Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

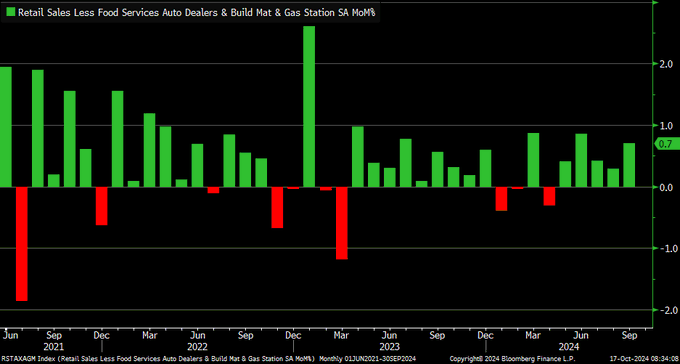

Beckham: This week’s retail sales report again showed a steady pace of consumer spending

Source: Charles Schwab as of 10.17.2024

Source: Charles Schwab as of 10.17.2024

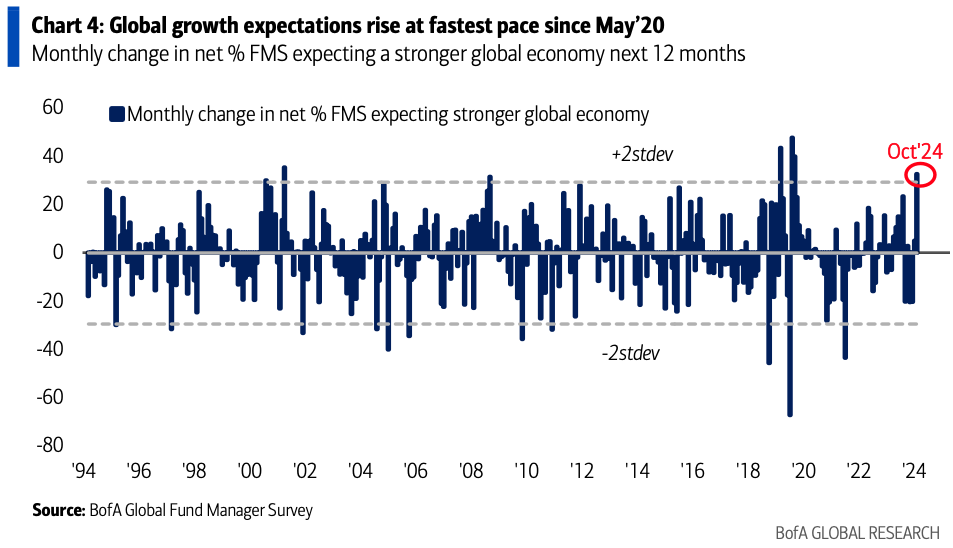

Joseph: which is part of the strength feeding into expectations for global growth

Data as of 10.15.2024

Data as of 10.15.2024

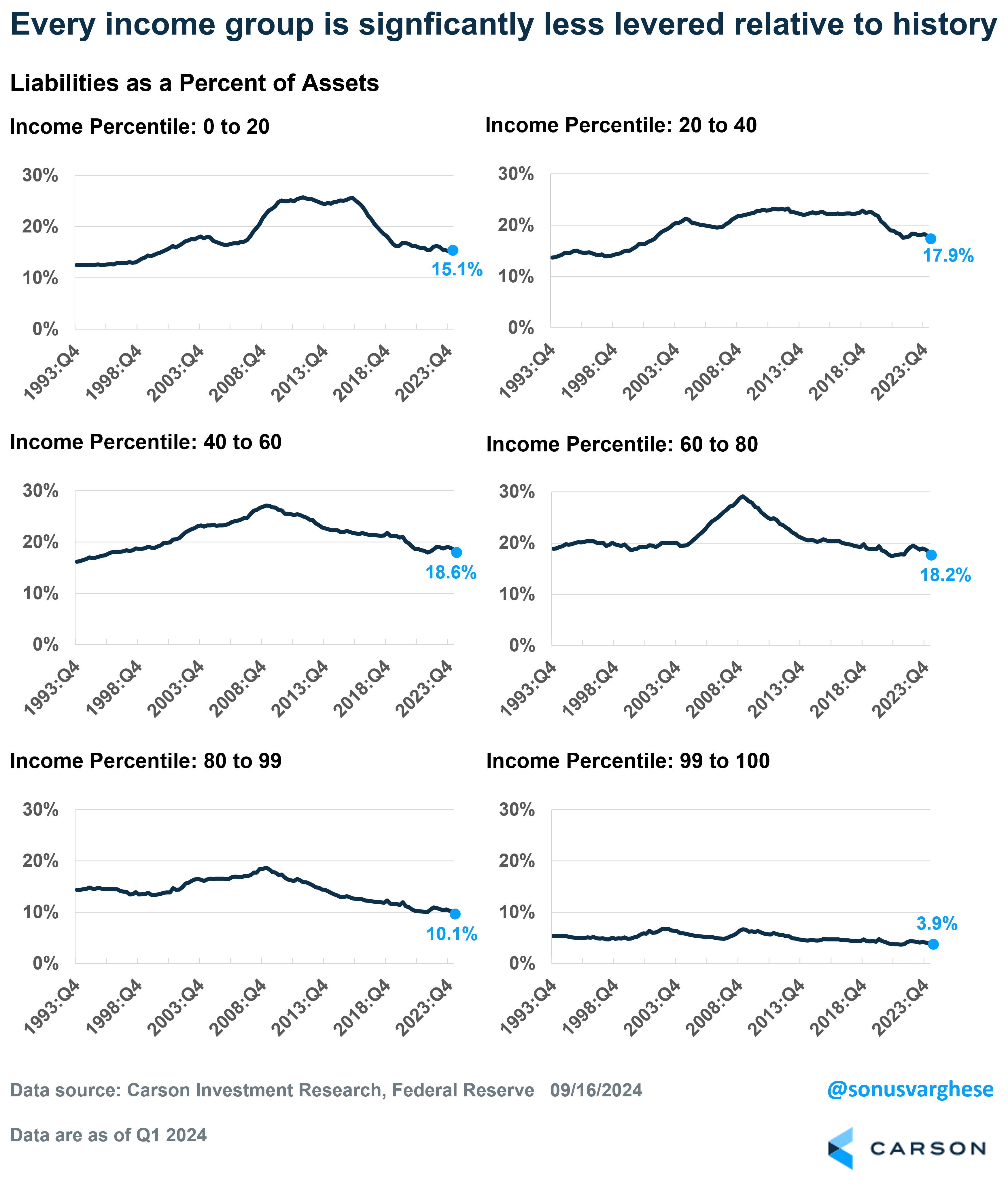

Arch: and while all income groups are benefitting from the economic tailwinds

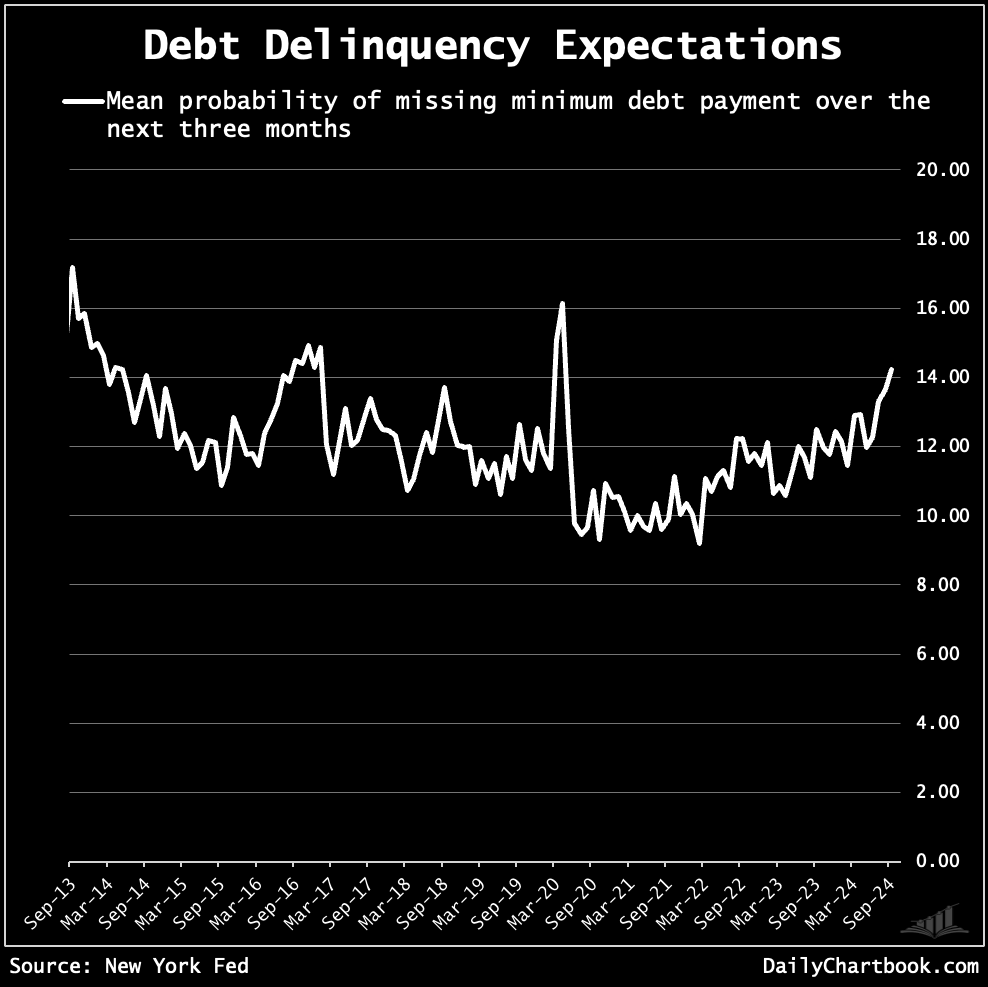

Brett: we’re seeing some challenges, likely for those who’ve not benefitted from the rise in home and stock prices

Data as of 10.15.2024

Data as of 10.15.2024

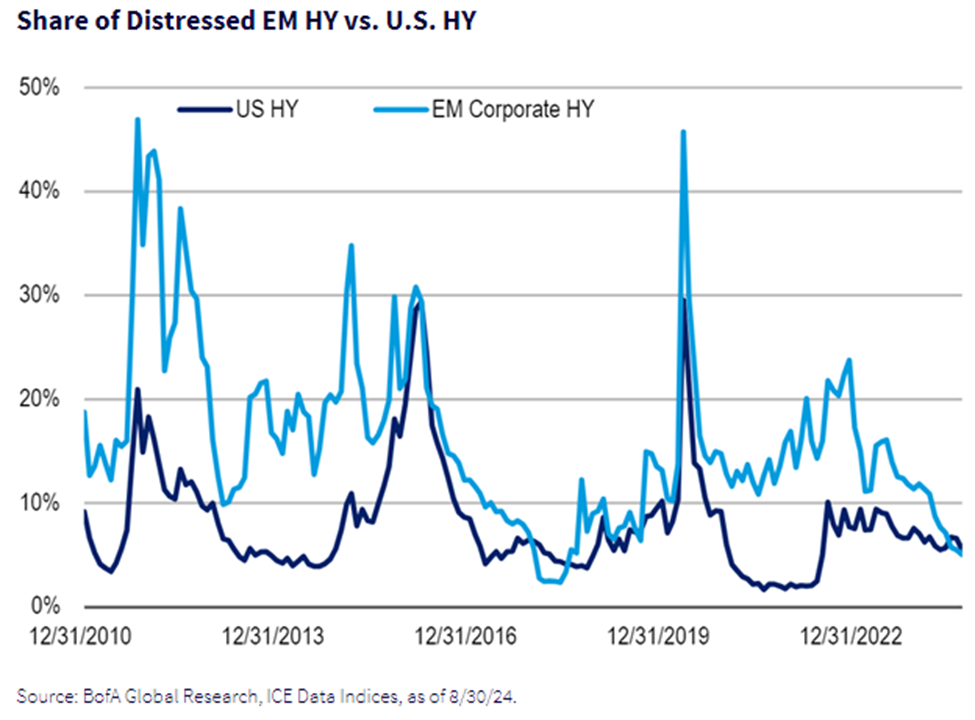

Brett: At the corporate level, we’re seeing few signs of difficulty in covering loan payments, here or overseas

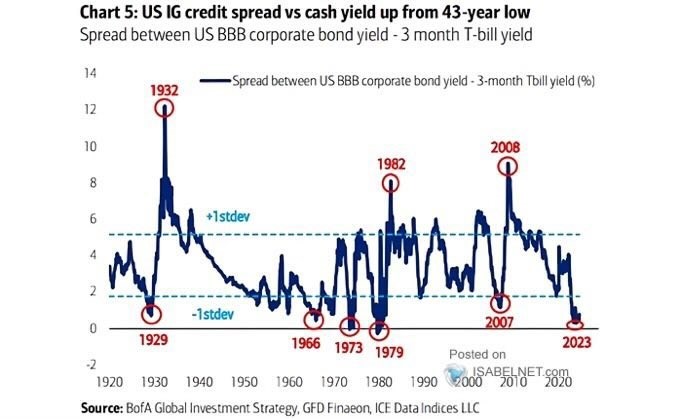

John Luke: resulting in historically low compensation for buyers of credit

Data as of 10.14.2024

Data as of 10.14.2024

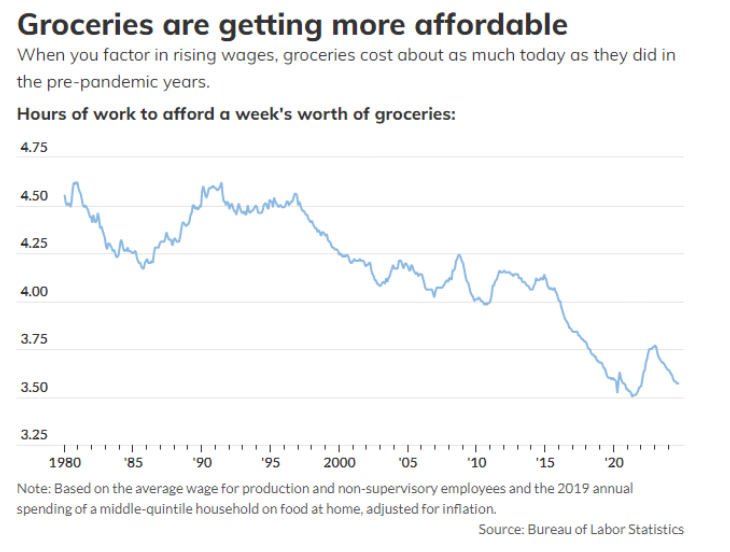

Brian: By one measure, the long downtrend of grocery bills relative to income has resumed after the 2021-22 spike

Source: MarketWatch as of 10.16.2024

Source: MarketWatch as of 10.16.2024

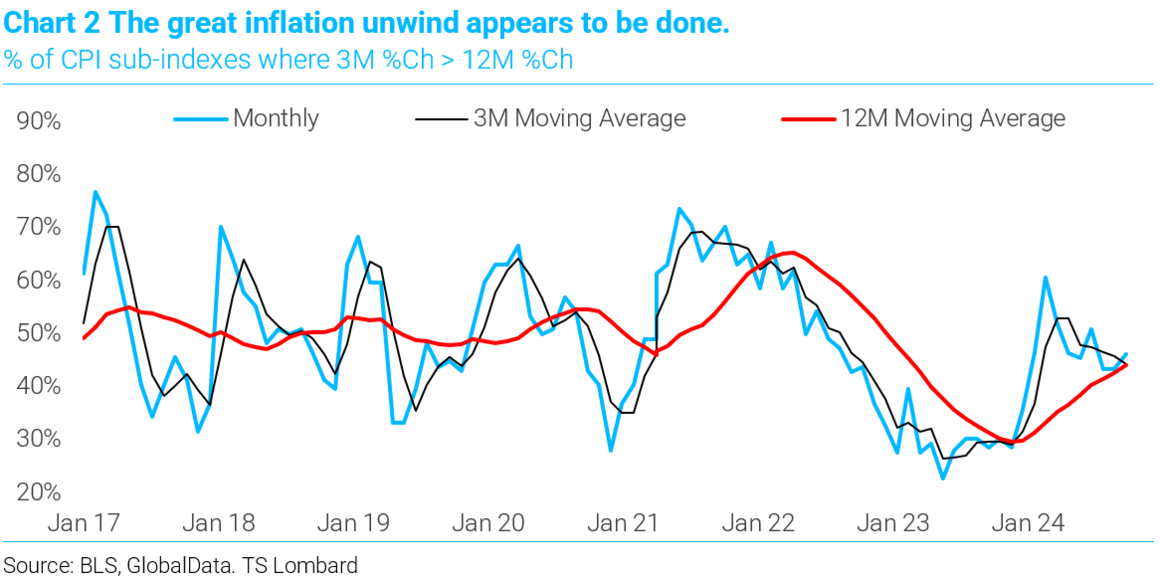

John Luke: though when you take a broader look at all components, it’s possible we’ve seen the low in inflation rates

Data as of 10.10.2024

Data as of 10.10.2024

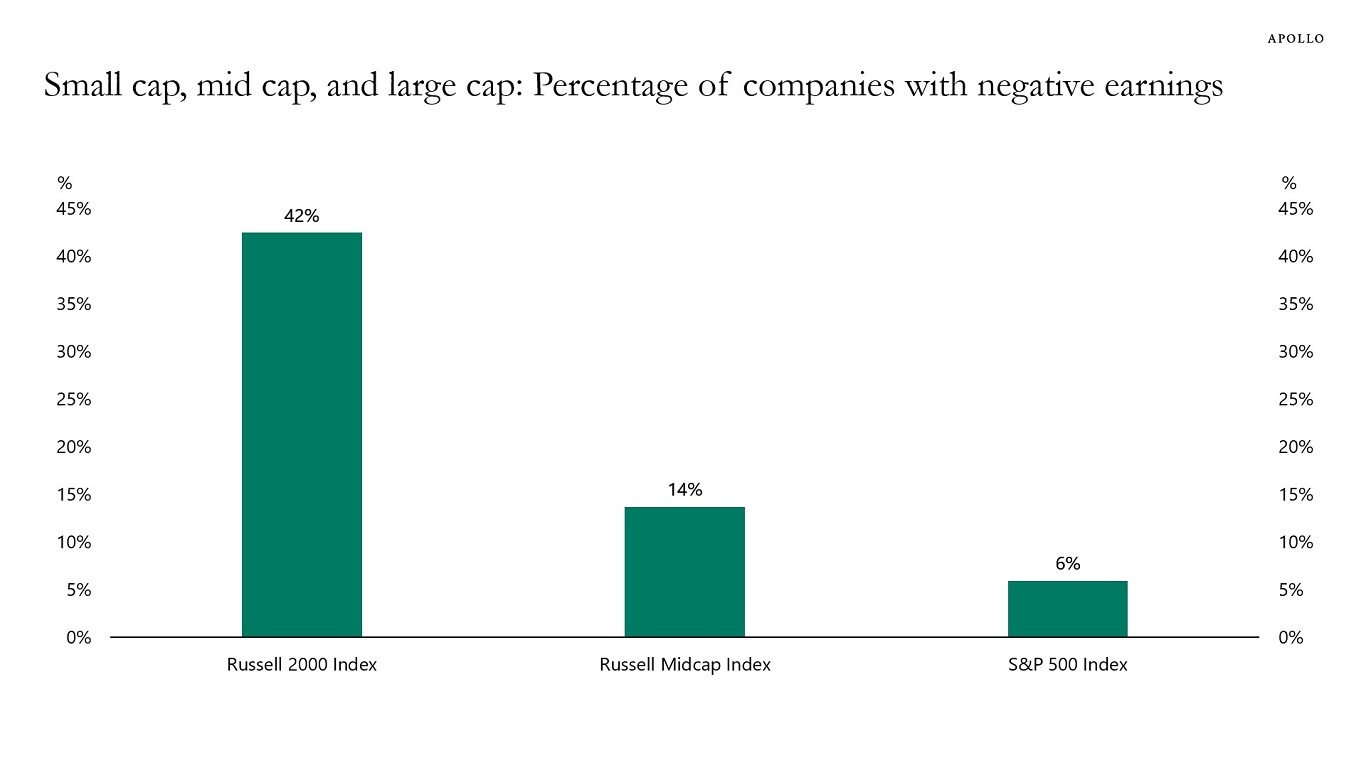

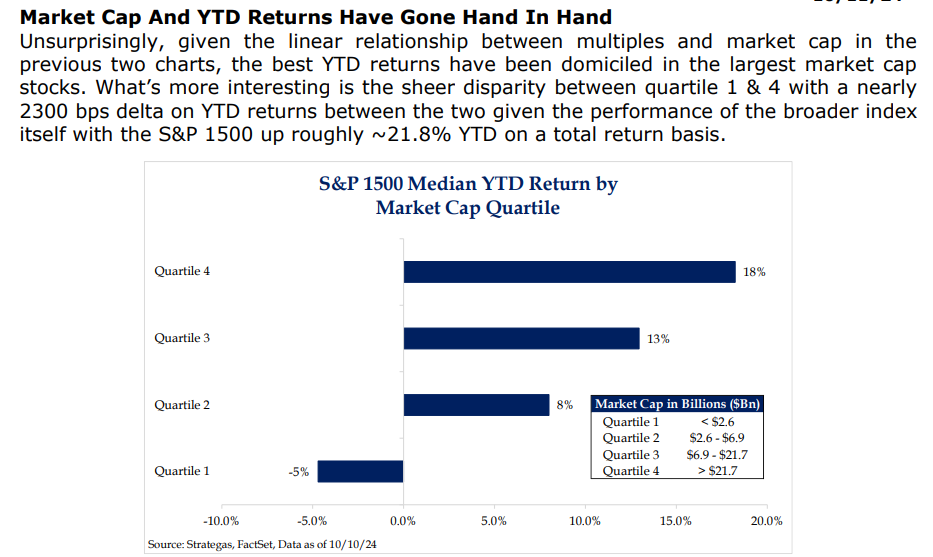

Joseph: It’s important to note that some passive indexes hold companies based strictly on market capitalization, with no regard for business fundamentals

Source: Apollo as of 09.30.2024

Source: Apollo as of 09.30.2024

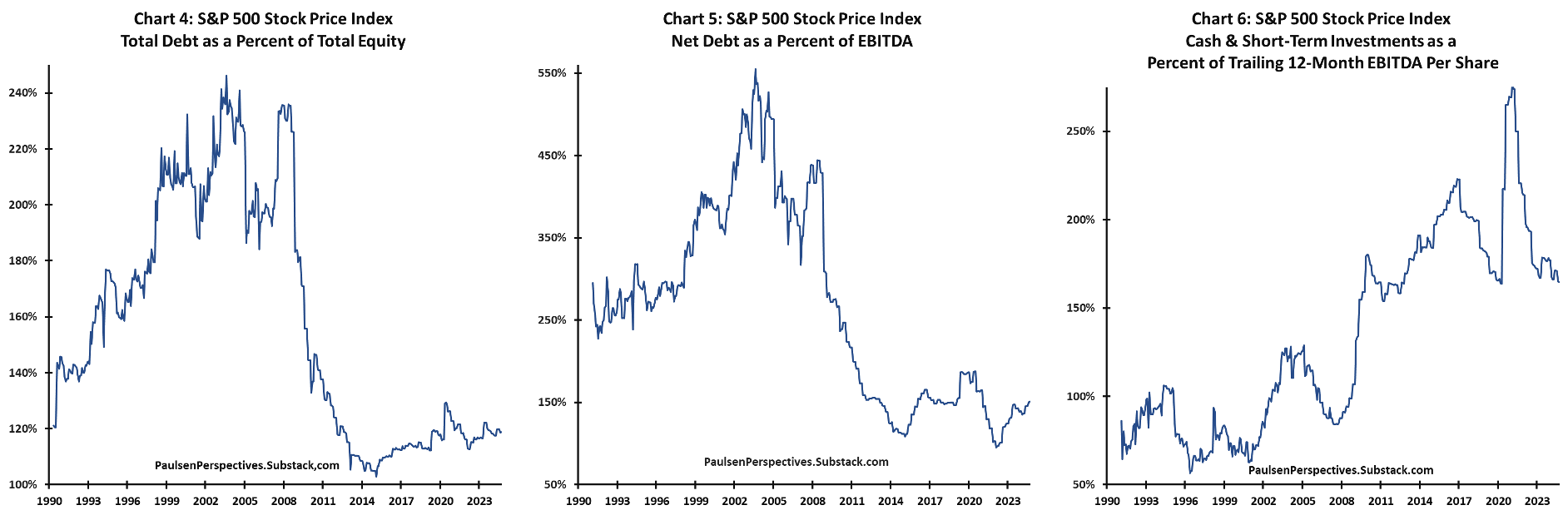

Beckham: while large-cap indexes continues to move in the direction of quality

Source: Paulsens Perspectives as of 10.15.2024

Source: Paulsens Perspectives as of 10.15.2024

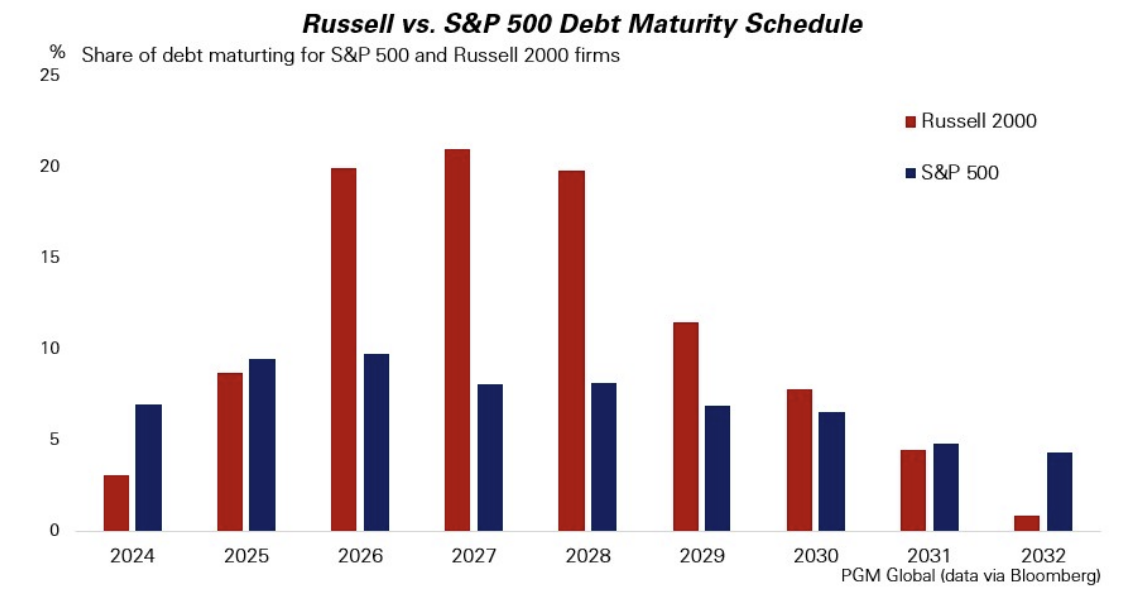

Dave: This difference is an important distinction when comparing “small caps” vs. large caps

Data as of September 2024

Data as of September 2024

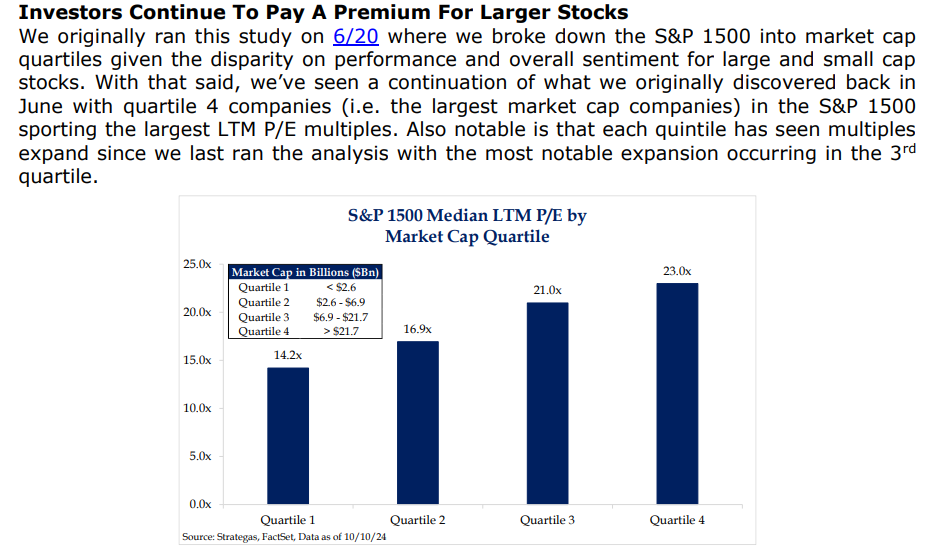

Dave: likely contributing to the unusual valuation discount despite the opportunities in smaller stocks

Dave: as their performance continues to trail large caps like it has for most of the past decade

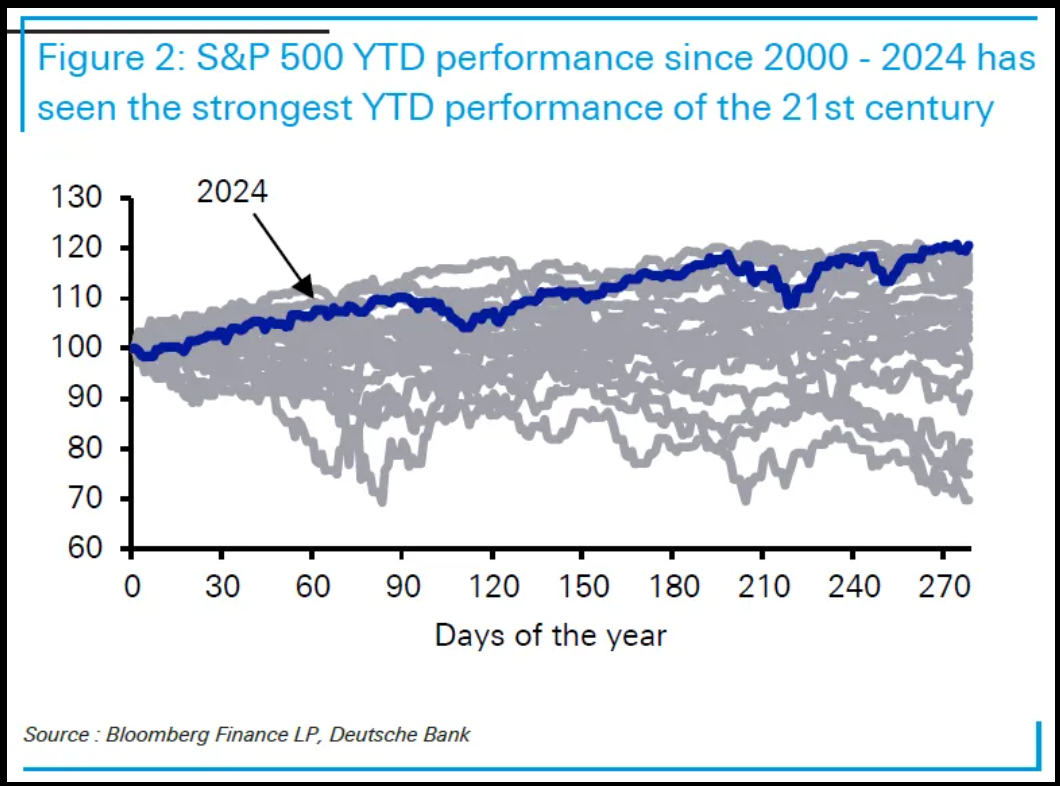

JD: To this point of the year, the advance in the S&P 500 beats every other year this century

Data as of 10.11.2024

Data as of 10.11.2024

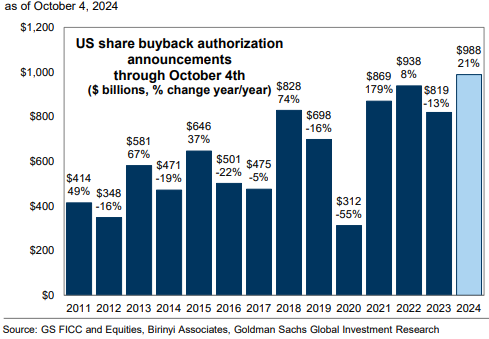

Brad: with companies continuing to announce large stock buybacks

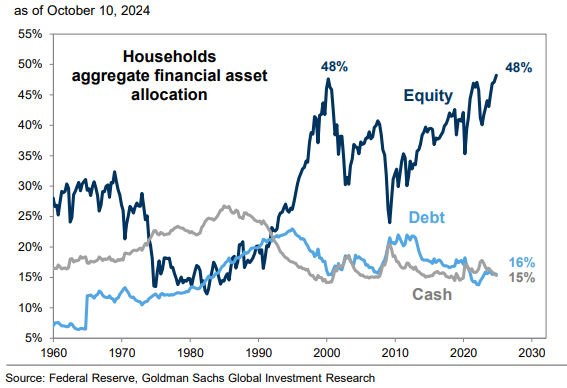

Brad: and households doing little to rebalance funds into other asset classes

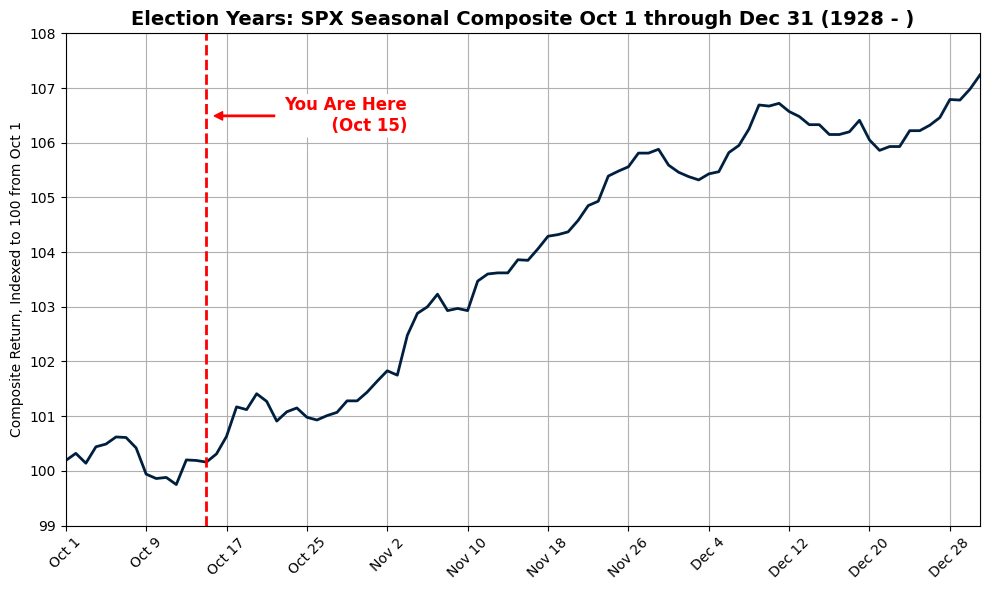

Brad: We have no idea what markets will do into and through this contentious election, but history has mostly been favorable

Source: Goldman Sachs

Source: Goldman Sachs

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2410-25.