Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

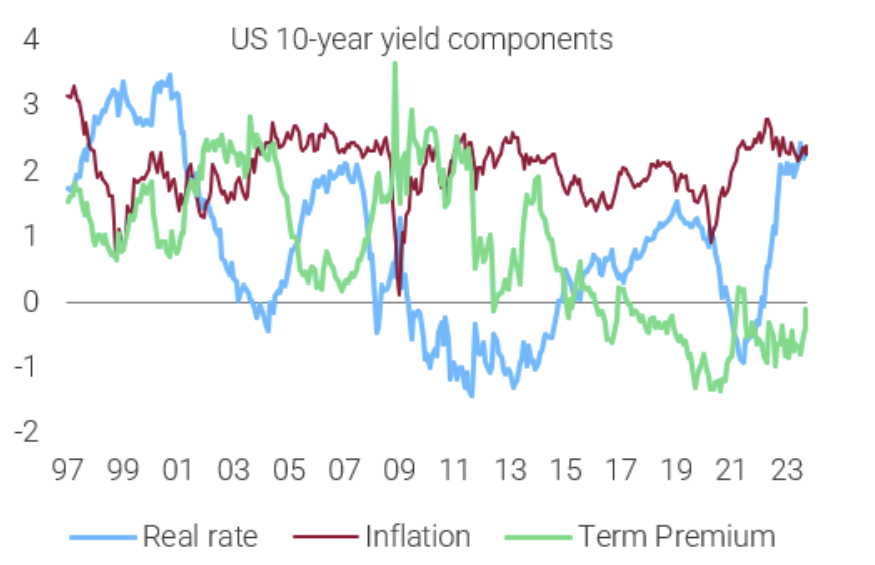

Dave: The story of the past year has been real rates exploding from negative territory into positive

Source: TS Lombard as of September 2023

Source: TS Lombard as of September 2023

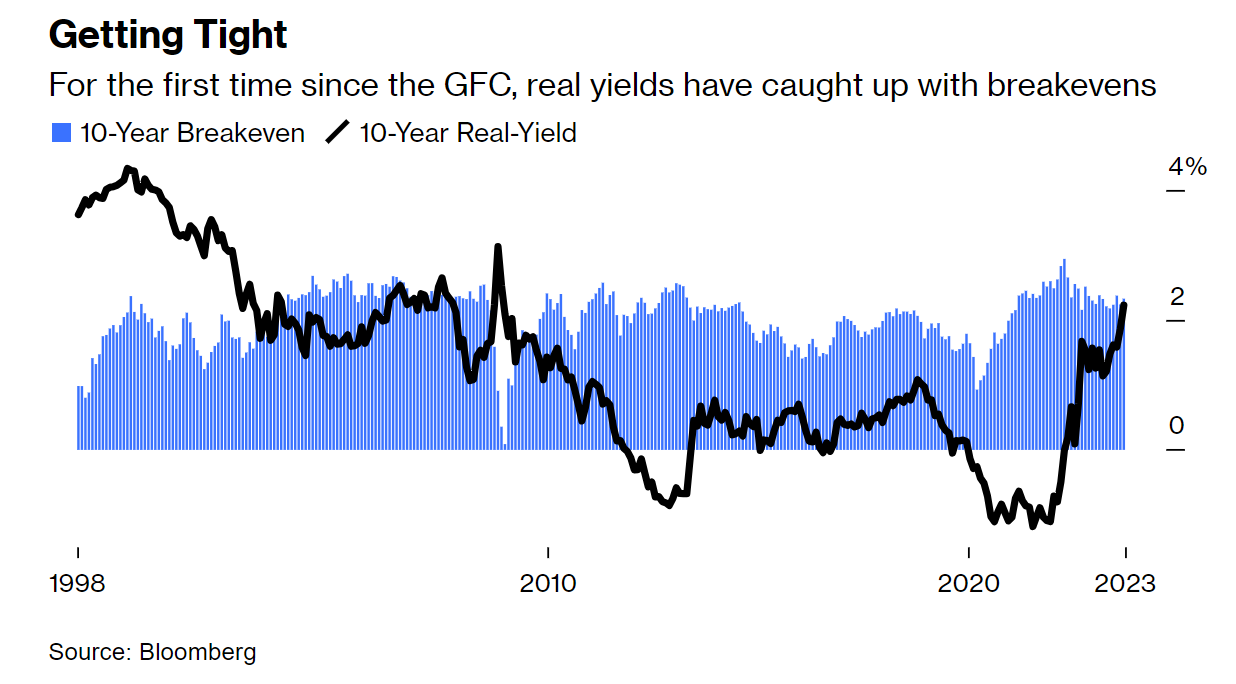

Joseph: which has FINALLY moved real rates into the same ballpark as inflation breakeven rates

Data as of September 2023

Data as of September 2023

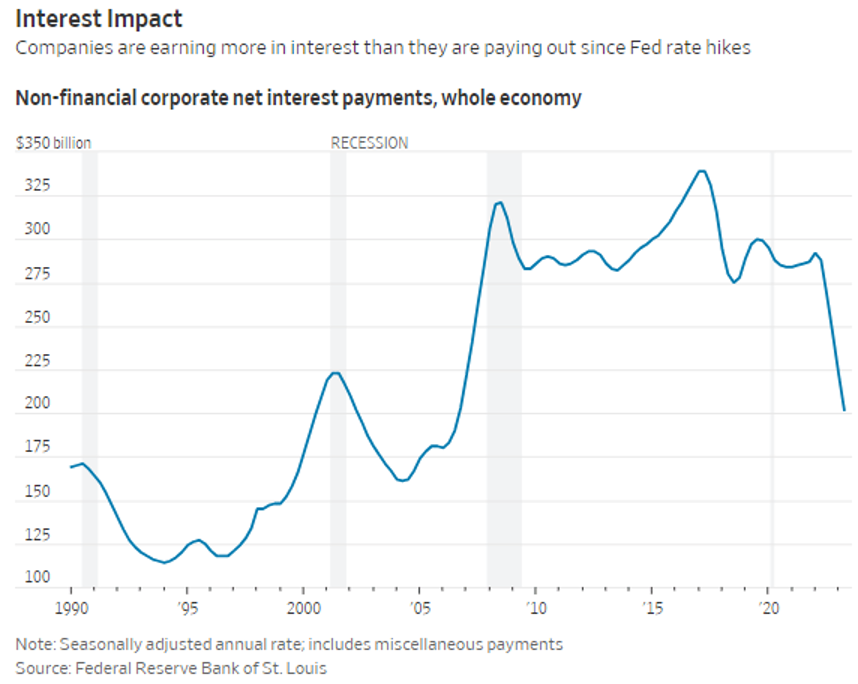

John Luke: The spike in rates has had barely an impact on the income statements of large corporations

Source: WSJ as of 09.23.2023

Source: WSJ as of 09.23.2023

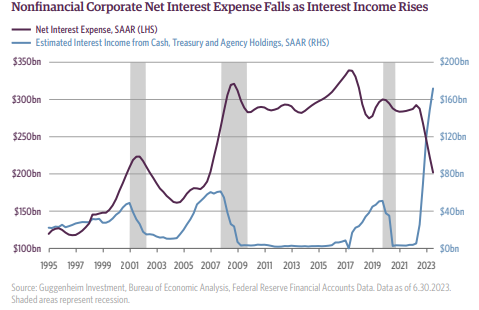

John Luke: and has in fact led to a boost in profitability as those firms gain extra interest income

Source: Guggenheim as of 09.23. 2023

Source: Guggenheim as of 09.23. 2023

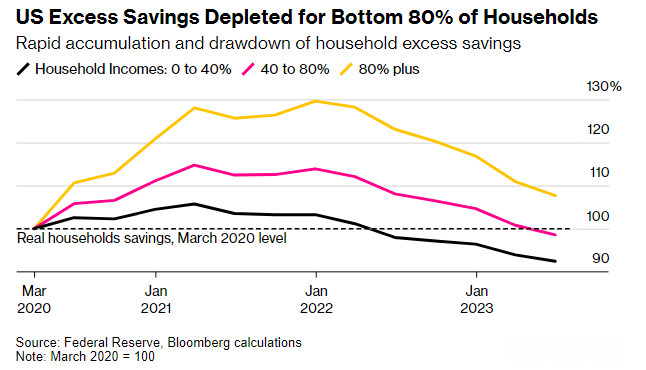

Beckham: The excess savings accumulated by US households has been depleted for the lower income population

Data as of September 2023

Data as of September 2023

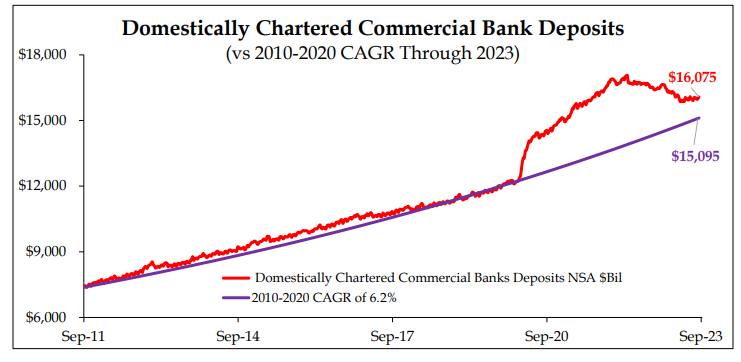

John Luke: but overall, total bank deposits are still well above the trendline of recent decades

Source: Strategas as of September 2023

Source: Strategas as of September 2023

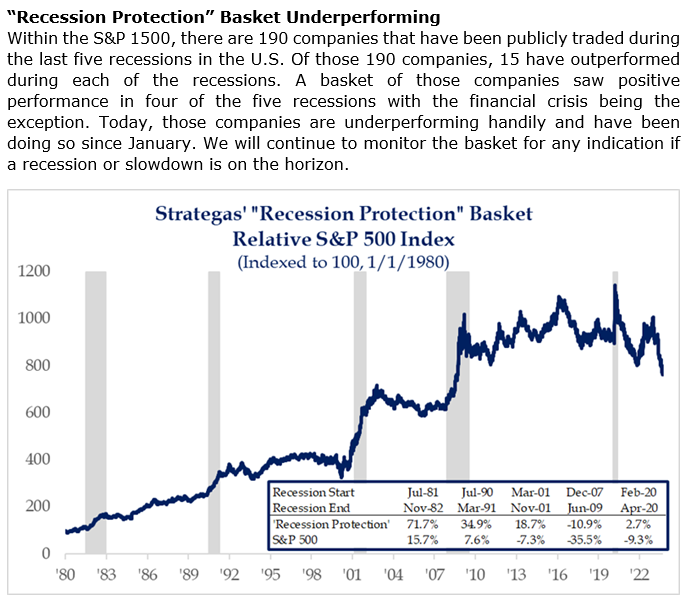

Brad: Weakness in defensive equity sectors doesn’t fit with a recession story

Source: Strategas as of September 2023

Source: Strategas as of September 2023

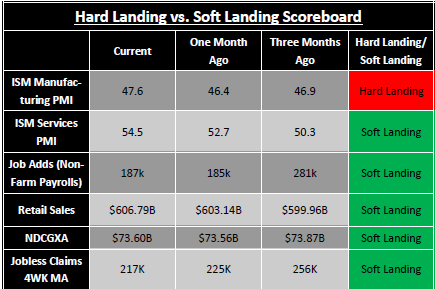

Brad: reinforcing the set of signals that has distinguished between soft and hard landings in the past

Source: Sevens Report as of 09.27.2023

Source: Sevens Report as of 09.27.2023

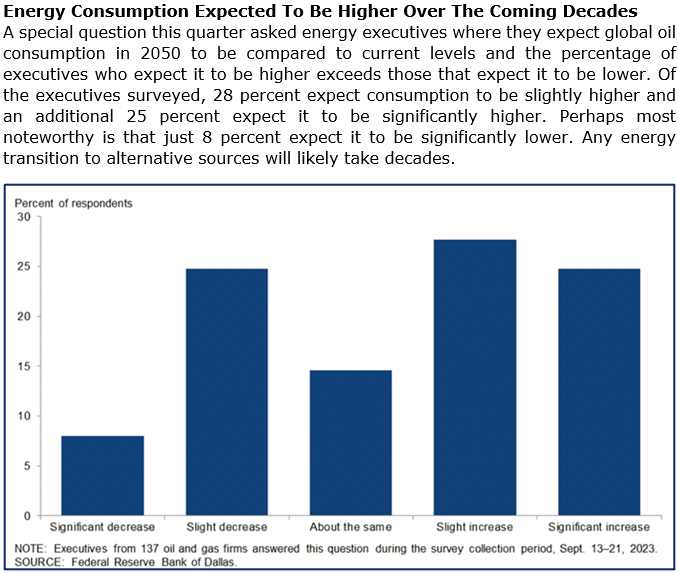

Brad: Broad use of oil as an energy source is not expected to radically change anytime soon

Source: Strategas as of 09.25.2023

Source: Strategas as of 09.25.2023

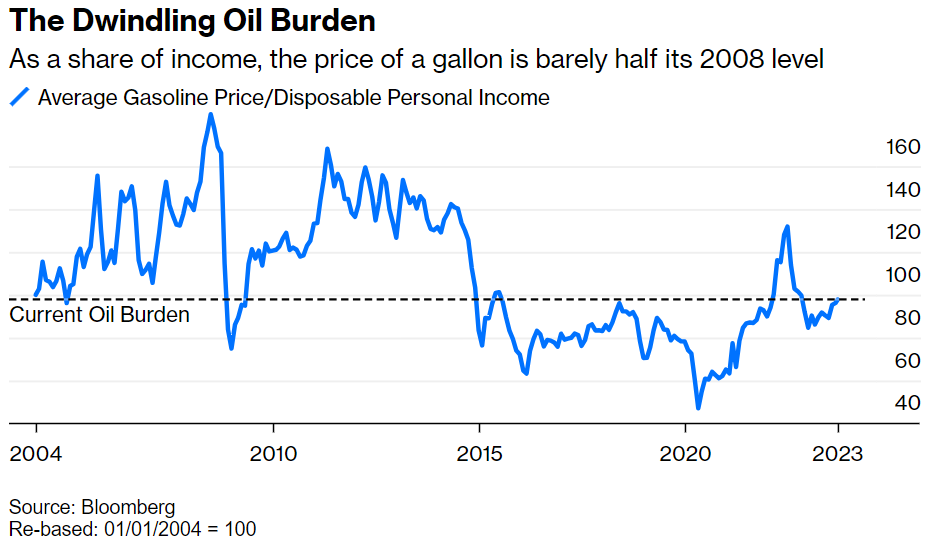

John Luke: and thankfully US consumers are still in an OK position to weather possible price spikes

Data as of September 2023

Data as of September 2023

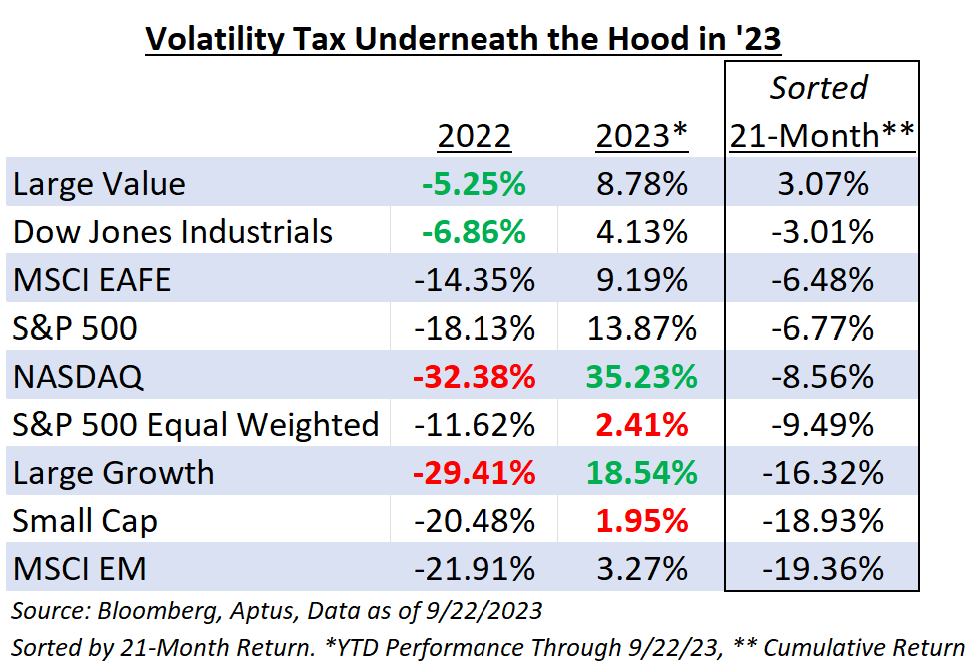

Dave: We often talk about the drag from the “volatility tax”, we generally refer to long-term compounding but the 2022-23 stretch gives a taste of the impact

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2309-30.