Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

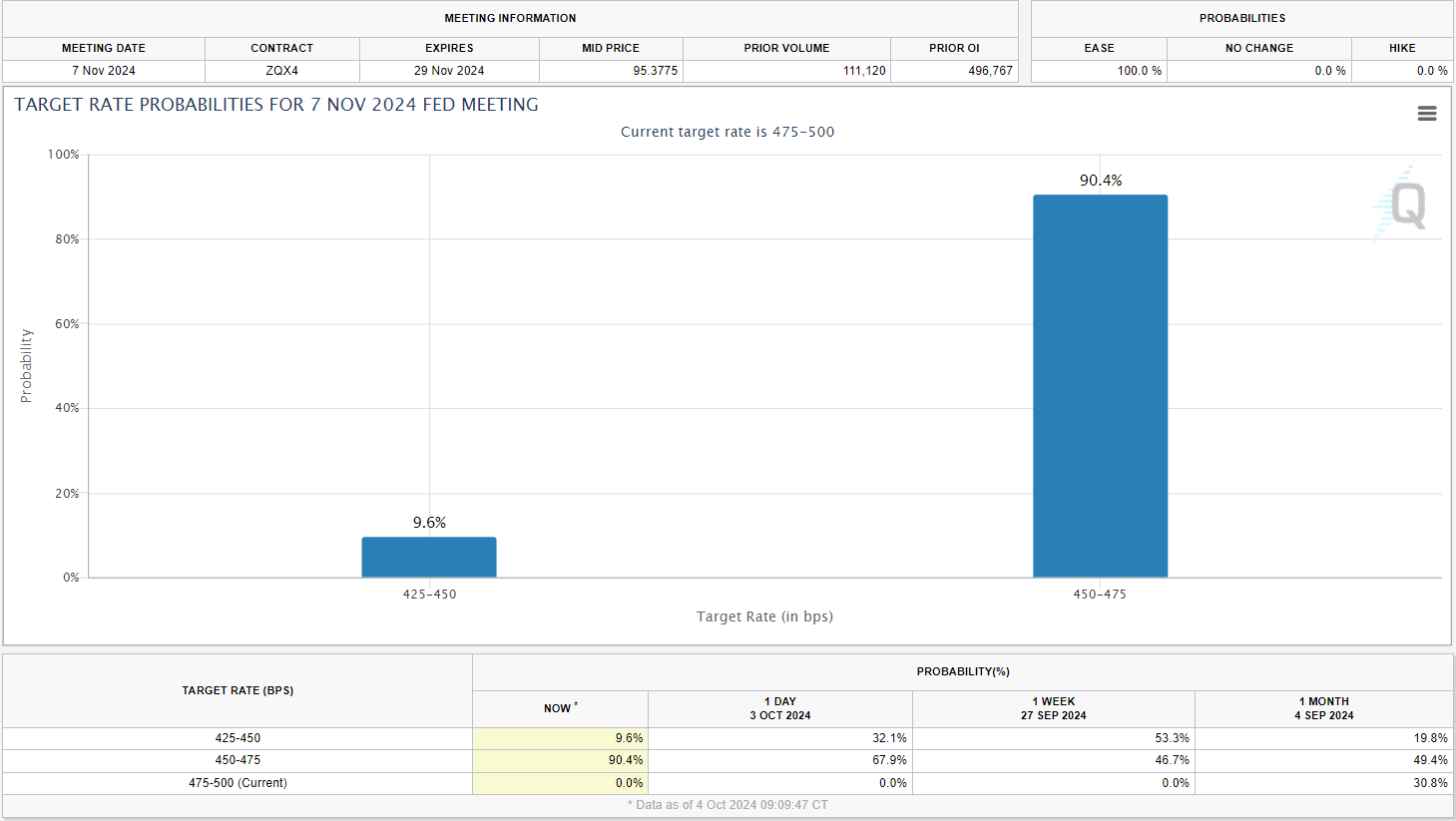

John Luke: Between the Fed Chair and the jobs report, the market’s expectations of another 50 bps cut have gone from a tossup to “not happening”

Source: CME FedWatch Tool

Source: CME FedWatch Tool

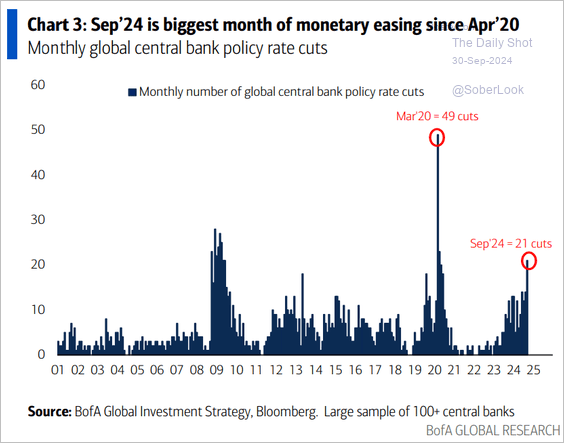

JD: but the global trend of central bank easing is well underway

Data as of 09.27.2024

Data as of 09.27.2024

Beckham: The jobs report was another push away from summer recession fears

Data as of 10.02.2024

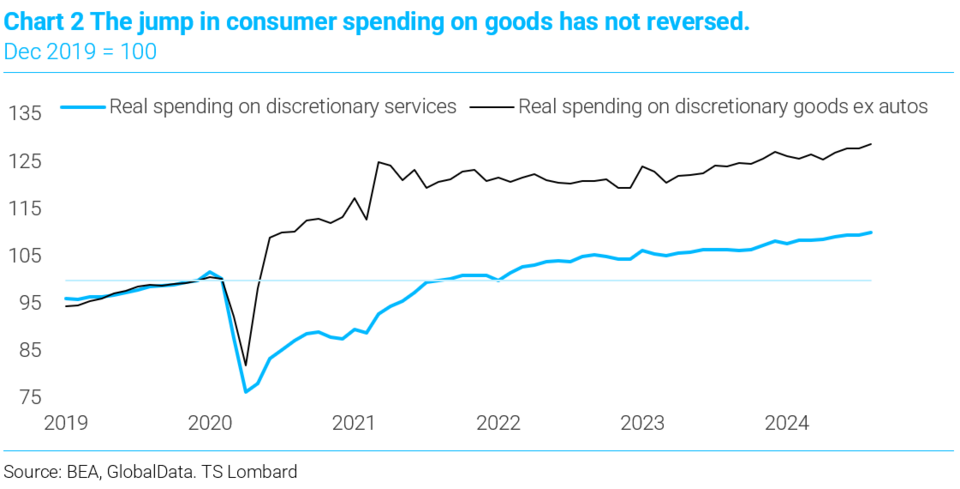

John Luke: with the consumer a key part of avoiding a real economic downturn

Data as of September 2024

Data as of September 2024

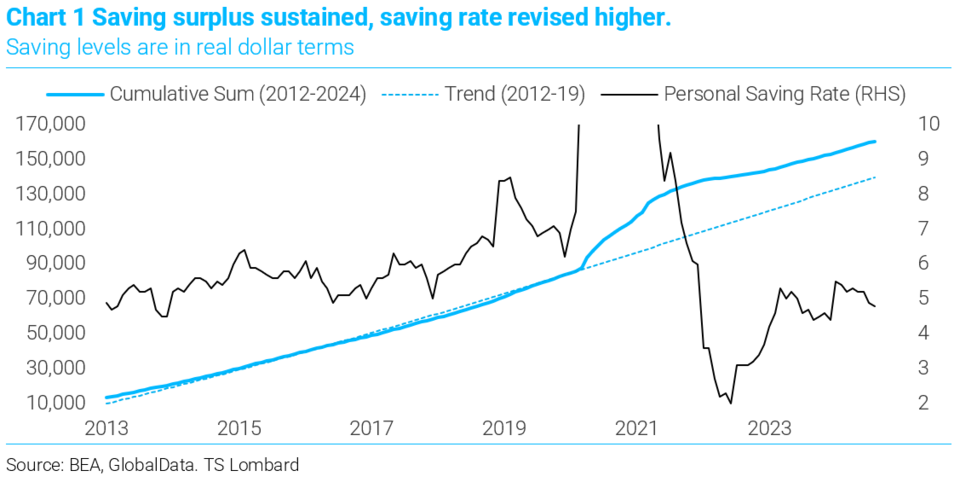

John Luke: and supported by a persistently high level of saving

Data as of September 2024

Data as of September 2024

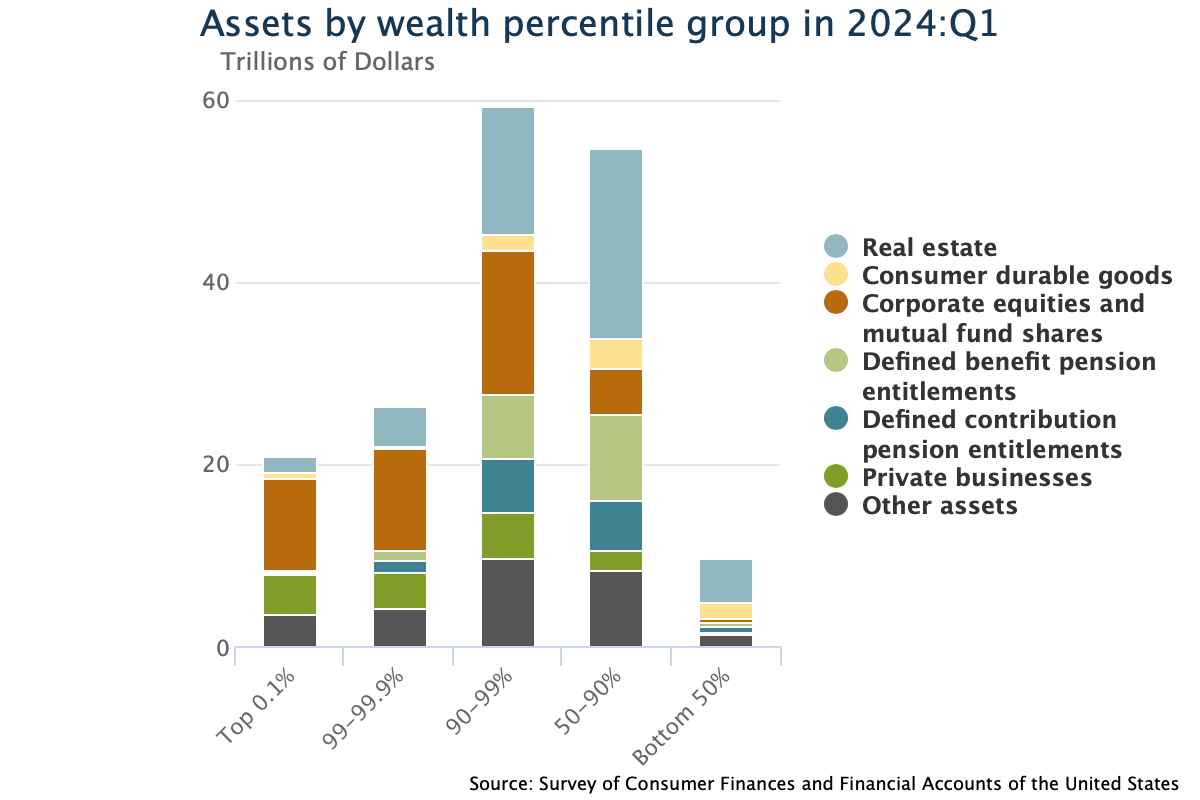

Arch: Housing is a huge piece of most consumer balance sheets, especially as you go down the wealth scale

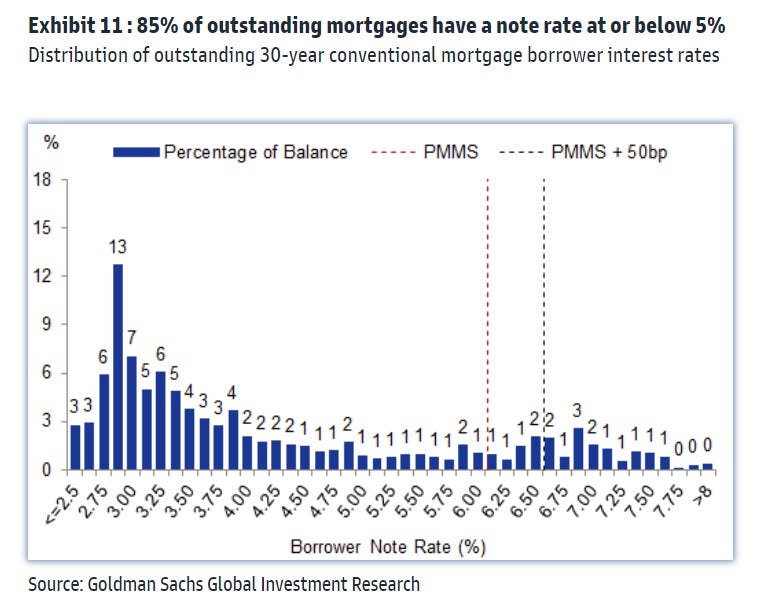

Beckham: and they’re benefitting from their ability to refinance mortgages in the 2020-2021 low rate window

Data as of September 2024

Data as of September 2024

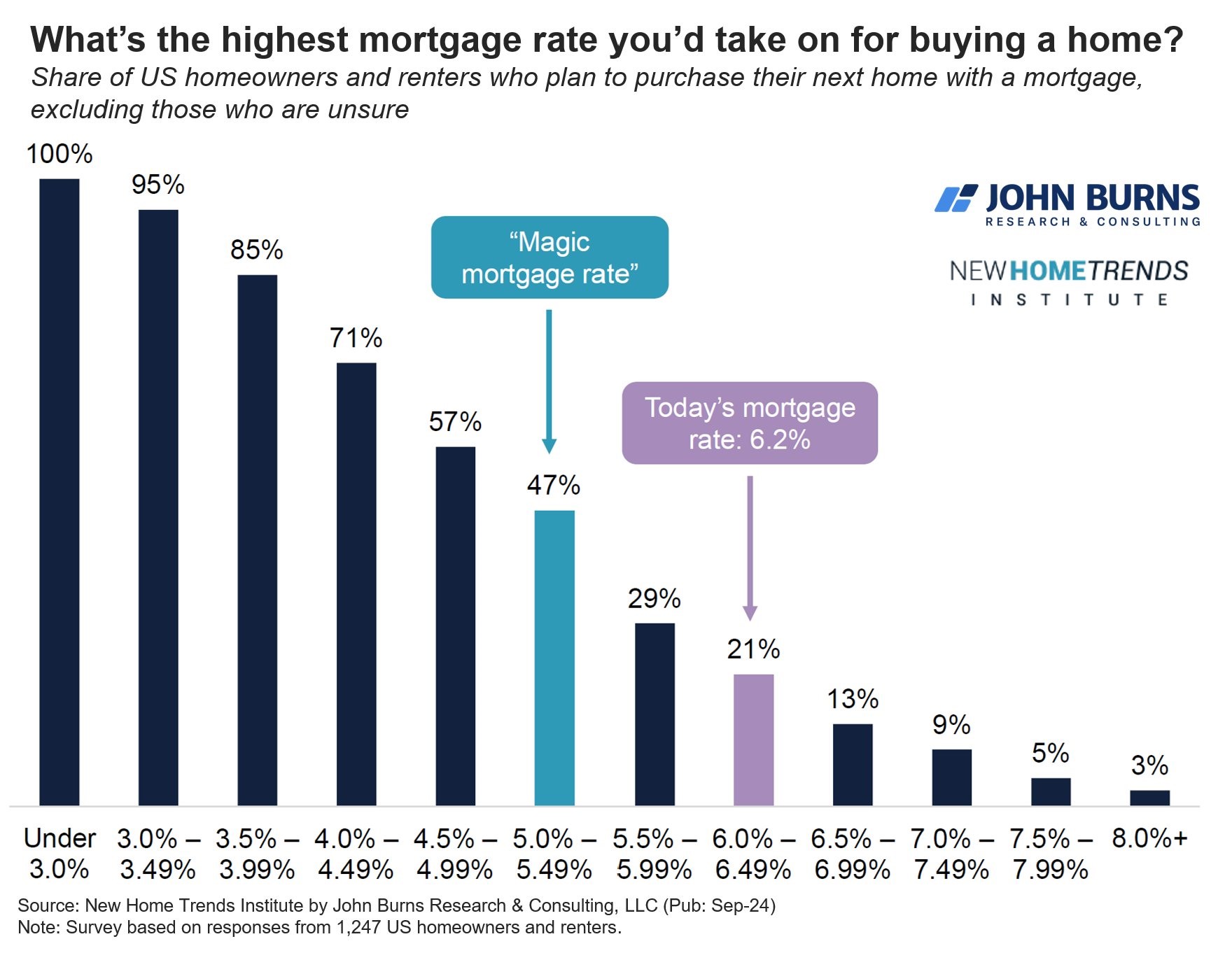

Joseph: which is a prime reason why it would seemingly take a further drop in mortgage rates to generate new mortgage activity

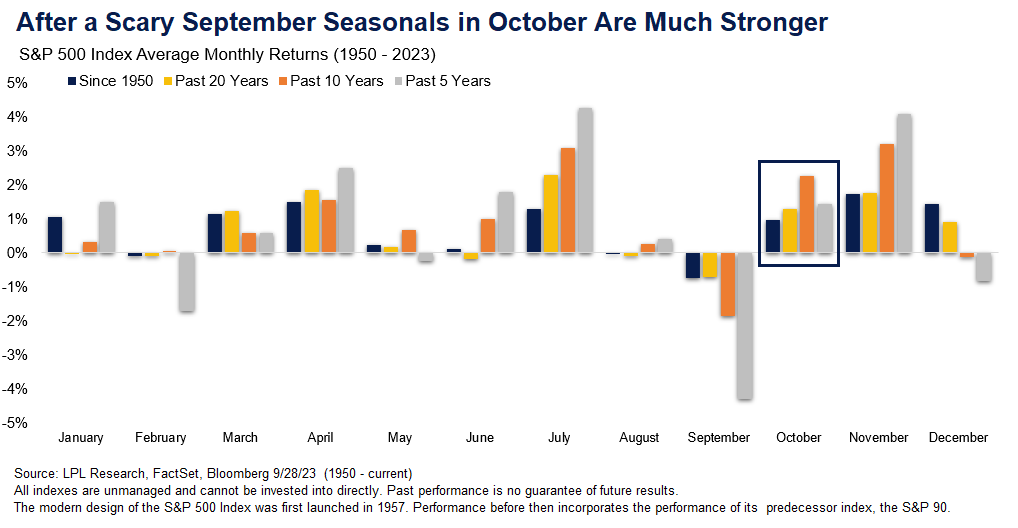

Brad: We’re heading into a seasonally strong period for stocks

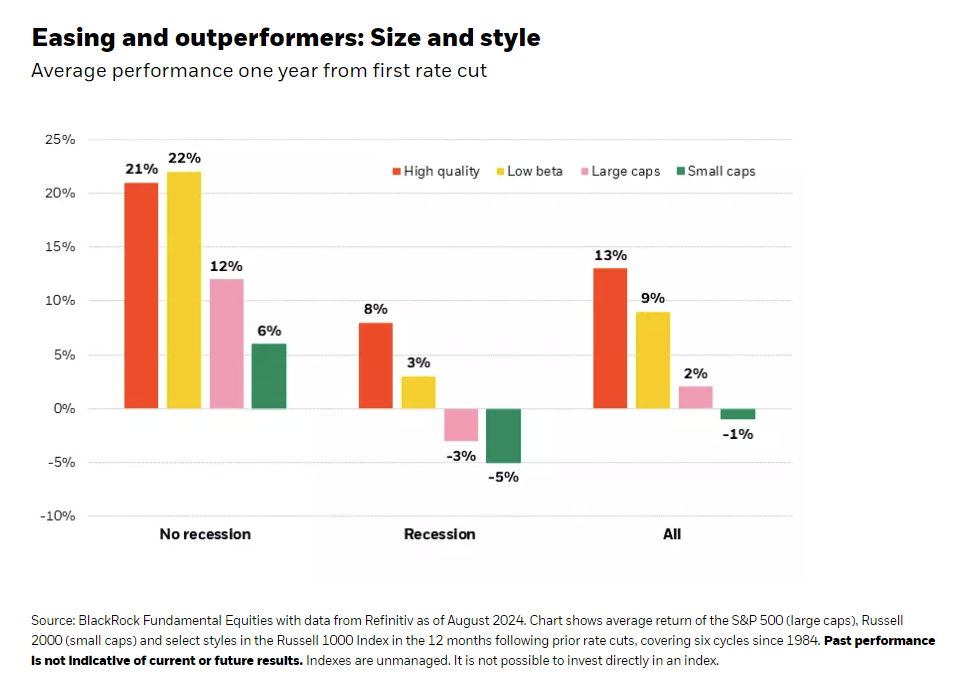

John Luke: and they’ve historically responded well to rate-cutting cycles that have avoided recessions

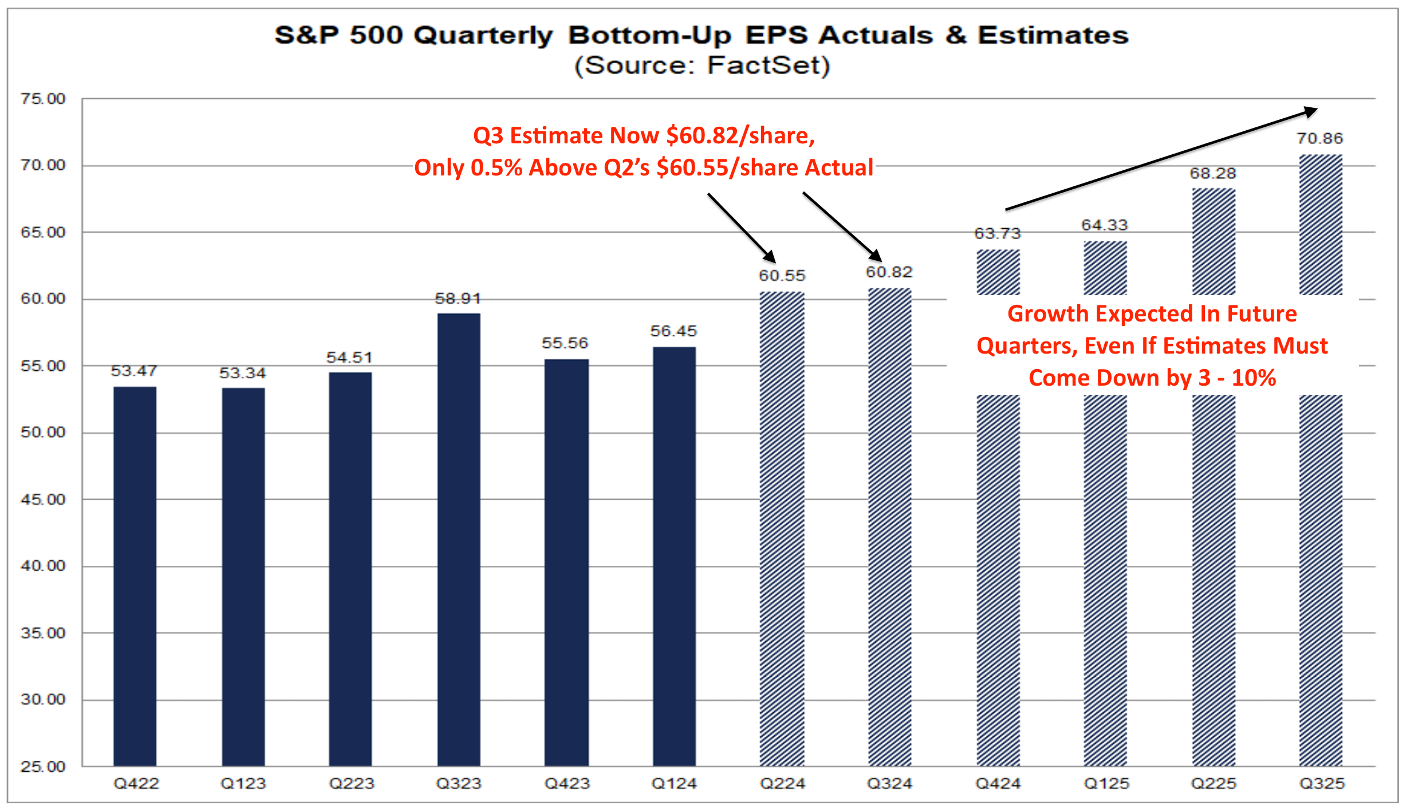

Dave: Q3 earnings estimates have retreated in recent weeks as investors began worrying about the economy

Data as of 10.02.2024

Data as of 10.02.2024

Brad: leading to a flattish set of comparisons in Q3 relative to Q2

Data as of 10.02.2024

Data as of 10.02.2024

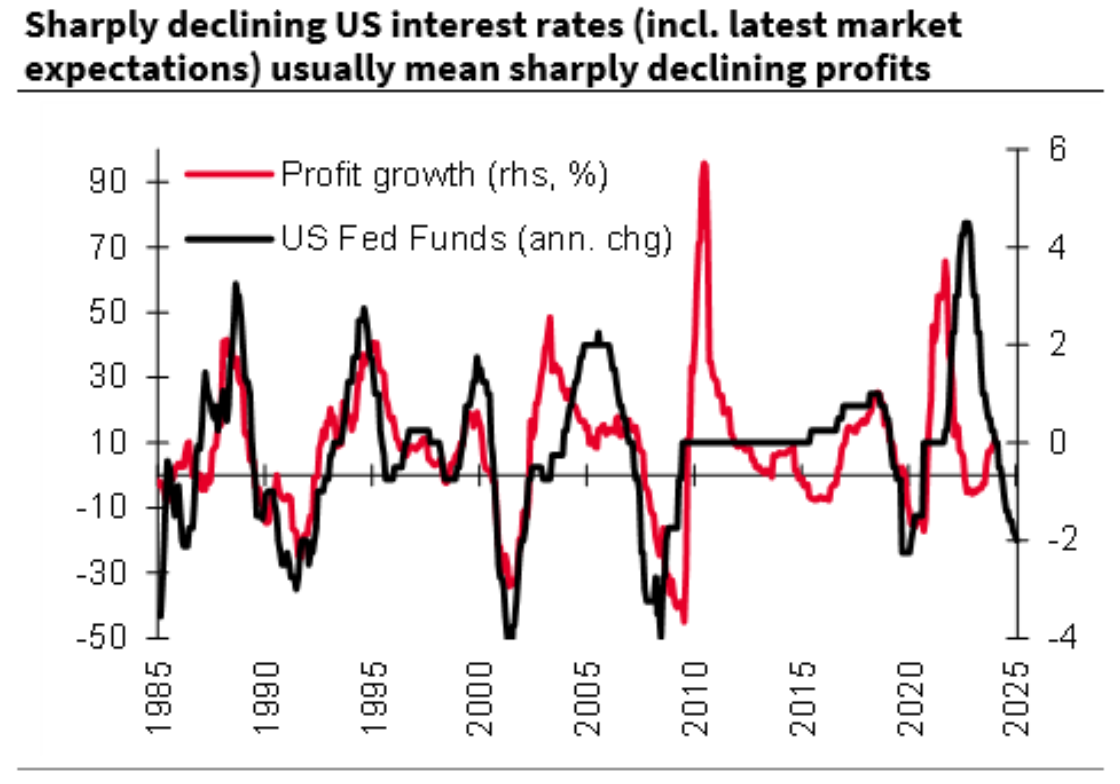

Brett: to an extent, this matches the history of earnings tracking along with interest rate cycles

Source: Societe Generale as of Sept 2024

Source: Societe Generale as of Sept 2024

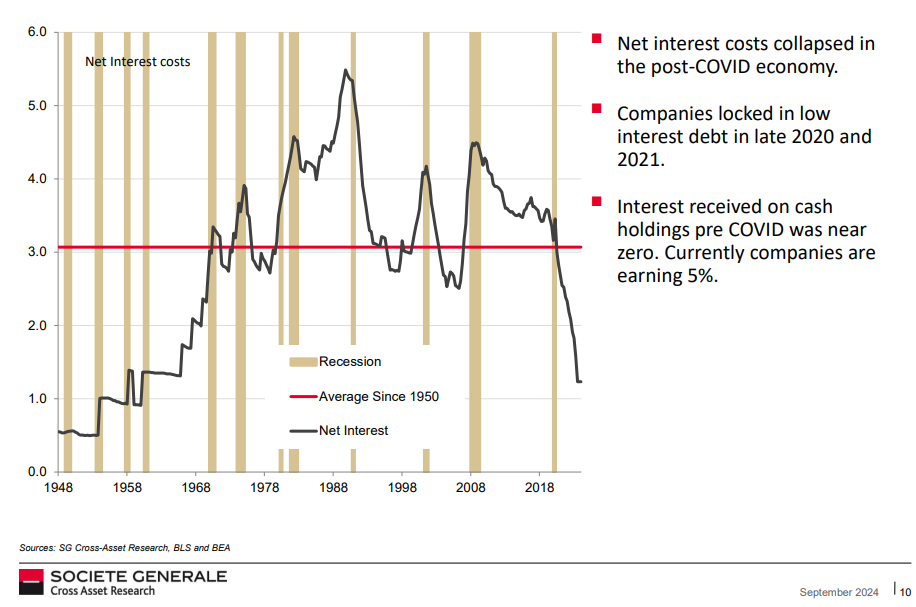

John Luke: but like homeowners, large US companies took advantage of historically low rates to at least reduce the interest expense line item

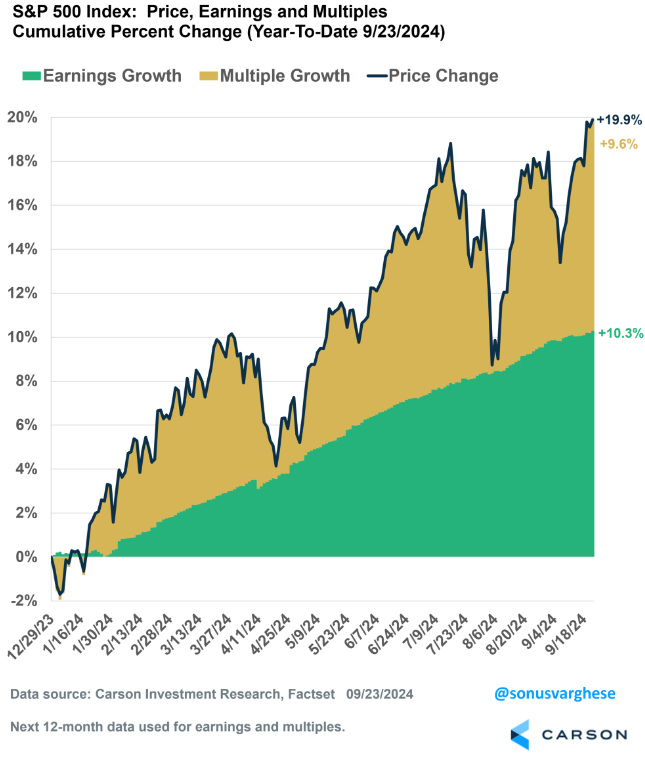

Brad: Good reminder that investor mood changes often but growth is the consistent driver of what markets can ultimately deliver

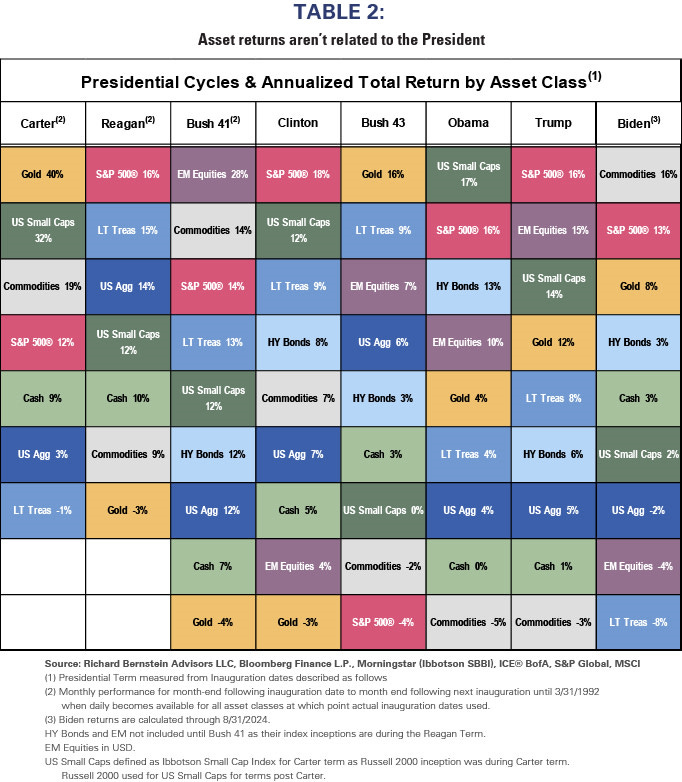

Dave: and a reminder that the election winner has little impact on the long-term drivers of wealth

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2410-12.