Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

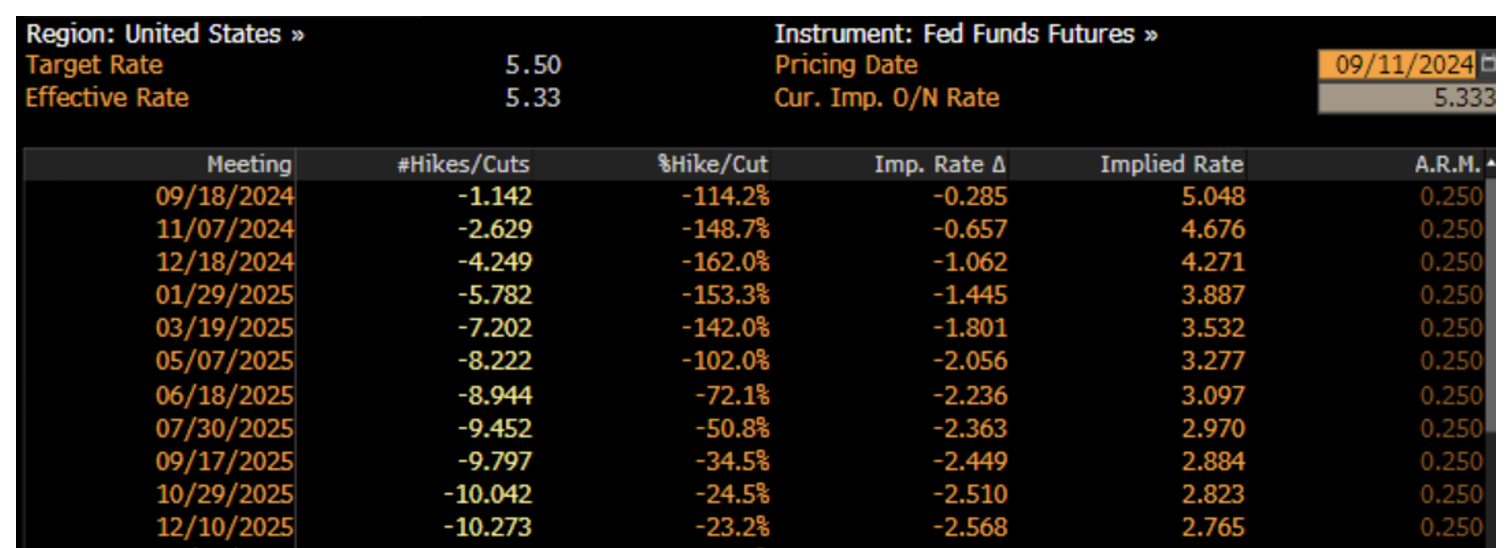

John Luke: Chatter around a 50 bps cut jumped a bit late in the week, we’ll see what’s in store next Wednesday

Source: Bloomberg

Source: Bloomberg

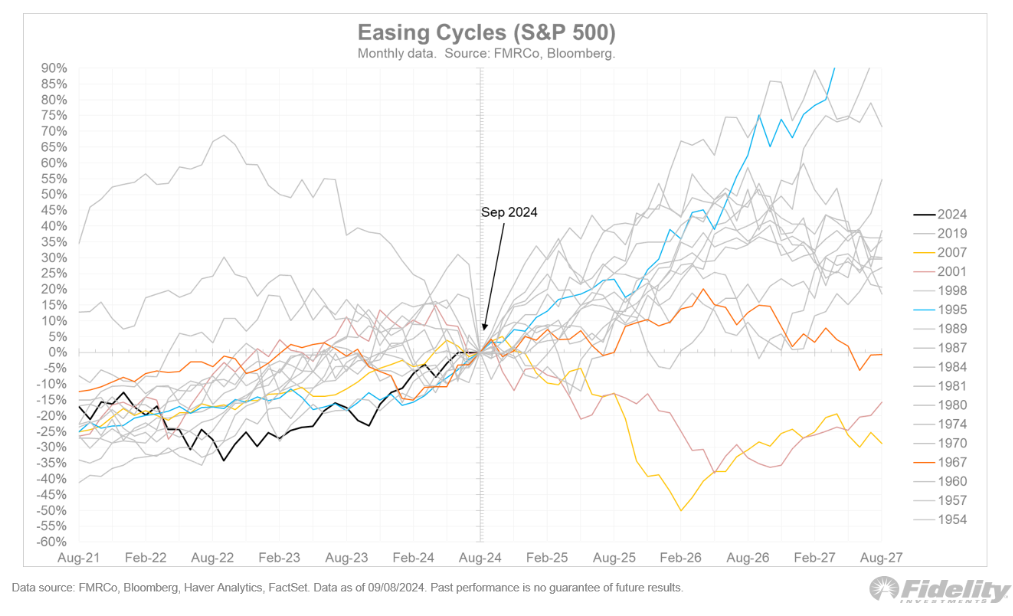

Beckham: what that means for future market returns will depend on the type of economic “landing”

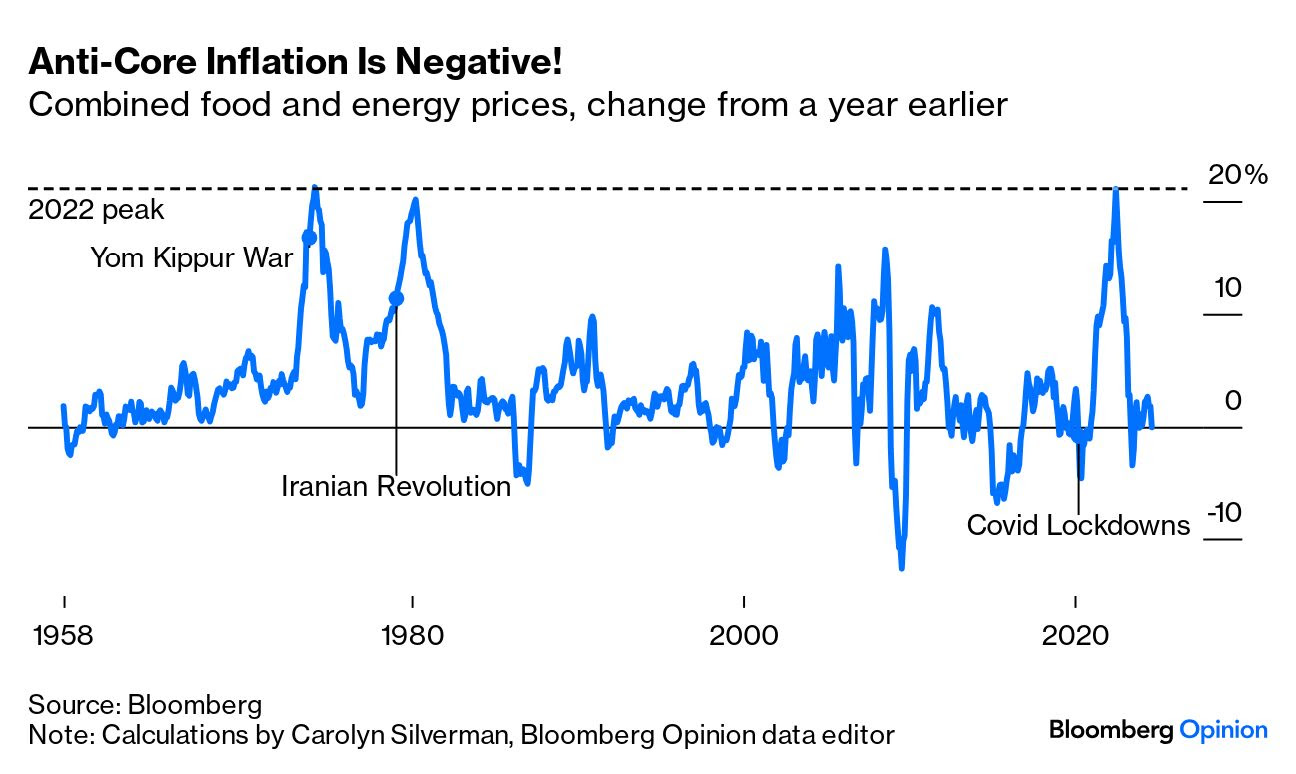

Joseph: Year-over-year CPI inputs for food and energy are now pretty much flat

Data as of 09.12.2024

Data as of 09.12.2024

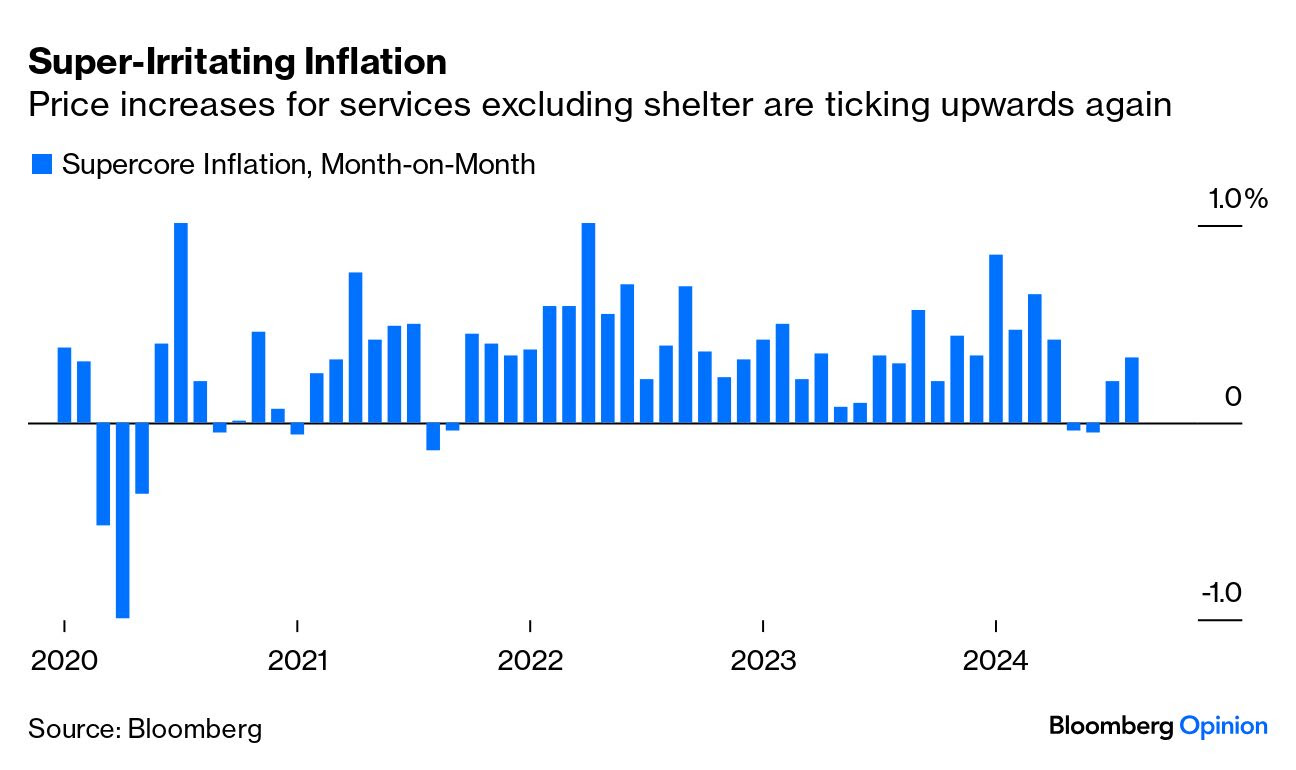

John Luke: but services inflation remains sticky, even without the impact from shelter

Data as of 09.12.2024

Data as of 09.12.2024

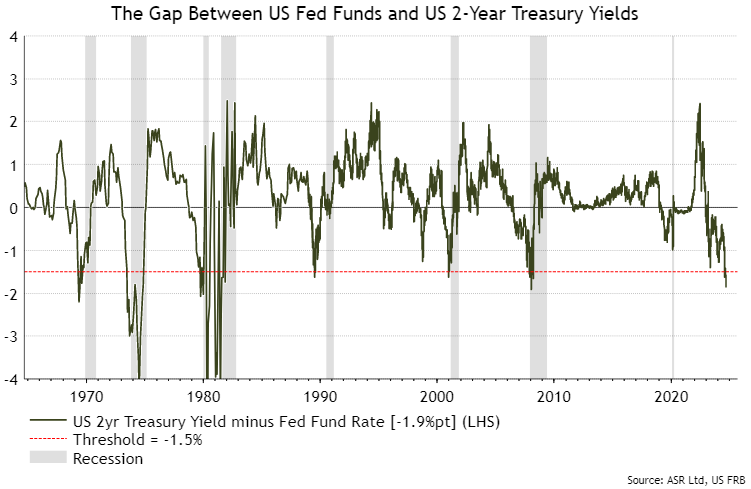

Arch: Historically, rates on 2-year Treasuries being this far below the Fed Funds rate has been a precursor to recession

Source: Bloomberg as of 09.12.2024

Source: Bloomberg as of 09.12.2024

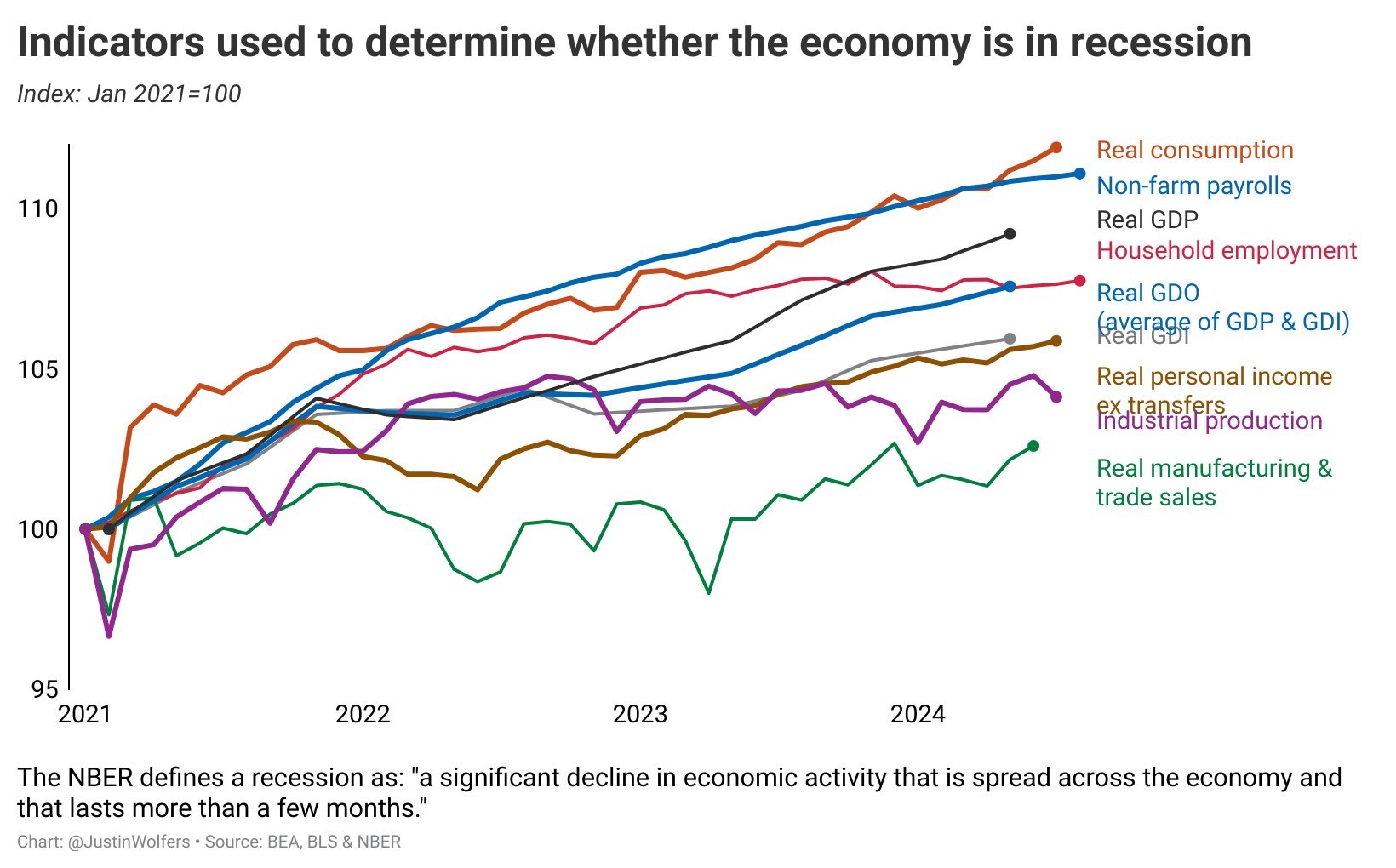

Brett: but a broad collection of data points show little danger of an imminent recession

Data as of 09.07.2024

Data as of 09.07.2024

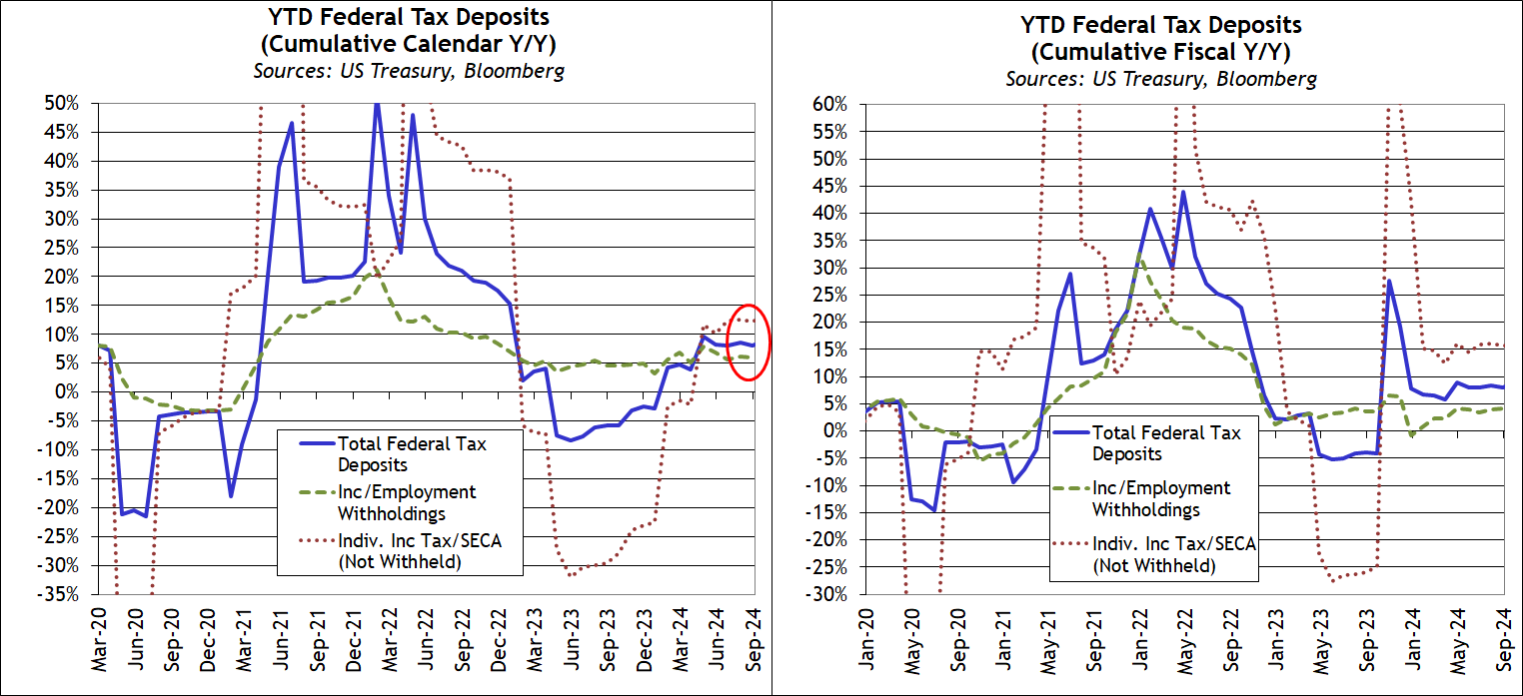

John Luke: and overall tax receipts have been stable and strong

Source: Pivotous as of 09.09.2024

Source: Pivotous as of 09.09.2024

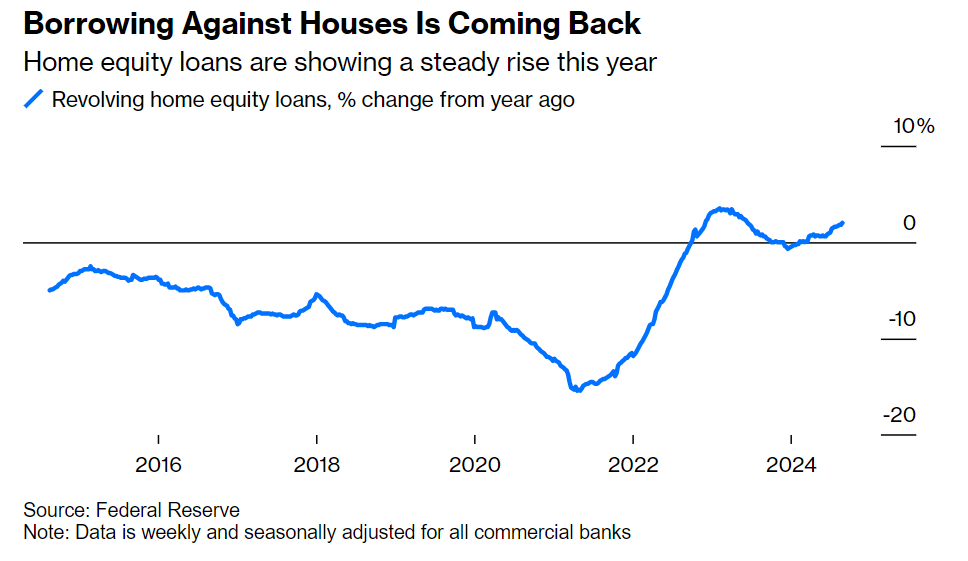

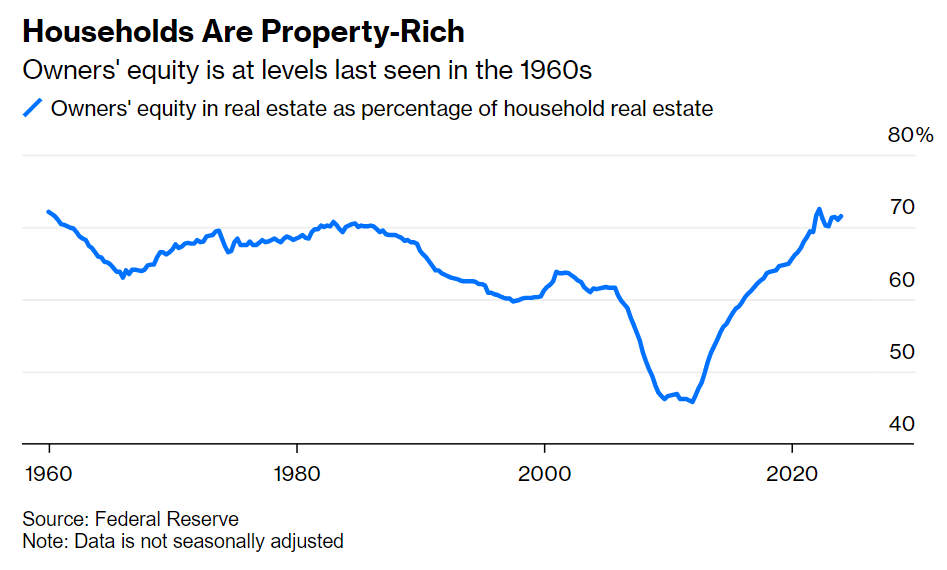

John Luke: A possible new economic tailwind is the tapping of home equity now that rates are falling

Source: Bloomberg as of 09.09.2024

Source: Bloomberg as of 09.09.2024

Beckham: without the concerns that created danger in housing ahead of the global financial crisis

Source: Bloomberg as of 09.09.2024

Source: Bloomberg as of 09.09.2024

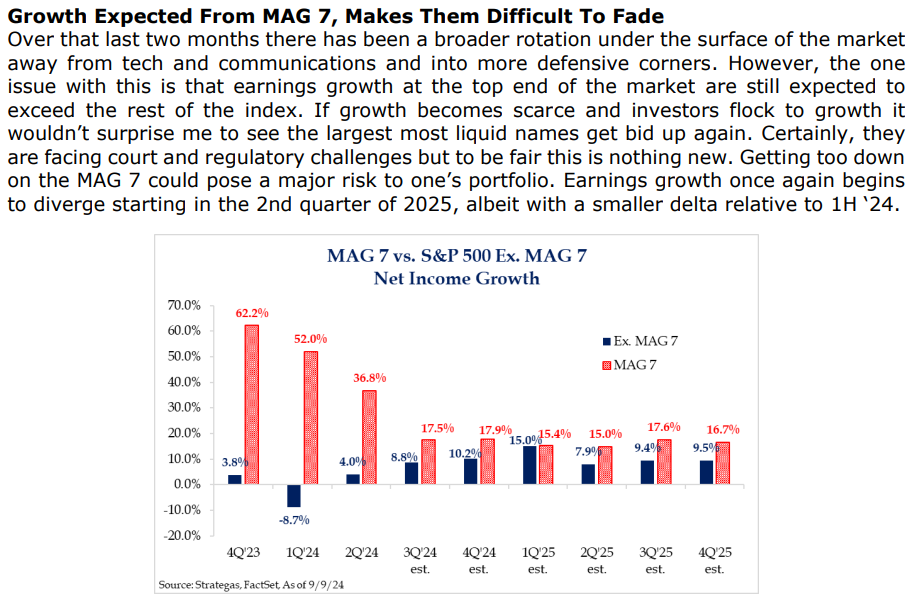

Dave: We’re entering the window when the broader market is expected to produce earnings growth closer to what we’re seeing in the to-date dominant Mag 7 results

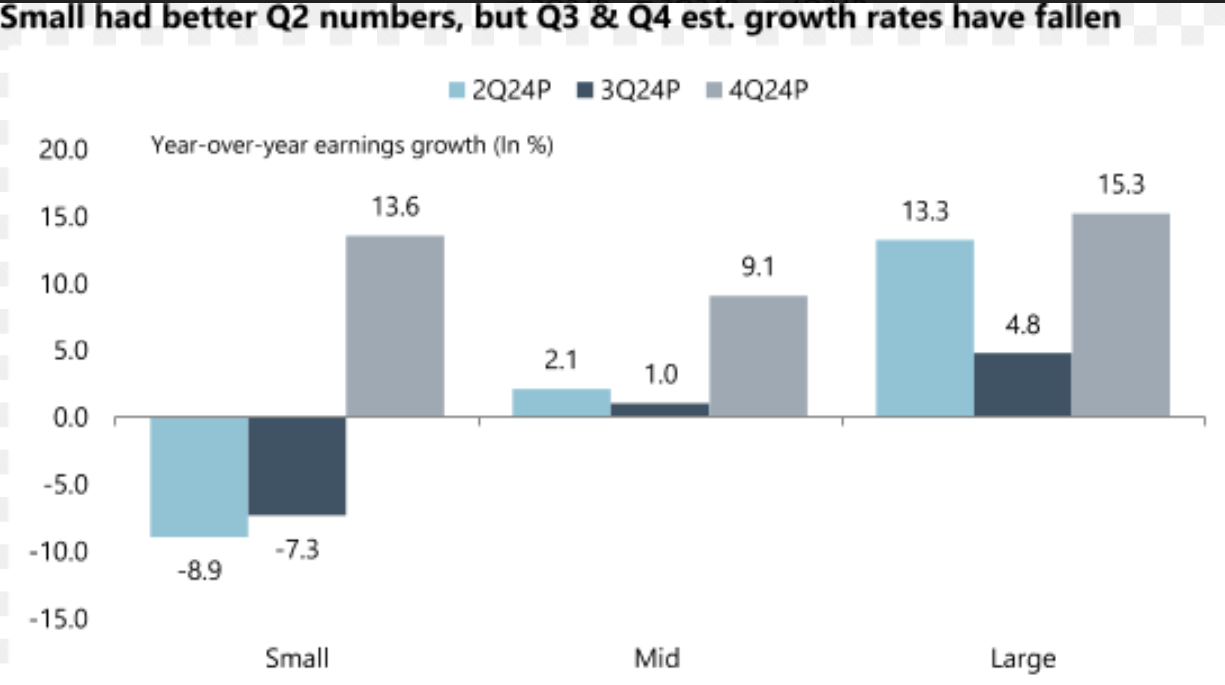

Dave: but the small cap earnings takeover remains elusive

Source: Goldman Sachs as of 09.11

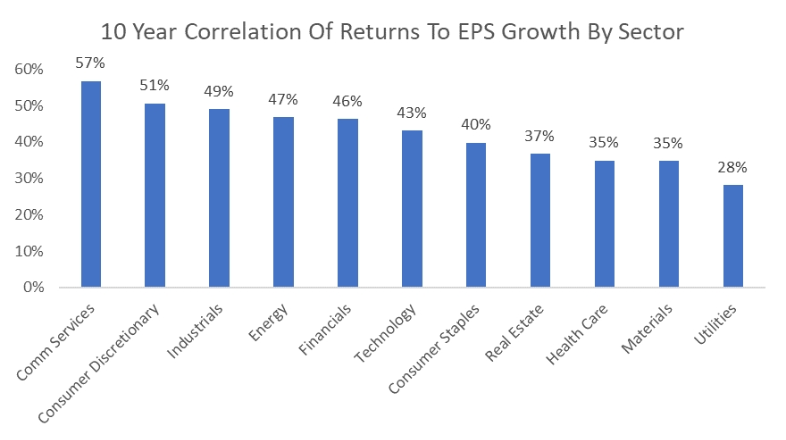

Dave: Some sectors have tighter earnings correlations than others, but there is still a fair bit of dispersion within sectors in the ability of companies to deliver growth

Source: Jefferies as of 09.10.2024

Source: Jefferies as of 09.10.2024

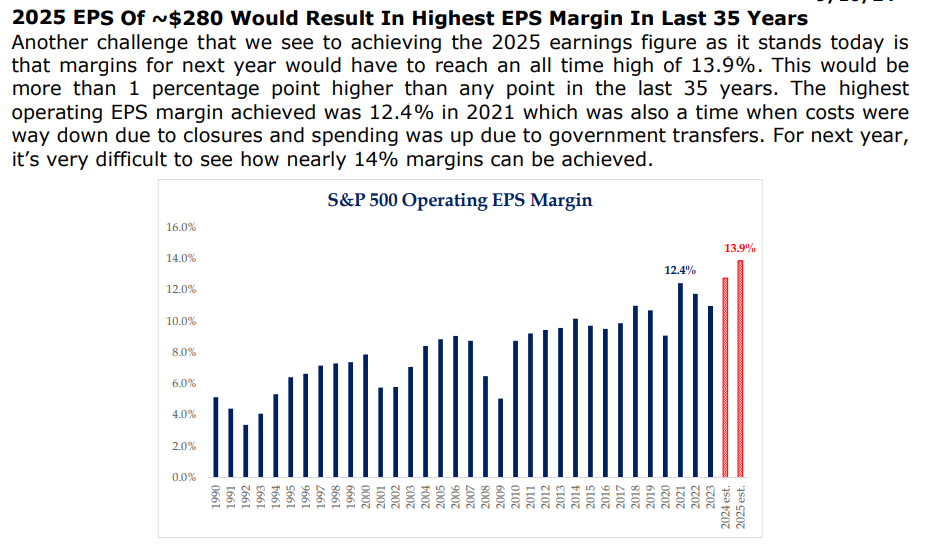

Dave: but at the overall market level, the consensus expectation is that the miracle of increasing margins continues

Source: Strategas as of 09.10.2024

Source: Strategas as of 09.10.2024

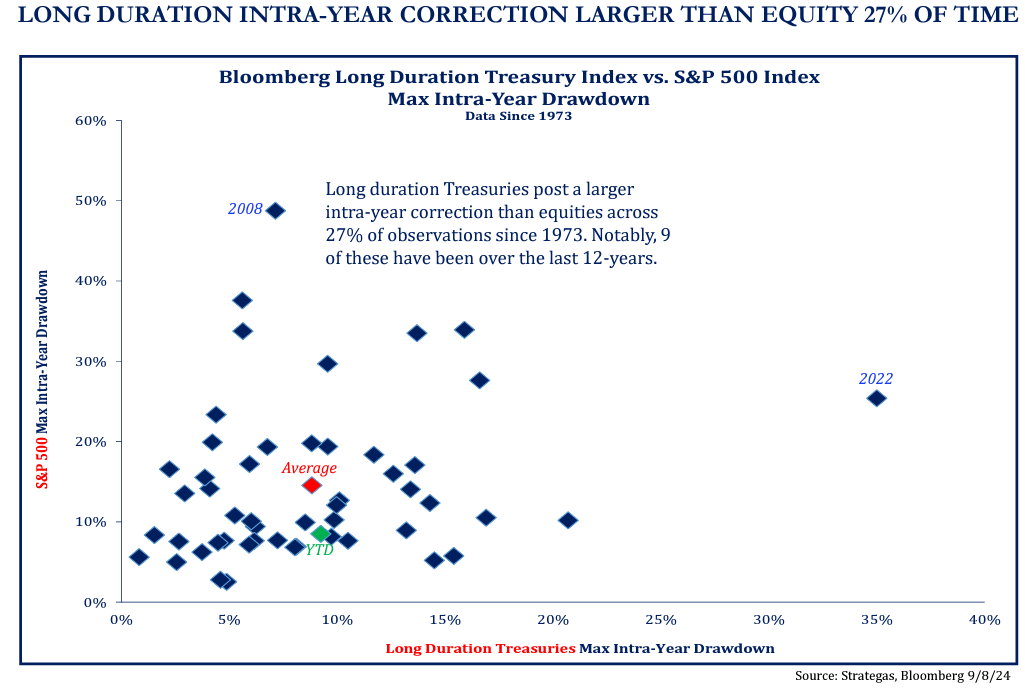

Dave: Bonds might be viewed by many as “safe money”, but they sure are capable of producing large drawdowns, bigger than stocks in many years

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-16.