Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and how they help fill the puzzle of evidence:

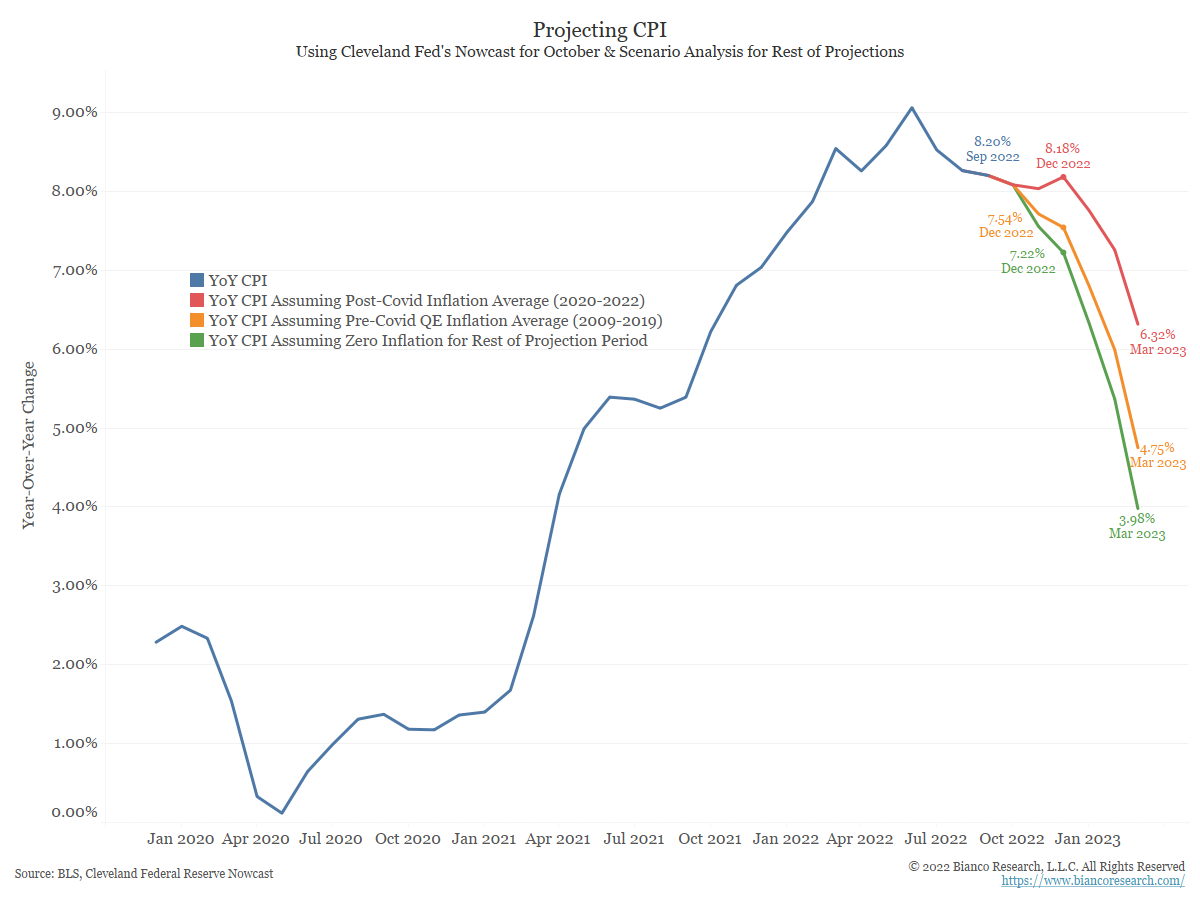

John Luke: Looking out at some possible ranges for CPI over the next 3-6 months

Data as of 10.12.2022

Data as of 10.12.2022

Brad: Another way to look at the wide range of outcomes, depending on how prices change over the coming months

Source: Strategas as of 10.13.2022

Source: Strategas as of 10.13.2022

Dave: 25% drops in the S&P 500 are not fun, but reward:risk has been solid from that level

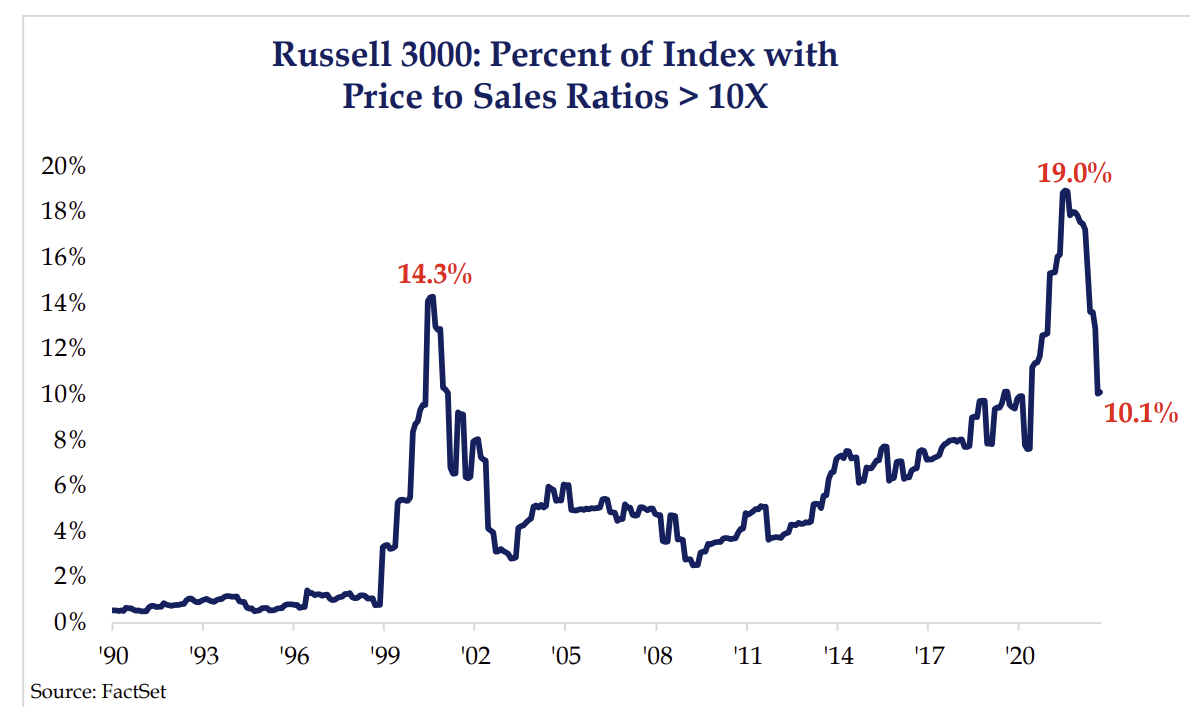

Dave: and the positive of a bear market is that speculative froth gets taken out. 2021 had a lot of overpriced junk

Source: Strategas as of 10.07.2022

Source: Strategas as of 10.07.2022

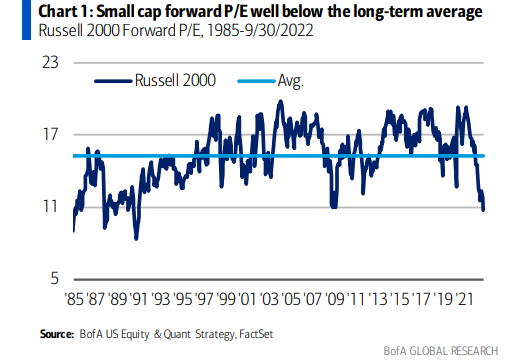

John Luke: helping set small-cap valuations to a historically significant discount

Data as of 10.03.2022

Data as of 10.03.2022

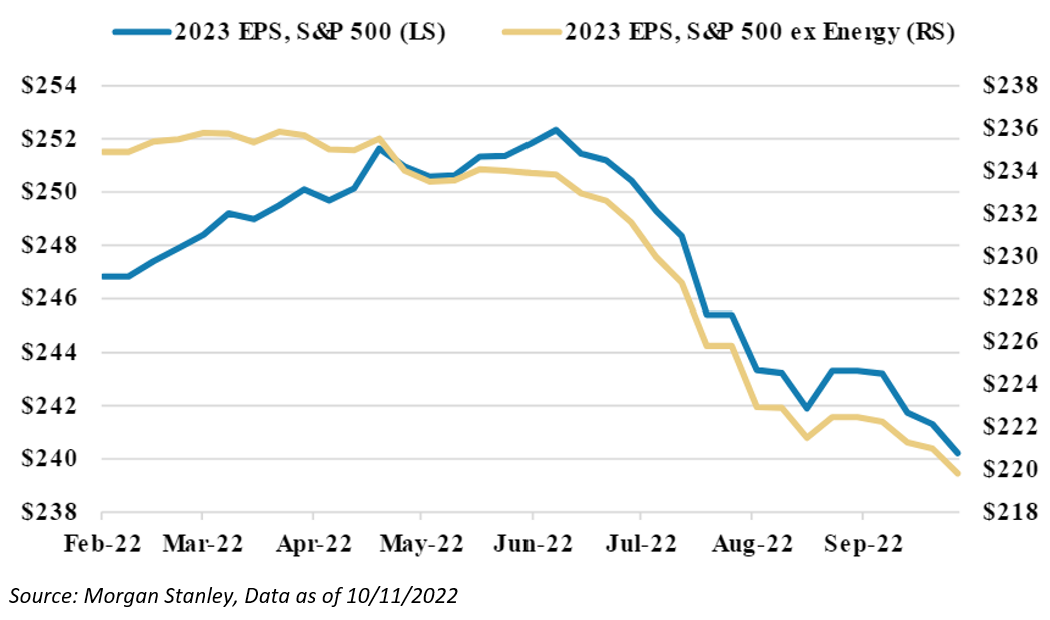

Dave: Earnings estimates are finally moving towards reality

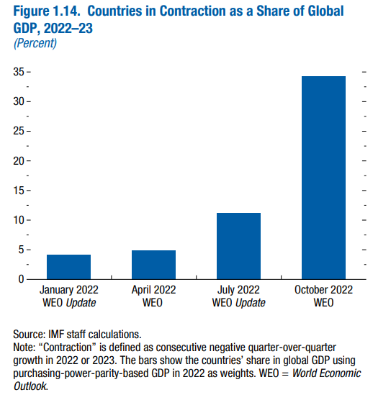

John Luke: The % of countries in economic contraction has been rising

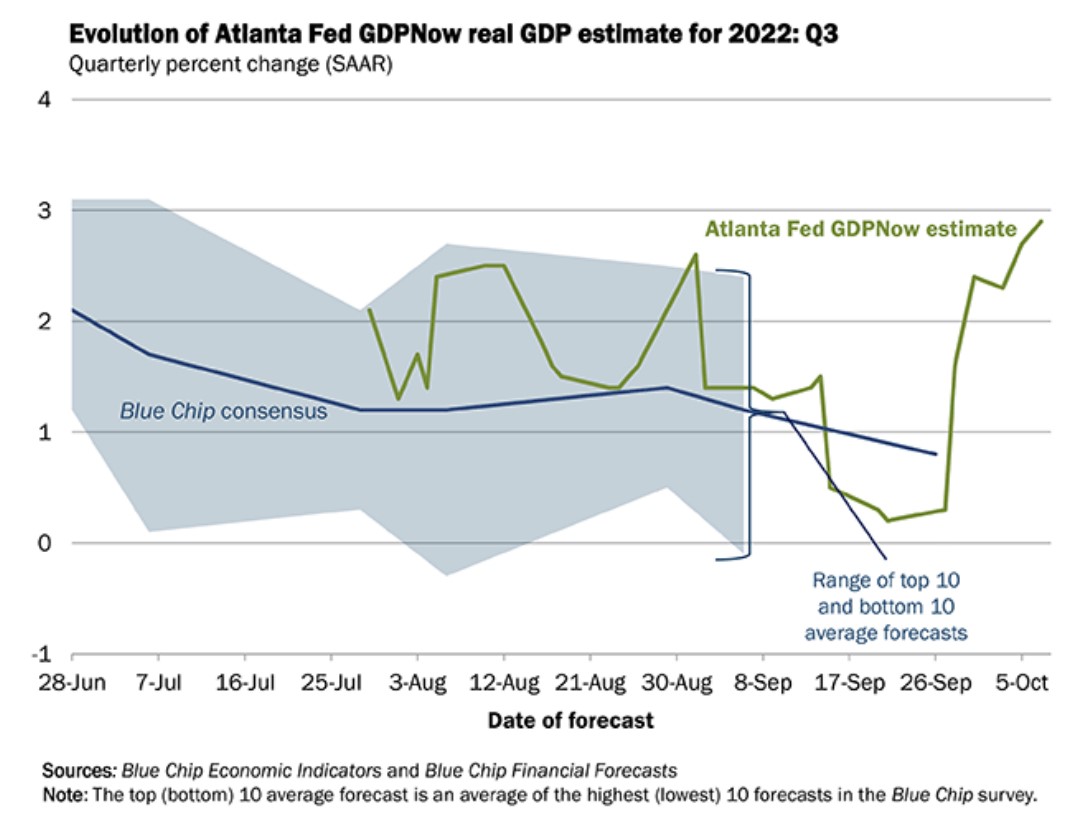

John Luke: but through some quirks with some of the data, this estimate has the US undergoing a renewed growth path

Data as of 10.12.2022

Data as of 10.12.2022

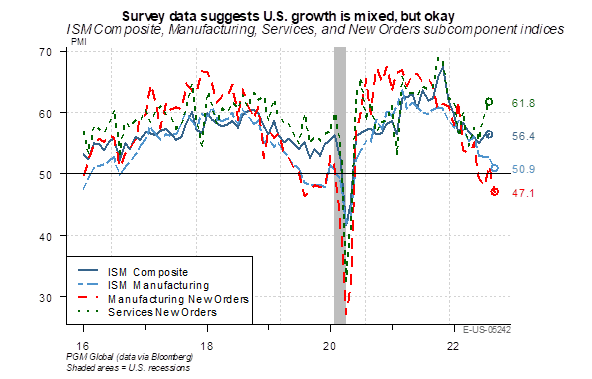

John Luke: and maybe US can get through this patch with minimal contraction

Data as of 10.07.2022

Data as of 10.07.2022

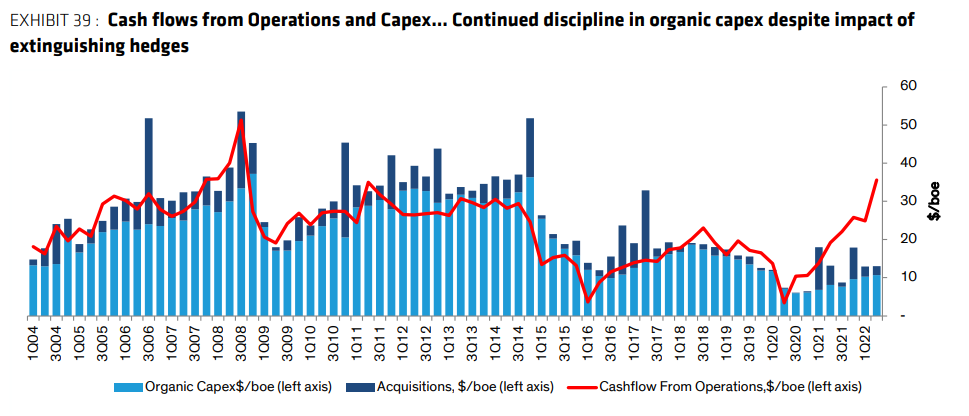

Dave: A unique feature of the post-COVID economy has been fiscal discipline by US corporations

Source: Bernstein as of 10.11.2022

Source: Bernstein as of 10.11.2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Russell 2000® Index measures the performance of the small cap segment of the U.S. equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 10% of the total market capitalization of that index. It includes approximately 2000 of the smallest securities based on a combination of their market cap and current index membership.

The Russell 3000® Index measures the performance of 3,000 large U.S. companies. The Index is market capitalization-weighted, comprised of stocks in the Russell 1000 and Russell 2000 indices and represents approximately 98% of the U.S. equity market.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2210-19.