Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

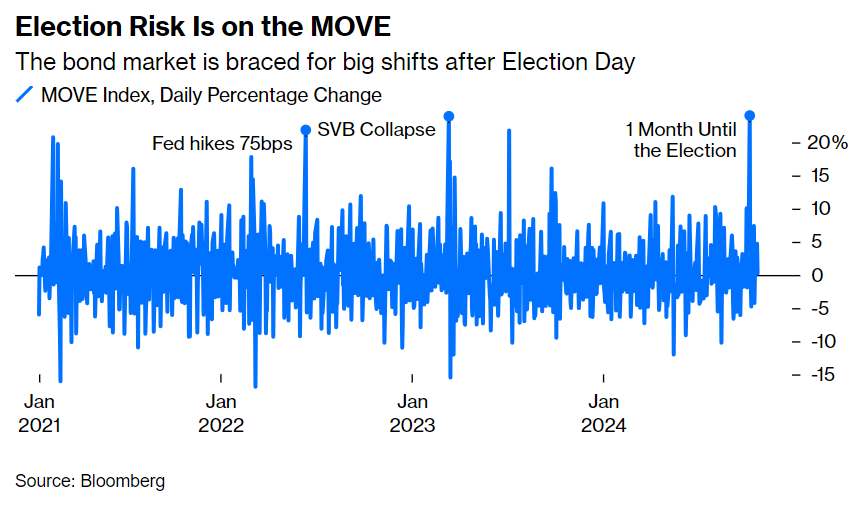

Joseph: Bonds have been the greater source of volatility since the Fed cut rates in September

Data as of 10.24.2024

Data as of 10.24.2024

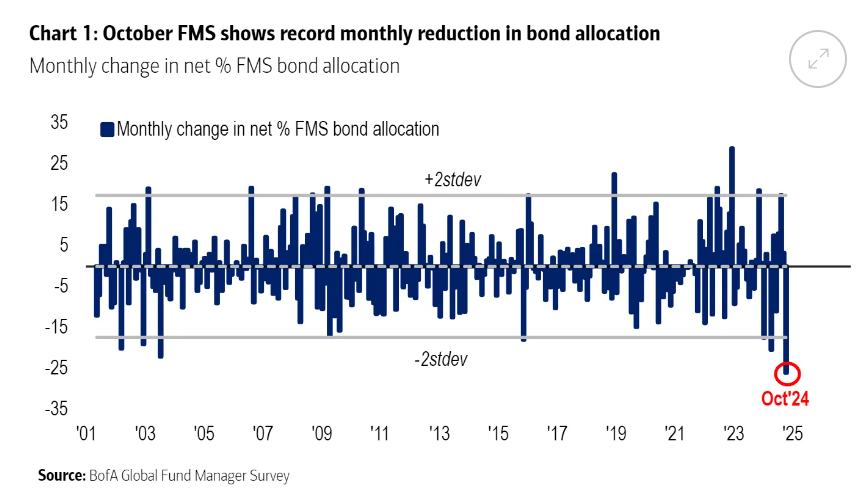

JD: and fund managers are losing enthusiasm for allocating to bonds

Data as of 10.21.2024

Data as of 10.21.2024

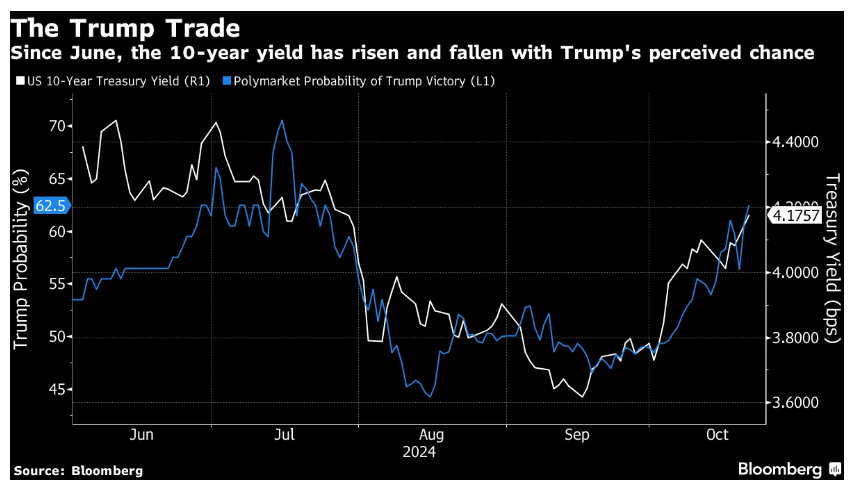

John Luke: Neither party will bring austerity but there’s been a notable correlation between the odds of a Trump win, and bond yields

Data as of 10.22.2024

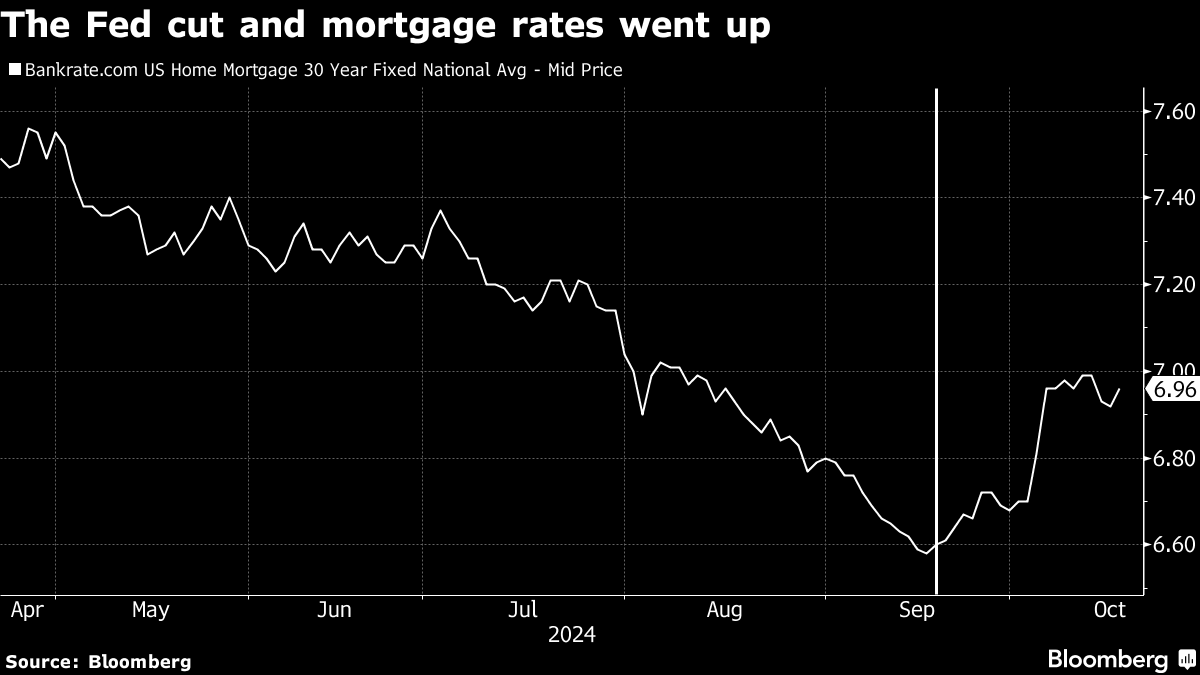

John Luke: This has fed into higher mortgage rates, which many had hoped would be coming down as the Fed starting cutting rates

Data as of 10.24.2024

Data as of 10.24.2024

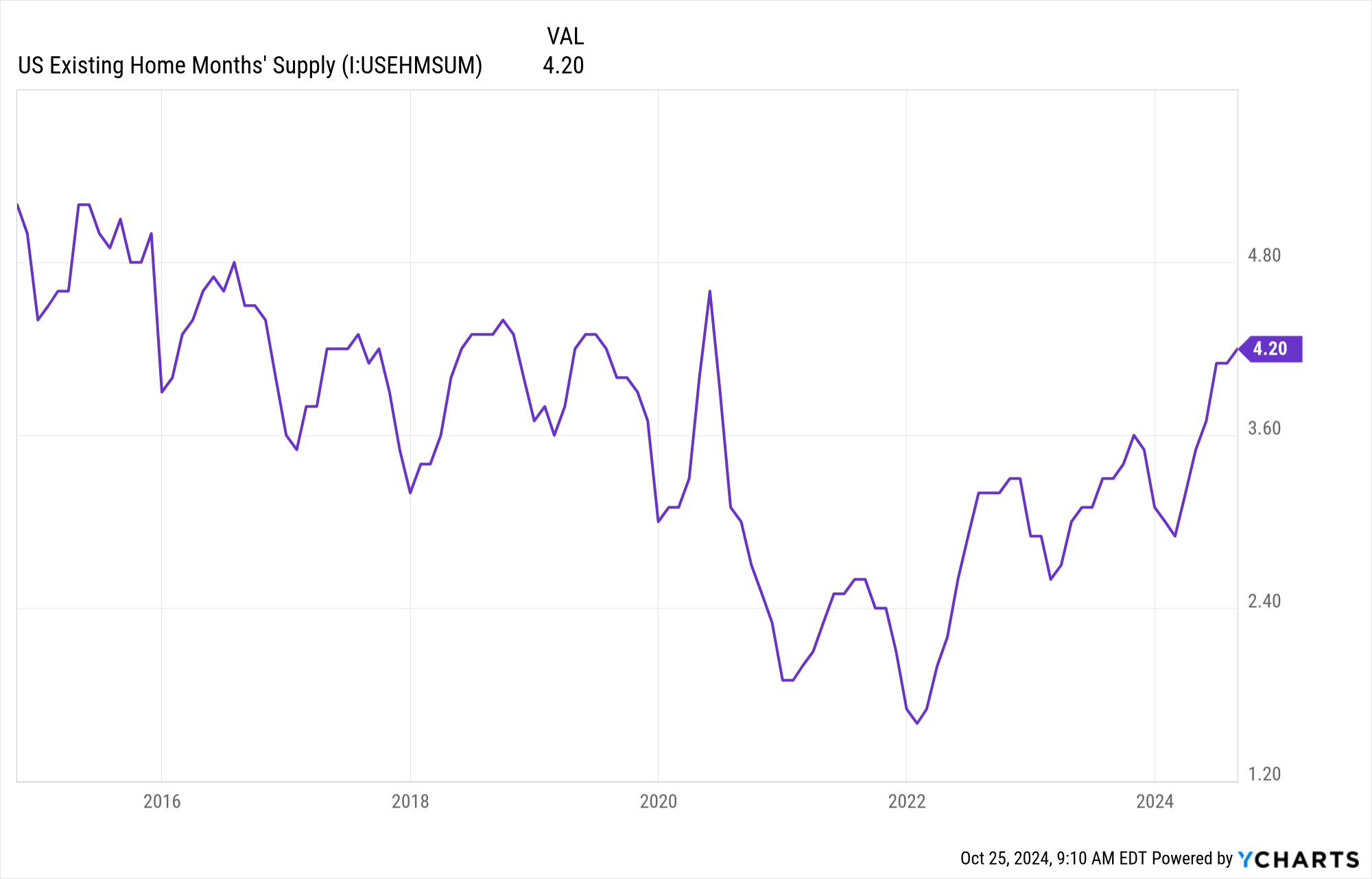

Arch: with the loss of downward rate momentum feeding into continued normalization of housing supply

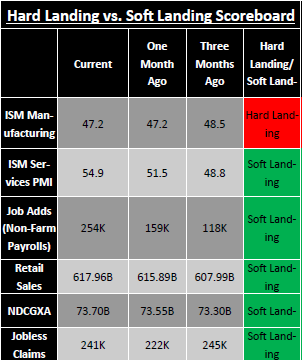

Brad: Evidence is mounting that the US economy is not at imminent risk of a recession

Source: Sevens Report 10.21.2024

Source: Sevens Report 10.21.2024

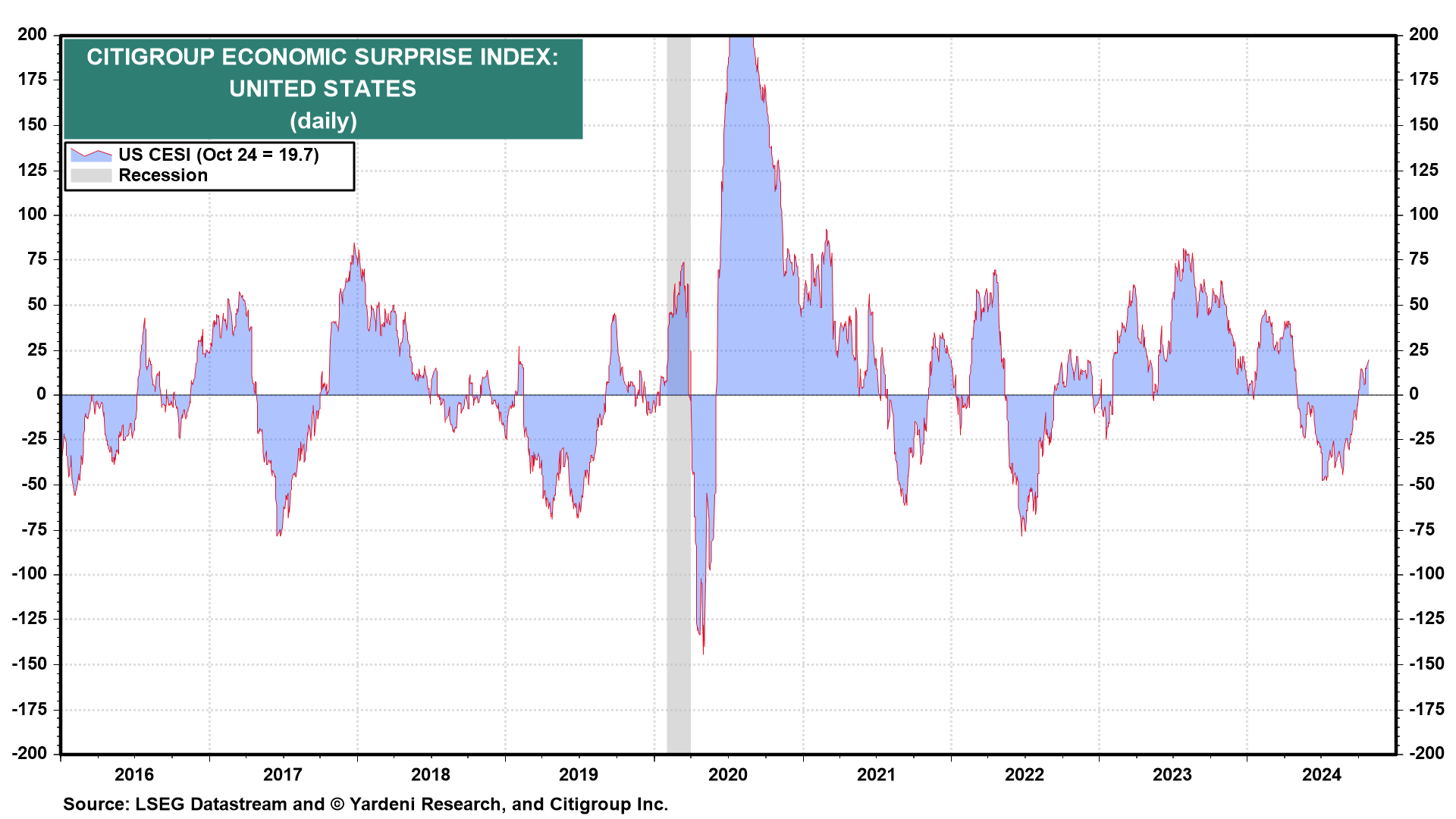

Brett: with recent economic surprises less likely to be occurring on the downside

Data as of 10.23.2024

Data as of 10.23.2024

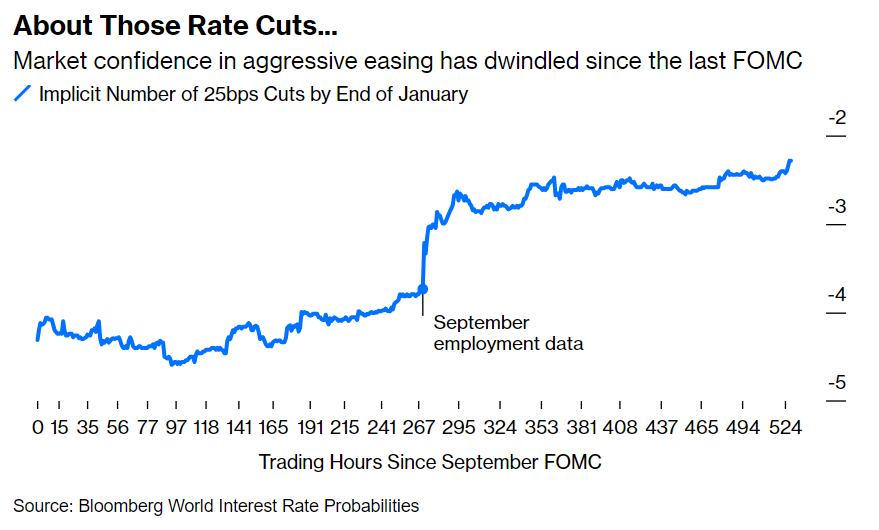

Beckham: and fewer rate cuts now being priced in by the bond market

Data as of 10.22.2024

Data as of 10.22.2024

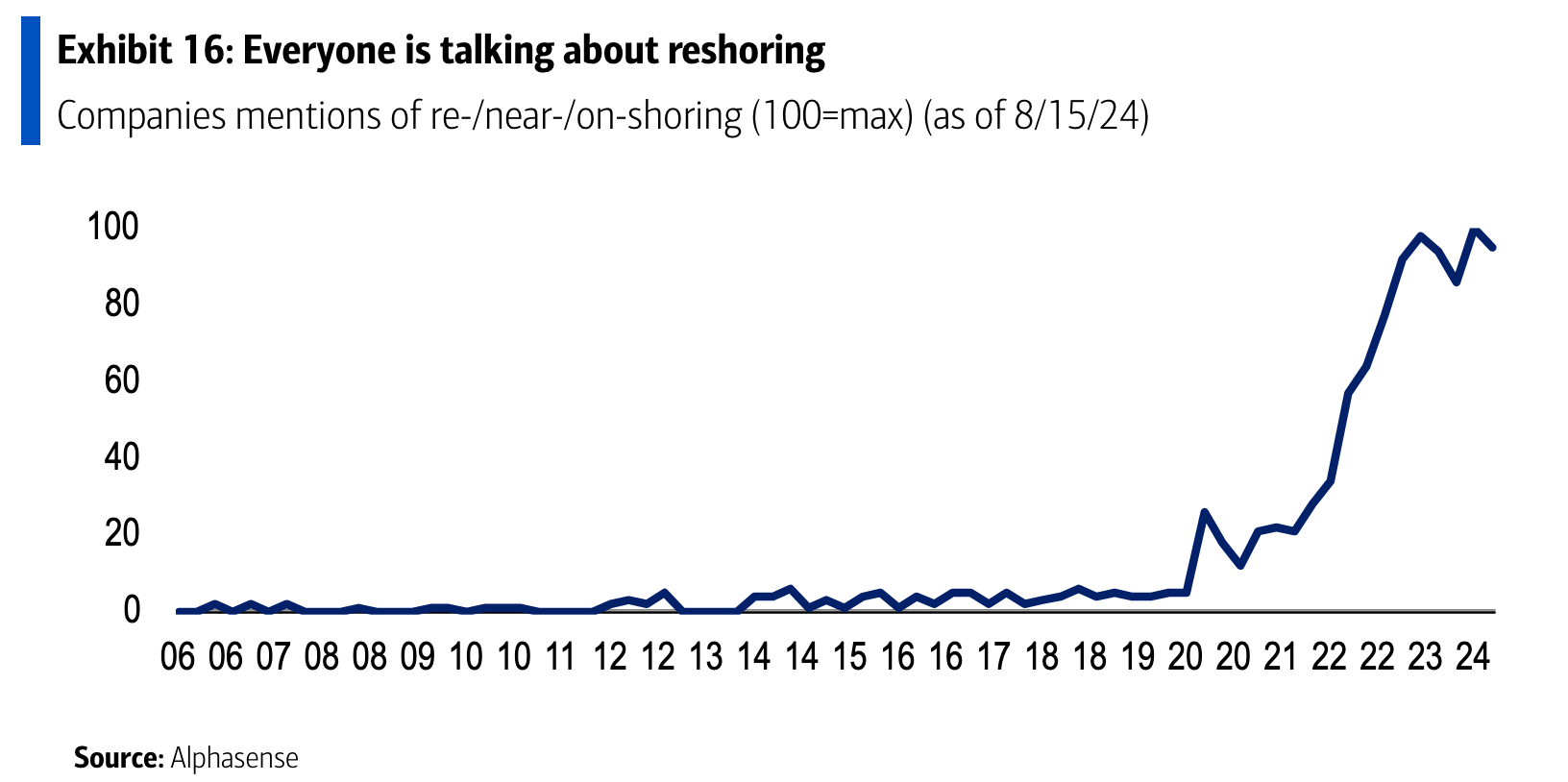

Brett: Earnings season is underway, will be interesting to note if recent trends regarding onshoring continue

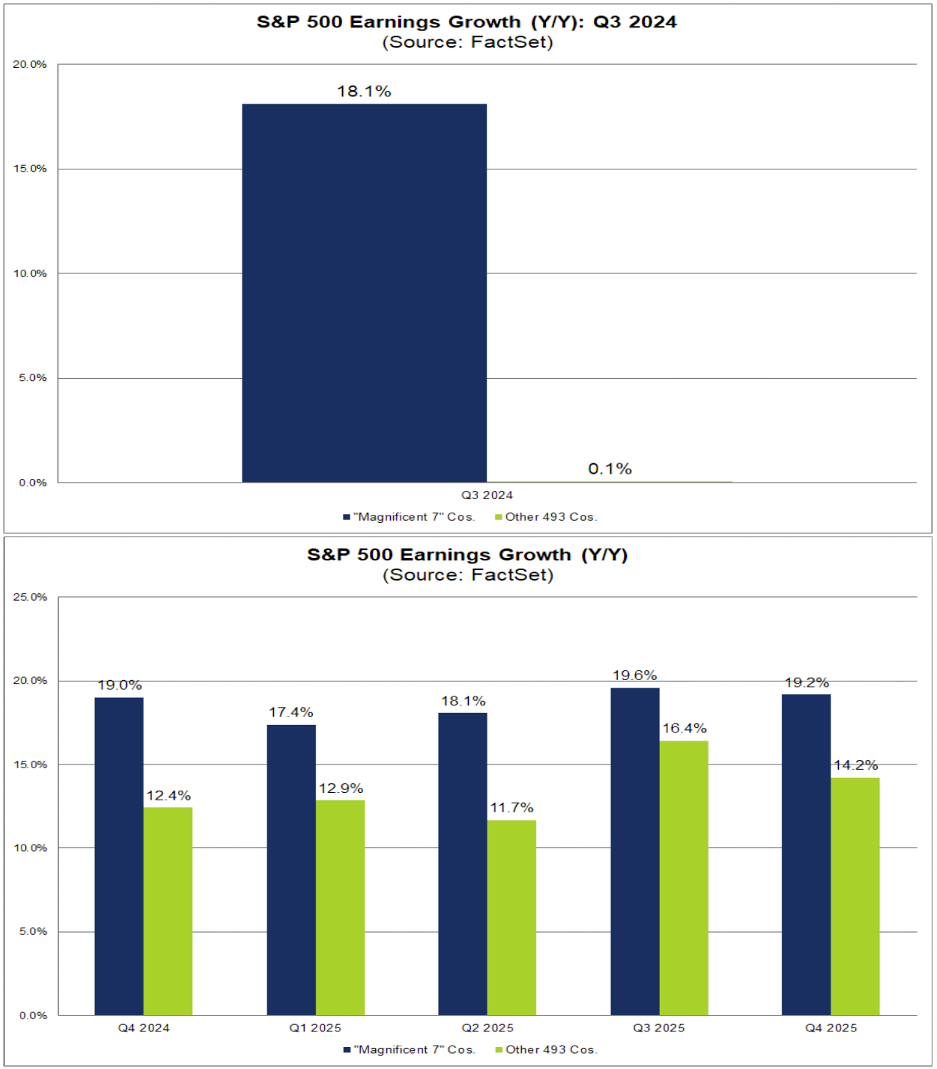

Dave: as we head into the heart of earnings, Q3 estimates show continued Mag 7 dominance but future earnings growth broadening out

Data as of 10.23.2024

Data as of 10.23.2024

Dave: the real story is that profit margins for the largest US corporations continue to improve

Source: Strategas as of 10.21.2024

Source: Strategas as of 10.21.2024

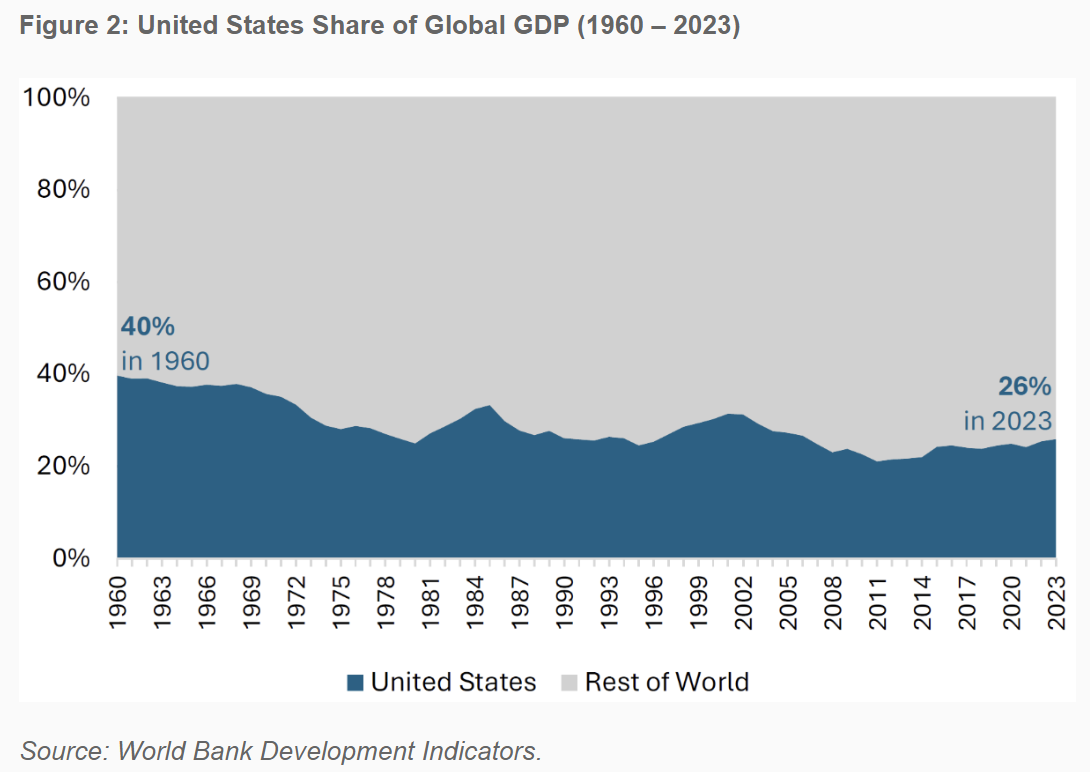

Beckham: this profitability and productivity miracle is a huge reason US stocks have dominated despite a decline in global economic impact

Source: Verdad as of March 2024

Source: Verdad as of March 2024

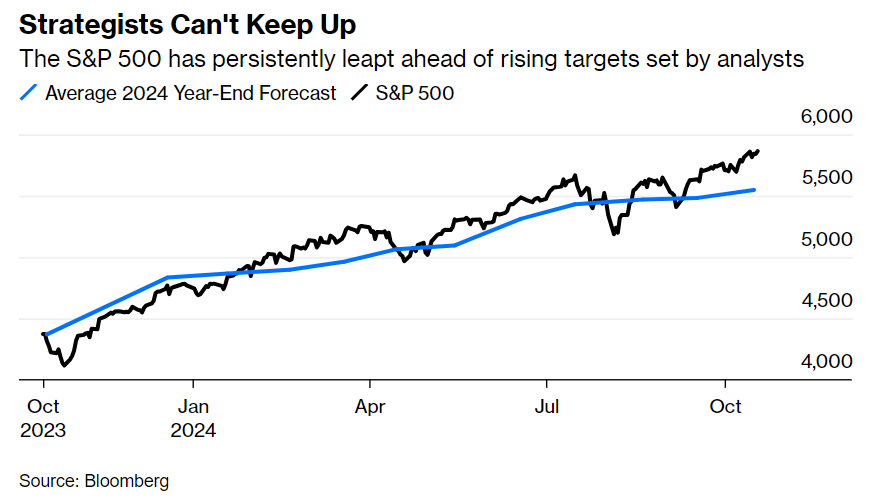

Brian: Wall Street strategists tend to just follow along with market movement, and like 2023 they just keep chasing prices higher

Data as of 10.21.2024

Data as of 10.21.2024

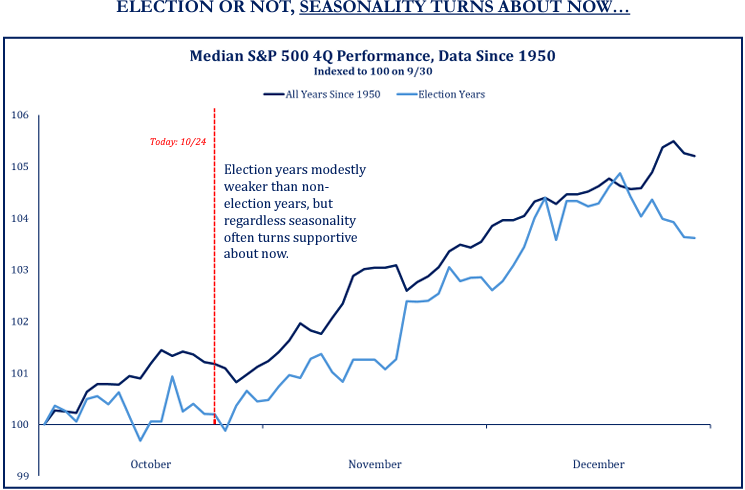

Brad: this as we head towards the setting of 2025 targets what is a historically favorable season for stocks

Source: Strategas as of 10.24.2024

Source: Strategas as of 10.24.2024

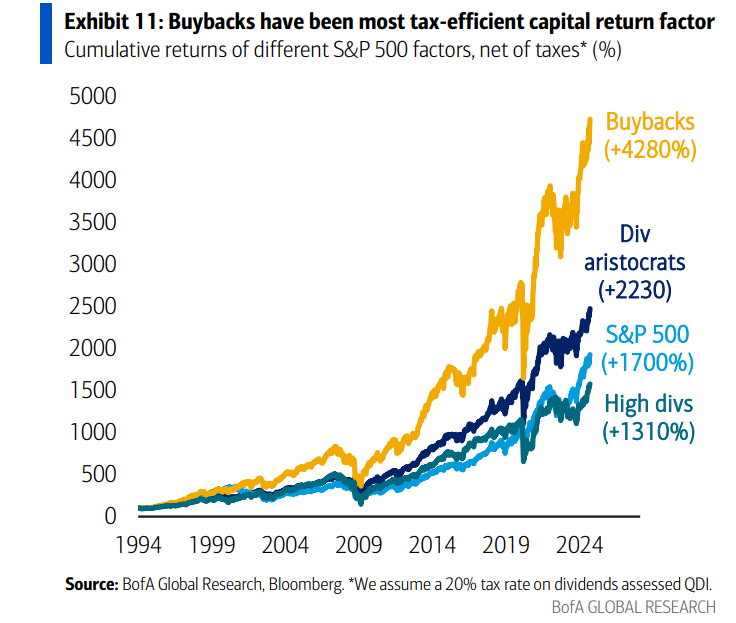

John Luke: Stock buybacks have become a political target, but they’ve been a huge tailwind for investors

Data as of 10.21.2024

Data as of 10.21.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2410-29.