Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

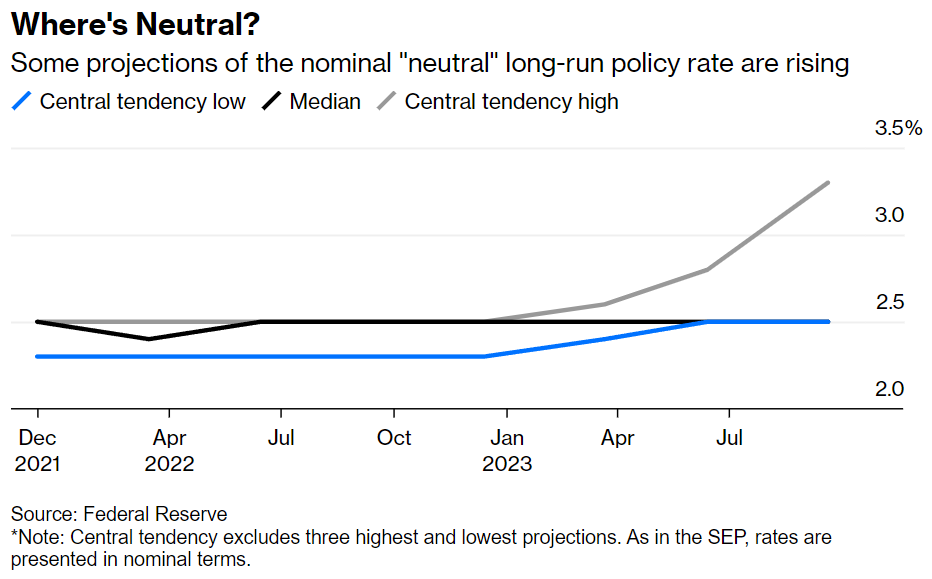

John Luke: The midpoint of the neutral policy rate hasn’t moved, but a few members have moved their targets higher

Source: Bloomberg as of September 2023

Source: Bloomberg as of September 2023

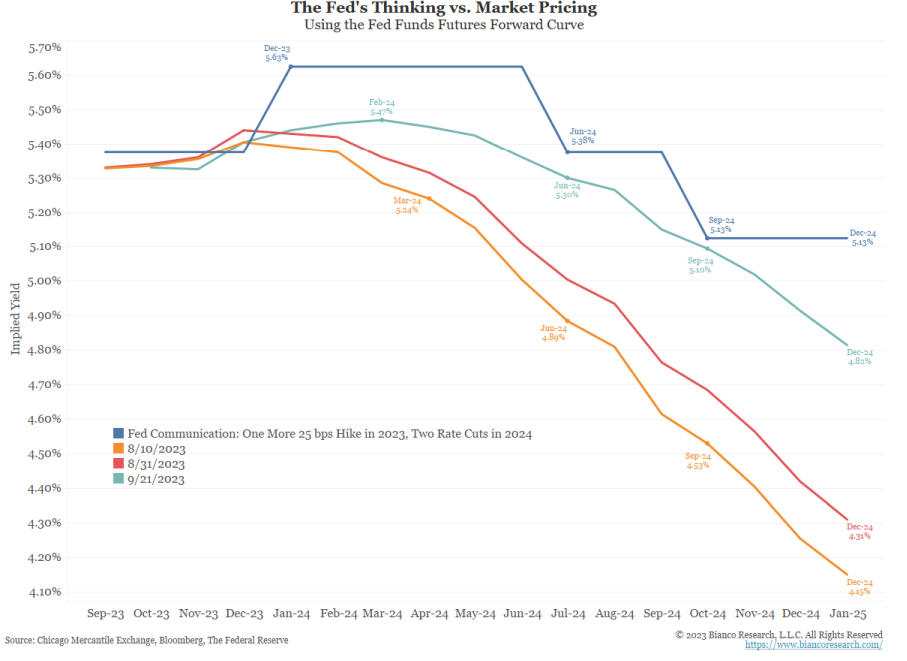

John Luke: and the market is again “catching up” to what Chairman Powell has repeatedly telling them what to expect

Source: Bianco as of 09.21.2023

Source: Bianco as of 09.21.2023

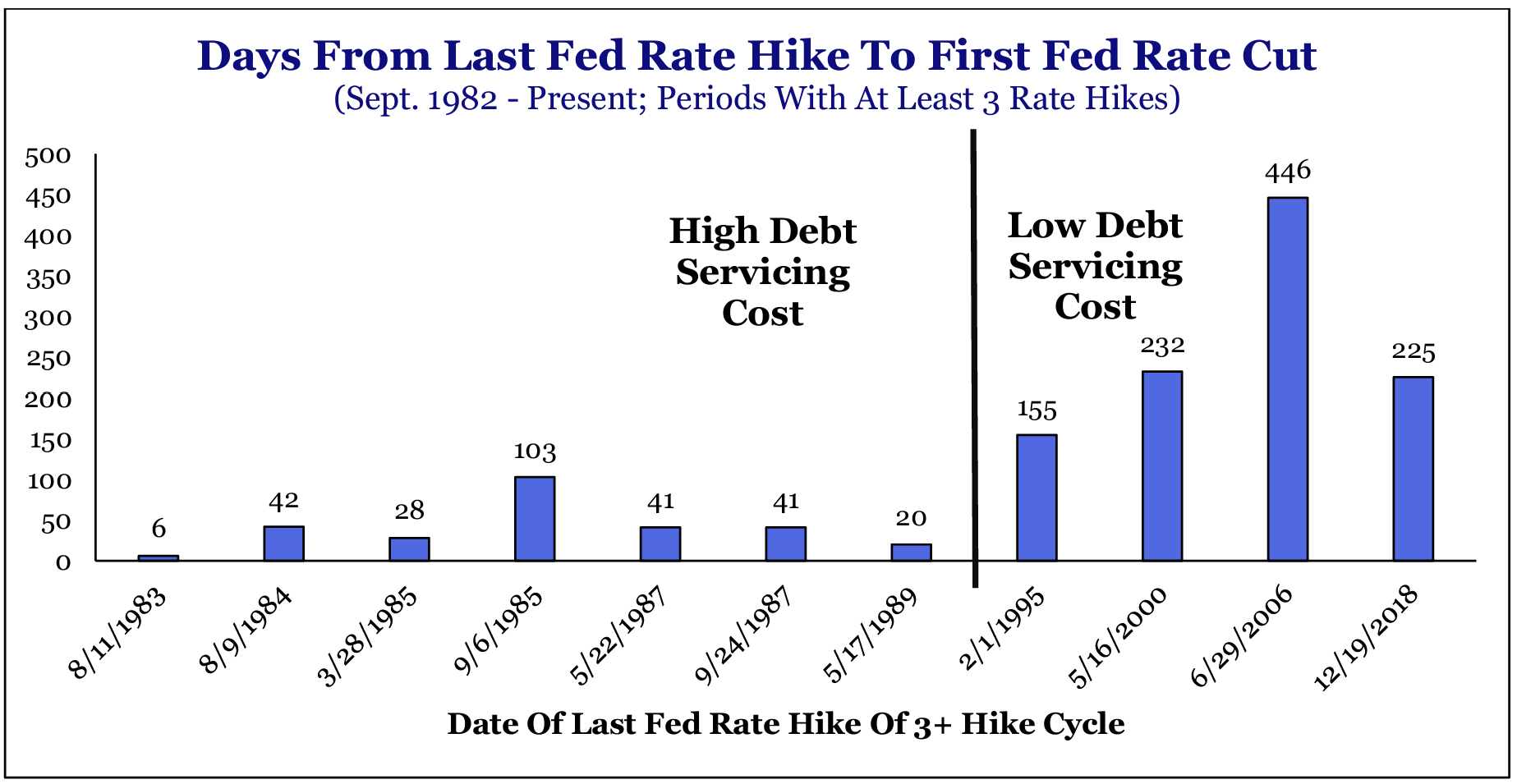

Dave: It’s interesting to see how Fed “pauses” have replaced “pivots” in the lower rate environment of recent decades

Source: Strategas as of September 2023

Source: Strategas as of September 2023

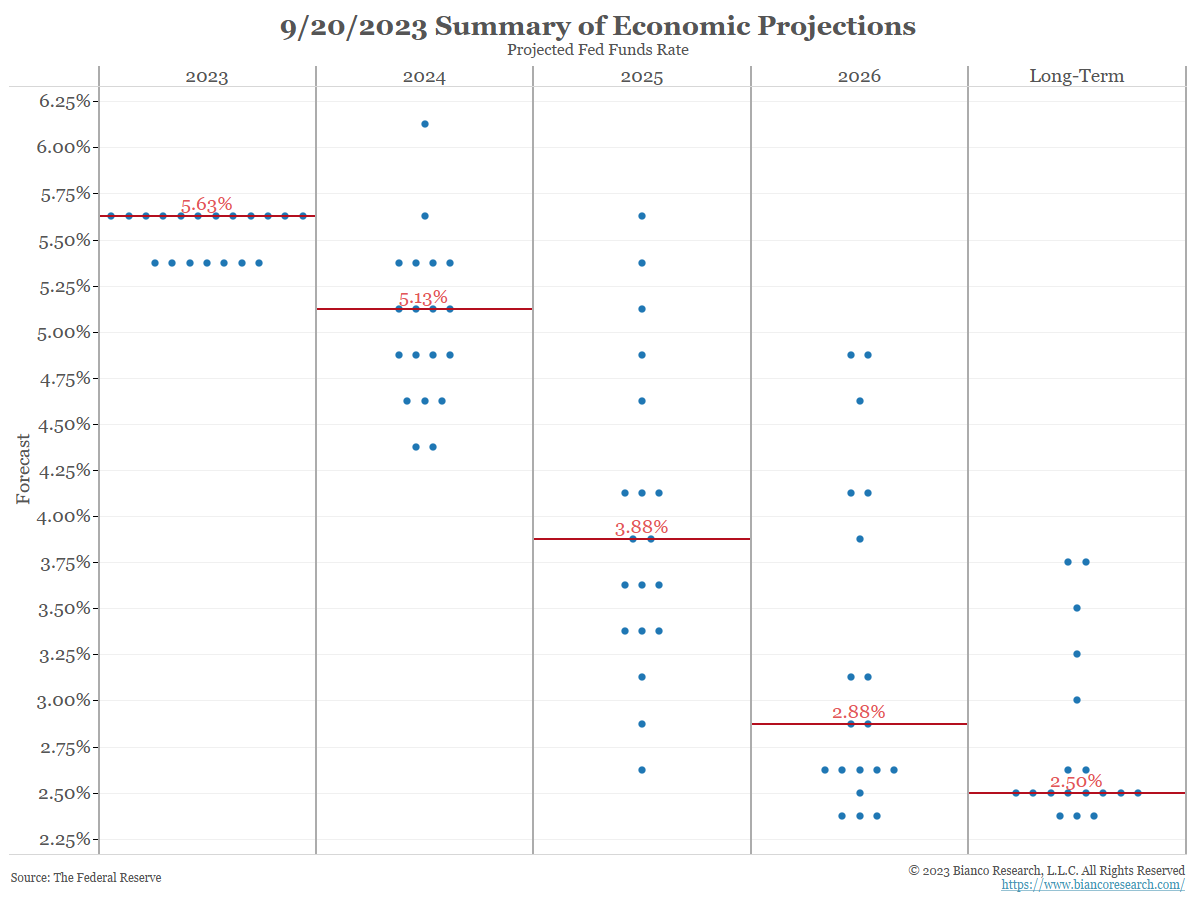

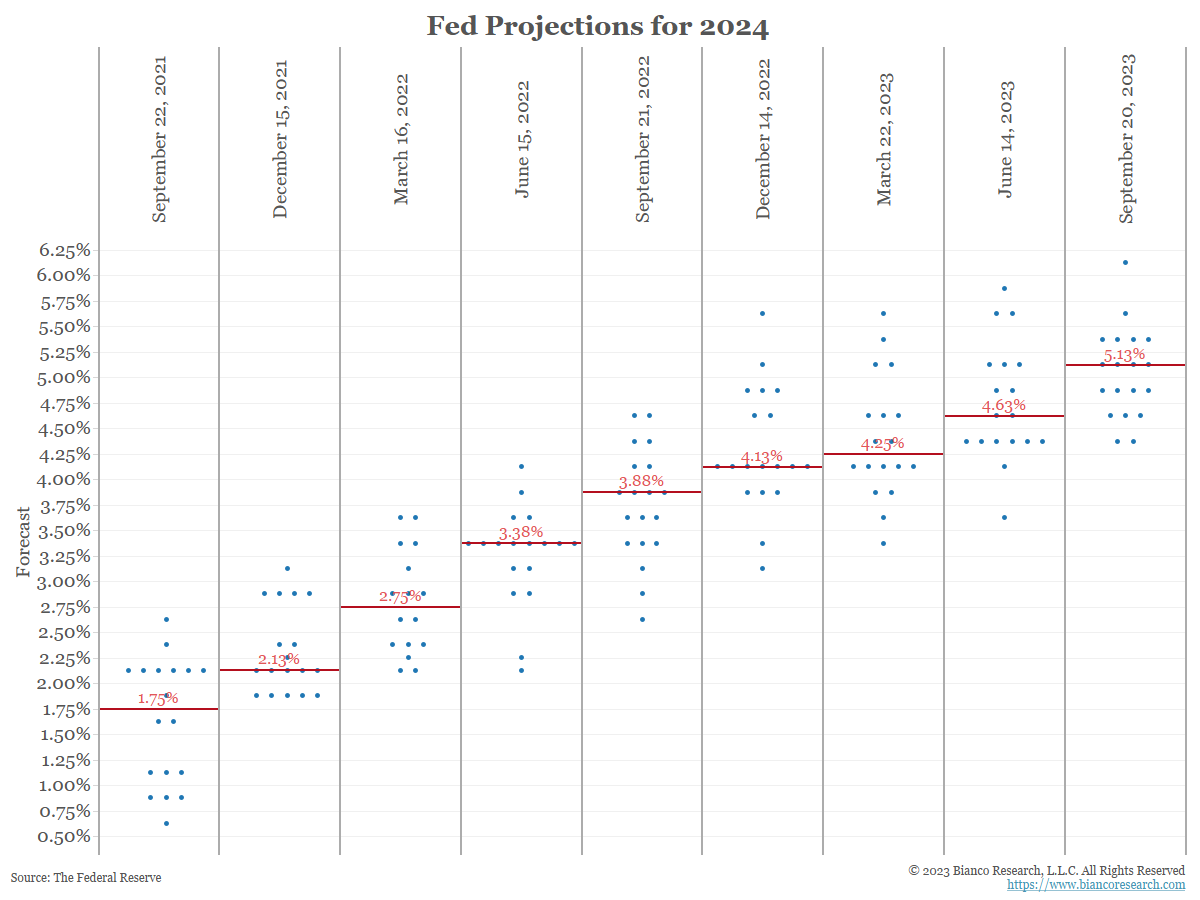

Dave: As investors get used to the Fed “dot plots” showing a commitment to higher rates…

Source: Bianco as of 09.21.2023

Source: Bianco as of 09.21.2023

Dave: it’s important to remember it wasn’t that long ago that ultra-low rates were expected by the FOMC members themselves

Source: Bianco as of 09.21.2023

Source: Bianco as of 09.21.2023

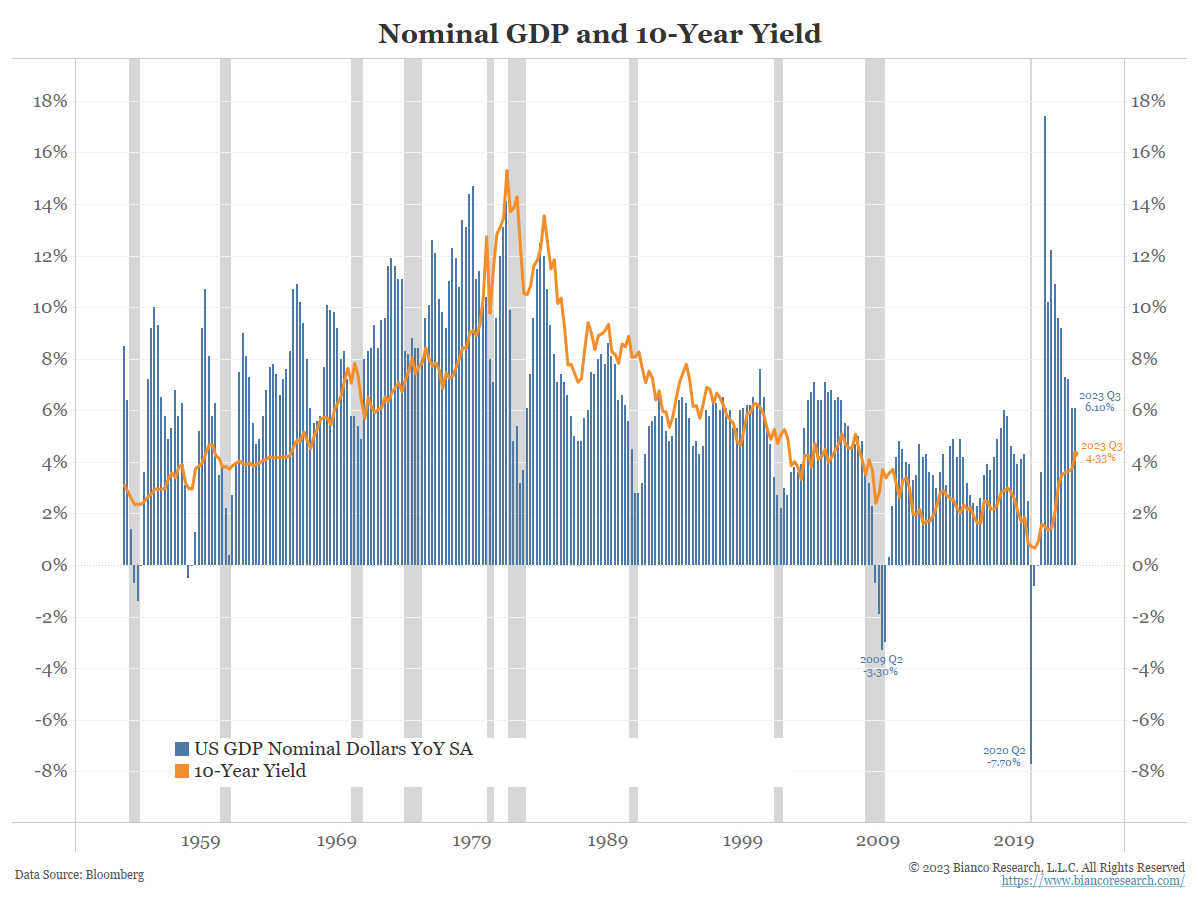

John Luke: With a few glaring exceptions like 2021, Treasury yields have historically tracked fairly closely to Nominal GDP growth

Data as of September 2023

Data as of September 2023

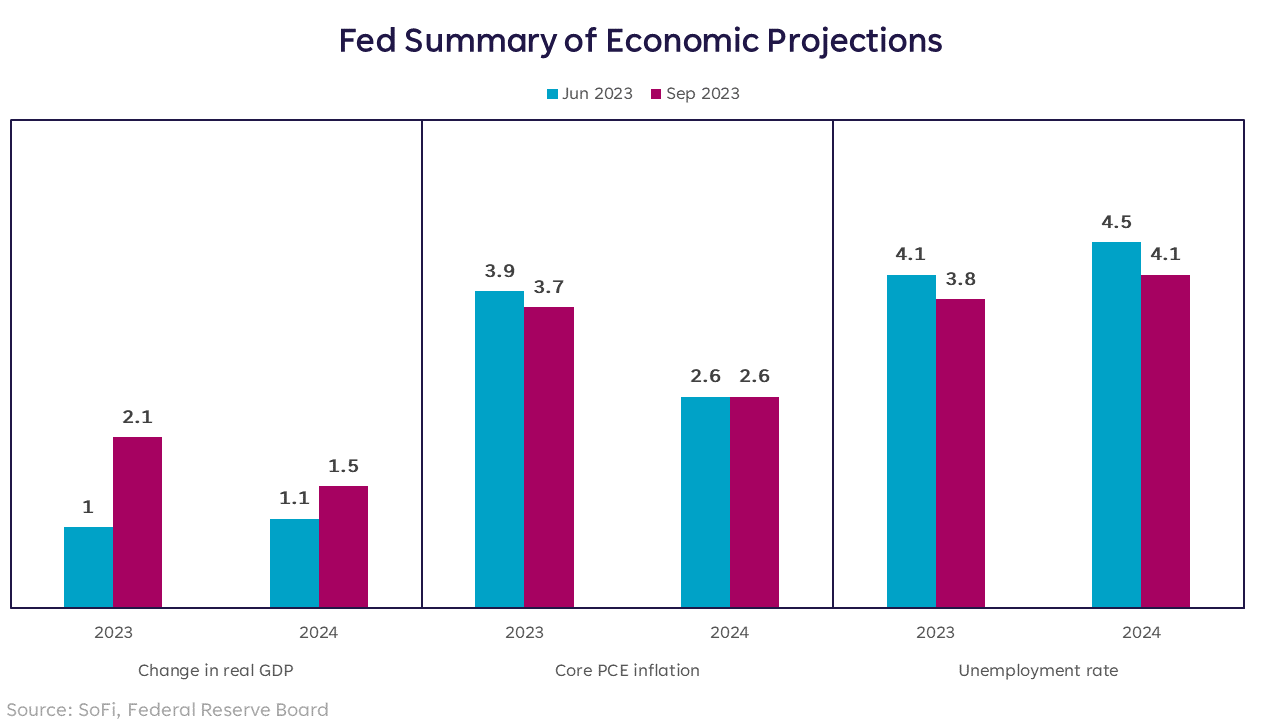

Beckham: and the Fed is now bumping up its projections of 2023 and 2024 Real GDP growth

Data as of September 2023

Data as of September 2023

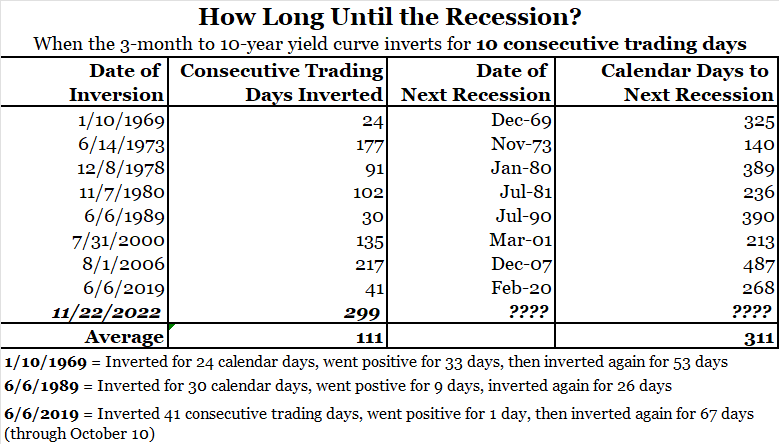

John Luke: but in the past, yield curve inversions have eventually led to recessions

Source: Bianco as of September 2023

Source: Bianco as of September 2023

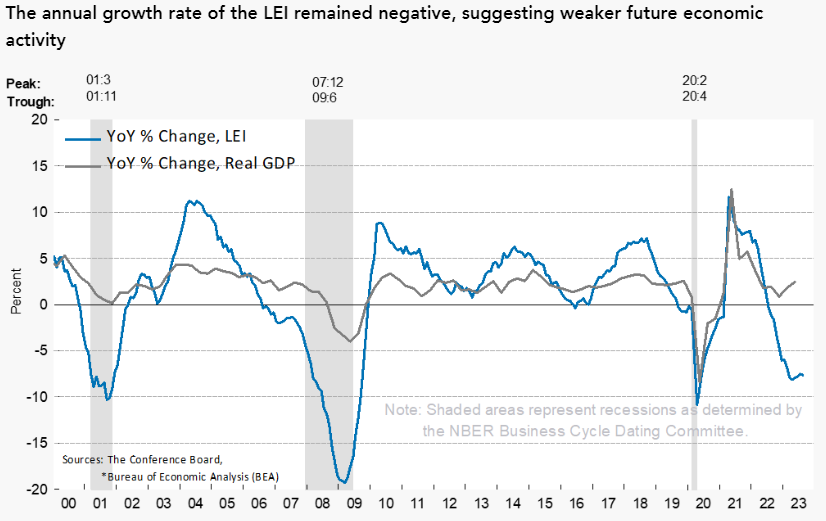

Joseph: and the Conference Board’s Leading Economic Indicators (LEI) have fallen 17 months in a row

Data as of 09.21.2023

Data as of 09.21.2023

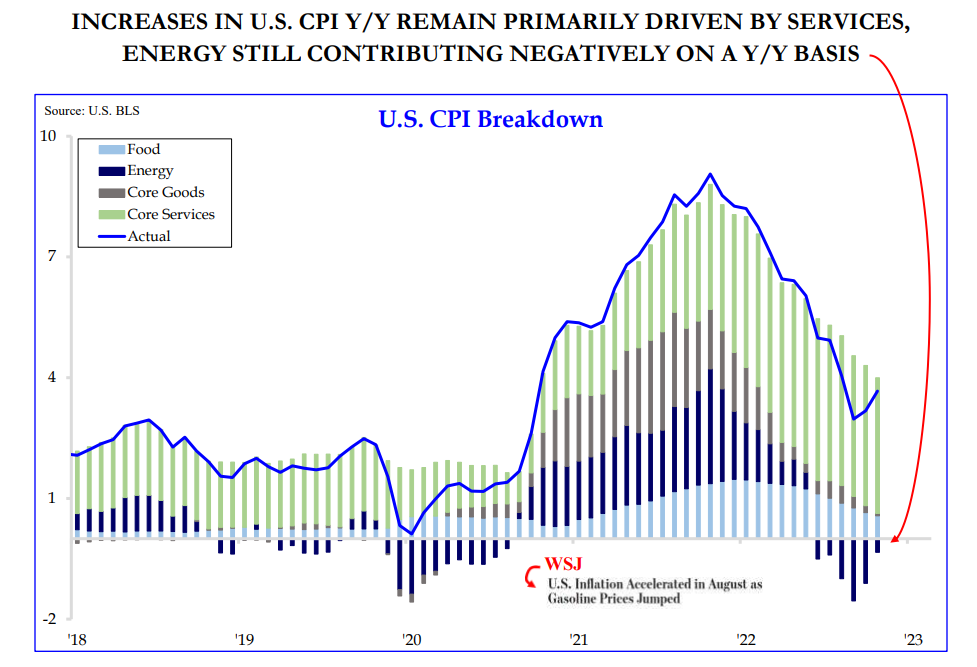

John Luke: CPI readings are still heavily driven by services inputs

Source: Strategas as of 09.19.2023

Source: Strategas as of 09.19.2023

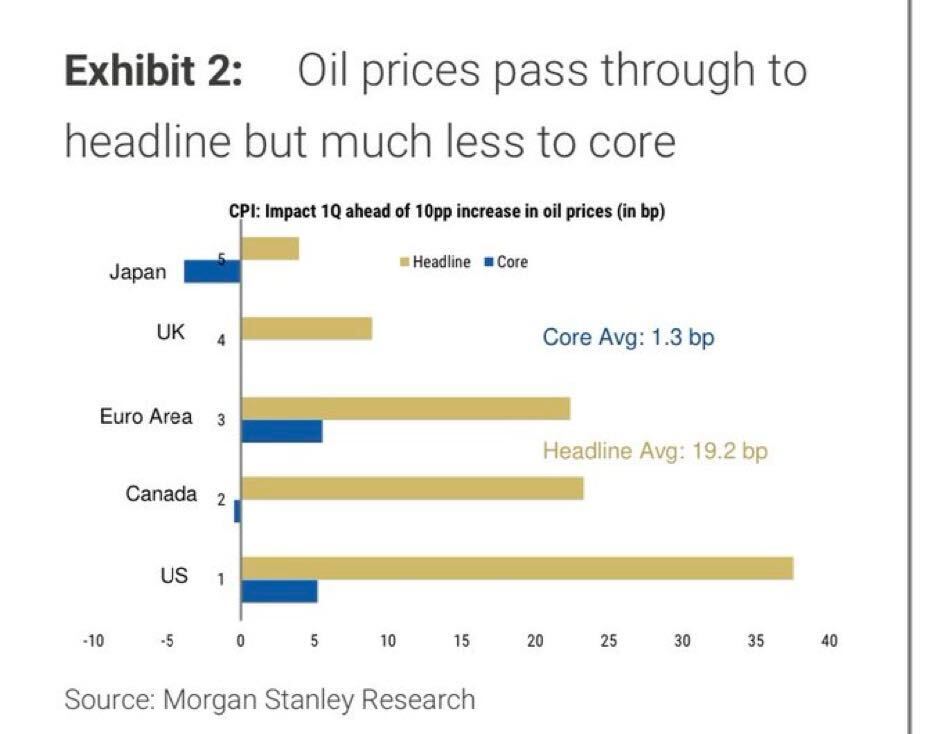

John Luke: muting the impact of recently rising oil prices on the “core” readings that seem to be closely followed by the Fed

Data as of September 2023

Data as of September 2023

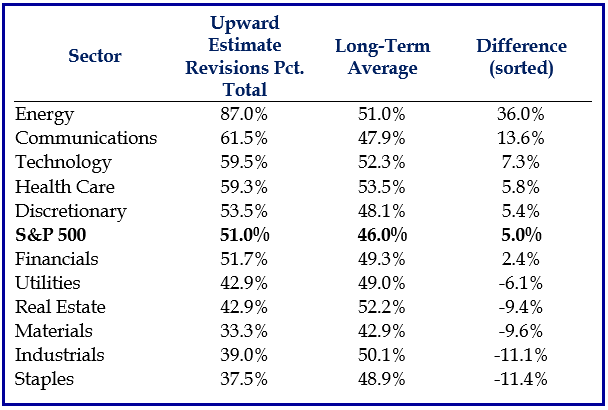

Brad: Those higher oil prices are leading to rising Q3 earnings estimates for energy stocks

Source: Strategas as of 09.20.2023

Source: Strategas as of 09.20.2023

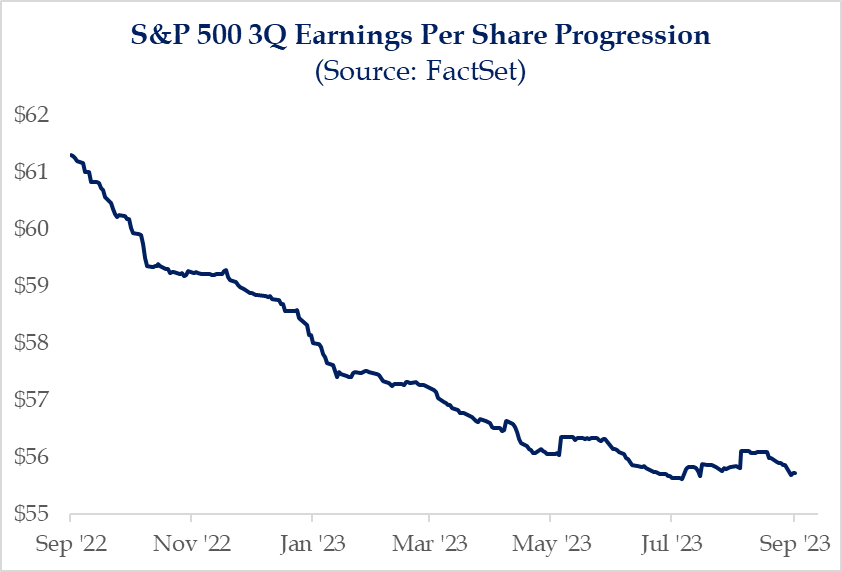

Brad: but the relatively small weighting of energy stocks means a muted impact on estimates for the S&P as a whole

Source: Strategas as of 09.20.2023

Source: Strategas as of 09.20.2023

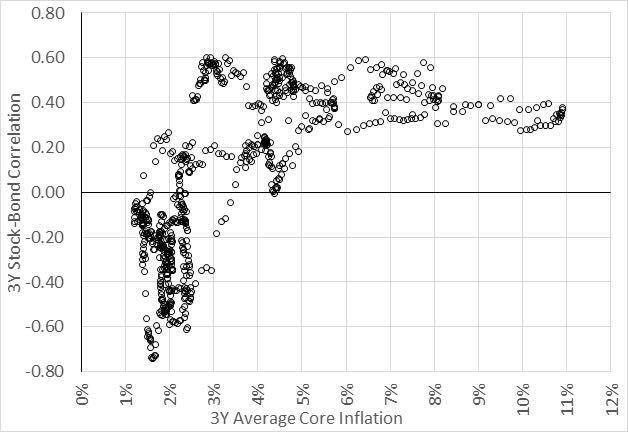

JD: Regular reminder that stocks and bonds often zig and zag together, especially in higher rate environments

Source: Verdad as of 09.11.2023

Source: Verdad as of 09.11.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2309-25.