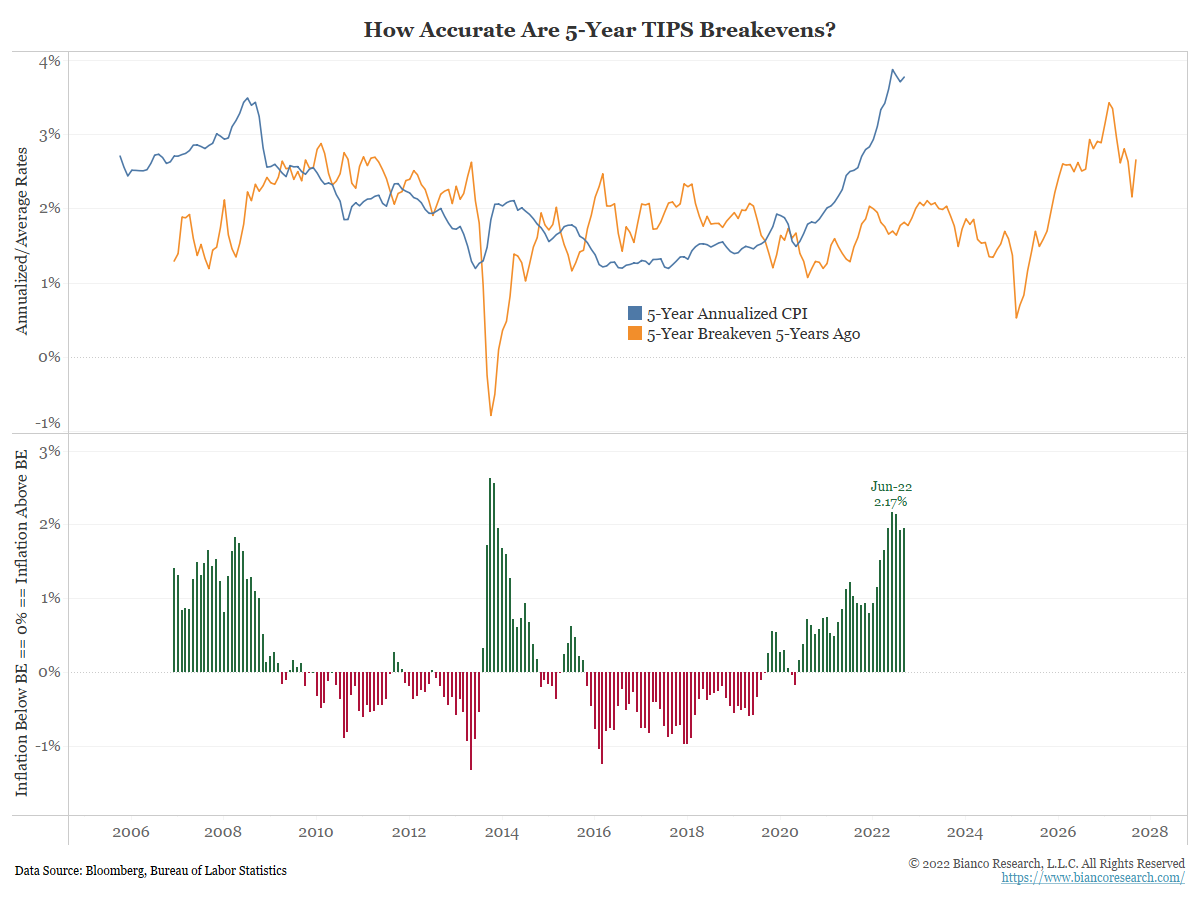

John Luke: Bond markets get credit for being better forecasters than equity investors, but they’ve not exactly nailed inflation expectations

Data as of 09.30.2022

Data as of 09.30.2022

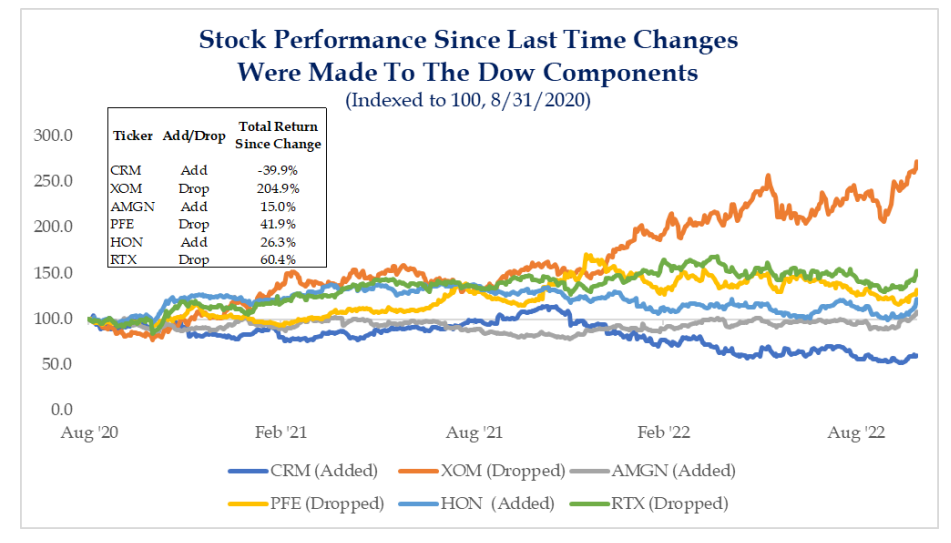

Dave: but it could be worse; they could be the committee deciding who to include in the Dow Jones Industrial Average

Source: Strategas as of 10.31.2022

Source: Strategas as of 10.31.2022

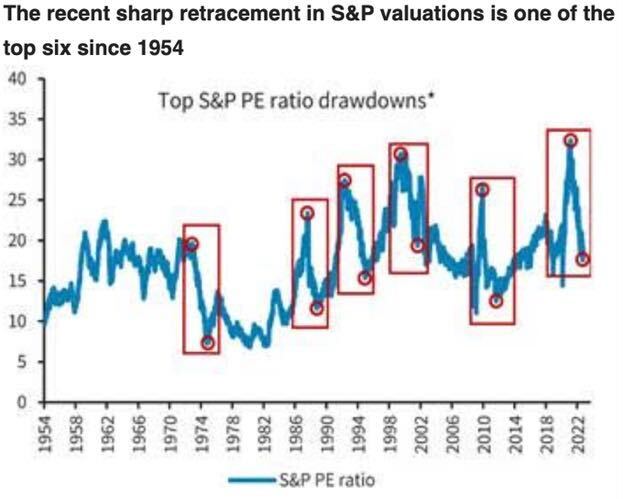

JD: This has been one of the sharper valuation resets in modern history

Source: Barclays as of 10.31

Source: Barclays as of 10.31

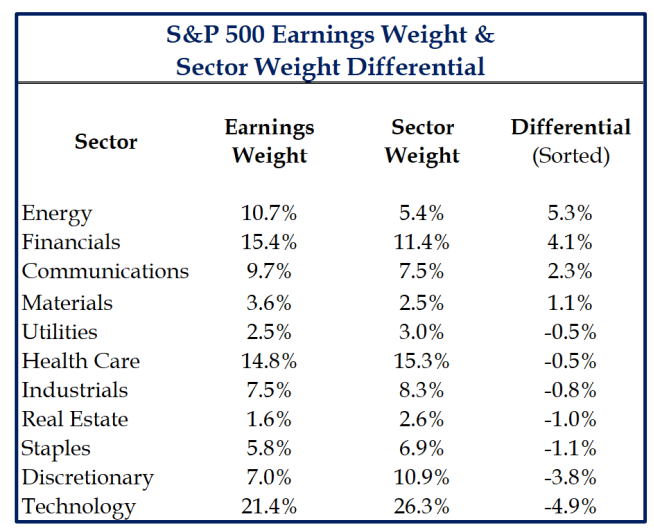

Dave: Markets have (correctly?) reset valuations this year, to better reflect business fundamentals

Source: Strategas as of 11.02.2022

Source: Strategas as of 11.02.2022

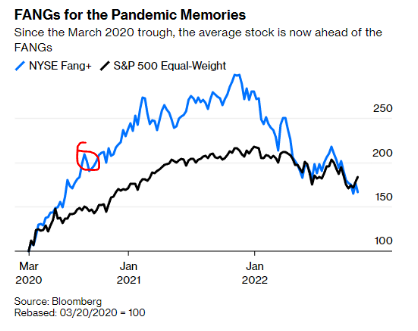

John Luke: and it’s showing up in the reduction of FANG dominance

Data as of 11.01.2022

Data as of 11.01.2022

Dave: and outperformance by US-centric Large Caps

Source: Raymond James as of 10.31.2022

Source: Raymond James as of 10.31.2022

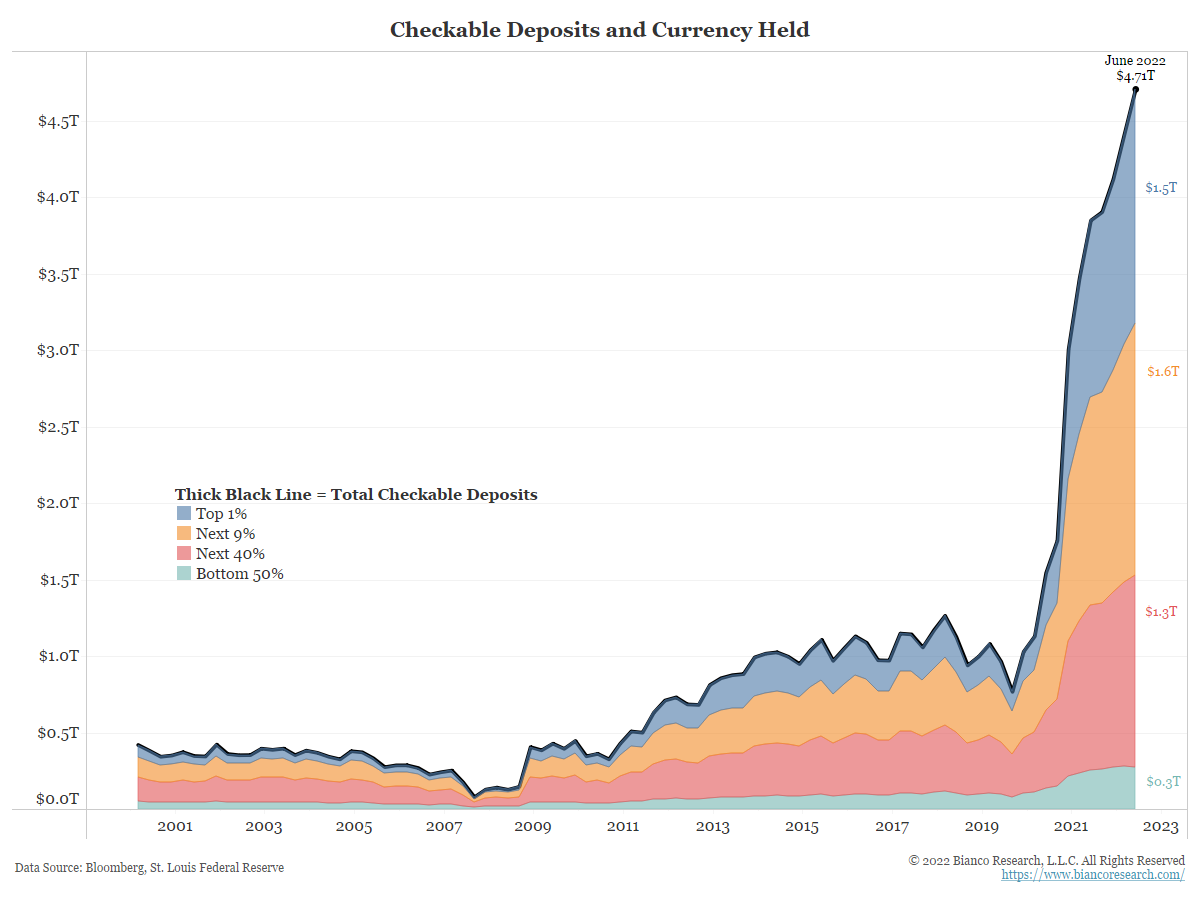

John Luke: Consumers remain flush, with deposits in checking accounts skyrocketing

Data as of 11.01.2022

Data as of 11.01.2022

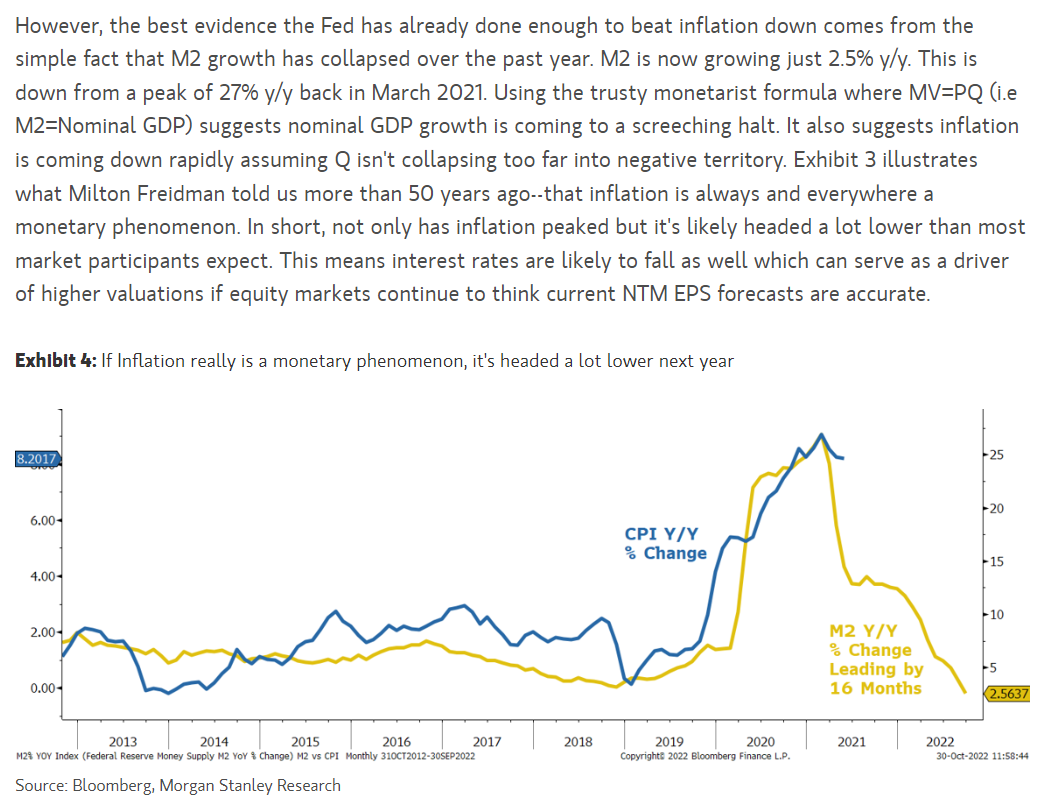

Dave: yet economy-wide money supply has been collapsing

Data as of 10.27.2022

Data as of 10.27.2022

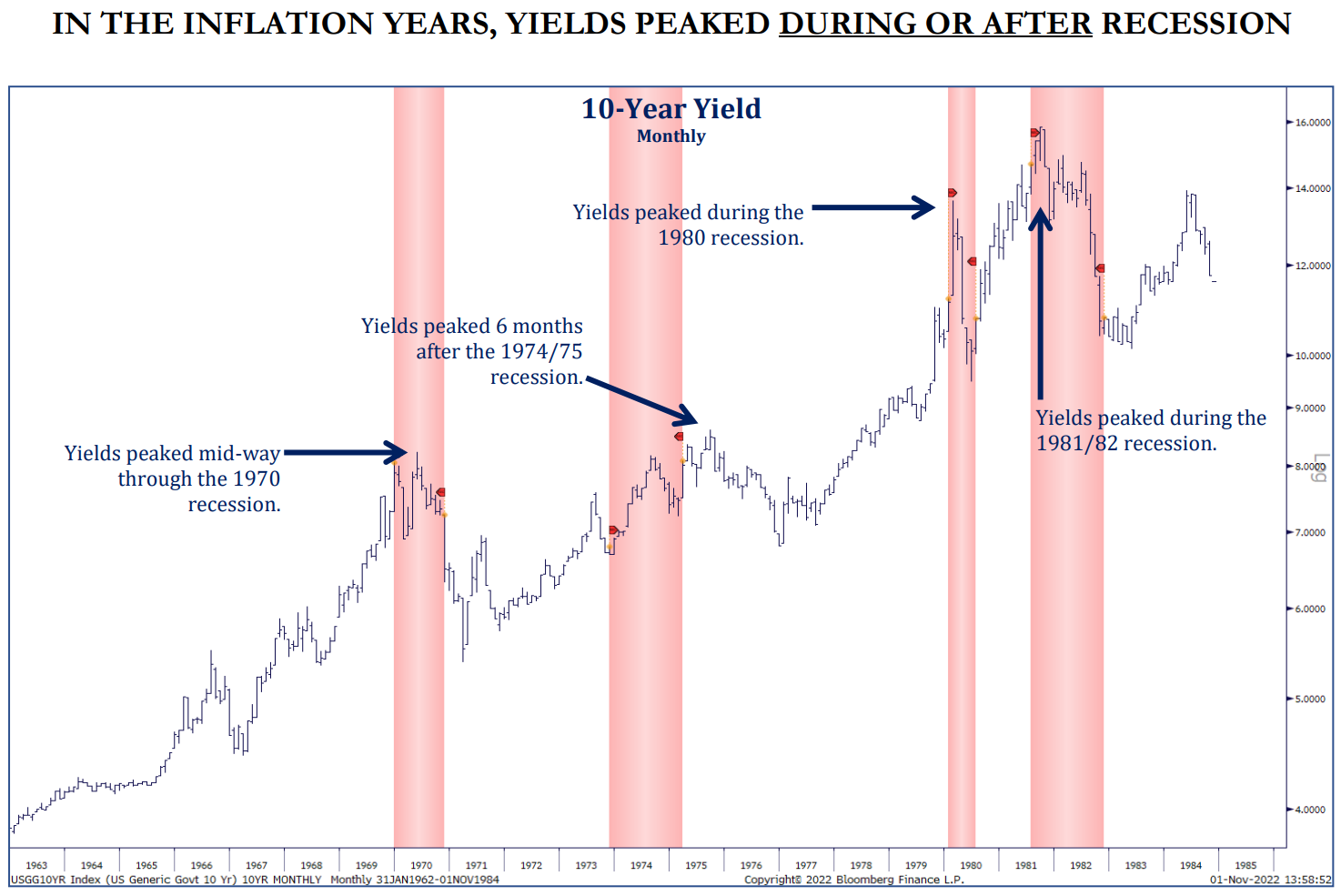

Dave: Pundits remain fixated on the terminal rate and peak yields, but sometimes those peaks have come later

Source: Strategas as of 11.02.2022

Source: Strategas as of 11.02.2022

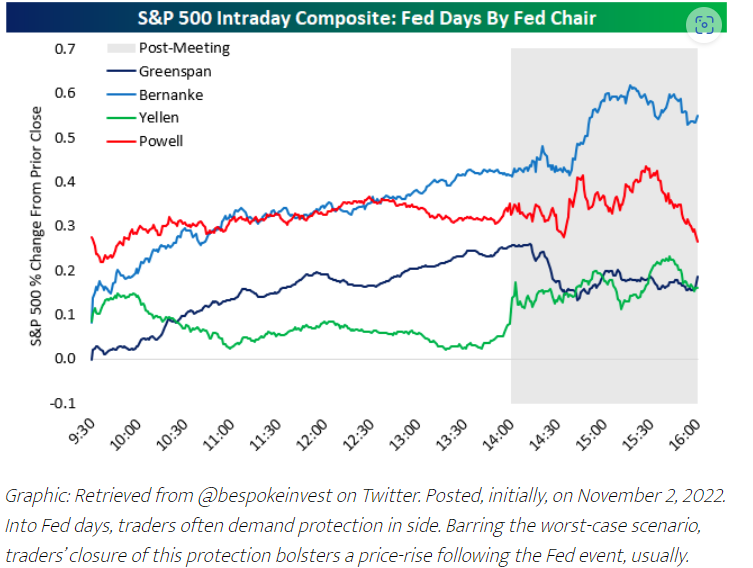

John Luke: Wednesday was an all-timer for worst post-Fed market reaction, not helping Chairman Powell’s reputation with equity investors

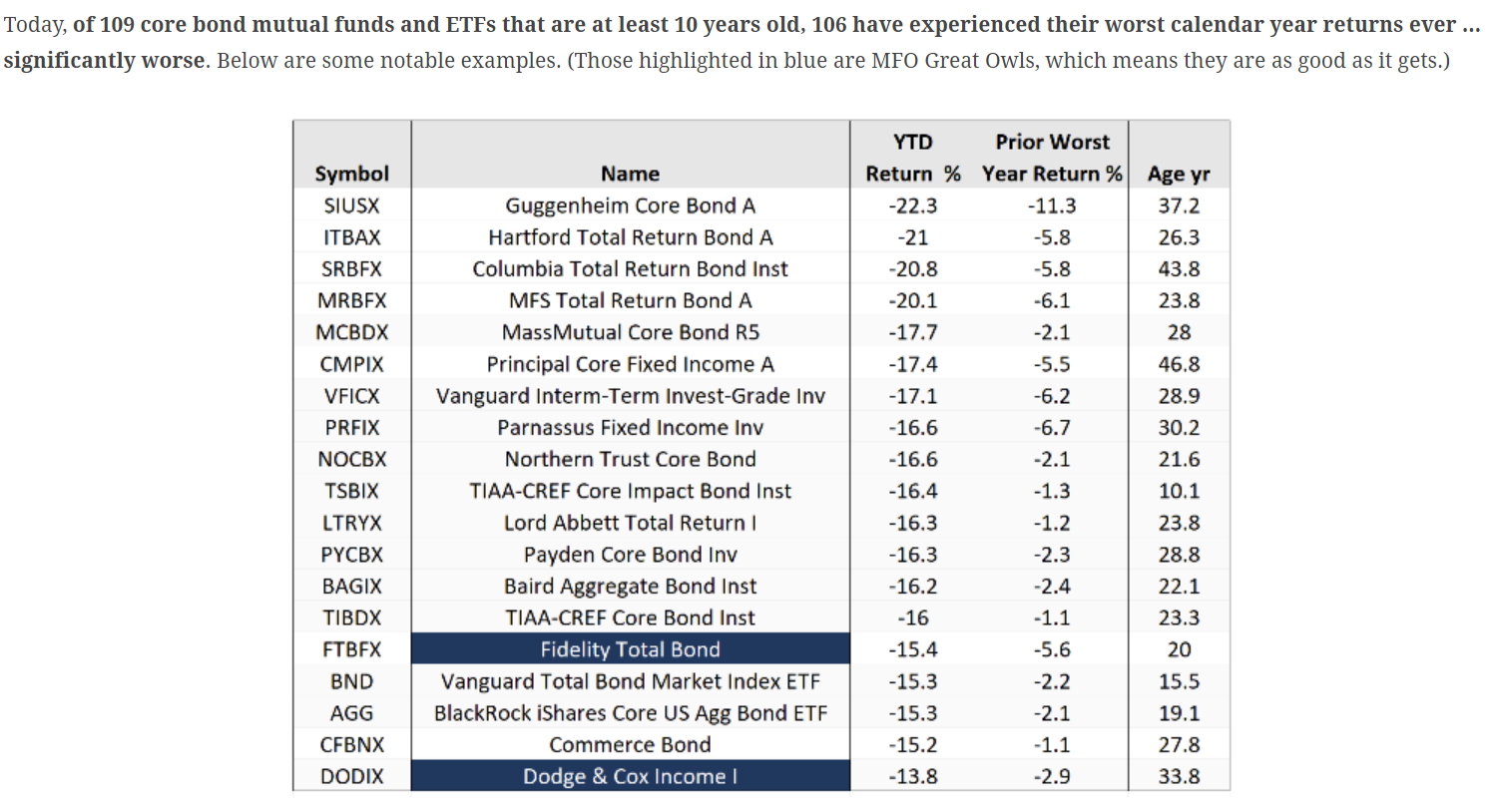

Derek: No way around it, 2022 has been rough for even the most experienced bond funds

Source: Mutual Fund Observer as of 10.31.2022

Source: Mutual Fund Observer as of 10.31.2022

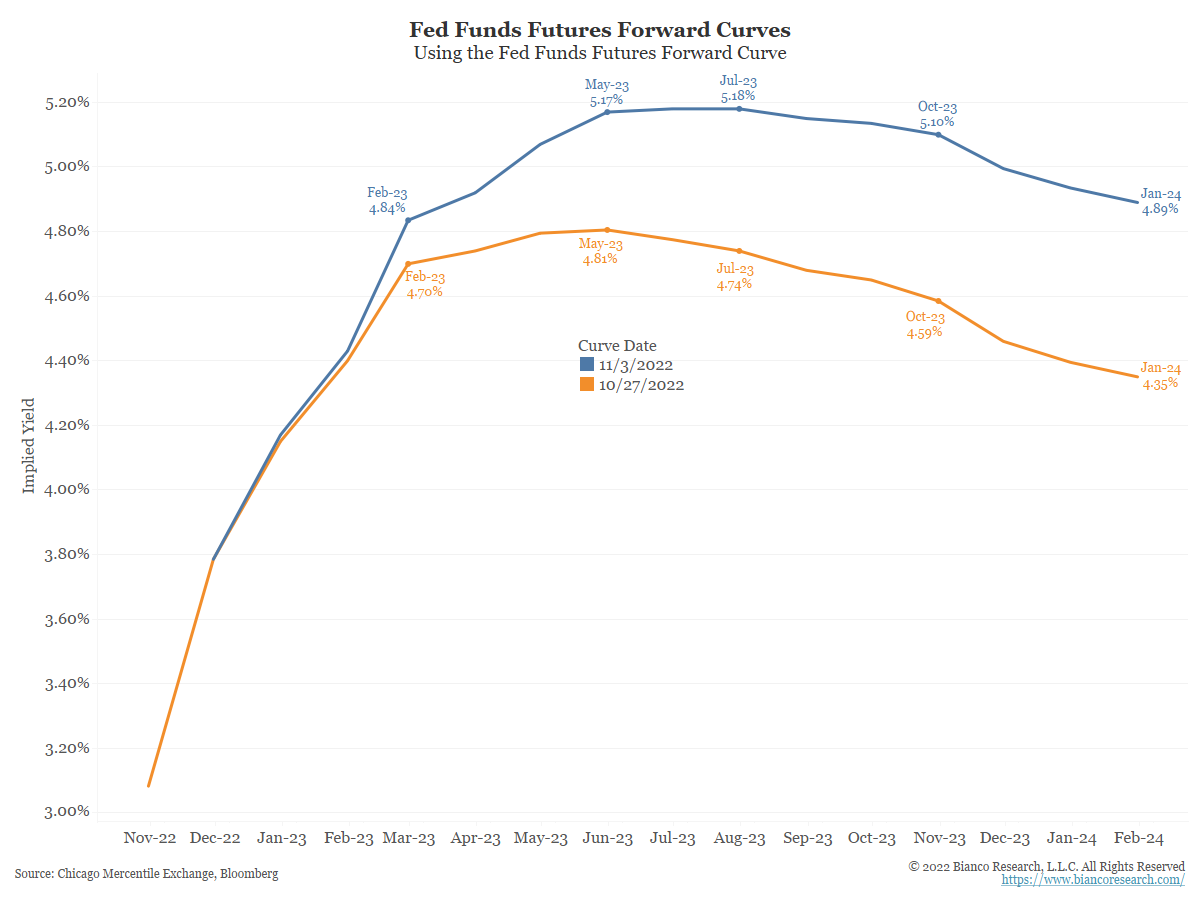

John Luke: and the Fed has shown no signs of taking their foot off of the rate pedal

Source: Bianco as of 11.03.2022

Source: Bianco as of 11.03.2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

Treasury Inflation-Protected Securities, or TIPS, provide protection against inflation. The principal of a TIPS increases with inflation and decreases with deflation, as measured by the Consumer Price Index.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The 10 Year Treasury Rate is the yield received for investing in a US government issued treasury security that has a maturity of 10 year. The 10 year treasury yield is included on the longer end of the yield curve. Many analysts will use the 10 year yield as the “risk free” rate when valuing the markets or an individual security.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

When a page is marked “Advisor Use Only” or “For Institutional Use”, the content is only intended for financial advisors, consultants, or existing and prospective institutional investors of Aptus. These materials have not been written or approved for a retail audience or use in mind and should not be distributed to retail investors. Any distribution to retail investors by a registered investment adviser may violate the new Marketing Rule under the Investment Advisers Act. If you choose to utilize or cite material we recommend the citation, be presented in context, with similar footnotes in the material and appropriate sourcing to Aptus and/or any other author or source references. This is notwithstanding any considerations or customizations with regards to your operations, based on your own compliance process, and compliance review with the marketing rule effective November 4, 2022.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2211-5.