Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

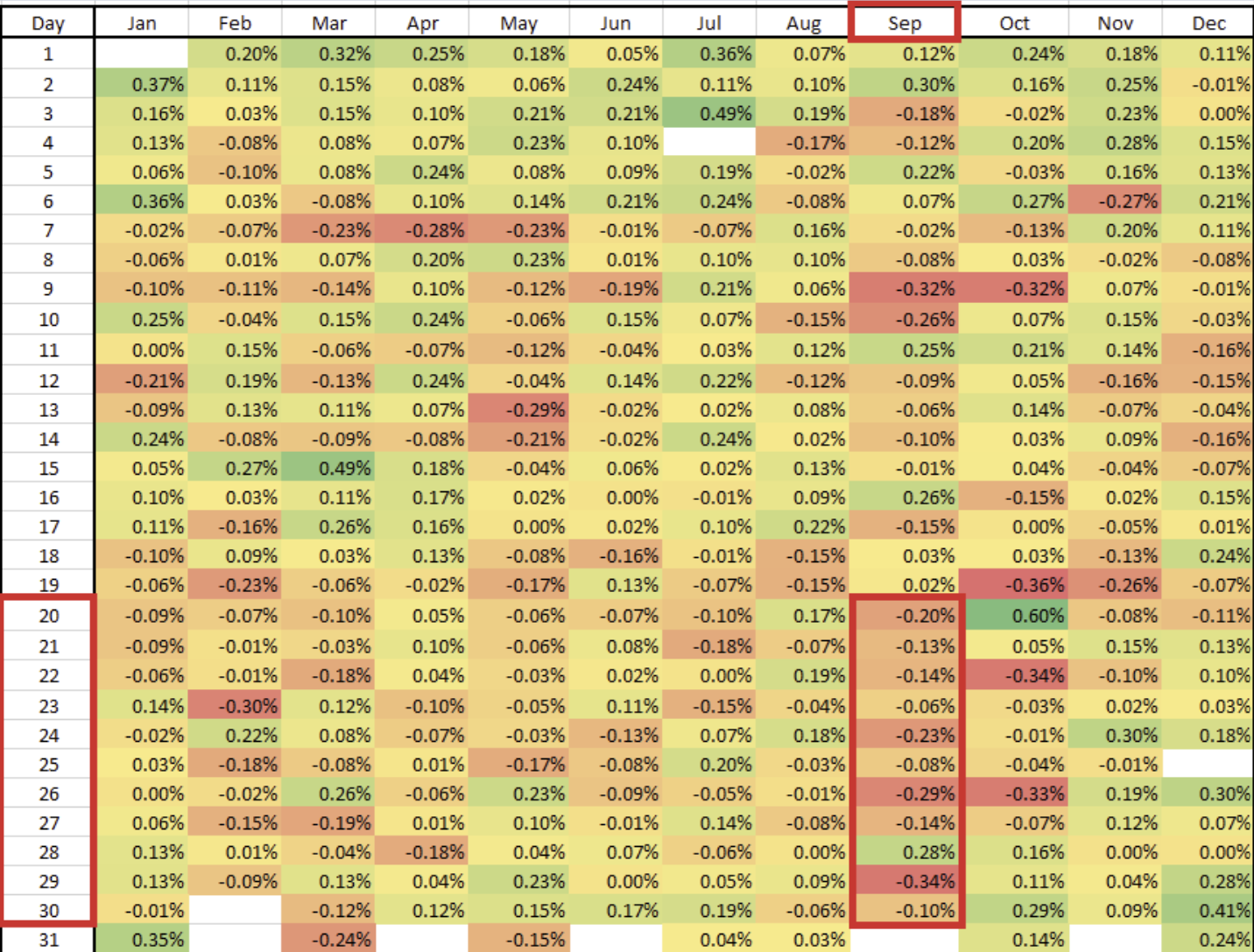

Dave: September is famous for being the weakest month for stocks, with the 2nd half being the most challenging

Daily Returns for S&P 500

Source: Goldman Sachs as of Sept 2023

Source: Goldman Sachs as of Sept 2023

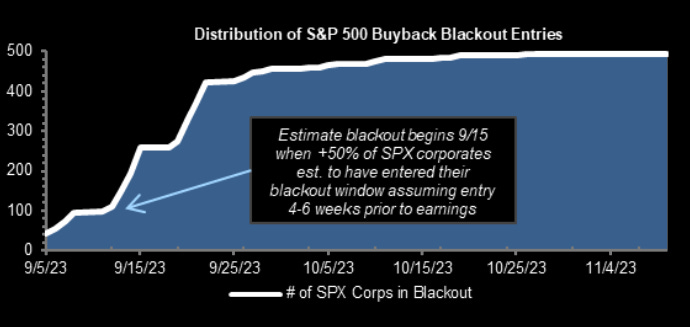

Beckham: and the inability of companies to buy their own shares in the weeks ahead doesn’t help

Source: Market Ear as of 09.12.2023

Source: Market Ear as of 09.12.2023

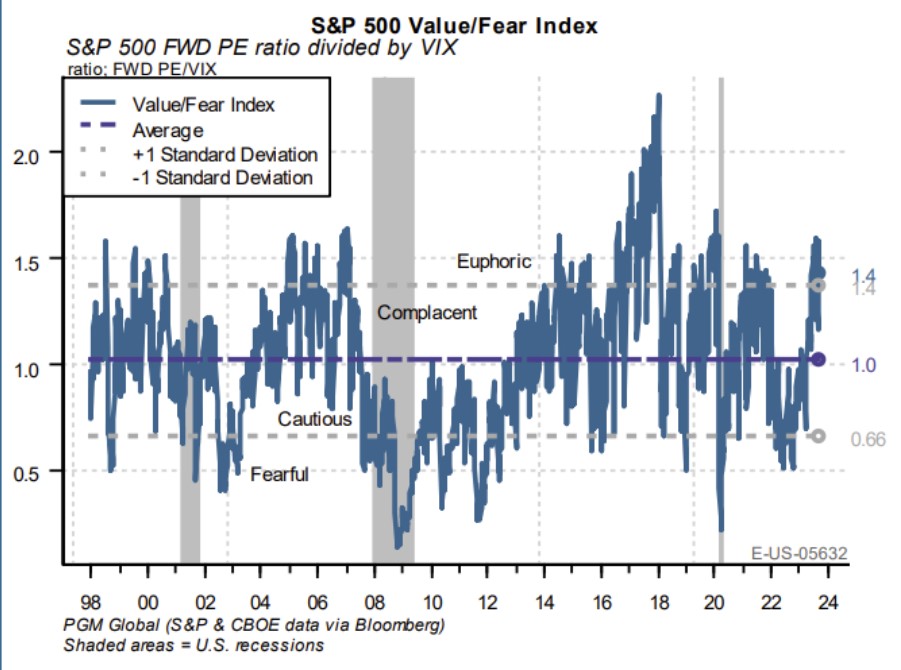

John Luke: Another challenge for stocks in the short-term is the valuation and sentiment backdrop

Source: PGM as of 09.12.2023

Source: PGM as of 09.12.2023

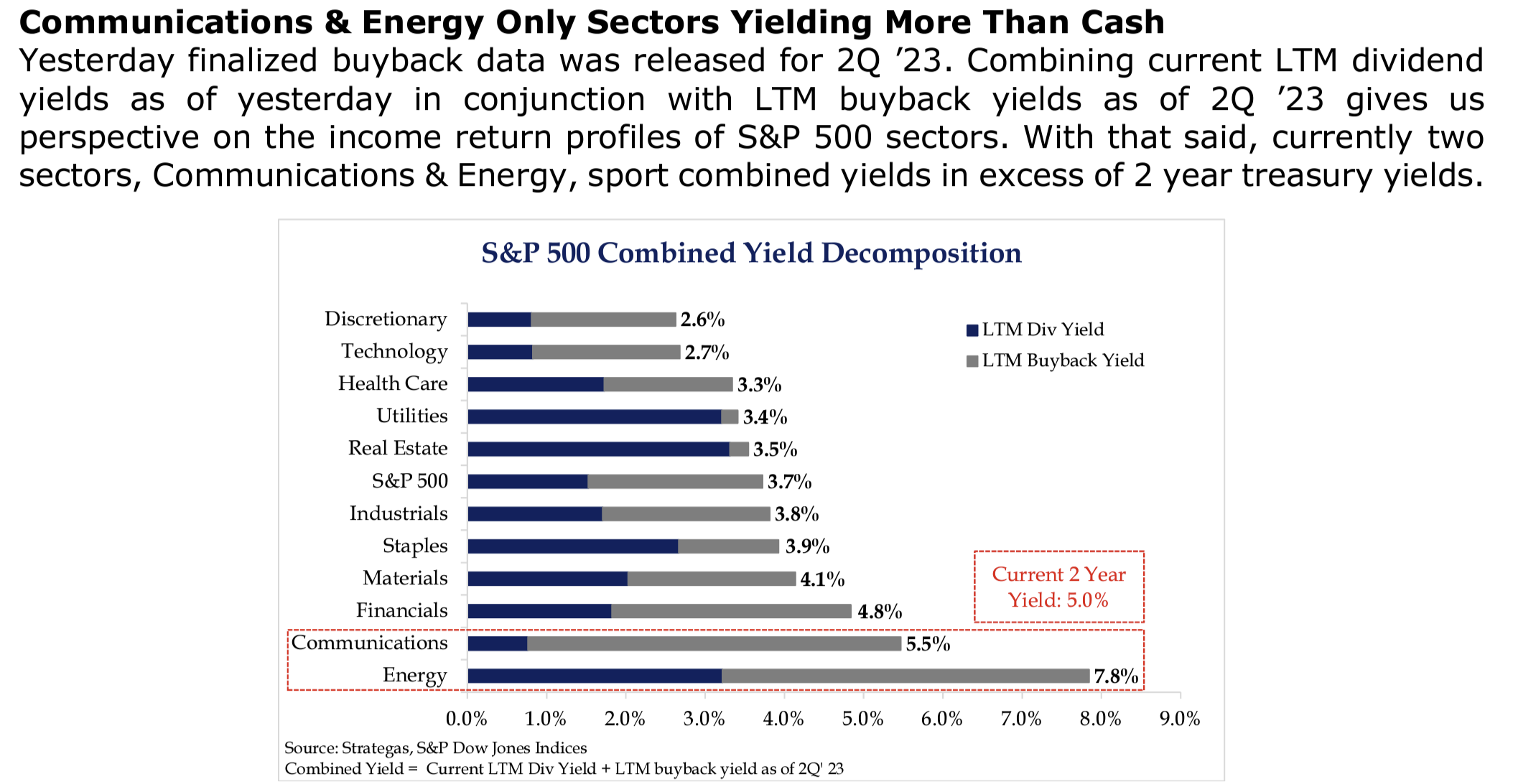

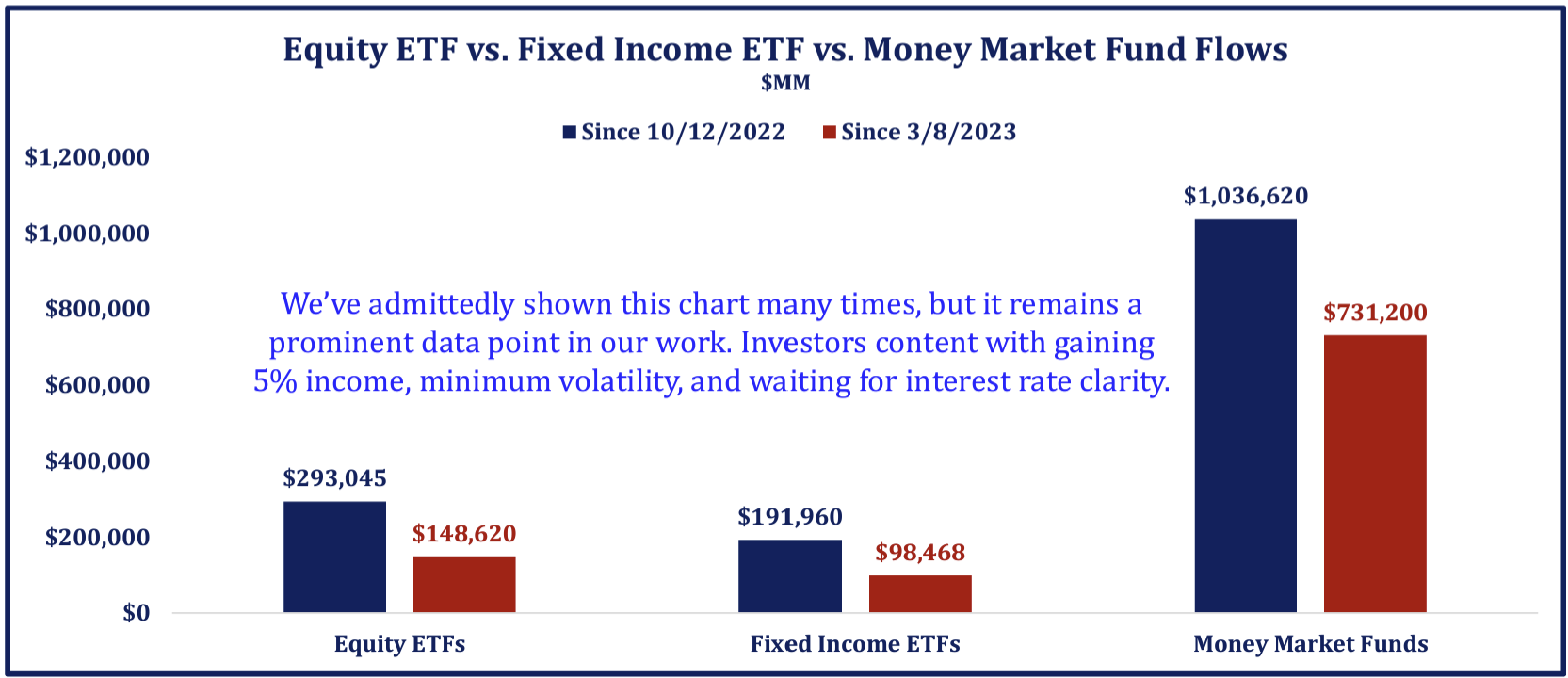

Dave: and at the moment, cash feels appealing to many against an uncertain backdrop

Source: Strategas as of 09.13.2023

Source: Strategas as of 09.13.2023

Dave: Speaking of cash, money market funds are grabbing most of the inflows

Source: Strategas as of 09.12.2023

Source: Strategas as of 09.12.2023

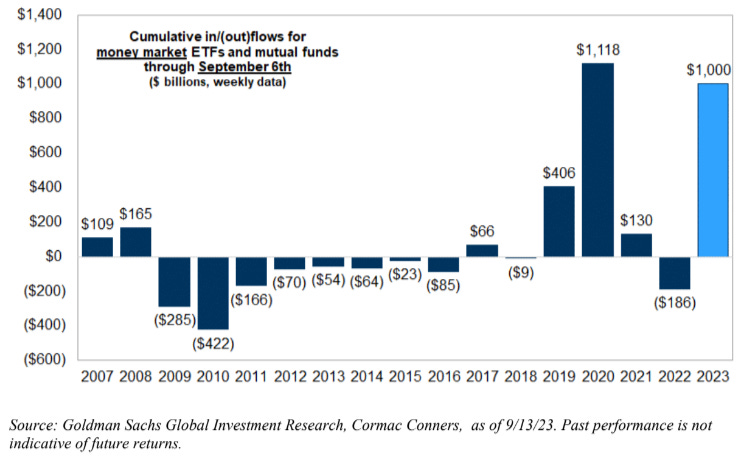

Brad: quite a change from most of the period since the financial crisis

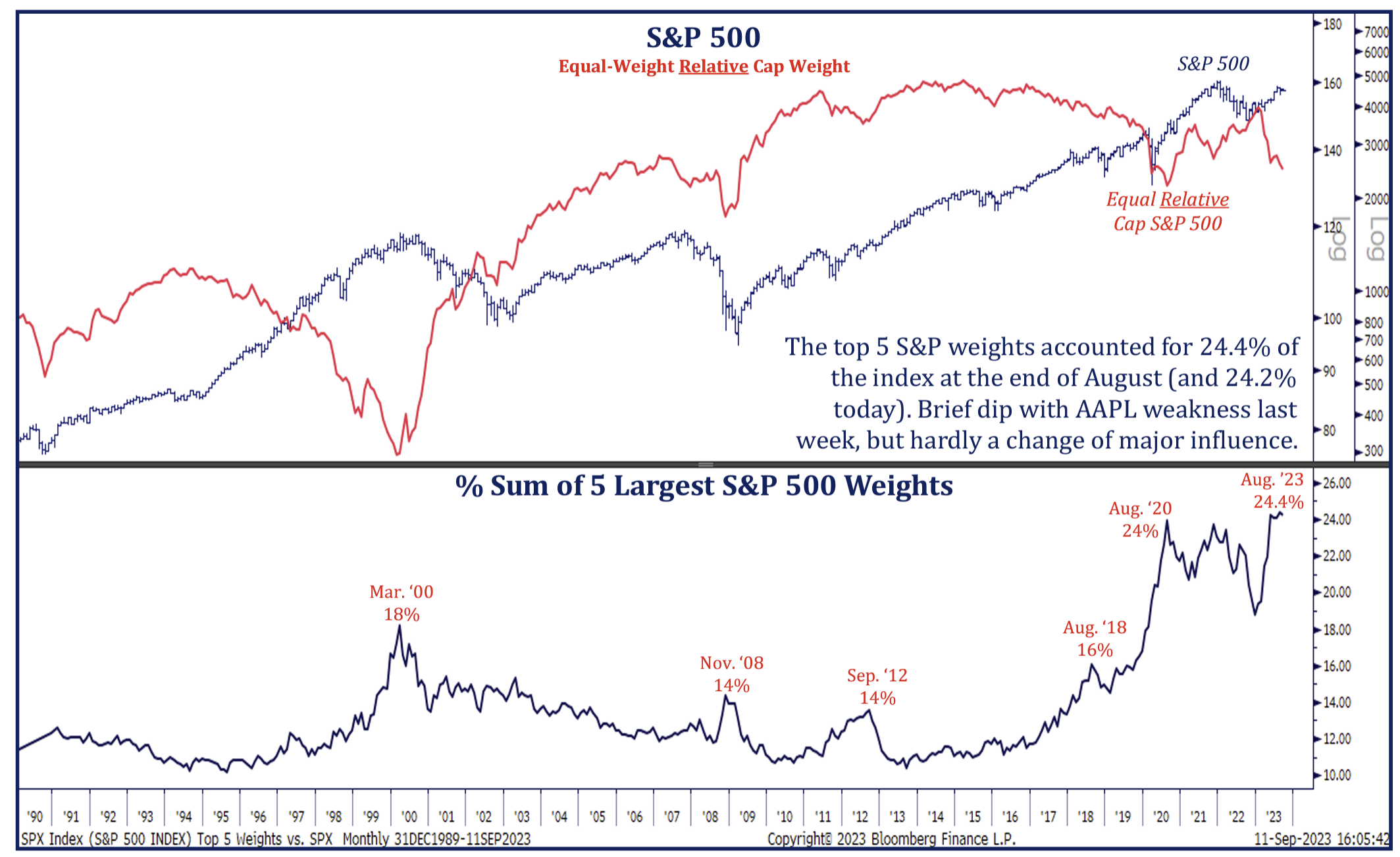

Dave: The largest US tech companies continue to dominate the market cap weighted S&P 500

Source: Strategas as of 09.11.2023

Source: Strategas as of 09.11.2023

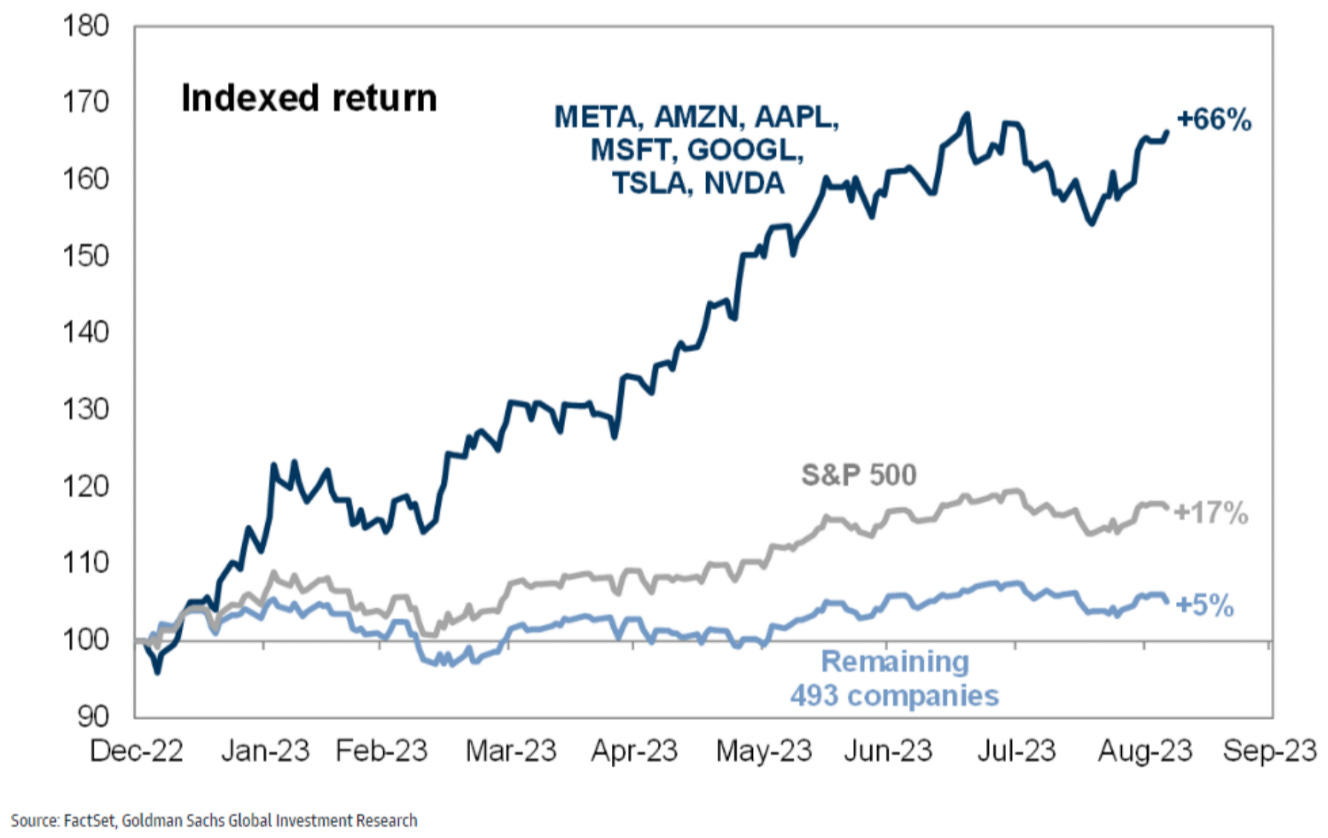

Joseph: expanding again in 2023 through eye-popping returns relative to the rest of the index

Data as of 09.13.2023

Data as of 09.13.2023

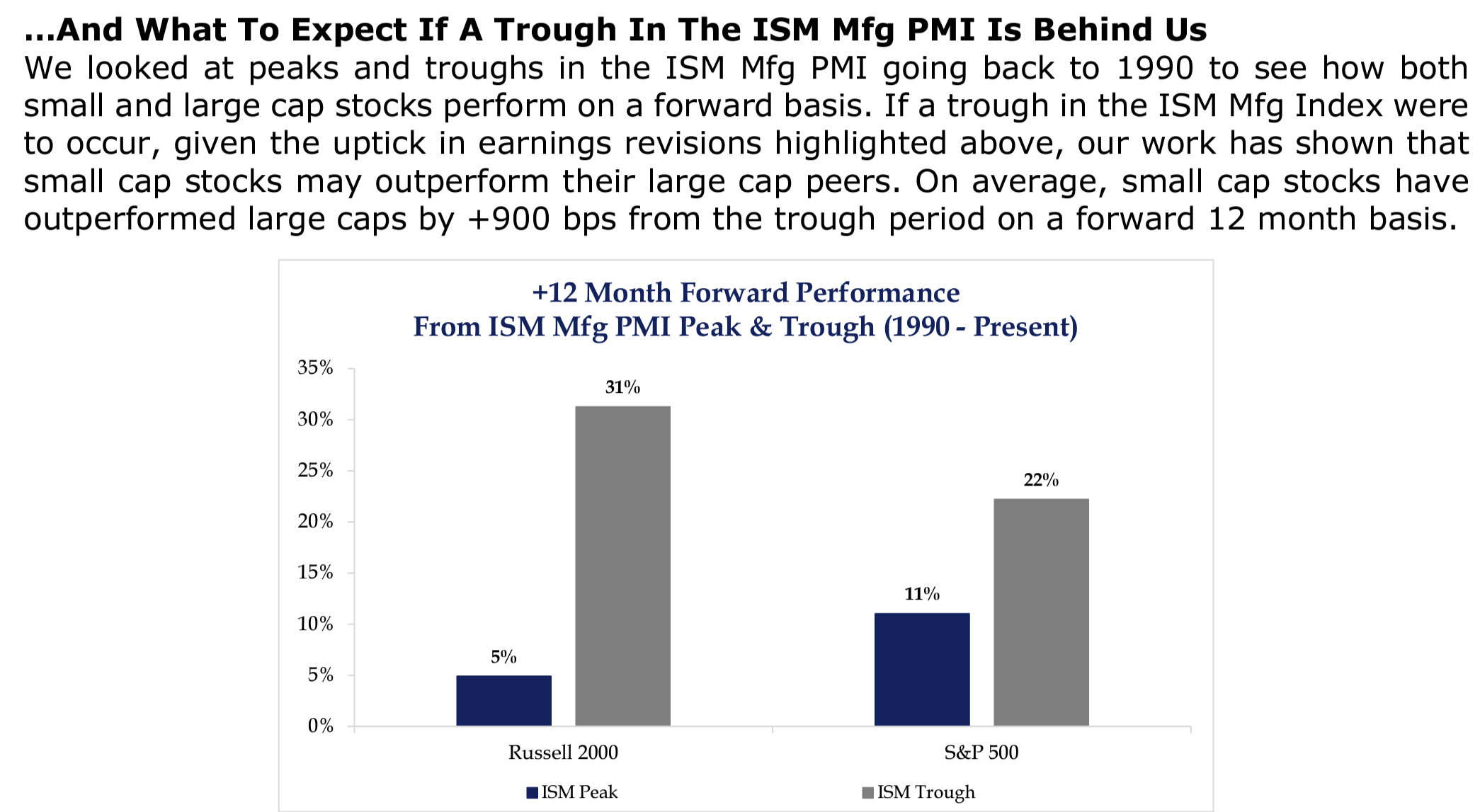

Dave: but there’s hope for smaller companies to recapture some mojo if economic growth resumes

Source: Strategas as of 09.12.2023

Source: Strategas as of 09.12.2023

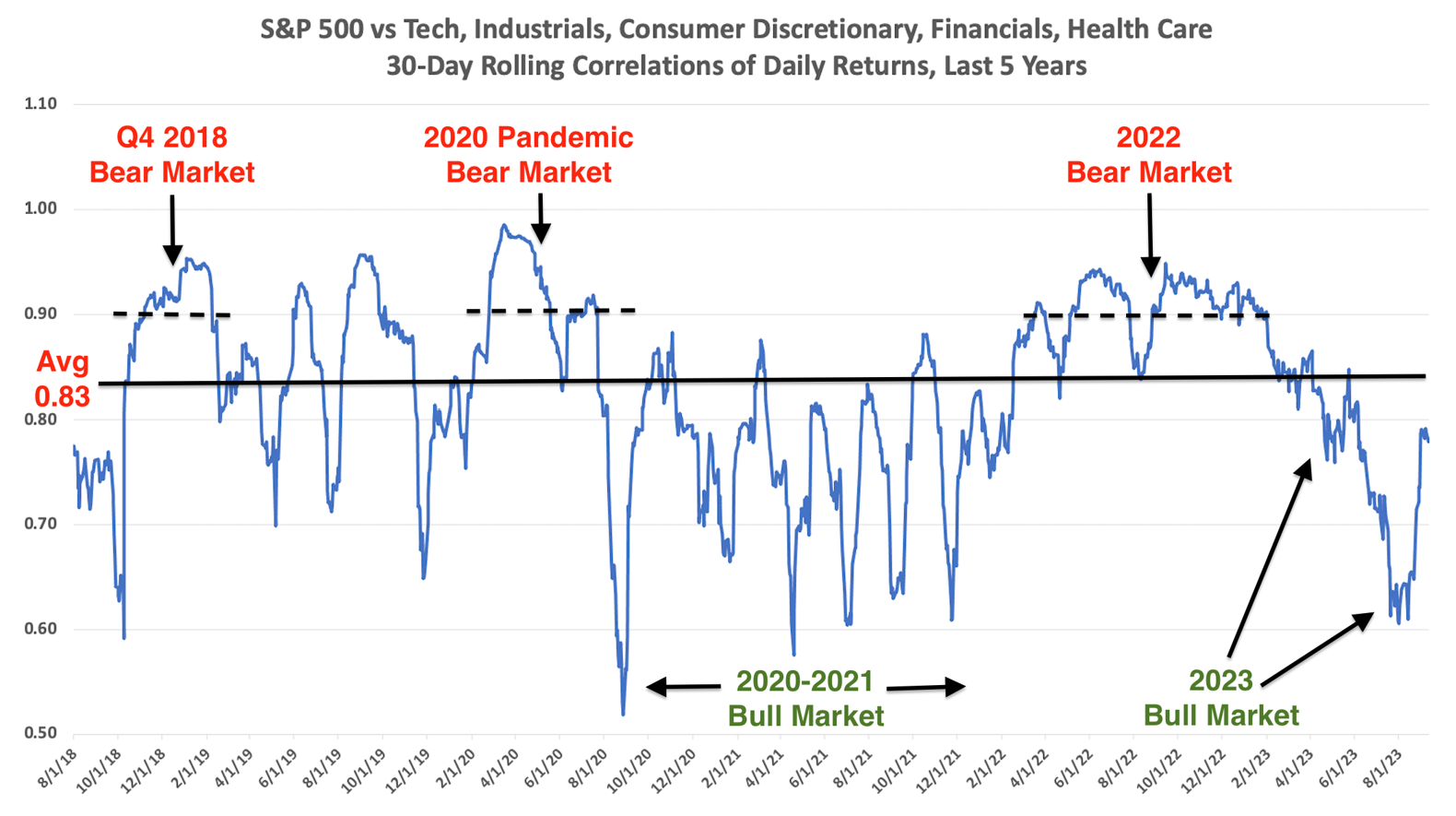

Beckham: and some dispersion has often been helpful in keeping a wall of worry intact

Source: DataTrek as of Sept 2023

Source: DataTrek as of Sept 2023

John Luke: The latest CPI report shows a troubling persistence in the rate of “super-core” inflation

Data as of 09.13.2023

Data as of 09.13.2023

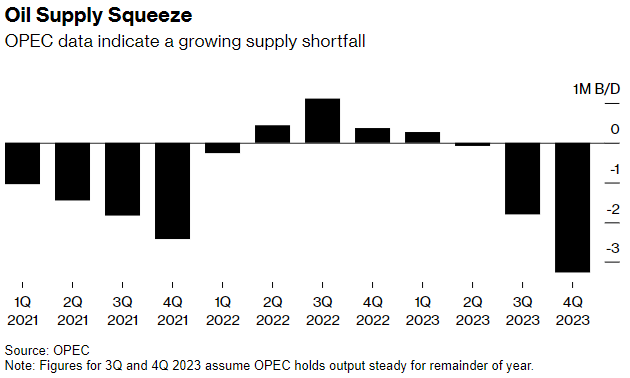

John Luke: and the tightness in energy supplies isn’t going to help the Fed instill confidence that inflation has been broken

Data as of 09.12.2023

Data as of 09.12.2023

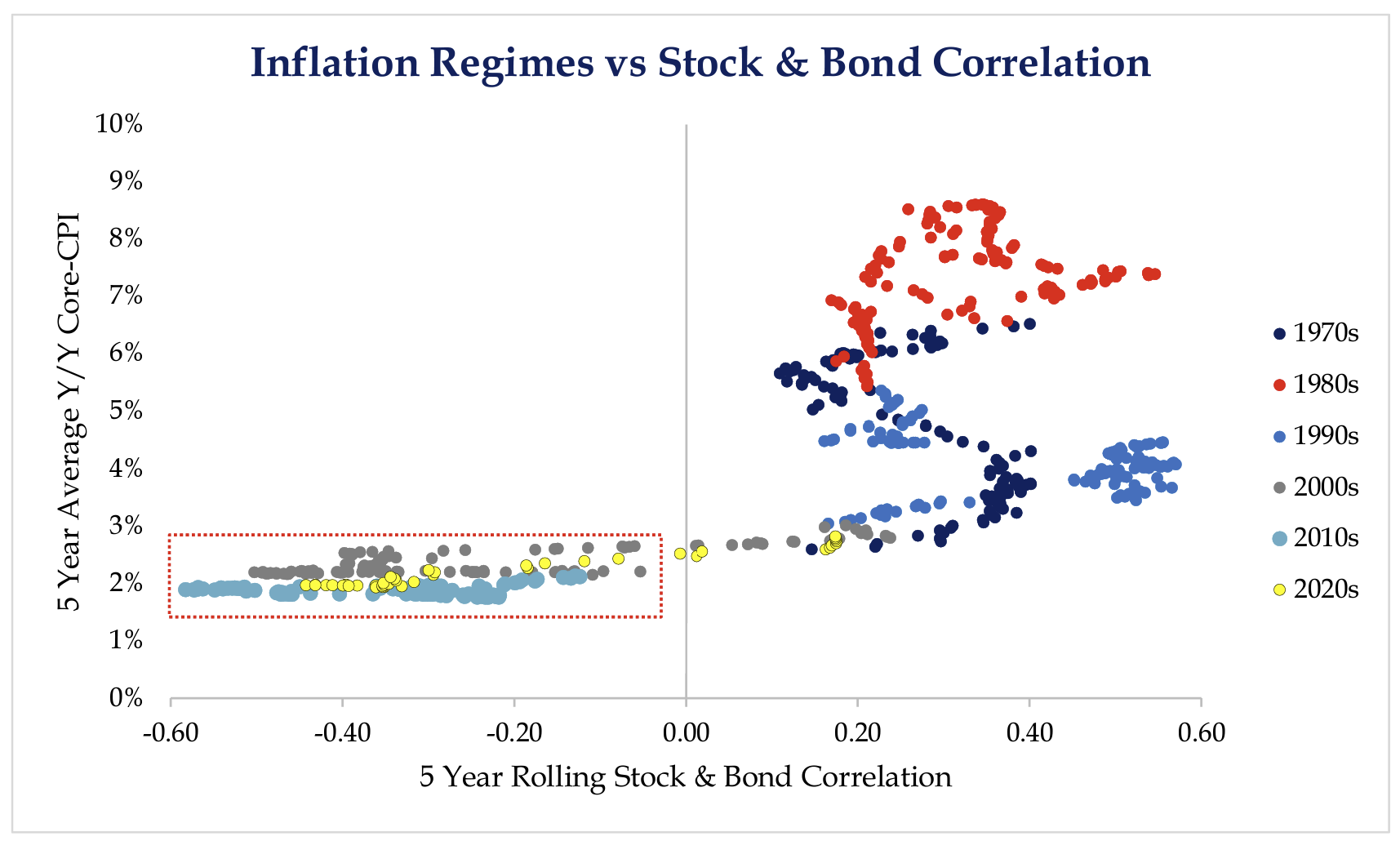

Dave: Correlation is a key input to diversification, and the challenge is that it moves around based on the state of inflation

Source: Strategas as of 09.12.2023

Source: Strategas as of 09.12.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2309-23.