Our team looks at a lot of research throughout each day. A few charts that caught our eye this week, and the way they fit the unfolding puzzle of evidence:

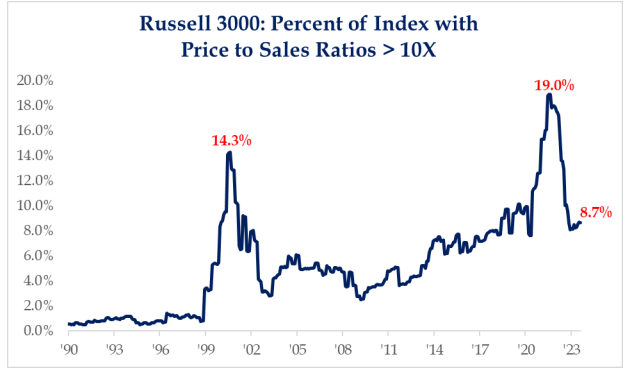

John Luke: NVDA is the current battleground stock, but remember when there were 100s of absurdly-priced “growth” stocks?

Source: Strategas as of 09.04.2023

Source: Strategas as of 09.04.2023

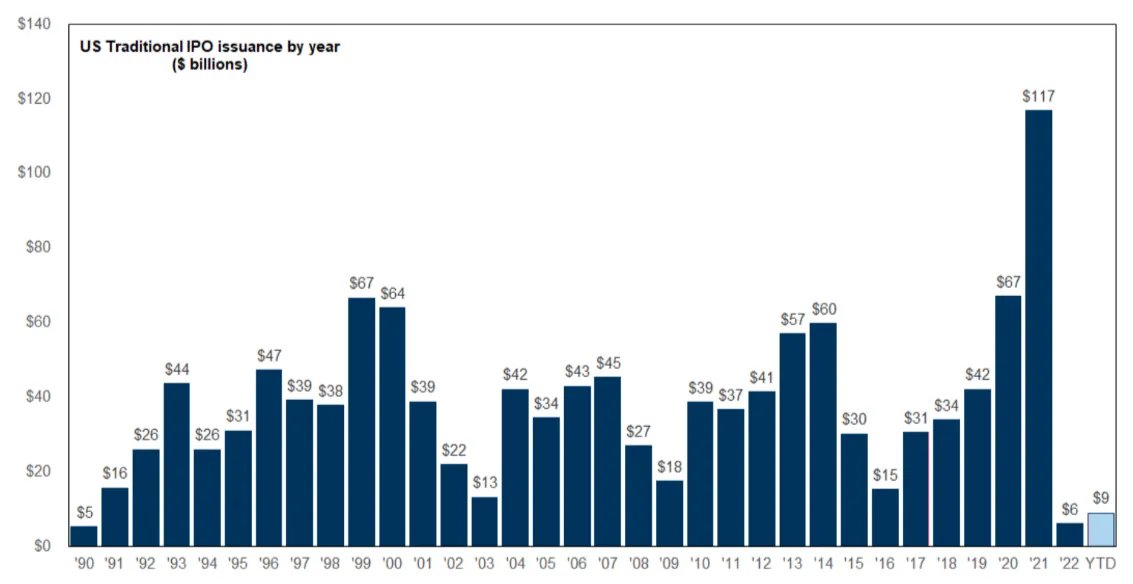

Beckham: and another way to view the craziness of 2021 is through the comparison of IPO activity

Source: Goldman Sachs as of August 2023

Source: Goldman Sachs as of August 2023

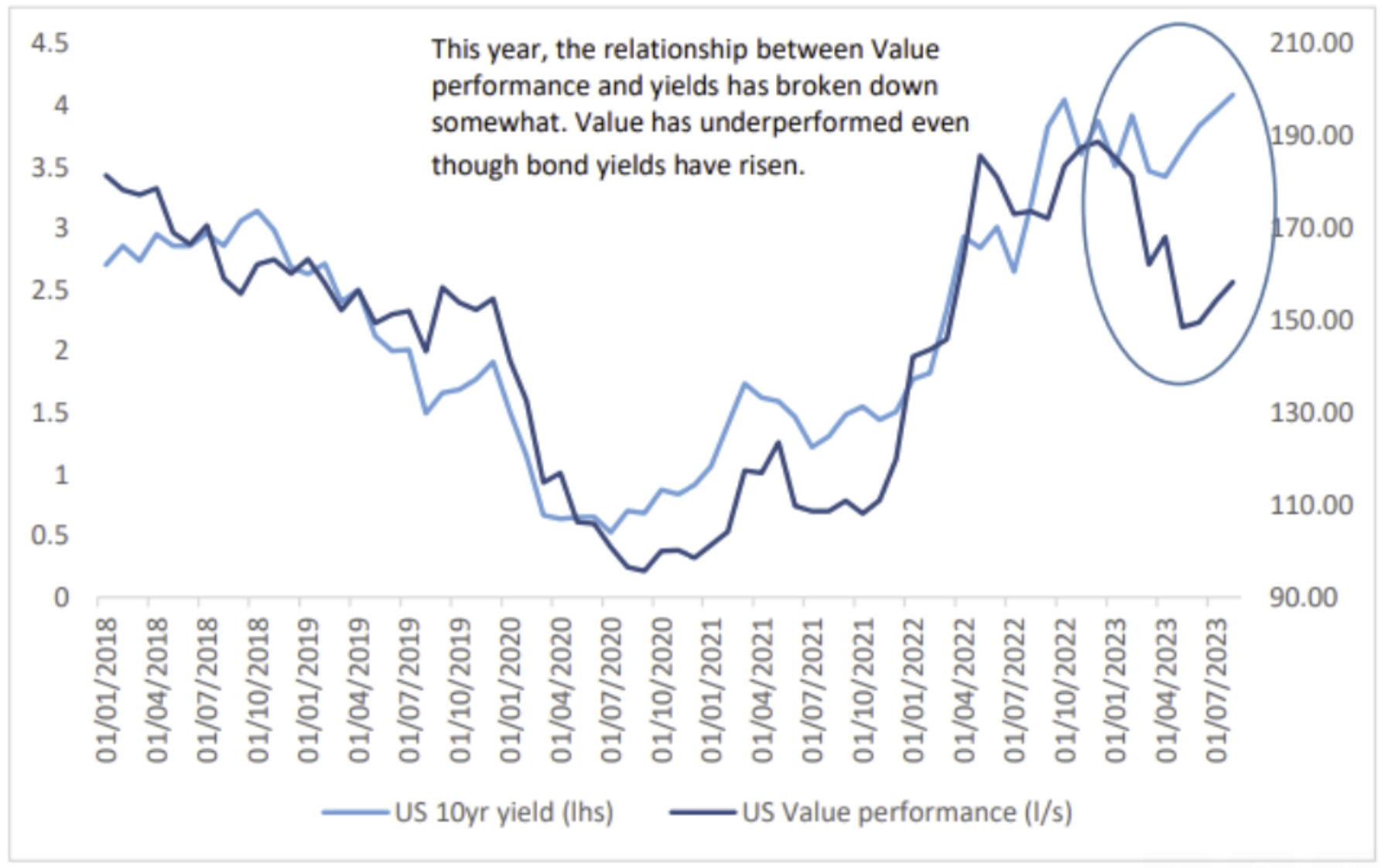

Dave: The big anomaly this year has been growth stocks outperforming in the face of higher real yields

Source: Bernstein as of 09.05.2023

Source: Bernstein as of 09.05.2023

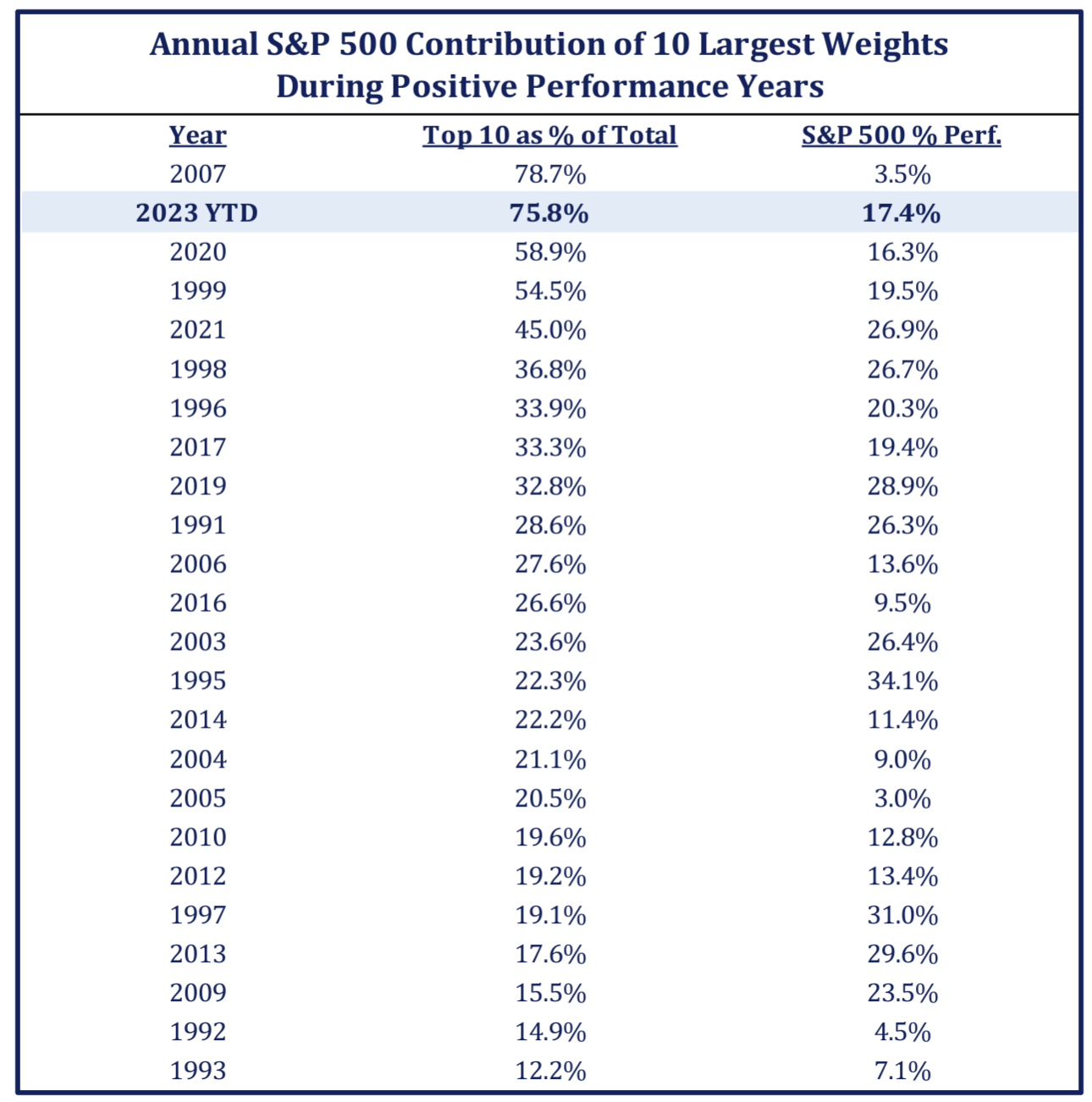

Dave: which has manifested itself in a tiny group of growth stocks contributing nearly the entire YTD return

Source: Strategas as of 09.04.2023

Source: Strategas as of 09.04.2023

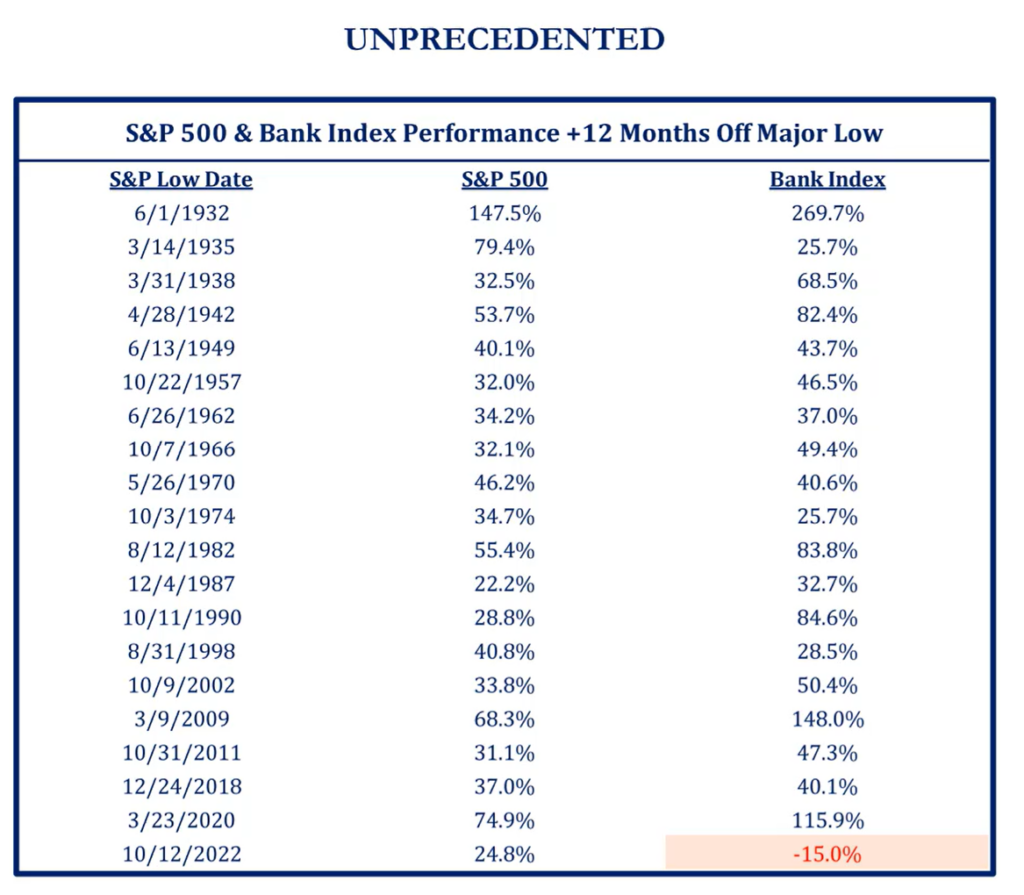

Dave: and significant dispersion vs. bank stocks

Source: Strategas as of 09.07.2023

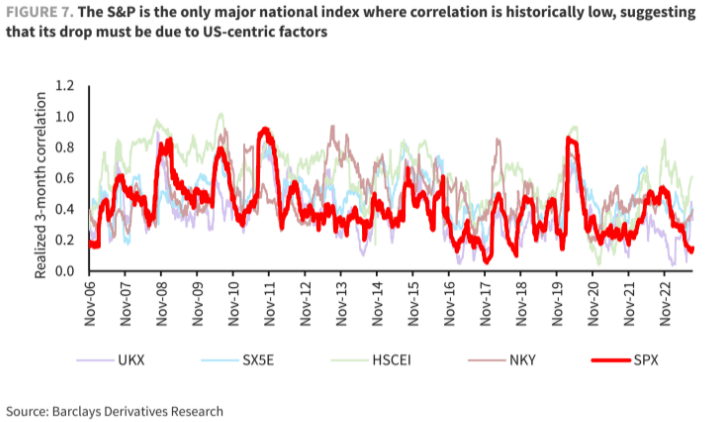

Brad: ironically, this intra-market split has been mostly a US story

Data as of August 2023

Data as of August 2023

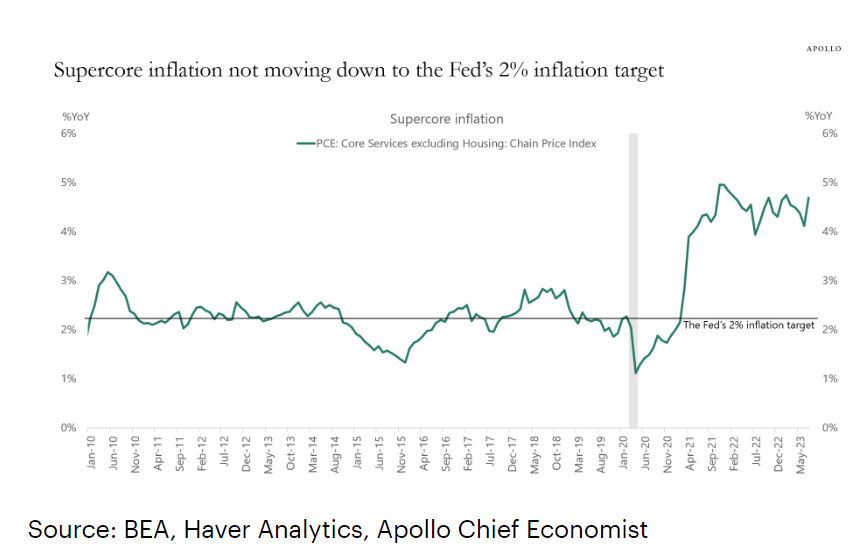

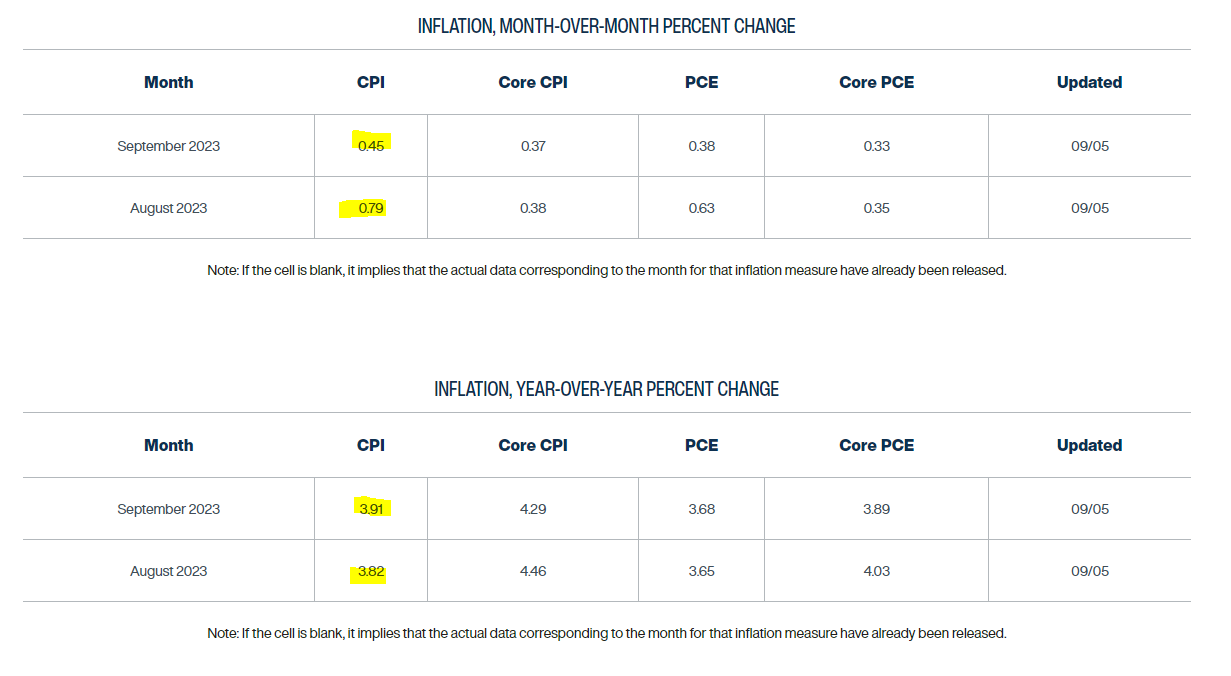

John Luke: Headline inflation has come down but the underlying drivers remain well above the Fed’s 2% target

Data as of 09.01.2023

Data as of 09.01.2023

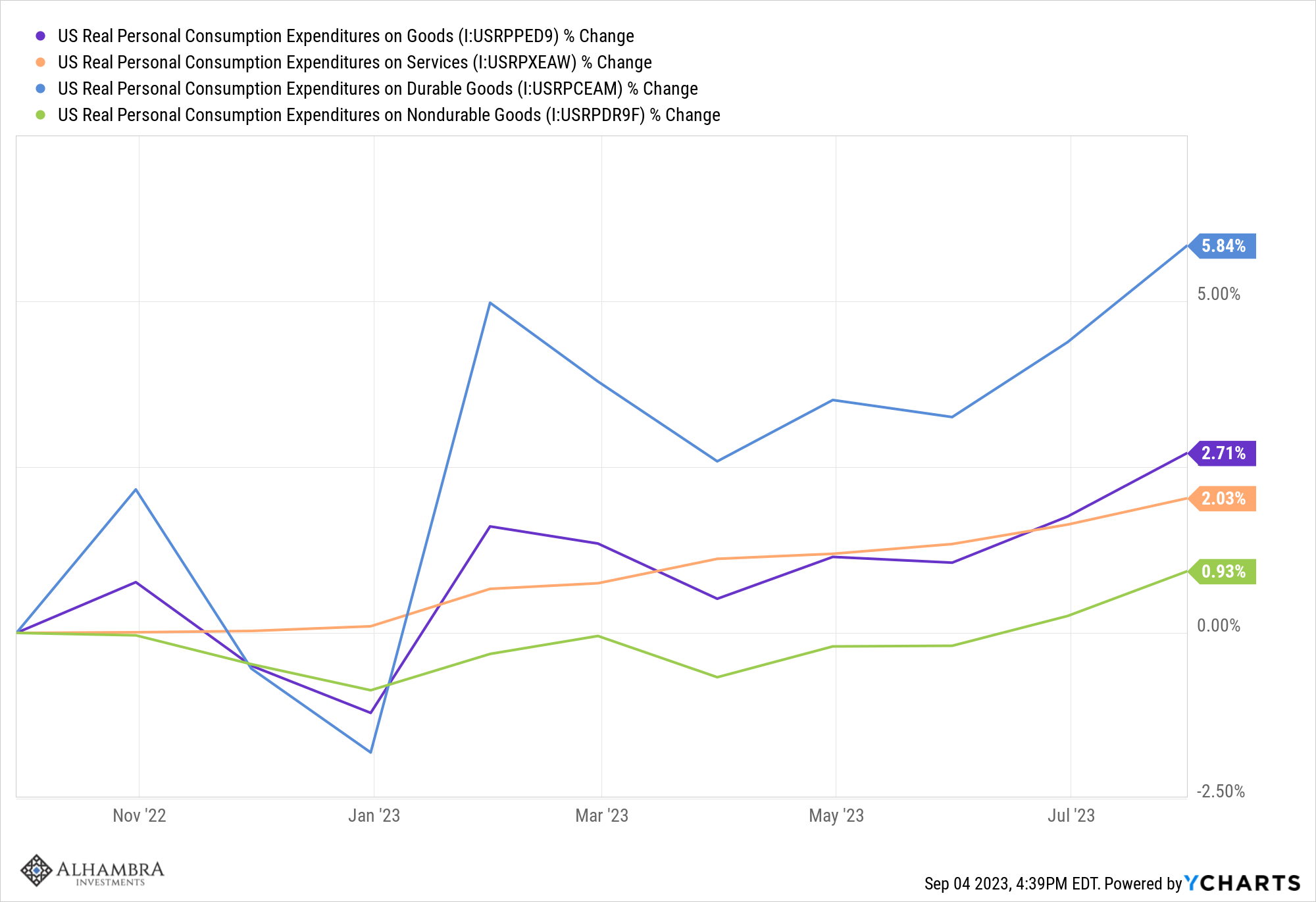

John Luke: and most of the inputs seem to have troughed, with the potential to rise together

Source: Alhambra Investments as of 09.04.2023

Source: Alhambra Investments as of 09.04.2023

John Luke: leading to a re-acceleration of headline inflation numbers

Source: Cleveland Fed as of 09.05.2023

Source: Cleveland Fed as of 09.05.2023

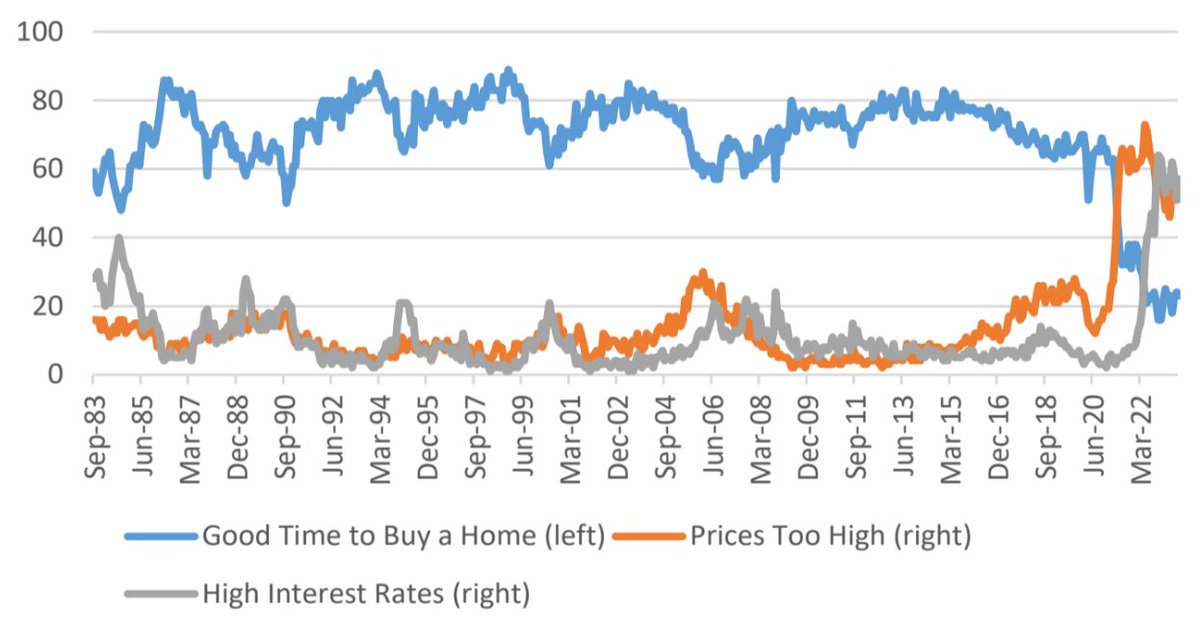

Beckham: The appetite for homebuying is running awfully low

Source: Morgan Stanley as of 09.06.2023

Source: Morgan Stanley as of 09.06.2023

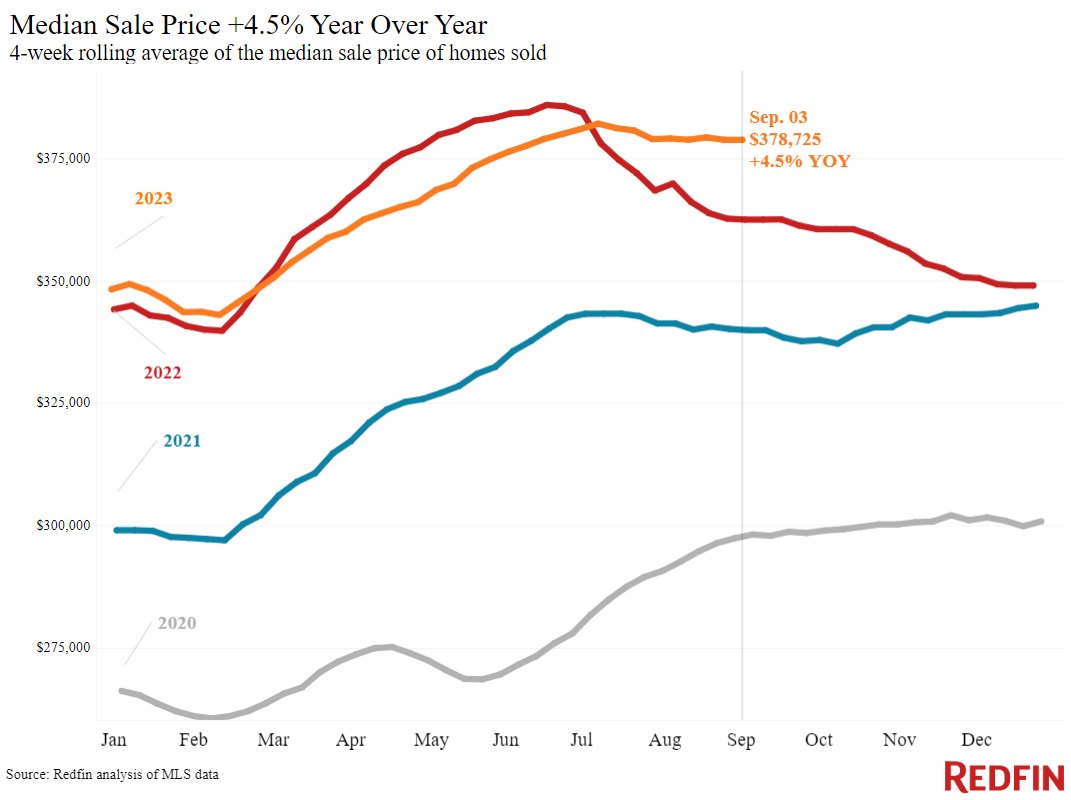

Dave: but home prices are sitting close to highs

Data as of 09.03.2023

Data as of 09.03.2023

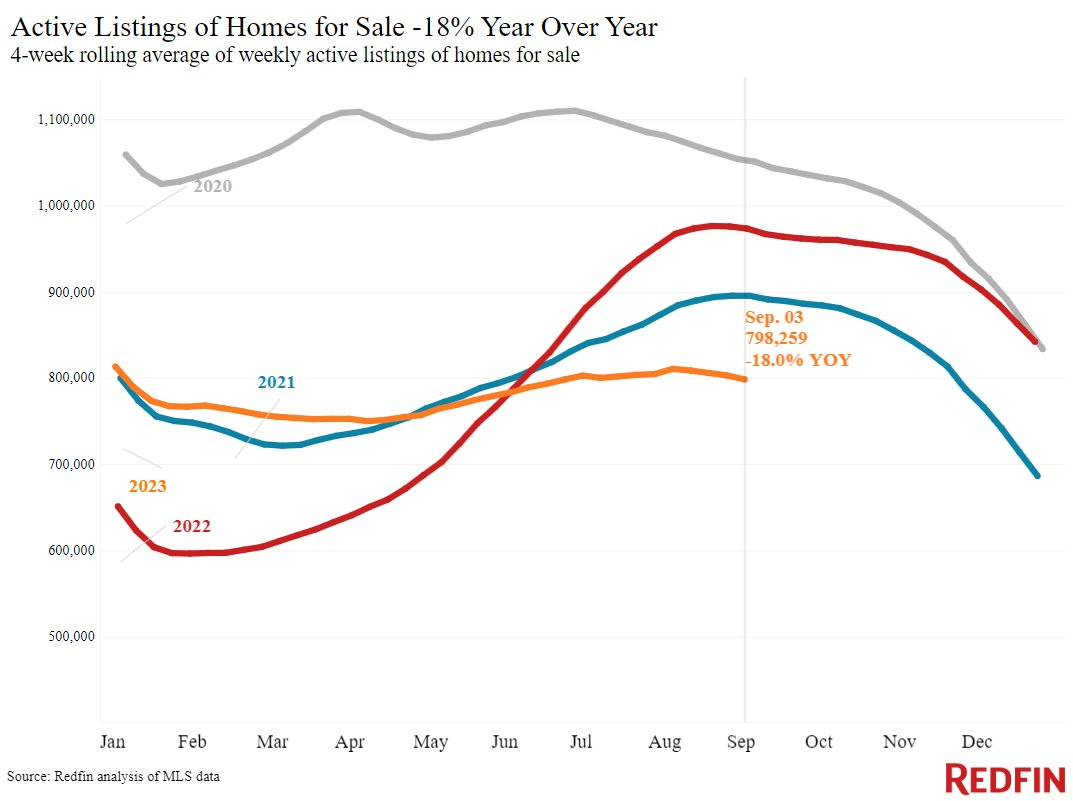

Dave: as the all-important supply side remains very tight since few want to give up their mortgages

Data as of 09.03.2023

Data as of 09.03.2023

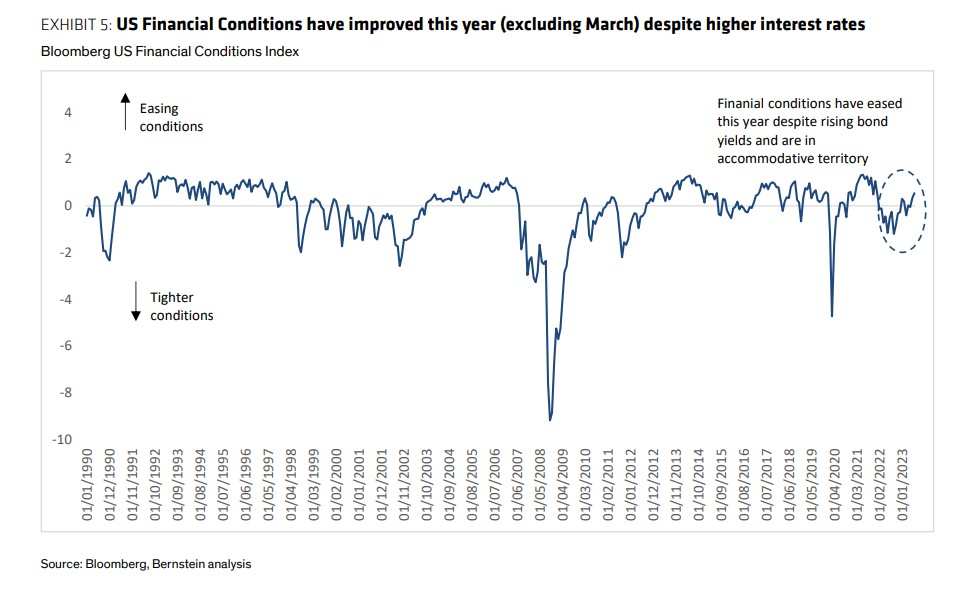

John Luke: Despite the continued rate hikes, market conditions under the surface have actually become a bit easier

Data as of August 2023

Data as of August 2023

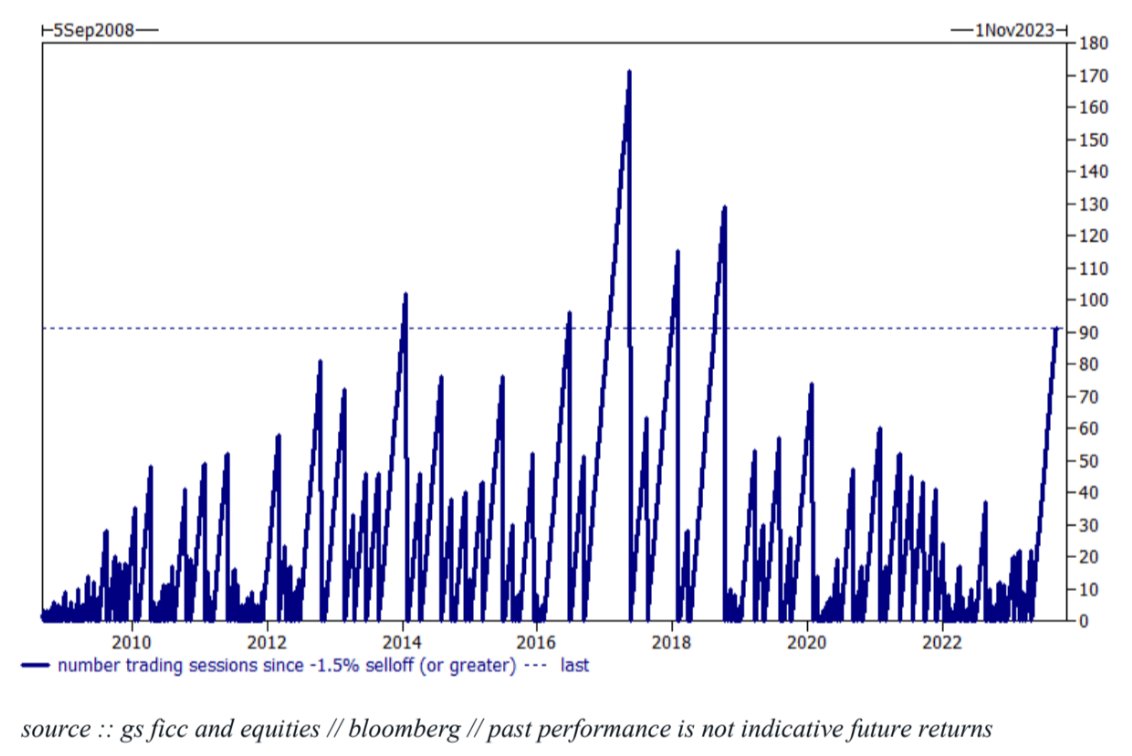

John Luke: which has probably contributed to the surprising lack of volatility in stocks

Source: Goldman Sachs as of 09.01.2023

Source: Goldman Sachs as of 09.01.2023

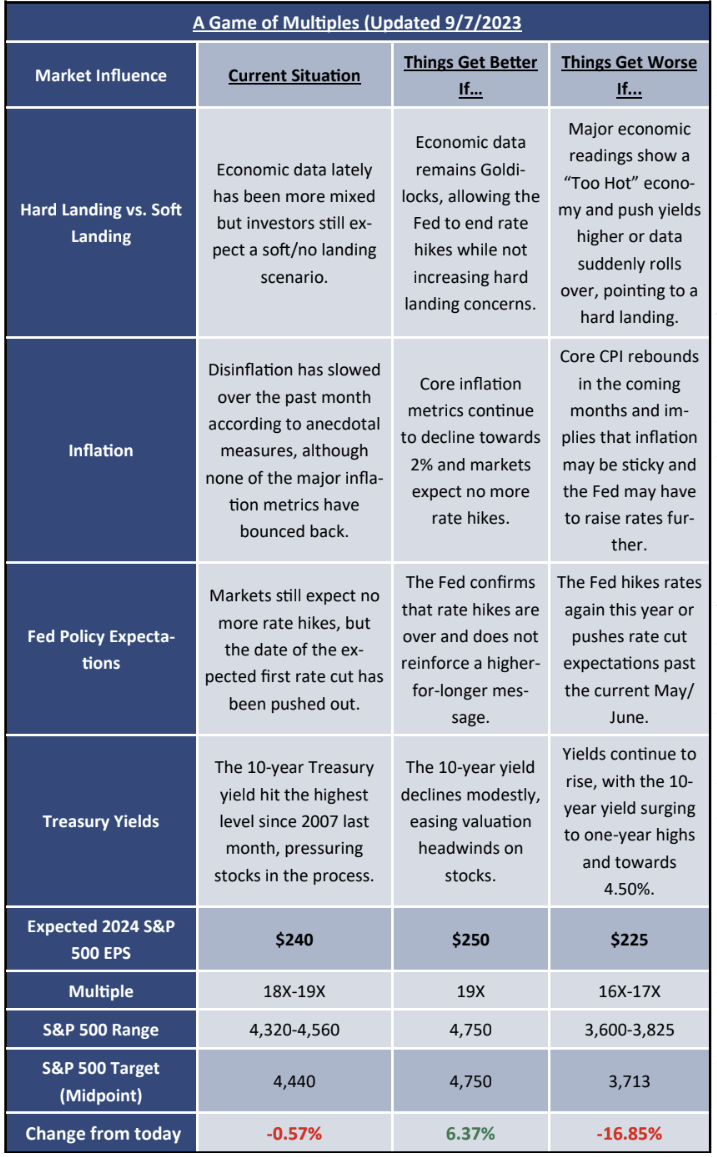

Dave: but often stability breeds instability and the range of outcomes from here is pretty wide

Source: Sevens Report as of 09.07.2023

Source: Sevens Report as of 09.07.2023

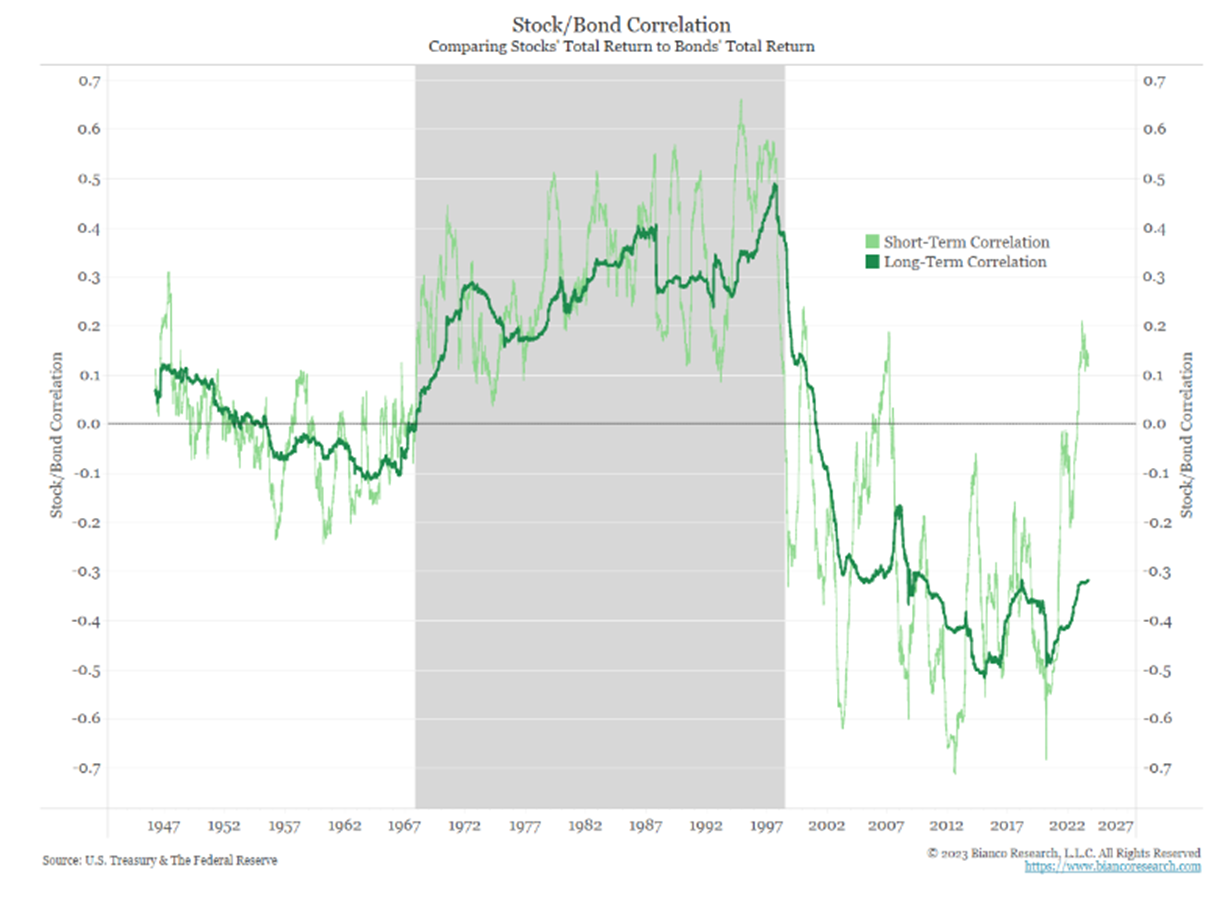

Joseph: Stock-bond correlation is dynamic not static, could be a new regime underway

Source: Bianco as of 09.01.2023

Source: Bianco as of 09.01.2023

Disclosures

Past performance is not indicative of future results. This material is not financial advice or an offer to sell any product. The information contained herein should not be considered a recommendation to purchase or sell any particular security. Forward-looking statements cannot be guaranteed.

Projections or other forward-looking statements regarding future financial performance of markets are only predictions and actual events or results may differ materially.

This commentary offers generalized research, not personalized investment advice. It is for informational purposes only and does not constitute a complete description of our investment services or performance. Nothing in this commentary should be interpreted to state or imply that past results are an indication of future investment returns. All investments involve risk and unless otherwise stated, are not guaranteed. Be sure to consult with an investment & tax professional before implementing any investment strategy. Investing involves risk. Principal loss is possible.

Advisory services are offered through Aptus Capital Advisors, LLC, a Registered Investment Adviser registered with the Securities and Exchange Commission. Registration does not imply a certain level or skill or training. More information about the advisor, its investment strategies and objectives, is included in the firm’s Form ADV Part 2, which can be obtained, at no charge, by calling (251) 517-7198. Aptus Capital Advisors, LLC is headquartered in Fairhope, Alabama. ACA-2309-10.