Our team looks at a lot of research throughout the day. Here are a handful that we think are good summations of investor activity, from an amazing run for low quality/high beta stocks, to the government shutdown, to earnings and inflation, and more on AI spending. Have a great weekend!

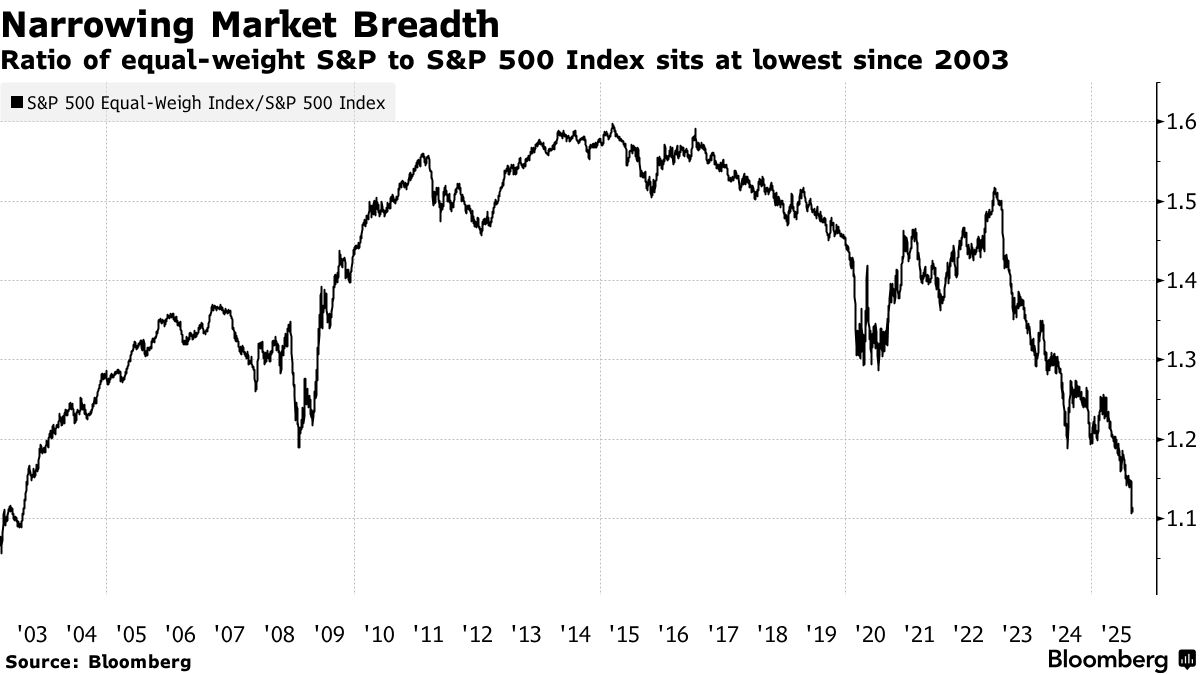

John Luke: The rally in the S&P 500 has continued to get more and more selective

Data as of 11.05.2025

Data as of 11.05.2025

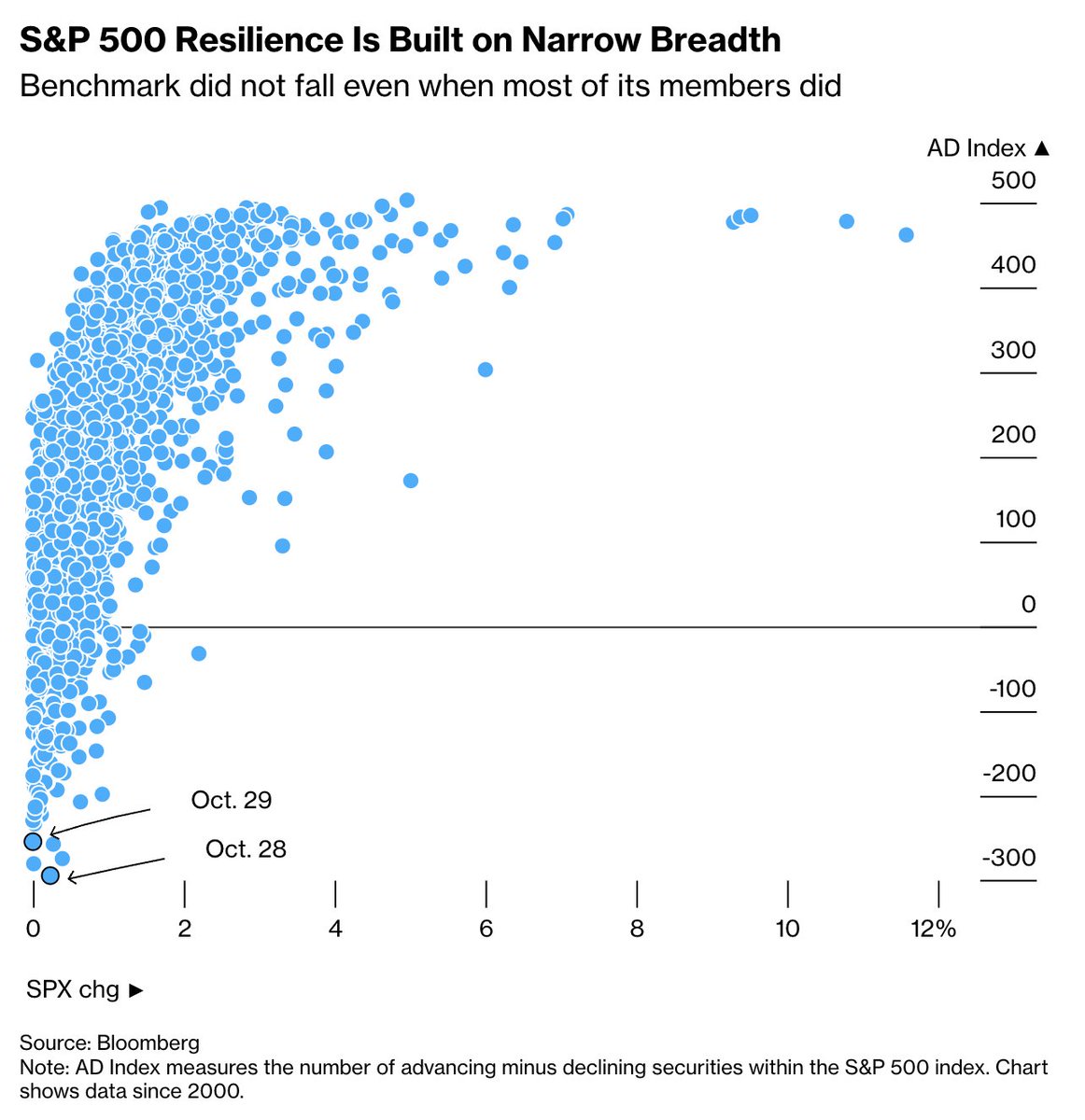

Jake: with some real outliers when it comes to the high number of stocks declining on recent flat days

Data as of 11.05.2025

Data as of 11.05.2025

Brett: that said, we’ve seen cases of extreme dispersion throughout the year, in both directions

Data as of 11.03.2025

Data as of 11.03.2025

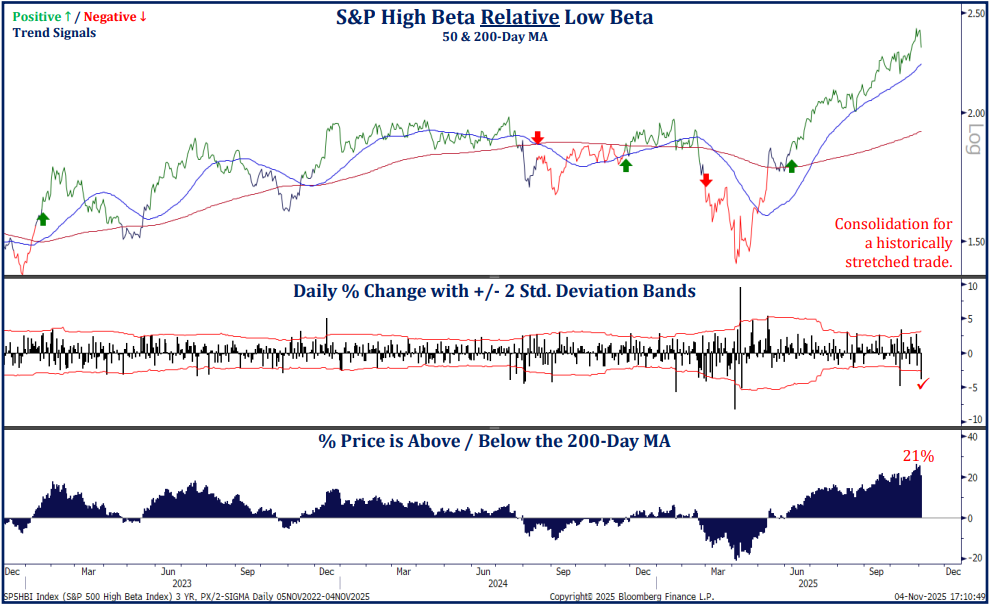

Brad: The big dispersion is mostly coming from days when low beta and high beta stocks are going in opposite directions, primarily favoring high beta

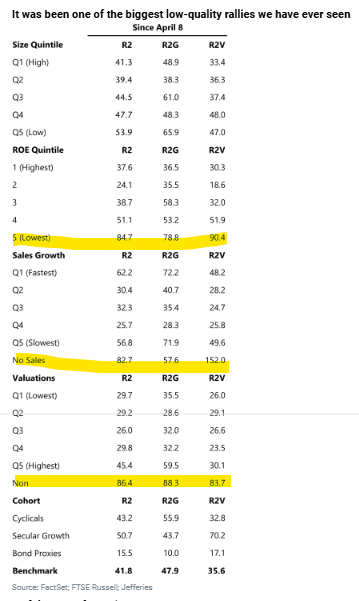

Dave: with much of that beta tied to companies with weaker business fundamentals

Data as of 11.03.2025

Data as of 11.03.2025

John Luke: The government shutdown is now the longest on record

Source: Strategas as of 11.03.2025

Source: Strategas as of 11.03.2025

Brian: with already-weak consumer sentiment taking a step lower

Data as of 11.07.2025

Data as of 11.07.2025

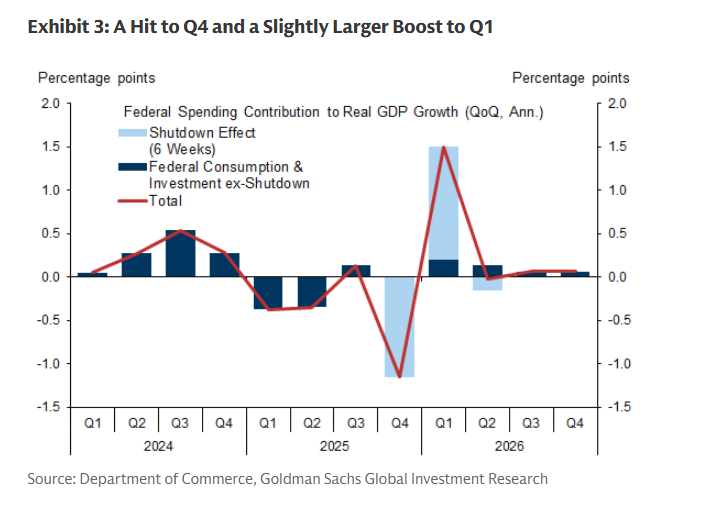

Brad: and economic forecasts adjusting for another drop and recovery similar to the tariff freeze in Q1/Q2

Data as of 10.31.2025

Data as of 10.31.2025

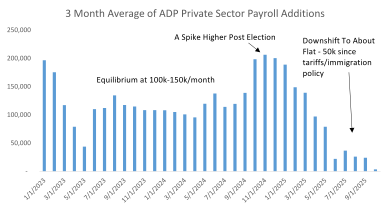

Dave: Like inflation finding a stable level near 3%, private payrolls are settling into a range just above the flatline on a monthly basis

Source: Raymond James as of 11.05.2025

Source: Raymond James as of 11.05.2025

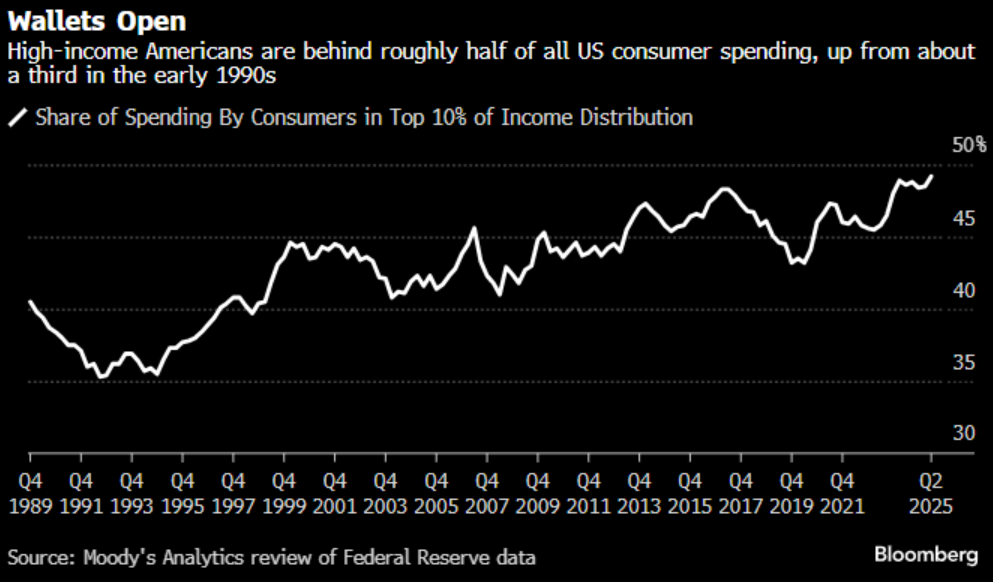

Joseph: with the general job weakness being offset by continued spending of the most affluent consumers

Data as of 11.04.2025

Data as of 11.04.2025

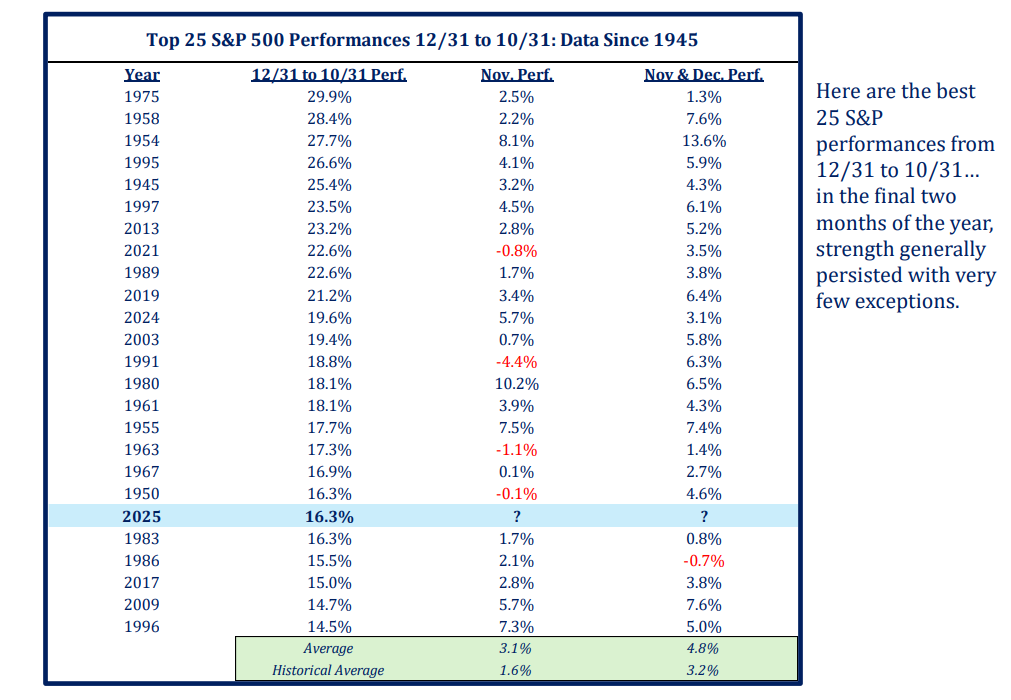

Dave: whose financial position has been helped by a strong stock market that is entering a period in which strength has beget strength

Source: Strategas as of 11.03.2025

Source: Strategas as of 11.03.2025

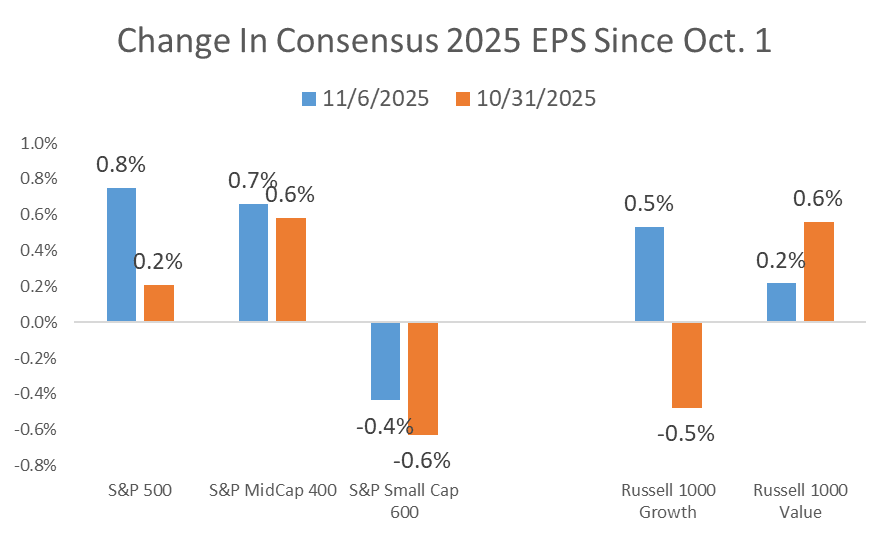

Dave: It’s been another season of earnings beating expectations

Source: Raymond James as of 11.06.2025

Source: Raymond James as of 11.06.2025

Dave: with strength across most sectors

Source: Strategas as of 11.04.2025

Source: Strategas as of 11.04.2025

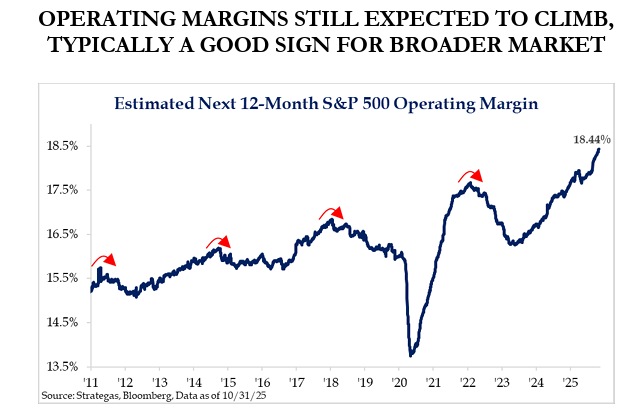

JD: and a continuation the margin miracle driving both earnings and valuations higher

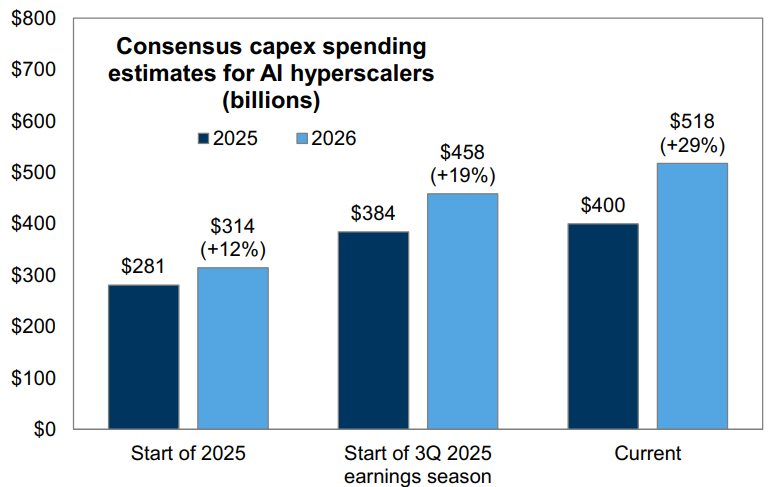

Brad: We’ve not yet seen the return on investment from AI capex, but the spending rages on

Source: Goldman Sachs as of 10.31.2025

Source: Goldman Sachs as of 10.31.2025

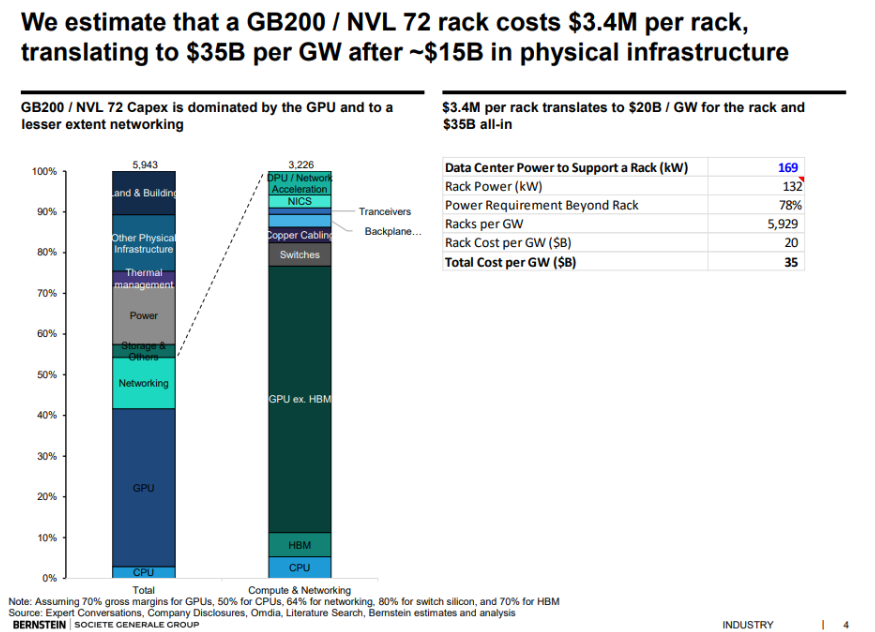

Dave: and there are a whole lot of pieces in a typical AI build

Data as of October 2025

Data as of October 2025

Beckham: It’s been just as important to avoid losers as it has been to find winners

Source: Bespoke as of 11.03.2025

Source: Bespoke as of 11.03.2025

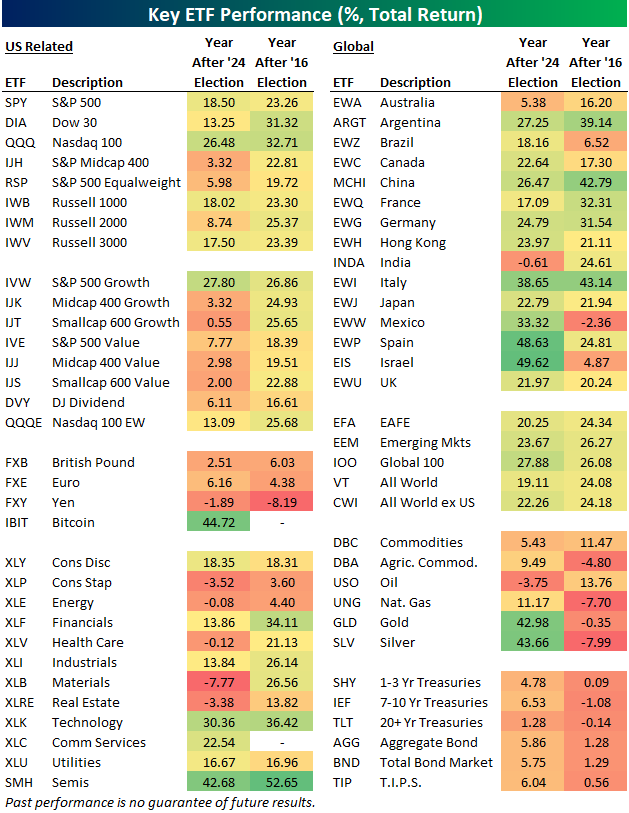

Ten: and the policy playbook may have similarities but investor outcomes are never a foregone conclusion

Source: Bespoke as of 11.03.2025

Source: Bespoke as of 11.03.2025

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level of skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2511-10.