Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

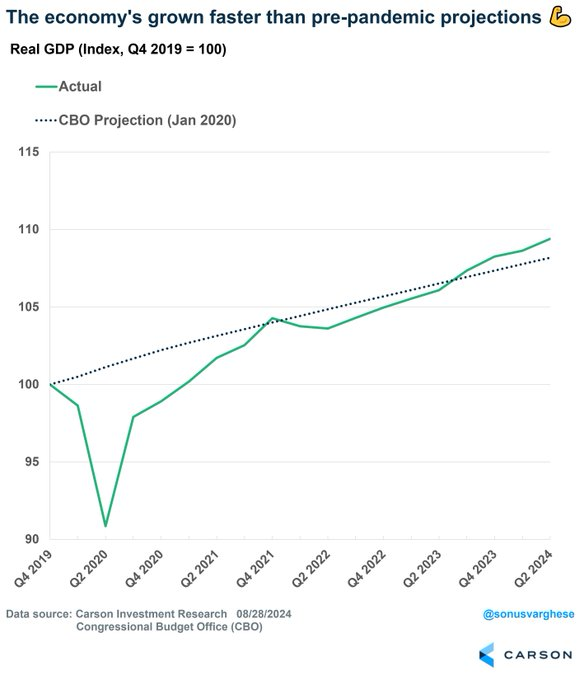

Brian: Despite a rough start to the decade, US growth has actually exceeded pre-COVID projections

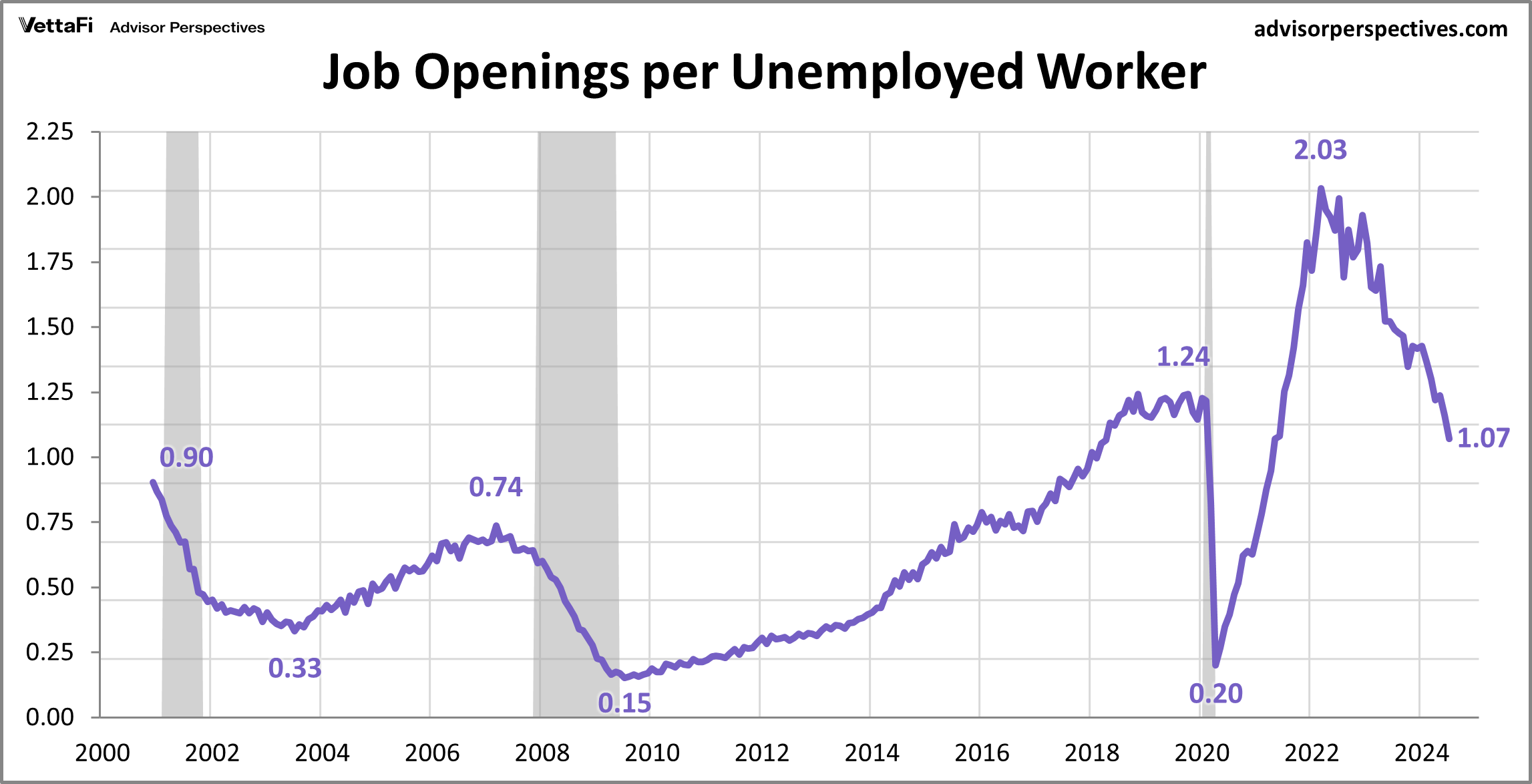

Beckham: though we’ve worked off most of the labor shortage in the past two years

Data as of August 2024

Data as of August 2024

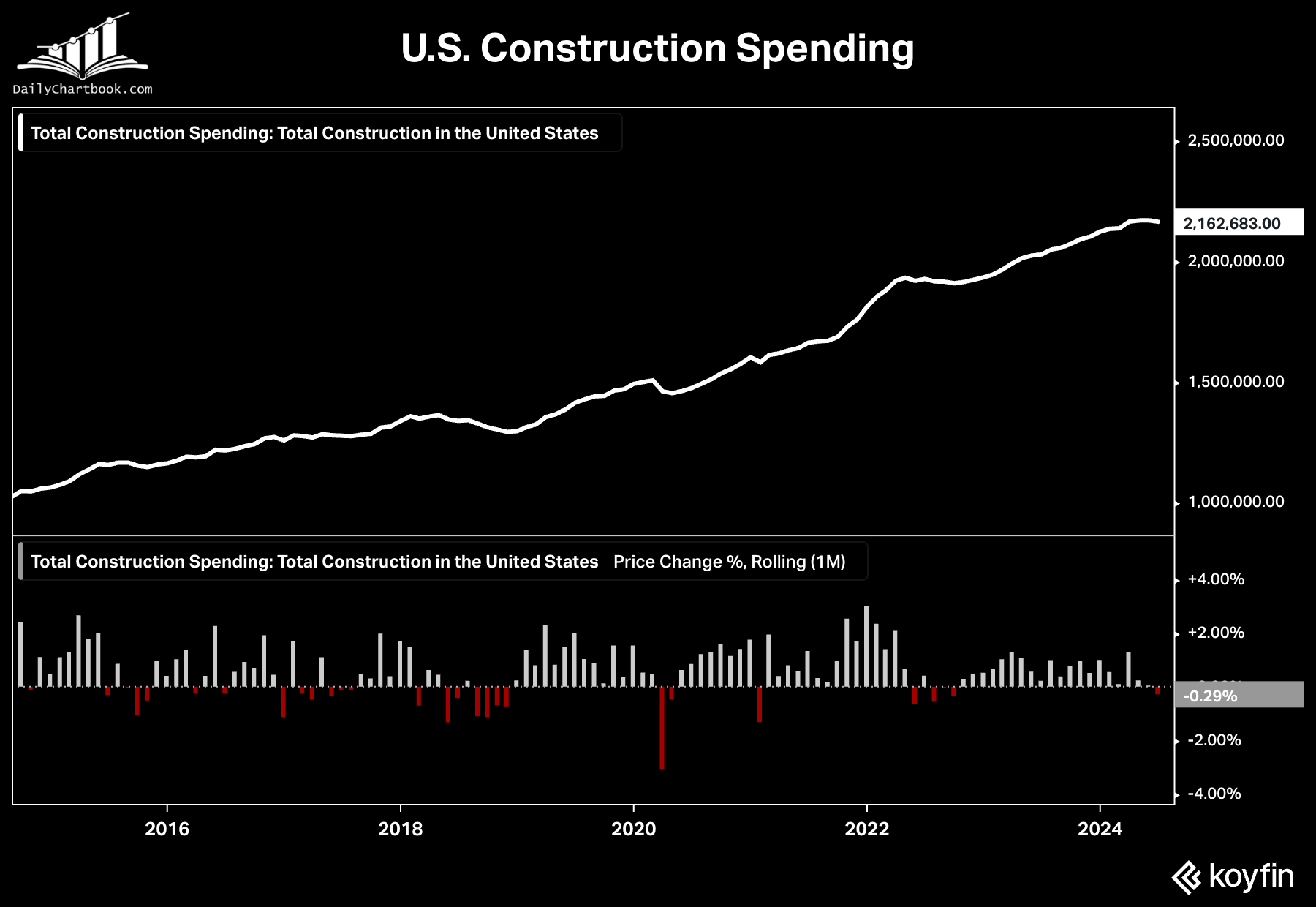

Arch: Construction spending fell in August for the first time since October 2022

Source: Daily Chartbook as of 09.04.2024

Source: Daily Chartbook as of 09.04.2024

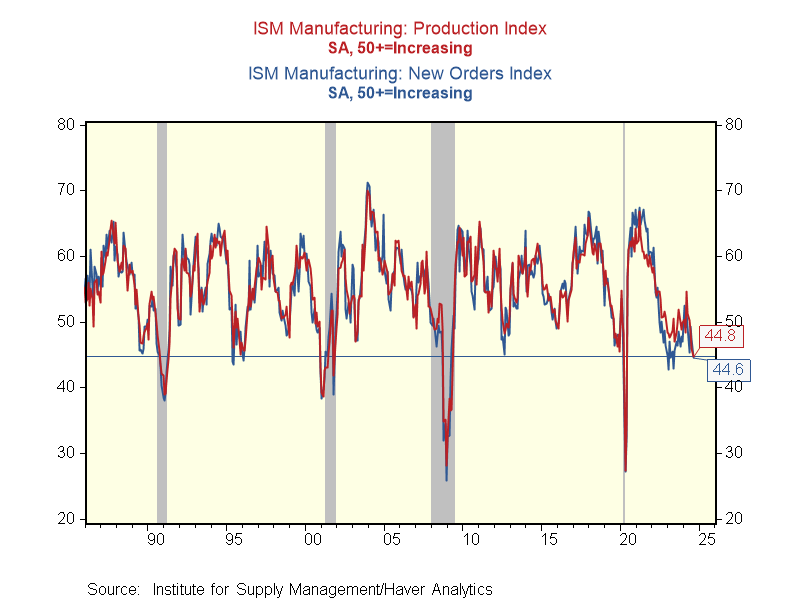

Brett: and signs of weakness are starting to show up in manufacturing data

Data as of 09.03.2024

Data as of 09.03.2024

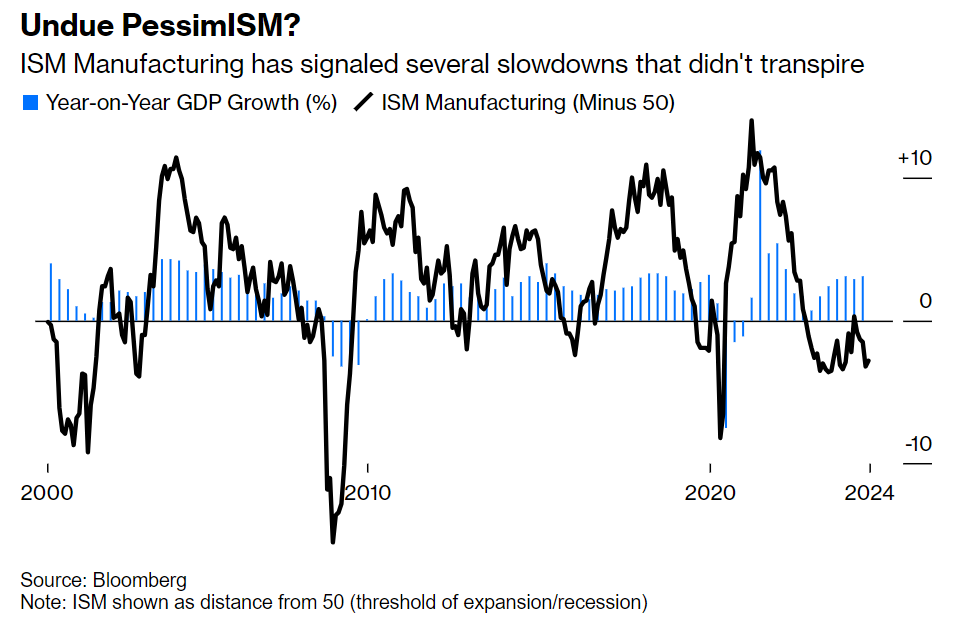

John Luke: that said, survey data has often forecasted economic weakness that hasn’t followed through

Data as of 09.04.2024

Data as of 09.04.2024

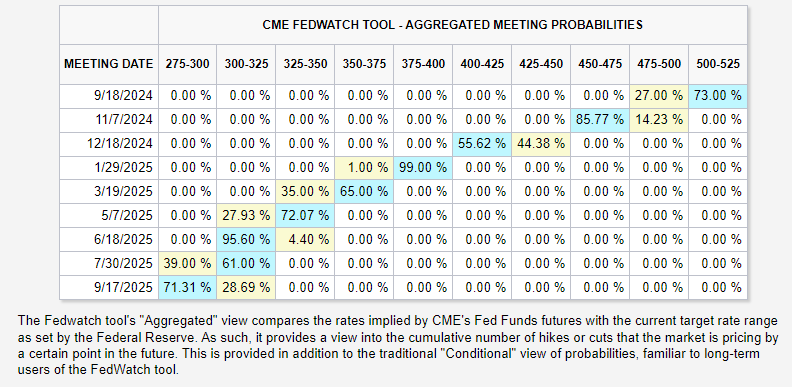

John Luke: With most of the pre-FOMC data behind us, markets are sticking to forecasts of at least 100 bps of cuts this year and another 100 next year

Source: CME FedWatch Tool as of 09.06.2024

Source: CME FedWatch Tool as of 09.06.2024

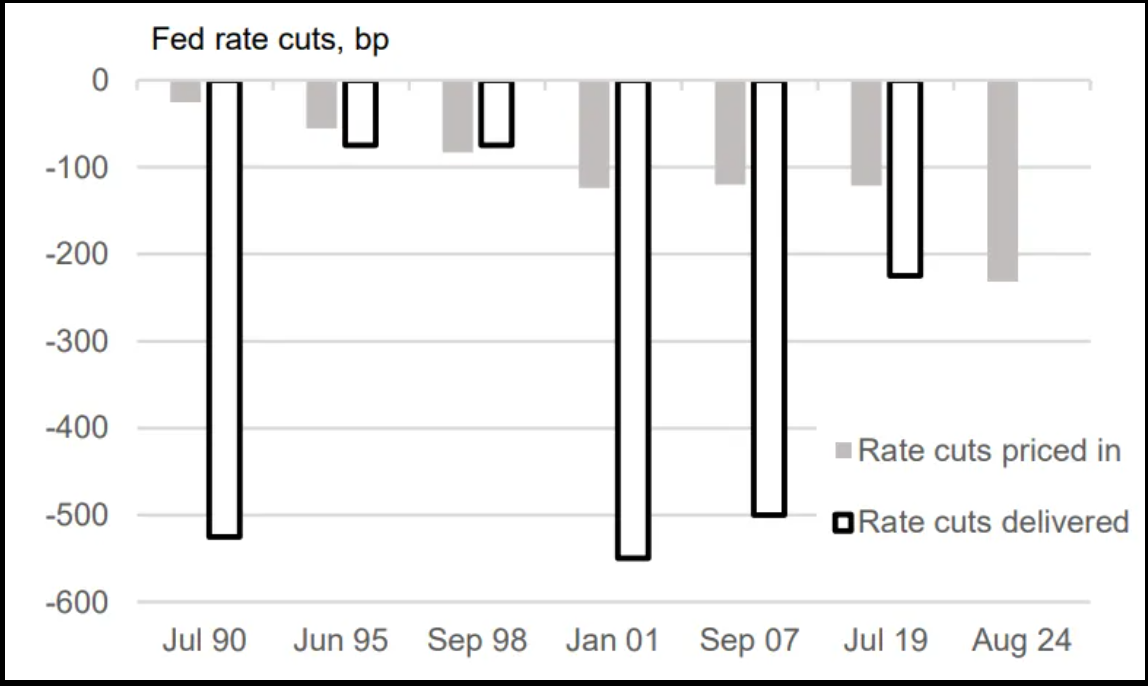

Dave: what’s interesting about that is the tendency for actual rate cuts to far exceed initial expectations

Source: Bloomberg as of 09.05.2024

Source: Bloomberg as of 09.05.2024

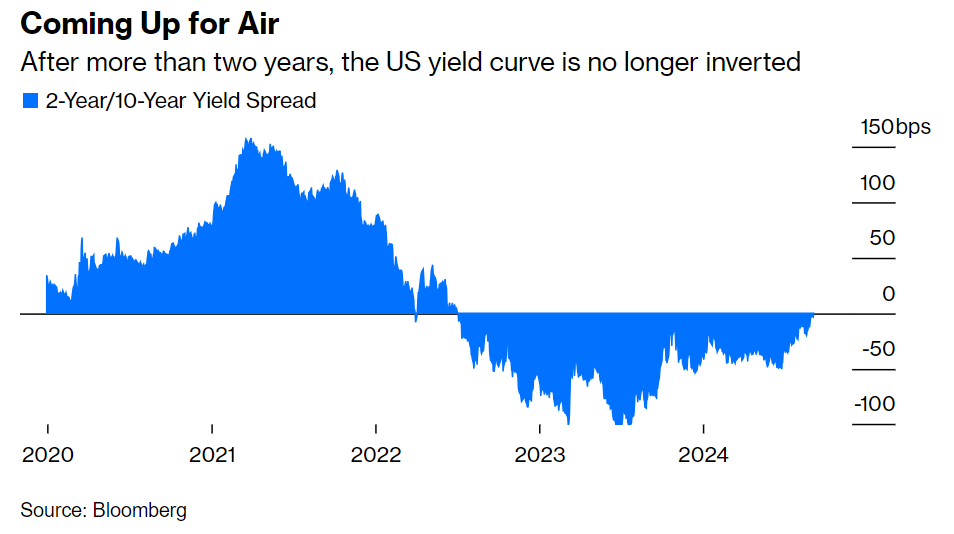

John Luke: The closely-watched 2yr/10yr yield curve has finally broken its lengthy inversion

Data as of 09.05.2024

Data as of 09.05.2024

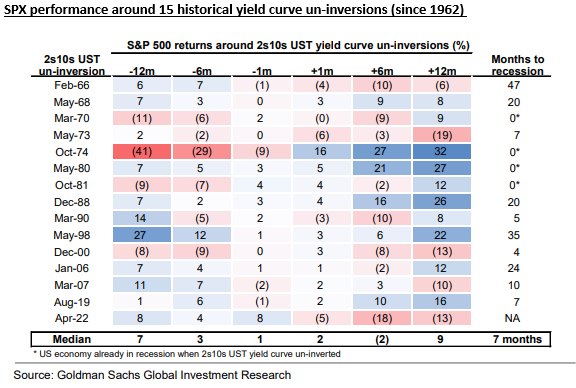

Brian: and the historic record for stocks after breaking the inversion is mixed

Data as of 09.03.2024

Data as of 09.03.2024

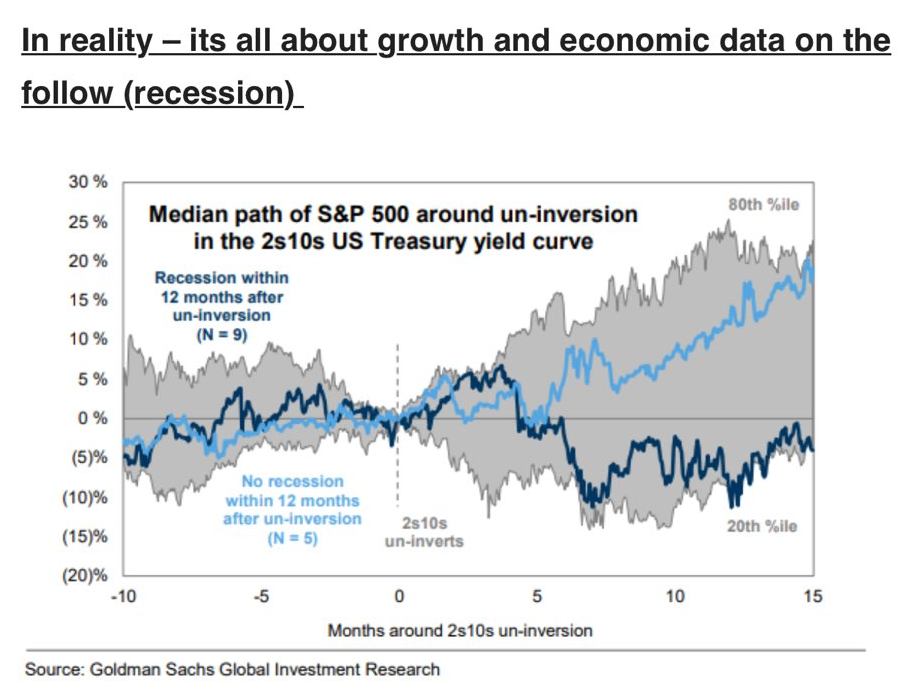

Brad: that said, history also says that where the economy lands is the most likely factor in good vs. bad outcomes for stocks

Data as of August 2024

Data as of August 2024

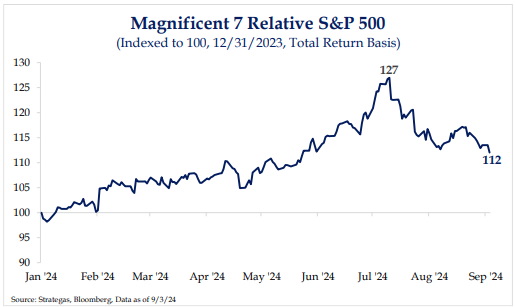

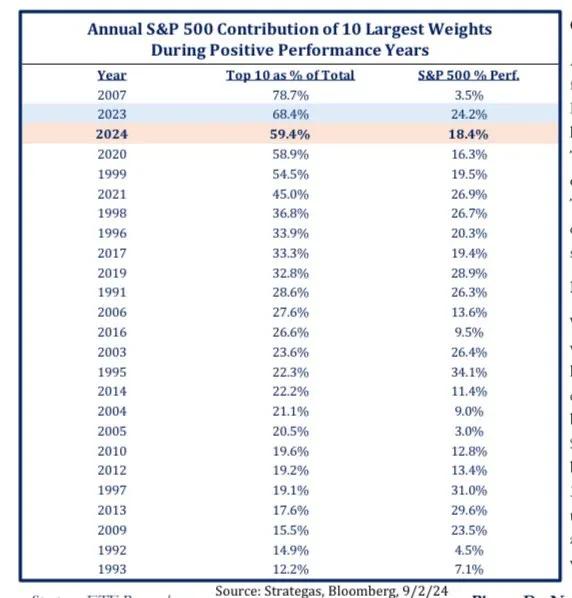

Joseph: The infamous megacap tech stocks are not dominating the broader market the way they had

Dave: though they’ve contributed the lion’s share of gains in 2023 and 2024

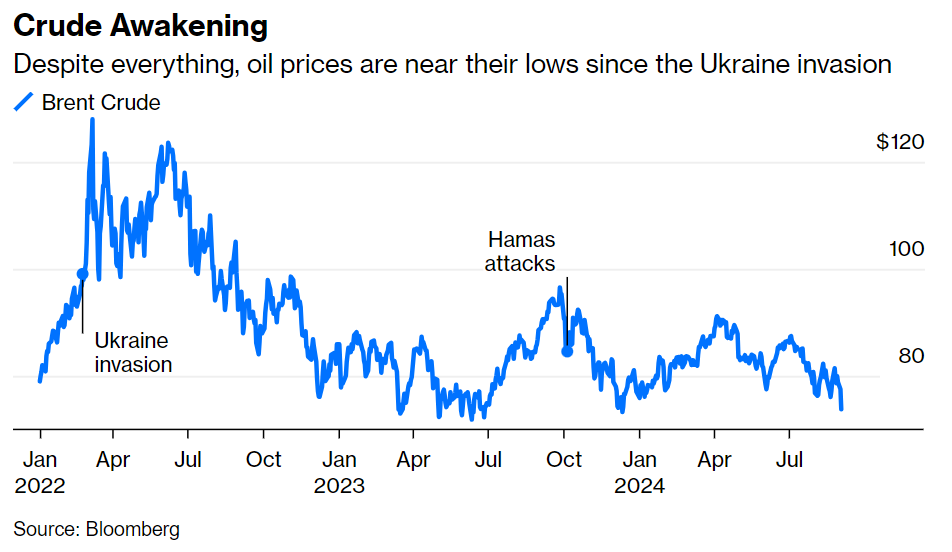

Joseph: Crude oil is trading near its lowest levels of the past few years

Data as of 09.04.2024

Data as of 09.04.2024

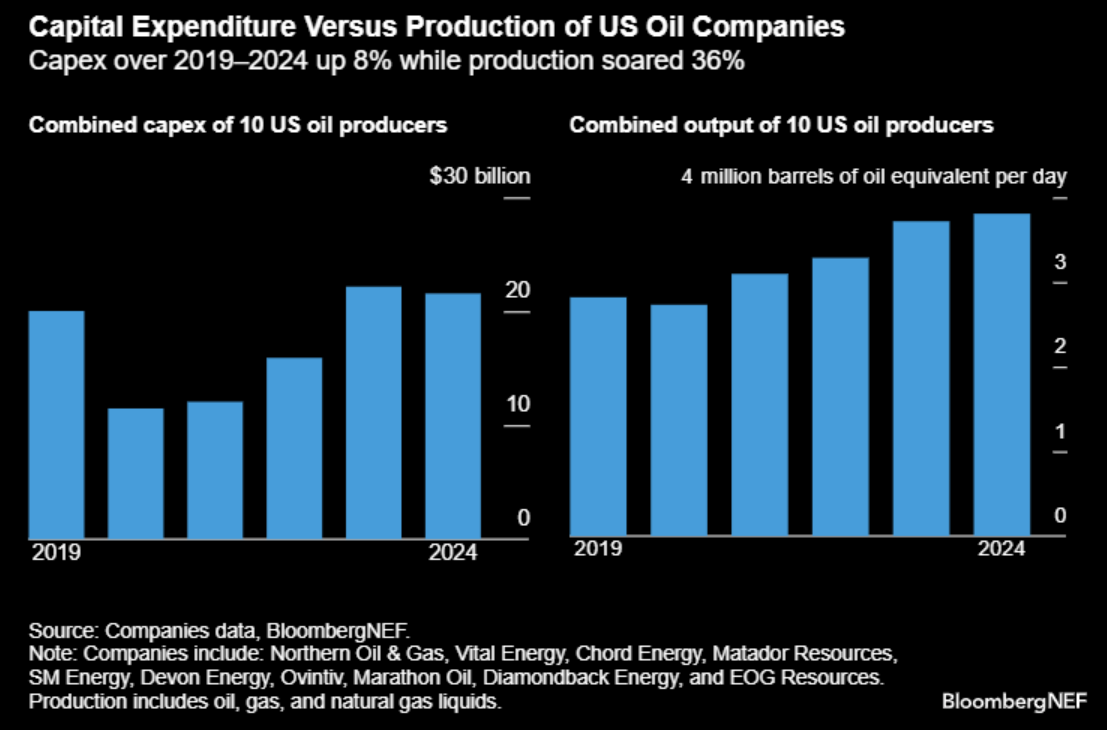

Joseph: partly due to global growth concerns but also from major efficiencies gained in the production process

Data as of 09.03.2024

Data as of 09.03.2024

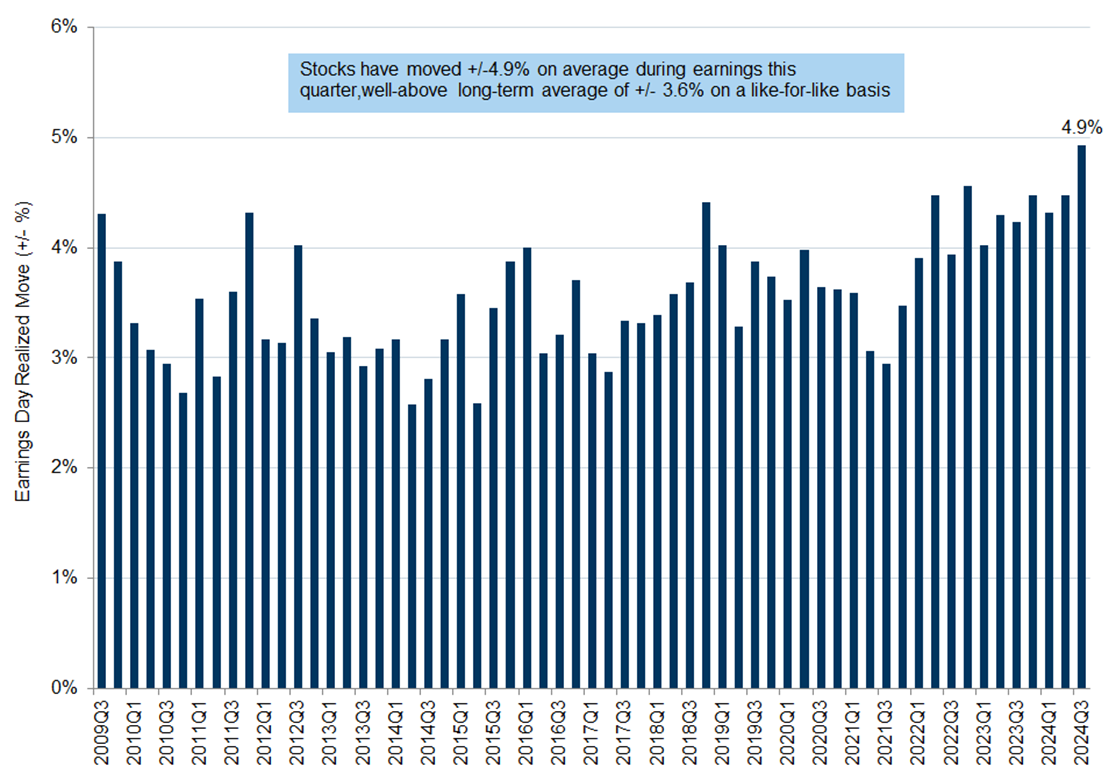

Brad: Q2 earnings season delivered the most volatile company reactions in years

Source: Goldman Sachs as of 08.30.2024

Source: Goldman Sachs as of 08.30.2024

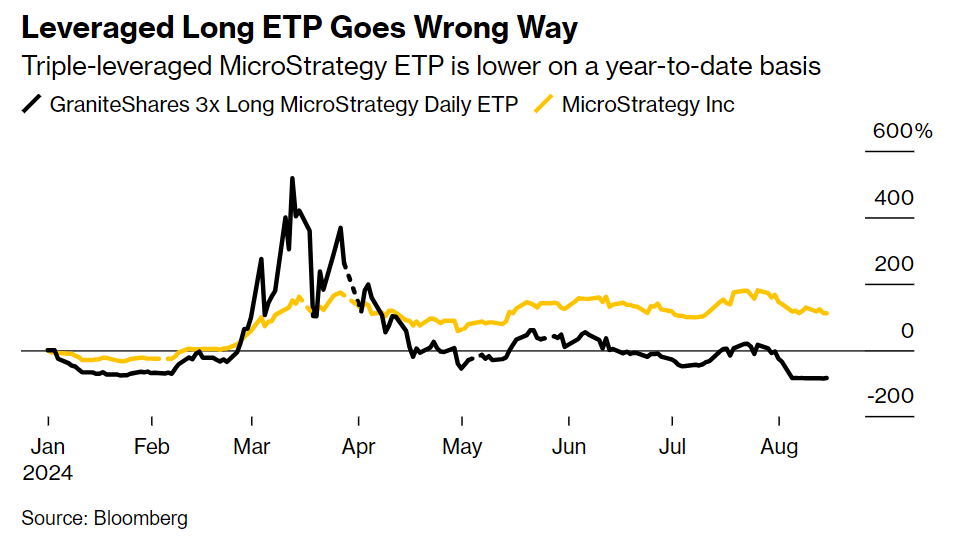

JD: speaking of volatility, leveraged ETFs are among the clearest examples of the “volatility tax” eating away at investor returns

Source: Bloomberg as of 09.03.2024

Source: Bloomberg as of 09.03.2024

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2409-11.