Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and how they help fill the puzzle of evidence:

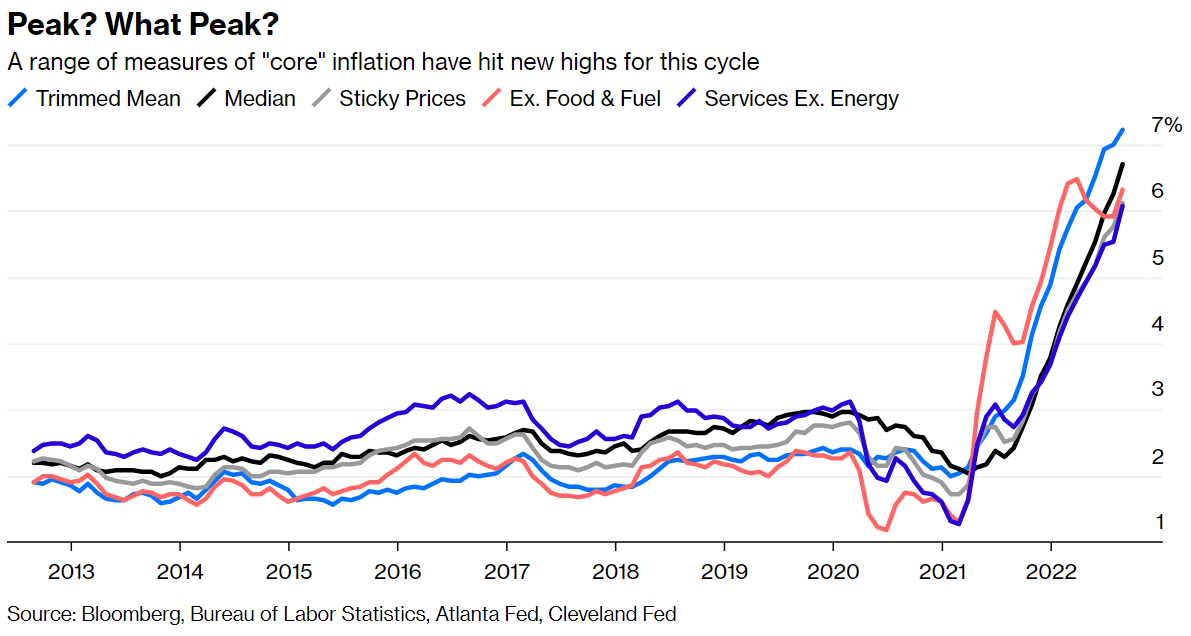

John Luke: Inflation was the topic of the week, its death may have been greatly exaggerated

Data as of 09.14.2022

Data as of 09.14.2022

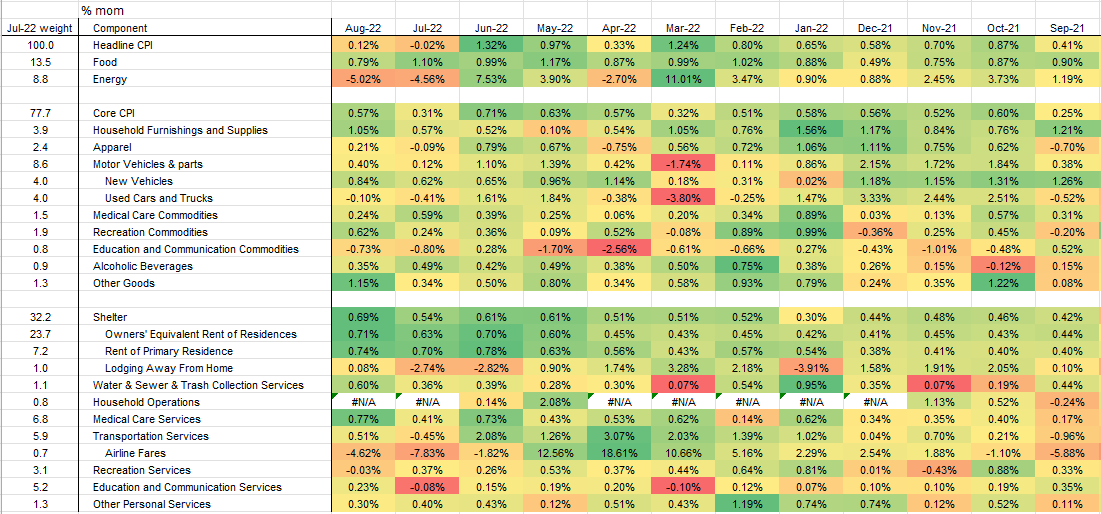

Joseph: and we saw broad price rises outside of energy prices

Source: B of A as of 09.14.2022

Source: B of A as of 09.14.2022

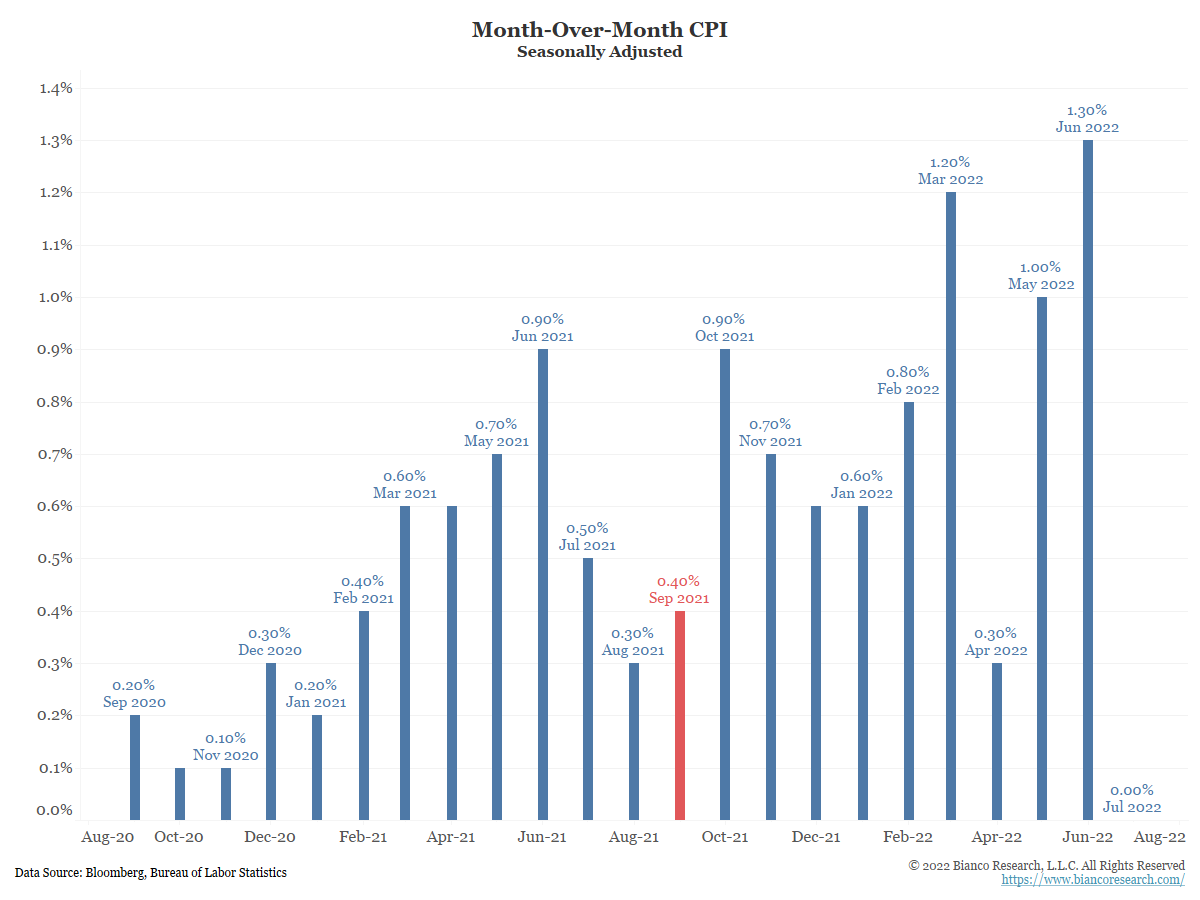

John Luke: From a headline standpoint, the bar for year-over-year increases gets pretty high after next month

Data as of 09.09.2022

Data as of 09.09.2022

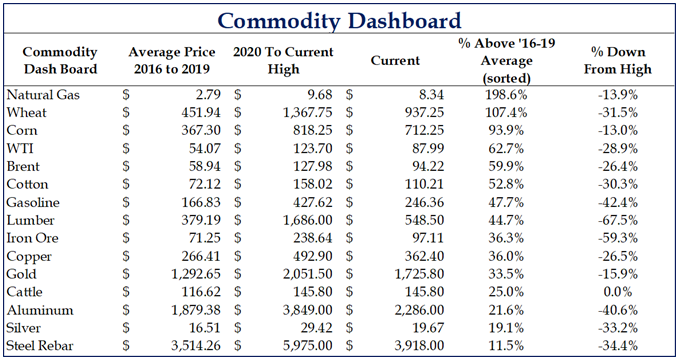

Brad: but despite commodity prices falling from highs, they’re still quite elevated vs. recent years

Source: Strategas as of 09.13

Source: Strategas as of 09.13

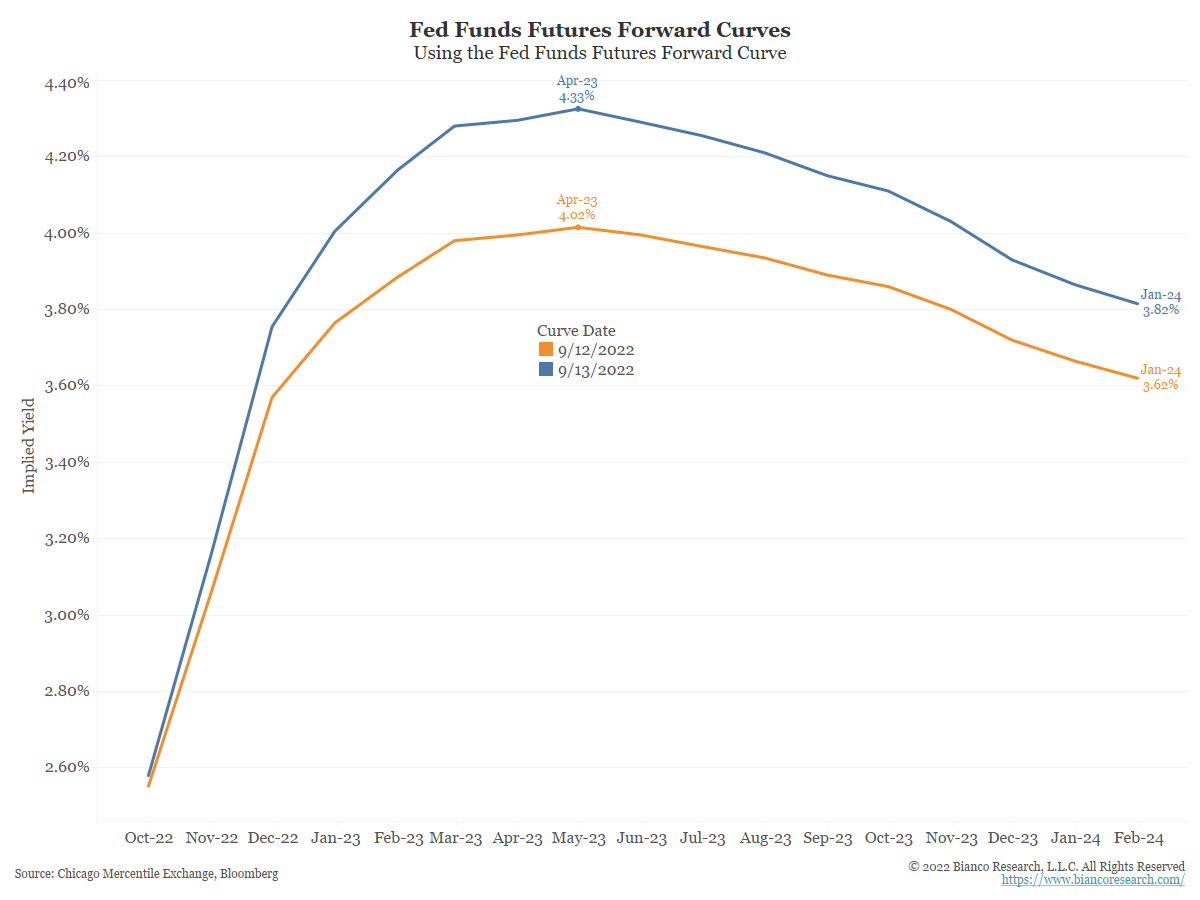

John Luke: Post-CPI, markets have bumped future rate expectations higher

Data as of 09.13.2022

Data as of 09.13.2022

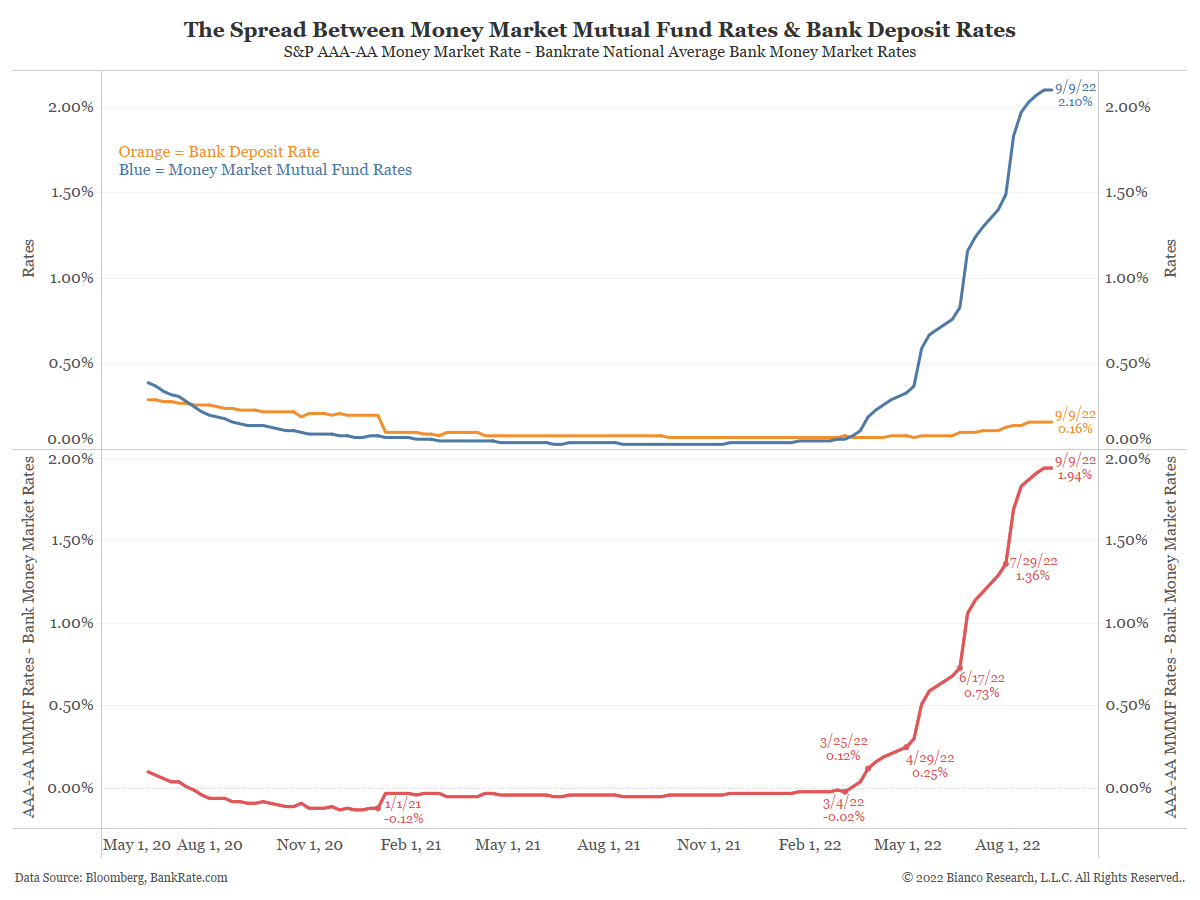

John Luke: but don’t expect banks to be friendly with the money market rates they offer

Data as of 09.09.2022

Data as of 09.09.2022

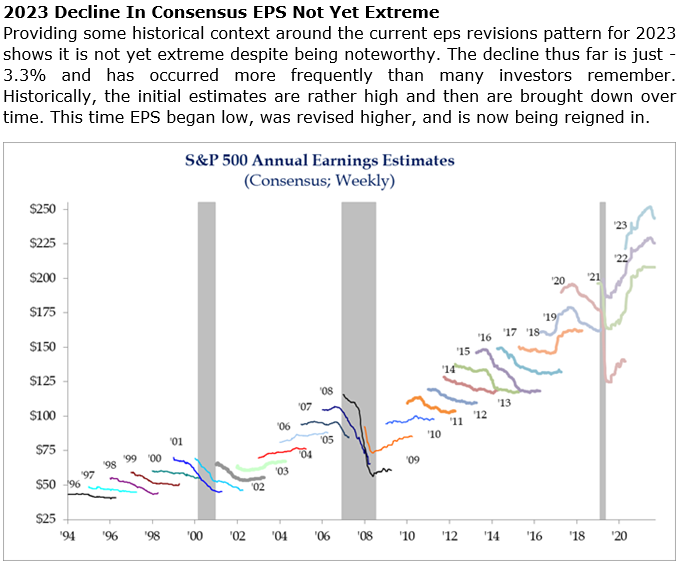

Brad: Consensus earnings estimates are following their usual pattern of rising early and fading late

Source: Strategas as of 09.09.2022

Source: Strategas as of 09.09.2022

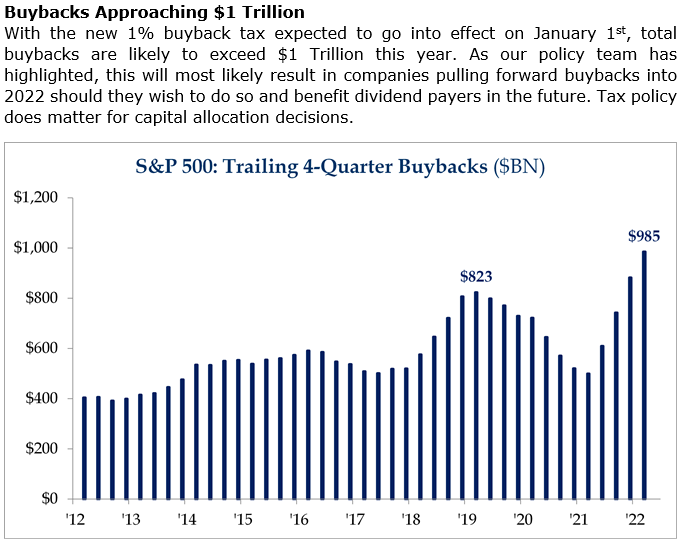

Brad: but corporations are jumping out in front of the forthcoming buyback tax

Source: Strategas as of 09.13.2022

Source: Strategas as of 09.13.2022

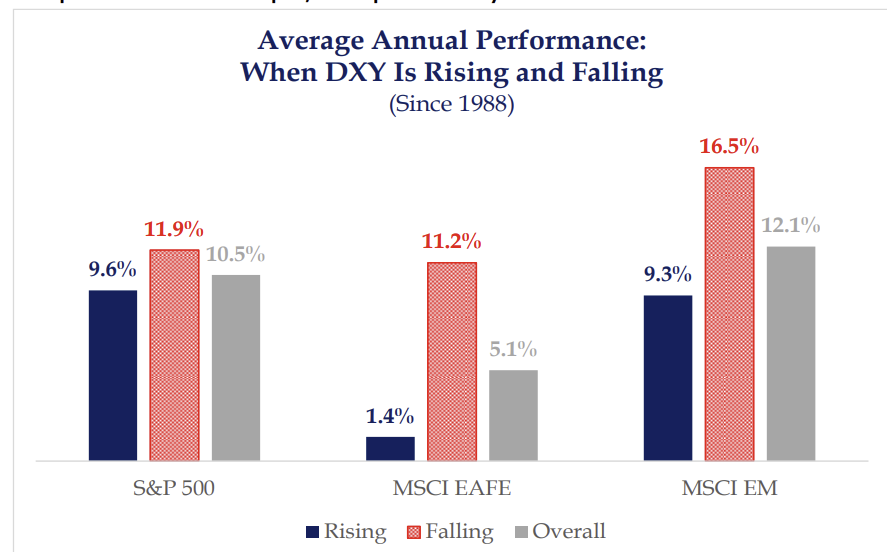

Dave: International markets face some stiff headwinds with the strength in the US Dollar

Source: Strategas as of 09.09.2022

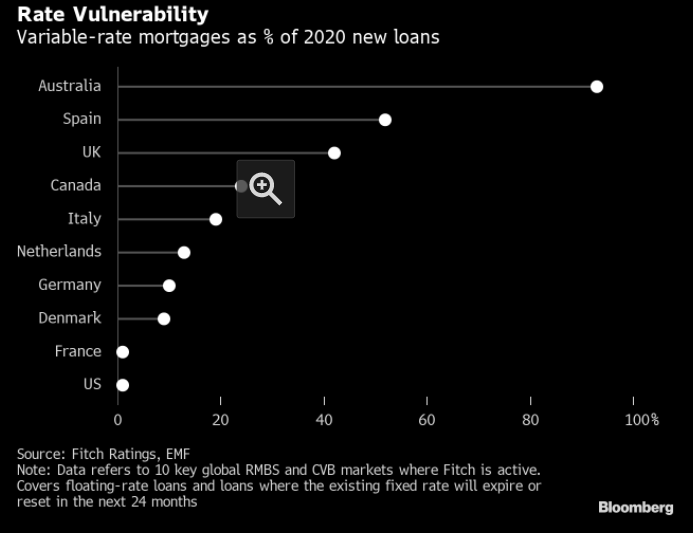

Joseph: and there are a handful of countries with a huge % of loans resetting higher

Source: Bloomberg as of 09.12.2022

Source: Bloomberg as of 09.12.2022

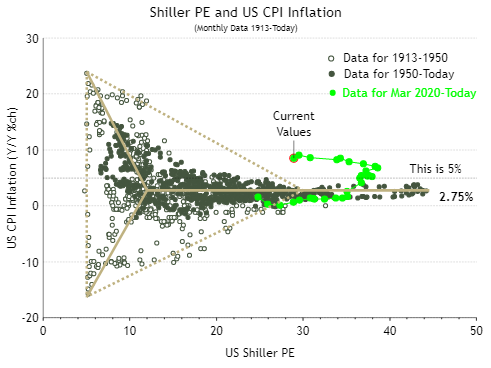

John Luke: Based on current inflation rates, expansion of P/E multiples seems off the table

Source: Shiller PE as of 9.13.22

Source: Shiller PE as of 9.13.22

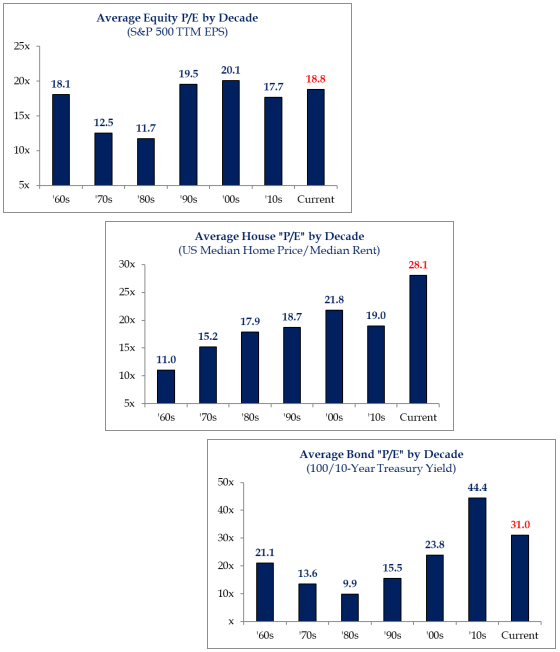

Brad: but maybe stocks aren’t the most expensive asset class for US investors?

Source: Strategas 09.09.2022

Source: Strategas 09.09.2022

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward looking statements cannot be guaranteed. Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

The S&P 500® Index is the Standard & Poor’s Composite Index and is widely regarded as a single gauge of large cap U.S. equities. It is market cap weighted and includes 500 leading companies, capturing approximately 80% coverage of available market capitalization.

The Consumer Price Index (CPI) measures the change in prices paid by consumers for goods and services. The CPI reflects spending patterns for each of two population groups: all urban consumers and urban wage earners and clerical workers.

The MSCI EAFE Index (Europe, Australasia, Far East) is a free float-adjusted market capitalization-weighted index that is designed to measure the equity market performance of developed markets, excluding the United States and Canada. The MSCI EAFE Index consists of the following 21 developed market countries: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the United Kingdom. The MSCI Emerging Markets Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market performance of emerging markets. The MSCI Emerging Markets Index consists of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Russia, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2209-16.