Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

Dave: In the past few decades, the highest-growing half of S&P 500 industries have steadily outperformed the 50 slowest-growing

Source: Raymond James as of 08.29.2023

Source: Raymond James as of 08.29.2023

Dave: which has lifted valuations as cap-weighted indexes tilt in the direction of higher-growth industries

Source: Goldman Sachs as of August 2023

Source: Goldman Sachs as of August 2023

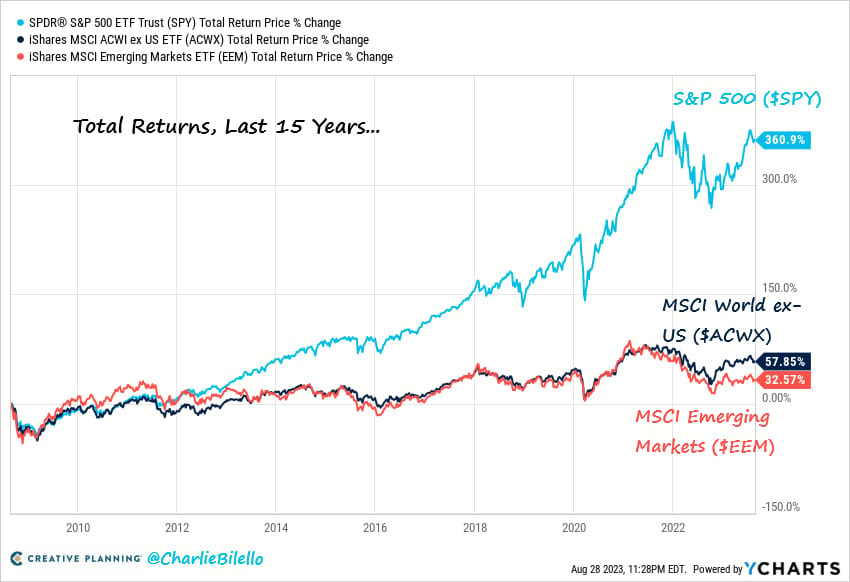

John Luke: The prevalence of growth-oriented sectors is a big reason for US dominance since the global financial crisis

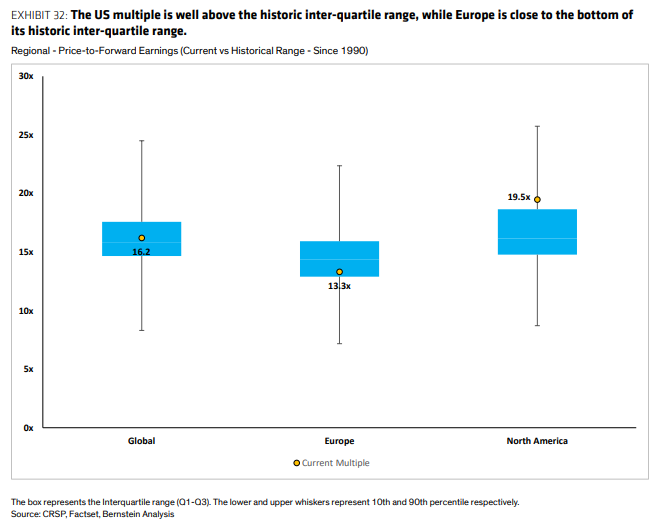

John Luke: and resulted in large disparities between valuations of US stocks and international ones

Source: Bernstein as of 08.28.2023

Source: Bernstein as of 08.28.2023

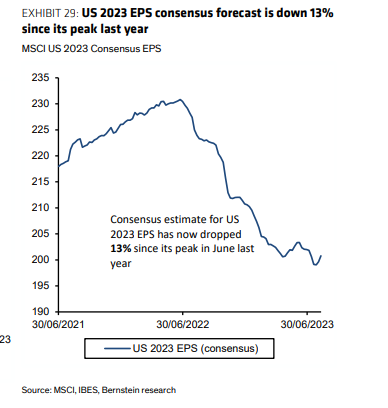

John Luke: Earnings estimates are now far lower than they were a year ago

Source: Bernstein as of 08.28.2023

Source: Bernstein as of 08.28.2023

Brad: but stable enough to have avoided the feared earnings recession

Source: Strategas as of 08.28.2023

Source: Strategas as of 08.28.2023

John Luke: Credit delinquencies are rising for young Americans

Source: Pavilion as of Aug 2023

Source: Pavilion as of Aug 2023

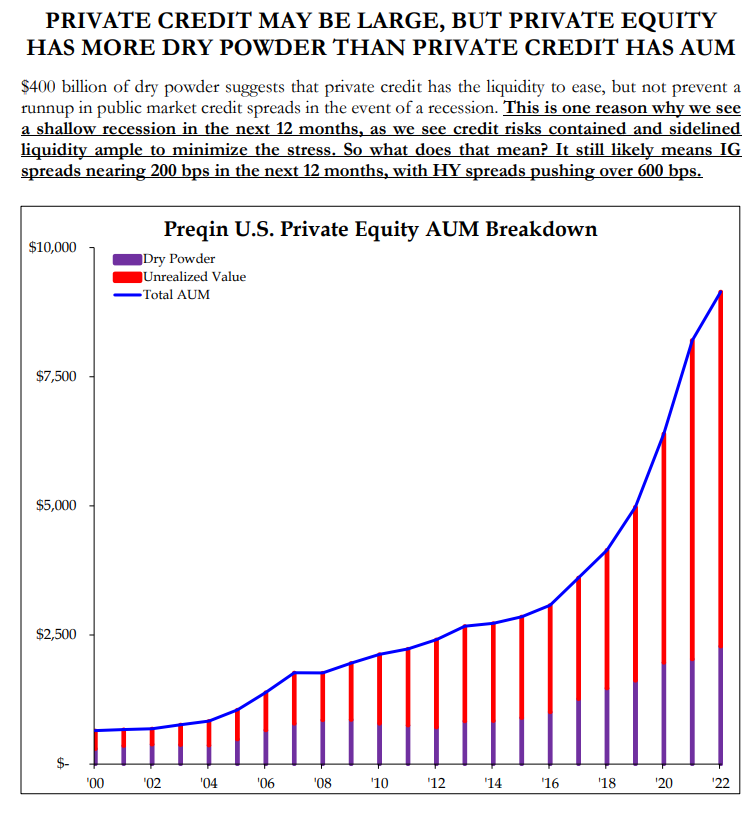

Joseph: but corporate credit spreads remain tight

Source: Strategas as of 08.28.2023

Source: Strategas as of 08.28.2023

John Luke: and a flood of private equity money is on hand to provide liquidity in any slowdown

Source: Strategas as of 08.28.2023

Source: Strategas as of 08.28.2023

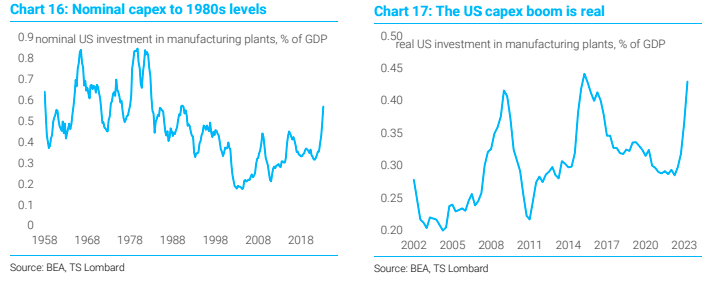

Joseph: US capital spending is surging

Data as of August 2023

Data as of August 2023

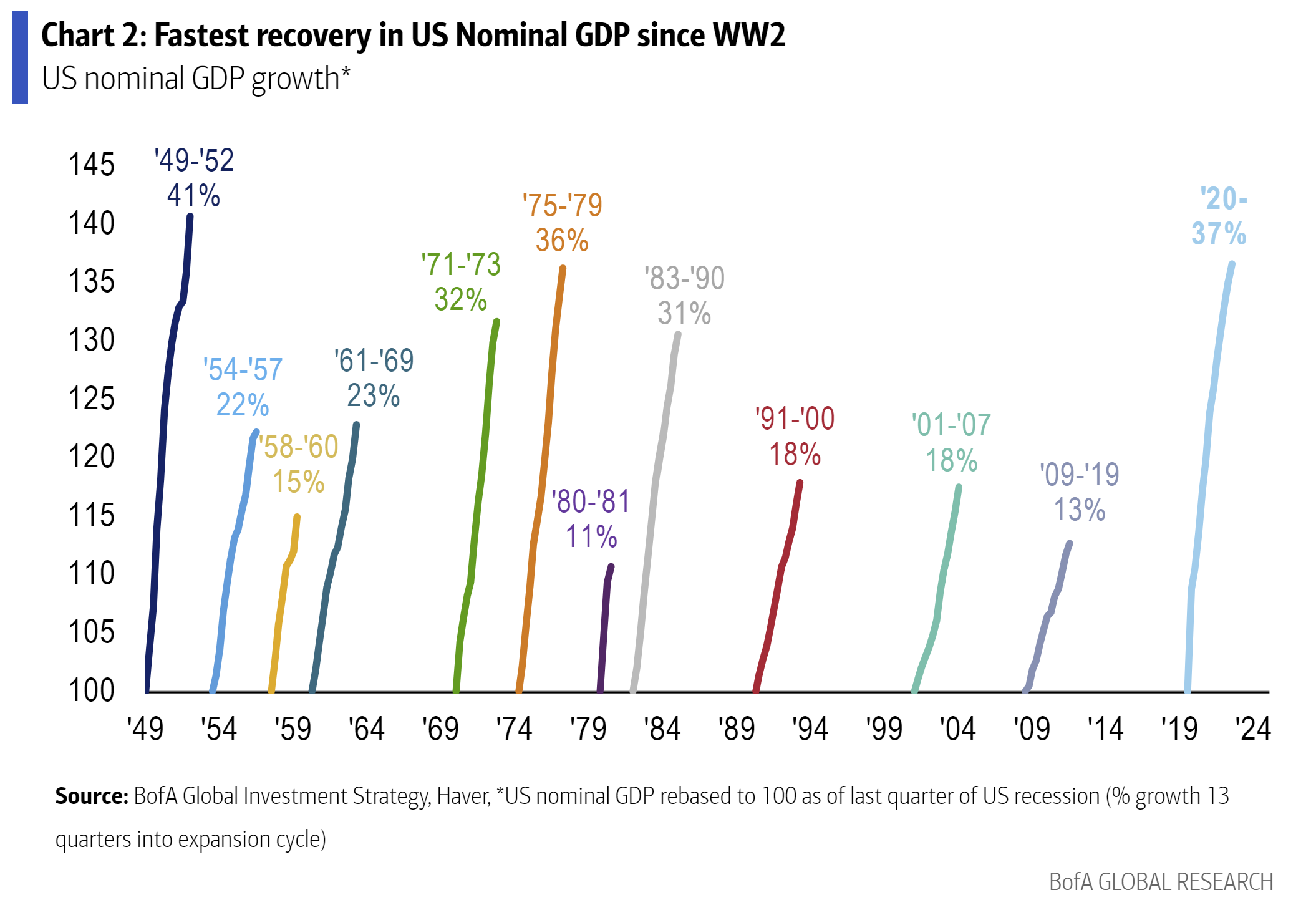

Dave: contributing to the largest multi-year GDP rise in decades

Data as of July 2023

Data as of July 2023

John Luke: US home prices are back to their highs after a slight dip

Data as of July 2023

Data as of July 2023

Brad: which, combined with higher rates, has led to a significant rise in the monthly expense of buying a home

Source: Strategas as of 08.28.2023

Source: Strategas as of 08.28.2023

Dave: leading to a major dip in new mortgage applications

Data as of August 2023

Data as of August 2023

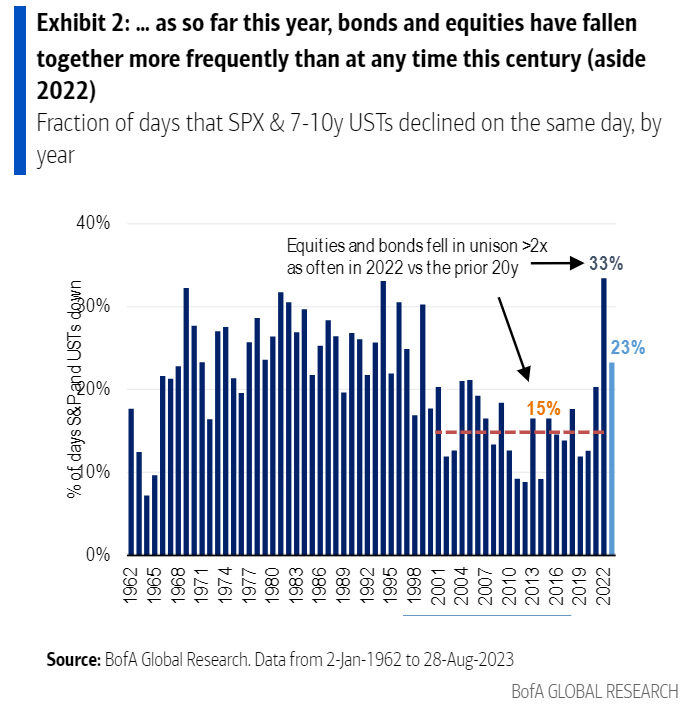

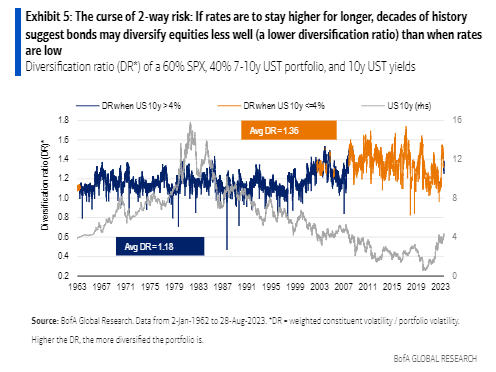

Beckham: Stocks and bonds have moved in tandem much more than usual this year

John Luke: revealing the imperfect nature of bonds as a diversifier to stocks

Source: BoA as of 08.28.2023

Source: BoA as of 08.28.2023

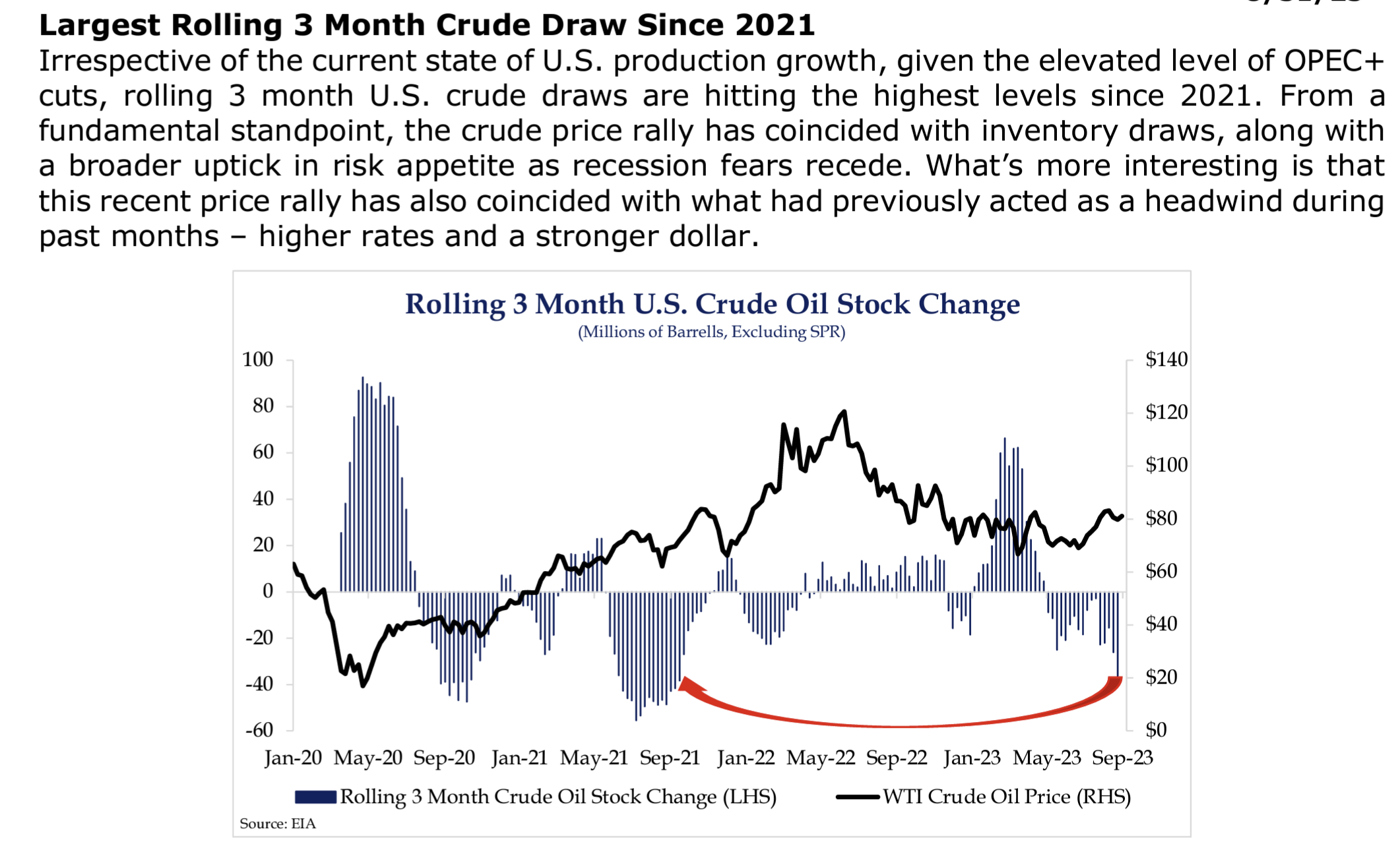

Dave: Worth repeating, we need a light hurricane season to avoid compounding the already tight situation in crude supply

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2309-1.