Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

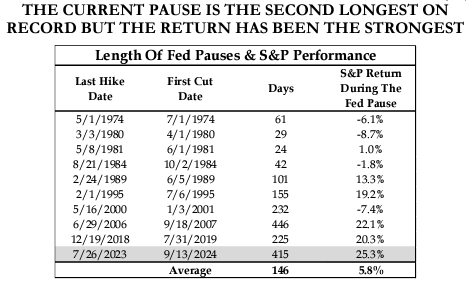

Dave: The long pause is over, stocks enjoyed it

Source: Strategas as of 09.16.2024

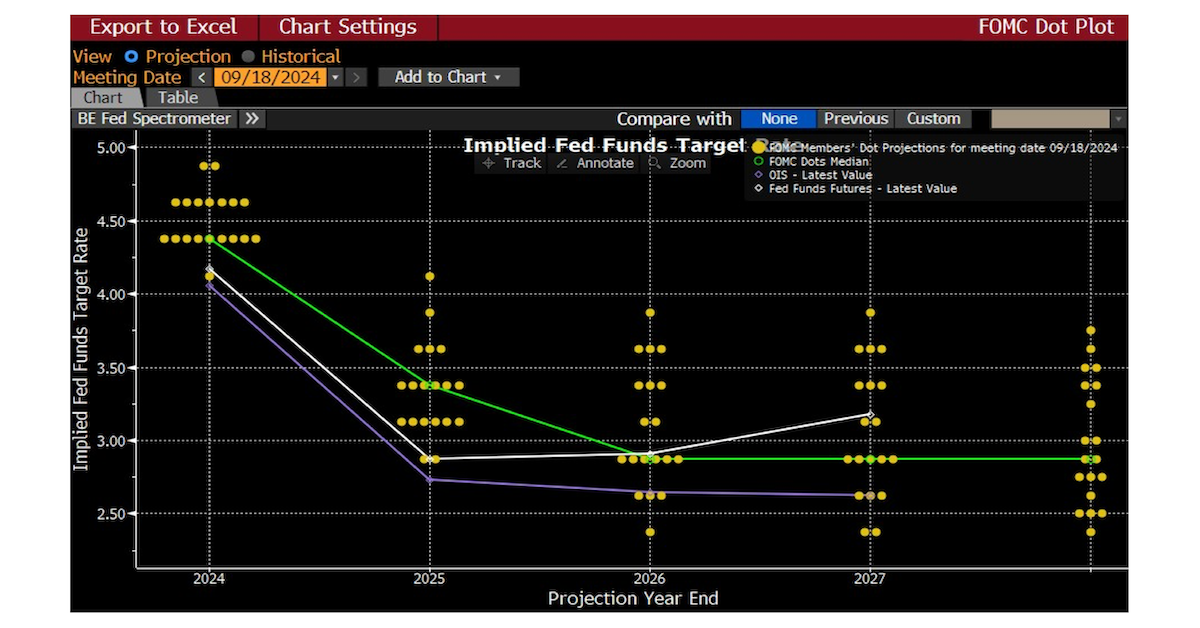

John Luke: the range of future forecasts for the Fed Funds rate is quite wide

Source: Bloomberg as of 09.18.2024

Source: Bloomberg as of 09.18.2024

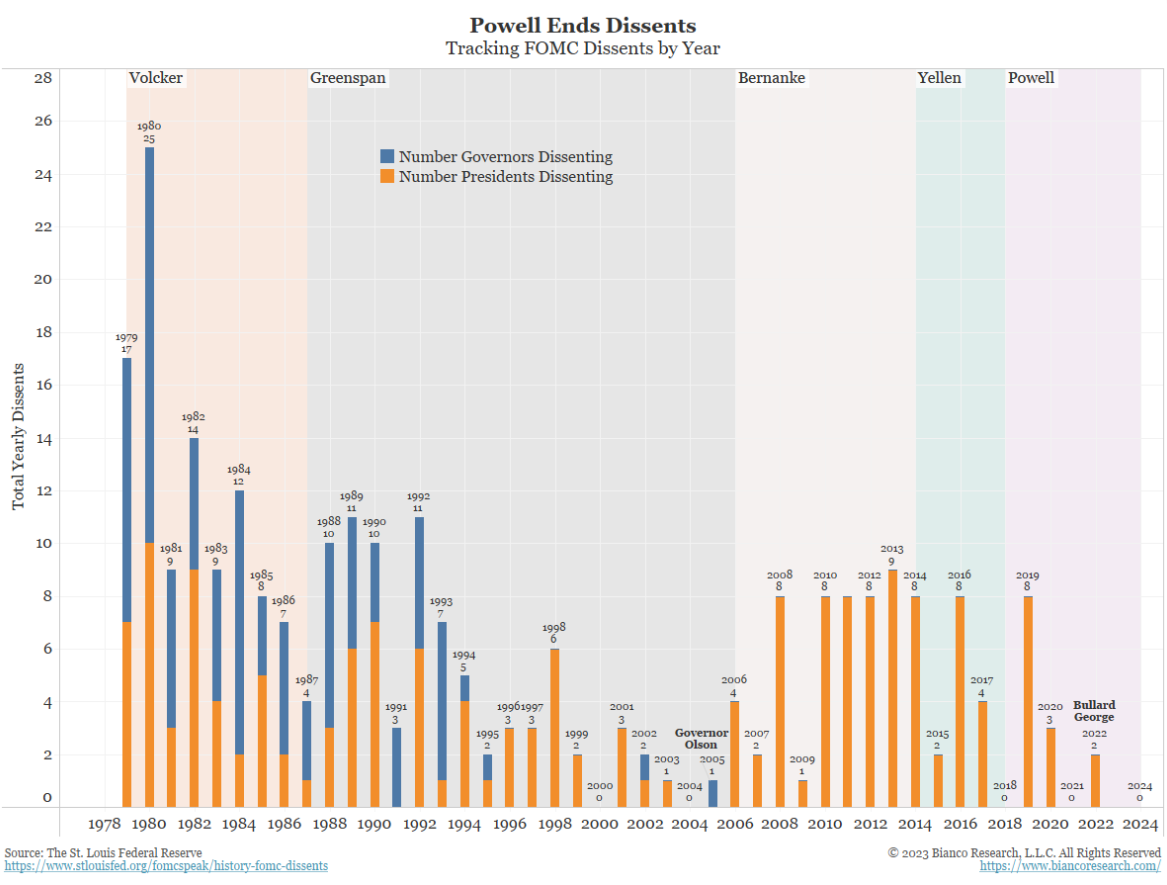

Beckham: and while this meeting had a rare “Powell Fed” dissenter

Data as of 09.17.2024

Data as of 09.17.2024

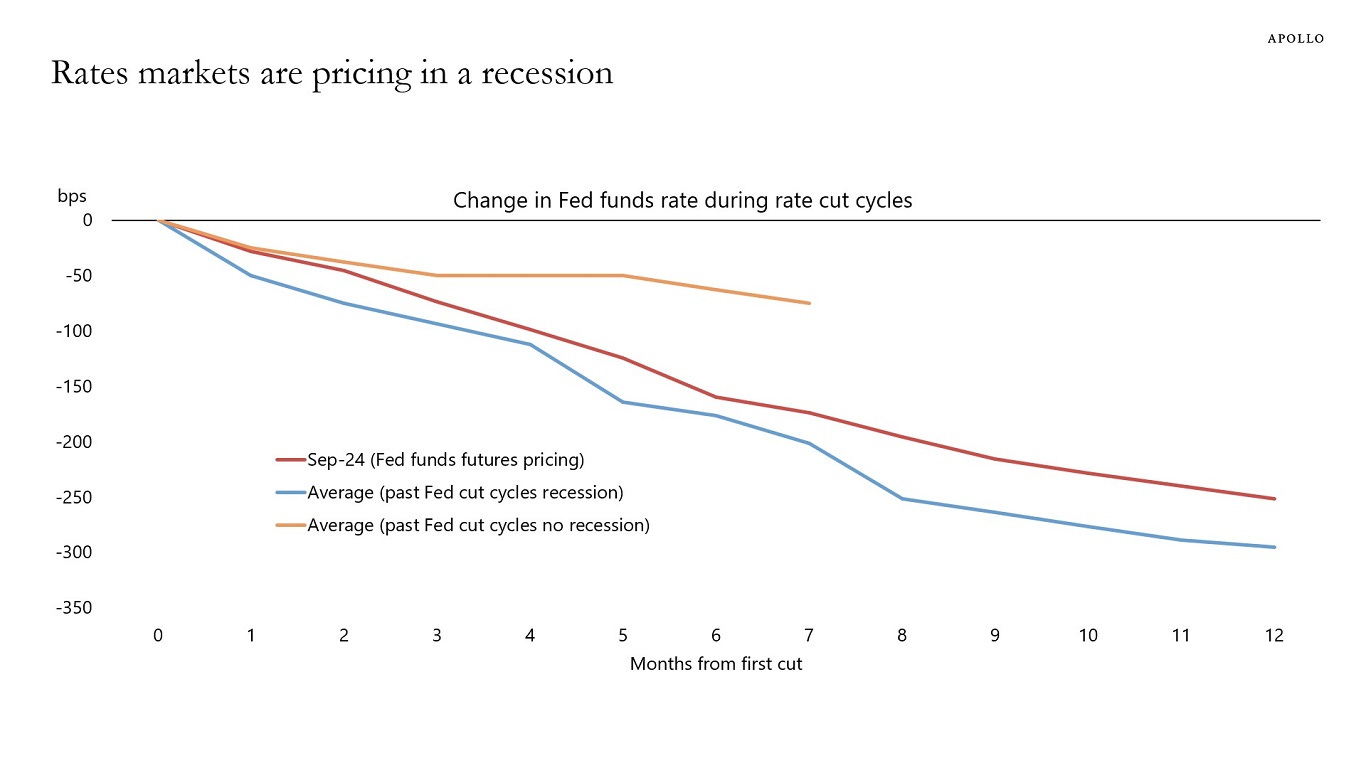

Brett: the generally assumed path of short-term rates resembles a recession path more than a soft landing

Source: Apollo as of 09.19.2024

Source: Apollo as of 09.19.2024

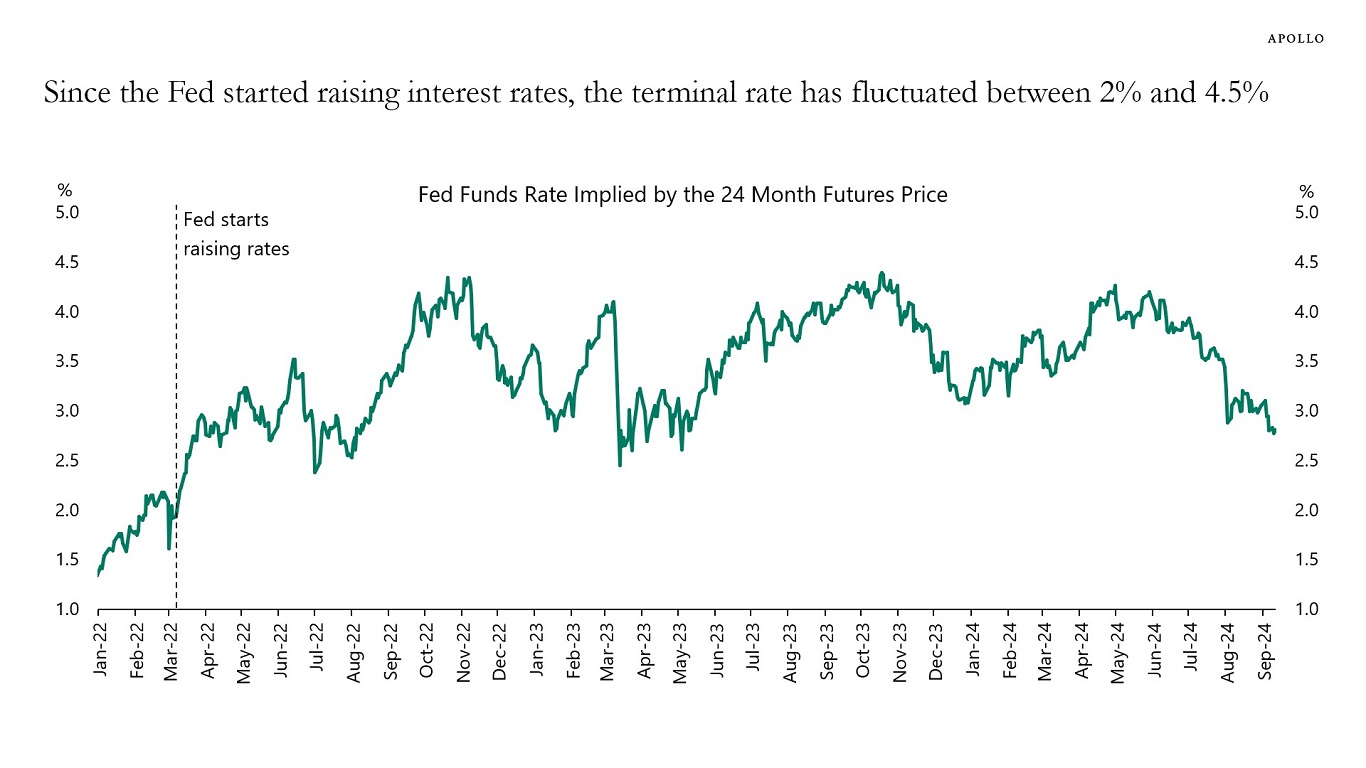

John Luke: While the rates market has been uncertain as to the terminal rate for this cycle’s Fed Funds rate

Source: Apollo as of 09.19 2024

Source: Apollo as of 09.19 2024

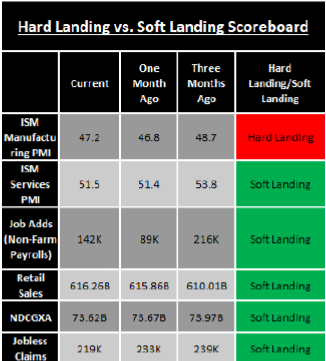

Brad: there’s not a ton of evidence suggesting an imminent recession

Source: Sevens Report as of 09.19.2024

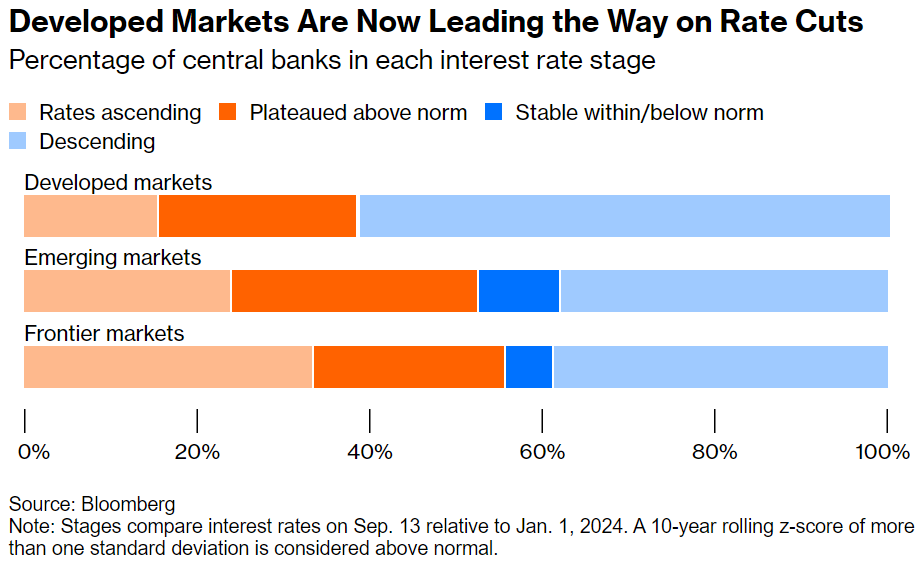

John Luke: and the cuts taking place across the globe should help cushion incoming effects from other economies

Data as of 09.13.2024

Data as of 09.13.2024

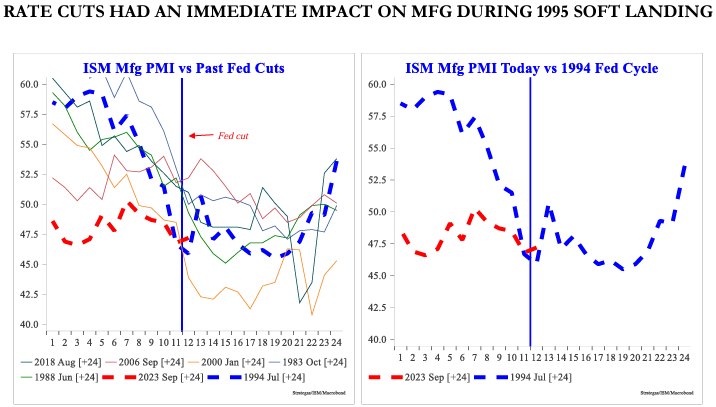

Brad: In the 1995 soft landing cycle, manufacturing immediately responded to rate cuts

Source: Strategas as of 09.17.2024

Source: Strategas as of 09.17.2024

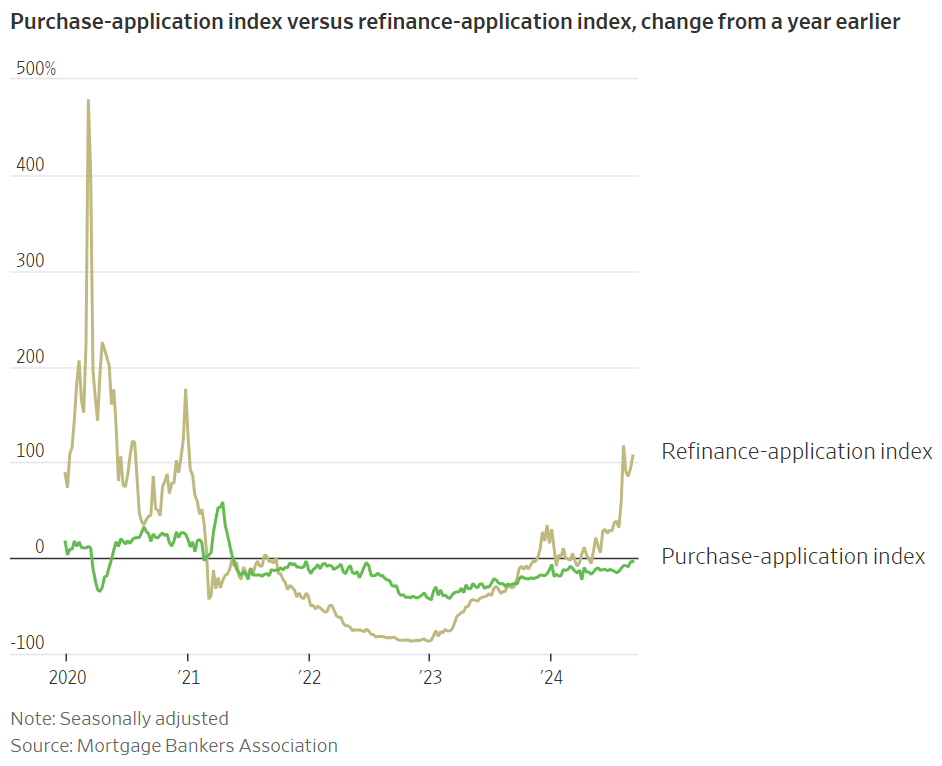

Arch: but the most closely-watched area in this cycle will likely be homebuying

Source: Bianco as of 09.18.2024

Source: Bianco as of 09.18.2024

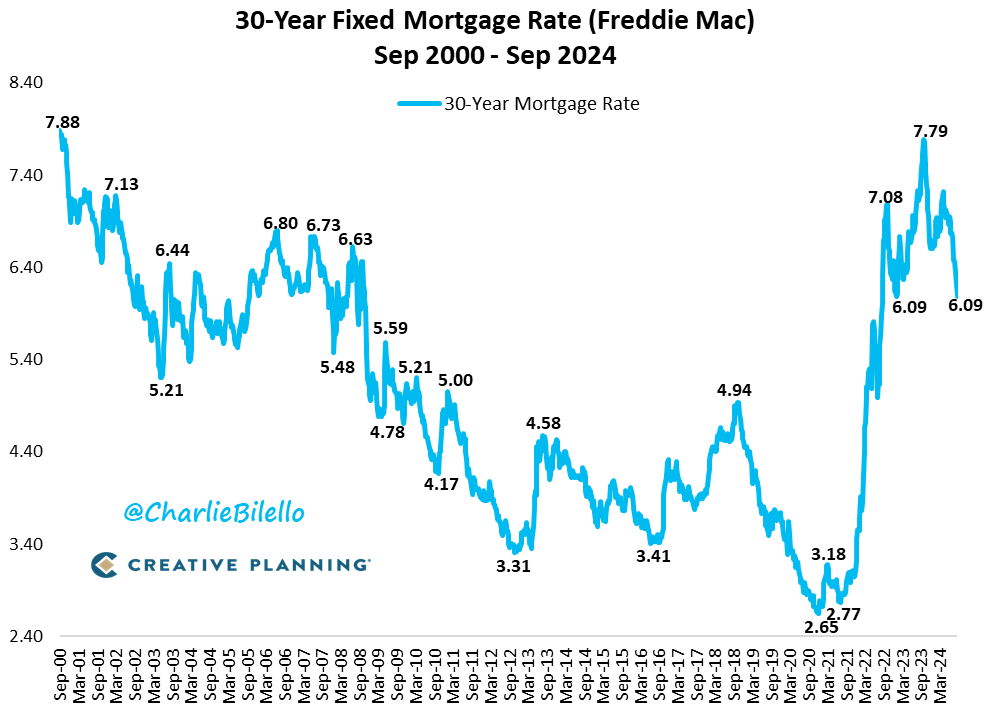

John Luke: While mortgage rates have come down from the 2023 highs

Data as of 09.16.2024

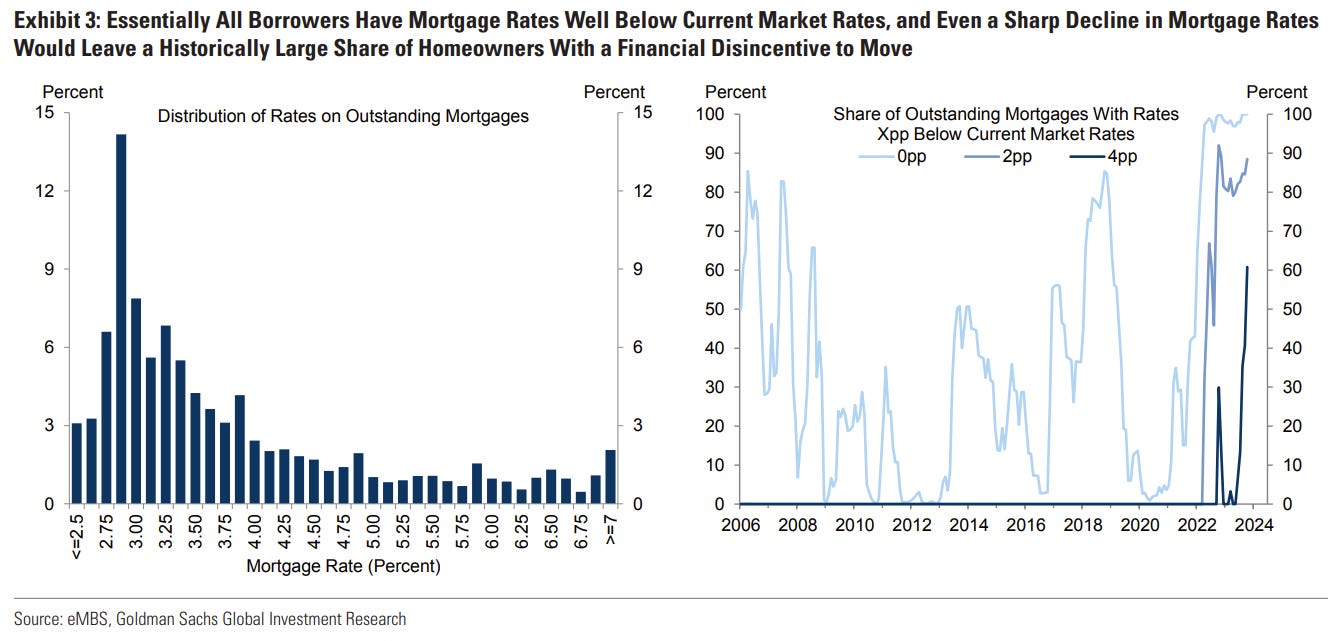

Joseph: there are still many homeowners in love with their existing mortgages of 2021 vintage

Data as of 09.16.2024

Data as of 09.16.2024

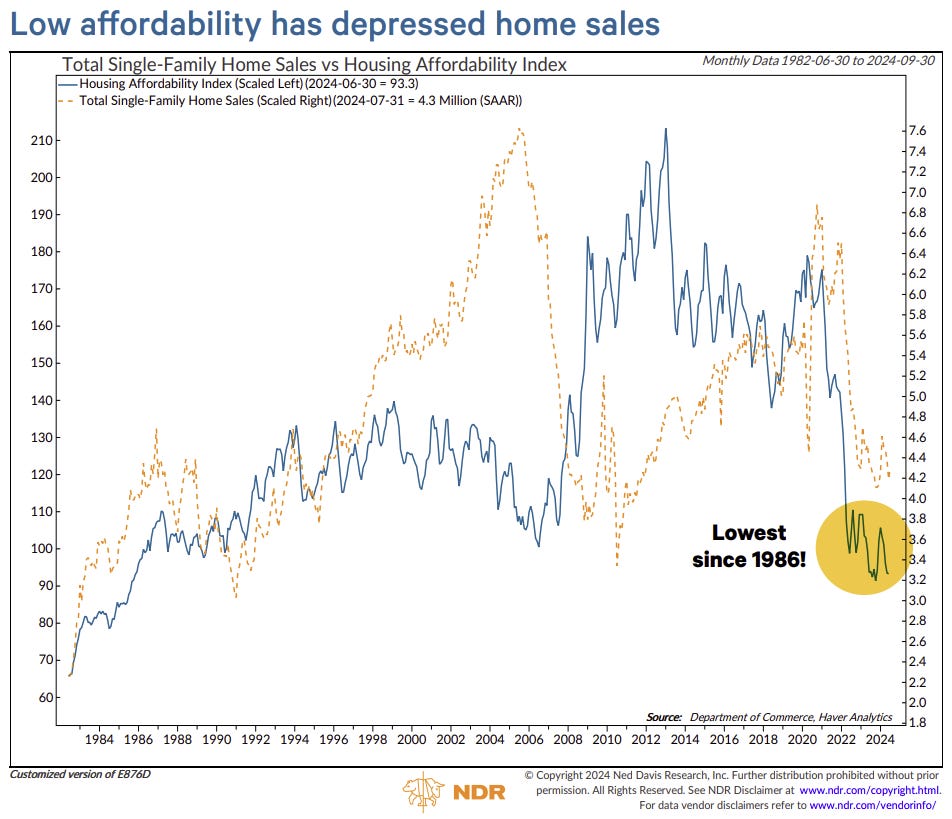

Beckham: and the general level of prices has stayed close to the highs in most parts of the country

Source: Sandbox Daily as of 09.16.2024

Source: Sandbox Daily as of 09.16.2024

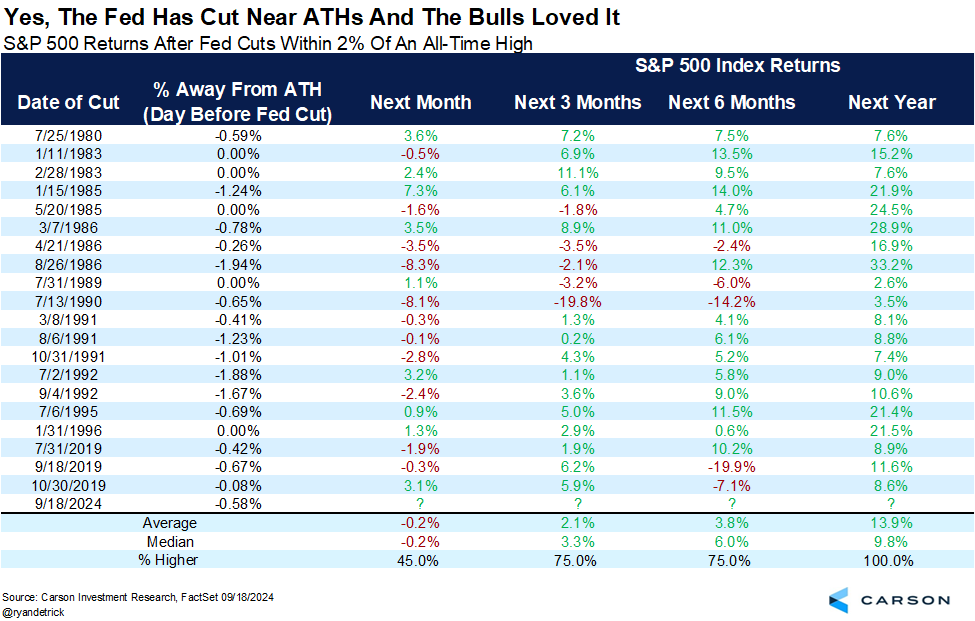

Dave: Looking at past instances, stocks have had a solid next 12 months when the Fed has cut rates near all-time equity highs

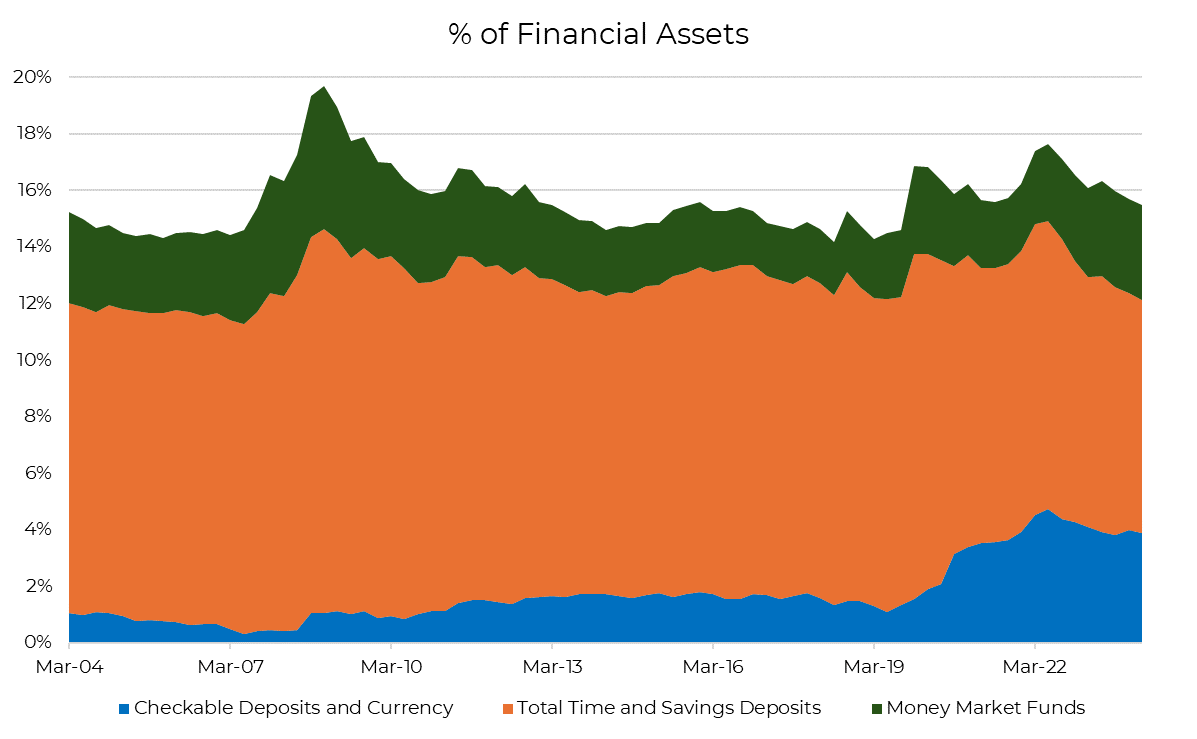

Brian: but if that pattern repeats itself, it won’t be because of the “cash on the sidelines”; that measure has been remarkably stable over time

Source: Aptus via FRED as of 09.13.2024

Source: Aptus via FRED as of 09.13.2024

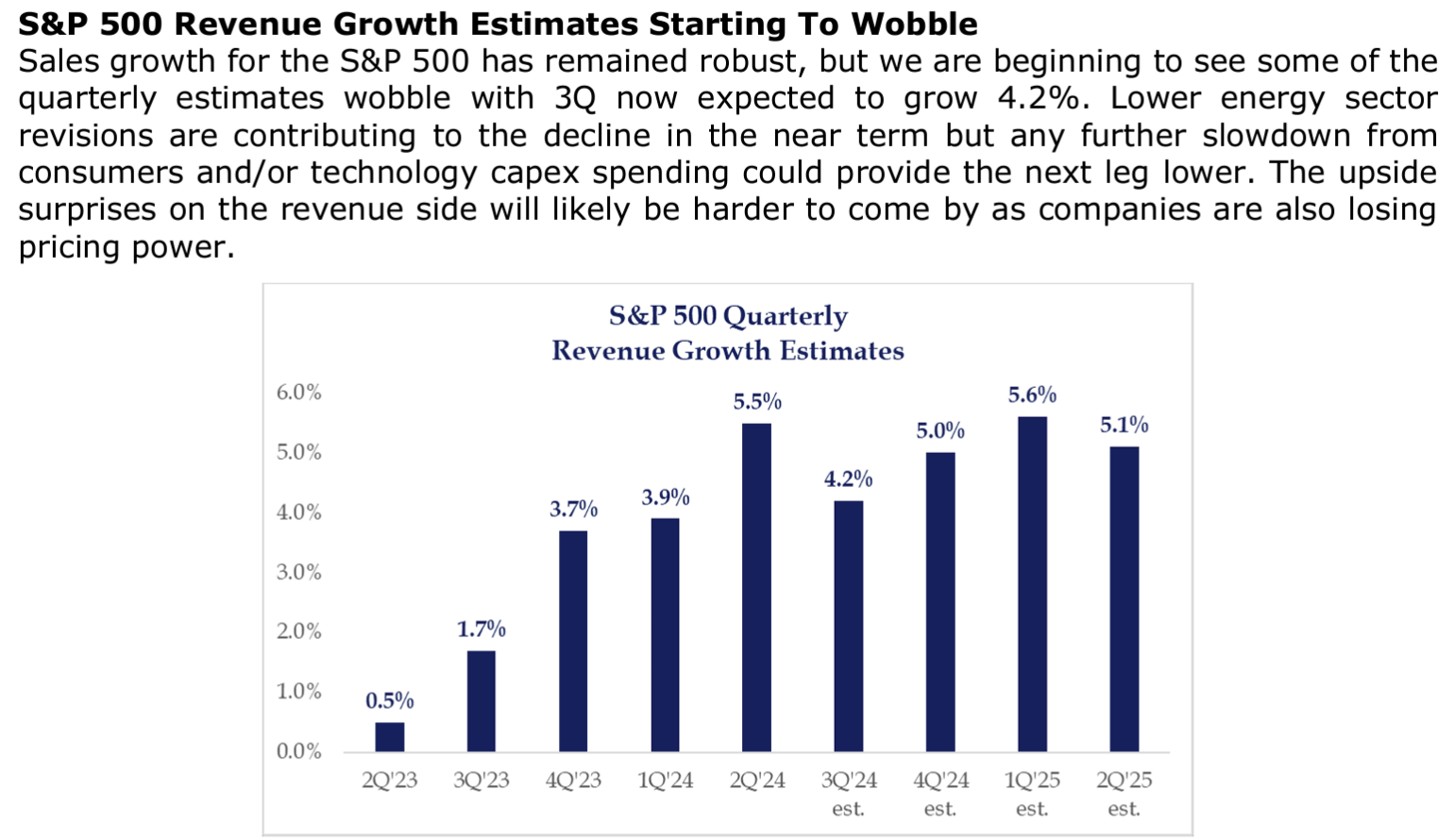

Dave: Heading into the end of Q3, sales forecasts have failed to accelerate

Source: Strategas as of 09.17.2024

Source: Strategas as of 09.17.2024

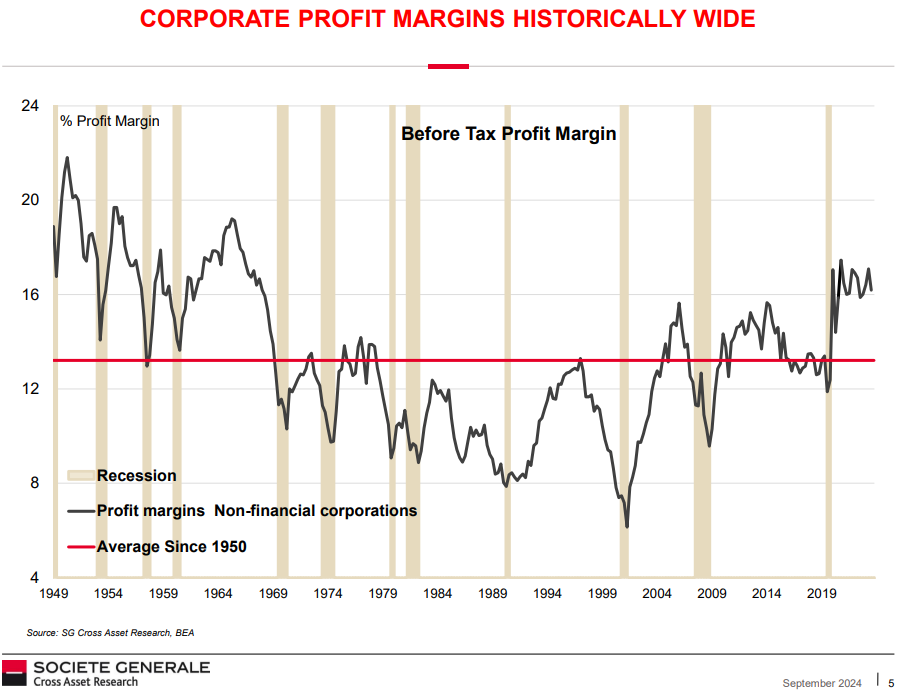

John Luke: but earnings have been supported by the profit margin recovery and expansion of recent years

Data as of August 2024

Data as of August 2024

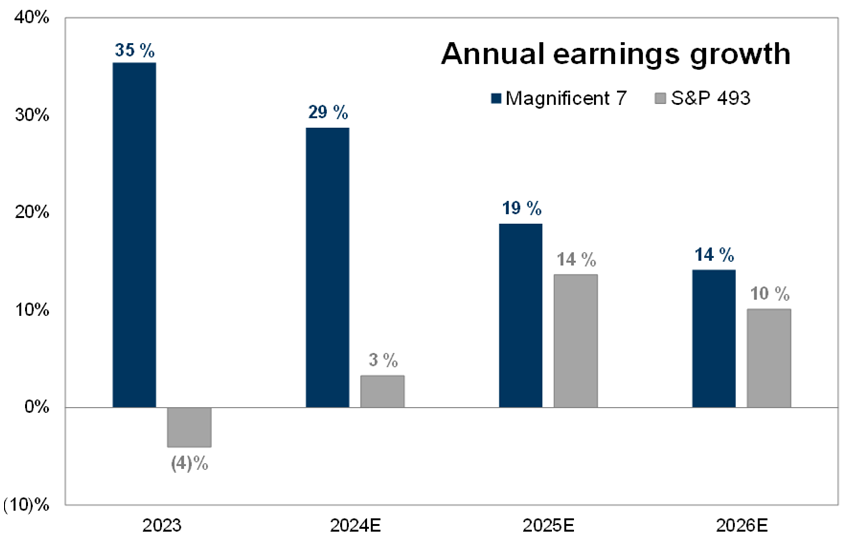

Brad: We’re still waiting for the broader market to grab the earnings baton from the megacap leaders

Source: Goldman Sachs as of 09.06.2024

Source: Goldman Sachs as of 09.06.2024

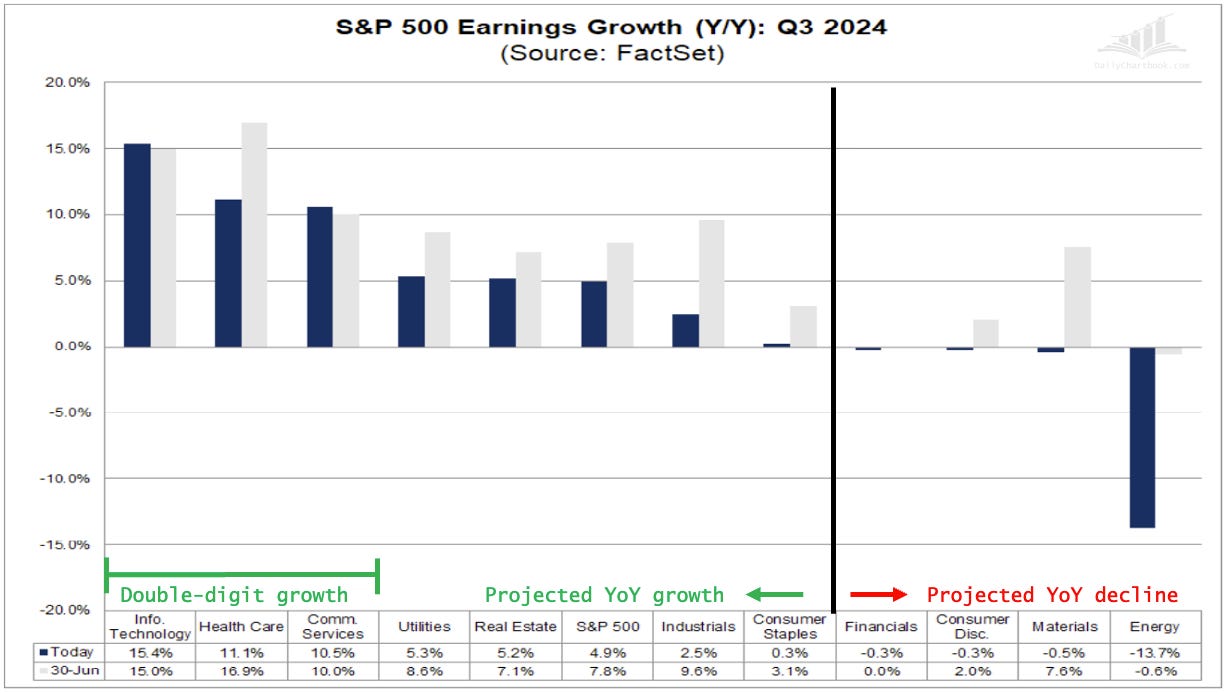

Brett: with energy the leading drag on overall results

Data as of 09.17.2024

Data as of 09.17.2024

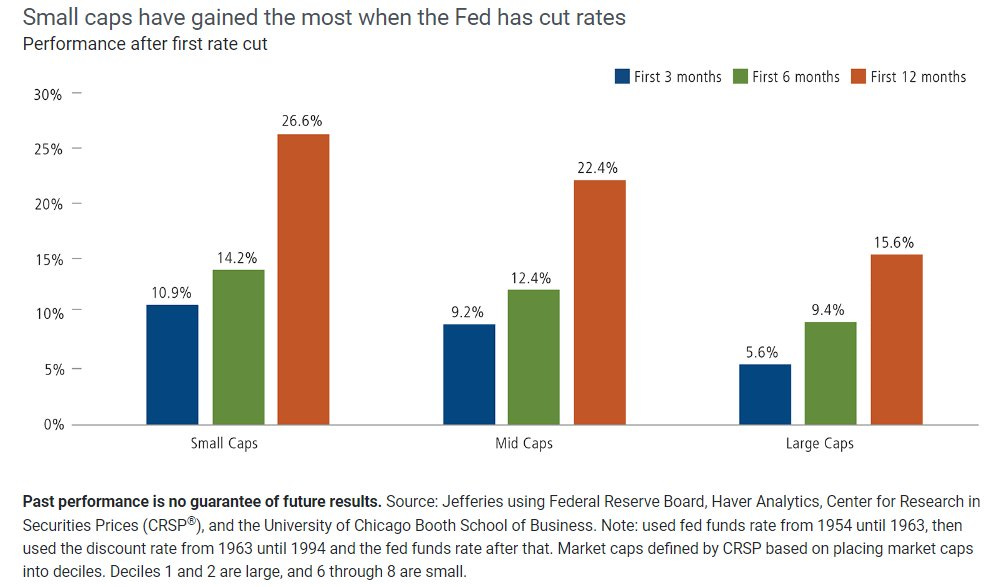

Brian: Small caps have historically performed well after rate-cutting cycles start

Data as of August 2024

Data as of August 2024

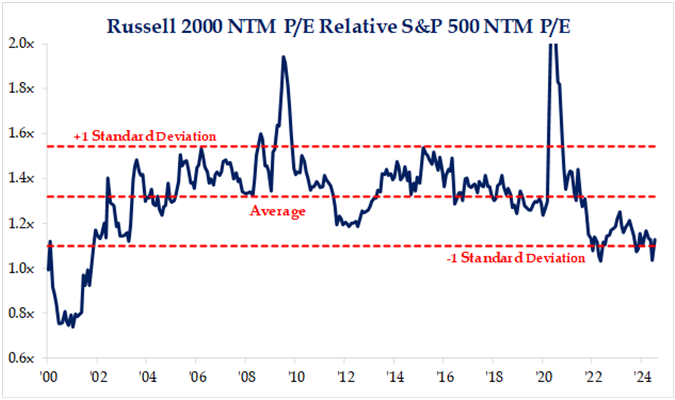

Brad: and with their valuations as low as they’ve been relative to large caps, there’s no excuse for failing to make up some ground

Source: Strategas as of 09.18.2024

Source: Strategas as of 09.18.2024

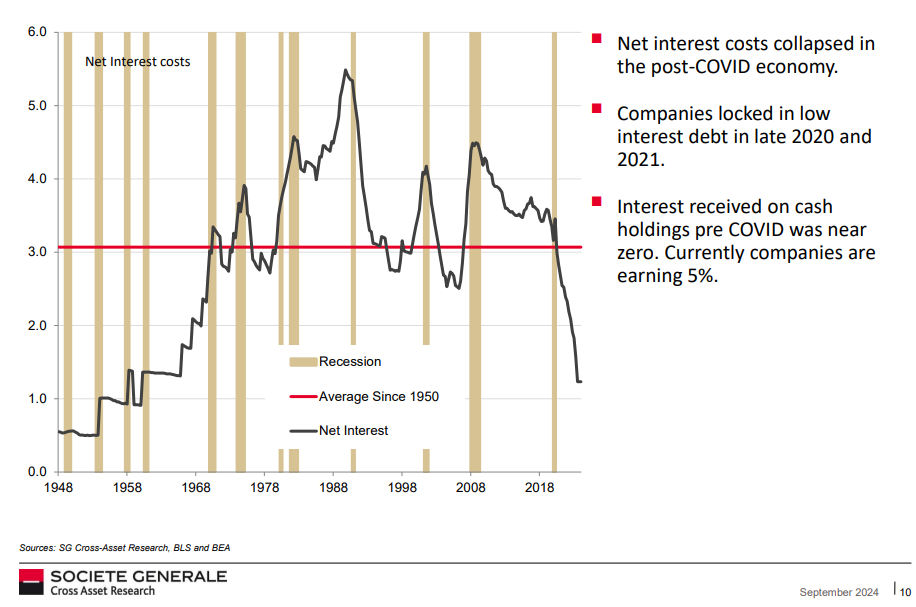

John Luke: Large US corporations used the zero-interest rate era to dramatically improve their financial footing

Data as of August 2024

Data as of August 2024

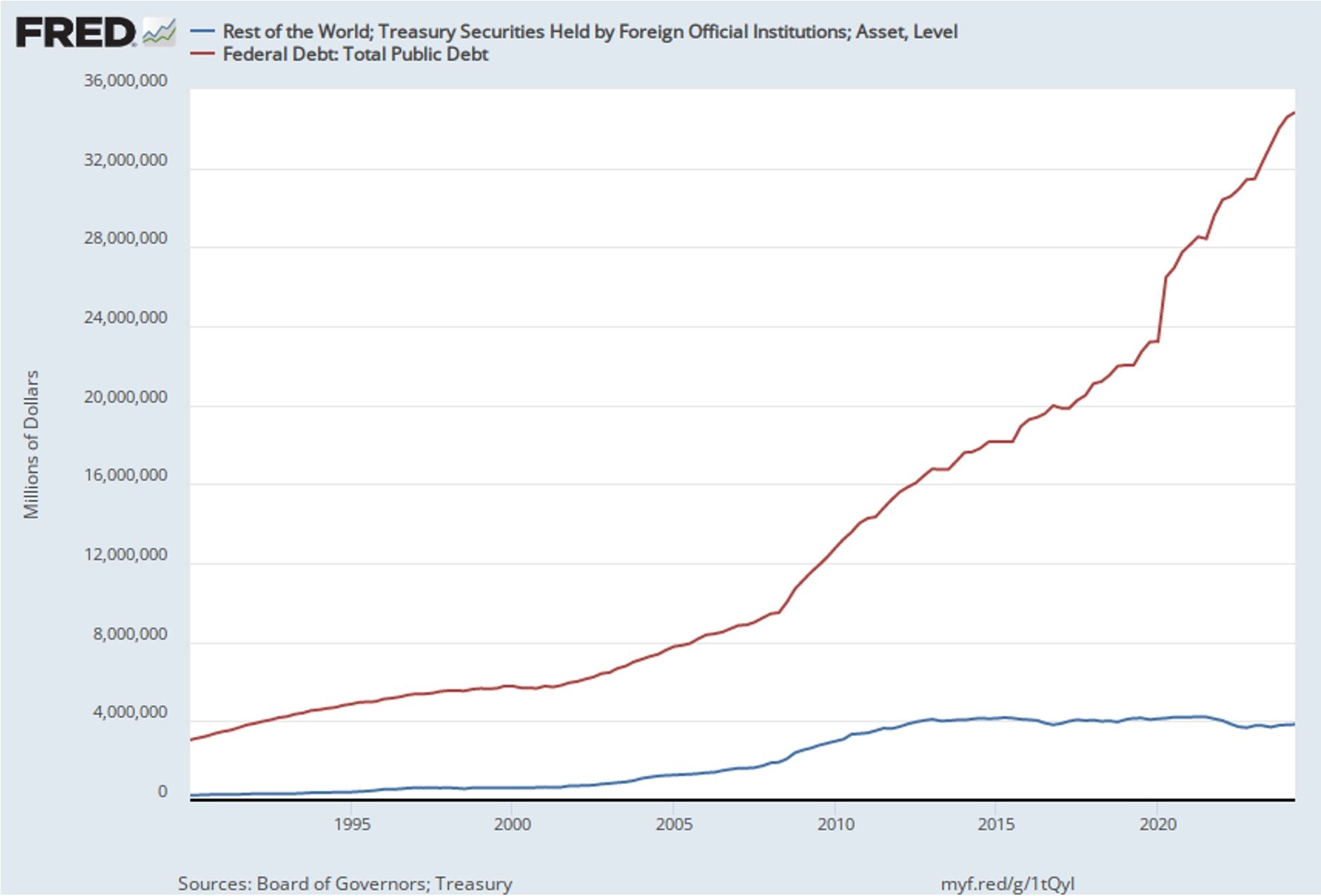

John Luke: can’t say the same for the US government

Source: @LukeGromen as of August 2024

Source: @LukeGromen as of August 2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-24.